SLETTO & ASSOCIATES, P - CHG Healthcare Services

SLETTO & ASSOCIATES, P - CHG Healthcare Services

SLETTO & ASSOCIATES, P - CHG Healthcare Services

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

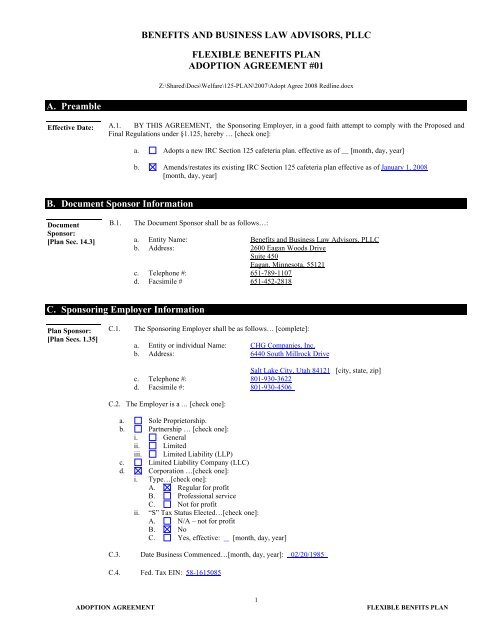

BENEFITS AND BUSINESS LAW ADVISORS, PLLC<br />

FLEXIBLE BENEFITS PLAN<br />

ADOPTION AGREEMENT #01<br />

Z:\Shared\Docs\Welfare\125-PLAN\2007\Adopt Agree 2008 Redline.docx<br />

A. Preamble<br />

Effective Date: A.1. BY THIS AGREEMENT, the Sponsoring Employer, in a good faith attempt to comply with the Proposed and<br />

Final Regulations under §1.125, hereby … [check one]:<br />

a. Adopts a new IRC Section 125 cafeteria plan. effective as of [month, day, year]<br />

b. Amends/restates its existing IRC Section 125 cafeteria plan effective as of January 1, 2008<br />

[month, day, year]<br />

B. Document Sponsor Information<br />

Document<br />

Sponsor:<br />

[Plan Sec. 14.3]<br />

B.1.<br />

The Document Sponsor shall be as follows…:<br />

a. Entity Name: Benefits and Business Law Advisors, PLLC<br />

b. Address: 2600 Eagan Woods Drive<br />

Suite 450<br />

Eagan, Minnesota, 55121<br />

c. Telephone #: 651-789-1107<br />

d. Facsimile # 651-452-2818<br />

C. Sponsoring Employer Information<br />

Plan Sponsor:<br />

[Plan Secs. 1.35]<br />

C.1.<br />

The Sponsoring Employer shall be as follows… [complete]:<br />

a. Entity or individual Name: <strong>CHG</strong> Companies, Inc.<br />

b. Address: 6440 South Millrock Drive<br />

Salt Lake City, Utah 84121 [city, state, zip]<br />

c. Telephone #: 801-930-3622<br />

d. Facsimile #: 801-930-4506<br />

C.2. The Employer is a … [check one]:<br />

a. Sole Proprietorship.<br />

b. Partnership … [check one]:<br />

i. General<br />

ii. Limited<br />

iii. Limited Liability (LLP)<br />

c. Limited Liability Company (LLC)<br />

d. Corporation …[check one]:<br />

i. Type…[check one]:<br />

A. Regular for profit<br />

B. Professional service<br />

C. Not for profit<br />

ii. “S” Tax Status Elected…[check one]:<br />

A. N/A – not for profit<br />

B. No<br />

C. Yes, effective: [month, day, year]<br />

C.3. Date Business Commenced…[month, day, year]: 02/20/1985<br />

C.4. Fed. Tax EIN: 58-1615085<br />

ADOPTION AGREEMENT<br />

1<br />

FLEXIBLE BENFITS PLAN

C.5.<br />

Fiscal Year-End of Employer: December<br />

C.6. Employer’s Principal Trade or Business…[enter same as on IRS Form 5500]:<br />

C.7.<br />

C.8.<br />

Business Code # … [enter same as on Employer’s IRS Tax Return]:<br />

Predecessor Employers … [check one and enter information if applicable]:<br />

a. N/A - no Predecessor Employer(s) existed<br />

b. See attached Predecessor Employer Addendum<br />

c. Enter entity name(s) and information:<br />

Entity Name: Entity Type: Fed. Tax EIN:<br />

Entity Name: Entity Type: Fed. Tax EIN:<br />

C.9. Affiliated Employers … [check one and enter information if applicable]:<br />

a. N/A - no Affiliated Employer(s) existed<br />

b. See attached Affiliated Employer Addendum<br />

c. Enter entity name(s) and information:<br />

Entity Name: CompHealth Associates, Inc. Entity Type: Corp Fed. Tax EIN: 06-0878058<br />

Entity Name: <strong>CHG</strong> Medical Staffing, Inc. Entity Type: Corp Fed. Tax EIN: 87-0502658<br />

Entity Name: <strong>CHG</strong> Management, Inc. Entity Type: Corp Fed. Tax EIN: 51-0343802<br />

Entity Name: Weatherby Locums, Inc. Entity Type: Corp Fed. Tax EIN: 65-0592339<br />

Entity Name: Entity Type: Fed. Tax EIN:<br />

Entity Name: Entity Type: Fed. Tax EIN:<br />

Note:<br />

Affiliated Employers may participate in this Plan by executing the Plan’s Adoption Agreement Participating<br />

Employer Addendum. "Affiliated Employer" means the Sponsoring Employer and those Employers<br />

required to be aggregated with the Sponsoring Employer under sections 414(b), (c), (m) or (o) of the Code.<br />

Such Employers will immediately cease to be a Participating Employer as of the date it ceases to be an<br />

Affiliated Employer.<br />

D. Plan Information<br />

Plan Name and<br />

Number:<br />

[Plan Secs. 1.30]<br />

D.1.<br />

The Plan’s name and number are as follows…[complete]:<br />

a. Current Name of Plan: <strong>CHG</strong> Companies, Inc. Staff Flexible Benefits Plan<br />

b. Previous Name of Plan:<br />

c. Plan Number: 506<br />

Note:<br />

This is the three-digit identifying number [e.g., 501] that the Sponsoring Employer assigns for<br />

Government filing purposes [e.g., Form 5500].<br />

Plan Year:<br />

[Plan Secs. 1.31]<br />

D.2.<br />

Plan Year is as follows…[check each that applies and complete]:<br />

a. The Plan Year is the twelve-consecutive-month period ending each December 31 [month, day]<br />

b. A short Plan Year occurs as follows … [check each that applies]:<br />

i.. The first Plan Year is a short year that began on the Effective Date and ended [month, day,<br />

year]<br />

ii. The Plan Year has been amended. The last Plan Year before the amendment ended<br />

[month, day, year] and the short Plan Year resulting from the amendment began the next day and<br />

ended [month, day, year]<br />

c. The Plan’s Initial Effective Date is as follows: January 1, 2004 [month, day, year]<br />

Note:<br />

Note:<br />

If two or more plans have been merged, or consolidated, insert the original effective date<br />

of the plan shown as the surviving plan for Federal filing purposes (e.g, Form 5500)]<br />

The Plan Anniversary Date is the last day of the applicable Plan Year.<br />

ADOPTION AGREEMENT<br />

2<br />

FLEXIBLE BENFITS PLAN

Plan<br />

Administrator:<br />

[Plan Secs. 1.1<br />

and 13.1]<br />

D.3.<br />

The Plan Administrator is the … [check one]:<br />

Note: To delegate administrative authority to an individual or committee, check item b. or c.<br />

and enter information.<br />

a. Sponsoring Employer, using its address as shown on Item C.1. and the following contact person:<br />

b. The following individual or entity … [complete]:<br />

i. Name:<br />

ii. Address:<br />

[city, state, zip]<br />

iii. Telephone #:<br />

iv. Facsimile #:<br />

v. Fed. I.D. #<br />

c. The following committee or individuals … [check one]:<br />

i. Name of committee:<br />

ii. Committee member(s) … [complete]:<br />

Note:<br />

Either enter the name of the committee or list the individual committee members.<br />

Trust Agreement:<br />

[Plan Secs.16.6]<br />

D.4.<br />

The Plan Trustee(s), if applicable, shall be as follows… [check one]:<br />

a. N/A - Plan assets are not maintained in a Trust [skip to E.1.]<br />

b. Plan assets are maintained in a Trust … [attach Trust Agreement and indicate type of Trustee<br />

and enter information]:<br />

i. Corporate Trustee:<br />

A. Name:<br />

B. Address:<br />

C. Telephone #:<br />

D. Facsimile #:<br />

E. Fed. I.D. #<br />

[city, state, zip]<br />

ii.<br />

Individual Trustee(s) [complete]:<br />

A. Name(s):<br />

B. Address:<br />

1. Use address/telephone/facsimile of Sponsoring Employer<br />

2. Use address/telephone/facsimile of Plan Administrator<br />

3. Use the following address/telephone/facsimile:<br />

a. Address:<br />

b. Telephone #:<br />

c. Facsimile #:<br />

[city, state, zip]<br />

iii.<br />

Unless the Trust Agreement specifically states otherwise, the State law that governs the<br />

Trust is [enter name of state] to the extent that such laws are not preempted by<br />

ERISA<br />

ADOPTION AGREEMENT<br />

3<br />

FLEXIBLE BENFITS PLAN

E. Participation<br />

Eligibility:<br />

[Plan Sec. 2.1]<br />

E.1 In order to be eligible to participate in the following Plan components, an Employee must meet the following<br />

eligibility requirements… [check each that applies]:<br />

Employee<br />

Salary<br />

Reductions<br />

Employer<br />

Contributions<br />

Eligibility<br />

Requirements<br />

N/A – Plan does not provide for this<br />

component<br />

a. AGE: i. N/A – no AGE requirement<br />

ii.<br />

Age<br />

b. SERVICE: i. N/A – no SERVICE requirement<br />

ii.<br />

Days(s) of Service<br />

iii. 1 1 Month(s) of Service<br />

iv.<br />

Year(s) of Service<br />

c. CLASSES:<br />

N/A – no CLASSES included/excluded<br />

included included<br />

The following CLASSES are to be:<br />

excluded excluded<br />

i. Highly Compensated Employee<br />

ii.<br />

iii.<br />

iv.<br />

vi.<br />

vii.<br />

viii.<br />

ix.<br />

Employees whose employment is governed by<br />

the terms of a collective bargaining agreement<br />

[Code § 7701(a)(46)] under which retirement<br />

benefits were the subject of good faith<br />

bargaining<br />

Key Employees<br />

Leased Employees<br />

Salaried Employees<br />

Hourly-wage Employees<br />

Employees paid primarily on a commission<br />

basis<br />

Employees eligible to participate in the<br />

Following Employee benefits plan or program<br />

[enter plan or program name]<br />

x. Employees classified as temporary<br />

xi.<br />

xii.<br />

xiii.<br />

xiv.<br />

Employees classified as seasonal<br />

All except Employees whose employment is<br />

governed by the terms of a collective<br />

bargaining agreement [Code § 7701(a)(46)]<br />

Employees expected to work less than<br />

Hours of Service per [week; pay period;<br />

calendar month; Plan Year quarter; Plan Year;<br />

other]<br />

Other…[enter CLASS included/excluded]<br />

ADOPTION AGREEMENT<br />

d. EXCEPTION: i.<br />

4<br />

N/A - no EXCEPTION<br />

FLEXIBLE BENFITS PLAN

ii.<br />

iii.<br />

iv.<br />

Employees employed as of the effective date<br />

of the most recent Plan amendment<br />

Employees employed as of the Anniversary<br />

Date of the most recent Plan amendment<br />

Other…[enter EXCEPTION]<br />

Date of Entry:<br />

[Plan Sec. 2.2]<br />

E.2 An Employee who meets the above eligibility requirements and who is not an excluded Employee,<br />

shall become a Participant effective as of… [check one and complete]:<br />

a. The date on which the Employee meets the requirements<br />

b. The first day of the pay period [week; pay period; calendar month; Plan Year quarter; other] that<br />

coincides with or next follows the date on which the Employee meets the requirements<br />

c. Same date that the Employee becomes eligible to participate in the Employer’s group<br />

medical plan<br />

d. Same date that the Employee becomes eligible to participate in the following employee<br />

benefits plan or program maintained by the Employer: Group health plan<br />

e. Other:<br />

Service<br />

Determinations:<br />

[Plan Sec. 2.1]<br />

Service with<br />

Other<br />

Employers:<br />

[Plan Sec. 2.3]<br />

E.3 Service will be determined as follows for eligibility purposes, using the … [check one]:<br />

a. N/A – no service requirement for participation in either the Salary Reduction or<br />

Employer Contribution component(s) of the Plan [skip to item F.1.]<br />

b. Elapsed time method<br />

c. Actual hours method<br />

i. An Employee must complete at least Hours of Service during the<br />

ii.<br />

applicable Computation Period for it to count as a of Service.<br />

An Employee for whom a record of actual hours is not maintained or available [e.g., salaried<br />

employees] will be credited with … [check one]:<br />

A. 10 Hours of Service for each day<br />

B. 45 Hours of Service for each week<br />

C. 95 Hours of Service for each semi-monthly payroll period<br />

D. 190 Hours of Service for each month<br />

… in which he/she has one or more Hour(s) of Service.<br />

iii. An Employee for whom a record of actual hours is maintained and available [e.g. hourly employees]<br />

will be credited using … [check one]:<br />

A. Actual hours method<br />

B. The same equivalency as specified in Item E.3.c.ii. above.<br />

iv. The Plan shall use the following computation periods for eligibility purposes… [check one]:<br />

A. N/A – no eligibility service period is specified<br />

B. Employment anniversary shifting to Plan Year<br />

C. Employment anniversary for all years<br />

E.4 An Employee’s service with the following employer(s) will be recognized for eligibility purposes… [check one]:<br />

a. N/A – no other service recognized<br />

b. All entities listed on the Affiliated Employers Addendum<br />

c. Service with the following employer(s) will be recognized…[enter employer’s name(s):<br />

F. Plan Compensation<br />

Plan<br />

Compensation:<br />

[Plan Sec. 1.8]<br />

F.1.<br />

Plan Compensation means earnings … [check one]:<br />

a. Wages, Tips, other Compensation [as reported on the Participant's IRS Form W-2 as required under<br />

sections 6041 and 6051 of the Code]<br />

b. Wages [as that term is defined in section 3401 of the Code for purposes of federal income tax<br />

withholding at the source]<br />

c. 415 (c)(3) Safe-Harbor Compensation<br />

ADOPTION AGREEMENT<br />

5<br />

FLEXIBLE BENFITS PLAN

F.2.<br />

Applicable Period means…[check one]:<br />

a. Plan Year<br />

b. Fiscal Year coinciding with or ending within the Plan Year<br />

c. Calendar Year coinciding with or ending within the Plan Year<br />

F.3.<br />

Plan Compensation exclusions … [check each that applies]:<br />

Employee<br />

Salary<br />

Reduction<br />

Employer<br />

Contribution<br />

Exclusions:<br />

N/A – Plan does not provide for this component<br />

a. N/A – No exclusions<br />

b. N/A Remunerations prior to Date of Entry<br />

c.<br />

Participant Code § 402(a)(8), 402(h)(1)(B) and/or 403(b) Elective<br />

N/A<br />

Deferrals<br />

d. N/A Participant Code § 125 salary reductions (cafeteria plan)<br />

e.<br />

N/A<br />

Reimbursements or other expense allowances, fringe benefits (cash and<br />

non-cash), moving expenses, deferred compensation and welfare benefits<br />

f. Severance pay due to Termination of Service<br />

g. Non-discretionary bonuses<br />

h. Discretionary bonuses<br />

i. Overtime<br />

j. Commissions.<br />

k. Other… [specify]:<br />

G. Benefit Election Period<br />

Benefit<br />

Election<br />

Period:<br />

[Plan Secs. 3.2<br />

and 3.3]<br />

G.1.<br />

The Benefit Election Period prior to the first payroll period that coincides with or next follows the Participant’s<br />

effective date of participation will be…[check one and complete]:<br />

a. A period of [enter number] [day(s), week(s), month(s), other] prior to the Participant’s entry date<br />

b. A period of 30 [enter number] days [day(s), week(s), month(s), other] prior to the first payroll period that<br />

coincides with or next follows the Participant’s effective date of participation<br />

c. A period determined annually at the Administrator's discretion and applied in a<br />

non-discriminatory manner<br />

d. Other… [specify]:<br />

G.2.<br />

The Benefit Election Period prior to each Plan Year for subsequent Plan Year’s of participation will be…[check<br />

one and complete]:<br />

a. A period of 30 [enter number] days [day(s), week(s), month(s), other]<br />

b. From the [enter number] to the [enter number] [day, week, month, other] period<br />

c. A period determined annually at the Administrator's discretion and applied in a<br />

non-discriminatory manner<br />

d. Other… [specify]:<br />

G.3.<br />

The extended Benefit Election Period for Participants who fail to elect during their initial Benefit Election Period<br />

will be…[check one and complete]:<br />

a. N/A – no extended Benefit Election Period<br />

b. A day period prior to [each; the next; other] payroll period(s)<br />

c. From the day of the day period prior to [each; the next; other] payroll period(s)<br />

d. A period prior to [each; the next; other] payroll period(s) determined annually at the<br />

Administrator's discretion and applied in a nondiscriminatory manner<br />

e. Other… [specify]: Thirty (30) days after the end of the Benefit Election Period, or such nondiscriminatory<br />

period determined by the Administrator.<br />

G.4.<br />

Participants who fail to make new Benefit elections during the subsequent Benefit Election Period(s) will [check<br />

one]:<br />

ADOPTION AGREEMENT<br />

a. Continue their prior year elections<br />

b. Continue their prior year elections, but only for insured Benefits<br />

c. Be deemed to have elected not to participate for the upcoming Plan Year<br />

d. Other… [specify]:<br />

6<br />

FLEXIBLE BENFITS PLAN

G.5.<br />

Participants will be automatically enrolled in the Insurance Premium Conversion Program to the extent of the<br />

premiums that they pay for insurance Benefits by payroll withholding… [check one]:<br />

a. N/A – Insurance Premium Conversion program is not available<br />

b. Yes - negative elections are allowed for Participants who do not wish to participate in the Insurance<br />

Premium Conversion program<br />

c. No - participation in the Insurance Premium Conversion program only by positive election<br />

H. Participant Salary Reductions<br />

Participant<br />

salary<br />

Reductions:<br />

[Plan Secs. 4.1<br />

and 4.2]<br />

H.1.<br />

Eligible Employees may elect to have their earnings reduced by… [check one and complete]:<br />

a. Not applicable [Employee Salary Reductions are not allowed - Skip to Section H.3.]<br />

b. By an amount sufficient to fund Benefits selected<br />

c. Percentage [check one or more and enter percentage amount(s)]:<br />

i. Minimum: % of Plan Compensation<br />

ii. Maximum: % of Plan Compensation<br />

d. Dollar [check one or more and enter dollar amount(s)] :<br />

i. Minimum: $ of Compensation<br />

ii. Maximum: $ of Compensation<br />

e. Percentage/Dollar [check one or more and enter dollar amount(s)]:<br />

i. Minimum: % of Plan Compensation or $ of Compensation<br />

ii. Maximum: % of Plan Compensation or $ of Compensation<br />

f. Other [specify]:<br />

H.2.<br />

The Salary Reduction period for the limitation(s) set forth in Item H.1. are as follows…[check one]:<br />

a. Payroll period<br />

b. Month<br />

c. Plan Year quarter<br />

d. Plan Year half<br />

e. Other [specify]:<br />

H.3.<br />

Participants may convert Paid Time Off into Plan contributions:…[check one]:<br />

a. N/A – Paid Time Off conversion not allowed<br />

b. Up to total available Paid Time Off<br />

c. Up to Days Paid Time Off<br />

d. Up to Dollars worth of Paid Time Off<br />

e. To the lesser of Days Paid Time Off or Dollars worth of Paid Time Off<br />

f. Other [specify]:<br />

I. Employer Credits<br />

Employer<br />

Contributions:<br />

[Plan Sec. 5.1]<br />

I.1.<br />

Employer Credits will be calculated as follows… [check one]:<br />

a. Not applicable [Skip to Item J.1.]<br />

b. At the Employer’s discretion<br />

c. dollars per Participant<br />

d. % of Compensation per eligible Participant<br />

e. Pursuant to the following formula…[enter contribution formula]:<br />

f. Other [specify]:<br />

ADOPTION AGREEMENT<br />

7<br />

FLEXIBLE BENFITS PLAN

I.2.<br />

The Employer Credit(s) shall be limited for each eligible Participant … [check one and complete]:<br />

a. Not applicable [no limit]<br />

b. By an amount sufficient to fund Benefits selected<br />

c. Percentage [check one or more and enter percentage amount(s)]:<br />

i. Minimum: % of Plan Compensation<br />

ii. Maximum: % of Plan Compensation<br />

d. Dollar [check one or more and enter dollar amount(s)] :<br />

i. Minimum: $ of Compensation<br />

ii. Maximum: $ of Compensation<br />

e. Percentage/Dollar [check one or more and enter dollar amount(s)]:<br />

i. Minimum: % of Plan Compensation or $ of Compensation<br />

ii. Maximum: % of Plan Compensation or $ of Compensation<br />

f. Other [specify]:<br />

I.3.<br />

The Employer Credit period applicable to Item I.1. and I.2. is as follows…[check one]:<br />

a. Payroll period<br />

b. Month<br />

c. Plan Year quarter<br />

d. Plan Year half<br />

e. Other [specify]:<br />

I.4.<br />

The Employer Credit(s) shall be submitted pro-rata each… [check one]:<br />

a. Pay period<br />

b. Month<br />

d. Plan Year quarter<br />

d. Plan Year half<br />

e. Other [specify]:<br />

Allocation<br />

Requirements:<br />

[Plan Sec. 5.4]<br />

I.5.<br />

To be eligible to receive an Employer Credit allocation for a Plan Year, the Participant<br />

must… [check one]:<br />

a. Not applicable [all Participants are eligible]<br />

b. Other [specify]:<br />

J. Insurance Premium Conversion<br />

Insurance<br />

Premium<br />

Conversion:<br />

[Plan Sec. 6.1]<br />

Dependent<br />

Coverage:<br />

[Plan Sec. 7.1]<br />

J.1.<br />

J.2.<br />

The following Insurance Benefits are available for payment through the Plan on a pre-tax basis… [check one]:<br />

a. N/A - Spending Accounts only [skip to Item J.2.]<br />

b. Accident or Health Insurance [IRC Section 106]<br />

i. Health Care<br />

ii. Accidental Death or Dismemberment<br />

iii. Dental Care<br />

iv. Vision Care<br />

v. Long-Term Disability<br />

vi. Other [specify]:<br />

c. Group-Term Life Insurance [IRC Section 79]<br />

d. Other [specify] :<br />

Dependent coverage may be elected by the Participant for… [check one]:<br />

a. Not applicable [only Participant coverage allowed]<br />

b. Health Care<br />

c. Accidental Death or Dismemberment<br />

d. Dental Care<br />

e. Vision Care<br />

f. Long-Term Disability<br />

g. Group-Term Life Insurance<br />

h. Other [specify] : ____________<br />

J.3.<br />

ADOPTION AGREEMENT<br />

Participants may, at the discretion of the Administrator, obtain individual policies for the following<br />

Insurance Benefits… [check one]:<br />

8<br />

FLEXIBLE BENFITS PLAN

a. Not applicable [no individual policies will be allowed]<br />

b. Health Care<br />

c. Dental Care<br />

d. Vision Care<br />

e. Long-Term Disability<br />

f. Other [specify] :<br />

J.4.<br />

In addition to legal limits, if any, Insurance Benefits will be limited as follows… [check one]:<br />

a. N/A [no additional limits]<br />

b. Other [Note: Group Term Life Insurance coverage over $50,000 of death benefit may result in taxation<br />

to the Participant.]<br />

K. Spending Accounts<br />

Spending<br />

Accounts:<br />

[Plan Sec. 6.2]<br />

K.1.<br />

Spending Accounts will be established for… [check one]:<br />

a. N/A [Insurance Premium Conversion only - skip to Item L.]<br />

b. Medical Reimbursement Expense [IRC Section 106]<br />

c. Dependent Care [IRC Section 129]<br />

d. Adoption Assistance [IRC Section 137]<br />

e. Health Savings Account [IRC Section 223]<br />

d. 401(k) [IRC Section 401(k)]<br />

e. Paid Time Off<br />

f. Cash Payments<br />

g. Other [specify; must not provide benefits which are prohibited under Prop. Reg. 1.125-1(q)]:<br />

K.2.<br />

In addition to legal limits, if any, Spending Accounts will be limited as follows… [check one]:<br />

a. N/A [no additional limits]<br />

b. Medical Reimbursement Expense [IRC Section 106]<br />

i. N/A [no additional limits]<br />

ii. Other [specify]: $5,000<br />

c. Dependent Care [IRC Section 129]<br />

i N/A [no additional limits]<br />

ii. Other [specify]:<br />

d. Adoption Assistance [IRC Section 137]<br />

i. N/A [no additional limits]<br />

ii. Other [specify]:<br />

d. 401(k) [IRC Section 401(k)]<br />

i N/A [no additional limits]<br />

ii. Other [specify]:<br />

e. Paid Time Off<br />

i N/A [no additional limits]<br />

ii. Other [specify]:<br />

f. Cash Payments<br />

i N/A [no additional limits]<br />

ii. Other [specify]:<br />

g. Other [specify]:<br />

Note:<br />

Even if no limit is specified by the Sponsoring Employer, the applicable legal<br />

limits to maintain the tax-qualified status of the applicable Benefit shall apply.<br />

K.3.<br />

For Medical Reimbursement Expense Account reimbursements, new elections due to a Change In Status are:<br />

[check one]:<br />

a. Not applicable [Benefit not allowed]<br />

b. Not permitted<br />

c. Permitted without limitation<br />

d. Permitted, but only to increase Benefit elections<br />

e. Permitted, but not lower than the net amount of claims as of the election date<br />

f. Other [specify]:<br />

ADOPTION AGREEMENT<br />

9<br />

FLEXIBLE BENFITS PLAN

K.4. For Medical Reimbursement Expense, Dependent Care and Adoption Assistance Spending Account<br />

reimbursements, Participants must file Benefit claims… [check one]:<br />

a. Not applicable [No Benefit is allowed]<br />

b. Within days after Plan Year end for expenses incurred in the current Plan Year<br />

c. By March 31 [enter Month and day] of the following Plan Year for expenses incurred in the current<br />

Plan Year<br />

d. Other [specify]:<br />

K.5. The applicable Grace Period for Medical Reimbursement Expense, Dependent Care, and Adoption Assistance<br />

Spending Account reimbursements will be… [check one](not to exceed the time period in K.5.b):<br />

a. Not applicable [No Benefits is allowed]<br />

b. The fifteenth day of the third month following the end of the Plan Year<br />

c. Sixty days after the end of the Plan Year<br />

d. Thirty days after the end of the Plan Year<br />

e. Other [specify]:<br />

K.6.<br />

Spending Account Forfeitures shall be reallocated during the following Plan Year as follows… [check one]:<br />

a. Not applicable<br />

b. Pro-rata by Eligible Participant<br />

c. Used to reduce Employer Contributions<br />

d. Added to Employer Contributions<br />

e. Other [specify]: Used to defray administrative expenses.<br />

K.7. An Employee who becomes ineligible to participate in the plan with an unused salary reduction amount in their<br />

Dependent Care Spending Account will… [check one]:<br />

a. Forfeit the account balance to the Forfeiture Surplus Account.<br />

b. be allowed to “spend down” those funds as long as they satisfy IRC §129.<br />

ADOPTION AGREEMENT<br />

10<br />

FLEXIBLE BENFITS PLAN

L. COBRA Elections<br />

COBRA<br />

Elections:<br />

[Plan Sec. 19.1]<br />

L.1.<br />

For Medical Reimbursements, if Employee is eligible for COBRA coverage, terminated Participants will do one<br />

of the following[check one]:<br />

a. COBRA will be offered as required by federal law and Participant could only elect COBRA if<br />

usage is less than contributions at the time of the Qualifying Event.<br />

b. At Participant’s election, contribution and reimbursements will continue for the remainder of the Plan Year<br />

to the extent initially elected, regardless of the usage at the time of the Qualifying Event.<br />

c. N/A; Medical Reimbursement is not offered under the Plan.<br />

M. FMLA Elections<br />

FMLA<br />

Elections:<br />

[Plan Sec. 20.1]<br />

M.1.<br />

Participants on unpaid FMLA Leave may elect from the following payment options to pay their Group Health<br />

Care Plan premiums… [check as appropriate]:<br />

a. Pay-as-you-go<br />

b. Pre-pay<br />

c. Catch-up<br />

d. Payments waived and paid by Employer with no repayment by the Participant<br />

Note:<br />

Pursuant to IRS Proposed Regulation Section 1.125-3 Q&A-3(b), the following exceptions apply:<br />

a. The pre-pay option cannot be the sole option offered to Eligible Employees on FMLA Leave. However,<br />

the Plan may include pre-payment as an option for Eligible Employees on FMLA Leave, even if<br />

such option is not offered to employees on non-FMLA Leave-without-pay.<br />

b. The catch-up option can be the sole option offered to Eligible Employees on FMLA Leave if and only if the<br />

catch-up option is the sole option offered to employees on non-FMLA Leave-without-pay.<br />

c. The Plan cannot offer Eligible Employees on FMLA Leave a choice of either the pre-pay option or the<br />

catch-up option without also offering the pay-as-you-go option, if the pay-as-you-go option is offered to<br />

employees on non-FMLA Leave-without-pay.<br />

M.2.<br />

Participants on non-FMLA Leave are entitled to, but not required to, continue the following non-health benefits…<br />

[check one]:<br />

a. N/A – non-FMLA Leave benefit continuation not allowed<br />

b. Life Insurance<br />

c. Dependent Care Spending Account<br />

d. Other…[specify] : As determined in Administrator’s discretion<br />

N. Other Elections<br />

N.1.<br />

The following additional Employer elections shall apply to the extent not in conflict with the qualification<br />

requirements of federal tax law or the provisions of the Plan… [check one]:<br />

a. Not applicable [no additional provisions elected]<br />

b. Other…[specify] :<br />

ADOPTION AGREEMENT<br />

11<br />

FLEXIBLE BENFITS PLAN

O. Employer Signatures<br />

IN WITNESS WHEREOF, the Sponsoring Employer has caused this Adoption Agreement to be adopted effective as of the date written on<br />

page 1.<br />

By executing this Adoption Agreement, the Sponsoring Employer certifies and warrants that it has relied on the advice of an attorney<br />

or other independent qualified advisor as to the legal and tax effect of adopting the Plan.<br />

Date signed: ________________________________<br />

Sponsoring Employer: <strong>CHG</strong> Companies, Inc.[same as Item<br />

C.1.A.]:<br />

By<br />

Name (Print)<br />

Its<br />

Trustee(s):<br />

N/A – Plan assets are not maintained in a Trust [Item<br />

D.4.a. elected]<br />

Date signed: ________________________________<br />

Corporate Trustee [Item D.4.b.i. elected - enter same as<br />

Item D.4.b.i.A.]:<br />

Note:<br />

Corporate Trustee signature only when Item D.4.b.1.<br />

of the Adoption Agreement has been completed and<br />

a Trust Agreement attached.<br />

By<br />

Name (Print)<br />

Its<br />

Date signed: ________________________________<br />

Individual Trustee(s) [Item D.4.b.ii. elected - enter same<br />

as Item D.4.b.ii.A.]:<br />

Note:<br />

Individual Trustee(s) signature only when Item<br />

D.4.b.2. of the Adoption Agreement has been<br />

completed and a Trust Agreement attached.<br />

ADOPTION AGREEMENT<br />

12<br />

FLEXIBLE BENFITS PLAN