Securities Prospectus Klöckner & Co SE Duisburg, Germany Deutsche ...

Securities Prospectus Klöckner & Co SE Duisburg, Germany Deutsche ...

Securities Prospectus Klöckner & Co SE Duisburg, Germany Deutsche ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Securities</strong> <strong>Prospectus</strong><br />

for the public offering and for the admission to the regulated market segment<br />

(regulierter Markt) of the Frankfurt Stock Exchange with simultaneous admission to the<br />

sub-segment of the regulated market with further post-admission obligations of the<br />

Frankfurt Stock Exchange (Prime Standard)<br />

of 33,250,000 new ordinary registered shares with no par value<br />

from the capital increase against cash contribution from authorized capital resolved by<br />

our management board on May 26, 2011 with the approval of our supervisory<br />

board on May 26, 2011<br />

with subscription rights for the shareholders of <strong>Klöckner</strong> & <strong>Co</strong> <strong>SE</strong>,<br />

each representing a proportionate amount of the issued share capital of EUR 2.50 per share<br />

with full dividend entitlement as of January 1, 2011<br />

of<br />

<strong>Klöckner</strong> & <strong>Co</strong> <strong>SE</strong><br />

<strong>Duisburg</strong>, <strong>Germany</strong><br />

— International <strong>Securities</strong> Identification Number (ISIN): DE000KC01000 —<br />

— German <strong>Securities</strong> Identification <strong>Co</strong>de (WKN): KC0100 —<br />

— <strong>Co</strong>mmon <strong>Co</strong>de: 025808576 —<br />

May 26, 2011<br />

Joint Global <strong>Co</strong>ordinators and Joint Bookrunners<br />

<strong>Deutsche</strong> Bank J.P. Morgan<br />

<strong>Co</strong>-Bookrunners<br />

COMMERZBANK HSBC The Royal Bank of Scotland UniCredit Bank AG

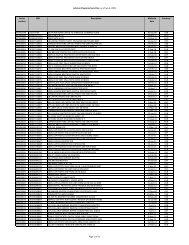

TABLE OF CONTENTS<br />

SUMMARY..................................................................... 1<br />

Overview ..................................................................... 1<br />

Our Strengths .................................................................. 3<br />

Our Strategy ................................................................... 4<br />

Use of Proceeds ................................................................ 5<br />

Selected <strong>Co</strong>nsolidated Financial and Other Operating Data ................................. 6<br />

Summary of Risk Factors ......................................................... 9<br />

Summary of the Offering. ......................................................... 10<br />

Summary of General Information on the <strong>Co</strong>mpany ....................................... 12<br />

Summary of Share Capital and Management of the <strong>Co</strong>mpany ............................... 12<br />

ZUSAMMENFASSUNG . . .......................................................... 13<br />

Überblick ..................................................................... 13<br />

Wettbewerbsstärken .............................................................. 15<br />

Strategie ...................................................................... 17<br />

Verwendung des Emissionserlöses................................................... 18<br />

Ausgewählte konsolidierte Finanz- und andere Geschäftsdaten .............................. 19<br />

Zusammenfassung der Risikofaktoren ................................................ 22<br />

Zusammenfassung des Angebots .................................................... 23<br />

Zusammenfassung allgemeiner Informationen zur Gesellschaft .............................. 25<br />

Zusammenfassung des Grundkapitals und des Managements der Gesellschaft ................... 25<br />

RISK FACTORS. ................................................................. 26<br />

Risks Related to Our Business ...................................................... 26<br />

Risks Related to the Offering. ...................................................... 36<br />

GENERAL INFORMATION ......................................................... 38<br />

Responsibility for the <strong>Co</strong>ntents of this <strong>Prospectus</strong>. ....................................... 38<br />

Documents Available for Inspection .................................................. 38<br />

Subject Matter of this <strong>Prospectus</strong> .................................................... 38<br />

Forward-Looking Statements ....................................................... 38<br />

Presentation of Sources of Market Data ............................................... 39<br />

Negative Numbers; Differences in Rounding ........................................... 39<br />

THE OFFERING ................................................................. 40<br />

General ....................................................................... 40<br />

Timetable ..................................................................... 40<br />

Subscription Offer ............................................................... 41<br />

Lock-up ...................................................................... 43<br />

Dilution ...................................................................... 43<br />

Offering Expenses and Net Proceeds of the Offering ..................................... 44<br />

Selling Restriction Notices ........................................................ 44<br />

Underwriters; Underwriting Agreement ............................................... 45<br />

Other Legal Relationships between the Underwriters and the <strong>Co</strong>mpany ........................ 45<br />

INFORMATION ABOUT THE NEW SHARES. .......................................... 46<br />

Form; Voting Rights . . . .......................................................... 46<br />

Dividend Entitlement; Share of Liquidation Proceeds ..................................... 46<br />

Admission to Stock Exchange Trading; Certification; Delivery .............................. 46<br />

ISIN; WKN; <strong>Co</strong>mmon <strong>Co</strong>de; Trading Symbol .......................................... 46<br />

Transferability; Prohibitions on Disposal .............................................. 46<br />

Notices; Paying and Registration Agent ............................................... 47<br />

Designated Sponsors . . . .......................................................... 47<br />

REASONS FOR THE OFFERING AND U<strong>SE</strong> OF PROCEEDS ............................... 48<br />

CAPITALIZATION AND INDEBTEDNESS, WORKING CAPITAL ........................... 49<br />

Capitalization .................................................................. 49<br />

Net Financial Debt .............................................................. 49<br />

<strong>Co</strong>ntingent and Indirect Liabilities ................................................... 50<br />

Statement on Working Capital ...................................................... 50<br />

EARNINGS PER SHARE AND DIVIDEND POLICY. ..................................... 51<br />

<strong>SE</strong>LECTED CONSOLIDATED FINANCIAL AND OTHER OPERATING DATA. ................. 52<br />

i

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS<br />

OF OPERATIONS .............................................................. 55<br />

Introduction ................................................................... 55<br />

Description of Key Line Items in the Income Statement ................................... 59<br />

Results of Operations for the Years 2008, 2009 and 2010 and the First Quarters of 2010 and 2011 . . . 61<br />

Liquidity and Capital Resources .................................................... 70<br />

Pension Obligations. ............................................................. 77<br />

Quantitative and Qualitative Information on Market Risks ................................. 78<br />

Critical Accounting Policies ....................................................... 78<br />

Additional Information on our Unconsolidated Financial Statements for the Financial Year 2010 ..... 82<br />

INDUSTRY ..................................................................... 83<br />

Market Overview ............................................................... 83<br />

<strong>Co</strong>mpetition ................................................................... 85<br />

Customers. .................................................................... 85<br />

Suppliers and Distribution ......................................................... 85<br />

Steel Volumes .................................................................. 85<br />

Steel Prices .................................................................... 86<br />

<strong>Co</strong>nsolidation .................................................................. 86<br />

BUSINESS. ..................................................................... 87<br />

Overview ..................................................................... 87<br />

Our History. ................................................................... 89<br />

Our Strengths .................................................................. 90<br />

Our Strategy ................................................................... 91<br />

The Acquisition of Macsteel ....................................................... 92<br />

The Acquisition of Frefer ......................................................... 93<br />

Products and Services . . .......................................................... 93<br />

Local Presence ................................................................. 96<br />

Customers. .................................................................... 100<br />

Sales and Distribution . . .......................................................... 101<br />

Inventory Management and Logistics ................................................. 101<br />

Procurement ................................................................... 101<br />

Employees .................................................................... 102<br />

Organization; Material Subsidiaries .................................................. 102<br />

Real Estate .................................................................... 103<br />

Intellectual Property Rights ........................................................ 104<br />

Environmental Matters . .......................................................... 104<br />

Insurance ..................................................................... 104<br />

LEGAL PROCEEDINGS . .......................................................... 105<br />

Fine Imposed and Additional Investigations by the French <strong>Co</strong>mpetition Authority ................ 105<br />

Investigations by the Spanish <strong>Co</strong>mpetition Authority ..................................... 105<br />

Asbestos Claims ................................................................ 105<br />

MTU Friedrichshafen GmbH/Allianz <strong>SE</strong> vs. Röhrenlager Mannheim GmbH .................... 105<br />

Xella Thermopierre S.A. vs. ODS B.V. ............................................... 106<br />

MATERIAL AGREEMENTS ........................................................ 107<br />

<strong>Co</strong>nvertible Bonds. .............................................................. 107<br />

Senior Revolving Credit Facility .................................................... 109<br />

Promissory Notes (Schuldscheindarlehen). ............................................. 111<br />

Bilateral Credit Facilities of International Subsidiaries .................................... 112<br />

ABS Programs ................................................................. 113<br />

RELATED PARTY TRANSACTIONS ................................................. 115<br />

MANAGEMENT ................................................................. 116<br />

Overview ..................................................................... 116<br />

Management Board .............................................................. 117<br />

Supervisory Board. .............................................................. 121<br />

Specific Information on the Members of the Management Board and the Supervisory Board ........ 125<br />

Shareholders’ General Meeting ..................................................... 126<br />

<strong>Co</strong>rporate Governance . . .......................................................... 127<br />

ii

GENERAL INFORMATION ON THE COMPANY ........................................ 128<br />

<strong>Co</strong>mpany Formation, Name, Registered Office and Financial Year ........................... 128<br />

Duration and Dissolution .......................................................... 128<br />

<strong>Co</strong>rporate Purpose ............................................................... 128<br />

Independent Auditors . . .......................................................... 128<br />

Disclosure Requirements for Shareholdings ............................................ 129<br />

DESCRIPTION OF SHARE CAPITAL ................................................. 131<br />

Issued Share Capital . . . .......................................................... 131<br />

Certification and Transferability of Shares ............................................. 131<br />

General Information on Capital Measures. ............................................. 131<br />

Statutory Subscription Rights. ...................................................... 132<br />

Exclusion of Minority Shareholders .................................................. 132<br />

Capital Increase for the New Shares. ................................................. 132<br />

Authorized Capital .............................................................. 132<br />

<strong>Co</strong>nditional Capital .............................................................. 134<br />

<strong>Co</strong>nvertible Bonds. .............................................................. 137<br />

Repurchase of Own Shares; Treasury Shares ........................................... 139<br />

Management and Employee Participation Plans ......................................... 140<br />

Listing ....................................................................... 140<br />

TAXATION IN THE FEDERAL REPUBLIC OF GERMANY ................................ 141<br />

Taxation of the <strong>Co</strong>mpany ......................................................... 141<br />

Taxation of Shareholders .......................................................... 142<br />

TAXATION IN LUXEMBOURG ..................................................... 148<br />

Taxation of Income Derived from and Capital Gains Realized on the Shares by Luxembourg Resident<br />

Taxpayers ................................................................... 148<br />

Taxation of Income Derived from and Capital Gains Realized on the Shares by Luxembourg Non-<br />

Resident Taxpayers . . .......................................................... 149<br />

Other Taxes ................................................................... 150<br />

FINANCIAL INFORMATION ....................................................... F-1<br />

RECENT DEVELOPMENTS AND OUTLOOK .......................................... O-1<br />

SIGNATURES ................................................................... S-1<br />

iii

[This page has been intentionally left blank]

SUMMARY<br />

The following summary is intended to be read as an introduction to this prospectus. It summarizes only selected<br />

information from the prospectus. Investors should read the entire prospectus before making an investment decision<br />

regarding the shares and subscription rights described herein. <strong>Klöckner</strong> & <strong>Co</strong> <strong>SE</strong>, <strong>Duisburg</strong>, <strong>Germany</strong> (the<br />

“<strong>Co</strong>mpany”, and together with its subsidiaries on a consolidated basis “we”, “us”, “our”, the “<strong>Klöckner</strong> & <strong>Co</strong><br />

Group”, “<strong>Klöckner</strong> & <strong>Co</strong>” or the “Group”), along with <strong>Deutsche</strong> Bank Aktiengesellschaft, Frankfurt am Main,<br />

<strong>Germany</strong>, and J.P. Morgan <strong>Securities</strong> Ltd., London, United Kingdom (the “Joint Global <strong>Co</strong>ordinators”) and<br />

COMMERZBANK Aktiengesellschaft, Frankfurt am Main, <strong>Germany</strong>, HSBC Trinkaus & Burkhardt AG, Düsseldorf,<br />

<strong>Germany</strong>, The Royal Bank of Scotland N.V. (London Branch), London, United Kingdom, and UniCredit Bank AG,<br />

Munich, <strong>Germany</strong> (together with the Joint Global <strong>Co</strong>ordinators, the “Underwriters”), assume responsibility for the<br />

content of this summary in accordance with section 5(2) sentence 3 no. 4 of the German <strong>Securities</strong> <strong>Prospectus</strong> Act<br />

(Wertpapierprospektgesetz — WpPG). We and the Underwriters can be held liable for that content, however only if<br />

the summary is misleading, inaccurate or contradictory when read in conjunction with the other portions of this<br />

prospectus. If an investor files claims in court on the basis of the information contained in this prospectus, the<br />

plaintiff investor may be required by the laws of the individual member states of the European Economic Area to<br />

bear the cost of translating the prospectus before the proceedings begin.<br />

Overview<br />

Our business<br />

We are the largest producer-independent steel and metal distributor in the combined European and North American<br />

markets measured by sales (source: Eurometal and our market data aggregation based on 2010 sales). In Europe,<br />

we are among the three largest warehousing multi-metal distributors measured by sales, including competitors that are<br />

controlled by steel or metal producers (source: Eurometal). In the United States, measured by sales, we believe that we<br />

are among the leading distributors of heavy carbon steel, our main focus in this market, and the tenth-largest<br />

warehousing multi-metal distributor overall. After giving effect to the acquisition of Macsteel, one of the leading<br />

service center companies in the United States, we believe we are the third-largest multi-metal distributor and steel<br />

service center in the United States. We operated from 246 distribution locations in 15 countries throughout Europe and<br />

North America and had 9,699 employees as of December 31, 2010. Through our recent acquisitions, we have<br />

increased our steel service center activities focused on the automotive and engineering sectors, thereby increasing our<br />

value added services with higher margin potential. Moreover, steel service centers include customers that enter into<br />

longer term master agreements providing for more stability in our business.<br />

Our main business is the distribution of steel products including service center activities (78.1% of total sales<br />

in 2010) and aluminum products (7.2% of total sales in 2010). We act as a link between producers and<br />

manufacturing customers and our position as a producer-independent supplier allows our customers to benefit<br />

from centrally coordinated purchases and from our broad local and global procurement capabilities. We purchase a<br />

range of steel and aluminum products from the producers in bulk, warehouse these products and sell and deliver<br />

them in smaller lots in accordance with our customers’ needs. We offer various value-added services, including<br />

cutting-to-length services, plasma cutting, shot-blasting, priming and bending, in particular through our increasing<br />

steel service center activities. In a number of our markets, we also distribute products other than steel and<br />

aluminum, such as non-ferrous metals and tools and industrial hardware, which in aggregate represented 14.7% of<br />

our total sales in 2010. We sell most of our products through our distribution locations. To a limited extent, we also<br />

arrange for direct sales, which involve direct shipment of products from the metal producer to our customers. Direct<br />

shipping accounted for approximately 10.8% of our sales in 2010. We usually buy and sell steel and other metals at<br />

market prices and have historically been able to pass on changes in market prices to our customers. Our sales are for<br />

the most part done on a spot basis and when we enter into long-term fixed price supply contracts with producers, we<br />

generally have corresponding sales commitments and do not engage in speculative trading.<br />

We have more than 170,000 active customers who have purchased from us during 2010. None of our customers<br />

accounted for more than 1.5% of our total sales in 2010. Our customers are mainly small and medium-sized steel<br />

consumers (and some larger customers in our steel service center business) in diverse industry sectors, such as<br />

construction, industrial machinery and equipment, on-sellers, appliances/durable goods manufacturers and automotive.<br />

We hold a wide range of inventory and are able to deliver on short notice flexible order sizes of products<br />

customized to our clients’ needs. This readily available inventory allows for one-stop shopping and, together with<br />

the reliable and timely delivery of products made possible by our extensive geographical distribution network,<br />

results in strong and loyal relationships with our customers, the majority of whom are repeat customers. With our<br />

acquisition of Becker Stahl-Service GmbH (“Becker Stahl”) in 2010, we added what is in our opinion the largest<br />

single-site steel service center in Europe to our distribution network with high flexibility to deliver on short notice<br />

1

almost all specifications covered; we also increased our purchasing power for flat steel significantly and diversified<br />

our customer base, thereby reducing the share of the construction industry. With our acquisition of Macsteel we will<br />

expand our business in the United States currently focused on long and plate products with a broad range of sheet<br />

and slit coil flat rolled steel service center products. We believe that the acquisition will in particular support our<br />

strategy to expand the flat steel product steel service center business with industrial customers.<br />

Historically, we have generally been able to pass on changes in market prices to our large and diverse customer<br />

base that is traditionally more focused on readily available inventory and reliable as well as timely delivery of<br />

flexible order sizes. Moreover, each of our distribution locations adapts its product and services offering to the<br />

requirements and demands of the local markets. For example, in our distribution locations in Switzerland we offer a<br />

wide range of hardware products to relatively small construction and mechanical engineering businesses, whereas<br />

in the United Kingdom, we offer special steel sections, known as cellular beams, to address specific construction<br />

practices in this market.<br />

Our suppliers include large steel and metal producers such as ArcelorMittal, <strong>Co</strong>rus, ThyssenKrupp, Nucor and<br />

Alcoa, as well as regional, specialized steel producers such as Riva/Ilva, Celsa, <strong>Co</strong>rrugados Gallardo and Gerdau<br />

Ameristeel. As an independent metal distributor, we are able to optimize our purchasing strategy independently and<br />

have the flexibility to source from a variety of steel and metal producers. In addition, we believe that our relatively<br />

large size, when compared to local and regional multi-metal distributors, provides us with a competitive advantage<br />

because we are generally able to negotiate volume discounts and improved payment terms with the steel and metal<br />

producers. We believe that we are an important customer for steel and metal producers because we account for a<br />

significant portion of these producers’ sales. At the same time, we are an important part of the distribution network<br />

for steel and metal producers, as we reach a customer base that steel and metal producers do for the most part not<br />

target directly, given our customers’ needs for intermittent deliveries of small quantities of customized products.<br />

Our customers also value our ability to deliver products on short notice as metal producers generally have much<br />

longer delivery times. This includes steel and metal producers with their own distribution operations, whose<br />

production capacity exceeds the capacity of their own distribution networks and their direct sales combined.<br />

Since the IPO in 2006, <strong>Klöckner</strong> & <strong>Co</strong> has transformed itself significantly. The implementation of our business<br />

optimization initiatives has resulted in stronger central control of our business, especially in the area of purchasing,<br />

product management and IT. More recently, we have launched initiatives to optimize and harmonize processes in<br />

logistics and warehousing operations. In our opinion the responsive and tight net working capital management<br />

during the financial crisis is an evidence of our optimization process. Our continuous acquisition activities have also<br />

had a significant impact on our business, reinforcing our market position in Europe and strongly expanding our<br />

footprint in the United States. In 2011 we entered the Brazilian market through the acquisition of Frefer. With the<br />

acquisitions of Becker Stahl and Macsteel we have also expanded our steel service center activities substantially,<br />

which we believe will result in a more balanced and stable business model. At the same time, we have been able to<br />

reduce our dependency on the construction industry. We plan to continue this transformation process via our<br />

<strong>Klöckner</strong> 2020 strategy outlined below.<br />

Industry overview<br />

As intermediaries between producers and purchasers of steel and metal products, metal distributors serve a key<br />

role in the market. The producers of steel and metal products primarily sell their products in large quantities and<br />

with long delivery times, while our end customers generally purchase smaller amounts and require product<br />

customization with short delivery times. For example, in 2010, the average order size of our customers was less than<br />

0.5 tons per item, while we believe that steel mills typically do not deliver in order lots of less than 10-25 tons per<br />

item and also typically require orders with six to ten weeks lead time. Metal distributors fill this gap by purchasing<br />

large quantities of goods with long delivery times from steel producers and then offering their customers short<br />

delivery times, smaller quantities, customized products and on-site delivery. At the same time, metal distributors<br />

enable their customers to maintain low stock levels, because they provide the availability of inventories on short<br />

notice. Some producers also sell small shares of their production through their own distribution channels.<br />

Steel is the most widely used metal in Europe and North America. In line with the broader market, we<br />

generated approximately 78.1% of our 2010 sales from steel products.<br />

2

Our Strengths<br />

Largest producer-independent steel and metal distributor in the combined European and North American<br />

markets<br />

As the largest manufacturer-independent steel and metal distributor in the combined European and<br />

North American markets and among the Top-3 distributors in the core European market where we are active,<br />

we believe that our size provides us with significant competitive advantages over smaller competitors. Our<br />

extensive geographic network of 246 distribution locations as of December 31, 2010 enables us to offer rapid and<br />

reliable delivery of our broad range of products and services, which allows our customers to turn to us for one-stop<br />

shopping for their metals requirements. Our customers typically value the fact that they can source all the products<br />

(flat and long steel products, aluminum, stainless, etc) they need from a single location. While our centralized<br />

sourcing enables us to obtain attractive volume discounts and improved payment terms from suppliers, we believe<br />

that the size of our distribution network with its central, regional and specialty distribution locations gives us an<br />

advantage over smaller competitors due to our ability to centralize stocks of less frequently requested products,<br />

thereby reducing overall stock levels without compromising the availability of products. In addition, we believe that<br />

our independence from steel producers enables us to be more flexible than mill-tied distributors and better able to<br />

react to changes in supply and demand in the marketplace, as we can source products from a variety of suppliers. At<br />

the same time, we are an important customer for many of our suppliers, including steel and metal producers with<br />

their own distribution operations, whose production capacity exceeds the capacity of their own distribution<br />

networks and their direct sales combined.<br />

Broad and diversified customer bases in Europe and North America<br />

We have more than 170,000 active customers who purchased from us during 2010 in the 15 countries in which<br />

we operate in Europe and North America. These customers are mainly small and medium-sized businesses, with an<br />

average order size of approximately EUR 1,200. In 2010, no single customer accounted for more than 1.5% of our<br />

total sales. We believe that in particular our smaller customers are generally less price-sensitive than large industrial<br />

users of steel that purchase directly from the steel producers (although the financial crisis has led to increased price<br />

sensitivity of our customers, too). Our customers are involved in a wide variety of industries, such as construction,<br />

industrial machinery and equipment, on-sellers, appliances/durable goods manufacturers and automotive. Through<br />

the acquisition of Becker Stahl in 2010 we have diversified our industry split and increased the share of automotive<br />

while the share of the construction industry, which has been severely hit by the financial crisis, has decreased. The<br />

acquisition of Becker Stahl also added a significant steel service center presence to our operations. We believe that<br />

the diversity of the geographies and the relatively wide range of industries in which we operate and of our customer<br />

base make us less vulnerable to regional or industry-specific downturns.<br />

Flexible business model in different economic cycles<br />

We buy steel and other metals in bulk at market prices and have generally been able to pass on price increases<br />

to our customers to whom we sell and deliver our inventories in smaller lots. Our large and diverse customer base<br />

primarily values service and availability in addition to pricing. Since we have only limited long-term purchase<br />

commitments, we can better adjust our sourcing and inventory volumes to reduced demand as we did during the<br />

economic crisis in 2008 and 2009. During that period, we significantly reduced our operating costs and our net<br />

financial debt. Among other measures, we reduced our total headcount. We believe that these actions have put us<br />

into an advantageous competitive position.<br />

Historically, we have been able to generate considerable cash flows and maintain a strong liquidity position<br />

during periods of falling demand and steel prices. Steel price decreases result in price driven losses in our<br />

inventories, but also in a reduction of our net working capital requirements due to the lower replacement cost of<br />

inventories and the lower volume of trade receivables. As a result, we generate high cash flows and enjoy a strong<br />

liquidity position at least for a significant period of time while steel prices are falling. For instance, since the<br />

beginning of the fourth quarter of 2008 until December 31, 2009, a period of rapidly falling steel prices, we reduced<br />

our working capital levels by EUR 1.083 million, or 63%, to EUR 637 million, which together with a capital<br />

increase in September 2009 enabled us to build up a cash balance of EUR 149.6 million, all as of December 31,<br />

2009. By contrast, in 2010 and the first quarter of 2011, higher steel prices and an increase in overall sales volumes<br />

led to an increase in working capital with further capital used to fund our acquisitions. While part of these funding<br />

requirements were covered by a rising operating cash flow from improved earnings, net debt increased to<br />

EUR 136.9 million as of December 31, 2010.<br />

3

Unlike a steel producer, we do not operate extensive production facilities and our comparatively low capital<br />

expenditure requirements and more flexible business model enable us to adapt more easily to a challenging<br />

environment such as the economic crisis in 2008 and 2009.<br />

Our capital structure benefits from a relatively strong equity position of 34.9% of total assets as of March 31,<br />

2011, diverse sources of working capital and other debt financing and the absence of performance based covenants<br />

from our Senior Revolving Credit Facility and ABS Programs. We believe that our comfortable capital base giving<br />

effect to this offering will position us well to take advantage of growth opportunities through acquisitions and to<br />

finance increased working capital requirements as economic conditions have improved.<br />

Experienced and proactive management with strong track record<br />

We believe that we have a dedicated, ambitious, loyal and competent management team with substantial<br />

experience in the multi-metal distribution business as well as other relevant industry experience. In years of growth,<br />

our management team has demonstrated its ability to follow a disciplined acquisition strategy and since 2006<br />

successfully acquired and integrated several new businesses. Since our IPO in 2006, our management team has also<br />

proven its capability by successfully implementing various restructuring programs which achieved significant cost<br />

reductions and optimized inventory management and sourcing strategies. For example, our management team sold<br />

the Canadian business Namasco in May 2008 (the transaction closed in July 2008), quickly responded to a<br />

challenging economic environment by initiating an immediate action program in October 2008 and expanding it in<br />

March 2009 with the goal of reducing operating costs and net financial debt as well as retaining flexible financing<br />

resources and liquidity. We also successfully restructured our Senior Revolving Credit Facility and our European<br />

ABS program by eliminating performance based covenants, executed a capital increase in difficult market<br />

conditions in 2009 and issued another long term convertible bond in 2010.<br />

Well positioned for future growth<br />

We believe that <strong>Klöckner</strong> & <strong>Co</strong> is well positioned for future growth opportunities in our established, and in<br />

prospective new markets. In our established markets, especially in Western Europe and the United States, we have<br />

in our opinion significant potential opportunities for growth over the next years. We expect the steel markets in these<br />

two regions to continue to recover and to display growth rates ahead of general gross domestic product (GDP)<br />

growth rates. We have implemented a lower cost base and leaner structures through our restructuring during the<br />

crisis in 2009, which together with our strong balance sheet following our capital market activities, has in our<br />

opinion improved our competitive position. We believe that this positions us well to take advantage of the growth<br />

opportunities compared to our smaller and less well capitalized competitors. We believe that our recent successful<br />

acquisitions, such as Becker Stahl in 2010 with its focus on profitable and stable growth steel service center<br />

activities, demonstrate the opportunities for fast and value-additive external growth in the current environment. The<br />

acquisition of Macsteel in 2011 in the United States represents a further step to implement our acquisition strategy,<br />

demonstrates our ability to act on market opportunities and we expect will further strengthen our position in the US<br />

market through a broader product offering and a higher service proportion. Besides our established markets, we see<br />

strong opportunities for growth in emerging markets and through our recent acquisition of Frefer, a Brazilian metal<br />

distributor, made a first step into this area. We believe that these initiatives position us well to achieve our strategic<br />

goal to develop <strong>Klöckner</strong> & <strong>Co</strong> into the first global multi-metal distributor.<br />

Our Strategy<br />

In October 2010, we unveiled our new long-term growth strategy, “<strong>Klöckner</strong> & <strong>Co</strong> 2020”. The upheaval<br />

created by the financial crisis and the resulting changes in economic conditions made it necessary to adjust our<br />

strategy that we had implemented largely without any changes since our IPO in 2006. The altered situation has<br />

resulted in steel consumption rates significantly below their pre-crisis levels in industrialized countries for years<br />

after the drastic collapse in 2009, while in developing countries, on the other hand, the growth trend has continued<br />

virtually uninterrupted. Against this background, we have redefined our strategy, focusing on the potential for<br />

further optimization. The strategy is based on the four pillars external growth, organic growth, business optimization<br />

and management and personnel development, highlighting prospects and guidelines for the next ten years.<br />

We want to develop <strong>Klöckner</strong> & <strong>Co</strong> into the first truly global multi-metal distributor. Subject in particular to<br />

identifying and closing suitable acquisitions, our growth targets include doubling our sales volumes in five years<br />

and tripling or quadrupling them by the year 2020.<br />

External growth: In our slower-growth European core market, we will focus on acquiring companies with<br />

higher-margin products, services, and customer segments, reducing our exposure to the construction industry. In<br />

North America, we want to significantly expand our market share, including through major acquisitions. Our recent<br />

4

acquisition of Macsteel is an important step towards that goal. Long-term, we want to secure a high growth rate by<br />

entering emerging markets, where we believe steel consumption will develop more dynamically than in established<br />

markets. We believe balancing our geographic reach will make us less exposed to different economic cycles and<br />

provide us with additional growth opportunities. We plan to focus on Brazil and China as entry points with different<br />

approaches. We have recently entered the Brazilian market through the acquisition of the Frefer group in May 2011<br />

and may consider further acquisitions of independent distributors. We will enter the Chinese market by establishing<br />

a medium-sized service center to service local subsidiaries of international companies and have recently rented the<br />

related facilities. We intend to differentiate ourselves from local competitors in China with just-in-time-delivery,<br />

added services, reliability and payment terms.<br />

Organic growth: The basic economic conditions in our core markets of Europe and North America have<br />

changed considerably. While previously we were selling into a growing market, we now face tough competition for<br />

a smaller market size. <strong>Co</strong>nsequently, we intend to significantly increase our focus on the customer to offer<br />

customized products and services to expand our market share. At the same time, we want to increase customer<br />

loyalty as well as customer benefits and intend to approach our customers more proactively, better marketing the<br />

advantages of our international network. In addition, we are going to further expand our product portfolio to include<br />

higher-margin products (focusing on sheets, plates, hollow sections, tubes and aluminum) and increase processing<br />

services offered. We believe this will make our business model less exposed to fluctuating steel prices and that<br />

integration along the value added chain should have a positive effect on our margin.<br />

Business optimization: For a global distributor such as <strong>Klöckner</strong> & <strong>Co</strong>, we believe that optimized, harmonized<br />

processes are a decisive success factor and a way of differentiating ourselves from the competition. As a<br />

result, we continue to place high priority on our efforts to optimize procurement, our logistics network and IT. We<br />

have established a new department “Operations Europe” to coordinate and monitor our various operations. By<br />

further improving our reliability and quality together with enhancing efficiency, we will seek to continue to compete<br />

by offering best in-class solutions and continuously expanding our competitive edge.<br />

Personnel and management development: As a service company, one of the main prerequisites for implementing<br />

our ambitious growth plans will be to develop our employees and managers. Well trained and motivated<br />

employees are key to our success. Therefore, we are currently developing better programs to expand significantly<br />

the training and education of our employees and senior officers, thereby making us more attractive as an employer.<br />

Use of Proceeds<br />

We estimate that the proceeds from the offering, net of underwriting fees and other offering expenses, will be<br />

approximately EUR 514.5 million. We intend to use the net proceeds of the offering, together with our current cash<br />

and future cash flow from operations, primarily to continue to pursue investment opportunities for our business, and<br />

for general corporate purposes. We expect investment opportunities to include acquisitions of other metal<br />

distributors and steel service centers, with the goal of expanding our customer base and regional product portfolios<br />

in existing and new markets. <strong>Co</strong>nsistent with our strategy, these acquisitions could be significant. With the proceeds<br />

from the offering we aim to keep our net indebtedness and our equity ratio at a level we consider to be appropriate.<br />

5

Selected <strong>Co</strong>nsolidated Financial and Other Operating Data<br />

The following tables summarize selected historical consolidated financial information for <strong>Klöckner</strong> & <strong>Co</strong> <strong>SE</strong><br />

as of and for the years ended December 31, 2008, 2009 and 2010 and the three month periods ended March 31, 2010<br />

and 2011, all in accordance with IFRS as adopted by the EU. The summary historical consolidated financial<br />

information for the years ended December 31, 2008, 2009 and 2010 has been derived from <strong>Klöckner</strong> & <strong>Co</strong> <strong>SE</strong>’s<br />

audited consolidated financial statements for such periods, which have been audited by KPMG Hartkopf + Rentrop<br />

Treuhand KG Wirtschaftsprüfungsgesellschaft, <strong>Co</strong>logne, <strong>Germany</strong> (for the financial years ended December 31,<br />

2008 and 2009), and KPMG AG Wirtschaftsprüfungsgesellschaft, Berlin, <strong>Germany</strong> (for the financial year ended<br />

December 31, 2010), and the summary historical consolidated financial information for the three month periods<br />

ended March 31, 2010 and 2011 has been derived from <strong>Klöckner</strong> & <strong>Co</strong> <strong>SE</strong>’s unaudited interim consolidated<br />

financial statements for such periods. In our consolidated financial statements for the year ended December 31,<br />

2009, certain comparison amounts relating to the income statement for the year ended December 31, 2008 have<br />

been amended from the amounts reported in the relevant historical consolidated financial statements due to the<br />

initial application of IFRIC 14. IFRIC 14 provides general guidance on how to assess the limit IAS 19 places on the<br />

amount of the surplus of a pension plan that can be recognized as an asset. In the tables below, amounts derived from<br />

the consolidated income statement and balance sheet data for the years 2008 and 2009 include such adjusted<br />

numbers.<br />

Years ended December 31, Three months ended March 31<br />

2008 2009 2010 2010 2011<br />

(unaudited) (unaudited)<br />

(in thousands of EUR)<br />

Selected data from the consolidated<br />

income statement<br />

Sales ........................... 6,749,595 3,860,493 5,198,181 1,048,841 1,586,799<br />

Other operating income .............. 371,182 127,359 35,822 8,028 8,475<br />

Change in inventory (1) ............... 10,832 (8,661) (7,383) (698) 7,342<br />

Own work capitalized ............... 73 10 39 5 —<br />

<strong>Co</strong>st of materials . . . ................ (5,394,417) (3,206,830) (4,054,830) (812,538) (1,241,008)<br />

Personnel expenses . ................<br />

Depreciation, amortization and<br />

(546,017) (441,184) (486,618) (111,180) (131,520)<br />

impairments .................... (67,372) (109,638) (85,783) (18,393) (18,653)<br />

thereof impairment losses. .......... — (41,782) — — —<br />

Other operating expenses. ............ (590,612) (399,684) (447,442) (103,372) (125,589)<br />

Operating result .................. 533,264 (178,135) 151,986 10,693 85,846<br />

Income from investments. ............ — 2 5 — —<br />

Financial result ................... (69,782) (61,699) (67,650) (15,156) (19,350)<br />

Income before taxes. ............... 463,482 (239,832) 84,341 (4,463) 66,496<br />

Income taxes. .....................<br />

Net income attributable to minority<br />

(79,308) 54,168 (4,129) 6,194 (22,350)<br />

interests .......................<br />

Net income attributable to <strong>Klöckner</strong> &<br />

(14,161) 2,820 2,671 565 684<br />

<strong>Co</strong> <strong>SE</strong> shareholders ............... 398,335 (188,484) 77,541 1,166 43,462<br />

Net income ......................<br />

Selected data from the consolidated<br />

balance sheets<br />

384,174 (185,664) 80,212 1,731 44,146<br />

Non-current assets. ................<br />

Of which<br />

811,727 711,916 855,961 859,633 806,859<br />

Intangible assets ................. 235,931 194,985 227,323 244,053 210,797<br />

Property, plant and equipment ....... 479,421 426,151 524,169 506,279 507,376<br />

Current assets ....................<br />

Of which<br />

2,272,041 2,000,846 2,635,134 2,181,046 2,973,352<br />

Inventories ..................... 1,000,612 570,918 898,841 798,354 1,043,235<br />

Trade receivables ................ 798,618 464,266 703,101 689,512 924,641<br />

Cash and cash equivalents (2) ........ 296,636 826,517 934,955 614,559 927,931<br />

Total assets ...................... 3,083,768 2,712,762 3,491,095 3,040,679 3,780,211<br />

6

Years ended December 31,<br />

Three months ended March<br />

31<br />

2008 2009 2010 2010 2011<br />

(unaudited) (unaudited)<br />

(in thousands of EUR)<br />

Equity (including minority interests). .. 1,081,352 1,123,263 1,290,494 1,137,412 1,318,158<br />

Non-current liabilities ..............<br />

Of which<br />

Provisions for pensions and similar<br />

1,176,576 926,758 1,361,392 1,001,346 1,406,748<br />

obligations. ...................<br />

Other provisions (including deferred<br />

180,095 174,598 174,442 177,143 173,486<br />

tax liabilities) ................. 123,797 102,316 111,423 103,538 101,459<br />

Financial liabilities ............... 813,000 618,744 1,020,582 668,448 1,097,112<br />

Current liabilities .................<br />

Of which<br />

825,840 662,741 839,209 901,921 1,055,305<br />

Other provisions ................. 284,766 109,868 107,259 107,588 101,928<br />

Financial liabilities ............... 48,112 52,169 39,578 90,776 45,935<br />

Other liabilities .................. 81,640 51,650 76,120 60,347 78,951<br />

Trade payables .................. 392,183 398,387 584,614 620,038 804,704<br />

Total equity and liabilities ...........<br />

Selected data from the consolidated cash<br />

flow statement<br />

3,083,768 2,712,762 3,491,095 3,040,679 3,780,211<br />

Cash flow from operating activities ..... 186,884 564,662 35,188 (60,366) (69,370)<br />

Cash flow from investing activities ..... 72,090 (8,032) (187,748) (127,313) (5,318)<br />

Cash flow from financing activities ..... (123,439) (23,848) 251,974 (26,196) 70,616<br />

Changes in cash and cash equivalents ..<br />

Other selected financial data and<br />

business information (unaudited)<br />

135,535 532,782 99,414 (213,875) (4,072)<br />

Tons shipped (in thousands of tons) ..... 5,974 4,119 5,314 1,180 1,498<br />

Gross profit (3) ..................... 1,366,083 645,012 1,136,007 235,610 353,133<br />

(4) (5)<br />

EBITDA .................... 600,636 (68,495) 237,774 29,086 104,499<br />

EBITDA, adjusted (6) ................ 406,491 — — — —<br />

Basic earnings per Share (IFRS) in EUR . . 8.56 (3.61) 1.17 0.02 0.65<br />

Capital expenditures (7) ............... 48,111 25,023 26,976 3,966 6,011<br />

Total financial liabilities ............. 861,112 670,913 1,060,160 759,224 1,143,047<br />

Financing costs .................... 6,312 5,977 11,669 5,263 12,186<br />

Total debt (8) ...................... 867,424 676,890 1,071,829 764,487 1,155,233<br />

Net financial debt (9)<br />

................ 570,788 (149,627) 136,874 149,928 227,302<br />

(1) Change in inventory represents the difference in the amount of work in progress and finished goods at period end compared to the beginning<br />

of the period, adjusted for currency effects. Most of our inventory consists of merchandise, changes of which are not reflected in this item,<br />

but included in cost of materials.<br />

(2) Cash and cash equivalents include cash, cash equivalents and marketable securities and, for the year ended December 31, 2008,<br />

EUR 3.105 million in restricted cash.<br />

(3) Gross profit represents sales plus change in inventories and capitalized expenses for own work, less cost of materials.<br />

(4) EBITDA represents net income plus financial result, income taxes, depreciation and amortization and impairment losses for the relevant<br />

period. EBITDA is not a recognized term under IFRS and does not purport to be an alternative to data from the income or cash flow statement<br />

prepared in accordance with IFRS. We are not presenting EBITDA here as a measure of our operating results. Our management believes that<br />

the presentation of EBITDA is helpful to investors as a measure of our ability to generate cash and to service debt. However, you should not<br />

construe EBITDA as an alternative to net income determined in accordance with IFRS or to cash flows from operating activities, investing<br />

activities or financing activities as a measure of cash flows. In particular, an increase in EBITDA may be accompanied by increased working<br />

capital requirements, whereas a decreased EBITDA may be accompanied by a working capital release. However, there is no uniform<br />

definition of EBITDA, which means that EBITDA shown by other companies may not necessarily be comparable with EBITDA of the<br />

<strong>Klöckner</strong> & <strong>Co</strong> Group.<br />

7

(5) The following calculation shows a reconciliation of net income to EBITDA:<br />

Years ended December 31,<br />

Three months ended<br />

March 31<br />

2008 2009 2010 2010 2011<br />

(unaudited)<br />

(in thousands of EUR)<br />

(unaudited)<br />

Net income . .................................... 384,174 (185,664) 80,212 1,731 44,146<br />

Income taxes . . . ............................... 79,308 (54,168) 4,129 (6,194) 22,350<br />

Financial result . . ...............................<br />

Amortization on intangible assets and depreciation of property,<br />

69,782 61,699 67,650 15,156 19,350<br />

plant and equipment and impairment losses thereon . . ...... 67,372 109,638 85,783 18,393 18,653<br />

EBITDA ....................................... 600,636 (68,495) 237,774 29,086 104,499<br />

(6) EBITDA, adjusted, for the year ended December 31, 2008, excludes gains of approximately EUR 273.4 million from divestitures in 2008,<br />

and adds back the net effect of EUR 79.3 million in 2008 of a French antitrust fine.<br />

(7) Capital expenditures represent payments for intangible assets, property, plant and equipment.<br />

(8) Total debt before deduction of financing costs.<br />

(9) Net financial debt represents current and non-current financial liabilities before deduction of financing costs less cash and cash equivalents.<br />

8

Summary of Risk Factors<br />

The <strong>Klöckner</strong> & <strong>Co</strong> Group is subject to a number of risk factors that could adversely affect its business,<br />

financial condition and results of operations. The following is a summary of these risks.<br />

Risks Related to Our Business<br />

Given the dependence of our industry on global economic conditions, the recent global economic crisis has<br />

materially and adversely affected our business, results of operations and financial condition, and a continued<br />

economic recovery will be important for the future of our business.<br />

Our financial condition and results of operations depend in large part on the prices for metals. These prices<br />

are inherently volatile, and rapid price changes could materially and adversely affect our profitability and<br />

cash flow.<br />

A failure to manage our working capital successfully could materially and adversely affect our profitability<br />

and liquidity.<br />

We service customers in industries that are cyclical and potentially significantly affected by economic<br />

conditions, including the economic crisis, and downturns in these industries are reducing our sales and<br />

profitability.<br />

Our business is very competitive and increased competition as well as further consolidation could impact our<br />

sales and profitability.<br />

The global economic crisis had a negative impact on our customers, including the risk of insolvency, which<br />

in turn has materially and adversely affected our results of operations and financial position.<br />

Our financial condition and results of operations may be materially and adversely affected if we are unable to<br />

control our operating costs.<br />

Currency and interest rate fluctuations may have a material impact on our financial condition and results of<br />

operations.<br />

Our acquisition strategy exposes us to risks; we may not be able to identify, finance, manage or integrate<br />

recent and future acquisitions, and acquisitions may prove to be unsuccessful, which could adversely affect<br />

our growth and profitability.<br />

In the course of our acquisitions, we have capitalized significant intangible assets which are subject to<br />

amortization and impairment tests.<br />

Our competitive position depends on our management team, and a loss of important members of our<br />

management team could have a material adverse effect on our business.<br />

We are subject to risks and uncertainties in the countries in which we operate and in new markets into which<br />

we may expand.<br />

Lead time in obtaining our supplies and the cost of our products could increase if we were to lose one of our<br />

primary suppliers.<br />

Damage to or delays in the upgrade of our information technology infrastructure could harm our business.<br />

Investigations by competition authorities and damage claims from third parties for violations of applicable<br />

antitrust laws could adversely affect our financial condition and results of operations.<br />

Strikes or other labor-related conflicts at the <strong>Klöckner</strong> & <strong>Co</strong> Group, in the steel or metal industries or in<br />

certain customer industries could have an adverse effect on our business.<br />

We could incur substantial costs in order to comply with, or to address any violations of or liabilities under,<br />

environmental laws, both in Europe and in North America, that could significantly increase our operating<br />

expenses and negatively affect our financial condition and results of operations.<br />

We have significant liabilities with respect to our pension plans and the actual costs of our pension plan<br />

obligations could exceed current estimates.<br />

If costs arising in connection with our intra-group restructurings and financings are not recognized for tax<br />

purposes, or if tax or social security authorities assert subsequent claims on other grounds, this could have a<br />

material adverse effect on the financial condition and results of operations of the <strong>Klöckner</strong> & <strong>Co</strong> Group.<br />

9

Our insurance policies provide limited coverage, potentially leaving us uninsured against some business<br />

risks.<br />

We may face significant product liability or warranty claims that may be costly, and which could negatively<br />

affect our financial condition and results of operations, and create adverse publicity.<br />

If we fail to meet our obligations under our financing agreements, our creditors could declare all amounts<br />

owed to them due and payable, which could lead to liquidity constraints.<br />

We may incur significant indebtedness, which may impair our financial and operating flexibility.<br />

Our ability to generate sufficient cash to service our debt depends on many factors beyond our control.<br />

Lack of available funding and higher costs for funding in the difficult current credit conditions may have a<br />

material impact on our financial condition and results of operations.<br />

Volatility in the commercial paper market and the solvency of certain financial institutions may affect<br />

funding costs or our ability to receive cash under our ABS Programs.<br />

We are subject to restrictive debt covenants, which may limit our operating flexibility.<br />

<strong>Klöckner</strong> & <strong>Co</strong> <strong>SE</strong> is a holding company and dependent on dividend payments from its subsidiaries,<br />

affecting its own ability to pay dividends.<br />

Risks Related to the Offering<br />

The capital markets and the price of our shares have been and may continue to be volatile.<br />

The holdings of shareholders who do not participate in this offering will be diluted.<br />

If the offering is not completed, or if our share price significantly decreases, the subscription rights could<br />

become worthless.<br />

It is not certain that an active trading market will develop for the subscription rights. If such trading does<br />

develop, the subscription rights may be subject to greater price fluctuations than our shares.<br />

If shareholders sell a large volume of our shares, this could cause significant downward pressure on the price<br />

of our shares.<br />

Summary of the Offering<br />

Subscription offer ................ OurmanagementboardresolvedonMay26,2011,withtheapprovalof<br />

the supervisory board on May 26, 2011, to increase our issued share<br />

capital by EUR 83,125,000 from EUR 166,250,000 to EUR 249,375,000,<br />

under the authorization granted in Section 4, para. 5a of our articles of<br />

association, by issuing 33,250,000 new ordinary registered shares with no<br />

par value (the “New Shares”). The New Shares carry full dividend rights<br />

from January 1, 2011.<br />

The New Shares are being subscribed for by the Underwriters, who, in<br />

accordance with section 186 (5) sentence 1 of the German Stock<br />

<strong>Co</strong>rporation Act (Aktiengesetz — AktG), have undertaken to offer<br />

them for subscription to our shareholders. 2 subscription rights entitle<br />

their holder to subscribe for 1 New Share.<br />

The registration of the capital increase in the commercial register of<br />

the local court of <strong>Duisburg</strong> is scheduled for June 8, 2011.<br />

Exercise of subscription rights. ...... Shareholders will be requested, through the publication of the subscription<br />

offer scheduled for May 26, 2011, to exercise their subscription<br />

rights during the subscription period from May 27, 2011,<br />

through June 9, 2011 (in each case including such dates), to avoid<br />

being excluded from exercising those rights.<br />

Shareholders may subscribe for 1 New Share of the <strong>Co</strong>mpany for<br />

every 2 existing shares, at the subscription price.<br />

10

Subscription price ................ Thesubscription price per New Share is EUR 15.85. The subscription<br />

price must be paid no later than June 9, 2011.<br />

Trading of subscription rights ....... Thesubscription rights (ISIN DE 000A1KRDK2) for the New Shares<br />

will be traded during the period from May 27, 2011 up to and<br />

including June 7, 2011 on the regulated market (XETRA Frankfurt<br />

Specialist) of the Frankfurt Stock Exchange. From May 27, 2011<br />

onward, our existing shares will be quoted on the Frankfurt Stock<br />

Exchange without subscription rights (ex Bezugsrecht). <strong>Deutsche</strong><br />

Bank Aktiengesellschaft may effect suitable transactions to provide<br />

liquidity for fair and orderly trading in subscription rights.<br />

Lock-up ........................ In the underwriting agreement signed on May 26, 2011, we have<br />

agreed with the Underwriters that, to the extent legally permissible, we<br />

will not, without the prior consent of the Joint Global <strong>Co</strong>ordinators,<br />

which may not be unreasonably withheld or delayed, for a period of<br />

six months from the date of first trading of the New Shares, issue or,<br />

directly or indirectly, sell, offer, contract to sell, or otherwise transfer<br />

or dispose of, pledge or create or grant another security interest in any<br />

of our shares, options on such shares, or securities that can be converted<br />

into or exchanged for such shares or that carry rights to acquire<br />

such shares. With certain exceptions, we also agreed not to announce<br />

any capital increase from authorized capital, or to initiate a capital<br />

increase, or to enter into other transactions the economic effect of<br />

which would be similar to that of the measures described above.<br />

Listing/Admission to stock exchange<br />

trading ......................... Allofourordinary registered shares are admitted to trading on the<br />

regulated market (regulierter Markt) of the Frankfurt Stock Exchange<br />

and to the sub-segment of the regulated market with further postadmission<br />

obligations of the Frankfurt Stock Exchange (Prime<br />

Standard).<br />

The New Shares are expected to be admitted to the regulated market of<br />

the Frankfurt Stock Exchange, with simultaneous admission to the<br />

sub-segment of the regulated market with further post-admission<br />

obligations of the Frankfurt Stock Exchange (Prime Standard), on<br />

June 9, 2011. We plan to have all of the New Shares included in the<br />

existing quotation of the listed shares of <strong>Klöckner</strong> & <strong>Co</strong> <strong>SE</strong> on<br />

June 10, 2011.<br />

Delivery and settlement ............ The New Shares will be represented by a global share certificate<br />

deposited with Clearstream Banking AG, Mergenthalerallee 61,<br />

65760 Eschborn, <strong>Germany</strong>. Subscribers or purchasers will be credited<br />

for their New Shares in their collective securities account. Shareholders<br />

are not entitled to receive individual share certificates.<br />

ISIN, WKN, <strong>Co</strong>mmon <strong>Co</strong>de, trading<br />

symbol for the existing and the New<br />

Shares ......................... International<strong>Securities</strong> Identification Number (ISIN): DE000KC01000<br />

German <strong>Securities</strong> Identification <strong>Co</strong>de (WKN): KC0100<br />

<strong>Co</strong>mmon <strong>Co</strong>de: 025808576<br />

Trading symbol: KCO<br />

ISIN, WKN for the Subscription<br />

Rights ......................... ISIN DE000A1KRDK2 / WKN A1K RDK<br />

11

Summary of General Information on the <strong>Co</strong>mpany<br />

Registered office and fiscal year of the<br />

<strong>Co</strong>mpany ....................... The<strong>Co</strong>mpany has its registered office in <strong>Duisburg</strong> and is registered<br />

under HRB 20486 in the commercial register maintained by the local<br />

court of <strong>Duisburg</strong>. Its headquarters are located at Am Silberpalais 1,<br />

47057 <strong>Duisburg</strong>, <strong>Germany</strong>, tel. +49-203-307-0.<br />

The <strong>Co</strong>mpany’s financial year is the calendar year.<br />

Statutory auditor ................. KPMGAGWirtschaftsprüfungsgesellschaft, Berlin, <strong>Germany</strong>.<br />

Summary of Share Capital and Management of the <strong>Co</strong>mpany<br />

Issued share capital ...............<br />

Management board and supervisory<br />

Ourissued share capital as recorded in the commercial register as of<br />

the date of this prospectus amounts to EUR 166,250,000, divided into<br />

66,500,000 ordinary registered shares. The shares are issued as no par<br />

value shares, each such share with a notional value of EUR 2.50.<br />

Following the implementation of the capital increase, our issued share<br />

capital will amount to EUR 249,375,000, divided into 99,750,000 ordinary<br />

registered shares.<br />

board .......................... Ourmanagement board consists of two members as of the date of this<br />

prospectus: Gisbert Rühl (Chairman) and Ulrich Becker.<br />

Our supervisory board consists of six members. The chairman of the<br />

supervisory board is Prof. Dr. Dieter H. Vogel.<br />

Major shareholders ............... Based on the notifications that we have received in accordance with<br />

the German <strong>Securities</strong> Trading Act (Wertpapierhandelsgesetz<br />

—WpHG) as of the date of this prospectus, the following shareholders<br />

hold a significant direct or indirect interest in the <strong>Co</strong>mpany within the<br />

meaning of sections 21 et seq. of the German <strong>Securities</strong> Trading Act:<br />

Norges Bank (Central Bank of Norway) — 1.84% of our voting<br />

rights;<br />

Amundi S.A. — 3.03% of our voting rights.<br />

12

ZUSAMMENFASSUNG<br />

Die folgende Zusammenfassung ist als Einführung zu diesem Prospekt zu verstehen. Sie enthält nur bestimmte,<br />

ausgewählte Informationen aus dem Prospekt. Anleger sollten den gesamten Prospekt lesen, bevor sie eine<br />

Anlageentscheidung hinsichtlich der in diesem Prospekt beschriebenen Aktien oder Bezugsrechte treffen. Die<br />

<strong>Klöckner</strong> & <strong>Co</strong> <strong>SE</strong>, <strong>Duisburg</strong>, Deutschland (die “Gesellschaft” und gemeinsam mit ihren konsolidierten Tochtergesellschaften<br />

“wir”, “uns”, “unsere”, die “<strong>Klöckner</strong> & <strong>Co</strong> Gruppe”, “<strong>Klöckner</strong> & <strong>Co</strong>” oder die “Gruppe”)<br />

sowie die <strong>Deutsche</strong> Bank Aktiengesellschaft, Frankfurt am Main, Deutschland, und J.P. Morgan <strong>Securities</strong> Ltd.,<br />

London, Großbritannien (die “Joint Global <strong>Co</strong>ordinators”) sowie die COMMERZBANK Aktiengesellschaft,<br />

Frankfurt am Main, Deutschland, HSBC Trinkaus & Burkhardt AG, Düsseldorf, Deutschland, The Royal Bank<br />

of Scotland N.V. (London Branch), London, Großbritannien, und die UniCredit Bank AG, München, Deutschland<br />

(zusammen mit den Joint Global <strong>Co</strong>ordinators die “Konsortialbanken”) übernehmen die Verantwortung für den<br />

Inhalt dieser Zusammenfassung gemäß § 5 Abs. 2 Satz 3 Nr. 4 Wertpapierprospektgesetz. Die Gesellschaft und die<br />

Konsortialbanken können für den Inhalt der Zusammenfassung haftbar gemacht werden, jedoch nur falls die<br />

Zusammenfassung irreführend, unrichtig oder widersprüchlich ist, wenn sie zusammen mit den anderen Teilen<br />

dieses Prospekts gelesen wird. Für den Fall, dass vor einem Gericht Ansprüche aufgrund der in diesem Prospekt<br />

enthaltenen Informationen geltend gemacht werden, könnte der als Kläger auftretende Anleger in Anwendung<br />

einzelstaatlicher Rechtsvorschriften der Staaten des Europäischen Wirtschaftsraums die Kosten für die Übersetzung<br />

des Prospekts vor Prozessbeginn zu tragen haben.<br />

Überblick<br />

Geschäftstätigkeit<br />

<strong>Klöckner</strong> & <strong>Co</strong> ist der größte produzentenunabhängige Stahl- und Metalldistributeur im europäischen und<br />

nordamerikanischen Gesamtmarkt (Quelle: Eurometal und unsere Zusammenführung von Marktdaten unter<br />

Zugrundelegung der Umsätze aus 2010). In Europa gehören wir gemessen am Umsatz zu den drei größten<br />

lagerhaltenden Multi-Metalldistributeuren, eingeschlossen Wettbewerber, die von Stahl- oder Metallherstellern<br />

kontrolliert werden (Quelle: Eurometal). Wir sind der Auffassung, dass wir in den Vereinigten Staaten gemessen am<br />

Umsatz zu den führenden Distributeuren für schweren Carbonstahl, unserem Hauptgeschäftsfeld in diesem Markt,<br />

zählen und dass wir dort insgesamt der 10. größte lagerhaltende Multi-Metallhändler sind. Im Anschluss an unsere<br />

Akquisition von Macsteel, eines der führenden Servicecenter-Unternehmen in den Vereinigten Staaten, sind wir<br />

unserer Auffassung nach der drittgrößte Multi-Metalldistributeur und Stahl Servicecenter in den Vereinigten<br />

Staaten. Zum 31. Dezember 2010 betrieben wir 246 Distributionsstandorte in 15 Ländern in Europa und Nordamerika<br />

und hatten zu diesem Datum 9.699 Mitarbeiter. Durch unsere jüngsten Akquisitionen haben wir unsere<br />

Stahl-Servicecenter-Aktivitäten und damit unsere Mehrwert steigernden Dienstleistungen mit potentiell höheren<br />

Gewinnspannen mit Fokus auf die Automobilindustrie und den Maschinen- und Anlagenbau ausgebaut. Stahl-<br />

Servicecenter haben darüber hinaus Kunden, mit denen sie langfristige Rahmenvereinbarungen abschließen, was zu<br />

einer größeren Stabilität für unser Geschäft führt.<br />

Unser Kerngeschäft ist die Distribution von Stahlprodukten einschließlich Stahl Servicecenter-Aktivitäten<br />

(78,1% des Gesamtumsatzes im Jahr 2010) und Aluminiumprodukten (7,2% des Gesamtumsatzes im Jahr 2010).<br />

Wir verbinden Hersteller und weiterverarbeitende Kunden, und unsere Position als herstellerunabhängiger<br />

Lieferant ermöglicht es unseren Kunden, von zentral koordinierten Einkäufen und von unseren breiten lokalen<br />

und globalen Lieferkapazitäten zu profitieren. Wir kaufen eine Reihe von Stahl- und Aluminiumprodukten in<br />

großen Mengen von den Herstellern, lagern diese Produkte und verkaufen und liefern sie dann in kleineren Mengen,<br />

die den Bedürfnissen unserer Kunden entsprechen. Wir bieten kundenspezifische Dienstleistungen wie Sägen,<br />

Plasma- und Brennschneiden, Sandstrahlen, Primern und Biegen vor allem durch unsere zunehmenden Stahl-<br />

Servicecenter-Aktivitäten an. In einigen der Märkte, in denen wir tätig sind, handeln wir auch mit anderen<br />

Produkten als Stahl und Aluminium, z.B. Nicht-Eisen-Metallen, Werkzeugen und Industriemetallwaren, die im<br />

Jahr 2010 zusammen 14,7% unseres Gesamtumsatzes ausmachten. Die meisten unserer Produkte verkaufen wir<br />

über unsere Distributionsstandorte. Zu einem kleineren Teil vermitteln wir auch Direktverkäufe, bei denen die<br />

Produkte direkt vom Metallhersteller an unsere Kunden geliefert werden. Direktverkäufe machten im Jahr 2010<br />

ungefähr 10,8% unseres Umsatzes aus. Wir kaufen und verkaufen Stahl und andere Metalle üblicherweise zu<br />

Marktpreisen und konnten Änderungen der Marktpreise in der Vergangenheit zumeist an unsere Kunden weitergeben.<br />

Der überwiegende Teil unserer Umsätze basiert auf kurzfristigen Handelgeschäften; soweit wir langfristige<br />

Lieferverträge zu Festpreisen mit Herstellern eingehen, stehen dem grundsätzlich korrespondierende<br />

Verkaufsverpflichtungen gegenüber und wir gehen keine spekulativen Geschäfte ein.<br />

Wir haben mehr als 170.000 aktive Kunden, die im Jahr 2010 von uns gekauft haben. Mit keinem unserer<br />

Kunden erzielten wir im Jahr 2010 mehr als 1,5% unseres Gesamtumsatzes. Unsere Kunden sind überwiegend<br />

13

kleinere und mittlere Stahlkonsumenten (und einige Großkunden in unserem Stahl Servicecenter Geschäft) aus<br />

verschiedenen Industriezweigen, wie der Bauindustrie, dem Maschinen- und Anlagenbau, dem Handel, der<br />

Produktion von Haushaltsgeräten und Gebrauchsgütern und der Automobilindustrie.<br />

Wir halten ein weit gefächertes Sortiment vor und sind in der Lage, Produkte in flexiblen Bestellgrößen, die<br />

auf die Bedürfnisse unserer Kunden zugeschnitten sind, kurzfristig zu liefern. Dieses rasch verfügbare Sortiment<br />

macht ein One-Stop-Shopping möglich. Zusammen mit der zuverlässigen und pünktlichen Lieferung der Produkte,<br />

die unser geografisch weit verzweigtes Distributions-Netzwerk ermöglicht, hat dies eine hohe Kundenloyalität zur<br />

Folge; die Mehrheit unserer Kunden kauft wiederholt bei uns ein. Mit der Akquisition von Becker Stahl-<br />

Service GmbH (“Becker Stahl”) in 2010 haben wir unser Distributions-Netzwerk um das nach unserer Ansicht<br />

größte an einem Standort befindliche europäische Stahl Service-Center ergänzt, das eine hohe Flexibilität bietet,<br />

auch kurzfristig Lieferungen mit fast allen Spezifikationen anzubieten. Wir haben außerdem unsere Einkaufsposition<br />

für Flachstahl wesentlich verbessert und unsere Kundenbasis weiter diversifiziert, indem wir insbesondere<br />

den Anteil der Bauindustrie reduziert haben. Mit unserer Akquisition von Macsteel werden wir unser in den<br />

Vereinigten Staaten bisher auf Langprodukte und Grobbleche fokussiertes Produktprogramm um ein breites<br />