Business Tax Act, 1987 - Seychelles Revenue Commission

Business Tax Act, 1987 - Seychelles Revenue Commission

Business Tax Act, 1987 - Seychelles Revenue Commission

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

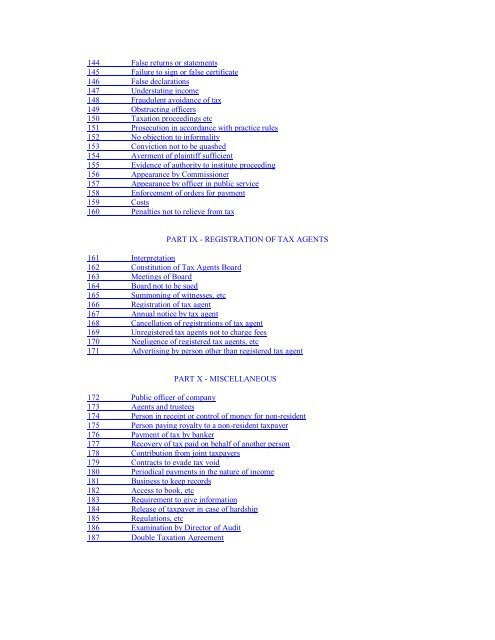

144 False returns or statements<br />

145 Failure to sign or false certificate<br />

146 False declarations<br />

147 Understating income<br />

148 Fraudulent avoidance of tax<br />

149 Obstructing officers<br />

150 <strong>Tax</strong>ation proceedings etc<br />

151 Prosecution in accordance with practice rules<br />

152 No objection to informality<br />

153 Conviction not to be quashed<br />

154 Averment of plaintiff sufficient<br />

155 Evidence of authority to institute proceeding<br />

156 Appearance by <strong>Commission</strong>er<br />

157 Appearance by officer in public service<br />

158 Enforcement of orders for payment<br />

159 Costs<br />

160 Penalties not to relieve from tax<br />

PART IX - REGISTRATION OF TAX AGENTS<br />

161 Interpretation<br />

162 Constitution of <strong>Tax</strong> Agents Board<br />

163 Meetings of Board<br />

164 Board not to be sued<br />

165 Summoning of witnesses, etc<br />

166 Registration of tax agent<br />

167 Annual notice by tax agent<br />

168 Cancellation of registrations of tax agent<br />

169 Unregistered tax agents not to charge fees<br />

170 Negligence of registered tax agents, etc<br />

171 Advertising by person other than registered tax agent<br />

PART X - MISCELLANEOUS<br />

172 Public officer of company<br />

173 Agents and trustees<br />

174 Person in receipt or control of money for non-resident<br />

175 Person paying royalty to a non-resident taxpayer<br />

176 Payment of tax by banker<br />

177 Recovery of tax paid on behalf of another person<br />

178 Contribution from joint taxpayers<br />

179 Contracts to evade tax void<br />

180 Periodical payments in the nature of income<br />

181 <strong>Business</strong> to keep records<br />

182 Access to book, etc<br />

183 Requirement to give information<br />

184 Release of taxpayer in case of hardship<br />

185 Regulations, etc<br />

186 Examination by Director of Audit<br />

187 Double <strong>Tax</strong>ation Agreement