First Gen corporation | 2011 annual report

First Gen corporation | 2011 annual report

First Gen corporation | 2011 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>First</strong> <strong>Gen</strong> <strong>corporation</strong> | <strong>2011</strong> Annual <strong>report</strong><br />

<strong>2011</strong> Annual Report<br />

a

Financial Highlights 1<br />

Why <strong>First</strong> <strong>Gen</strong>? 2<br />

Portfolio of Assets 4<br />

<strong>2011</strong> By the Numbers 5<br />

Chairman’s Message 6<br />

President’s Report 10<br />

Business Review<br />

Natural Gas 16<br />

Geothermal 20<br />

Hydro 24<br />

Corporate Social Responsibility 28<br />

Board of Directors 34<br />

Management Committee 38<br />

Corporate Governance 40<br />

Statement of Management’s<br />

Responsibility for Financial Statements 44<br />

Independent Auditor’s Report 45<br />

Financial Statements 46<br />

Corporate Structure 162<br />

Glossary of Terms 163<br />

Corporate Directory 164<br />

Shareholder Information<br />

IBC<br />

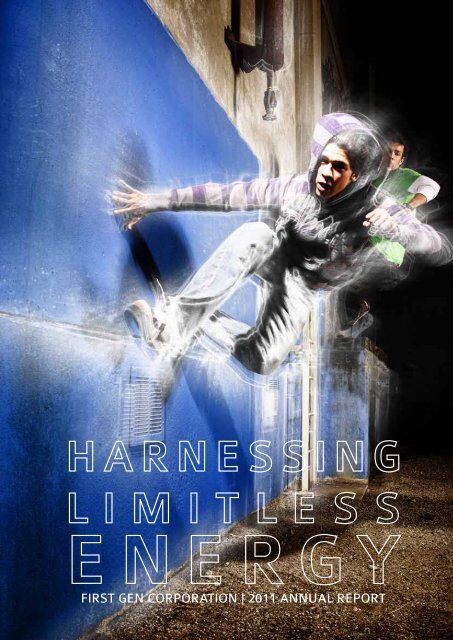

ABOUT OUR COVER<br />

The cover photo is of a young<br />

man doing parkour. This discipline<br />

shows lots of energy and directed<br />

or calculated moves that find new<br />

paths, avoiding obstacles to get to<br />

its desired goal.<br />

FIRST GEN CORPORATION | <strong>2011</strong> ANNUAL REPORT<br />

OUR VISION<br />

<strong>First</strong> <strong>Gen</strong> desires to enhance its position as the leading world-class Filipino energy company. <strong>First</strong> <strong>Gen</strong> aims to deliver cost-effective and<br />

reliable energy services to customers. <strong>First</strong> <strong>Gen</strong> will rise to the challenges of world-class competition.<br />

OUR MISSION<br />

TO BE THE PREFERRED PROVIDER: We are committed to be the preferred provider of energy services. In performing our role as the<br />

preferred provider, we will acquire, develop, finance, operate, and maintain our investments with the single-minded focus on delivering<br />

superior services to our customers.<br />

TO BE THE PREFERRED EMPLOYER: We are a company of talented, dynamic, highly motivated, and fun-loving individuals. We<br />

provide a work environment that encourages innovative and entrepreneurial employees to build our business. We retain and attract<br />

talent by offering competitive benefits and compensation packages as well as professional development.<br />

TO BE THE PREFERRED INVESTMENT: We strive to grow the business and enhance shareholder value by proactively pursuing<br />

opportunities and subjecting these to a diligent analysis of risks and rewards. We remain focused on our core power generation<br />

business while developing and seeking other viable energy-related business opportunities. We value our relationships with our investors<br />

and partners, and demonstrate this through good governance, transparency and professionalism.<br />

TO BE THE PREFERRED PARTNER: We aim to be the preferred partner in nation-building and community development. We are<br />

committed to the fulfillment of our social, ethical, environmental, and economic responsibilities.<br />

b<br />

<strong>First</strong> <strong>Gen</strong>

FINANCIAL<br />

HIGHLIGHTS<br />

<strong>First</strong> <strong>Gen</strong> Corporation (Consolidated)<br />

In US Dollars Thousands, Except Per Share Data<br />

<strong>2011</strong> 2010 2009<br />

Gross revenues * 1,351,627 1,230,002 1,015,174<br />

EBITDA ** 276,847 312,856 301,810<br />

Net Income 86,610 121,000 95,007<br />

Net Income attributable to Equity holders<br />

of the Parent company<br />

35,021 70,217 16,754<br />

Recurring net income 83,065 57,012 34,205<br />

Current Assets 560,634 377,889 346,515<br />

Noncurrent Assets 1,995,977 1,963,504 1,814,508<br />

Total Assets 2,556,611 2,341,393 2,161,023<br />

Current Liabilities 254,336 383,621 282,566<br />

Noncurrent Liabilities 895,458 809,803 1,071,420<br />

Equity attributable to Equity holders<br />

of the Parent company<br />

1,226,187 989,296 663,034<br />

Non-controlling Interests 180,630 158,673 144,003<br />

Basic Earnings Per Share for Net Income attributable<br />

to the Equity holders of the Parent company<br />

$0.008 $0.021 $0.013<br />

* Excluding mark-to-market gain on derivatives, interest income on cash and cash equivalents and foreign exchange gains.<br />

** EBITDA was calculated based on income before income tax plus interest & financing charges, depreciation & amortization, foreign exchange losses and other<br />

charges. Interest income and mark-to-market gain on derivatives were deducted from gross revenues.<br />

<strong>2011</strong> FINANCIAL PERFORMANCE<br />

(IN US$ MILLIONS)<br />

<strong>2011</strong><br />

35.0<br />

86.6<br />

83.1<br />

<strong>2011</strong><br />

276.8<br />

1,351.6<br />

2010<br />

57.0<br />

70.2<br />

121.0<br />

2010<br />

312.9<br />

1,230.0<br />

2009<br />

34.2<br />

16.8<br />

95.0<br />

2009<br />

301.8<br />

1,015.2<br />

Consolidated net income<br />

Recurring net income<br />

Net Income attributable to<br />

Equity holders of the Parent Company<br />

Gross revenues<br />

EBITDA<br />

<strong>2011</strong> Annual Report<br />

1

2 <strong>First</strong> <strong>Gen</strong>

A FORMIDABLE MARKET PLAYER<br />

<strong>First</strong> <strong>Gen</strong> is one of the country’s largest power providers with<br />

15 power plants located in Luzon, Visayas and Mindanao.<br />

CLEANEST PORTFOLIO OF<br />

POWER PLANTS<br />

<strong>First</strong> <strong>Gen</strong> is the country’s leading power firm with the cleanest<br />

power portfolio utilizing clean, renewable and indigenous<br />

fuels such as geothermal, hydro and natural gas.<br />

PREDICTABLE CASH FLOW<br />

FROM STRONG CONTRACTUAL<br />

ARRANGEMENTS<br />

Majority of <strong>First</strong> <strong>Gen</strong>’s power generation is sold under longterm<br />

power contracts with take-or-pay arrangements.<br />

2,763 MW<br />

1,523 MW<br />

>90%<br />

US$277M<br />

Gross <strong>Gen</strong>eration<br />

Capacity<br />

Net Attributable Capacity<br />

Percentage of portfolio<br />

under contracts<br />

Consolidated<br />

<strong>2011</strong> EBITDA<br />

PROJECT DEVELOPMENT EXPERT<br />

<strong>First</strong> <strong>Gen</strong>’s power development expertise ranges from project<br />

siting to power plant operations and maintenance. <strong>First</strong> <strong>Gen</strong> has<br />

not just built plants from the ground up, it has also purchased<br />

numerous plants, enhanced operations and capacity.<br />

SOLID CASH FLOWS<br />

AND OPERATING INCOME<br />

Bulk of energy sold is through Power Purchase Agreements<br />

with take-or-pay arrangements. <strong>First</strong> <strong>Gen</strong>’s investments deliver<br />

steady earnings.<br />

INVESTMENT PORTFOLIO<br />

POISED FOR GROWTH<br />

<strong>First</strong> <strong>Gen</strong> is the largest shareholder in EDC – the Philippines’<br />

principal geothermal power producer and the world’s largest<br />

fully integrated geothermal company.<br />

47%<br />

US$83.1M<br />

Economic stake in<br />

Energy Development<br />

Corporation<br />

Consolidated <strong>2011</strong><br />

Recurring Net Income<br />

PIONEERS OF NATURAL GAS-FIRED<br />

POWER PLANTS IN THE COUNTRY<br />

The 1,000-MW Santa Rita and 500-MW San Lorenzo plants<br />

comprise the country’s largest natural gas-fired power plant<br />

facility. It is also the largest offtaker of Malampaya natural gas,<br />

and supplies approximately 37 per cent of Meralco’s power<br />

requirements. Meralco is the country’s largest distribution utility.<br />

<strong>2011</strong> Annual Report<br />

3

PORTFOLIO OF<br />

ASSETS<br />

Natural Gas<br />

Geothermal<br />

1,000-MW <strong>First</strong> Gas<br />

Power Corporation<br />

500-MW FGP Corp.<br />

130-MW<br />

Bacon-Manito<br />

Geothermal<br />

Production Field<br />

132-MW Pantabangan-Masiway<br />

Hydro<br />

192.5-MW Southern<br />

Negros Geothermal<br />

Production Field<br />

700.9-MW Leyte<br />

Geothermal<br />

Production Field<br />

106-MW Mindanao<br />

Geothermal<br />

Production Field<br />

Kidapawan<br />

1.6-MW FG Bukidnon<br />

4 <strong>First</strong> <strong>Gen</strong>

<strong>2011</strong><br />

BY THE NUMBERS<br />

Carbon Intensity<br />

0.37<br />

0.35 0.36<br />

2004<br />

2005<br />

2006<br />

0.34<br />

0.28<br />

0.28<br />

0.27<br />

0.27<br />

0.27<br />

TON/MWH<br />

2007<br />

2008<br />

2009<br />

2010<br />

<strong>2011</strong><br />

Total Installed Capacity and <strong>Gen</strong>eration Mix<br />

<strong>First</strong> <strong>Gen</strong> Total Installed Capacity and <strong>Gen</strong>eration Mix<br />

Natural gas<br />

54%<br />

1,500-MW<br />

Indigenous energy<br />

Base load<br />

2,763<br />

MW<br />

Geothermal<br />

41%<br />

1,129-MW<br />

Indigenous and<br />

renewable energy<br />

Base load / Mid merit<br />

Hydro<br />

5%<br />

134-MW<br />

Indigenous and<br />

renewable energy<br />

Base load / Peak<br />

18%<br />

<strong>First</strong> <strong>Gen</strong> share in national<br />

grid installed capacity (1)<br />

15% of Luzon (2)<br />

25% of Visayas-Mindanao (3)<br />

Net Income decrease by 28% = US$86.6M<br />

Consolidated revenues up by 10% = US$1.3B<br />

1,523 MW<br />

Net attributable capacity<br />

Notes:<br />

(1) Actual installed capacity of FGEN based on ERC Installed <strong>Gen</strong>erating Capacities <strong>2011</strong> is 2,683 MW<br />

(2) Based on Santa Rita, San Lorenzo, Pantabangan-Masiway and BacMan plants as a percentage of Luzon grid capacity<br />

(3) Based on Palinpinon, Tongonan, Mindanao 1&2, Unified Leyte and Agusan Hydro plants as a percentage of Visayas and Mindanao grid capacity<br />

<strong>2011</strong> Annual Report<br />

5

6 <strong>First</strong> <strong>Gen</strong><br />

FEDERICO R. LOPEZ<br />

Chairman and CEO

“The year <strong>2011</strong> saw us assiduously<br />

strengthening and consolidating our<br />

energy platform on all fronts.“<br />

This year, we thought of the theme “Harnessing Limitless Energy” not merely<br />

to capture the drive and dynamism of our people at <strong>First</strong> <strong>Gen</strong> but also as a<br />

reminder that if we treat our indigenous energy resources with respect, they are<br />

practically boundless.<br />

The year <strong>2011</strong> saw us assiduously strengthening and consolidating our energy<br />

platform on all fronts. At Energy Development Corp. (EDC), work on rehabilitating<br />

the various geothermal power plants we acquired from National Power Corp (NPC),<br />

namely BacMan, Palinpinon and Tongonan, has been unrelenting as we push further<br />

towards becoming a fully integrated geothermal power producer. In this respect,<br />

last year was historic as this was the first year EDC no longer had any revenues<br />

from steam sales. All our revenues today come from kilowatt-hour sales from our<br />

integrated steam fields and power plants.<br />

We had our share of disappointment, however, as EDC reckoned with finally having<br />

to write down Php5.0 billion of its Northern Negros power project. The non-cash<br />

write-down was the main cause of the 86 per cent drop in EDC’s earnings last year<br />

and was the sensible thing to do given the insufficiency of the steam resource. The<br />

decision, however, was cash positive to EDC and reduced NNGP’s cash operating<br />

costs down from Php800.0 million to less than Php275.0 million. These operating<br />

costs will be pared down further and most of the Php5.0 billion in impairment<br />

charges reversed as we redeploy the 40-megawatt (MW) power plant to the<br />

Southern Negros geothermal plant complex and commence its operation sometime<br />

in 2014.<br />

We continue to be staunch believers in EDC’s potential moving forward and since<br />

our original acquisition from government in November of 2007, we have purchased<br />

an additional 8.8 per cent of common shares at an average price of Php5.50 per<br />

share bringing our equity stake today to 48.8 per cent. In <strong>2011</strong>, our economic stake<br />

in EDC was 47.02 per cent.<br />

<strong>2011</strong> Annual Report<br />

7

“We are also conscious<br />

of the role we need to<br />

play here at home as<br />

our country’s partner<br />

in progress. The needs<br />

are still great and we are<br />

continually working on<br />

exploring and developing<br />

new projects that will<br />

meet the growing<br />

demand for electricity.”<br />

We’ve always been firm advocates of our hydropower<br />

platform’s unique strategic value to the Luzon grid. The<br />

Pantabangan-Masiway Hydroelectric Plant (PMHEP), now<br />

running at its upgraded 132 MW, has gotten an additional<br />

boost to its revenues since August after being accredited by<br />

grid operator National Grid Corporation of the Philippines<br />

(NGCP) as an ancillary services provider. <strong>First</strong> <strong>Gen</strong> Hydro<br />

Power Corp. (FG Hydro), operator of PMHEP, last year earned<br />

46 per cent of its revenues providing contingency reserve,<br />

dispatchable reserves, reactive voltage support and black<br />

start capabilities to the grid operator. It is an affirmation of our<br />

original belief in these plants’ intrinsic value.<br />

Our <strong>First</strong> Gas platform continues to perform superbly with<br />

our Santa Rita and San Lorenzo plants operating at a record<br />

Net Capacity Factor last year of 89.2 per cent – the highest<br />

since they began commercial operations in June 2000. We<br />

continue to operate these plants at stellar levels of reliability,<br />

availability and safety. As these plants remain the bedrock of<br />

<strong>First</strong> <strong>Gen</strong>’s earnings base, we must always assure the stability<br />

of their operations. Moving forward, we hope to consolidate<br />

our ownership over these assets through our acquisition of<br />

BG plc’s 40 per cent stake should there be an opportunity to<br />

do so at a mutually beneficial price. Should we conclude this,<br />

the acquisition would have the effect of adding 600 MW to<br />

our portfolio without taking us incrementally closer to Electric<br />

Power Industry Reform Act -mandated grid capacity limits.<br />

The acquisition would also enable us to seek new partners<br />

with a more vibrant view towards developing a gas industry<br />

in the Philippines in the years to come. We still believe in the<br />

role natural gas has to play as a bridge fuel before scalable<br />

renewable energy sources become commercially feasible<br />

without subsidies.<br />

As we consolidate, rehabilitate and optimize our assets and<br />

revenue sources in the years to come, the <strong>First</strong> <strong>Gen</strong> group<br />

of companies will reach a legislated limit to its growth in the<br />

Philippines. Although as a group we are still more than 1,793<br />

MW away from EPIRA-mandated grid caps, we are already<br />

anticipating and preparing for a global growth path beyond<br />

8 <strong>First</strong> <strong>Gen</strong>

that. We intend to bring the benefits of clean, indigenous<br />

geothermal energy to other parts of the world as well.<br />

Therefore, we consider it a watershed in <strong>First</strong> <strong>Gen</strong>’s history<br />

when we acquired a 70 per cent stake and full management<br />

control of three geothermal projects (Longavi in Chile and<br />

Quellapacheta and Chocopata in Peru) after signing a joint<br />

venture agreement with Australian firm Hot Rock Limited in<br />

November <strong>2011</strong>. Aside from this joint venture, EDC was also<br />

awarded by the Chilean government exclusive contracts to<br />

develop three more sites – Newen, San Rafael and Batea –<br />

and have pending applications for 13 more concession areas<br />

there as well. All in all, EDC will simultaneously develop 11<br />

sites in Chile, Peru and Indonesia over the next seven years<br />

which are programmed to be in commercial operations<br />

towards the end of 2019.<br />

Although we are conscious of the role we play in bringing<br />

EDC’s 35 years of experience in geothermal energy to the<br />

global stage, we are also conscious of the role we need to play<br />

here at home as our country’s partner in progress. The needs<br />

are still great and we are continually working on exploring and<br />

developing new projects that will meet the growing demand<br />

for electricity. We are currently working on several run-ofriver<br />

projects in Mindanao with a combined capacity of 91<br />

MW and an 86-MW wind project in Burgos, Ilocos Norte. Our<br />

Business Development Team is constantly in search of viable<br />

projects that enhance shareholder value and contribute to the<br />

country’s economic progress.<br />

We pride ourselves on being long-term stewards and<br />

guardians not only of the steam and hydro resources but<br />

of surrounding communities, forest cover, biodiversity and<br />

all the ecosystem services nature provides around our<br />

power plants and steam fields. For us, unlike too many<br />

companies today, sustainability isn’t merely a buzz word<br />

used to “greenwash” bad practices. Sustainability is built into<br />

the heart and soul of our business model and we are proud<br />

that EDC leads the energy sector in this way of thinking.<br />

Since December 2008, EDC has reforested a total of 3,091.6<br />

hectares across the country with 2.38 million tree saplings of<br />

more than 96 premium and endangered species. These were<br />

planted in EDC’s five geothermal project sites, at watersheds<br />

surrounding our Pantabangan-Masiway Hydro Plant, at our<br />

wind project site in Burgos, Ilocos Norte as well as selected<br />

school grounds in various provinces. We implemented<br />

these projects with close to a hundred organizations, local<br />

government units, government agencies and partner schools<br />

all over the country and by the end of ten years we will have<br />

reforested over 10,000 hectares. We are also continuing<br />

biodiversity studies with the UP Institute of Biology to establish<br />

a baseline of flora and fauna that exist in our various hydro<br />

and geothermal sites. As they say “you can’t protect what<br />

you don’t know.” Thus, it is fundamental that we understand<br />

the natural treasures that surround our sites. In this way, we<br />

preserve and rejuvenate the ecosystem in the correct way.<br />

In Batangas, we closely support Bantay Dagat (Sea Watch)<br />

volunteers in the municipalities of Tingloy and Mabini. Both<br />

teams have been instrumental in deterring illegal fishing<br />

activities in these areas which form part of the Verde Island<br />

Passage, dubbed the “Center of the Center” of global marine<br />

biodiversity and considered among the richest marine<br />

ecosystems in the world.<br />

Meanwhile, through our Kananga-EDC Institute of Technology<br />

(KEITECH) in Leyte, residents of EDC’s host communities have<br />

a shot at a better life through more job opportunities here and<br />

abroad. Since we established it in 2008, more than 238 cadets<br />

have graduated and 95 per cent of them have landed jobs,<br />

including two now in Singapore.<br />

As we move towards a new and exciting chapter in our<br />

Company’s history, we would like to thank you, our investors<br />

and stakeholders, for placing your trust and faith in us. We<br />

believe that with your continued commitment, we will be able<br />

to harness the true potential of limitless energy wherever in<br />

the world we may find it.<br />

Thank you.<br />

FEDERICO R. LOPEZ<br />

Chairman and<br />

Chief Executive Officer<br />

<strong>2011</strong> Annual Report<br />

9

FRANCIS GILES B. PUNO<br />

President and<br />

Chief Operating Officer<br />

10 <strong>First</strong> <strong>Gen</strong>

“We take pride in our Company’s strong position<br />

as the country’s leading developer and operator<br />

of power plants fuelled by indigenous, clean and<br />

renewable energy sources.”<br />

Dear Stakeholders,<br />

At <strong>First</strong> <strong>Gen</strong>, we take pride in our Company’s strong position as the country’s<br />

leading developer and operator of power plants fuelled by indigenous, clean and<br />

renewable energy sources. As such, the theme “Harnessing Limitless Energy”<br />

is appropriate and especially consistent with the renewable-side of our portfolio,<br />

while the cover photo featuring the young person in active motion performing freerunning<br />

or “parkour” relates to the limitless energy and pioneering entrepreneurial<br />

spirit of the men and women behind <strong>First</strong> <strong>Gen</strong>. As a team, we have grown<br />

the Company to what it is today – a unique and competitive portfolio of 2,763<br />

megawatts (MW) or 18 per cent of the country’s total installed power generation<br />

capacity, comprising 1,500 MW from natural gas, 1,129 MW from geothermal<br />

steam and 134 MW from hydro resources.<br />

It is my pleasure to present <strong>First</strong> <strong>Gen</strong>’s operating and financial highlights for <strong>2011</strong>.<br />

While we achieved many positive milestones across the portfolio, we were also<br />

reminded of certain risks and challenges inherent in the business. The operating<br />

highlights of the year were as follows:<br />

• We continue to benefit from the high availability and reliability of the <strong>First</strong> Gas<br />

plants. The Santa Rita and San Lorenzo plants operated at a combined net<br />

capacity factor of 89.2 per cent, equivalent to 12,237 Gigawatt-hours (GWh)<br />

of electricity sold, from 82.7 per cent in 2010. This was the highest dispatched<br />

plant in the Luzon grid and was also the highest dispatch level since the plants<br />

went into commercial operations. The <strong>2011</strong> <strong>annual</strong> gas consumption of 77.11<br />

petajoule (PJ) net calorific value (NCV) exceeded the 74.55 PJ (NCV) Annual<br />

Contract Quantities for the first time and consumed the remaining banked gas.<br />

The plants’ level of safety reached new highs as <strong>First</strong> Gas attained three million<br />

man-hours without lost time incident. We also commend the O&M Contractor,<br />

Siemens Power Operations, Inc., who achieved five million man-hours without<br />

lost time incident.<br />

• In <strong>2011</strong>, FG Hydro celebrated its fifth year as owner and operator of the<br />

Pantabangan-Masiway plants. During the five years, the completion of a major<br />

rehabilitation and upgrading of Pantabangan raised the plant’s total capacity<br />

by over 20 MW to 132 MW. FG Hydro also expanded its electricity revenue<br />

base when it secured the approval from the Energy Regulatory Commission<br />

<strong>2011</strong> Annual Report<br />

11

for its Ancillary Services Procurement Agreement with<br />

National Grid Corporation of the Philippines (NGCP) to<br />

supply it with ancillary services such as contingency<br />

reserve, dispatchable reserve, reactive power support,<br />

and black start service. In its five years with the group,<br />

FG Hydro was certified by Certification International<br />

of the Philippines with three Integrated Management<br />

Standards for Quality (ISO 9001:2008), Environment<br />

(ISO 14001:2004) and Occupational Health and Safety<br />

(OHSAS 18001:2007).<br />

• Pantabangan-Masiway’s electricity sales of<br />

approximately 511 GWh are broken down as follows:<br />

252 GWh (49 per cent) from bilateral contracts, 224 GWh<br />

(44 per cent) from ancillary services and the remaining<br />

35 GWh (7 per cent) from the Wholesale Electricity Spot<br />

Market (WESM).<br />

• EDC, which consolidates FG Hydro (among others), in<br />

<strong>2011</strong> generated electricity of 6,847.4 GWh. It <strong>report</strong>ed<br />

revenues from sale of electricity of Php24.5 billion, a<br />

Php1.6 billion increase compared with Php22.9 billion<br />

in 2010. The increase was primarily brought about<br />

by Tongonan 1 and Palinpinon power plants’ WESM<br />

sales; re-pricing of Green Core Geothermal Inc. (Green<br />

Core) power supply agreements (PSAs); and the fresh<br />

contribution from FG Hydro’s ancillary services. Of the<br />

total sales volume, 55.9 per cent or 3,827.9 GWh was<br />

generated by Unified Leyte in <strong>2011</strong> as compared with<br />

3,794.8 GWh in 2010. Mindanao I and II generated total<br />

sales volume of 791.8 GWh, higher by 3.8 GWh than its<br />

minimum energy off-take (MEOT) volume of 788 GWh.<br />

• After conducting extensive analysis and third-party<br />

expert review, EDC concluded that the Northern Negros<br />

Geothermal Project (NNGP) could only be sustainably<br />

operated at 5 MW to 10 MW compared with the<br />

power plant’s rated capacity of 49.4 MW. NNGP was<br />

decommissioned and, correspondingly, an impairment<br />

provision was booked for the remaining value of the<br />

NNGP assets. The provision of Php5.0 billion in <strong>2011</strong> is in<br />

addition to the Php3.4 billion recorded in 2010 and Php0.4<br />

billion in 2009. EDC is currently conducting a steam<br />

field optimization test to determine the right size of the<br />

power plant for the site. In the meantime, EDC is already<br />

working on a program to transfer the existing power plant<br />

to EDC’s concession in the Southern Negros geothermal<br />

plant complex by 2014.<br />

• EDC continued to pursue the rehabilitation of the power<br />

generating plants purchased from PSALM, including<br />

the 192.5-MW Palinpinon, 112.5-MW Tongonan and<br />

130-MW Bacon-Manito (BacMan) power plants. Since<br />

the turnover of the BacMan power plants in September<br />

2010, EDC undertook a comprehensive rehabilitation<br />

program to rebuild the power plants and be able to<br />

operate the plants safely and reliably at a capacity of<br />

130 MW comprising two units of 55 MW and one unit<br />

of 20 MW. Unfortunately, difficult weather conditions<br />

and poor quality work on the repair of the generator<br />

rotors required EDC to completely redo the rewinding<br />

with another contractor thus causing some delay in the<br />

company’s internal accelerated schedule. The rewinding<br />

activity on the generator rotors of the two 55 MW units<br />

will be redone by Alstom of France. The generator<br />

rotor of BacMan Unit 1 has been shipped to Alstom’s<br />

facility in the United Kingdom, while Unit 2 will also be<br />

sent for rewinding after the work in Unit 1 is completed.<br />

Complete rehabilitation of the three units is expected by<br />

September 2012.<br />

ONE-TIME IMPAIRMENT LOSSES<br />

AT EDC AFFECT EARNINGS<br />

<strong>First</strong> <strong>Gen</strong> <strong>report</strong>ed an attributable net income to the Parent of<br />

US$35.0 million in <strong>2011</strong>, a decline of 50.1 per cent compared<br />

with last year’s US$70.2 million. The decline was mostly<br />

due to the lower income contribution from its affiliate EDC,<br />

as it incurred a loss of US$9.3 million in <strong>2011</strong> (exclusive of<br />

FG Hydro’s income) compared with an income contribution<br />

of US$52.5 million in 2010. The loss from EDC had mainly<br />

resulted from a non-cash impairment of US$115.3 million<br />

(or Php5.0 billion) on NNGP and foregone steam revenues<br />

of Php1.2 billion following EDC’s acquisition of the BacMan<br />

plants in September 2010, which are currently undergoing an<br />

extensive rebuilding program.<br />

12 <strong>First</strong> <strong>Gen</strong>

Improved earnings from <strong>First</strong> Gas and FG Hydro combined<br />

with reduced operating and financing costs helped offset<br />

EDC’s losses. The <strong>First</strong> Gas plants contributed stable<br />

attributable earnings to <strong>First</strong> <strong>Gen</strong> of US$70.9 million in <strong>2011</strong><br />

compared with US$69.4 million in the previous year. FG<br />

Hydro’s attributable earnings to <strong>First</strong> <strong>Gen</strong> rose dramatically<br />

by 150.5 per cent to US$24.8 million from US$9.9 million<br />

previously as it generated supplemental earnings from<br />

additional electricity sales through ancillary services it<br />

provided the transmission grid operator. Additional benefits<br />

were derived from US$19.3 million in savings from lower<br />

interest expense and financing charges and a US$3.6-million<br />

reduction in administrative costs.<br />

Adjusting for non-recurring items, <strong>First</strong> <strong>Gen</strong> <strong>report</strong>ed a<br />

remarkable increase in recurring attributable net income of<br />

US$83.1 million in <strong>2011</strong>. This was US$26.1 million, or 45.7<br />

per cent, higher than the recurring net income of US$57.0<br />

million in 2010. The improvement was mostly due to the<br />

increase in revenues from ancillary services, as well as the<br />

reduction of interest expense that were partially offset by<br />

lower earnings from EDC due to the foregone steam sales, as<br />

well as the increased expenses on maintenance of the steam<br />

field facilities.<br />

<strong>First</strong> <strong>Gen</strong>’s consolidated revenues rose by US$119.3 million,<br />

or 9.6 per cent, to US$1.4 billion in <strong>2011</strong> from US$1.2 billion<br />

in 2010. The increased revenues reflect the higher dispatch<br />

and fuel prices of the 1000-MW Santa Rita and 500-MW San<br />

Lorenzo natural gas power plants. The gas plants operated at<br />

their highest dispatch to date of 89.2 per cent compared with<br />

82.7 per cent in the previous year.<br />

FG Hydro was able to partially offset the loss of EDC by<br />

contributing significantly higher earnings from ancillary<br />

services that it provided NGCP beginning last August. FG<br />

Hydro generated Php2.4 billion in total revenues in <strong>2011</strong>,<br />

which was 12.6 per cent higher than in 2010. Electricity<br />

sales via ancillary services were 46.0 per cent of total<br />

revenues. Translated into dollars, it contributed earnings<br />

of US$24.8 million to <strong>First</strong> <strong>Gen</strong>, which was 150.5 per cent<br />

higher compared with US$9.9 million in 2010. The strong<br />

<strong>2011</strong> earnings of FG Hydro will allow <strong>First</strong> <strong>Gen</strong> to generate an<br />

earn-out of US$11.4 million payable in 2012.<br />

EDC also <strong>report</strong>ed improved electricity revenues of Php24.5<br />

billion in <strong>2011</strong> from Php22.9 billion previously. Its Palinpinon<br />

and Tongonan power plants generated higher revenues<br />

by Php1.6 billion to Php8.4 billion from its bilateral power<br />

contracts and WESM sales. However, for the same period,<br />

EDC had foregone steam revenues of Php1.2 billion. It<br />

previously generated steam sales from BacMan because of<br />

the then prevailing Steam Sales Agreement with National<br />

Power Corporation (NPC). Following EDC’s acquisition of the<br />

BacMan geothermal power plants, the steam contract was<br />

cancelled in September 2010.<br />

The poor financial performance of EDC was indeed<br />

disappointing but, nevertheless, expected given that current<br />

operations are focused on the rehabilitation of the 130-MW<br />

BacMan, 192.5-MW Palinpinon and 112.5-MW Tongonan<br />

power plants that were purchased from the PSALM<br />

privatization bids. The full impairment of NNGP in EDC’s<br />

books clears up a long-standing issue.<br />

On the finance front, <strong>First</strong> <strong>Gen</strong> redeemed US$72.5 million of<br />

its Convertible Bonds at a price of 115.6 per cent as part of a<br />

scheduled put option that was exercised on February 11, <strong>2011</strong>.<br />

The redeemed amount formed part of the US$260 million in<br />

Convertible Bonds that <strong>First</strong> <strong>Gen</strong> issued on February 11, 2008<br />

as part of the fund-raising needs to refinance the short-term<br />

loans used to acquire EDC. The bonds bear interest at 2.5<br />

per cent per annum and will be fully redeemed on February<br />

11, 2013. Upon maturity, <strong>First</strong> <strong>Gen</strong> is required to redeem the<br />

bonds at 128.02 per cent of its principal amount. In addition,<br />

<strong>First</strong> <strong>Gen</strong> bought back and retired another US$117.5 million of<br />

the bonds at an average price of 116.5 per cent. By the end of<br />

<strong>2011</strong>, <strong>First</strong> <strong>Gen</strong>’s Convertible Bonds in the reduced amount of<br />

US$70.0 million remained outstanding.<br />

<strong>2011</strong> Annual Report<br />

13

The Php10-billion Perpetual Preferred Series “F” shares<br />

issued by <strong>First</strong> <strong>Gen</strong> in July <strong>2011</strong> enabled the Company to<br />

prepay the Php5.1-billion debt of its subsidiary, Unified<br />

Holdings Corporation, and buy back some of its Convertible<br />

Bonds. As a result, the Company’s consolidated interest<br />

expense dropped by US$19.3 million from US$104.2 million<br />

in 2010 to US$84.9 million in <strong>2011</strong>.<br />

Consolidated debt levels were lower in <strong>2011</strong> by US$112.6<br />

million, with the repayment and prepayment of debt,<br />

from US$1,002.5 million in 2010 to US$889.9 million. The<br />

Company also drew down on a US$142.0-million Term Loan<br />

Facility and US$51.0 million of a US$100.0-million Notes<br />

Facility during the first quarter of <strong>2011</strong>.<br />

“We are also very excited<br />

about our international<br />

prospects and believe<br />

that, at some stage in the<br />

future, it will deliver future<br />

growth and value for the<br />

Company.”<br />

The increase in <strong>First</strong> <strong>Gen</strong>’s equity was mostly brought<br />

about by the issuance on July 25, <strong>2011</strong> of the Php10.0-<br />

billion cumulative, non-voting, non-convertible Series “F”<br />

Preferred Shares, with a dividend rate of 8.0 per cent. On its<br />

seventh anniversary date, or on any dividend payment date<br />

thereafter, <strong>First</strong> <strong>Gen</strong> has the option, but not the obligation, to<br />

redeem all of the Series “F” Preferred Shares outstanding.<br />

Despite the negative earnings contribution of EDC in <strong>2011</strong>,<br />

we continue to be a firm believer in the company’s future<br />

value and have, in fact, increased our ownership by taking<br />

advantage of opportunities that allow us to buy stakes at<br />

optimal prices. The Company exercised the call option in the<br />

agreements executed in April 2010 with the Philplans and<br />

STI group. Some 195 million EDC common shares were<br />

purchased at an exercise price of Php5.67 per share on<br />

March 8, <strong>2011</strong> and an additional 390 million EDC common<br />

shares at an exercise price of Php5.51 per share on April<br />

5, <strong>2011</strong>. By yearend, <strong>First</strong> <strong>Gen</strong> increased its EDC common<br />

shares to 47.02 per cent.<br />

STRONGLY COMMITTED TO GROWTH<br />

<strong>First</strong> <strong>Gen</strong> continues to pursue its growth strategy across<br />

its portfolio. We continue to seek ways to expand our gas<br />

portfolio and, depending on the availability of additional<br />

gas reserves from Camago-Malampaya, our San Gabriel<br />

project located adjacent to the existing <strong>First</strong> Gas units can be<br />

constructed in the next three years. In addition, we continue<br />

to express interest in purchasing the 40 per cent stake of our<br />

partner, BG plc, in <strong>First</strong> Gas and continue to evaluate options.<br />

We are dissatisfied with the slow developments in<br />

implementing the Renewable Energy Law, including the<br />

approval of the Feed-in Tariff. Run-of-river hydro projects<br />

totaling 91 MW are being pursued by <strong>First</strong> <strong>Gen</strong> to meet the<br />

14 <strong>First</strong> <strong>Gen</strong>

power needs of Mindanao. We will begin by developing the<br />

30-MW Puyo project in Agusan del Norte and the 23-MW<br />

Bubunawan project in Bukidnon. Through EDC, we will also<br />

develop the 86-MW Burgos wind farm in Ilocos Norte.<br />

We will pursue various expansion projects at existing<br />

geothermal sites via EDC, namely, the transfer of the 40-MW<br />

power plant from Northern Negros to the Southern Negros<br />

geothermal plant complex, the 50-MW Mindanao 3 in Mt.<br />

Apo, the 40-MW BacMan 3, and the 40-MW Kayabon projects<br />

in Albay and Sorsogon.<br />

In <strong>2011</strong>, EDC also took significant steps in becoming a global<br />

leader in geothermal energy. EDC signed in November<br />

<strong>2011</strong> a Heads of Terms Agreement with Australia-based<br />

company Hot Rock Limited (HRL), relating to three<br />

geothermal projects in Chile and Peru. In February 2012, a<br />

Joint Venture Agreement (JVA) was executed to co-develop<br />

Longavi projects in Chile, as well as the Quellaapacheta<br />

and Chocopata projects in Peru. Under the JVA, EDC will<br />

have a 70.0 per cent controlling interest in each project with<br />

the remaining 30.0 per cent owned by HRL. In January<br />

2012, EDC won and was directly awarded three sites under<br />

the government’s tender process – Batea, Newen and<br />

San Rafael. EDC has mobilized close to 27 geologists and<br />

technicians to Chile for the initial exploration of the sites.<br />

A limited number of assets for sale by PSALM remain as<br />

we reach the tail end of a successful privatization program.<br />

We continue to support the government’s program by<br />

participating in the bids. We are also awaiting the Supreme<br />

Court resolution regarding the 218-MW Angat hydro plant bid<br />

and are keen to participate in bidding for the Unified Leyte<br />

independent power producer administrator (IPPA).<br />

LOOKING FORWARD TO<br />

HARNESSING LIMITLESS OPPORTUNITIES<br />

Overall, we are generally satisfied with the performance<br />

of our portfolio but acknowledge that we need to continue<br />

to work hard to succeed. The <strong>First</strong> Gas plants continue to<br />

provide very steady operations and consistent cash flow and<br />

earnings. FG Hydro, with its fully rehabilitated Pantabangan<br />

plants, celebrated its five years since its privatization and<br />

had a banner year with a dramatic rise in earnings driven by<br />

additional electricity revenues from ancillary services.<br />

EDC continues to be a central area of focus for us. Over the<br />

last four years since taking over the company, we have many<br />

accomplishments to be thankful for, but we also continue to<br />

face certain challenges. We successfully bid for and acquired<br />

all the remaining power generating plants in our steam fields<br />

that have shifted EDC’s business model from steam sales<br />

to electricity sales under integrated operations. We “bit the<br />

bullet” on the Northern Negros plant by decommissioning<br />

it and fully impairing its remaining value in EDC’s balance<br />

sheet. We are currently pursuing the transfer of the power<br />

plant to Southern Negros geothermal plant complex and<br />

target completing it in 2014. Despite delays in the BacMan<br />

rehabilitation, we are still targetting to complete the project<br />

in 2012 which, frankly speaking, is still consistent with our<br />

bid assumptions. Once BacMan is completed and generates<br />

electricity sales, we will be able to recover the steam sales<br />

loss that we used to earn from NPC.<br />

We will continue to proritize improvements in operating<br />

efficiency and prudent asset management of the plants,<br />

including the ongoing rehabilitation of the Palinpinon and<br />

Tongonan plants. We are also very excited about our<br />

international prospects and believe that, at some stage in the<br />

future, it will deliver future growth and value for the Company.<br />

Despite the challenges, we continue to be a firm believer in<br />

EDC and have, in fact, increased our ownership to over 47<br />

per cent from the original 40 per cent economic stake we<br />

purchased in 2007. I would like to make the point that we<br />

are clearly ahead of where we thought we would be at this<br />

stage and are pleased about this accomplishment. We are<br />

confident that our efforts will pay off.<br />

Moving forward, we are definitely excited about the<br />

opportunities that are available to the Company. We remain<br />

committed to building the platform and take advantage of the<br />

“limitless” growth opportunities to address the future energy<br />

demands of the country and other new markets we serve.<br />

Thank you for your continued support.<br />

FRANCIS GILES B. PUNO<br />

President and<br />

Chief Operating Officer<br />

<strong>2011</strong> Annual Report<br />

15

16 <strong>First</strong> <strong>Gen</strong>

<strong>First</strong> Gas Power Corporation (FGPC), owner of the 1000-MW Santa Rita<br />

gas-fired power plant, recorded gross revenues of US$904.1 million in<br />

<strong>2011</strong>, 15.6 per cent higher than the US$782.0 million posted in 2010.<br />

Net income attributable to <strong>First</strong> <strong>Gen</strong>, which is 60 per cent of FGPC’s net<br />

income, rose by US$4.4 million or 11.5 per cent to US$42.6 million from<br />

US$38.2 million in 2010.<br />

The significant increase in FGPC’s gross revenues was mainly due to higher fuel charges. These charges were driven by<br />

the increase in gas prices from an average of US$10.2 per million metric British thermal unit (MMBTu) in 2010 to US$12.2/<br />

MMBTu in <strong>2011</strong>. Contributing to the increase in revenues was the plant’s improved capacity factor, which reached a record<br />

level of 89 per cent in <strong>2011</strong> from 82 per cent in 2010.<br />

On an overall basis, FGPC’s net income improved due to lower interest and financing charges, as well as a decrease in<br />

operating and maintenance expenses following the full-year effectivity of the new Operations & Maintenance (O&M) contract<br />

with Siemens Power Operations Inc. (SPOI) for the Santa Rita plant.<br />

In <strong>2011</strong>, FGPC’s Santa Rita power plant generated 8,122 gigawatt-hours (GWh) of electricity, or 7.8 per cent more than the<br />

7,531 GWh produced in 2010. Plant availability was 95.0 per cent, which surpassed the target of 93.0 per cent. Reliability,<br />

which reached 99.5 per cent in <strong>2011</strong>, likewise exceeded the target of 97.0 per cent.<br />

FGP Corp. (FGP), owner of the 500-MW San Lorenzo gas-fired power plant, posted gross revenues of US$450.4 million in<br />

<strong>2011</strong>, or 12.2 per cent higher than the level of US$401.2 million in 2010. Net income attributable to <strong>First</strong> <strong>Gen</strong>, equivalent<br />

to 60 per cent of FGP’s net income, however, dipped by US$2.9 million or 9.2 per cent to US$28.3 million in <strong>2011</strong> from<br />

<strong>2011</strong> Annual Report<br />

17

The plants’ level of safety<br />

also reached a new<br />

high as they achieved<br />

three million man-hours<br />

without lost time incident<br />

in <strong>2011</strong>.<br />

US$31.2 million in 2010. This was primarily due to higher<br />

depreciation expenses arising from the installation of new<br />

turbine blades as part of its scheduled major maintenance<br />

outage. The drop in FGP’s net income was tempered by<br />

lower interest and financing charges, as well as a decrease<br />

in operating and maintenance expenses due to the full-year<br />

effectivity of the new O&M contract with SPOI for the San<br />

Lorenzo plant. FGP also benefited from an improvement in<br />

its average net capacity factor, which went up to 89.0 per<br />

cent in <strong>2011</strong> from 83.2 per cent in 2010.<br />

In <strong>2011</strong>, FGP’s San Lorenzo plant generated 4,114 GWh<br />

of electricity, or 7.2 per cent higher than the 3,818 GWh<br />

generated in 2010. The plant availability reached 96.4 per<br />

cent, which is more than the target of 93.0 per cent; while<br />

reliability hit 99.1 per cent or better than the target of 97.0<br />

per cent.<br />

18 <strong>First</strong> <strong>Gen</strong>

FIRST GEN SUPPORTS<br />

BANTAY DAGAT<br />

VOLUNTEERS<br />

The Bantay Dagat volunteers in the towns of<br />

Mabini and Tingloy in Batangas are not the usual<br />

kind of volunteers. Instead of using only old bancas<br />

and kerosene lamps, they use hi-tech gadgets,<br />

such as global positioning system devices and<br />

mobile phones, to chase and deter illegal fishers in<br />

their area.<br />

But not too long ago, these volunteers felt they were<br />

no match against the poachers. The volunteers were<br />

ill-equipped and lacked fuel for their pump boats.<br />

<strong>First</strong> Gas’s power plants reached several milestones in<br />

<strong>2011</strong>. Their combined net capacity factor went up to 89.2<br />

per cent in <strong>2011</strong> from 82.7 per cent in 2010 − the highest<br />

combined dispatch level since the gas plants went into<br />

commercial operations. For the first time also since they<br />

went into operations, both plants have exceeded their<br />

respective <strong>annual</strong> contracted quantities. The plants’ level<br />

of safety also reached a new high as they achieved three<br />

million man-hours without lost time incident in <strong>2011</strong>.<br />

In August <strong>2011</strong>, the <strong>First</strong> Gas group also hosted the 7 th<br />

Asia-Pacific Siemens V-users Group Conference at the<br />

Sofitel Hotel in Manila. At least 43 delegates joined the<br />

three-day conference to discuss the latest developments<br />

and issues on gas turbine operations and maintenance,<br />

as well as gas turbine modifications and upgrades being<br />

offered by Siemens.<br />

The situation changed after <strong>First</strong> <strong>Gen</strong> Corporation<br />

threw its support behind the Bantay Dagat<br />

volunteers by providing them fuel, food and financial<br />

subsidies, as well as equipment. The support is part<br />

of the Company’s long-term commitment under<br />

Project Center of Center, a program started in 2004<br />

to protect the fragile ecosystem of the Verde Island<br />

Passage, including the coastal waters of Batangas.<br />

In 2010, <strong>First</strong> <strong>Gen</strong> assumed the role of direct<br />

implementer of the project.<br />

“Nowadays, poachers leave us alone, because they<br />

know we have the fuel to last even in a long chase,”<br />

Silvestre Baquilos, chairman of Bantay Dagat in<br />

Mabini, said in Filipino. Rey Manalo, chairman of<br />

Bantay Dagat in Tingloy, echoed the sentiment.<br />

“<strong>First</strong> <strong>Gen</strong>’s support is making a big difference in<br />

our campaign to save Tingloy’s marine ecosystem,”<br />

Mang Rey said.<br />

Now, <strong>First</strong> <strong>Gen</strong>’s support is helping the marine<br />

resources recover. “For a while we missed catching<br />

fish, such as tuna; but now we catch not only many<br />

but big tuna,” Mang Nestor de Austria, Bantay<br />

Dagat vice-chairman of Mabini, observed.<br />

<strong>2011</strong> Annual Report<br />

19

20 <strong>First</strong> <strong>Gen</strong>

Energy Development Corporation (EDC), the world’s largest<br />

vertically integrated geothermal company, <strong>report</strong>ed revenues from<br />

electricity sales of Php24.5 billion in <strong>2011</strong>, a Php1.6-billion increase<br />

compared with Php22.9 billion in 2010.<br />

The increase was mainly due to Tongonan 1 and Palinpinon power plants’ WESM sales, the re-pricing of the power<br />

supply agreements (PSAs) of Green Core Geothermal, Inc. (Green Core or GCGI), as well as the improved electricity<br />

sales of <strong>First</strong> <strong>Gen</strong> Hydro Power Corporation (FG Hydro).<br />

EDC’s consolidated net earnings for <strong>2011</strong>, however, went down by 86 per cent to Php0.61 billion from Php4.40 billion<br />

in 2010 due mainly to the Php5-billion impairment provision as an offshoot of the decommissioning of the Northern<br />

Negros Geothermal Plant (NNGP), and the foregone steam revenues given the ongoing rehabilitation of the Bacon-<br />

Manito geothermal plants (BacMan) in Albay and Sorsogon.<br />

<strong>2011</strong> Annual Report<br />

21

EDC is also undertaking<br />

expansion activities within<br />

its existing geothermal<br />

contract areas. These<br />

expansion activities aim<br />

to create an estimated<br />

230 MW in additional<br />

geothermal capacity to EDC.<br />

In <strong>2011</strong>, EDC generated 6,847.4 GWh of electricity, slightly<br />

lower than 6,883 GWh in 2010. Of the total sales volume,<br />

Unified Leyte accounted for 55.9 per cent or 3,827.9 GWh<br />

compared with 3,794.8 GWh in 2010. Mindanao I and II<br />

generated total sales volume of 791.8 GWh, or 3.8 GWh<br />

higher than its minimum energy off-take volume of 788<br />

GWh.<br />

EDC’s operating expenses went up to Php16.0 billion in<br />

<strong>2011</strong> from Php14.7 billion in 2010 due to the company’s<br />

intensified rehabilitation and restoration activities, primarily<br />

for Unified Leyte and BacMan.<br />

EDC continued to pursue the rehabilitation of the powergenerating<br />

plants purchased from PSALM, including the<br />

192.5-MW Palinpinon, the 112.5-MW Tongonan and the<br />

130-MW BacMan power plants. Since the BacMan plants’<br />

turnover in September 2010, EDC has been undertaking<br />

a comprehensive rehabilitation program to rebuild and<br />

operate the plants safely and reliably at a capacity of<br />

130 MW (two units of 55 MW and one unit of 20 MW).<br />

Inclement weather and substandard quality of repair<br />

work on the generator rotors, however, required EDC to<br />

completely redo the rewinding with Alstom, the original<br />

equipment manufacturer, thus, causing some delay in the<br />

company’s internal accelerated schedule. The generator<br />

rotor of BacMan Unit 1 has been shipped to Alstom’s<br />

facility in the United Kingdom, while Unit 2 will also be<br />

sent for rewinding after the work in Unit 1 is accomplished.<br />

Complete rehabilitation of the three units is expected by<br />

September 2012.<br />

FINANCIAL MILESTONES<br />

EDC’s decision on NNGP form part of the steps it took<br />

to clean the company’s balance sheet and strengthen<br />

its financial base. To minimize its foreign currency risks,<br />

EDC successfully retired in <strong>2011</strong> roughly Php4.8 billion in<br />

Japanese yen-denominated debts, thereby trimming down<br />

its yen-denominated loans to only Php0.02 billion by end-<br />

<strong>2011</strong>.<br />

In June <strong>2011</strong>, EDC closed a six-year US$175-million<br />

syndicated loan facility with a group of seven foreign<br />

banks. Loan proceeds from the syndicated loan facility<br />

were used to refinance an existing three-year US$175-<br />

million credit facility maturing in 2013. Effectively, the new<br />

loan has extended the facility’s maturity to six years from<br />

two, while at the same time lowering its interest cost.<br />

The syndicated loan was EDC’s third successful fundraising<br />

exercise in <strong>2011</strong>. In January <strong>2011</strong>, EDC issued<br />

a 10-year, US$300-million Regulation S Bonds. In May<br />

<strong>2011</strong>, EDC signed a 15-year US$75-million loan facility<br />

with the International Finance Corporation (IFC). EDC used<br />

the proceeds from the IFC facility to fund its mediumterm<br />

capital expenditure program. All three fund-raising<br />

exercises carried favorable terms and covenants allowing<br />

EDC to save over US$2 million per annum in interest<br />

22 <strong>First</strong> <strong>Gen</strong>

expenses. These fund-raising exercises also helped EDC<br />

build a war chest in excess of US$200 million to finance its<br />

growth program.<br />

GROWTH PLANS<br />

EDC is also undertaking expansion activities within its<br />

existing geothermal contract areas. These expansion<br />

activities aim to create an estimated 230 MW in additional<br />

geothermal capacity to EDC. The company is likewise<br />

pursuing the 86-MW wind power project in Burgos, Ilocos<br />

Norte, as well as other wind projects in Balaoi-Pagudpud,<br />

Ilocos Norte; and in Camiguin.<br />

CHILE AND PERU<br />

In <strong>2011</strong>, EDC also took momentous steps in its pursuit<br />

of becoming a global leader in geothermal energy. EDC<br />

signed in November <strong>2011</strong> a Heads of Terms Agreement<br />

with Australia-based company Hot Rock Limited (HRL),<br />

relating to three geothermal projects in Chile and Peru.<br />

In February 2012, a Joint Venture Agreement (JVA) was<br />

executed to co-develop Longavi projects in Chile, as well as<br />

the Quellaapacheta and Chocopata projects in Peru. Under<br />

the JVA, EDC will have a 70.0 per cent controlling interest<br />

in each project with the remaining 30.0 per cent ownership<br />

held by HRL. In January 2012, EDC won and was directly<br />

awarded three sites – in Batea, Newen, and San Rafael –<br />

under the Chilean government’s tender process. EDC has<br />

deployed a team of 27 geologists and technicians to Chile<br />

for the initial exploration of the sites.<br />

IFC AWARD<br />

EDC’s exemplary governance and sustainable business<br />

practices also gained global recognition when it received<br />

the Client Leadership Award from the IFC during<br />

ceremonies held in Washington, DC in October <strong>2011</strong>.<br />

As part of its commitment to the environment, EDC<br />

continues to implement a reforestation project that is<br />

considered the biggest of its kind among local power<br />

generation companies. Dubbed BINHI, the project aims to<br />

reforest 10,000 hectares over 10 years from its launch in<br />

December 2008. For <strong>2011</strong>, EDC’s BINHI covered an area<br />

of 1,052 hectares in seven sites all over the country with<br />

770,000 different tree saplings.<br />

EDC’S KEITECH<br />

MAKES BIG IMPACT<br />

Kananga, one of the host communities of Energy<br />

Development Corporation, often was described as<br />

a sleepy town in Leyte with an unemployment rate<br />

of 15 per cent, twice the national average. But<br />

that perception, as well as the high unemployment<br />

rate, is changing because of EDC’s support. After<br />

its privatization, EDC coordinated with the local<br />

government of Kananga and the Technical Educations<br />

and Skills Development Authrotiy to introduce a new<br />

CSR project – a technical school -- to help alleviate the<br />

town’s unemployment problem. The project is now<br />

known as the Kananga-EDC Institute of Technology or<br />

KEITECH. Inaugurated in 2009, KEITECH is one of EDC’s<br />

four CSR projects and one of two education-related<br />

projects in Kananga.<br />

The training curriculum of KEITECH fits the trends in work opportunities in such sectors as construction, metals<br />

engineering, tourism, health and social services. As part of the curriculum, a trainee gets 10 months of training,<br />

including eight-hour hands-on modules. All trainees are from EDC host communities, with 75 per cent coming<br />

from Kananga.<br />

This early, KEITECH is making a big difference in the lives of its beneficiaries. Among the 238 cadets that<br />

KEITECH trained since its opening, 95 per cent have landed jobs, including two graduates now in Singapore. This<br />

augurs well for 140 KEITECH students graduating this year.<br />

Parents of graduates also say KEITECH’s training builds character. “I’ve seen a lot of changes with Johnnidel, my<br />

son, since he started his training at KEITECH,” says Lilia Suazo of her son who trained at KEITECH.<br />

<strong>2011</strong> Annual Report<br />

23

24 <strong>First</strong> <strong>Gen</strong>

FIRST GEN HYDRO POWER CORPORATION<br />

FG Hydro, owner and operator of the 132.8-MW<br />

Pantabangan-Masiway Hydroelectric Plant (PMHEP)<br />

complex in Nueva Ecija, recorded total revenues of<br />

Php2.41 billion in <strong>2011</strong>, or 12.6 per cent more than the<br />

Php2.14 billion total revenues posted in 2010. FG Hydro’s<br />

net income amounted to Php1,207.7 million or 71.4 per<br />

cent higher than the Php704.6-million level in 2010.<br />

Almost half or 46 per cent of FG Hydro’s total revenues<br />

in <strong>2011</strong> represented revenues from the ancillary services<br />

that FG Hydro started providing to the National Grid<br />

Corporation of the Philippines (NGCP) in August <strong>2011</strong>.<br />

In June <strong>2011</strong>, the Energy Regulatory Commission<br />

(ERC) issued a provisional authority for FG Hydro to<br />

start offering ancillary services. The ERC issued the<br />

provisional authority after the company secured an<br />

accreditation from NGCP for FG Hydro’s capability to<br />

supply the following ancillary services: (1) contingency<br />

reserve service; (2) dispatchable reserve service; (3)<br />

reactive power support service; and (4) black start<br />

service. FG Hydro’s accreditation as ancillary service<br />

provider was a milestone in the company’s history.<br />

FG Hydro revenues from sale of electricity through<br />

ancillary services more than made up for its lower<br />

revenues from sale of electricity to the Wholesale<br />

Electricity Spot Market and bilateral contracts with<br />

electric utilities and industrials, which went down by 18<br />

per cent to 287 GWh in <strong>2011</strong> from 349 GWh in 2010.<br />

FG Hydro’s available capacity for <strong>2011</strong> was affected by<br />

the low dam elevation, measured at 202.4 meters above<br />

sea level (MASL) at the start of <strong>2011</strong> or 12.6 meters<br />

lower than the 215.0 MASL in 2010. The lower water<br />

elevation, in turn, was an offshoot of the lingering effect<br />

of El Niño phenomenon that the country experienced<br />

during the second semester of 2010 and throughout the<br />

first semester and early part of the second semester<br />

of <strong>2011</strong>. The El Niño phenomenon obliged the National<br />

Irrigation Administration to limit water releases during<br />

said period. In the latter part of <strong>2011</strong>, FG Hydro’s<br />

electricity generation was also affected, this time, by<br />

floods from typhoons “Pedring” and “Quiel.” Due to<br />

<strong>2011</strong> Annual Report<br />

25

<strong>First</strong> <strong>Gen</strong> continued its<br />

efforts in developing<br />

renewable energy projects<br />

particularly in hydro and<br />

wind power through its<br />

wholly owned subsidiaries<br />

- <strong>First</strong> <strong>Gen</strong> Mindanao<br />

Hydro Power Corporation<br />

(FGMHPC) and <strong>First</strong> <strong>Gen</strong><br />

Renewables, Inc. (FGRI).<br />

the floods, the release of water for NIA’s irrigation<br />

delivery requirement was cut off from September 26 to<br />

December 1, 2012.<br />

FG Hydro recorded a milestone in <strong>2011</strong> as it marked its<br />

fifth year as owner and operator of the Pantabangan-<br />

Masiway hydroelectric plants. Aside from securing an<br />

accreditation as ancillary service provider, FG Hydro’s<br />

milestones during the five-year period included the<br />

completion of a major rehabilitation and upgrading of<br />

the two units of the Pantabangan hydroelectric plant in<br />

2010 and the installation of new transformers in <strong>2011</strong>.<br />

Together with the 12-MW Masiway hydroelectric plant,<br />

the installed capacity of the Pantabangan-Masiway<br />

hydroelectric plants now stands at 132.8 MW. Within<br />

that same five-year period, FG Hydro’s Integrated<br />

Management System also received from Certification<br />

International of the Philippines certifications for<br />

international standards on Quality (ISO 9001:2008),<br />

Environment (ISO 14001:2004) and Occupational Health<br />

and Safety (OHSAS 18001:2007).<br />

FG BUKIDNON<br />

FG Bukidnon Power Corporation (FG Bukidnon), the<br />

owner and operator of the 1.6-MW Agusan mini-hydro<br />

plant in Bukidnon, recorded revenues of Php51.2 million<br />

in <strong>2011</strong>. The amount of revenues in <strong>2011</strong>, which was<br />

34.3 per cent more than the year-ago level of Php38.1<br />

million, also marked its highest level since FG Bukidnon<br />

acquired the plant in 2005. The plant generated 12,454<br />

MWh of electricity in <strong>2011</strong>, or 27 per cent more than the<br />

9,806 MWh it generated in 2010. The higher output was<br />

mainly due to the relatively high water inflow of the plant<br />

in <strong>2011</strong>.<br />

Pursuant to an ERC order issued in April <strong>2011</strong>, FG<br />

Bukidnon was able to recover from Cagayan Electric<br />

Power and Light Company, Inc. (CEPALCO) Php1.76<br />

million in under-recoveries from March to August<br />

2010. FG Bukidnon sells all electricity output from its<br />

mini-hydro plant to CEPALCO through a Power Supply<br />

Agreement (PSA). Approved by the ERC on November<br />

16, 2009, the PSA is effective until March 2025.<br />

Floodwaters from typhoon “Sendong,” which hit<br />

Mindanao in December <strong>2011</strong>, reached the power plant<br />

and partially submerged some of its vital equipment,<br />

including generators, power cables and instrument<br />

transformers. FG Bukidnon personnel promptly<br />

attended to the repair and replacement of the damaged<br />

equipment, thereby minimizing the plant’s downtime<br />

to only seven days. The plant has since then resumed<br />

its normal and reliable operation. FG Bukidnon also<br />

provided assistance and distributed relief goods to the<br />

victims of the floods in Bukidnon and Cagayan de Oro.<br />

FG Bukidnon’s Integrated Management System (IMS)<br />

underwent an audit conducted in December <strong>2011</strong> by<br />

TUV SUD PSB, the Philippine subsidiary of Munich,<br />

Germany-based TÜV SÜD AG, a leading service<br />

provider for a comprehensive and integrated suite of<br />

product testing, inspection, and certification services.<br />

After the audit, FG Bukidnon was commended by<br />

TUV SUD PSB for compliance with the requirements<br />

set by ISO 9001:2008, ISO 14001:2009, and OHSAS<br />

18001:2007.<br />

FIRST GEN RENEWABLES, INC.<br />

In <strong>2011</strong>, <strong>First</strong> <strong>Gen</strong> continued its efforts in developing<br />

renewable energy projects particularly in hydro and<br />

wind power through its wholly owned subsidiaries <strong>First</strong><br />

26 <strong>First</strong> <strong>Gen</strong>

<strong>Gen</strong> Mindanao Hydro Power Corporation (FGMHPC) and<br />

<strong>First</strong> <strong>Gen</strong> Renewables, Inc. (FGRI).<br />

FG HYDRO’S<br />

EDUCATION INCENTIVE<br />

PROGRAM BOOSTS<br />

MASIWAY STUDENTS’<br />

PERFORMANCE<br />

FGMHPC conducted various studies in the following five<br />

potential hydropower sites in Mindanao.<br />

• 30-MW Puyo River in Jabonga, Agusan del Norte;<br />

• 23-MW Bubunawan River in Baungon and Libona,<br />

Bukidnon;<br />

• 10-MW Cabadbaran River in Cabadbaran, Agusan<br />

del Norte;<br />

• 8-MW Tumalaong River in Baungon, Bukidnon; and<br />

• 20-MW Tagoloan River in Impasugong and Sumilao,<br />

Bukidnon.<br />

For these five sites, FGMHPC holds Hydropower<br />

Service Contracts that it signed with the Department of<br />

Energy (DOE).<br />

FGMHPC expects to complete in the second quarter of<br />

2012 the preliminary engineering design (PED) phase for<br />

the Puyo and the Bubunawan projects. FGMHPC aims to<br />

tender these projects for construction in the third quarter<br />

of 2012. The company targets the fourth quarter of 2014<br />

and the first quarter of 2015 as dates for the start of<br />

commercial operations of both projects.<br />

The feasibility study for the Cabadbaran project was<br />

completed in December <strong>2011</strong>, while its PED was set to<br />

commence in the first quarter of 2012 . Construction of<br />

the project, on the other hand, is targeted to start in 2013.<br />

The feasibility studies for the Tagoloan and Tumalaong<br />

projects, which are ongoing, are expected to be<br />

completed in the second quarter of 2012. The conduct of<br />

the PED for these projects will proceed, if the feasibility<br />

studies confirm the economic viability of the projects.<br />

FGRI continues to assess other sites in the Philippines<br />

for potential wind exploration and development. In <strong>2011</strong>,<br />

FGRI pre-signed Wind Energy Service Contracts with<br />

the DOE for three sites. They are located in Mercedes,<br />

Camarines Norte; Burgos, Ilocos Norte; and Palanan<br />

and Ilagan, Isabela. FGRI has been conducting wind<br />

measurements in the Mercedes site for almost two years<br />

now. Conducting wind measurements is one of the first<br />

activities needed to confirm the viability of a site for a<br />

wind power project.<br />

Residents of Sitio Masiway in Barangay Sampaloc,<br />

Pantabangan often keep to themselves because<br />

their sitio is so remote and so out of the way. But<br />

the isolation was also affecting the students of<br />

Masiway Elementary School, the only school in the<br />

sitio. In fact, when Grade 6 pupils there took the<br />

National Achievement Test of the Department of<br />

Education (DepEd) in 2008, their mean percentage<br />

score (MPS) languished at 48 per cent – way below<br />

the DepEd’s 75 per cent passing mark.<br />

Last year, something remarkable happened: the<br />

MPS of Grade 6 students jumped to 82 per cent.<br />

The dramatic improvement was a result of the<br />

decision of <strong>First</strong> <strong>Gen</strong> Hydro Power Corporation<br />

(FG Hydro) to adopt the school, along with five<br />

other public schools in Pantabangan, Nueva Ecija.<br />

Their adoption came in 2008, or shortly after the<br />

turnover to the company of the Pantabangan-<br />

Masiway hydroelectric power plants.<br />

The schools’ adoption gave birth to FG Hydro’s<br />

education incentive program (EIP) for its host<br />

communities.<br />

A lot of components go to FG Hydro’s EIP. To<br />

reduce malnutrition, for instance, FG Hydro<br />

sponsored an in-school feeding program. Aside<br />

from donating books, reading materials and school<br />

supplies to the students and teachers, FG Hydro<br />

also supported the teachers’ fresh training. Grade<br />

6 students were each given a monthly allowance of<br />

Php400 as incentive to attend classes.<br />

FG Hydro’s EIP has earned the gratitude of<br />

Masiway residents. “Masiway Elementary School<br />

is very fortunate for having FG Hydro,” said Shiela<br />

Cariaso, a local teacher.<br />

<strong>2011</strong> Annual Report<br />

27

28 <strong>First</strong> <strong>Gen</strong>

As part of efforts to help develop and improve the quality of life<br />

of residents in the host communities and promote their level of<br />

self-reliance, <strong>First</strong> <strong>Gen</strong> continues to implement various corporate<br />

social responsibility (CSR) and community relations (ComRel)<br />

projects. These CSR and ComRel activities focus on four areas: 1)<br />

education, 2) community health and safety, 3) poverty alleviation,<br />

and 4) environment.<br />

<strong>2011</strong> Annual Report<br />

29

In <strong>2011</strong>, the most<br />

significant improvement<br />

from FG Hydro’s education<br />

incentive program was<br />

observed at the Masiway<br />

Elementary School, where<br />

pupils recorded a mean<br />

percentage score of 82 per<br />

cent.<br />

EDUCATION<br />

<strong>First</strong> <strong>Gen</strong>, through <strong>First</strong> <strong>Gen</strong> Hydro Power Corporation<br />

(FG Hydro), noted significant increases in the National<br />

Achievement Test (NAT) mean percentage scores of<br />

pupils from four public elementary schools in host<br />

communities in Pantabangan, Nueva Ecija. The four<br />

schools receive benefits from FG Hydro’s education<br />

incentive program, one of <strong>First</strong> <strong>Gen</strong>’s activities for<br />

the benefit of the school children. Under FG Hydro’s<br />

educational incentive program, the company provides<br />

educational assistance to Grade 6 students from the four<br />

public elementary schools in Pantabangan to help assure<br />

completion of their primary education. To complement<br />

the education incentive program, teachers were trained<br />

in various teaching skills and methodology that are based<br />

on a training module approved by the Department of<br />

Education (DepEd) and designed to make lessons more<br />

interesting and comprehensible to students.<br />

In <strong>2011</strong>, the most significant improvement from FG<br />

Hydro’s education incentive program was observed at<br />

the Masiway Elementary School, where pupils recorded<br />

a NAT mean percentage score of 82 per cent. This was a<br />

marked improvement from the mean percentage score of<br />

pupils there in 2010, which was recorded at a dismal 60<br />

per cent − or way below the 75 per cent passing mark set<br />

by the DepEd. The mean percentage score of pupils from<br />

the town’s Kalayaan Elementary School also jumped<br />

to 82 per cent in <strong>2011</strong> from 77 per cent in 2010; that of<br />

Sampaloc Elementary School, to 80 per cent from 76 per<br />

cent; and West Central Elementary School, to 77 per cent<br />

from a failing mark of 70 per cent the year before.<br />

FG Hydro tie-up with Knowledge Channel<br />

30 <strong>First</strong> <strong>Gen</strong>

Training for teachers<br />

In Batangas, subsidiary <strong>First</strong> Gas tied up with Batangas<br />

State University to implement the Teachers’ Education<br />

for Students Thrust (TEST) program. Under TEST, 20<br />

teachers from Sta. Rita Aplaya Elementary School<br />

(SRAES) and Sta. Rita Karsada Elementary School<br />

(SRKES) each completed a Master in Education<br />

degree. By enhancing the proficiency of the teachers,<br />

the TEST program of <strong>First</strong> Gas aims, in turn, to<br />

improve the mean percentage score of pupils from<br />

both public elementary schools, located within the host<br />

barangay of Sta. Rita in Batangas.<br />

Both <strong>First</strong> Gas and FG Hydro implemented other<br />

education-related projects in <strong>2011</strong> for the benefit of<br />

their respective host communities. These included<br />

school cleanup and repainting drives; plant tours for<br />

visiting teachers and students; and the distribution of<br />

free school supplies for thousands of indigent pupils.<br />

FG Hydro also reached an agreement with Knowledge<br />

Channel Foundation, Inc., a non-profit Lopez Group<br />

member company, to bring free satellite-fed educational<br />

television programs to two other public schools within<br />

the host community – the Pantabangan East Central<br />

School and Tanawan Elementary School. <strong>First</strong> Gas, on<br />

the other hand, sponsored review classes for SRKES<br />

and SRAES students taking up the DepEd’s NAT.<br />

HEALTH<br />

Malnutrition or hunger affects the school performance<br />