Canadian Mining Magazine - Matrix Group Publishing Inc.

Canadian Mining Magazine - Matrix Group Publishing Inc.

Canadian Mining Magazine - Matrix Group Publishing Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Canadian</strong><br />

Summer 2011<br />

<strong>Mining</strong><br />

<strong>Magazine</strong><br />

Canada Post Publications Agreement Number: 40609661<br />

<strong>Mining</strong> in<br />

Alberta:<br />

Gaining Momentum<br />

Through Diversity

<strong>Canadian</strong> <strong>Mining</strong><br />

<strong>Magazine</strong><br />

Summer 2011<br />

Published By:<br />

<strong>Matrix</strong> <strong>Group</strong> <strong>Publishing</strong> <strong>Inc</strong>.<br />

Publication Mail Agreement<br />

Number 40609661<br />

Return Undeliverable<br />

<strong>Canadian</strong> Addresses to:<br />

300 - 52 Donald Street<br />

Winnipeg, MB R3C 1L6<br />

Toll Free Phone: (866) 999-1299<br />

Toll Free Fax: (866) 244-2544<br />

www.matrixgroupinc.net<br />

www.canadianminingmagazine.com<br />

President & CEO<br />

Jack Andress<br />

Senior Publisher<br />

Maurice LaBorde<br />

mlaborde@matrixgroupinc.net<br />

Editor-in-Chief<br />

Shannon Savory<br />

ssavory@matrixgroupinc.net<br />

Editors<br />

Karen Kornelsen<br />

kkornelsen@matrixgroupinc.net<br />

Alexandra Walld<br />

Finance/Accounting & Administration<br />

Shoshana Weinberg, Pat Andress, Nathan Redekop<br />

accounting@matrixgroupinc.net<br />

Director of Marketing & Circulation<br />

Shoshana Weinberg<br />

Sales Manager - Winnipeg<br />

Neil Gottfred<br />

Sales Manager - Hamilton<br />

Jessica Potter<br />

Sales Team Leader<br />

Albert Brydges<br />

<strong>Matrix</strong> <strong>Group</strong> <strong>Publishing</strong> <strong>Inc</strong>. Account<br />

Executives<br />

Rick Kuzie, Miles Meagher, Ken Percival,<br />

Peter Schulz, Benjamin Schutt, Rob Choi,<br />

Brian Davey, Jim Hamilton, Chantal<br />

Duchaine, Gary Nagy, Declan O’Donovan,<br />

Brian Macintyre, Thomas Campbell, Jamie<br />

Steward, Dennis Lee, Cole Williams,<br />

Matthew Oliphant, Trish Bird<br />

Layout & Design<br />

Travis Bevan<br />

Advertising Design<br />

James Robinson<br />

©2011 <strong>Matrix</strong> <strong>Group</strong> <strong>Publishing</strong> <strong>Inc</strong>.<br />

All rights reserved. Contents may not be<br />

reproduced by any means, in whole or in<br />

part, without the prior written permission<br />

of the publisher.<br />

Table of Contents<br />

Cover Section<br />

<strong>Mining</strong> in Alberta: Gaining Momentum Through Diversity<br />

Alberta’s Mineral Resource Base. ............................ 6<br />

Ensuring Growth Through Education ........................ 8<br />

Economic Impact of Alberta’s <strong>Mining</strong> Industry ................ 10<br />

Ironstone Resources’ Clear Hills Project ..................... 12<br />

Digging for Details<br />

HR Report - Workplace Diversity: A Core Value at Suncor Energy .. 14<br />

Transaction Report ..................................... 17<br />

Junior <strong>Mining</strong> News .................................... 19<br />

Tools of the Trade ...................................... 20<br />

News Watch: From Coast to Coast<br />

The North ............................................ 22<br />

British Columbia. ...................................... 23<br />

Alberta .............................................. 24<br />

Saskatchewan ......................................... 25<br />

Manitoba ............................................ 26<br />

Ontario .............................................. 27<br />

Quebec .............................................. 28<br />

Atlantic Canada. ....................................... 29<br />

Buyer’s Guide ..................................... 34<br />

Check out the new<br />

<strong>Canadian</strong> <strong>Mining</strong> <strong>Magazine</strong> website:<br />

canadianminingmagazine.com<br />

You can also follow us on<br />

Download the<br />

free app for your<br />

smartphone to<br />

scan this code at<br />

2dscanlife.com<br />

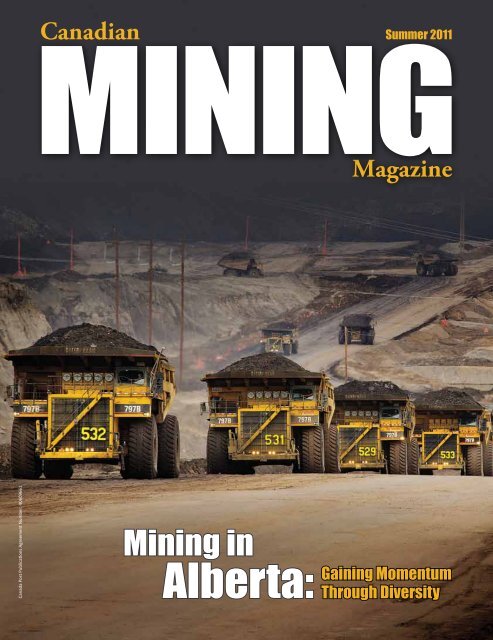

ON THE COVER:<br />

Big league opportunities:<br />

Finning’s teams in Edmonton<br />

and in the oilsands are looking<br />

to add more skilled technicians<br />

to service growing fleets of<br />

equipment. (Photo courtesy of<br />

Finning Canada.)<br />

<strong>Canadian</strong> <strong>Mining</strong> <strong>Magazine</strong> 5

Alberta <strong>Mining</strong><br />

Alberta’s Mineral<br />

Resource Base:<br />

Gaining Momentum Through Diversity.<br />

By D. Roy Eccles and Gary V. White<br />

As of April 2011, Alberta had<br />

1328 active mineral permits<br />

for metallic and industrial<br />

minerals covering<br />

6,159,610 hectares. Based<br />

on corporate websites and news releases,<br />

mineral exploration companies searched<br />

for a diverse suite of commodities in Alberta,<br />

some of which include diamonds,<br />

uranium, polymetallic black shale, iron,<br />

placer gold, titanium-bearing minerals,<br />

magnetite, and lithium.<br />

Industrial mineral production included<br />

aggregate, sulphur, peat, salt, and silica.<br />

As of December 31, 2010 there were<br />

1,150 coal leases totalling 604,000 hectares.<br />

Coal production remained strong in<br />

Alberta with 13 mines producing approximately<br />

32 million tonnes during 2010. A<br />

summary of some of Alberta’s recent mining<br />

and mineral exploration highlights follows.<br />

Coal<br />

Alberta’s coal reserves are estimated<br />

at between 33-37 billion tonnes. During<br />

2010, there were 13 operating coal<br />

mines in Alberta with production dominated<br />

by subbituminous coal (24 million<br />

tonnes), followed by bituminous thermal<br />

and metallurgical coal (8 million tonnes).<br />

Coalspur Mines Limited is currently developing<br />

the Vista Coal project, a large<br />

scale, thermal coal project located near<br />

Hinton in west-central Alberta. A prefeasibility<br />

study by Coalspur Mines reports<br />

initial proven and probable marketable<br />

coal reserves of 260 million tonnes defined<br />

from a recoverable coal reserve of<br />

522 million tonnes. Coalspur estimates<br />

a 31-year mine life producing 9.0 million<br />

tonnes of saleable coal per year making<br />

this project North America’s largest dedicated<br />

export thermal coal mine.<br />

Several companies including Swan Hills<br />

Synfuels and Laurus Energy <strong>Inc</strong>orporated<br />

are currently investigating opportunities<br />

to convert coals normally considered too<br />

deep for conventional mining into gas by<br />

in-situ coal gasification (ISCG). Swan Hills<br />

Synfuels in the Swan Hills area of westcentral<br />

Alberta proposes a 300 mega watt<br />

electricity generation plant by converting<br />

the coal resources into clean burning syngas.<br />

Rare metals<br />

Several companies have expressed interest<br />

in lithium from formation waters<br />

in the Swan Hills area in west-central Alberta.<br />

The interest is due to mid-1990s<br />

government reports showing that lithium<br />

concentrations of up to 140 mg/L<br />

in formation waters are associated with<br />

carbonate build-ups of the Leduc Formation<br />

in the Woodbend <strong>Group</strong> and the<br />

Swan Hills Formation of the Beaverhill<br />

Lake <strong>Group</strong>. During 2009, at least two exploration<br />

companies, Channel Resources<br />

Limited and First Lithium Resources <strong>Inc</strong>orporated<br />

verified the lithium potential<br />

of the Swan Hills formation waters when<br />

they reported compositions of up to 112<br />

mg/L from brine-sampling programs of<br />

producing oil and gas wells in the area.<br />

In addition to lithium, these companies<br />

also reported elevated boron (223 mg/L),<br />

potassium (5,870 mg/L) and therefore the<br />

potential for a multi-element separation<br />

plant. Channel Resources has extracted<br />

a sample of approximately 2,000 litres of<br />

brine to test recovery methods and plans<br />

to generate resource estimates for lithium<br />

to an intermediary compound, up to<br />

88 per cent elemental bromine, up to 100<br />

per cent of the boron as sodium borate,<br />

and approximately 40 per cent potassium<br />

as carnallite salt.<br />

Testing also reported that potash (potassium<br />

chloride) can be separated from<br />

the carnallite with a greater than 70 per<br />

cent recovery of potassium. Future testing<br />

will pre-treat the brine to reduce overall<br />

calcium content potentially yielding<br />

greater recovery of potash and lithium.<br />

Uranium<br />

The western portion of the Athabasca<br />

Basin, which is underexplored but<br />

analogous to the highly mineralized unconformity<br />

style of the Eagle Point-Cigar<br />

Lake-McArthur River-Key Lake uranium<br />

belt, continues to attract exploration interest.<br />

Some of the companies actively<br />

exploring in the area since 2007 include<br />

Fission Energy Corporation (North Shore<br />

property), CanAlaska Uranium Limited<br />

(Alberta project on the western arm of<br />

Lake Athabasca), and Brazilian Gold Corporation<br />

(Rea project). In addition to interest<br />

in the Athabasca Basin, several<br />

companies including Fission Energy Corporation,<br />

Ultra Energy Limited, and North<br />

American Gem Limited, are investigating<br />

roll front-type uranium mineralization in<br />

other parts of Alberta including the Caribou<br />

Mountains in northern Alberta, and<br />

various portions of southern Alberta.<br />

Titanium (zircon)<br />

Titanium Corporation <strong>Inc</strong>orporated<br />

hopes to develop technology to mine the<br />

sludge from oil sands tailings in northeastern<br />

Alberta for water, zircon, bitumen,<br />

and solvent. In theory, the project<br />

would reduce the environmental impact<br />

of oil sands production in north-eastern<br />

Alberta by reducing tailings pond emissions<br />

as part of a process to recover bitumen<br />

and heavy minerals, During October<br />

2010, Titanium Corporation <strong>Inc</strong>orporated<br />

and Sustainable Development Technology<br />

6 Summer 2011 / www.canadianminingmagazine.com

Canada announced the successful completion<br />

of the first phase of its oil sands<br />

tailings pilot demonstration project. The<br />

demonstration pilot yielded between 70-<br />

75 per cent recovery such that Titanium<br />

hopes to recover annually 10-15 million<br />

cubic metres of water, 70,000 tonnes of<br />

zircon, three million barrels of bitumen,<br />

and 300,000 barrels of solvent from a typical<br />

oil sands plant. The next phase of the<br />

project will operate a pilot plant to evaluate<br />

froth treatment tailings from three oil<br />

sands operating sites.<br />

Polymetallic black shale<br />

DNI Metals <strong>Inc</strong>orporated is exploring<br />

metalliferous (Mo-Ni-U-V±Zn±Cu±Co±Ag)<br />

black shale in at least two areas of Late<br />

Cretaceous Second White Speckled Shale<br />

Formation in the Birch Mountains area of<br />

northeastern Alberta. During September<br />

2010, DNI Metals <strong>Inc</strong>orporated expanded<br />

its property interest and implemented<br />

stage-2 leaching tests. Bioleaching tests<br />

reported recoveries of Mo-15.6%; Ni-<br />

88.4%; U-88%; V-5.8%; Zn-82.8%; Co-<br />

88.1%. Metal recoveries measured<br />

without the addition of bio-organisms, to<br />

evaluate effects of biotic intermediation<br />

on metals recoveries, reported Mo2.5%;<br />

Ni-86.6%; U-81.9%; V-8.3%; Zn-83.7%; Co-<br />

83.2%; Cu-49.4%. The recoveries demonstrate<br />

that metals can be readily extracted<br />

from the black shale through bioleaching<br />

and that recoveries are high enough<br />

to warrant expansion of the test work.<br />

During February 2011, DNI Metals <strong>Inc</strong>orporated<br />

drilled eight HQ diameter holes<br />

totalling 650 metres, on the Buckton and<br />

Asphalt properties for expanded bioleach<br />

test work and reserve estimates.<br />

Diamond<br />

During March 2010, Canterra Minerals<br />

Corporation completed a 54 drillhole<br />

program comprising 8,328 metres to<br />

test five high interest kimberlite bodies in<br />

the Buffalo Head Hills kimberlite field in<br />

north-central Alberta. The work, which<br />

was completed as part of a joint-venture<br />

agreement with Shore Gold <strong>Inc</strong>. and En-<br />

Cana Corporation, is expected to lead to<br />

the development of three-dimensional<br />

models for the K5, K6, K14, K91 and K252<br />

kimberlites. Diamond results are pending.<br />

In late 2009, Shear Minerals Limited<br />

commenced drilling at the Liege diamond<br />

Ironstone Outcrop along Rambling Creek. (Photo courtesy of Ironstone Resources Ltd.)<br />

project, located about 80 kilometres east<br />

of the Buffalo Head Hills kimberlite field.<br />

Shear tested three initial priority targets<br />

based on pipe-like features identified<br />

from seismic, high-resolution airborne<br />

and ground geophysical surveying completed<br />

between 2006 and 2008. The<br />

results of the drilling have not been disclosed.<br />

Ferrous minerals (Clear Hills iron<br />

deposits)<br />

During 2008, Ironstone Resources Limited<br />

drilled and recovered 385 metres of<br />

unoxidized iron ore from 47 out of 51<br />

drill holes that tested the Clear Hills ooidal<br />

ironstone deposits in north-western Alberta.<br />

During 2010, Ironstone released a<br />

National Instrument 43-101 compliant<br />

report highlighting 140 million tonnes<br />

of indicated resource (33% Fe, 0.22%<br />

V2O4) and 63 million tonnes of inferred<br />

resource (33% Fe). In addition, Ironstone<br />

embarked on a multidisciplinary program<br />

to determine if commercial grades of precious<br />

metals exist in the ore body, and<br />

cited 240 million tonnes of coal (lignite)<br />

within the boundaries of the property.<br />

Ironstone’s 2011 expenditure forecast includes<br />

drilling 160 drill holes to expand<br />

resource. To March 2011, Ironstone completed<br />

144 diamond core holes (12,000<br />

metres total drilling) for further resource<br />

estimates and announced the successful<br />

completion of a bulk sample pit at<br />

its Rambling Creek property, which removed10,000<br />

tonnes of ore for beneficiation<br />

feasibility trials.<br />

Magnetite<br />

In south-western Alberta, Micrex Development<br />

Corporation continues to<br />

move towards mine permitting of the<br />

Burmis magnetite deposit. At full production,<br />

Micrex hopes to mine between<br />

20,000 and 40,000 tonnes of finished<br />

magnetite product per year. A 10-12<br />

year mine life is anticipated. Through<br />

public consultation, Micrex has revised<br />

their proposed production system to<br />

use no water, process 100 per cent of<br />

the raw ore, eliminate tailings issues<br />

and extended the life of the proposed<br />

mine.<br />

Industrial minerals<br />

In June 2010, Athabasca Minerals <strong>Inc</strong>orporated<br />

received its second straight<br />

honour of being the top aggregate producer<br />

in Canada as published in Aggregates<br />

and Road Building <strong>Magazine</strong>. With<br />

industrial mineral land holdings in the<br />

Fort McMurray and Peace River areas<br />

of northern Alberta, Athabasca Minerals<br />

delivered some 6.6 million tonnes<br />

of aggregate. The company is also pursuing<br />

other industrial mineral commodities<br />

including silica sand, limestone,<br />

gypsum and salt.<br />

M<br />

D. Roy Eccles was formerly with the<br />

Alberta Geological Survey and recently<br />

accepted a position with Apex Geological<br />

Ltd.<br />

Gary V. White works for the Alberta<br />

Department of Energy, Coal and Mineral<br />

Development.<br />

Alberta <strong>Mining</strong><br />

<strong>Canadian</strong> <strong>Mining</strong> <strong>Magazine</strong> 7

Alberta <strong>Mining</strong><br />

Ensuring Growth Through<br />

Education<br />

The U of A has positioned itself as a trustworthy resource for high-quality<br />

By graduates Jen Reid with a depth of knowledge which will serve them well in future careers.<br />

By Jen Reid<br />

The University of Alberta’s<br />

School of <strong>Mining</strong> and Petroleum<br />

Engineering is a<br />

necessary element in the<br />

<strong>Canadian</strong> resource sector.<br />

The mining industry requires staff<br />

who are capable, industrious and forward-thinking<br />

to keep up with continued<br />

growth, and these engineers<br />

must be able to hit the ground running.<br />

Home to a mining program which has<br />

continued to grow through times of recession,<br />

the U of A has positioned itself<br />

as a trustworthy resource for high-quality<br />

graduates with a depth of knowledge<br />

which will serve them well in future careers.<br />

Forty graduates per year emerge<br />

with a Bachelor of Science in <strong>Mining</strong> Engineering,<br />

making the U of A program<br />

the largest mining program in Canada.<br />

While 50 per cent of students opt for<br />

the five year co-op program over the<br />

four-year traditional stream, all undergraduate<br />

students come through an intense<br />

and immersive period of study<br />

which combines lectures from six venerable<br />

and energetic professors, leadingedge<br />

facilities, and frequent input from<br />

practicing mining engineers.<br />

The School resides in the Natural Resources<br />

Engineering Facility, completed<br />

in 2004, which houses all mining-specific<br />

labs for the study of rock mechanics,<br />

instrumentation, mine waste, and surface<br />

mining, as well as computer labs<br />

with mining-specific software and peripherals<br />

to assist with mine design activities.<br />

Combining this modern equipment<br />

with industry-provided samples including<br />

oil sands, suspensions, dragline<br />

ropes, tires and core samples provides<br />

students with hands-on experience<br />

from the beginning of their careers.<br />

“The practical side gets students<br />

realizing, and developing. They see<br />

their errors in measurement and can<br />

grasp exactly why those errors occur,”<br />

says mining professor Tim Joseph, adding<br />

that he believes getting out of the<br />

lecture hall is vital to the education of<br />

young mining engineers.<br />

Each of the 140 current undergraduate<br />

students is trained to understand the<br />

depth and breadth of evaluation needed<br />

for each mining project, and must adapt<br />

to the extremely varied environments<br />

which each mine can present. The overall<br />

mining curriculum is designed to ensure<br />

the students emerge from the<br />

program as capable and responsible engineers<br />

with an understanding of the<br />

economic, legal, environmental and social<br />

aspects of the mining industry. The<br />

School and its students consistently exceed<br />

expectations from industry, government<br />

and academia.<br />

The Faculty of Engineering and the<br />

region’s mining organizations provide<br />

more and more support for events and<br />

competitions, opening up opportunities<br />

for research through financial awards,<br />

and presenting incentives to submit to<br />

online journals and magazines. Other<br />

elements include frequent site visits and<br />

debates between mining and environmental<br />

engineering students, opening<br />

up opportunity to explore current situations<br />

and technologies beyond the<br />

mathematical elements.<br />

The School of <strong>Mining</strong> and Petroleum<br />

invites a number of guest lecturers<br />

to provide their unique reflections.<br />

These speakers are highly experienced<br />

A class trip near Butte, Montana. August 2005. (Photographer: Doug Booth.)<br />

mining engineers from major organizations,<br />

expounding on everything from<br />

economics to efficiency. The team of<br />

mining engineering professors hopes<br />

these interactions will better guide their<br />

graduating students as they step into<br />

the mining industry, which may lose<br />

a great deal of the expert knowledge<br />

in the coming decade as many of their<br />

more seasoned colleagues step into retirement.<br />

Adjunct professors from around the<br />

world and across the disciplines provide<br />

their perspectives each year; as Komatsu<br />

area manager John Sammut says,<br />

they’re here to ensure the environment<br />

maintains its essential academic focus,<br />

but is enriched and, as he says, “flavoured<br />

with reality.”<br />

Supported by a professoriate who<br />

have been honoured with numerous<br />

career recognitions, distinguished service<br />

medals and teaching awards in the<br />

last year alone, students are increasingly<br />

encouraged to perform research at<br />

the undergraduate level—with increasing<br />

summer research programs available—and,<br />

if they choose, to continue<br />

into graduate study.<br />

The University of Alberta’s mining<br />

faculty members are often acknowledged<br />

by their peers in industry and<br />

academia for being pragmatic and enthusiastic<br />

researchers, instructors and<br />

citizens of the mining community. With<br />

their active research and knack for instructing<br />

in disciplines across the spectrum<br />

from rock mechanics, blasting, and<br />

materials handling to resource management,<br />

equipment development, mine<br />

planning, economics and environmental<br />

elements, no stone is left unturned.<br />

8 Summer 2011 / www.canadianminingmagazine.com

While some might assume the proximity<br />

of the oil sands might have a disproportionate<br />

influence on mining<br />

education in Alberta, School of <strong>Mining</strong><br />

and Petroleum director Clayton Deutsch<br />

indicates a more well-balanced approach.<br />

“There’s no question—the oil<br />

sands are in our backyard, but our students<br />

go to do underground mining in<br />

Manitoba and Saskatchewan, diamond<br />

mining up in the Northwest Territories,<br />

and internationally. We’re giving mining<br />

engineering degrees, not oil sands mining<br />

engineering degrees. With some of<br />

the local case studies, anecdotes and<br />

speakers, students might see more of<br />

the oil sands and get more of it in their<br />

work terms, but our education is very<br />

well-rounded. The students are prepared<br />

to work in any type of mining.”<br />

But how do you create leaders? Ask<br />

the leaders themselves.<br />

When the School of <strong>Mining</strong> and<br />

Petroleum was absorbed into the Department<br />

of Civil and Environmental Engineering<br />

fifteen years ago, the <strong>Mining</strong><br />

Industry Advisory Committee (MIAC)<br />

was born. Composed of top executives<br />

and highly-experienced managers from<br />

more than fifteen <strong>Canadian</strong> mining organizations,<br />

the committee is progressive,<br />

integrative and highly effective,<br />

and now provides a model for similar industry<br />

groups. It continues to be highly<br />

involved in providing resources, guidance<br />

and advice to the faculty and administration<br />

involved with the mining<br />

group and maintains an extremely solid<br />

record of ensuring summer and permanent<br />

employment for mining students in<br />

recent years.<br />

The committee plays a major role<br />

in developing the school’s curriculum.<br />

Keeping up with industry standards and<br />

developing technologies can be a challenge,<br />

but the focus is to ensure the<br />

education—at the undergraduate or<br />

graduate level—is modern and comprehensive.<br />

Deutsch indicates that along<br />

with the 100 per cent employment rate<br />

for new grads, the students and industry<br />

have found symmetry in the mining program.<br />

“Our students have never come<br />

back and say they didn’t get the education<br />

they needed,” says Deutsch. “We’re<br />

very cognizant of the entire lifecycle of<br />

a mining operation and ensuring our<br />

Taken near Hinton, Alberta at Cheviot Mine, prior to the mine going into production.<br />

September 2004. (Photographer: Jennifer Williams/Tim Joseph.)<br />

students are able to be slotted in wherever<br />

they’re needed.”<br />

If the University of Alberta’s firstplace<br />

result in this year’s <strong>Mining</strong><br />

Games indicates anything, the program<br />

recruits, and delivers, the very<br />

best in the business. Reports from employers<br />

have confirmed over recent<br />

years that graduates from the program<br />

are equipped with the knowledge,<br />

tools and skills required by<br />

industry, and often stand out from<br />

the crowd even in the early years of<br />

their careers. Those graduates continue<br />

to give back, with several highly<br />

distinguished alumni—including several<br />

<strong>Canadian</strong> <strong>Mining</strong> Hall of Fame inductees—remaining<br />

involved with the<br />

current mining students through scholarships,<br />

sponsorship and seminars.<br />

With a recent Fraser Institute survey<br />

declaring Alberta as the world`s<br />

most attractive jurisdiction for mineral<br />

exploration and development and naming<br />

the superior infrastructure as a major<br />

element, the key now is to ensure<br />

the School of <strong>Mining</strong> and Petroleum Engineering<br />

maintains that distinction by<br />

progressing and producing the best possible<br />

mining engineers available. Talent<br />

is the most critical resource in any<br />

economy, and the University of Alberta<br />

continues to find ways to nurture it by<br />

providing the best possible resources<br />

and opportunities for its students. M<br />

Jen Reid is the communications assistant<br />

for the Department of Civil and<br />

Environmental Engineering and School<br />

of <strong>Mining</strong> and Petroleum Engineering<br />

at the University of Alberta. Reid<br />

is a graduate of the Bachelor of Communications<br />

Studies from University of<br />

Calgary and is also an experienced technical<br />

writer, web writer, videographer/<br />

editor and graphic designer.<br />

Alberta <strong>Mining</strong><br />

<strong>Canadian</strong> <strong>Mining</strong> <strong>Magazine</strong> 9

Alberta <strong>Mining</strong><br />

Economic Impact of<br />

Alberta’s <strong>Mining</strong> Industry<br />

<strong>Mining</strong> in Alberta—a sunrise industry.<br />

The world’s largest truck—the Caterpillar 797—<br />

at work in the oil sands. (Photo courtesy of Finning<br />

Canada.)<br />

By Laura Severs<br />

Alberta’s mining sector<br />

has set its eyes on its<br />

share of the size of the<br />

prize.<br />

That prize, according<br />

to a recently released 2011 report<br />

from the Edmonton-based Alberta<br />

Chamber of Resources (ACR), is huge.<br />

In the report, the ACR task force on<br />

resource development and the economy<br />

forecasts that over the next 10<br />

years, development of Alberta’s resource<br />

basket—ranging from oil and<br />

gas, minerals and forestry—could<br />

add $700 billion in incremental GDP,<br />

just under four million person-years<br />

of employment and more than $110<br />

billion in provincial government revenue.<br />

“What we have here in Alberta<br />

is what the world will need for (at<br />

least) the next 30 years and a lot of<br />

it is mined here—the oilsands, coal,<br />

and sand and gravel—and we’re hunting<br />

for diamonds and uranium,” says<br />

ACR Executive Director Brad Anderson,<br />

who emphasizes that mining in<br />

Alberta is a sunrise, not a sunset, industry.<br />

“The Alberta Chamber of Resources<br />

firmly believes that natural resource<br />

recovery and development<br />

have a strong future and will remain<br />

the motor driving the Alberta<br />

economy and a mainstay of the <strong>Canadian</strong><br />

economy,” says Anderson.<br />

With the natural resource sectors<br />

accounting for about 22 per cent of<br />

<strong>Canadian</strong> GNP and about 62 per cent<br />

of Alberta’s GDP in recent years, including<br />

direct and indirect impacts,<br />

Anderson expects that the task force<br />

report will help to guide an orderly<br />

and responsible development of natural<br />

resources in Alberta.<br />

Initial reaction to the report has<br />

been positive, with work already<br />

underway on some of its recommendations.<br />

That bodes well for Edmonton,<br />

adds Edmonton Economic Development<br />

Corp. (EEDC) President and CEO<br />

Ron Gilbertson. “We’ve clearly set<br />

ourselves as the service sector for the<br />

heavy oil and the mining sector. The<br />

procurement side, production work,<br />

and manufacturing are predominantly<br />

coming out of Edmonton,” says<br />

Gilbertson. “That has a very positive<br />

impact on the economy. That’s where<br />

we’re going.”<br />

That impact is already evident with<br />

employment levels bouncing back<br />

from the lows of the recent recession.<br />

When the heavy oil sector—and<br />

its significant mining component—<br />

took a hit from the economic downturn,<br />

Edmonton’s unemployment<br />

level more than doubled in just nine<br />

months. Now unemployment numbers<br />

are down to the 5.7 per cent<br />

mark and approaching the five-percent-level<br />

where Edmonton will be<br />

in a structural employment situation.<br />

“Once we hit around five per cent unemployment,<br />

it’s considered almost<br />

as full employment,” says Gilbertson.<br />

Factor in the oilsands, the world’s<br />

third-largest reserves of oil, and the<br />

outlook for the future of the mining<br />

sector is even stronger.<br />

Over at Finning Canada, a division<br />

of Finning International <strong>Inc</strong>., the<br />

world’s largest Caterpillar equipment<br />

dealer, the mining sector is helping to<br />

drive the company’s Edmonton headquarters<br />

to new heights. Substantially<br />

improved profitability in Finning’s<br />

<strong>Canadian</strong> operations played a role in<br />

Finning International recording a 32<br />

per cent increase in revenue—at $1.3<br />

billion—in the first quarter of 2011<br />

compared to the first quarter of 2010.<br />

“We have a very optimistic outlook<br />

across our region, specifically in Edmonton<br />

with commodity prices and<br />

the demand for commodities increasing,”<br />

says Finning Canada <strong>Mining</strong> Vice<br />

President Gordon Finlay. “We look to<br />

help our customers achieve the lowest<br />

cost per ton in their mine operations.<br />

As a result, the demand for our<br />

10 Summer 2011 / www.canadianminingmagazine.com

services is growing. We see a huge opportunity<br />

for us to hire and develop<br />

more people to serve the industry.”<br />

Finning is looking to recruit an<br />

additional 400 heavy equipment technicians<br />

by 2012.<br />

In Canada, it employs 1,000 people<br />

in Edmonton, another 800 in the oilsands,<br />

and a total of 4,000 employees<br />

across western Canada, including<br />

more than 100 employees at the Ekati<br />

diamond mine in the Northwest Territories<br />

but which are also supported<br />

from Edmonton.<br />

“Edmonton, thanks to its central<br />

location, is well-situated to serve mining<br />

activity in western Canada,” adds<br />

Finlay, “And it’s one of our strategic<br />

goals to grow our mining business.”<br />

Meanwhile at OEM Remanufacturing,<br />

a Finning supplier, the future is<br />

looking bright.<br />

“Business is going strong and we<br />

are growing rapidly. We have hired<br />

about 55 people in 2011. We have<br />

hired 110 in people in 2010 and we<br />

expect to continue to hire another<br />

50 people this year,” says Craig Priddle,<br />

president and CEO of OEM, which<br />

is based in Edmonton. The company<br />

employs 520 people and is one of<br />

North America’s most advanced engine<br />

and powertrain component remanufacturing<br />

operations. “The level<br />

of activity in mining is what drives our<br />

growth. We expect to double in size<br />

over the next five years.”<br />

OEM’s expansion and hiring is<br />

based on a fair expectation of what<br />

the company thinks will happen. But<br />

they’re preparing for the possibility<br />

that they may have to double in size<br />

over the next three years.<br />

M<br />

Laura Severs is an Edmonton-based<br />

freelance writer whose work has appeared<br />

in newspapers, on websites<br />

and in magazines across Canada. For<br />

five years she was the Edmonton correspondent<br />

and reporter for the Calgary-based<br />

Business Edge newspaper.<br />

Severs also has a strong grounding in<br />

the new media sector, having worked<br />

on the editorial side of the team that<br />

introduced the Canada.com website<br />

now under the control of the Postmedia<br />

Network.<br />

She currently specializes in business,<br />

technical and travel writing.<br />

Unrivalled product support: Finning mechanic inspects Caterpillar D11 tractor ripper<br />

cylinder barrel. (Photo courtesy of Finning Canada.)<br />

Alberta <strong>Mining</strong><br />

<strong>Canadian</strong> <strong>Mining</strong> <strong>Magazine</strong> 11

Alberta <strong>Mining</strong><br />

Ironstone Resources’ Clear Hills Project<br />

Cementing Alberta as one of the world’s best places for resource development in minerals.<br />

By Andrew Reader<br />

In March 2011, the Fraser Institute<br />

announced that Alberta has<br />

surpassed Quebec as the world’s<br />

most attractive jurisdiction for<br />

mineral exploration and development,<br />

citing its resource-friendly government,<br />

competitive taxation regime and<br />

superior infrastructure as a few of its notable<br />

strengths. With over $70 billion in infrastructure<br />

development by Alberta’s oil and<br />

gas industry, the majority of the province is<br />

extremely amenable to mineral exploration<br />

and development.<br />

The oil and gas industry in Alberta has a<br />

history of exploration that spans over 100<br />

years, but the discovery of uranium mineralization<br />

at Rabbit Lake in 1968 changed<br />

much of the exploration focus in Alberta towards<br />

mineral exploration within the Athabasca<br />

Basin. More recently, the discovery of<br />

kimberlite pipes throughout Northern Alberta<br />

in the 1990s renewed the mineral exploration<br />

focus in Alberta. However, while<br />

the prospectivity for kimberlites and uranium<br />

in Alberta is well known, the existence<br />

of a significant open pit-mineable iron ore<br />

deposit remains largely unrecognized.<br />

Ironstone Resources Ltd. is a privately<br />

held <strong>Canadian</strong> exploration and development<br />

company with a resource portfolio<br />

focused on mineral exploration within Alberta.<br />

Headquartered in Calgary, Alberta,<br />

Ironstone has a significant land position in<br />

the Clear Hills region of northwest Alberta,<br />

which contains a world-class iron ore and<br />

vanadium deposit. The company is currently<br />

active in development of the Clear Hills<br />

ironstone deposit, recently completing a<br />

12,000 metre drilling program to increase<br />

its NI 43-101 compliant resource from 203<br />

million tonnes to 500 million tonnes.<br />

The Clear Hills ironstone deposit is located<br />

approximately 490 kilometres northwest<br />

of Edmonton. The deposit was originally<br />

discovered in 1924 by local trappers in the<br />

region, but was not seriously explored until<br />

its rediscovery in the early 1950s after the<br />

drilling of an exploratory oil and gas well<br />

which penetrated the iron-rich sandstone.<br />

Extensive exploratory drilling was completed<br />

in the late 1950s and early 1960s to delineate<br />

the deposit, and in 1980 the Alberta<br />

government assigned a resource of 1.124<br />

billion tonnes grading approximately 34<br />

per cent Fe (not fully NI 43-101 compliant).<br />

The size of this deposit makes it the largest<br />

known iron deposit present in the western<br />

provinces of Canada. Recent analytical work<br />

on the ore identified the existence of approximately<br />

0.22 per cent vanadium pentoxide<br />

(V₂O₅) in addition to the iron, which<br />

would represent a potential in-situ resource<br />

of 5 billion pounds of V 2<br />

O 5<br />

.<br />

Ironstone completed a 51-hole drilling<br />

program in the winter of 2008 on the Rambling<br />

Creek block at the northern end of the<br />

deposit which, in combination with the historic<br />

drilling through the 50s and 60s, was<br />

used to determine an NI 43-101 compliant<br />

resource of an indicated 139.6 million<br />

tonnes grading 33 per cent Fe and 0.21<br />

per cent V 2<br />

O 5<br />

, and an inferred 62.8 million<br />

tonnes grading 33.7 per cent Fe. The Rambling<br />

Creek block at the northern end of the<br />

deposit currently hosts the largest compliant<br />

vanadium resource in North America at<br />

646 million pounds of V 2<br />

O 5<br />

.<br />

In the winter of 2011 Ironstone completed<br />

a 144-hole drilling program to the<br />

south of the Rambling Creek block in order<br />

to expand the iron and vanadium resource<br />

on the Clear Hills property. The company<br />

expects to release its second NI 43-101<br />

compliant resource by September 2011,<br />

raising the total compliant iron and vanadium<br />

resource in the Clear Hills to 500 million<br />

tonnes.<br />

In addition to the drilling, Ironstone<br />

opened a 45,000 tonne bulk sample pit<br />

from which 10,000 tonnes of ore were extracted<br />

and stockpiled for process and pilot<br />

plant trials to be completed through 2011.<br />

The company will be producing a direct reduced<br />

iron product with over 90 per cent<br />

iron metallization along with a vanadium<br />

pentoxide co-product. The robust grain enlargement<br />

process deports away contaminants<br />

like phosphorus and silica from the<br />

nearly pure iron, while permitting extraction<br />

and concentration of the increasingly<br />

important vanadium commodity.<br />

The Clear Hills deposit is considered to<br />

be mineable through low cost and low impact<br />

open-pit mining methods. Due to oil<br />

and gas development in the Clear Hills,<br />

there is excellent local infrastructure including<br />

nearby gas pipelines for energy, coal for<br />

iron processing, roads into the mine site,<br />

and access to nearby rail for transportation<br />

to Pacific Rim and North American steel<br />

producers.<br />

Ironstone’s Clear Hills iron and vanadium<br />

project is expected to have an economic<br />

impact on the scale of the oilsands,<br />

clearly cementing Alberta as one of the<br />

world’s best places for resource development<br />

in minerals, alongside it’s rich heritage<br />

as Canada’s energy hub.<br />

M<br />

Andrew Reader is a recent graduate<br />

from the University of Calgary with a focus<br />

on mineral exploration, and is currently employed<br />

by Ironstone Resources Ltd.<br />

Completed bulk sample pit in March 2011. (Photo courtesy of<br />

Dan Christal.)<br />

Late-stage construction of bulk sample pit in March 2011.<br />

(Photo courtesy of Dan Christal.)<br />

12 Summer 2011 / www.canadianminingmagazine.com

<strong>Canadian</strong> <strong>Mining</strong> <strong>Magazine</strong> 13<br />

Alberta <strong>Mining</strong>

Workplace Diversity:<br />

A core value at Suncor Energy.<br />

By Lindsay Forcellini<br />

An increasingly competitive<br />

labour market is affecting<br />

all industry sectors,<br />

but particularly those that<br />

rely on skilled trades and<br />

highly educated professionals. The <strong>Canadian</strong><br />

mining industry, with its strong<br />

commodity market and current growth<br />

projections, is particularly vulnerable to<br />

labour shortages.<br />

In addition, the industry is facing a<br />

demographic challenge; an aging population<br />

means that in the next 10 years<br />

alone, 40 per cent of the mining workforce<br />

will be eligible for retirement, driving<br />

the need for approximately 100,000<br />

new workers by 2020, according to<br />

MiHR’s latest labour market information<br />

report, <strong>Canadian</strong> <strong>Mining</strong> Industry<br />

Employment and Hiring Forecasts 2010.<br />

In Canada’s oil sands alone, employment<br />

is expected to double from 12,000<br />

to 24,000 by 2020, says Anne Marie<br />

Toutant, vice president of mining operations<br />

for Suncor Energy, located in Fort<br />

McMurray, Alberta.<br />

Diversity is an integral component of<br />

the HR solution and falls under one of<br />

Suncor’s four areas of operational excellence—people.<br />

“People are at the heart of each<br />

piece of equipment you operate, so for<br />

us, having an engaged, competent and<br />

effective team of people is really important,”<br />

Toutant explains.<br />

Attracting and retaining non-traditional<br />

sources of talent that have previously<br />

been under-represented in mining<br />

is critical to ensure the necessary people<br />

and skills are available in the short and<br />

longer term for the sustainability of the<br />

industry.<br />

But for Toutant, addressing the HR<br />

challenge is merely one advantage of<br />

building a diverse workforce.<br />

“We believe that better business<br />

decisions are made when a team is<br />

comprised of people who come from<br />

different backgrounds, have different<br />

Diversity is an integral component of Suncor’s HR solution. (Photo courtesy of MiHR.)<br />

educational training and different problem<br />

solving techniques,” affirms Toutant.<br />

“With that kind of diversity, you bring a<br />

unique view of the challenges and a<br />

more thorough and robust approach to<br />

finding solutions.”<br />

Diversity in thinking<br />

There are many opportunities to revitalize<br />

the workforce and diversify<br />

the potential talent pool. A number of<br />

groups that are currently under-represented<br />

in the mining industry, yet available<br />

in the general labour force include<br />

women, youth, new <strong>Canadian</strong>s, Aboriginal<br />

peoples and workers from comparable<br />

industries that have experienced a<br />

downturn.<br />

MiHR plays a key role in taking on<br />

this challenge. Last summer, the Council<br />

received $850,000 in funding from<br />

Human Resources and Skills Development<br />

Canada for its new diversity research<br />

project, SHIFT: Changing the Face<br />

of Canada’s <strong>Mining</strong> Industry. The project<br />

will be developed over the next three<br />

years and includes a number of outcomes<br />

to reduce barriers to workplace<br />

diversity. The Take Action for Diversity<br />

report, published in May 2011, is one<br />

deliverable of the SHIFT initiative. The<br />

report was developed to assist employers<br />

in their efforts to attract and retain<br />

staff from specific pools of talent, including<br />

Aboriginal peoples, youth, women,<br />

new <strong>Canadian</strong>s, mature/transitioning<br />

workers, and persons with disabilities.<br />

It provides valuable insight on the perspectives<br />

of members of these key target<br />

groups and aims to expand upon<br />

existing research by exploring industryspecific<br />

barriers to their inclusion in Canada’s<br />

mining industry.<br />

Suncor is a company that is making<br />

strides in workplace diversity. It recruits<br />

from seven to eight universities across<br />

Canada to tap into the full spectrum of<br />

talent students can offer.<br />

In 2010, about 6.4 per cent of Suncor’s<br />

mining workforce self-identifies as<br />

Aboriginal, which is just shy of the industry<br />

average of 6.5 per cent. Toutant says<br />

Suncor also encourages an open dialogue<br />

with Aboriginal communities by<br />

inviting elders to visit the mine site to<br />

share their knowledge about the local<br />

environment and cultural practices.<br />

Suncor is a strong supporter of the<br />

National Aboriginal Achievement Foundation,<br />

which provides pre-trade bursaries<br />

to help Aboriginal people achieve<br />

high school credentials or skill upgrades<br />

to enter trades professional careers.<br />

Suncor also supports Women Building<br />

Futures, a pre-trades program for underemployed<br />

or unemployed women, 20<br />

per cent of which are Aboriginal. This<br />

program provides an entry skill set for<br />

candidates to enrol in an apprenticeship<br />

program.<br />

14 Summer 2011 / www.canadianminingmagazine.com

Diversity is an important factor at<br />

all levels of an organization and Suncor<br />

is creating opportunities for female<br />

leaders to network, explains Toutant.<br />

Women make up about 22 per cent of<br />

the mining professional or staff positions<br />

and 12.4 per cent of the total workforce,<br />

with 60 women holding management or<br />

senior management positions at the Oil<br />

Sands facility.<br />

Partnering with the Suncor Energy<br />

Foundation in 2010, Suncor invited female<br />

leaders to participate in a Famous<br />

5 Speaker series, allowing them to share<br />

their experiences and providing opportunities<br />

for them to partner together.<br />

In 2011 those same leaders were asked<br />

to bring other Suncor women to the<br />

Famous 5 Speaker series. Suncor’s Taking<br />

the Stage workshop is an interactive<br />

session which enhances women leaders’<br />

confidence by making them comfortable<br />

in the spotlight, unlocking the<br />

power of their voices, creating strong<br />

scripts and stories and achieving dynamic<br />

presence.<br />

A core value<br />

Enhancing workplace diversity offers<br />

many benefits, but it can be challenging.<br />

Toutant’s advice: Don’t get caught up in<br />

the numbers.<br />

“It’s important to know where you<br />

are and be focused on building toward<br />

a new future, but our aim is to get the<br />

best person for the job all of the time,”<br />

Toutant explains. “If you hold [diversity]<br />

as a core value, you have fewer pitfalls.”<br />

MiHR is committed to supporting<br />

the industry’s ability to actively engage<br />

non-traditional sources of labour<br />

and its newly-funded diversity project<br />

is poised to tackle this challenge<br />

and offer industry-wide benefits. Building<br />

upon MiHR’s previous work, <strong>Mining</strong><br />

for Diversity (available at www.<br />

mihr.ca), SHIFT will address technology<br />

and intergenerational workforces, barriers<br />

to workplace diversity and best<br />

HR practices to increase Aboriginal inclusion<br />

in mining.<br />

M<br />

For more information on SHIFT,<br />

please contact MiHR’s Director of Attraction,<br />

Retention and Transition, Melanie<br />

Sturk at msturk@mihr.ca.<br />

<strong>Canadian</strong> <strong>Mining</strong> <strong>Magazine</strong> 15

Upcoming Events<br />

Missed our upcoming events section?<br />

Go to<br />

canadianminingmagazine.com/upcoming-events<br />

to keep up to date!<br />

Or scan the code on the right to go<br />

straight to the page with your smartphone.<br />

Download<br />

the free app<br />

for your<br />

smart phone<br />

to scan this<br />

code at<br />

2dscanlife.com<br />

16 Summer 2011 / www.canadianminingmagazine.com

Transaction Report<br />

Equinox acknowledges Barrick takeover offer<br />

successful and declared unconditional<br />

Equinox Minerals Ltd. announced on June 1, 2011 that<br />

729 million common shares of Equinox representing approximately<br />

83 per cent of the outstanding Equinox Shares on a<br />

fully diluted basis have been deposited into the offer by Barrick<br />

Gold Corporation to acquire all of the Equinox Shares at<br />

a price of C$8.15 per Equinox Share by way of a takeover bid.<br />

All of the conditions of the offer have been satisfied and<br />

Barrick has taken up all such deposited shares and will pay for<br />

all such shares by June 6, 2011. Barrick and its affiliates now<br />

collectively own about 747 million Equinox Shares, representing<br />

approximately 85 per cent of the outstanding Equinox<br />

Shares on a fully diluted basis.<br />

The offer has also been extended to enable the remaining<br />

Equinox shareholders to receive prompt payment of C$8.15<br />

(cash) per Equinox Share. Barrick will take up and pay for any<br />

Equinox Shares validly tendered within three business days of<br />

such tender. Barrick intends to acquire all Equinox Shares not<br />

tendered to the offer following its expiry pursuant to a compulsory<br />

acquisition or a subsequent acquisition transaction.<br />

The offer is now open for acceptance until 5:00 p.m. on<br />

June 14, 2011, unless the offer is further extended. Barrick<br />

expects to mail a formal notice of extension shortly.<br />

Equinox Minerals Ltd. is an international mining company<br />

dual-listed on the <strong>Canadian</strong> (Toronto) and Australian stock exchanges.<br />

Selwyn announces completion of acquisition of<br />

ScoZinc Ltd.<br />

Selwyn Resources Ltd. announced on June 1, 2011 the acquisition<br />

of all the assets of ScoZinc Ltd., including the Scotia<br />

Mine in Nova Scotia, through the purchase of all the shares<br />

of ScoZinc. As previously announced, the purchase price for<br />

ScoZinc was CAD$10 million, including certain payments<br />

made to the province of Nova Scotia related to increased<br />

bonding requirements for an amended reclamation and closure<br />

plan for the Scotia Mine and production royalties.<br />

“The completion of the acquisition of the shares of<br />

ScoZinc Ltd. marks a turning point, as it provides an early opportunity<br />

for Selwyn to join the ranks of the producers,” Dr.<br />

Harlan Meade, president and CEO of Selwyn, says of the acquisition.<br />

“The projected cash flows from the re-start of the<br />

Scotia Mine expected in early 2012 are strategically important<br />

to the securing of debt and equity for the development<br />

of the Selwyn Project that is being jointly advanced with its<br />

joint venture partner, Chihong Canada <strong>Mining</strong> Ltd., a wholly<br />

owned subsidiary of Yunnan Chihong Zinc & Germanium Co.<br />

Ltd. The commencement of production at the Scotia Mine<br />

should act as a catalyst for the revaluation of Selwyn and its<br />

Selwyn Project based on discounted future cash flows. Additionally,<br />

Selwyn is expanding its management team to undertake<br />

the re-start of the Scotia Mine, with the recent addition<br />

of several key senior management personnel as an important<br />

step in preparing for financing of the Selwyn Project.”<br />

Selwyn will shortly embark on the raising of US$30 million<br />

of debt financing to provide approximately US$20 million<br />

in re-start capital for the Scotia Mine and US$10 million<br />

in working capital. A new mine plan and economic model is in<br />

preparation to provide a more definitive estimate of operating<br />

costs and cash flow projections necessary for securing the<br />

approximate US$30 million for the resumption of operations<br />

at the Scotia Mine.<br />

Selwyn intends to resume definition drilling of known mineralization<br />

adjacent to the Main deposit in an effort to expand<br />

reserves and mine life. Drilling is also planned at the<br />

Northeast deposit after completion of drilling adjacent to the<br />

Main deposit. The Northeast deposit was initially permitted<br />

as a high grade underground mine.<br />

HudBay Minerals announces commencement of<br />

compulsory acquisition of remaining shares of<br />

Norsemont <strong>Mining</strong><br />

HudBay Minerals <strong>Inc</strong>. announced on May 4, 2011 it is exercising<br />

its right under the compulsory acquisition provisions of<br />

the Business Corporations Act (British Columbia) to acquire<br />

all outstanding common shares of Norsemont <strong>Mining</strong> <strong>Inc</strong>. not<br />

already beneficially owned by it on the terms set out in its offer<br />

dated January 24, 2011, as extended (the “Offer”). Further<br />

details are provided in HudBay’s Notice of Compulsory<br />

Acquisition, which will be made available on SEDAR at www.<br />

sedar.com.<br />

Upon completion of the compulsory acquisition, HudBay<br />

intends to de-list the common shares of Norsemont from the<br />

Toronto and Lima stock exchanges and to cause Norsemont<br />

to cease to be a reporting issuer.<br />

As previously announced, HudBay has been successful<br />

in its bid to acquire Norsemont, having taken up a total of<br />

112,185,931 common shares of Norsemont validly deposited<br />

to the Offer, representing approximately 96.6 per cent of the<br />

issued and outstanding common shares of Norsemont not already<br />

owned by HudBay (on a fully-diluted basis). <br />

M<br />

<strong>Canadian</strong> <strong>Mining</strong> <strong>Magazine</strong> 17

18 Summer 2011 / www.canadianminingmagazine.com

Queenston discovers a new<br />

gold zone and updates drill<br />

results at Upper Canada<br />

Queenston <strong>Mining</strong> <strong>Inc</strong>. has announced<br />

results from an additional 44<br />

surface diamond drill holes (12,861 m)<br />

from the ongoing drilling program on<br />

the 100 percent owned Upper Canada<br />

property located in Kirkland Lake, Ontario.<br />

The drilling has expanded both<br />

the pit and underground resource potential<br />

and also resulted in the discovery<br />

of the new Northland Zone, it was<br />

announced June 7, 2011.<br />

The new drill holes are not included<br />

in the recent, initial mineral resource<br />

announced on the property<br />

that included an in‐pit indicated resource<br />

of 1,721,000 t grading 1.88 g/t<br />

(104,000 oz) and an in‐pit inferred resource<br />

of 1.273,000 t grading 1.86<br />

g/t (76,000 oz). The initial mineral resource<br />

also outlined an underground<br />

indicated resource of 238,000 t grading<br />

4.25 g/t (33,000 oz) and an underground<br />

inferred resource of 3,622,000 t<br />

grading 4.78 g/t (557,000 oz). The mineral<br />

resource estimate was prepared in<br />

accordance with NI 43‐101 by P&E <strong>Mining</strong><br />

Consultants <strong>Inc</strong>. under direction of<br />

Qualified Person Eugene Puritch.<br />

Assay results from the recent phase<br />

of drilling are available at www.queenston.ca.<br />

“We continue to be pleased with<br />

the results at Upper Canada as drilling<br />

begins to extend the surface and<br />

underground resource potential. We<br />

are particularly excited with the new<br />

Northland Zone, where a significant<br />

width of gold mineralization has been<br />

discovered on surface north of the previous<br />

mine workings,” says Charles<br />

Page, president and CEO of Queenston.<br />

“The mineralization at Upper Canada<br />

remains open and drilling will continue<br />

with four rigs focused on building<br />

a larger resource on both the existing<br />

Junior<br />

<strong>Mining</strong><br />

News<br />

and new gold zones. Upper Canada is<br />

a key ingredient in the company’s goal<br />

of advancing the Kirkland East Project<br />

towards feasibility and, ultimately, production.”<br />

“We continue to be pleased<br />

with the results at Upper<br />

Canada as drilling begins<br />

to extend the surface and<br />

underground resource<br />

potential.”<br />

Both shallow and deeper drilling will<br />

continue targeting both the open pit<br />

and deeper underground mineralization<br />

employing four drill rigs. The focus<br />

will continue along the main South<br />

Branch to further define and extend<br />

the open pit resource and the deeper<br />

C Zone. On the new Northland Zone,<br />

drilling will begin to step‐out both east<br />

and west along trend and a program<br />

of stripping and trench will expose<br />

the mineralization at surface. Drilling<br />

will also begin to test the potential for<br />

a bulk underground resource targeting<br />

the Upper L Zone. Past production<br />

from this zone totaled 439,000 ounces<br />

of gold from approximately 1,300,000<br />

t grading 11 g/t. The L Zone dips vertically<br />

and there remains a mineralized<br />

envelope measuring up to 40 m thick<br />

adjacent to the 2 m wide vein zone historically<br />

mined. If drilling can prove<br />

continuity, a potentially large tonnage<br />

underground mining scenario may exist<br />

at Upper Canada.<br />

Stornoway announces exploration<br />

drill program at Hammer property,<br />

Nunavut<br />

Stornoway Diamond Corporation has<br />

announced plans for an upcoming exploration<br />

drill program at the Hammer property<br />

located within the Coronation Gulf/<br />

North Slave Diamond District of Nunavut.<br />

The Hammer property is a joint venture<br />

between Stornoway and North Arrow<br />

Minerals <strong>Inc</strong>. and hosts the Hammer kimberlite,<br />

which was discovered by prospecting<br />

in July 2009. The Hammer kimberlite<br />

has not yet been drill tested and the upcoming<br />

program will be designed to delineate<br />

its size and diamond content for<br />

the first time, it was announced May 25,<br />

2011. Concurrently, Stornoway intends<br />

to drill for the presence of additional undiscovered<br />

kimberlites associated with<br />

kimberlitic mineral trains that have been<br />

identified on nearby claims owned 100<br />

percent by Stornoway.<br />

Stornoway’s flagship property is the<br />

100 percent owned Renard Diamond<br />

Project in north-central Quebec, where<br />

a feasibility study and an associated environmental<br />

and social impact assessment<br />

are on track for completion in the<br />

third quarter of this year. On April 26,<br />

2011, Stornoway announced a $5.6M<br />

budget for complimentary grass roots exploration<br />

at several additional projects<br />

within Canada where the potential exists<br />

for new kimberlite discoveries. The 2011<br />

Hammer drilling represents an expenditure<br />

of $1.3M within this exploration program.<br />

The Hammer Property is located approximately<br />

500km north of Yellowknife,<br />

Northwest Territories and was acquired<br />

by the joint venture in October 2008. The<br />

Hammer kimberlite was first identified<br />

as a topographic anomaly at the head of<br />

a kimberlitic indicator mineral train with<br />

strong diamond inclusion chemistry.<br />

The goal of the program will be to delineate<br />

the true size and shape of the<br />

body, test for multiple phases of kimberlite,<br />

and collect sufficient samples to permit<br />

an estimate of diamond content.<br />

Stornoway Diamond Corporation is<br />

one of Canada’s leading diamond exploration<br />

and development companies,<br />

involved in the discovery of over 200<br />

kimberlites in seven <strong>Canadian</strong> diamond<br />

districts.<br />

M<br />

<strong>Canadian</strong> <strong>Mining</strong> <strong>Magazine</strong> 19

Tools of the Trade<br />

Yaskawa Releases the A1000 Variable Speed Drive<br />

The Drives & Motion Division of<br />

Yaskawa America, <strong>Inc</strong>. announces the<br />

release of the A1000 variable speed<br />

drive, a full featured drive, providing<br />

outstanding quality, performance, flexibility,<br />

and environmental friendliness<br />

through 1000HP. For new installations<br />

or retrofits, the A1000 provides a single<br />

robust solution, regardless of your<br />

application.<br />

Exceptional quality is the hallmark<br />

of Yaskawa products. This is demonstrated<br />

no better than in the new<br />

A1000, having a calculated design life<br />

that is twice as long as previous generations.<br />

Compatibility with interior<br />

and surface permanent magnet motors<br />

provides highly efficient, precision<br />

control with incredible performance,<br />

producing up to 200 per cent torque<br />

with or without feedback.<br />

User-friendly configuration tools, including a multi-language<br />

LCD display, parameter storage, application presets,<br />

and a portable USB copy unit make programming and configuration<br />

simple. DriveWizard® computer software delivers<br />

configuration, monitoring, and trending functions enhanced<br />

by direct connectivity through the A1000’s standard USB port.<br />

A significant quantity of control points<br />

are included as standard. For applications<br />

requiring more functionality, the<br />

A1000 offers three expansion ports for<br />

additional I/O, feedback, and network<br />

communications, including DeviceNet,<br />

EtherNet/IP, Modbus TCP/IP, Profibus-<br />

DP, PROFINET, and MECHATROLINK-II.<br />

Embedded applications functions, such<br />

as PID control, droop control, and function<br />

block programming provide system<br />

level control without the use of a standalone<br />

controller.<br />

Energy efficiency is maximized with<br />

variable speed control, and A1000’s integrated<br />

DC reactors reduce harmonic<br />

demand from the power system, contributing<br />

to a cleaner environment.<br />

Additionally, all materials used in the<br />

A1000 comply with the directive for<br />

Restriction of Hazardous Substances<br />

(RoHS).<br />

The A1000 drive is available in 200-240VAC Three Phase<br />

50/60 Hz (up to 175 HP), 380-480VAC Three Phase 50/60 Hz<br />

(up to 1000 HP), and 500-600VAC Three Phase 50/60Hz (up<br />

to 250 HP) ratings. In addition, the A1000 is designed for use<br />

around the world, and carries agency certifications for all major<br />

geographical regions.<br />

20 Summer 2011 / www.canadianminingmagazine.com

Introducing the New<br />

IMPACTO® DRYRIGGER’s Gloves<br />

Impacto Protective Products <strong>Inc</strong>.<br />

specializes in design, manufacturing<br />

and distribution of custom ergonomic<br />

products to help prevent cumulative<br />

trauma and repetitive strain injuries.<br />

One of the latest innovative products<br />

added to the Hand Protection<br />

Line is the DRYRIGGER, #WGRIGG.<br />

Durable design, oil and water resistant<br />

gloves help prevent hairline<br />

fractures, bruising and pinched fingers;<br />

protect the hand and fingers<br />

from impact and abrasion; designed<br />

to ensure excellent dexterity, fit and<br />

comfort. Ultimate hand protection to<br />

prevent finger pinching, severe cuts,<br />

abrasions and crushing injuries. The<br />

New IMPACTO DRYRIGGERs work extra<br />

hard to ensure protection!<br />

Features and Benefits:<br />

• Neoprene cuff offers excellent fit;<br />

• High-visibility yellow laminated<br />

fabric on the back of the hand<br />

repels oil and water;<br />

• Ultra Suede fabric in the palm<br />

repels oil and water;<br />

• Under layer of PVC nitrile offers an<br />

extra barrier of protection in oily<br />

conditions;<br />

• Silicone dots on the palm and<br />

fingertips provide excellent grip;<br />

• Heavy duty TPR padded across<br />

the knuckles ideal for confined<br />

spaces;<br />

• Heavy duty TPR on back of<br />

fingers, thumb & back of the<br />

hand protects against bruises and<br />

bumps; and<br />

• Durable patches in the webbing<br />

area assure long wear.<br />

Abitibi Geophysics contributes to<br />

Galahad Metals’ discovery of auriferous<br />

deposits<br />

Through the use of a new and better performing<br />

approach than conventional methods,<br />

Abitibi Geophysics has contributed to the discovery<br />

of a geophysical anomaly surveyed at 79.4g/t<br />

Au per 3.6 meters on the Regcourt property belonging<br />

to Galahad Metals located east of Val<br />

D’Or.<br />

The new H2H-3D-IP Approach<br />

The experience acquired by Abitibi Geophysics<br />

over the past 27 years in induced polarization<br />

drilling has uncovered a new and better<br />

performing approach in mineral exploration:<br />

the hole-to-hole IP technique with 3D modelling<br />

(H2H -3D-IP).<br />

The H2H-3D-IP radius of investigation is not<br />

dictated by the depth of the hole but by the spacing<br />

of the holes instead. A localized target near,<br />

or under the edge of the hole can easily be detected<br />

whereas with conventional methods,<br />

sensitivity declines toward the end of the hole.<br />

Because the technique is less sensitive to geological<br />

noise (in-hole type mineralization) than<br />

conventional techniques, it results in an improved<br />

resolution for signatures from distant sources.<br />

A 3D image of causative sources is produced<br />

using simultaneous inversion of information gathered<br />

in each of the pairs of holes.<br />

For more information contact: Abitibi Geophysics:<br />

Mr. Pierre Bérubé, Eng. and President:<br />

819 874-8800, www.ageophysics.com.<br />

<strong>Canadian</strong> <strong>Mining</strong> <strong>Magazine</strong> 21

News Watch:<br />

The North<br />

NORTHWEST TERRITORIES<br />

Northwest Territories Energy<br />

Report offers opportunities<br />

to develop alternative energy<br />

sources<br />

The Northwest Territories (NWT)<br />

Energy Report, released May 19, 2011<br />

by the Ministerial Energy Coordinating<br />

Committee (MECC), highlights opportunities<br />

to develop alternative energy<br />

sources, reducing the high cost of energy<br />

in the territory and an overview of GNWT<br />

energy projects and programs.<br />

“Early in the mandate of the 16th<br />

Legislative Assembly, our government<br />

made an unprecedented $60 million<br />

commitment to address energy issues<br />

in the NWT,” says Minister Bob McLeod,<br />

chair of the MECC. “The NWT leads the<br />

country in the installation of commercial<br />

wood pellet boilers, we have invested<br />

millions of dollars in energy conservation<br />

and efficiency programs and we continue<br />

our efforts to develop local sources of<br />

energy supply for communities.”<br />

The NWT Energy Report includes current<br />

information regarding a number of<br />

initiatives outlined in the NWT Energy<br />

Plan (2007), the NWT Greenhouse Gas<br />

Strategy (2007) and the Energy Priorities<br />

Framework released by the MECC<br />

in 2008. Also included in the report is an<br />

environmental scan of energy resources,<br />

development and use in the NWT and<br />

details on GNWT investment in energy<br />

programs and initiatives.<br />

By reducing imported fossil fuels and<br />

mitigating the environmental impacts of<br />

energy use, the GNWT is taking action to<br />

maintain an environment that will sustain<br />

present and future generations, a<br />

key goal of the 16 th Assembly.<br />

NUNAVUT<br />

Kivalliq presented with 2011<br />

Environmental Excellence Award<br />

by the KIA<br />

Kivalliq Energy Corporation is the recipient<br />

of the 2010 Environmental Excellence<br />

Award, presented by the Kivalliq<br />

Inuit Association (KIA). The company<br />

has been acknowledged for outstanding<br />

environmental stewardship at Kivalliq<br />

Energy’s Angilak Property in the Kivalliq<br />

Region.<br />

Kivalliq also congratulates Allison Rippin<br />

Armstrong, the company’s permitting<br />

and environmental consultant, who was<br />

jointly awarded the Mike Hine Award,<br />

in recognition of an individual who has<br />

made significant contribution to the mining<br />

industry in Nunavut.<br />

The awards were presented to both<br />

Jeff Ward, President of Kivalliq Energy<br />

Corporation and Allison Rippin Armstrong<br />

at the 2011 Nunavut <strong>Mining</strong> Symposium<br />

from April 5 -7, 2011 in Iqaluit,<br />

Nunavut.<br />

YUKON<br />

National Energy Strategy<br />

documents unveiled at Northern<br />

Premiers’ Forum<br />

Territorial Premiers met April 28, 2011<br />

to discuss issues of importance to northerners<br />

and all <strong>Canadian</strong>s. The Northern<br />

Premiers’ Forum provides premiers with<br />

the opportunity to consider issues of<br />

common concern and develop northern<br />

solutions.<br />

Premiers discussed the <strong>Canadian</strong><br />

Energy Framework currently being developed<br />

by federal, provincial and territorial<br />

Energy Ministers. Premiers<br />

agreed that establishing a shared vision,<br />

common principles and objectives<br />

will strengthen the efforts of all <strong>Canadian</strong><br />

jurisdictions to work together.<br />

They noted the importance of a national<br />

energy strategy that reflects Canada’s<br />

unique energy challenges and opportunities<br />

from coast to coast.<br />

Two pan-territorial documents were<br />

released at the forum: the Pan-Territorial<br />

Adaptation Strategy (PTAS) and the Pan-<br />

Territorial Renewable Energy Inventory<br />

(PTREI). These papers will be an important<br />

contribution to the national discussion<br />

on Canada’s Energy Framework.<br />

The PTAS describes the challenges<br />

and goals of Canada’s three northern<br />

territories in addressing climate change.<br />

Yukon, Nunavut and the Northwest Territories<br />

agreed to share knowledge and<br />

best practices to address areas of concern<br />

for adaptation to climate change in<br />

Arctic regions. The territories will continue<br />