Announcement - ABN AMRO Markets

Announcement - ABN AMRO Markets

Announcement - ABN AMRO Markets

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

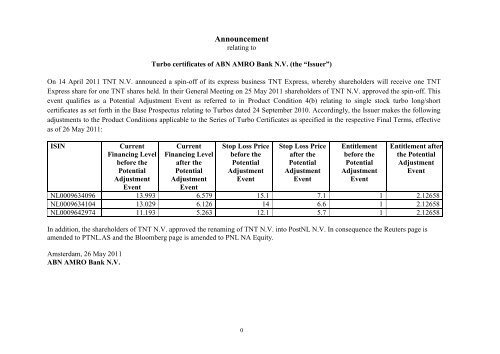

<strong>Announcement</strong><br />

relating to<br />

Turbo certificates of <strong>ABN</strong> <strong>AMRO</strong> Bank N.V. (the “Issuer”)<br />

On 14 April 2011 TNT N.V. announced a spin-off of its express business TNT Express, whereby shareholders will receive one TNT<br />

Express share for one TNT shares held. In their General Meeting on 25 May 2011 shareholders of TNT N.V. approved the spin-off. This<br />

event qualifies as a Potential Adjustment Event as referred to in Product Condition 4(b) relating to single stock turbo long/short<br />

certificates as set forth in the Base Prospectus relating to Turbos dated 24 September 2010. Accordingly, the Issuer makes the following<br />

adjustments to the Product Conditions applicable to the Series of Turbo Certificates as specified in the respective Final Terms, effective<br />

as of 26 May 2011:<br />

ISIN<br />

Current<br />

Financing Level<br />

before the<br />

Potential<br />

Adjustment<br />

Event<br />

Current<br />

Financing Level<br />

after the<br />

Potential<br />

Adjustment<br />

Event<br />

Stop Loss Price<br />

before the<br />

Potential<br />

Adjustment<br />

Event<br />

Stop Loss Price<br />

after the<br />

Potential<br />

Adjustment<br />

Event<br />

Entitlement<br />

before the<br />

Potential<br />

Adjustment<br />

Event<br />

Entitlement after<br />

the Potential<br />

Adjustment<br />

Event<br />

NL0009634096 13.993 6.579 15.1 7.1 1 2.12658<br />

NL0009634104 13.029 6.126 14 6.6 1 2.12658<br />

NL0009642974 11.193 5.263 12.1 5.7 1 2.12658<br />

In addition, the shareholders of TNT N.V. approved the renaming of TNT N.V. into PostNL N.V. In consequence the Reuters page is<br />

amended to PTNL.AS and the Bloomberg page is amended to PNL NA Equity.<br />

Amsterdam, 26 May 2011<br />

<strong>ABN</strong> <strong>AMRO</strong> Bank N.V.<br />

0

DATED 30 NOVEMBER 2010<br />

<strong>ABN</strong> <strong>AMRO</strong> BANK N.V.<br />

500,000 AEGON TURBO SHORT CERTIFICATES ISSUE PRICE EUR 0.93<br />

500,000 AEGON TURBO SHORT CERTIFICATES ISSUE PRICE EUR 0.71<br />

100,000 BMW TURBO SHORT CERTIFICATES ISSUE PRICE EUR 2.20<br />

100,000 BMW TURBO SHORT CERTIFICATES ISSUE PRICE EUR 1.77<br />

100,000 BMW TURBO LONG CERTIFICATES ISSUE PRICE EUR 0.51<br />

100,000 CORIO N.V. TURBO LONG CERTIFICATES ISSUE PRICE EUR 11.66<br />

100,000 DEXIA S.A. TURBO SHORT CERTIFICATES ISSUE PRICE EUR 0.63<br />

100,000 DEXIA S.A. TURBO LONG CERTIFICATES ISSUE PRICE EUR 0.84<br />

500,000 ING GROEP TURBO SHORT CERTIFICATES ISSUE PRICE EUR 1.03<br />

500,000 ING GROEP TURBO LONG CERTIFICATES ISSUE PRICE EUR 1.86<br />

1

500,000 KBC GROEP N.V. TURBO SHORT CERTIFICATES ISSUE PRICE EUR 0.50<br />

100,000 KONINKLIJKE BOSKALIS WESTMINSTER NV TURBO SHORT CERTIFICATES ISSUE PRICE EUR 1.27<br />

100,000 KONINKLIJKE BOSKALIS WESTMINSTER NV TURBO SHORT CERTIFICATES ISSUE PRICE EUR 0.40<br />

100,000 REED ELSEVIER N.V. TURBO SHORT CERTIFICATES ISSUE PRICE EUR 1.03<br />

100,000 REED ELSEVIER N.V. TURBO LONG CERTIFICATES ISSUE PRICE EUR 2.53<br />

500,000 ROYAL DUTCH SHELL PLC TURBO SHORT CERTIFICATES ISSUE PRICE EUR 2.17<br />

100,000 TNT N.V. TURBO SHORT CERTIFICATES ISSUE PRICE EUR 8.55<br />

100,000 TNT N.V. TURBO SHORT CERTIFICATES ISSUE PRICE EUR 2.07<br />

100,000 TNT N.V. TURBO LONG CERTIFICATES ISSUE PRICE EUR 7.11<br />

100,000 TOMTOM TURBO SHORT CERTIFICATES ISSUE PRICE EUR 1.89<br />

100,000 TOMTOM TURBO LONG CERTIFICATES ISSUE PRICE EUR 1.73<br />

2

FINAL TERMS<br />

Terms used herein shall be deemed to be defined as such for the purposes of the General Conditions and the Product Conditions applicable to each Series of<br />

Turbo certificates described herein (the “relevant Product Conditions”) as set forth in the Base Prospectus relating to Turbos dated 24 September 2010 (the<br />

“Base Prospectus”) as supplemented from time to time which constitutes a base prospectus for the purposes of the Prospectus Directive (Directive<br />

2003/71/EC) (the “Prospectus Directive”). This document constitutes the Final Terms of each Series of the Turbo certificates described herein for the<br />

purposes of Article 5.4 of the Prospectus Directive and must be read in conjunction with the Base Prospectus as so supplemented. Full information on the<br />

Issuer and each Series of the Turbo certificates described herein is only available on the basis of the combination of these Final Terms and the Base<br />

Prospectus as so supplemented. The Base Prospectus as so supplemented is available for viewing at the registered office of the Issuer at Gustav Mahlerlaan<br />

10, 1082 PP Amsterdam, The Netherlands and copies may be obtained free of charge from the Issuer at that address and on www.abnamro.com.<br />

These Final Terms must be read in conjunction with, and are subject to, the General Conditions and the relevant Product Conditions contained in the Base<br />

Prospectus as so supplemented. These Final Terms, the relevant Product Conditions and the General Conditions together constitute the Conditions of each<br />

Series of the Turbo certificates described herein and will be attached to the Global Certificate representing each such Series of the Turbo Certificates. In the<br />

event of any inconsistency between these Final Terms and the General Conditions or the relevant Product Conditions, these Final Terms will govern.<br />

The Netherlands Authority for the Financial <strong>Markets</strong> has provided the Banking, Finance and Insurance Commission (CBFA) in Belgium with a certificate<br />

of approval attesting that the Base Prospectus has been drawn up in accordance with the Prospectus Directive.<br />

So far as the Issuer is aware, no person (other than the Issuer and the Calculation Agent, see “Risk Factors – Actions taken by the Calculation Agent may<br />

affect the Underlying” in the Base Prospectus) involved in the issue of the Turbo certificates has an interest material to the offer.<br />

3

Issuer:<br />

<strong>ABN</strong> <strong>AMRO</strong> Bank N.V., acting through its principal office at Gustav<br />

Mahlerlaan 10, 1082 PP Amsterdam, The Netherlands<br />

Clearing Agents:<br />

Euroclear Netherlands N.V., Amsterdam, Netherlands<br />

Pricing Date(s): 30 November 2010<br />

Subscription Period:<br />

Not Applicable<br />

“As, If and When” issued Trading:<br />

Not Applicable<br />

Issue Date: 1 December 2010<br />

Listing:<br />

Euronext Amsterdam<br />

Listing Date: 1 December 2010<br />

Admission to trading:<br />

Application has been made for the Securities to be admitted to trading on<br />

NYSE Euronext in Amsterdam with effect from 1 December 2010<br />

<strong>Announcement</strong>s to Holders:<br />

Delivered to Clearing Agents<br />

Principal Agent:<br />

Goldman Sachs International, London, UK<br />

Paying Agent(s):<br />

Citibank International plc, Breda<br />

Calculation Agent:<br />

Goldman Sachs International, London, UK<br />

Dealer:<br />

Goldman Sachs International, London, UK<br />

Indication of yield:<br />

Not Applicable<br />

Amendments to General Conditions or Product Conditions:<br />

Amendments to the General Conditions and/or Product Conditions as required<br />

by applicable consumer protection and other laws and/or clearing system and<br />

exchange rules. Such amendments may be (i) deletion of one or more General<br />

Conditions and/or Product Conditions in part or in its entirety; (ii) addition of<br />

disclosure and/or publication requirements; (iii) addition of clearing system<br />

details and applicable clearing rules and arrangements agreed between the<br />

Issuer and the relevant clearing system; and (iv) other changes which are not<br />

materially prejudicial to the interest of the holders of Securities.<br />

4

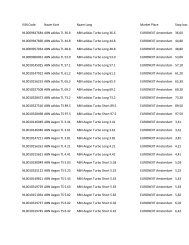

SINGLE STOCK TURBO CERTIFICATES<br />

TABLE 1 – SPECIFIC PRODUCT TERMS (MULTI-ISSUANCES):<br />

ISIN /<br />

Common Code /<br />

Mnemonic<br />

NL0009642719 /<br />

052983789 / 5286A<br />

NL0009642727 /<br />

052983797 / 5287A<br />

NL0009642735 /<br />

052983819 / 5288A<br />

NL0009642743 /<br />

052983827 / 5289A<br />

NL0009642750 /<br />

052983835 / 5290A<br />

NL0009642784 /<br />

052983860 / 5293A<br />

NL0009642792 /<br />

052983878 / 5294A<br />

NL0009642800 /<br />

052983886 / 5295A<br />

NL0009642917 /<br />

052984009 / 5306A<br />

Underlying<br />

(Share)<br />

Series<br />

(Type)<br />

Issue Size / Issue<br />

Price (in EUR) /<br />

Settlement<br />

Currency<br />

Aegon N.V. Short 500,000 / 0.93 /<br />

EUR<br />

Aegon N.V. Short 500,000 / 0.71 /<br />

EUR<br />

Bayerische<br />

Motoren Werke<br />

AG (BMW)<br />

Bayerische<br />

Motoren Werke<br />

AG (BMW)<br />

Bayerische<br />

Motoren Werke<br />

AG (BMW)<br />

Short 100,000 / 2.20 /<br />

EUR<br />

Short 100,000 / 1.77 /<br />

EUR<br />

Long 100,000 / 0.51 /<br />

EUR<br />

Corio N.V. Long 100,000 / 11.66 /<br />

EUR<br />

Dexia S.A. Short 100,000 / 0.63 /<br />

EUR<br />

Dexia S.A. Long 100,000 / 0.84 /<br />

EUR<br />

ING Groep N.V Short 500,000 / 1.03 /<br />

EUR<br />

Current Financing Level on the Issue<br />

Date (in the Financing Level<br />

Currency) / Current Financing Level<br />

Rounding / Financing Level Currency<br />

Stop Loss Price on the Issue<br />

Date (in the Financing<br />

Level Currency) / Stop Loss<br />

Price Rounding<br />

Current Spread on the Issue Date /<br />

Current Stop Loss Premium Rate on the<br />

Issue Date / Maximum Spread /<br />

Maximum Premium / Minimum<br />

Premium<br />

Valuation Date<br />

5.223 / 0.001 / EUR 4.7 / 0.1 2%/ 10%/ 2%/ 30%/ 5% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

5 / 0.001 / EUR 4.5 / 0.1 2%/ 10%/ 2%/ 30%/ 5% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

79.463 / 0.001 / EUR 73.9 / 0.1 2%/ 7%/ 2%/ 18%/ 3% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

75.162 / 0.001 / EUR 69.9 / 0.1 2%/ 7%/ 2%/ 18%/ 3% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

52.429 / 0.001 / EUR 56.1 / 0.1 2%/ 7%/ 2%/ 18%/ 3% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

33.581 / 0.001 / EUR 36.1 / 0.1 2%/ 7.5%/ 2%/ 30%/ 5% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

3.5556 / 0.0001 / EUR 3.2 / 0.1 2%/ 10%/ 2%/ 30%/ 5% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

2.0909 / 0.0001 / EUR 2.3 / 0.1 2%/ 10%/ 2%/ 30%/ 5% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

8 / 0.001 / EUR 7.4 / 0.1 2%/ 7.5%/ 2%/ 30%/ 5% The Business Day<br />

on which the<br />

Entitlement<br />

1<br />

1<br />

0.1<br />

0.1<br />

0.1<br />

1<br />

1<br />

1<br />

1<br />

5

ISIN /<br />

Common Code /<br />

Mnemonic<br />

NL0009642925 /<br />

052984017 / 5307A<br />

NL0009642933 /<br />

052984025 / 5308A<br />

NL0009642768 /<br />

052983843 / 5291A<br />

NL0009642776 /<br />

052983851 / 5292A<br />

NL0009642818 /<br />

052983894 / 5296A<br />

NL0009642826 /<br />

052983908 / 5297A<br />

NL0009642941 /<br />

052984033 / 5309A<br />

NL0009642958 /<br />

052984041 / 5310A<br />

NL0009642966 /<br />

052984050 / 5311A<br />

NL0009642974 /<br />

052984068 / 5312A<br />

Underlying<br />

(Share)<br />

Series<br />

(Type)<br />

Issue Size / Issue<br />

Price (in EUR) /<br />

Settlement<br />

Currency<br />

ING Groep N.V Long 500,000 / 1.86 /<br />

EUR<br />

KBC<br />

N.V.<br />

GROEP<br />

Koninklijke<br />

Boskalis<br />

Westminster NV<br />

Koninklijke<br />

Boskalis<br />

Westminster NV<br />

Reed<br />

N.V.<br />

Reed<br />

N.V.<br />

Elsevier<br />

Elsevier<br />

Royal Dutch Shell<br />

plc<br />

Short 500,000 / 0.50 /<br />

EUR<br />

Short 100,000 / 1.27 /<br />

EUR<br />

Short 100,000 / 0.40 /<br />

EUR<br />

Short 100,000 / 1.03 /<br />

EUR<br />

Long 100,000 / 2.53 /<br />

EUR<br />

Short 500,000 / 2.17 /<br />

EUR<br />

TNT N.V. Short 100,000 / 8.55 /<br />

EUR<br />

TNT N.V. Short 100,000 / 2.07 /<br />

EUR<br />

TNT N.V. Long 100,000 / 7.11 /<br />

EUR<br />

Current Financing Level on the Issue<br />

Date (in the Financing Level<br />

Currency) / Current Financing Level<br />

Rounding / Financing Level Currency<br />

Stop Loss Price on the Issue<br />

Date (in the Financing<br />

Level Currency) / Stop Loss<br />

Price Rounding<br />

Current Spread on the Issue Date /<br />

Current Stop Loss Premium Rate on the<br />

Issue Date / Maximum Spread /<br />

Maximum Premium / Minimum<br />

Premium<br />

Valuation Date<br />

Securities are validly<br />

exercised<br />

5.116 / 0.001 / EUR 5.5 / 0.1 2%/ 7.5%/ 2%/ 30%/ 5% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

32.325 / 0.001 / EUR 29.9 / 0.1 2%/ 7.5%/ 2%/ 30%/ 5% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

45.298 / 0.001 / EUR 41.9 / 0.1 2%/ 7.5%/ 2%/ 30%/ 5% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

36.649 / 0.001 / EUR 33.9 / 0.1 2%/ 7.5%/ 2%/ 30%/ 5% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

10.163 / 0.001 / EUR 9.4 / 0.1 2%/ 7.5%/ 2%/ 18%/ 3% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

6.604 / 0.001 / EUR 7.1 / 0.1 2%/ 7.5%/ 2%/ 18%/ 3% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

25.406 / 0.001 / EUR 23.5 / 0.1 2%/ 7.5%/ 2%/ 30%/ 5% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

26.919 / 0.001 / EUR 24.9 / 0.1 2%/ 7.5%/ 2%/ 30%/ 5% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

20.433 / 0.001 / EUR 18.9 / 0.1 2%/ 7.5%/ 2%/ 30%/ 5% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

11.255 / 0.001 / EUR 12.1 / 0.1 2%/ 7.5%/ 2%/ 30%/ 5% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

NL0009642982 / TomTom Short 100,000 / 1.89 / 9.1342 / 0.0001 / EUR 7.49 / 0.01 2%/ 18%/ 2%/ 30%/ 5% The Business Day 1<br />

Entitlement<br />

1<br />

0.1<br />

0.1<br />

0.1<br />

1<br />

1<br />

1<br />

1<br />

1<br />

1<br />

6

ISIN /<br />

Common Code /<br />

Mnemonic<br />

Underlying<br />

(Share)<br />

Series<br />

(Type)<br />

Issue Size / Issue<br />

Price (in EUR) /<br />

Settlement<br />

Currency<br />

Current Financing Level on the Issue<br />

Date (in the Financing Level<br />

Currency) / Current Financing Level<br />

Rounding / Financing Level Currency<br />

Stop Loss Price on the Issue<br />

Date (in the Financing<br />

Level Currency) / Stop Loss<br />

Price Rounding<br />

Current Spread on the Issue Date /<br />

Current Stop Loss Premium Rate on the<br />

Issue Date / Maximum Spread /<br />

Maximum Premium / Minimum<br />

Premium<br />

Valuation Date<br />

052984076 / 5313A EUR on which the<br />

Securities are validly<br />

exercised<br />

NL0009642990 /<br />

052984084 / 5314A<br />

TomTom Long 100,000 / 1.73 /<br />

EUR<br />

5.5169 / 0.0001 / EUR 6.51 / 0.01 2%/ 18%/ 2%/ 30%/ 5% The Business Day<br />

on which the<br />

Securities are validly<br />

exercised<br />

Entitlement<br />

1<br />

TABLE 2 – INFORMATION ON THE UNDERLYING (MULTI-ISSUANCES):<br />

Underlying Share Company ISIN / Reuters page / Bloomberg page Exchange Relevant<br />

Currency<br />

Ordinary Shares of Aegon N.V. Aegon N.V. NL0000303709 / AEGN.AS / AGN NA<br />

Equity<br />

Ordinary Shares of Bayerische Motoren Werke<br />

AG (BMW)<br />

Ordinary Shares of Koninklijke Boskalis<br />

Westminster NV<br />

Bayerische Motoren Werke AG<br />

(BMW)<br />

Koninklijke<br />

Westminster NV<br />

Boskalis<br />

DE0005190003 / BMWG.DE / BMW<br />

GY Equity<br />

NL0000852580 / BOSN.AS / BOKA NA<br />

Equity<br />

Ordinary Shares of Corio N.V. Corio N.V. NL0000288967 / COR.AS / CORA NA<br />

Equity<br />

Ordinary Shares of Dexia S.A. Dexia S.A. BE0003796134 / DEXI.BR / DEXB BB<br />

Equity<br />

Ordinary Shares of ING Groep N.V ING Groep N.V NL0000303600 / ING.AS / INGA NA<br />

Equity<br />

Ordinary Shares of KBC GROEP N.V. KBC GROEP N.V. BE0003565737 / KBC.BR / KBC BB<br />

Equity<br />

Ordinary Shares of Reed Elsevier N.V. Reed Elsevier N.V. NL0006144495 / ELSN.AS / REN NA<br />

Equity<br />

Ordinary Shares of Royal Dutch Shell plc Royal Dutch Shell plc GB00B03MLX29 / RDSa.AS / RDSA<br />

NA Equity<br />

Ordinary Shares of TNT N.V. TNT N.V. NL0000009066 / TNT.AS / TNT NA<br />

Equity<br />

Ordinary Shares of TomTom TomTom NL0000387058 / TOM2.AS / TOM2 NA<br />

Equity<br />

EURONEXT<br />

Amsterdam<br />

Notional<br />

Amount<br />

Dividend<br />

Underlying website<br />

EUR Applicable www.euronext.com<br />

XETRA EUR Applicable www.deutscheboerse.com<br />

EURONEXT<br />

Amsterdam<br />

EURONEXT<br />

Amsterdam<br />

EURONEXT<br />

Brussels<br />

EURONEXT<br />

Amsterdam<br />

EURONEXT<br />

Brussels<br />

EURONEXT<br />

Amsterdam<br />

EURONEXT<br />

Amsterdam<br />

EURONEXT<br />

Amsterdam<br />

EURONEXT<br />

Amsterdam<br />

EUR Applicable www.euronext.com<br />

EUR Applicable www.euronext.com<br />

EUR Applicable www.euronext.com<br />

EUR Applicable www.euronext.com<br />

EUR Applicable www.euronext.com<br />

EUR Applicable www.euronext.com<br />

EUR Applicable www.euronext.com<br />

EUR Applicable www.euronext.com<br />

EUR Applicable www.euronext.com<br />

7

Series: As specified in Table 1<br />

Issue Price: As specified in Table 1<br />

Additional Market Disruption Events:<br />

None<br />

Business Day: As specified in Product Condition 1<br />

Cash Amount: As specified in Product Condition 1<br />

Share: As specified in Table 1 and Table 2<br />

Share Company: As specified in Table 2<br />

Current Financing Level on the Issue Date: As specified in Table 1<br />

Current Financing Level Rounding:<br />

Current Spread on the Issue Date: As specified in Table 1<br />

Current Stop Loss Premium Rate on the Issue Date: As specified in Table 1<br />

Emerging Market Disruption Events: As stated in Product Condition 1<br />

Entitlement: As specified in Table 1<br />

Exchange: As specified in Table 2<br />

upwards (in case of Long Certificates) and downwards (in case of Short Certificates) to the<br />

next whole unit of the Financing Level Currency as specified in Table 1<br />

Exercise Time:<br />

11.00am Amsterdam Time<br />

Final Reference Price: As specified in Product Condition 1<br />

Financing Level Currency: As specified in Table 1<br />

Issuer Call Commencement Date:<br />

The first Business Day following the Issue Date<br />

Maximum Premium: As specified in Table 1<br />

Maximum Spread: As specified in Table 1<br />

Minimum Premium: As specified in Table 1<br />

Notional Dividend Amount: As specified in Table 2<br />

Notional Dividend Period: As specified in Product Condition 1<br />

Relevant Currency: As stated in Product Condition 1<br />

Relevant Number of Trading Days:<br />

For the purposes of:<br />

Issuer Call Date: 5, or in respect of an Emerging Market Disruption Event only, 180<br />

Valuation Date: 5, or in respect of an Emerging Market Disruption Event only, 180<br />

Reset Date:<br />

Each Business Day, at the determination of the Calculation Agent<br />

Securities Exchange:<br />

NYSE Euronext in Amsterdam<br />

Settlement Currency: As specified in Table 1<br />

Settlement Date:<br />

Standard Currency: As stated in Product Condition 1<br />

Stop Loss Event: As specified in Product Condition 1<br />

Up to the fifth Business Day following the Valuation Date, the last day of the Stop Loss<br />

Termination Valuation Period or the Issuer Call Date, as the case may be<br />

Stop Loss Price on the Issue Date: As specified in Table 1<br />

Stop Loss Price Rounding:<br />

upwards (in case of Long Certificates) and downwards (in case of Short Certificates) to the<br />

8

next whole unit of the Financing Level Currency as specified in Table 1<br />

Stop Loss Reset Date:<br />

15th day<br />

Stop Loss Termination Reference Price: As specified in Product Condition 1<br />

Valuation Date: As specified in Table 1<br />

ISIN: As specified in Table 1<br />

Common Code: As specified in Table 1<br />

Other Securities Code: As specified in Table 1<br />

INFORMATION ON THE UNDERLYING<br />

Page where information about the past and future performance of<br />

the Underlying and its volatility can be obtained:<br />

As specified in Table 2<br />

9

RESPONSIBILITY<br />

The Issuer accepts responsibility for the information contained in these Final Terms.<br />

10