PDF - Part of the Annual Report - Ludwig Beck

PDF - Part of the Annual Report - Ludwig Beck

PDF - Part of the Annual Report - Ludwig Beck

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

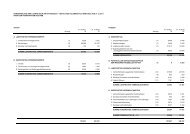

50 | Management <strong>Report</strong><br />

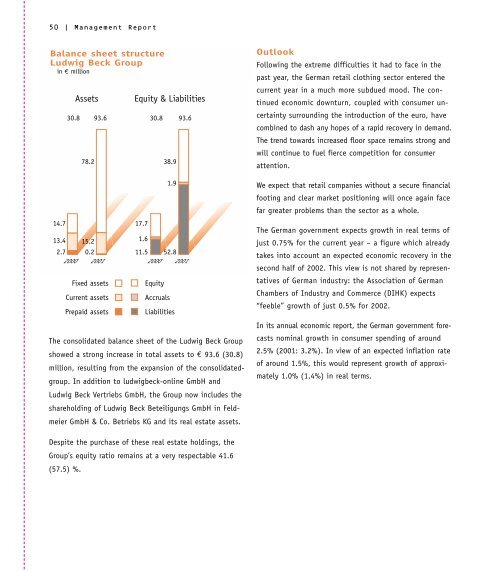

Balance sheet structure<br />

<strong>Ludwig</strong><br />

Balance<br />

<strong>Beck</strong><br />

sheet<br />

Group<br />

structure<br />

in <strong>of</strong> € million <strong>the</strong> <strong>Ludwig</strong> <strong>Beck</strong> Group<br />

in € million<br />

Assets Equity & Liabilities<br />

30.8 93.6 30.8 93.6<br />

78.2<br />

38.9<br />

1.9<br />

14.7<br />

17.7<br />

13.4 15.2<br />

1.6<br />

2.7 0.2<br />

11.5 52.8<br />

2000 2001 2000 2001<br />

Fixed assets Equity<br />

Current assets Accruals<br />

Prepaid assets Liabilities<br />

The consolidated balance sheet <strong>of</strong> <strong>the</strong> <strong>Ludwig</strong> <strong>Beck</strong> Group<br />

showed a strong increase in total assets to € 93.6 (30.8)<br />

million, resulting from <strong>the</strong> expansion <strong>of</strong> <strong>the</strong> consolidatedgroup.<br />

In addition to ludwigbeck-online GmbH and<br />

<strong>Ludwig</strong> <strong>Beck</strong> Vertriebs GmbH, <strong>the</strong> Group now includes <strong>the</strong><br />

shareholding <strong>of</strong> <strong>Ludwig</strong> <strong>Beck</strong> Beteiligungs GmbH in Feldmeier<br />

GmbH & Co. Betriebs KG and its real estate assets.<br />

Outlook<br />

Following <strong>the</strong> extreme difficulties it had to face in <strong>the</strong><br />

past year, <strong>the</strong> German retail clothing sector entered <strong>the</strong><br />

current year in a much more subdued mood. The continued<br />

economic downturn, coupled with consumer uncertainty<br />

surrounding <strong>the</strong> introduction <strong>of</strong> <strong>the</strong> euro, have<br />

combined to dash any hopes <strong>of</strong> a rapid recovery in demand.<br />

The trend towards increased floor space remains strong and<br />

will continue to fuel fierce competition for consumer<br />

attention.<br />

We expect that retail companies without a secure financial<br />

footing and clear market positioning will once again face<br />

far greater problems than <strong>the</strong> sector as a whole.<br />

The German government expects growth in real terms <strong>of</strong><br />

just 0.75% for <strong>the</strong> current year – a figure which already<br />

takes into account an expected economic recovery in <strong>the</strong><br />

second half <strong>of</strong> 2002. This view is not shared by representatives<br />

<strong>of</strong> German industry: <strong>the</strong> Association <strong>of</strong> German<br />

Chambers <strong>of</strong> Industry and Commerce (DIHK) expects<br />

“feeble” growth <strong>of</strong> just 0.5% for 2002.<br />

In its annual economic report, <strong>the</strong> German government forecasts<br />

nominal growth in consumer spending <strong>of</strong> around<br />

2.5% (2001: 3.2%). In view <strong>of</strong> an expected inflation rate<br />

<strong>of</strong> around 1.5%, this would represent growth <strong>of</strong> approximately<br />

1.0% (1.4%) in real terms.<br />

Despite <strong>the</strong> purchase <strong>of</strong> <strong>the</strong>se real estate holdings, <strong>the</strong><br />

Group’s equity ratio remains at a very respectable 41.6<br />

(57.5) %.

![Ludwig Beck[cd]](https://img.yumpu.com/49294504/1/184x260/ludwig-beckcd.jpg?quality=85)