PDF - Part of the Annual Report - Ludwig Beck

PDF - Part of the Annual Report - Ludwig Beck

PDF - Part of the Annual Report - Ludwig Beck

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

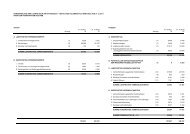

46 | Management <strong>Report</strong><br />

Consolidated DVFA/SG-based earnings<br />

According to <strong>the</strong> DVFA (German Association <strong>of</strong> Financial<br />

Analysts) calculation <strong>of</strong> earnings, pr<strong>of</strong>its are to be<br />

encumbered with deferred taxes in years following losses,<br />

even though <strong>Ludwig</strong> <strong>Beck</strong> was once again effectively<br />

exempted from tax in <strong>the</strong> past fiscal year.<br />

DVFA/SG-based earnings <strong>of</strong><br />

<strong>Ludwig</strong> <strong>Beck</strong> Group<br />

2001 2000<br />

€ million € million<br />

Net income 3.8 5.2<br />

Deferred taxes -1.6 -2.5<br />

Minority interests 0.3 0.0<br />

DVFA/SG-based earnings 2.5 2.7<br />

Earnings per share (€) 0.78 0.83<br />

IAS-based earnings<br />

Companies listed in <strong>the</strong> SMAX segment <strong>of</strong> <strong>the</strong> German<br />

stock exchange are obliged to publish annual financial<br />

statements according to international accounting standards<br />

for years beginning after December 31, 2001.<br />

<strong>Ludwig</strong> <strong>Beck</strong> has once again already fulfilled this future<br />

obligation in its annual financial statements for 2001<br />

with <strong>the</strong> inclusion <strong>of</strong> a reconciliation table according<br />

to IAS (International Accounting Standards).<br />

Reconciliation chart acc. to IAS<br />

2001 2000<br />

€ million € million<br />

Consolidated net income<br />

acc. to HGB 3.8 5.2<br />

Adjustments to IAS:<br />

Financial leasing 0.1 0.1<br />

Intangible assets 0.1 0.1<br />

Own shares 0.0 0.1<br />

Discounted liabilities -0.7 0.0<br />

O<strong>the</strong>rs 0.0 0.1<br />

Deferred taxes -1.6 -2.4<br />

Change in value <strong>of</strong> loss<br />

carryforward 0.0 -1.2<br />

Result acc. to IAS 1.7 2.0<br />

Outstanding shares (million) 3,180 3,310<br />

Undiluted results per share (€) 0.52 0.59

![Ludwig Beck[cd]](https://img.yumpu.com/49294504/1/184x260/ludwig-beckcd.jpg?quality=85)