AMB Dividend Trust Fund (AMBDTF) - Fundsupermart.com

AMB Dividend Trust Fund (AMBDTF) - Fundsupermart.com

AMB Dividend Trust Fund (AMBDTF) - Fundsupermart.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

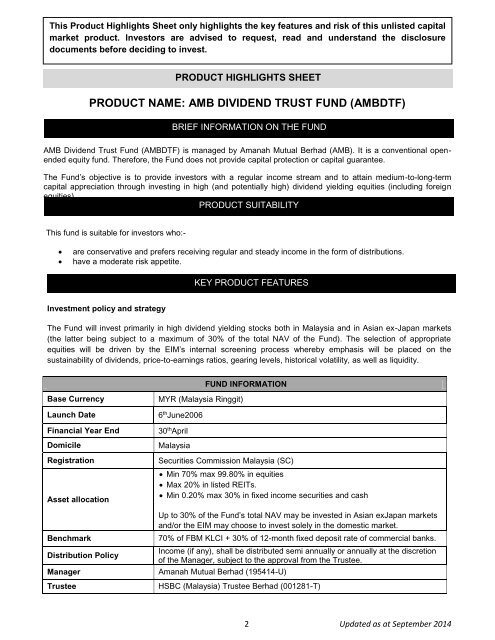

This Product Highlights Sheet only highlights the key features and risk of this unlisted capital<br />

market product. Investors are advised to request, read and understand the disclosure<br />

documents before deciding to invest.<br />

PRODUCT HIGHLIGHTS SHEET<br />

PRODUCT NAME: <strong>AMB</strong> DIVIDEND TRUST FUND (<strong>AMB</strong>DTF)<br />

BRIEF INFORMATION ON THE FUND<br />

<strong>AMB</strong> <strong>Dividend</strong> <strong>Trust</strong> <strong>Fund</strong> (<strong>AMB</strong>DTF) is managed by Amanah Mutual Berhad (<strong>AMB</strong>). It is a conventional openended<br />

equity fund. Therefore, the <strong>Fund</strong> does not provide capital protection or capital guarantee.<br />

The <strong>Fund</strong>’s objective is to provide investors with a regular in<strong>com</strong>e stream and to attain medium-to-long-term<br />

capital appreciation through investing in high (and potentially high) dividend yielding equities (including foreign<br />

equities).<br />

PRODUCT SUITABILITY<br />

This fund is suitable for investors who:-<br />

<br />

<br />

are conservative and prefers receiving regular and steady in<strong>com</strong>e in the form of distributions.<br />

have a moderate risk appetite.<br />

KEY PRODUCT FEATURES<br />

Investment policy and strategy<br />

The <strong>Fund</strong> will invest primarily in high dividend yielding stocks both in Malaysia and in Asian ex-Japan markets<br />

(the latter being subject to a maximum of 30% of the total NAV of the <strong>Fund</strong>). The selection of appropriate<br />

equities will be driven by the EIM’s internal screening process whereby emphasis will be placed on the<br />

sustainability of dividends, price-to-earnings ratios, gearing levels, historical volatility, as well as liquidity.<br />

FUND INFORMATION<br />

Base Currency<br />

Launch Date<br />

Financial Year End<br />

Domicile<br />

Registration<br />

Asset allocation<br />

Benchmark<br />

Distribution Policy<br />

Manager<br />

<strong>Trust</strong>ee<br />

MYR (Malaysia Ringgit)<br />

6 th June2006<br />

30 th April<br />

Malaysia<br />

Securities Commission Malaysia (SC)<br />

Min 70% max 99.80% in equities<br />

Max 20% in listed REITs.<br />

Min 0.20% max 30% in fixed in<strong>com</strong>e securities and cash<br />

Up to 30% of the <strong>Fund</strong>’s total NAV may be invested in Asian exJapan markets<br />

and/or the EIM may choose to invest solely in the domestic market.<br />

70% of FBM KLCI + 30% of 12-month fixed deposit rate of <strong>com</strong>mercial banks.<br />

In<strong>com</strong>e (if any), shall be distributed semi annually or annually at the discretion<br />

of the Manager, subject to the approval from the <strong>Trust</strong>ee.<br />

Amanah Mutual Berhad (195414-U)<br />

HSBC (Malaysia) <strong>Trust</strong>ee Berhad (001281-T)<br />

2 Updated as at September 2014