AMB Dividend Trust Fund (AMBDTF) - Fundsupermart.com

AMB Dividend Trust Fund (AMBDTF) - Fundsupermart.com

AMB Dividend Trust Fund (AMBDTF) - Fundsupermart.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Interest rate risk<br />

Fixed in<strong>com</strong>e securities are particularly sensitive to movements in interest rates. When interest rates rise, the<br />

value of fixed in<strong>com</strong>e securities falls and vice versa, thus affecting the NAV of the <strong>Fund</strong>. Furthermore, fixed<br />

in<strong>com</strong>e securities with longer maturity and lower yield coupon rates are more susceptible to interest rate<br />

movements.<br />

Currency risk<br />

Currency risk is also known as foreign exchange risk. It is the risk associated with investments that are<br />

denominated in foreign currencies. When the foreign currencies fluctuate in an unfavourable direction against the<br />

RM, the investments will face currency losses in addition to the capital gains/losses. This may lead to a lower<br />

NAV of the <strong>Fund</strong>.<br />

Country risk<br />

The foreign investments of the <strong>Fund</strong> may be affected by risks specific to the country, in which it invests. Such<br />

risks include changes in a country’s economic fundamentals, social and political stability, currency movements<br />

and foreign policies, etc. These may impact on the prices of listed securities in the particular country.<br />

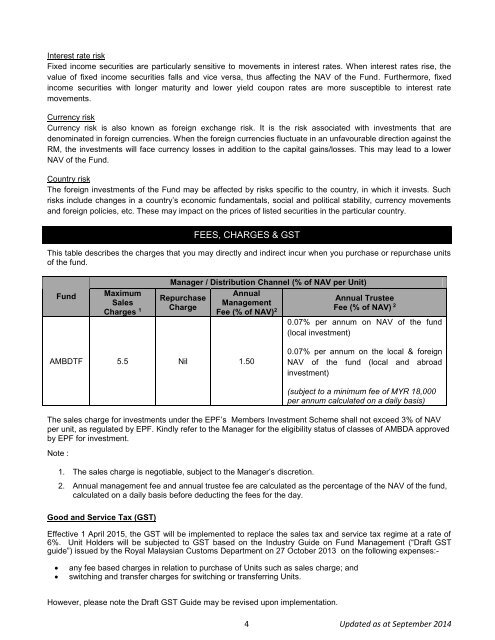

FEES, CHARGES & GST<br />

This table describes the charges that you may directly and indirect incur when you purchase or repurchase units<br />

of the fund.<br />

<strong>Fund</strong><br />

Maximum<br />

Sales<br />

Charges 1<br />

Manager / Distribution Channel (% of NAV per Unit)<br />

Annual<br />

Management<br />

Fee (% of NAV) 2<br />

Repurchase<br />

Charge<br />

Annual <strong>Trust</strong>ee<br />

Fee (% of NAV) 2<br />

0.07% per annum on NAV of the fund<br />

(local investment)<br />

<strong>AMB</strong>DTF 5.5 Nil 1.50<br />

0.07% per annum on the local & foreign<br />

NAV of the fund (local and abroad<br />

investment)<br />

(subject to a minimum fee of MYR 18,000<br />

per annum calculated on a daily basis)<br />

The sales charge for investments under the EPF’s Members Investment Scheme shall not exceed 3% of NAV<br />

per unit, as regulated by EPF. Kindly refer to the Manager for the eligibility status of classes of <strong>AMB</strong>DA approved<br />

by EPF for investment.<br />

Note :<br />

1. The sales charge is negotiable, subject to the Manager’s discretion.<br />

2. Annual management fee and annual trustee fee are calculated as the percentage of the NAV of the fund,<br />

calculated on a daily basis before deducting the fees for the day.<br />

Good and Service Tax (GST)<br />

Effective 1 April 2015, the GST will be implemented to replace the sales tax and service tax regime at a rate of<br />

6%. Unit Holders will be subjected to GST based on the Industry Guide on <strong>Fund</strong> Management (“Draft GST<br />

guide”) issued by the Royal Malaysian Customs Department on 27 October 2013 on the following expenses:-<br />

<br />

<br />

any fee based charges in relation to purchase of Units such as sales charge; and<br />

switching and transfer charges for switching or transferring Units.<br />

However, please note the Draft GST Guide may be revised upon implementation.<br />

4 Updated as at September 2014