annUaL rEporT 2008 - Äeská rafinérská, as

annUaL rEporT 2008 - Äeská rafinérská, as

annUaL rEporT 2008 - Äeská rafinérská, as

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ČESKÁ RAFINÉRSKÁ, a.s.<br />

NOTES TO FINANCIAL STATEMENTS<br />

YEAR ENDED 31 DECEMBER <strong>2008</strong><br />

15. BANK LOANS AND OTHER BORROWINGS<br />

At 31 December <strong>2008</strong>, the Company did not have any bank loan.<br />

The interest expense relating to bank loans and short-term overdrafts for <strong>2008</strong> w<strong>as</strong><br />

CZK 172 thousand (2007: CZK 161 thousand).<br />

Interest expense for the year <strong>2008</strong> in the amount of CZK 14,063 thousand relates to<br />

long-term liability (Note 21).<br />

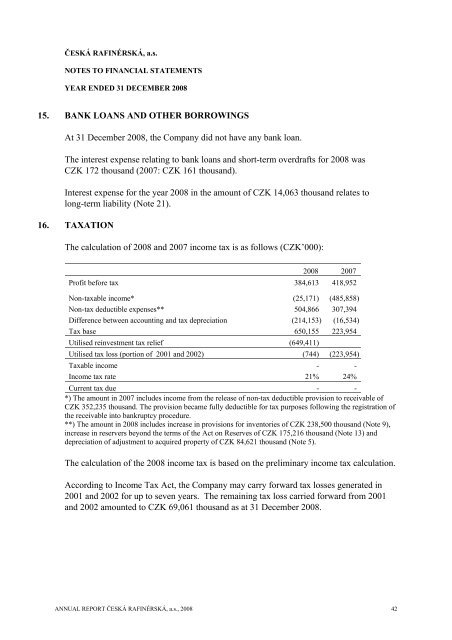

16. TAXATION<br />

The calculation of <strong>2008</strong> and 2007 income tax is <strong>as</strong> follows (CZK’000):<br />

<strong>2008</strong> 2007<br />

Profit before tax 384,613 418,952<br />

Non-taxable income* (25,171) (485,858)<br />

Non-tax deductible expenses** 504,866 307,394<br />

Difference between accounting and tax depreciation (214,153) (16,534)<br />

Tax b<strong>as</strong>e 650,155 223,954<br />

Utilised reinvestment tax relief (649,411)<br />

Utilised tax loss (portion of 2001 and 2002) (744) (223,954)<br />

Taxable income - -<br />

Income tax rate 21% 24%<br />

Current tax due - -<br />

*) The amount in 2007 includes income from the rele<strong>as</strong>e of non-tax deductible provision to receivable of<br />

CZK 352,235 thousand. The provision became fully deductible for tax purposes following the registration of<br />

the receivable into bankruptcy procedure.<br />

**) The amount in <strong>2008</strong> includes incre<strong>as</strong>e in provisions for inventories of CZK 238,500 thousand (Note 9),<br />

incre<strong>as</strong>e in reservers beyond the terms of the Act on Reserves of CZK 175,216 thousand (Note 13) and<br />

depreciation of adjustment to acquired property of CZK 84,621 thousand (Note 5).<br />

The calculation of the <strong>2008</strong> income tax is b<strong>as</strong>ed on the preliminary income tax calculation.<br />

According to Income Tax Act, the Company may carry forward tax losses generated in<br />

2001 and 2002 for up to seven years. The remaining tax loss carried forward from 2001<br />

and 2002 amounted to CZK 69,061 thousand <strong>as</strong> at 31 December <strong>2008</strong>.<br />

ANNUAL REPORT ČESKÁ RAFINÉRSKÁ, a.s., <strong>2008</strong> 42