You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

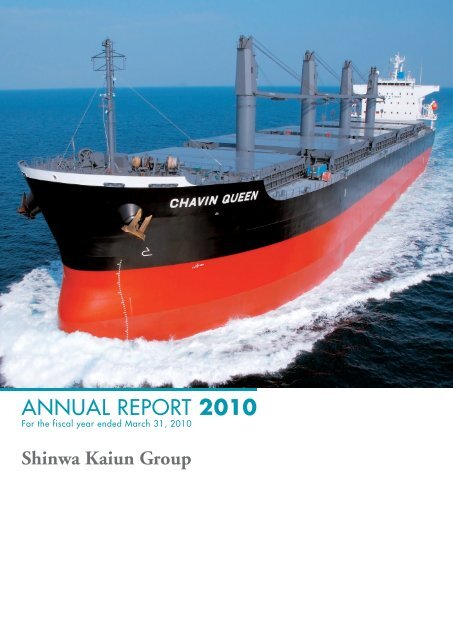

ANNUAL REPORT <strong>2010</strong><br />

For the fiscal year ended March 31, <strong>2010</strong><br />

Shinwa Kaiun Group

Profile<br />

Spanning the Oceans of the World with Safe,<br />

Environmentally Sound Transport<br />

Since its establishment over 40 years ago, Shinwa Kaiun has been engaging in worldwide logistics.<br />

We have endeavored to develop finely tuned services in response to ever-changing needs of customers,<br />

thereby accumulating optimal transport expertise towards realizing our ultimate fundamental objective of<br />

providing “Reliable Worldwide Shipping.”<br />

With high priority on safe navigation and conservation of the global environment, Shinwa Kaiun will<br />

continue to chart new directions into the future.<br />

Iron Ore<br />

and<br />

Coking Coal<br />

Transport Service<br />

Oil/Gas<br />

Transport<br />

Service<br />

Our<br />

Core Businesses<br />

Coal/Bulk<br />

Transport<br />

Service<br />

Near Sea<br />

Service<br />

Tramp<br />

Chartering<br />

Service<br />

Contents<br />

Profile<br />

Consolidated Financial Highlights<br />

To Our Stakeholders<br />

About the Merger with Nippon Steel Shipping Co., Ltd. (October 1, <strong>2010</strong>)<br />

Our Major Vessels and Plan for Future Development<br />

Sectoral Overview<br />

Management Structure<br />

Corporate Social Responsibility<br />

Management’s Discussion and Analysis<br />

Consolidated Financial Statements (Summary)<br />

History<br />

Corporate Data<br />

1<br />

2<br />

3<br />

4<br />

5<br />

7<br />

9<br />

10<br />

11<br />

13<br />

16<br />

17<br />

Disclaimer Regarding<br />

Forward-Looking Statements<br />

This annual report contains forward-looking statements related to<br />

management’s expectations about future business conditions. Actual<br />

business conditions may differ significantly from management’s expectations<br />

and accordingly affect the Company’s sales and profitability. Actual results<br />

may differ as a result of factors over which the Company has no control,<br />

including unexpected changes in competitive and economic conditions,<br />

government regulations, technology and other factors.<br />

On the cover: The 51,241dwt CHAVIN QUEEN is a Handy bulk carrier that joined the SHINWA fleet in November 2009.<br />

1<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>

Consolidated Financial Highlights<br />

Millions of yen<br />

Years ended March 31, <strong>2010</strong> and 2009 <strong>2010</strong> 2009<br />

For the year:<br />

Revenues ¥ 95,106 ¥ 132,799<br />

Operating income 4,796 13,168<br />

Ordinary income 4,053 12,498<br />

Income before income taxes 1,438 10,924<br />

Net income 1,215 6,689<br />

Per share data (yen):<br />

Net assets per share 284.59 262.98<br />

Net income per share 7.50 41.31<br />

At year-end:<br />

Total assets 114,370 107,009<br />

Net assets 47,938 44,225<br />

Revenues<br />

Operating Income<br />

and Net Income<br />

Total Assets<br />

and Return on Assets<br />

Net Assets<br />

and Return on Equity<br />

Millions of yen<br />

Millions of yen<br />

Millions of yen<br />

Millions of yen<br />

Operating income<br />

Net income<br />

Total assets<br />

Return on assets (%)<br />

Net assets<br />

Return on equity (%)<br />

150,000<br />

25,000<br />

120,000<br />

20<br />

50,000<br />

75<br />

120,000<br />

20,000<br />

90,000<br />

15<br />

40,000<br />

60<br />

90,000<br />

15,000<br />

30,000<br />

45<br />

60,000<br />

10<br />

60,000<br />

10,000<br />

20,000<br />

30<br />

30,000<br />

5,000<br />

30,000<br />

5<br />

10,000<br />

15<br />

0<br />

0<br />

0 0<br />

0<br />

06 07 08 09 10 06 07 08 09 10 06 07 08 09 10 06 07 08 09 10<br />

0<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> 2

To Our Stakeholders<br />

I assumed the post of President/President Executive<br />

Officer as of April 1, <strong>2010</strong>. I am pleased to report<br />

business results for the fiscal year ended March 31,<br />

<strong>2010</strong> (FY <strong>2010</strong>).<br />

At the beginning of 2009, we set up the<br />

Emergency Countermeasure Committee headed by<br />

the former president, with the aim of preventing the<br />

company from falling into deficit. We bolstered the<br />

financial balance sheet through measures such as the<br />

early return of high-cost chartered vessels. At the<br />

same time, we reviewed our fleet scale, investment<br />

and manpower plans, reduced costs and improved<br />

the management and operational efficiency. We<br />

addressed the issue of internal controls, since safe<br />

navigation is our utmost priority.<br />

We were able to upwardly revise our initial<br />

full-year forecast for consolidated ordinary income<br />

due to a considerable contribution from the<br />

unexpectedly robust dry bulk market, particularly<br />

in the capesize bulk carriers, which was supported<br />

by iron ore imports by China, together with our<br />

efforts to improve ship deployment efficiency.<br />

However, in light of the uncertainty clouding the<br />

outlook for our business environment, we have<br />

decided that our best strategy for building a more<br />

solid business foundation is to further reinforce<br />

the competitiveness of our fleet by implementing<br />

the early return of high-cost chartered vessels.<br />

Consequently, we reported early cancellation<br />

fees on charter contracts and so forth as an<br />

extraordinary loss, and income before income taxes<br />

dropped to a low level.<br />

Carefully considering an appropriate return of<br />

profits to shareholders, the Company’s financial<br />

standing, and other factors, we have decided to pay<br />

a year-end dividend of two yen per share for FY<br />

<strong>2010</strong>.<br />

On October 1, the Company decided to merge<br />

with Nippon Steel Shipping Co., Ltd., with the<br />

Company being the surviving company. The new<br />

corporate name is NS United Kaiun Kaisha, Ltd.<br />

While our comprehensive strength is supported by<br />

our client base with long-term contractual<br />

relationships and our broad business portfolio,<br />

which includes natural resources and energy<br />

transportation, the strength of Nippon Steel<br />

Shipping is based on its high expertise in the<br />

transportation of raw materials and fuel for the iron<br />

production industry, as the industrial carrier for<br />

Nippon Steel Corporation. By combining the<br />

respective strengths of both companies, we aim to<br />

further increase our corporate value while<br />

responding in a timely fashion to future changes in<br />

the business environment.<br />

I will assume the position of Representative<br />

Director/Vice President Executive Officer of NS<br />

United Kaiun Kaisha, Ltd.<br />

Your continued support for Shinwa Kaiun and<br />

the Shinwa Group is highly appreciated.<br />

June 25, <strong>2010</strong><br />

Hiroshi Sugiura, President<br />

3<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>

About the Merger with Nippon Steel Shipping Co., Ltd. (October 1, <strong>2010</strong>)<br />

Basic concept of the merger<br />

(a) Increased competitiveness due to the combination and expansion of the Companies’ fleets.<br />

(b) Expansion of ability to deliver fleets.<br />

(c) Further accumulation of technological skills.<br />

(d) Improvement in profitability and efficiency and cost reduction.<br />

(e) Securement of reliable source of ship crew.<br />

Outline of the merger and change of the corporate name<br />

Summary of the parties to the merger (as of March 31, <strong>2010</strong>)<br />

Company name Shinwa Kaiun Kaisha, Ltd. Nippon Steel Shipping Co., Ltd.<br />

Business<br />

Marine transportation business and Marine transportation business<br />

other businesses related or incidental thereto<br />

Date of incorporation April 1, 1950 February 6, 1948<br />

Registered address 8-1 Otemachi 1-chome, Chiyoda-ku, Tokyo 3-2 Kasumigaseki 3-chome, Chiyoda-ku, Tokyo<br />

Name and position of<br />

representative<br />

President, Representative Director<br />

Hiroshi Sugiura<br />

President, Representative Director<br />

Keiichiro Shimakawa<br />

Paid-in capital 8,100 million yen 2,227 million yen<br />

Number of issued shares 162,000,000 shares 44,557,750 shares<br />

Net assets (consolidated) 47,938 million yen 16,548 million yen<br />

Total assets (consolidated) 114,370 million yen<br />

33,342 million yen<br />

Fiscal year-end March 31 March 31<br />

Number of employees 591 (consolidated) 82 (consolidated)<br />

Post-merger position<br />

Corporate name<br />

Business<br />

Registered address<br />

Name and position of<br />

representative<br />

Capital<br />

Number of issued shares<br />

Net assets (consolidated)<br />

NS United Kaiun Kaisha, Ltd.<br />

Marine transportation business and other businesses related or incidental thereto<br />

21st and 22nd Floors, Otemachi 1st Square West Tower, 5-1 Otemachi 1-Chome, Chiyoda-ku, Tokyo<br />

President, Representative Director/President, Executive Officer<br />

Keiichiro Shimakawa (Scheduled)<br />

Representative Director/Vice President, Executive Officer<br />

Hiroshi Sugiura (Scheduled)<br />

10,300 million yen<br />

230,764,400 shares<br />

Has not yet been determined<br />

Total assets (consolidated) Has not yet been determined<br />

Fiscal year-end March 31<br />

Main shareholders and<br />

their shareholdings<br />

(scheduled)<br />

Note: Please refer to page 17 for new company executives.<br />

Nippon Steel Corporation 34.00%<br />

Nippon Yusen Kabushiki Kaisha (NYK LINE) 18.74%<br />

Tokio Marine & Nichido Fire Insurance Co., Ltd. 4.34%<br />

Sompo Japan Insurance Inc. 3.62%<br />

Mizuho Corporate Bank, Ltd. 3.25%<br />

Mitsui Sumitomo Insurance Company, Limited 2.54%<br />

Japan Trustee Services Bank, Ltd. (Trust account) 2.52%<br />

Mitsubishi Heavy Industries, Ltd. 2.34%<br />

Hsin Chien Marine Co., Ltd. 2.19%<br />

The Master Trust Bank of Japan, Ltd. (Trust account) 1.05%<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> 4

Our Major Vessels and Plan for Future Development<br />

New Vessels<br />

Bulk Carrier:<br />

ATLANTIC DIANA<br />

Length:<br />

169.37 M<br />

Breadth:<br />

27.20 M<br />

Summer Full-Load Draft: 9.82 M<br />

Deadweight:<br />

28,419 KT<br />

Full-Load Speed: 14.0 KNOT<br />

Log/Bulk Carrier:<br />

TAMAKI PRINCESS<br />

Length:<br />

103.64 M<br />

Breadth:<br />

18.80 M<br />

Summer Full-Load Draft: 9.065 M<br />

Deadweight:<br />

10,024 KT<br />

Full-Load Speed: 12.5 KNOT<br />

FY2011 Shinwa Kaiun Group Fleet Development Plan<br />

(Including the long-term [5 years or longer] chartered fleet)<br />

Vessel name / type DWT (K/T) Delivery (scheduled)<br />

Overseas vessel SAKURA WAVE / Bulk carrier 88,299 April 16, <strong>2010</strong><br />

Domestic vessel FUYO-MARU NO.6 / Cement carrier 5,445 April 22, <strong>2010</strong><br />

Overseas vessel DIAMOND WIND / Bulk carrier 76,000 June 4, <strong>2010</strong><br />

Domestic vessel Fly ash carrier 4,750 June <strong>2010</strong><br />

Overseas vessel Bulk carrier 88,000 June <strong>2010</strong><br />

Overseas vessel Bulk carrier 33,000 July <strong>2010</strong><br />

Overseas vessel Bulk carrier 83,000 July <strong>2010</strong><br />

Overseas vessel Bulk carrier 33,000 September <strong>2010</strong><br />

Overseas vessel Bulk carrier 51,000 January 2011<br />

5<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>

Major Vessels<br />

Bulk Carrier: YUGAWASAN<br />

Deadweight: 302,481 KT<br />

Very Large Ore Carrier: SHINWA-MARU<br />

Deadweight: 297,541 KT<br />

Bulk Carrier: KEFALONIA<br />

Deadweight: 28,742 KT<br />

Bulk Carrier: CRYSTAL WIND<br />

Deadweight: 76,523 KT<br />

FY<strong>2010</strong> Shinwa Kaiun Group Fleet Development Achievements<br />

(Including the long-term [5 years or longer] chartered fleet)<br />

✽ Non-newbuilding<br />

Vessel name / type DWT (K/T) Delivery<br />

Overseas vessel CARIBBEAN ORCHID / Chemical tanker 19,998 April 7, 2009<br />

Domestic vessel YASUTAKA/ Cement carrier 2,219 April 22, 2009<br />

Overseas vessel ATLANTIC DIANA / Bulk carrier 28,419 May 11, 2009<br />

Overseas vessel TAMAKI PRINCESS / Log/Bulk carrier 10,024 May 14, 2009<br />

Domestic vessel FUKURYU-MARU / Steel products carrier 1,650 May 29, 2009<br />

Domestic vessel KEISHO-MARU / Log/Bulk carrier 1,830 July 19, 2009<br />

Overseas vessel CHAVIN QUEEN / Bulk carrier 51,241 November 4, 2009<br />

Overseas vessel KM KEELUNG / Bulk carrier 82,100 February 24, <strong>2010</strong><br />

Overseas vessel E.R. BAVARIA / Bulk carrier 178,838 February 24, <strong>2010</strong><br />

Overseas vessel MARITSA / Bulk carrier ✽ 76,015 March 1, <strong>2010</strong><br />

Overseas vessel E.R. BRANDENBURG / Bulk carrier 178,991 March 3, <strong>2010</strong><br />

Domestic vessel YUKAI-MARU / Bulk carrier ✽ 6,000 March 31, <strong>2010</strong><br />

Domestic vessel SHUTTLE ACE / Car carrier ✽ 5,271 March 31, <strong>2010</strong><br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> 6

Sectoral Overview<br />

Eighty-plus percent of the consolidated revenue of the<br />

Shinwa Kaiun Group is from overseas shipping<br />

services, while the coastal shipping services, driven by<br />

our consolidated subsidiaries Shinwa Naiko Kaiun<br />

Kaisha, Ltd. and Shinwa Chemical Tanker Co., Ltd.,<br />

accounts for a little under 20%. The overseas shipping<br />

services comprise Shinwa Kaiun and SHINWA<br />

(SINGAPORE) PTE. LTD., which serve as shipping<br />

operators, Shinwa Marine Corp., which assumes<br />

shipping administration, and overseas owner subsidiaries.<br />

As for businesses other than shipping services, the<br />

Company operates Shinwa Business Management<br />

Kaisha, Ltd., which is engaged in property management<br />

services and entrusted with the administrative and<br />

accounting business of Group members, Shinwa<br />

Systems Co., Ltd., which is engaged in information<br />

systems development and maintenance, and Shinwa<br />

Engineering Services Co., Ltd., which is engaged in<br />

onshore equipment maintenance services.<br />

Operational reviews for overseas shipping<br />

services, coastal shipping services, and other services<br />

for the consolidated fiscal year under review are as<br />

follows.<br />

Overseas Shipping Services<br />

The charter market for Capesize bulk carriers<br />

(170,000-DWT class) was affected by sluggish cargo<br />

movements at the beginning of the fiscal year, due to<br />

production adjustment by steelmakers stemming<br />

from the rapid economic recession following the<br />

Lehman shock. However, average charter rates for<br />

main four routes reached a level surpassing 40,000<br />

U.S. dollars per day because of the recovery of iron<br />

ore imports by China in the second half of the fiscal<br />

year, as well as the recovery of crude steel production<br />

in Japan and Europe, resulting in a gradual increase<br />

in cargo movement and the tightening of supply and<br />

demand for vessels.<br />

In the Panamax bulk carrier (70,000-DWT class)<br />

market, charter rates for the Pacific round service<br />

remained sluggish, at around 10,000 U.S. dollars per<br />

day at the beginning of the fiscal year, because of a<br />

decline in transportation demand for Japan.<br />

However, rates rose to approximately 30,000 U.S.<br />

dollars per day toward the end of the fiscal year<br />

because cargo movements of coal and grain bound<br />

mainly for China and India were increasingly brisk<br />

after summer, and because supply and demand for<br />

vessels tightened, due partly to prolonged ship<br />

congestion in Australia.<br />

In the Handy bulk carrier (30,000-DWT class)<br />

market, charter rates for the Pacific round service<br />

remained sluggish, at approximately 8,000 U.S.<br />

dollars per day in the first half of the fiscal year.<br />

However, cargo movements increased as the world<br />

economy gradually recovered, and the market continued<br />

to show moderate growth. Furthermore, as demand<br />

for vessels notably increased after winter, charter rates<br />

reached a level surpassing approximately 20,000 U.S.<br />

dollars per day at the end of the fiscal year.<br />

While the transport of our main outward cargo,<br />

steel products from Japan to North America, slowed<br />

down, we worked to improve ship-deployment<br />

efficiency through booking combination cargo to<br />

Central and South America, and achieved success.<br />

We maintained stable profits through long-term<br />

contracts for nonferrous ore from the west coast of<br />

South America, one of our main homeward cargos.<br />

In grain transport from the Gulf Coast of the U.S. to<br />

the west coast of South America, we worked to<br />

improve profits through efficient deployment of our<br />

fleet, while benefitting from a market rise.<br />

In near-sea trade using small-sized carriers<br />

(5,000- to 10,000-DWT class), the transport of steel<br />

products bound for China and Southeast Asia<br />

remained at a much higher level than expected, while<br />

demand for the transport of raw materials bound for<br />

Japan was extremely sluggish.<br />

In the field of VLCCs (300,000-DWT-class<br />

tankers), VLGCs (80,000-cubic-meter liquefied gas<br />

7<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>

carriers) and MR product tankers (medium-range oil<br />

product tankers), the balance of supply and demand<br />

significantly deteriorated due to the global economic<br />

crunch following the Lehman shock. Despite a<br />

pickup trend from the fourth quarter, the transport<br />

of crude oil, LPG, and oil products as a whole<br />

remained at a historically low level.<br />

Regarding the chemical tanker business<br />

conducted by SHINWA (SINGAPORE) PTE.<br />

LTD., the delivery of a new vessel in April 2009<br />

brought the number of vessels in the fleet to four, all<br />

of which have operated smoothly. In near-sea dry<br />

bulk activities, despite the impact of the market crash<br />

in the previous fiscal year, we endeavored to reduce<br />

charter rates and improve efficiency in ship<br />

deployment by returning ships with high charter<br />

rates and shifting to short- and medium-term<br />

affreightment contracts.<br />

In this business environment, although our<br />

overseas shipping service was confronted with<br />

negative factors affecting earnings results, including a<br />

settlement loss from fuel oil futures contracts signed<br />

in the previous year, we took measures under the<br />

initiative of the Emergency Countermeasure<br />

Committee, launched in the previous year and<br />

headed by the former president, aimed at returning<br />

high-cost ships early and concluding new<br />

affreightment contracts. While we were able to earn<br />

stable profits through ship deployment to existing<br />

medium- and long-term affreightment contracts on a<br />

timely basis, we were also able to earn higher<br />

revenues than our initial target as a result of flexible<br />

adjustment of our managed ships’ tonnage and<br />

improved efficiency in ship deployment.<br />

Coastal Shipping Services<br />

production cuts by steel makers, but increased in the<br />

second half along with the production of coke, due<br />

to steel makers’ production recovery. The transport<br />

volume of cement remained at a low level because of<br />

sluggish domestic demand.<br />

In respect to Shinwa Chemical Tanker Co., Ltd.,<br />

with regard to the demand for LPG, a declining<br />

trend continued for both industrial and consumer<br />

use due to a downturn in demand. The transport of<br />

petrochemicals and black oil (heavy oil, etc.) fell<br />

short of expectations, affected by a sluggish transport<br />

volume in the first half of the fiscal year. Although<br />

LNG demand for industrial use was sluggish due to<br />

the economic recession, overall transport volume<br />

remained firm, thanks to brisk consumer demand for<br />

LNG as clean energy.<br />

In this business climate we focused on cost<br />

reduction, in conjunction with efficient ship<br />

deployment and operation, in the coastal shipping<br />

sector. As a result, we were able to earn higher<br />

revenues overall than our initial target.<br />

Other Services<br />

Other services are provided by Shinwa Kaiun Group<br />

companies, such as Shinwa Marine Corp., which is<br />

engaged in ship management services; Shinwa<br />

Business Management Kaisha, Ltd., engaged in<br />

property management services and entrusted with<br />

the administrative and accounting business of Group<br />

members; Shinwa Systems Co., Ltd., which conducts<br />

information systems development and maintenance;<br />

and Shinwa Engineering Services Co., Ltd., which is<br />

engaged in onshore equipment maintenance services.<br />

The Group’s business results roughly matched our<br />

initial forecast.<br />

In respect to Shinwa Naiko Kaiun Kaisha, Ltd., the<br />

transport volume of steel products dropped sharply<br />

in the first half of the fiscal year due to significant<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> 8

Management Structure<br />

Shinwa Kaiun has adopted the auditor governance<br />

model. However, the Company has been<br />

maintaining and enhancing its management<br />

efficiency by forming a board of directors consisting<br />

of directors being well acquainted with the<br />

Company’s businesses. Three of the four corporate<br />

auditors are external corporate auditors, and each<br />

auditor attends meetings held by various<br />

committees, including the Compliance Committee,<br />

in addition to meetings of the board of directors<br />

and executive officers, in order to monitor the<br />

status of management and business execution.<br />

Moreover, the Internal Audit Office under the<br />

direct control of the president monitors the status<br />

of business execution in order to enhance the<br />

effectiveness of corporate governance in<br />

collaboration with the corporate auditors.<br />

The Company has also established a code of conduct<br />

in order to implement its corporate philosophy in<br />

specific terms. In addition, the Company has<br />

established a compliance committee chaired by the<br />

director in charge of general affairs to ensure that all<br />

directors and employees comply with laws, internal<br />

regulations and ethical standards in their execution<br />

of their duties.<br />

Organization Chart Including the Management System of Internal Controls As of June 25, <strong>2010</strong><br />

General Shareholders’ Meeting<br />

Elections<br />

Board of Directors<br />

Basic policy for the internal controls system<br />

(Resolutions)<br />

Supervision<br />

Operational audit Elections<br />

Elections<br />

Audit of accounts<br />

Exchange of opinions<br />

Board of Corporate Auditors<br />

Independent<br />

Public<br />

Accountants<br />

Audit of accounts<br />

Board of Executive Committee<br />

President Executive Officer<br />

Executive Officers<br />

Co-operation<br />

Co-operation<br />

Supervision<br />

Supervision<br />

Each Executive Officer<br />

GL Committee (Note)<br />

Various Committees<br />

<strong>Report</strong><br />

CSR Committee<br />

Compliance Committee<br />

Safety and Health Committee<br />

Investor Relations Committee<br />

Ship Safety and Environmental Committee<br />

Disaster Prevention and<br />

Countermeasures Committee<br />

CAPSS Execution Committee<br />

Budget Execution Committee<br />

General Systems Planning Committee<br />

Project Team<br />

Assistance;<br />

coordinator<br />

Supervision<br />

Suggestions/recommendations<br />

Internal Audit<br />

Attorneys<br />

Supervision<br />

Executives and employees of<br />

company divisions<br />

Overseas offices<br />

Ships<br />

Internal Audit Office<br />

Subsidiaries<br />

Assistance in<br />

monitoring system<br />

operations<br />

Executive Officer in<br />

charge of internal controls<br />

and corporate ethics<br />

Assistance<br />

Assistance<br />

Promoting<br />

committee<br />

of internal<br />

controls<br />

(Internal Control Secretariat)<br />

Note: Composed of the Company’s group leaders<br />

9<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>

Corporate Social Responsibility<br />

Prevention of Global Warming<br />

Global warming is said to be caused by greenhouse gases such as CO2. Vessels need to burn fossil fuel such as<br />

fuel oil to run, and these emit CO2-containing exhaust fumes. At present, the only effective way to reduce this<br />

CO2 gas is to reduce fuel consumption. We are taking the following measures to reduce fuel consumption:<br />

• Use of energy-saving equipment and<br />

devices.<br />

• Improving propulsion performance by<br />

hull cleaning/propeller polishing.<br />

• Speed reduction and best-route planning<br />

in accordance with changing situations.<br />

• Minimizing fuel consumption per<br />

transported unit with efficient shipping<br />

schedules and increased cargo loads.<br />

Before propeller polishing<br />

After propeller polishing<br />

Before hull cleaning<br />

After hull cleaning<br />

Installation of Lubricant (M/E Cylinder Oil) Saving Equipment<br />

The vessels owned by Shinwa Kaiun that have cross-head engines are being converted from mechanical to<br />

electronically controlled lubricators to reduce the amount of lubrication and lower cylinder oil consumption.<br />

Cross-head engines use two types of lubricant: cylinder oil in the cylinder liner and system oil in the<br />

crankcase. The system oil undergoes a circulation cycle so that it can be reused. The cylinder oil, however,<br />

cannot be reused because it is burned up inside the cylinders, and<br />

The structure of a cross-head engine this oil must be fed in constantly for the engine to continue<br />

Exhaust valve<br />

operating.<br />

Exhaust<br />

Lubrication ports There used to be mechanical lubricators attached directly to<br />

Lubricator<br />

the engine. These would feed oil at a fixed frequency (once every<br />

one or two revolutions of the engine). Now, however,<br />

Piston<br />

electronically controlled lubricators have made it possible to feed<br />

Air supply<br />

oil accurately and in a way that is appropriate to the main<br />

Piston rod engine’s current operational status. Reducing the wasteful<br />

Cross-head feeding of oil makes it possible to reduce the amount of<br />

lubrication and lower the consumption of cylinder oil. Shinwa<br />

Crankshaft Kaiun is actively engaged in fitting electronically controlled<br />

lubricators.<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> 10

Management’s Discussion and Analysis<br />

Outline of Operating Results<br />

■ Overall Operations<br />

During the fiscal year under review, as a result of<br />

the successful financial measures which various<br />

countries took in response to the unprecedented<br />

recession triggered by the financial crisis in 2008, in<br />

general the world economy emerged from the worst<br />

phase of the crisis, and the pickup trend increased.<br />

Looking at a regional breakdown, the U.S.<br />

economy staged a moderate recovery as seen in the<br />

improvement in capital investment and personal<br />

consumption, although the U.S. indexes related to<br />

housing and employment remained severe. In<br />

Europe, economies gradually picked up with the<br />

improved business sentiment. However, the<br />

unemployment rates remained high, and the pace of<br />

recovery became sluggish due to the fiscal crises in<br />

Greece and Spain. In China, major economic<br />

indicators remained firm, and large-scale stimulus<br />

measures helped to facilitate a rapid recovery led<br />

by domestic demand. In Japan, although<br />

employment and capital investment failed to fully<br />

recover, the pickup trend increased with<br />

production activities and exports showing signs of<br />

recovery as well as gradual improvement in the<br />

corporate earnings environment.<br />

In overseas shipping, the dry bulk market<br />

experienced large fluctuations in Capesize bulk<br />

carriers during the fiscal year, while small- and<br />

medium-sized bulk carriers remained firm in general.<br />

The tanker market remained sluggish as a whole,<br />

reaching a record low level at the beginning of the<br />

fiscal year. The coastal shipping market remained at<br />

a low level in general due to significant decline in<br />

the transport volume of steel-related products, etc.<br />

in the first half of the fiscal year.<br />

Fuel oil prices remained at a low level in the<br />

first quarter due to the decline in crude oil prices<br />

resulting from the global financial turmoil and<br />

world economic downturn, but then stayed at a<br />

high level with an increase in crude oil prices. As a<br />

result, the average purchase price of fuel oil in the<br />

fiscal year under review declined to about 421 U.S.<br />

dollars per ton, down about 137 U.S. dollars from<br />

the previous year.<br />

The average exchange rate of the Japanese yen<br />

against the U.S. dollar was 93.25 yen in the fiscal<br />

year, which is a 1.75 yen appreciation from the<br />

Consolidated Sales by Sector<br />

Trends in U.S. Dollar-Yen<br />

Exchange Rate<br />

(inter-office rate)<br />

Trends in Prices of Fuel Oil<br />

(bonded fuel oil of Japan)<br />

Coastal<br />

Shipping<br />

18%<br />

Other<br />

1%<br />

Yen FY2009 FY<strong>2010</strong><br />

115<br />

110<br />

US$/ton FY2009 FY<strong>2010</strong><br />

800<br />

700<br />

105<br />

600<br />

100<br />

500<br />

95<br />

400<br />

Overseas<br />

Shipping<br />

81%<br />

90<br />

300<br />

85<br />

200<br />

(Month) 4 5 6 7 8 9 10 11 12 1 2 3<br />

(Month) 4 5 6 7<br />

8 9 10 11 12 1 2 3<br />

11<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>

initial estimate at the beginning of the fiscal year,<br />

and a 7.50 yen appreciation from the previous year.<br />

As for the coastal shipping sector, in the midst<br />

of economic recession following 2009, exports<br />

started to make a partial recovery from September<br />

despite some weakness, inventory adjustment in the<br />

automobile and electronics industries advanced,<br />

and production cuts eased. Accordingly, the<br />

transport of steel products and electric powerrelated<br />

transport remained strong.<br />

Within this business environment, in the<br />

consolidated fiscal year under review, the Company<br />

posted consolidated revenues of 95,106 million yen<br />

(down 28.4% from the previous year), operating<br />

income of 4,796 million yen (down 63.6%), and<br />

ordinary income of 4,053 million yen (down<br />

67.6%). Net income was 1,215 million yen (down<br />

81.8%) as a result of recording an extraordinary loss<br />

of 2,937 million yen due to cancellations of charter<br />

contracts. These cancellations were attributable to<br />

the early return of vessels, implemented as a way to<br />

strengthen our fleet’s competitiveness.<br />

■ Forecast for the Next Fiscal Year<br />

In the next fiscal year, the world economy is<br />

anticipated to continue recovering gradually, and<br />

the overseas shipping market is expected to remain<br />

firm, reflecting strong transportation demand for<br />

iron ore, coal, and other materials in emerging<br />

countries including China and India. However,<br />

concerns remain about appreciation of the yen,<br />

which is the variable factor for earnings results in<br />

the overseas shipping service, and about a further<br />

rise in fuel oil prices. Moreover, there is concern<br />

that the shipping market will deteriorate as a result<br />

of loosening supply and demand for vessels, due to<br />

the large number of completions of new vessels.<br />

These concerns make prospects unpredictable.<br />

In this business environment, for the next<br />

consolidated fiscal year, we expect 110,000 million<br />

yen ✽ in consolidated revenue for the whole year,<br />

operating income of 7,000 million yen ✽ , ordinary<br />

income of 6,000 million yen ✽ , and net income of<br />

3,500 million yen ✽ . The above projections assume an<br />

exchange rate of 90 yen to the U.S. dollar and an internal<br />

bunker C fuel oil price of 540 U.S. dollars per ton.<br />

✽ The effect from the merger with the Nippon Steel Shipping Co., Ltd. is<br />

excluded from the amount.<br />

Trends in Time Charter Rates (Charter period: one year)<br />

Capesize Bulk Carriers<br />

Panamax Bulk Carriers<br />

Handy Bulk Carriers<br />

US$/day FY2009 FY<strong>2010</strong><br />

180,000<br />

150,000<br />

120,000<br />

90,000<br />

60,000<br />

30,000<br />

US$/day FY2009 FY<strong>2010</strong><br />

90,000<br />

75,000<br />

60,000<br />

45,000<br />

30,000<br />

15,000<br />

US$/day FY2009 FY<strong>2010</strong><br />

45,000<br />

40,000<br />

35,000<br />

30,000<br />

25,000<br />

20,000<br />

15,000<br />

10,000<br />

5,000<br />

0<br />

0<br />

0<br />

(Month)<br />

4 5 6<br />

7<br />

8 9 10 11 12 1 2 3<br />

(Month) 4 5 6 7 8 9 10 11 12 1 2 3<br />

(Month) 4 5 6 7<br />

8 9 10 11 12 1 2 3<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> 12

Consolidated Financial Statements (Summary)<br />

Consolidated Balance Sheet<br />

Millions of yen<br />

As of March 31, <strong>2010</strong> and 2009 <strong>2010</strong> 2009<br />

ASSETS<br />

Current assets ¥ 32,095 ¥ 30,725<br />

Fixed assets 82,275 76,284<br />

Tangible fixed assets 75,012 70,108<br />

Intangible fixed assets 412 429<br />

Investments and other assets 6,851 5,747<br />

Total assets 114,370 107,009<br />

LIABILITIES<br />

Current liabilities 23,813 20,858<br />

Long-term liabilities 42,619 41,926<br />

Total liabilities 66,432 62,784<br />

NET ASSETS<br />

Shareholders’ equity<br />

Common stock 8,100 8,100<br />

Capital surplus 20 20<br />

Retained earnings 42,990 41,775<br />

Treasury stock, at cost (25) (24)<br />

Total shareholders’ equity 51,085 49,871<br />

Valuation and translation adjustments<br />

Unrealized gains (losses) on securities 204 (434)<br />

Gains (losses) on deffered hedge (2,639) (3,869)<br />

Foreign currency translation adjustments (2,569) (2,986)<br />

Total valuation and translation adjustments (5,004) (7,289)<br />

Minority interests 1,857 1,643<br />

Total net assets 47,938 44,225<br />

Total liabilities and net assets ¥ 114,370 ¥ 107,009<br />

13<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>

Consolidated Statement of Income<br />

Millions of yen<br />

For the Years Ended March 31 <strong>2010</strong> 2009<br />

Revenues ¥ 95,106 ¥ 132,799<br />

Operating expenses 85,404 114,655<br />

Gross profit 9,702 18,144<br />

General and administrative expenses 4,906 4,976<br />

Operating income 4,796 13,168<br />

Non-operating income 369 676<br />

Non-operating expenses 1,112 1,346<br />

Ordinary income 4,053 12,498<br />

Extraordinary profits 322 879<br />

Extraordinary losses 2,937 2,453<br />

Income before income taxes 1,438 10,924<br />

Income taxes—current 607 4,355<br />

Income taxes—deferred (590) (232)<br />

Minority interests 206 112<br />

Net income ¥ 1,215 ¥ 6,689<br />

Consolidated Statement of Cash Flows<br />

Millions of yen<br />

For the Years Ended March 31 <strong>2010</strong> 2009<br />

Cash flow from operating activities ¥ 9,427 ¥ 8,360<br />

Cash flow from investing activities (11,374) (10,006)<br />

Cash flow from financing activities 2,850 5,445<br />

Effect of exchange rate changes on cash and cash equivalents (48) (138)<br />

Net increase in cash and cash equivalents 855 3,661<br />

Cash and cash equivalents at the beginning of the year 10,213 6,552<br />

Cash and cash equivalents at year-end ¥ 11,068 ¥ 10,213<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> 14

Consolidated Financial Statements (Summary)<br />

Consolidated Statement of Shareholders’ Equity<br />

Millions of yen<br />

Shareholders’ equity<br />

For the Years Ended March 31<br />

Common<br />

stock<br />

Capital<br />

surplus<br />

Retained<br />

earnings<br />

Treasury<br />

stock,<br />

at cost<br />

Total<br />

shareholders’<br />

equity<br />

Balance at March 31, 2009 8,100 20 41,775 (24) 49,871<br />

Changes of items during the term<br />

Dividends from retained earnings — —<br />

Net income 1,215 1,215<br />

Acquisition of treasury stock (1) (1)<br />

Net changes of items other than<br />

shareholders’ equity<br />

Total changes of items during the term — — 1,215 (1) 1,214<br />

Balance at March 31, <strong>2010</strong> 8,100 20 42,990 (25) 51,085<br />

Millions of yen<br />

For the Years Ended March 31<br />

Unrealized<br />

gains (losses)<br />

on securities<br />

Valuation and translation adjustments<br />

Gains (losses)<br />

on deferred<br />

hedge<br />

Foreign currency<br />

translation<br />

adjustments<br />

Total valuation<br />

and translation<br />

adjustments<br />

Minority<br />

interests<br />

Total<br />

net assets<br />

Balance at March 31, 2009 (434) (3,869) (2,986) (7,289) 1,643 44,225<br />

Changes of items during the term<br />

Dividends from retained earnings —<br />

Net income 1,215<br />

Acquisition of treasury stock (1)<br />

Net changes of items other than<br />

shareholders’ equity<br />

638 1,230 417 2,285 214 2,499<br />

Total changes of items during the term 638 1,230 417 2,285 214 3,713<br />

Balance at March 31, <strong>2010</strong> 204 (2,639) (2,569) (5,004) 1,857 47,938<br />

15<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>

History<br />

Apr. 1950<br />

Dec. 1957<br />

Feb. 1962<br />

May 1964<br />

Sep. 1969<br />

Jan. 1970<br />

Jun. 1974<br />

May 1975<br />

Mar. 1976<br />

Apr. 1977<br />

Feb. 1981<br />

Apr. 1992<br />

Jul. 1993<br />

Sep. 1994<br />

Jan. 1995<br />

Jun. 1996<br />

Feb. 1998<br />

Nov. 1999<br />

Jul. 2001<br />

Jul. 2004<br />

Aug. 2005<br />

Oct. 2006<br />

Apr. 2007<br />

Mar. 2008<br />

Mar. <strong>2010</strong><br />

Established Nittetsu Steamship Co. (2-2 Marunouchi, Chiyoda-ku, Tokyo, Japan); separated from shipping<br />

department of former Nippon Steel Corp.<br />

Opened a liaison office in London<br />

Merged with Toho Kaiun Kaisha and changed the registered name to SHINWA KAIUN KAISHA, LTD.<br />

(1-3 Kyobashi, Chuo-ku, Tokyo, Japan)<br />

Became a part of Nippon Yusen Kabushiki Kaisha group due to the Marine Transportation Restructuring Act<br />

Opened a New York liaison office<br />

Established Shinwa (U.K.) Ltd., a subsidiary<br />

Established Shinwa Naiko Kaiun Kaisha, Ltd.; separated from coastal shipping section<br />

Established Shinwa (U.S.A.) Inc., a subsidiary<br />

Established P.T. Pakarti Tata in Jakarta<br />

Opened liaison office in Melbourne (Relocated to Sydney in April 1993)<br />

Moved the head office to 2-2-2 Uchisaiwaicho, Chiyoda-ku, Tokyo, Japan<br />

Opened a liaison office in Singapore<br />

Opened a liaison office in Beijing<br />

Moved the head office to 1-5-7 Kameido, Koto-ku, Tokyo, Japan<br />

Opened a liaison office in Hong Kong<br />

Established Shinwa Shipping (H.K.) Co., Ltd., a subsidiary<br />

Merged with Shinsei Kaiun Kaisha, Ltd.<br />

Established Dajin Shipping Pte. Ltd., a subsidiary in Singapore<br />

Dissolved P.T. Pakarti Tata in Jakarta<br />

Opened a liaison office in Shanghai<br />

Moved the head office to 1-8-1 Otemachi, Chiyoda-ku, Tokyo, Japan<br />

Closed Beijing Representative Office<br />

Absorbed Dajin Shipping Pte. Ltd. as a wholly-owned subsidiary and changed its name to Shinwa<br />

(Singapore) Pte. Ltd. in order to enter the chemical carrier business<br />

In order to further strengthen business relationships, Nippon Steel Corporation increased holdings of shares<br />

in Shinwa Kaiun Kaisha, Ltd. and became an “Other related company” of Shinwa Kaiun Kaisha, Ltd.<br />

(“Other related company” refers to a company of which Shinwa Kaiun Kaisha, Ltd. is an affiliate)<br />

In order to further strengthen business relationship with Nippon Coke & Engineering Co., Ltd. (a group<br />

company of Nippon Steel Corporation), Shinwa Naiko Kaiun Kaisha Co., Ltd. made Muromachi Shipping<br />

Company, Limited (a wholly-owned subsidiary of Nippon Coke & Engineering) its subsidiary by acquiring<br />

all of the company’s shares.<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> 16

Corporate Data<br />

Outline of the Company<br />

(As of March 31, <strong>2010</strong>)<br />

Registered Name<br />

SHINWA KAIUN KAISHA, LTD.<br />

Established<br />

April 1, 1950<br />

Capital<br />

8.1 billion yen<br />

Number of Employees<br />

591 (Consolidated)<br />

165 (Non-consolidated)<br />

Head Office<br />

KDDI Otemachi Bldg., 8-1, Otemachi 1-chome,<br />

Chiyoda-ku, Tokyo 100-8108, Japan<br />

Number of Employees<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Fleet Scale<br />

800<br />

600<br />

400<br />

200<br />

0<br />

154 154 162 165<br />

07 08 09<br />

543 568<br />

07 08 09<br />

10<br />

624 654<br />

Ten thousands ton<br />

10<br />

Directors, Corporate Auditors and<br />

Executive Officers<br />

(As of June 25, <strong>2010</strong>)<br />

Directors, Corporate Auditors and Executive Officers<br />

(post-merger)<br />

(As of October 1, <strong>2010</strong>)<br />

Representative Director and Chairman<br />

Takahiko Kakei<br />

President/<br />

President Executive Officer<br />

Hiroshi Sugiura<br />

Directors/<br />

Managing Executive Officers<br />

Kenji Oyama<br />

Kimio Ohama<br />

Yoshiro Kishi<br />

Outside Corporate Auditors<br />

Teruhiko Sano<br />

Hidetoshi Kikutake<br />

Shigeru Shimizu<br />

Corporate Auditor<br />

Yasushi Horie<br />

Managing Executive Officers<br />

Naofumi Wakao<br />

Kazumi Takagi<br />

Executive Officers<br />

Yoshio Sakamoto<br />

Takashi Matsumoto<br />

Hironobu Sato<br />

Akihiko Kawai<br />

Yoshio Kawamura<br />

Toyohiko Yokomizo<br />

Yasukazu Sakata<br />

Chairman<br />

Takahiko Kakei<br />

President/President Executive Officer<br />

Keiichiro Shimakawa<br />

Representative Director/<br />

Vice-President Executive Officer<br />

Hiroshi Sugiura<br />

Directors/Managing Executive Officers<br />

Osamu Nagano<br />

Kenji Oyama<br />

Yoshiro Kishi<br />

Masaaki Ando<br />

Outside Director<br />

Tooru Obata<br />

Outside Corporate Auditors<br />

Teruhiko Sano<br />

Hidetoshi Kikutake<br />

Shigeru Shimizu<br />

Corporate Auditor<br />

Yasushi Horie<br />

Managing Executive<br />

Officers<br />

Naofumi Wakao<br />

Kazumi Takagi<br />

Toyohiko Yokomizo<br />

Executive Officers<br />

Yoshio Sakamoto<br />

Takashi Matsumoto<br />

Hironobu Sato<br />

Akihiko Kawai<br />

Yoshio Kawamura<br />

Yasukazu Sakata<br />

Hiroshi Sanda<br />

Tai Sugawara<br />

17<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>

Principal Overseas Subsidiaries<br />

SHINWA (U.K.) LTD.<br />

7th Floor, 76 Shoe Lane, London, EC4A 3JB<br />

UNITED KINGDOM<br />

TEL: +44-20-7716-0055<br />

FAX: +44-20-7716-0056<br />

E-mail: shinwa@shinwauk.com<br />

SHINWA (U.S.A.) INC.<br />

4th Floor, 300 Harmon Meadow Blvd., Secaucus,<br />

New Jersey 07094, U.S.A.<br />

TEL: +1-201-348-2101<br />

FAX: +1-201-319-0305<br />

E-mail: susa@shinwausa.com<br />

SHINWA SHIPPING (H.K.) CO., LTD.<br />

Room 1002, Ocean Centre, Harbour City,<br />

5 Canton Road, Kowloon, HONG KONG<br />

TEL: +852-2110-1228<br />

FAX: +852-2370-9781<br />

E-mail: akiyama@shinwaship.com.hk<br />

kwchan@shinwaship.com.hk<br />

TLX: 48827 HKSSC HX<br />

SHINWA (SINGAPORE) PTE. LTD.<br />

138 Robinson Road #19-04/05,<br />

The Corporate Office, SINGAPORE 068906<br />

TEL: +65-6323-6716<br />

FAX: +65-6323-6718<br />

E-mail: bulk@shinwa.com.sg<br />

tank@shinwa.com.sg<br />

SHINWA KAIUN KAISHA, LTD. SHANGHAI OFFICE<br />

RM 1103, Ruijin Building 205,<br />

Mao Ming Nan Lu, Shanghai 200020, CHINA<br />

TEL: +86-21-6415-3557<br />

FAX: +86-21-6415-3667<br />

E-mail: watanabe@shinwaship-sh.com.cn<br />

Stock Information<br />

(As of March 31, <strong>2010</strong>)<br />

Total Number of Authorized Shares<br />

Shares of Common Stock Issued<br />

Number of Shareholders<br />

Principal Shareholders<br />

Share Price Chart (unit: yen)<br />

800<br />

600<br />

400<br />

200<br />

0<br />

Number of shares<br />

held (thousands)<br />

600,000,000<br />

162,000,000<br />

10,337<br />

Percentage of<br />

shares held (%)<br />

Nippon Yusen Kabushiki Kaisha (NYK LINE) 43,247 26.71<br />

Nippon Steel Corporation 24,300 15.01<br />

Tokio Marine & Nichido Fire Insurance Co., Ltd. 8,024 4.96<br />

Japan Trustee Services Bank, Ltd. (Trust account) 5,806 3.59<br />

Mitsubishi Heavy Industries, Ltd. 5,400 3.34<br />

Mitsui Sumitomo Insurance Co., Ltd. 5,140 3.17<br />

SOMPO JAPAN INSURANCE INC. 5,073 3.13<br />

Mizuho Corporate Bank, Ltd. 4,052 2.50<br />

The Master Trust Bank of Japan, Ltd. (Trust account) 2,419 1.49<br />

The Bank of Tokyo-Mitsubishi UFJ, Ltd. 2,250 1.39<br />

Stock Price (the candle)<br />

high high<br />

close open<br />

open close<br />

low low<br />

open price < close price open price > close price<br />

4<br />

2008 5 6 7 8 9 101112 2009 1 2 3 4 5 6 7 8 9 101112 <strong>2010</strong><br />

1 2 3<br />

4 5<br />

(Year/month)<br />

Shinwa Kaiun Group <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> 18

KDDI Otemachi Bldg., 8-1, Otemachi 1-chome,<br />

Chiyoda-ku, Tokyo 100-8108, Japan<br />

TEL: +81-3-5290-6400 FAX: +81-3-5290-6230<br />

E-mail: LEGAL@shinwaship.co.jp<br />

Company Website<br />

We are posting the latest news and other IR information on our web site.<br />

www.shinwaship.co.jp/english/index.html

![[Consolidated] Balance Sheet (B/S)(PDF/35KB)](https://img.yumpu.com/49745625/1/184x260/consolidated-balance-sheet-b-spdf-35kb.jpg?quality=85)