View PDF - WEA Trust Member Benefits

View PDF - WEA Trust Member Benefits

View PDF - WEA Trust Member Benefits

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

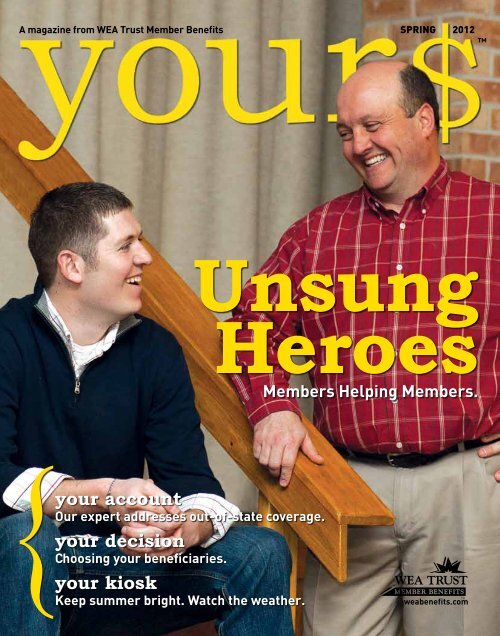

A magazine from <strong>WEA</strong> <strong>Trust</strong> <strong>Member</strong> <strong>Benefits</strong><br />

SPRING 2012<br />

<br />

Unsung<br />

Heroes<br />

<strong>Member</strong>s Helping <strong>Member</strong>s.<br />

}<br />

your account<br />

Our expert addresses out-of-state coverage.<br />

your decision<br />

Choosing your beneficiaries.<br />

your kiosk<br />

Keep summer bright. Watch the weather.<br />

TM<br />

weabenefits.com

{<br />

your$<br />

contents SPRING 2012<br />

<br />

3 YOUR ACCOUNT<br />

- Avoid inactive account fees.<br />

- Moving to cell phone only?<br />

- Learn about coverage for<br />

out-of-state situations.<br />

4 YOUR RESOURCE<br />

- Financial mentors help colleagues<br />

get on the road to financial<br />

security.<br />

6 YOUR DECISION<br />

- Who will inherit your retirement<br />

accounts? A guide to choosing<br />

beneficiaries.<br />

6<br />

8 YOUR MISSION<br />

- Mission Possible: Summer<br />

seminars coming your way.<br />

10 YOUR KIOSK<br />

- Reduce loss: Watch the weather<br />

- Give savings a boost with the<br />

payroll tax cut.<br />

- We’ve been nominated!<br />

president’s letter<br />

{Dave Kijek, President/CEO, <strong>WEA</strong> <strong>Trust</strong> <strong>Member</strong> <strong>Benefits</strong><br />

10<br />

4<br />

© 2011 <strong>WEA</strong> <strong>Member</strong> Benefit <strong>Trust</strong>.<br />

All Rights Reserved.<br />

How will you celebrate National Financial Literacy Month?<br />

April was officially<br />

designated National<br />

Financial Literacy<br />

Month in 2004 in<br />

an effort to highlight<br />

the importance of<br />

financial literacy<br />

and teach Americans<br />

how to establish and<br />

maintain healthy<br />

financial habits.<br />

At <strong>Member</strong> <strong>Benefits</strong>, financial<br />

literacy is something we focus on all<br />

year round. Helping Wisconsin public<br />

school employees learn and implement<br />

ways to build their financial security<br />

is fundamental to the mission of our<br />

organization and our staff is passionate<br />

about it.<br />

Our passion is shared by the six<br />

financial mentors highlighted in this<br />

issue. They represent a contingent of<br />

education professionals who have made<br />

it their personal mission to help their<br />

colleagues succeed in the classroom and<br />

financially. Chances are there’s a financial<br />

mentor down the hall from you.<br />

Speaking of missions—check out the<br />

“Mission Possible” summer seminar<br />

promotion on page eight. These<br />

seminars are a great way to increase your<br />

knowledge about important financial<br />

issues. Or, pass the invitation along to a<br />

colleague who might benefit.<br />

Finally, I am thrilled that our Don’t<br />

Be Jack financial learning game has<br />

been nominated for an award from the<br />

Institute for Financial Literacy. We’ll have<br />

to wait until later this month to learn the<br />

results, but just being nominated is quite<br />

an honor.<br />

Thank you for continuing to support<br />

these financial programs created<br />

specifically for you. We are always looking<br />

for ways to improve your experience and<br />

enhance our offerings. Let us know what<br />

we can do for you.<br />

Have a fantastic spring.<br />

2 weabenefits.com

{ your account<br />

IRA and 403(b) News<br />

Avoid inactive account minimum annual fee<br />

There is a minimum annual fee of $25 for an inactive <strong>WEA</strong>C IRA and/or<br />

<strong>WEA</strong> TSA <strong>Trust</strong> 403(b) account with balances less than $5,556 (IRA) or $7,143<br />

(TSA). Inactive accounts are accounts with no contributions or distributions<br />

within a calendar year. You can avoid the fee by making a single contribution<br />

or by taking a distribution (if eligible) at any time during the calendar year.<br />

Also consolidating other accounts into your <strong>WEA</strong>C IRA and/or <strong>WEA</strong> TSA <strong>Trust</strong><br />

403(b) account could help reduce the amount of fees you are paying. Give us<br />

a call at 1-800-279-4030 to review your account.<br />

Did you change where you bank?<br />

Make sure your electronic contributions to your <strong>WEA</strong>C IRA and/or personal<br />

insurance continue without interruption by notifying us if you have changed<br />

where you bank or if your account information has changed.<br />

IRA 5498 forms on their way<br />

Form 5498 is an informational tax form that IRA holders receive at the end of<br />

May if a contribution was made for 2011 or if there was an account balance as<br />

of December 31, 2011. A contribution is defined as Traditional and/or Roth IRA<br />

contributions made between January 1, 2011, and April 17, 2012, for 2011 tax<br />

year and rollovers, conversions (Traditional to Roth), and recharacterizations.<br />

Privacy notice enclosed with your statement<br />

Protection of your nonpublic personal financial information is very important<br />

to us. Enclosed with your 403(b) or IRA statement this quarter is a copy<br />

of the <strong>WEA</strong> TSA <strong>Trust</strong> privacy policy. Please read it carefully.<br />

Cutting off your landline?<br />

As cell phone usage increases, it’s more and more common for people to drop their<br />

landline service. If you have decided to eliminate your “home phone” or if you are<br />

thinking about it, make sure to plan for the transition.<br />

While you may rarely use your landline, you probably have your home phone number<br />

on record with financial institutions, your child’s school, health care providers, etc. Provide<br />

your new number to those who need it.<br />

That includes us.<br />

Auto, home, renters insurance<br />

• Call 1-800-279-4010<br />

• Use our easy online Update Your Policy<br />

application at weabenefits.com<br />

403(b) or IRA account<br />

• Call us at 1-800-279-4030<br />

• Log into your <strong>WEA</strong>ccess account to make the change<br />

You may also send an e-mail to memberbenefits@weabenefits.com.<br />

Please include the products you have with us so we can make all appropriate changes.<br />

weabenefits.com<br />

Insurance News<br />

Ask the Expert<br />

Our expert this<br />

issue is Skip Miller,<br />

Underwriting Manager<br />

for <strong>Member</strong> <strong>Benefits</strong>.<br />

I’m considering retiring out of<br />

state. Can I keep my <strong>WEA</strong> P&C<br />

insurance?<br />

Because <strong>WEA</strong> P&C is only licensed<br />

as an insurance carrier in the state of<br />

Wisconsin, we are not able to provide<br />

coverage for non-Wisconsin residents.<br />

So, if you decide to take up permanent<br />

residence outside of Wisconsin in<br />

retirement, you will have to find another<br />

insurance carrier.<br />

Snowbirds who choose to go south<br />

or elsewhere for an extended period<br />

continue to be eligible as long as they<br />

maintain their primary residence in<br />

Wisconsin. However, vehicles licensed<br />

in another state for use during their stay<br />

cannot be included on their <strong>WEA</strong> P&C<br />

policy. Also, we are only able to provide<br />

home, condo, or renters insurance for<br />

property inside of Wisconsin.<br />

Our daughter is going to college<br />

in Iowa and she will be taking<br />

one of our family vehicles with<br />

her. Can it still be covered on our<br />

<strong>WEA</strong> P&C auto policy?<br />

Students attending college outside of<br />

Wisconsin who take a vehicle with them<br />

may continue to insure that vehicle<br />

under their parents’ auto policy with<br />

a special out-of-state rating for that<br />

vehicle. However, if the child resides in<br />

that state full-time due to a job, etc., that<br />

driver and vehicle will be removed from<br />

the parents’ policy at the renewal.<br />

Property and casualty insurance programs<br />

are underwritten by <strong>WEA</strong> Property &<br />

Casualty Insurance Company. The terms<br />

and conditions of your coverage are<br />

exclusively controlled by your written policy.<br />

Please refer to your policy for details.<br />

3

{ your resource<br />

Tim McCarthy (right) takes<br />

time to provide fellow<br />

colleagues like Michael Theine<br />

(left) with the information they<br />

need to make good financial<br />

decisions early in their career.<br />

Tim is a band teacher<br />

at Glen Hills Middle School<br />

in Glendale.<br />

Unsung Heroes<br />

Educators across the state find financial encouragement, advice, and guidance for becoming<br />

financially secure in the profession they love from someone down the hall.<br />

4<br />

Google “unsung hero”<br />

and you’ll get: a person<br />

who makes a substantive<br />

yet unrecognized<br />

contribution; a role<br />

model; someone who<br />

helped or took action for the betterment<br />

of someone else; one who does things for<br />

the mere sake of doing something good.<br />

Our unsung heroes reflect those<br />

characteristics and more as financial<br />

mentors. They’re also modest—they don’t<br />

like to toot their own horn. One thing they<br />

are not shy about, however, is their passion<br />

for helping their colleagues build financial<br />

security. Their common mission is to<br />

share knowledge and information about<br />

how one can do good as an education<br />

professional and do well financially.<br />

Dinner with Tim<br />

Three years ago, when Michael Theine<br />

first started teaching second grade at<br />

Parkway Elementary in Glendale, he<br />

was invited to a dinner hosted by Tim<br />

McCarthy, the middle school band<br />

teacher. Tim is also the chief negotiator/<br />

handbook committee chair in his local.<br />

He has a tradition of inviting the nontenured<br />

(new teachers) to his home at<br />

the beginning of each school year to<br />

learn about their contract/handbook and<br />

the financial aspects of their benefits.<br />

“My goal is to help the best and the<br />

brightest grow their enthusiasm for<br />

teaching and stay in the profession,” Tim<br />

says.<br />

To do that, he believes that new<br />

teachers must understand the economics<br />

of their situation. “I want them to take<br />

control over their finances right out of the<br />

gate. With our buying power shrinking<br />

and the future of employee benefits in a<br />

state of uncertainty, members need to<br />

make informed financial decisions.”<br />

Food, fun, finances<br />

“It’s a very casual night and it’s not<br />

a lecture,” Michael emphasizes. “Tim<br />

shares advice and information in terms<br />

we understand, and he uses himself as an<br />

example. We get to learn from his mistakes<br />

and experiences.”<br />

This year, Tim included the financial<br />

learning game Don’t Be Jack (offered by<br />

<strong>Member</strong> <strong>Benefits</strong>) to the evening. “The<br />

game was fun. Each team made financial<br />

decisions for different life scenarios. Then<br />

in the end, we got to see what those<br />

weabenefits.com

decisions meant in terms of our financial<br />

security. Powerful stuff,” Michael said.<br />

Paying it forward<br />

While in graduate school years ago,<br />

Tim met a gentleman from South Africa.<br />

“He introduced me to the beauty of dollar<br />

cost averaging and compounding.” Tim<br />

now shares these concepts with his new<br />

colleagues to illustrate the importance of<br />

saving early for retirement. “Then I started<br />

teaching and Ron Bruce, a PE teacher, was<br />

a great motivator for me to start saving.<br />

He is the one who told me about the <strong>WEA</strong><br />

TSA <strong>Trust</strong> 403(b) program.”<br />

Now, Tim is the motivator. “Having<br />

someone like Tim who will sit down and<br />

talk without judgement or pressure to<br />

buy something is important. It’s about<br />

knowing what you have, what you can<br />

do with it, and then making your own<br />

decisions,” says Michael.<br />

Planning for the future is top of mind<br />

for Michael. He’s getting married this<br />

summer and thinking ahead to starting a<br />

family. “I’m thankful for Tim’s mentoring<br />

now, but I have a feeling I will be thanking<br />

him even more when it comes time to<br />

retire!”<br />

Alleviate stress: Plan now<br />

In the current environment, Tim<br />

emphasizes it’s more important than ever<br />

to start building up personal retirement<br />

savings.<br />

“Planning for the future will alleviate<br />

some of the anxiety related to health insurance<br />

changes, frozen/declining salaries,<br />

eroding retirement benefits, and changes<br />

to WRS. I tell them, ‘regardless of outside<br />

influences, your 403(b) money is yours<br />

alone. It’s the one constant you have.’”<br />

Ken Loest<br />

Ken Loest<br />

retired after 28<br />

years of teaching<br />

math in the Fond<br />

du Lac school<br />

district. Recently,<br />

he went back to<br />

teach Calculus and<br />

Pre-Calculus part-time at Elkhart Lake-<br />

Glenbeulah High School—a perfect gig<br />

for Ken.<br />

As a math guy, Ken is a natural financial<br />

mentor, but he insists that you don’t<br />

have to be a math wiz to build financial<br />

security. Over the years, Ken has helped<br />

many people develop a plan. “I was the<br />

FEA treasurer and had the opportunity<br />

to address new educators each year. The<br />

message is simple: start early, pay yourself<br />

first, and use investments that utilize the<br />

mathematics of compounding.”<br />

Ken:<br />

It is incumbent upon educators to<br />

plan for retirement and maximize<br />

every opportunity. We need to take<br />

control of our future.<br />

Compounding is when your investment<br />

earns interest and then the interest earns<br />

interest and so on. “The longer your<br />

timeline the better the result, so start<br />

saving as soon as you can with a Roth IRA<br />

and 403(b).”<br />

Ken has a great affection for his profession<br />

and his passion for helping his colleagues<br />

succeed financially has a paternal feel to<br />

it. “Dedicated educators have earned and<br />

deserve financial stability in their life, while<br />

working, and in retirement. However, it is<br />

incumbent upon each educator, especially<br />

in this environment, to plan for retirement<br />

and maximize every investment vehicle<br />

available to them.”<br />

Almost 30 years ago, Ken opened a <strong>WEA</strong><br />

TSA <strong>Trust</strong> 403(b) account and he’s never<br />

looked back. He continues encouraging<br />

and assisting others to take action. “I show<br />

them how to get started, how to fill out the<br />

forms, and guide them through the whole<br />

process. I’m happy to do it.”<br />

Sandy Nass<br />

As the UniServ<br />

Director for West<br />

Suburban Council<br />

in Brookfield,<br />

Sandy Nass advocates<br />

for public<br />

school employees,<br />

everything<br />

from negotiating contracts to providing<br />

retirement and long-term financial planning<br />

assistance. As a financial mentor,<br />

her message is: Start saving for retirement<br />

right away—before you get that first paycheck—with<br />

a 403(b) or an IRA.<br />

Sandy:<br />

You don’t have to start saving a<br />

huge amount. But, start you must.<br />

“When I meet with new hires, I ask<br />

‘who knows how much their first paycheck<br />

will be?’ In 25 years, not a single hand<br />

has gone up. The point is that it’s easier<br />

to start saving right away before you get<br />

comfortable with your paycheck and find<br />

ways to spend it.”<br />

At retirement, the difference between<br />

those who saved early and those who did<br />

not is significant. “I’ve never once met<br />

a member who was sorry they started a<br />

403(b) or IRA early in their career. Too<br />

often I hear the regrets of those who wish<br />

they had started sooner.”<br />

When Sandy started teaching in<br />

Orfordville years ago, she would listen to<br />

a group of math teachers who were always<br />

talking about investing and saving. “It<br />

continued on page 9<br />

April is National<br />

Financial Literacy Month:<br />

A perfect time to recognize financial mentors.<br />

Six individuals are featured here, but there are many others in schools<br />

across the state who share their knowledge, an encouraging word, stories of<br />

their successes, as well as mistakes and regrets with their colleagues. Look<br />

around. Listen. Do you know a financial mentor? Maybe it’s you.<br />

Nominate a financial mentor.<br />

We would like to recognize individuals who have given their time and talents to<br />

mentor others on the benefits of good financial planning and saving for retirement.<br />

Anyone can be nominated for a Financial Mentor Award. Nominations for the 2012<br />

awards will be accepted beginning June 1, 2012, and they will be announced on<br />

October 15. To get a nomination form, go to weabenefits.com/mentor.<br />

5<br />

weabenefits.com<br />

5

{ your decision<br />

Who will inherit your<br />

403(b) or IRA account?<br />

Don’t leave it to<br />

CHANCE.<br />

Choosing beneficiaries comes down to this: How do you want your assets distributed<br />

after you’re gone? Know your options so you can make the best choice for you.<br />

Naming beneficiaries for your<br />

403(b) and IRA retirement<br />

accounts is an important first<br />

step in your estate planning,<br />

but not all beneficiaries are treated alike.<br />

A beneficiary can be a person or persons, a<br />

trust, a charity, or your estate. Which is right<br />

for you? Without careful consideration,<br />

your decision may have unexpected tax and<br />

estate planning implications.<br />

benefit from tax deferral features associated<br />

with the retirement accounts.<br />

The trust option<br />

There may be circumstances when<br />

you may want to name a trust as your<br />

retirement account beneficiary. Naming a<br />

trust as your beneficiary is a way to control<br />

post-death distributions and restrict access<br />

for beneficiaries who might need help<br />

are quirky. If not set up properly, it can go<br />

very badly for your beneficiaries. Make<br />

sure to work with someone who has<br />

expertise with setting up trusts to ensure<br />

your wishes are met.<br />

Charity as beneficiary<br />

If you have already provided for your<br />

heirs and you have charitable inclinations,<br />

6<br />

The estate option<br />

Generally, naming your estate as your<br />

beneficiary by design or by default is bad<br />

estate planning. In general, it produces<br />

unfavorable distribution options and makes<br />

your retirement funds subject to probate,<br />

which can be an expensive and timeconsuming<br />

process.<br />

Because only a person can own a<br />

retirement account, your account(s) will<br />

need to be liquidated in order to pay your<br />

estate. Liquidating the account eliminates<br />

all flexibility for your heirs to take<br />

distributions from the account over their<br />

life expectancy, which means they will not<br />

Generally, naming your estate as beneficiary—by<br />

design or default—is bad estate planning.<br />

managing the money from large inherited<br />

accounts.<br />

However, there are pitfalls to a trust.<br />

There are no tax benefits to naming a trust<br />

for the exclusive purpose of managing the<br />

distribution of your retirement savings<br />

accounts. Because a trust is not a person, as<br />

with the estate option, retirement accounts<br />

need to be liquidated. Additionally, trusts<br />

naming a charity is also an option.<br />

Generally, withdrawals from pre-tax<br />

retirement accounts are subject to tax.<br />

However, an exception may apply to direct<br />

distributions to qualified charities. If you<br />

decide to name a charity, contact the<br />

charity to get the proper name to avoid<br />

confusion or problems later on.<br />

weabenefits.com

Your spouse as<br />

primary beneficiary<br />

Spousal beneficiaries are most common<br />

and have the greatest flexibility regarding<br />

distribution options. Spouses can:<br />

• Keep the 403(b) or IRA account<br />

with <strong>WEA</strong> <strong>Trust</strong> <strong>Member</strong> <strong>Benefits</strong>.<br />

Many benficiaries choose this option<br />

because it allows them to continue<br />

enjoying our low fees, the guaranteed<br />

investment, and great customer service.<br />

Spouses who choose this option have<br />

many withdrawal options.<br />

• Liquidate all or part of the account.<br />

Cashing out an IRA or 403(b) in a lump<br />

sum lets your spouse get the money all<br />

at once, though they’ll have to pay taxes<br />

on the amount withdrawn if it’s a pretax<br />

account. Some financial advisors say<br />

it’s wiser to spread out the tax burden by<br />

taking distributions over time.<br />

• Roll the account over to their own<br />

retirement plan or IRA account.<br />

Rolling it over may be advantageous if<br />

your spouse is younger than you, as your<br />

spouse may defer receiving distributions<br />

until his or her own required distribution<br />

date.<br />

Naming someone other than<br />

your spouse<br />

Although spousal beneficiaries have<br />

the most flexibility with an inherited<br />

retirement account, you may name anyone<br />

as a beneficiary of your account. A person<br />

other than your spouse may take the entire<br />

distribution (liquidating the account)<br />

or “stretch” the distributions over his or<br />

her own life expectancy. Stretching the<br />

account allows the beneficiary to maintain<br />

the tax-deferred and/or tax-free status of<br />

the account throughout their lifetime.<br />

403(b) or IRA, your account balance<br />

may become part of your estate and will<br />

need to go through probate, which as<br />

previously mentioned, can be a lengthy<br />

and costly process.<br />

In Wisconsin, you are not required to<br />

name your spouse as a beneficiary of your<br />

403(b) or IRA account. However, since<br />

Wisconsin is a marital property state, your<br />

spouse could claim their right to 50% of<br />

your account.<br />

Primary vs. contingent<br />

beneficiaries<br />

When designating beneficiaries for your<br />

account(s), you have the option to name<br />

primary and contingent beneficiaries.<br />

Primary beneficiaries are entitled<br />

to receive any assets in your account<br />

following your death. They will share<br />

Review your beneficiaries periodically to ensure<br />

they are still appropriate.<br />

Per stirpes example<br />

Primary Beneficiary(ies):<br />

• 50% John (brother);<br />

per stirpes<br />

• 50% Sally (sister);<br />

per stirpes<br />

John dies a few days before<br />

you. Fifty percent of your 403(b)<br />

TSA balance will go to Sally as<br />

indicated. John’s three children<br />

will share in the remaining 50%.<br />

(Without per stirpes designation,<br />

Sally would also receive John’s<br />

designated share.)<br />

equally in your account unless you specify<br />

different percentages. If a beneficiary<br />

Useful facts<br />

Contingent<br />

beneficiary example<br />

Primary Beneficiary(ies):<br />

• Spouse: 100%<br />

Contingent Beneficiary:<br />

• Son: 100%<br />

In this case, if your spouse<br />

predeceases you, your son<br />

would receive any undistributed<br />

assets in the account.<br />

predeceases you, his or her share of your<br />

account will be divided proportionately<br />

among the surviving beneficiaries unless<br />

you have indicated you wish their share<br />

distributed per stirpes. Per stirpes allows<br />

any undistributed assets of your account<br />

to pass to the natural and legally adopted<br />

children of a designated beneficiary that<br />

predeceases you, rather than be divided<br />

among the living co-beneficiaries.<br />

Your contingent beneficiaries will be<br />

entitled to receive any assets in your account<br />

only if you have no surviving primary<br />

beneficiaries (and per stirpes was not<br />

designated for your primary beneficiaries)<br />

at the time of your death. If there are<br />

no surviving primary beneficiaries, your<br />

contingent beneficiaries will share equally<br />

in your account unless you note otherwise.<br />

Review your beneficiary<br />

designations<br />

Life changes such as marriage, divorce,<br />

or death are indicators that you may need<br />

to review your beneficiary designations<br />

to make sure they are still appropriate<br />

and reflect your wishes. You may want to<br />

consult your attorney to ensure that you<br />

understand all aspects of your decision.<br />

This is for informational purposes only and<br />

not intended to be legal or tax advice. Consult<br />

your tax advisor or attorney before taking any<br />

action.<br />

• Beneficiaries named on your retirement<br />

account supercede your will.<br />

• Beneficiaries may keep the account<br />

• Only a person (age 18+)—not<br />

with us and/or may open a <strong>WEA</strong>C<br />

What happens if I do not name an estate or a trust—can own<br />

IRA and rollover the inherited<br />

a beneficiary?<br />

a retirement account.<br />

account. They can also name their<br />

If a beneficiary is not designated for<br />

your retirement account(s), such as your<br />

• Probate can be a lengthy and<br />

costly process.<br />

own beneficiaries for the inherited<br />

account.<br />

weabenefits.com 7

SECURe your future<br />

Mission<br />

Possible<br />

Your mission, should you<br />

choose to accept it…<br />

• gather Intelligence: Attend a seminar to<br />

uncover secrets to successful retirement<br />

savings and plannning.<br />

• MARK Your Target: Identify your<br />

timeline, your options, and<br />

desired outcome at retirement.<br />

• IDENTIFY A “FRIENDLY”: Learn what questions to ask and how to<br />

ID a financial partner who is on your side.<br />

Intelligence gatherings: Choose one or all<br />

10:00 am • Retirement Savings 101: The Keys to Success*<br />

11:30 am • Understanding Long-Term Care Insurance (lunch included)<br />

1:00 pm • Retirement Planning 101*<br />

at 16 locations<br />

Appleton<br />

Brookfield<br />

Burlington<br />

Fond du Lac<br />

Free financial seminars July 10 thru Aug 14<br />

Green Bay<br />

Janesville<br />

La Crosse<br />

Madison<br />

Menomonie<br />

Milwaukee<br />

Mosinee<br />

Platteville<br />

Racine<br />

Rhinelander<br />

Rice Lake<br />

Sheboygan<br />

Dates, descriptions, and registration at<br />

weabenefits.com/mission<br />

or 1-800-279-4030 Ext. 8563<br />

*Includes<br />

WRS info<br />

and pension<br />

study<br />

updates!<br />

Seminars are free to attend; however, if you choose to invest in the <strong>WEA</strong> Tax Sheltered Annuity <strong>Trust</strong> or <strong>WEA</strong>C IRA program, fees will apply. Consider all expenses prior to investing.<br />

8 weabenefits.com

Unsung Heroes —continued from page 5<br />

made sense to me when they explained<br />

that a pre-tax 403(b) contribution of $10<br />

per check was really only about $6 or $7<br />

out of my take-home pay. Sounded like a<br />

deal to me, so I started.” When she left the<br />

teaching ranks, she left her money in the<br />

account. “It’s been growing for 25 years.<br />

I’m glad I did it.”<br />

Sandy is very aware that your choice of<br />

products impacts your financial future.<br />

“I opened an IRA through a brokerage<br />

firm. I thought it was pretty good based<br />

on what the broker told me. After several<br />

years, I realized that the majority of my<br />

earnings were being eaten up by fees. Plus,<br />

there were redemption charges (surrender<br />

fees) to move the money out. I felt so<br />

taken advantage of. I finally bit the bullet<br />

and moved the account to a <strong>Member</strong><br />

<strong>Benefits</strong> IRA account. The 403(b) and<br />

IRA programs offered by <strong>Member</strong> <strong>Benefits</strong><br />

have always been at the very top—great<br />

service, low fees, and the guaranteed rate.”<br />

Deb Huppert<br />

Have you heard<br />

the story of the<br />

three-legged stool?<br />

and payroll information and retirement<br />

planning. I really like the Jack and Jill<br />

brochure that <strong>Member</strong> <strong>Benefits</strong> created.<br />

It clearly shows the advantages to saving<br />

early and it reinforces the advice I give to<br />

all staff: Pay yourself first.”<br />

Mark Leschke<br />

“There was this<br />

group of ten,”<br />

Mark remembers it<br />

like it was yesterday<br />

even though it<br />

was 22 years ago.<br />

“The first week<br />

of my first year of<br />

teaching in Appleton they told me, ‘you’ve<br />

been surviving the last four years in college<br />

on microwave burritos and gas station hot<br />

dogs. The money you are now making is<br />

way more than you’ve survived on. Here<br />

are the forms. Start putting this much<br />

away via payroll. You’ll never miss it.’”<br />

Mark:<br />

Start saving your first year by<br />

payroll duducting a percentage of<br />

your income (not a flat rate).<br />

If you didn’t start your first year, it’s never<br />

too late to start.<br />

Mark admits that he still eats microwave<br />

burritos and gas station hot dogs. “Now<br />

because I want to, not because I have to.”<br />

John Hansen<br />

John is in his fifth<br />

year of teaching<br />

high school science<br />

in the Norwalk-<br />

Ontario-Wilton<br />

School District.<br />

“When I first<br />

started investing, I<br />

didn’t know a lot and I feel like I got taken<br />

advantage of by the investment agent.<br />

I don’t want others to get ‘ripped off’ by<br />

some of these aggressive representatives.”<br />

To this end, John holds an open meeting<br />

each year to:<br />

• Inform new staff about retirement<br />

investment opportunities.<br />

• Share the importance of investing early<br />

in one’s career.<br />

• Compare other investment companies<br />

to <strong>WEA</strong> <strong>Trust</strong> <strong>Member</strong> <strong>Benefits</strong>.<br />

• Point them in the right direction if they<br />

have other financial questions.<br />

It’s a story that<br />

Prescott Human Mark followed the instruction of<br />

Resources Coordinator,<br />

Deb Hup-<br />

contributing to a <strong>WEA</strong> TSA <strong>Trust</strong> 403(b). Learn from my mistakes. Make sure<br />

his seasoned colleagues and started John:<br />

pert, uses with staff “They were right, I never missed the you have accurate information.<br />

to illustrate the need to save for retirement. money because I never got to see it on<br />

my paycheck as something to spend. Each During the meeting, John says, “I<br />

Deb:<br />

time I got a little bump in pay, I increased describe the different types of investments<br />

While it’s never too late to start, my contribution a little as well.”<br />

[Roth IRA, Traditional IRA, and the<br />

the earlier the better.<br />

Now, he is the one with the message 403(b)]. I point out the advantages of<br />

for new staff. This year Mark’s job is split opening an account with <strong>Member</strong> <strong>Benefits</strong><br />

“One leg is their retirement income between New Teacher Induction Program over other investment companies, such as<br />

from the Wisconsin Retirement System. Leader and teaching AP Psychology. the low fees with the annual fee cap and<br />

The second leg is their Social Security “The district encourages staff mentors to the <strong>Member</strong> <strong>Benefits</strong> representatives are<br />

Benefit. And, the third leg is personal promote financial literacy and allows me, noncommissioned. My goal is to help<br />

savings. As the future of Social Security in my new role, to help first-year hires them feel comfortable about investing<br />

is somewhat uncertain for younger learn more about saving for retirement.” their money, even in the uncertain<br />

employees, I always emphasize the need to Mark also works through his local economic environment we face today.”<br />

supplement personal savings to make up teacher’s association to bring financial<br />

For details about fees associated with the IRA<br />

for that uncertainty. I highly recommend education to all staff. “The district and<br />

and 403(b) offered through <strong>Member</strong> <strong>Benefits</strong>,<br />

they consider participating in a Roth or the teacher’s association have an excellent go to weabenefits.com. The 403(b) retirement<br />

Traditional 403(b) or IRA plan, and while relationship when it comes to financial program is offered by the <strong>WEA</strong> TSA <strong>Trust</strong>.<br />

it is never too late to start saving, the literacy. In addition, the payroll specialists TSA program securities offered through <strong>WEA</strong><br />

Investment Services, Inc., member FINRA.<br />

earlier the better.”<br />

who help members with paperwork are<br />

The <strong>Trust</strong>ee for the <strong>WEA</strong>C IRA program is First<br />

Deb Huppert loves talking benefits with phenomenal.” This makes it easy to get his Business <strong>Trust</strong> & Investments. Principal and<br />

staff and how they can be utilized to their message out.<br />

net credited interest are fully guaranteed by<br />

financial advantage. “One of the most Mark’s message is simple: Start saving Prudential Retirement Insurance and Annuity<br />

Company (PRIAC). Such guarantees are based<br />

rewarding things I do is meet individually via payroll deduction your first year. Save a<br />

upon the financial strength and claims-paying<br />

with new employees. I go over all benefit percentage of your income, not a flat rate. ability of PRIAC.<br />

weabenefits.com 9

{ your kiosk<br />

Severe Weather:<br />

The dark side of summer<br />

by Bob Manor<br />

10<br />

When I think of spring and<br />

summer, I think of sunshine,<br />

backyard barbeques, bike<br />

rides, and all the outdoor<br />

activities I’ve been dreaming about all winter<br />

long. However, as the Claims Manager at<br />

<strong>WEA</strong> P&C, I am all too aware that warmer<br />

weather also means the potential for severe<br />

weather. Dangerous lightning, heavy rains,<br />

high winds, and hail can cause property<br />

damage.<br />

Over the last couple of years, we’ve<br />

experienced some crazy weather in Wisconsin,<br />

and crazy weather can cost a pretty penny<br />

for you and your insurance company.<br />

Nationwide, the property and casualty (P&C)<br />

insurance industry experienced record-setting<br />

losses due to weather-related claims in 2010<br />

and 2011. <strong>WEA</strong> P&C was no exception. We<br />

have paid our member policyholders nearly<br />

$5 million dollars for storm-related claims<br />

during that same time period.<br />

Such heavy losses have consequences for<br />

both insurers and their customers. Inevitably,<br />

it means homeowner rate increases for<br />

customers—a trend that experts predict will<br />

play out industry-wide as significant losses<br />

were already reported on March 1 when a<br />

system of tornadoes ravaged the Midwest<br />

from Nebraska to Kentucky.<br />

Keeping claims down is good for everyone.<br />

And while we have no control over nature’s<br />

Hail storms last an average of<br />

six minutes; however, the cost<br />

to property adds up to over a<br />

billion dollars a year.<br />

wrath, there are steps you can take to help<br />

reduce losses due to storm damage.<br />

Be aware of the weather<br />

Keeping an eye on the sky (or the<br />

Weather Channel) or an ear to your radio<br />

may give you enough warning to prevent<br />

loss. For example:<br />

• Park your car in the garage or under<br />

a canopy of trees. Good parking<br />

practices can save you hundreds of<br />

deductible dollars. And remember, a<br />

deductible applies for each car.<br />

• Store or secure patio furniture, grills,<br />

and anything that could become a<br />

flying missile in high winds. The cost<br />

of replacing patio furniture is seldom<br />

above the deductible, but it is one of<br />

Tree removal. It’s covered.<br />

Downed trees during severe weather is common and removal can be expensive.<br />

<strong>WEA</strong> P&C homeowners insurance covers up to $1,500 for removal of downed<br />

trees even due to windstorm. Most insurers have more limited coverage for tree<br />

removal. If you’re with another company, compare your current coverage with us.<br />

It’s simply better insurance. Call us for a quote 1-800-279-4010.<br />

Property and casualty insurance programs are underwritten by <strong>WEA</strong> Property & Casualty<br />

Insurance Company. The terms and conditions of your coverage are exclusively controlled by<br />

your written policy. Please refer to your policy for details. Deductibles apply.<br />

the most frequently damaged items in<br />

summer storms.<br />

• Unplug your computer and other<br />

electronics during lightning storms<br />

or if you are leaving for a vacation.<br />

A surge protector is no match for a<br />

lightning strike.<br />

More tips for preventing loss due<br />

to severe weather can be found at<br />

weabenefits.com/stormyweather.<br />

Weather-related events<br />

affect a lot of people<br />

If you do suffer from a storm loss, we<br />

are here to help you. Keep in mind that<br />

damaging storms affect many people at<br />

one time. This means resources (people<br />

and materials) are stretched thin and can<br />

sometimes cause delays in service— whether<br />

it is the insurance adjuster, the tree removal<br />

company, the electric company who turns<br />

your power back on, or the contractor who<br />

repairs your house. It helps to be patient.<br />

Likewise, if you call us with a weatherrelated<br />

claim, there are probably many<br />

members calling with a similar claim. Our<br />

claims department has a customer service<br />

satisfaction rate above 95%, and we will do<br />

everything we can maintain the high level<br />

of service you expect.<br />

weabenefits.com

And the winner is...<br />

We are so excited! Our Don’t be Jack financial learning game has been<br />

nominated to win an Excellence In Financial Literacy Education (EIFLE)<br />

Award in the category of instructional games. The EIFLE Awards were<br />

created by the Institute for Financial Literacy to acknowledge innovation,<br />

dedication, and a strong commitment to financial literacy education.<br />

Winners will be announced on April 18, 2012, during the Annual<br />

Conference on Financial Education in Orlando, Florida.<br />

Watch for the results in our July your$ issue.<br />

Want to learn more about Don’t Be Jack?<br />

Go to weabenefits.com/dontbejack<br />

Payroll Tax Cut:<br />

An opportunity to boost<br />

retirement savings<br />

The payroll tax cut<br />

decreases your Social<br />

Security tax withholding rate<br />

from 6.2% to 4.2%—meaning<br />

an increase to your net pay.<br />

For a family earning $50,000<br />

a year, the cut results in<br />

approximately $1,000 more in<br />

take-home pay in 2012.<br />

Consider using this extra<br />

income to start a 403(b) or<br />

Roth IRA account or increase<br />

your contributions to an<br />

existing one. Contribute to<br />

a pre-tax 403(b) and you’ll<br />

actually be able to save even<br />

more without impacting<br />

your net pay. For instance,<br />

$1,000 applied to a pre-tax<br />

403(b) could be bumped up<br />

to $1,333 assuming a 25%<br />

tax bracket. Because pretax<br />

contributions lower your<br />

taxable income, investing<br />

$1,333 only lowers your<br />

annual take-home pay by<br />

$1,000.<br />

It’s a sweet way to boost your<br />

savings, but it’s temporary, so<br />

don’t delay.<br />

Call us for<br />

assistance at<br />

1-800-279-4030.<br />

weabenefits.com 11

TM<br />

PRESORTED<br />

STANDARD<br />

US POSTAGE<br />

PAID<br />

MADISON WI<br />

PERMIT NO 2750<br />

PO Box 7893, Madison, WI 53707-7893<br />

5 ve<br />

reasons<br />

#1<br />

Evaluate<br />

my current<br />

coverage.<br />

Is it enough?<br />

to check out your insurance program.<br />

#2<br />

Get a<br />

comparison<br />

quote.<br />

Save money?<br />

#3<br />

It’s simply<br />

better<br />

insurance.<br />

Great value!<br />

#4<br />

96%<br />

satisfaction.<br />

Great<br />

service!<br />

Three easy ways to get a quote.<br />

1. Call 1-800-279-4010 to speak with one of our<br />

insurance consultants.<br />

2. Request a comparison quote for your auto<br />

or home using our easy online application.<br />

Applications can be submitted with as little as<br />

your name and phone number.<br />

Go to weabenefits.com/getaquote.<br />

3. Register for a personal phone consultation<br />

at a time convenient for you. Look under the<br />

Seminars tab at weabenefits.com.<br />

#5<br />

Created for<br />

Wisconsin public<br />

school employees.<br />

TM<br />

Property and casualty insurance programs are underwritten by <strong>WEA</strong> Property &<br />

Casualty Insurance Company. The terms and conditions of your coverage are exclusively<br />

controlled by your written policy. Please refer to your policy for details.