RAO “UES OF RUSSIA” ANNUAL REPORT 2006

RAO “UES OF RUSSIA” ANNUAL REPORT 2006

RAO “UES OF RUSSIA” ANNUAL REPORT 2006

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

34 Corporate Governance System<br />

Corporate Governance System 35<br />

2 0 0 6 <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>OF</strong> <strong>RAO</strong> <strong>“UES</strong> <strong>OF</strong> <strong>RUSSIA”</strong><br />

Dividend Policy<br />

The corporate governance system at <strong>RAO</strong> UES<br />

Holding Company ensures that the rights of<br />

In <strong>2006</strong>, OAO <strong>RAO</strong> <strong>“UES</strong> of Russia” paid<br />

RUB2,757.6 million in dividends for 2005,<br />

which was in line with the dividends paid for<br />

Standards amounted to RUB745,088 million.<br />

Such amount of net income was due to the revaluation<br />

of investments in shares of subsid-<br />

Dividends Declared by the SDCs of <strong>RAO</strong> "UES of Russia", millions of RUB<br />

2004 2005 <strong>2006</strong><br />

shareholders of the Parent Company and its<br />

2004. At the same time, the dividends made<br />

iaries and dependent companies of <strong>RAO</strong> <strong>“UES</strong><br />

Dividends<br />

Total for 2003 for 2004* Total for 2004 for 2005* Total for 2005 for <strong>2006</strong>*<br />

subsidiaries and dependent companies in res-<br />

13.2 percent of the Company’s net income for<br />

of Russia” caused by the increased market<br />

pect of dividend payments are protected in<br />

2005, up 1.7 percent on the figure for 2004. Of<br />

prices of the companies’ shares, and was not<br />

Total 11,781 5,909 5,872 10,118 5,738 4,380 14,239 8,641 5,598<br />

a sector reform environment.<br />

<strong>RAO</strong> <strong>“UES</strong> of Russia” is guided by the Dividend<br />

Policy Principles approved by the Board<br />

of Directors.<br />

The dividends are calculated in accordance<br />

with the Revised Methodology for Dividend<br />

that amount, RUB1,294 million was paid to<br />

the state, and the remaining part to the Company’s<br />

minority shareholders.<br />

Dividends Paid to Shareholders<br />

of OAO <strong>RAO</strong> <strong>“UES</strong> of Russia” for <strong>2006</strong><br />

supported by any actual cash flows.<br />

As provided by Article 5.3 of the Company<br />

Charter, the total amount of dividends payable<br />

on preferred shares should be at least 10 percent<br />

of the Company’s net income divided by<br />

the number of preferred shares, which make<br />

including:<br />

dividends paid<br />

to OAO <strong>RAO</strong> <strong>“UES</strong> of Russia”<br />

dividends payable to other<br />

shareholders<br />

8,179 3,749 4,430 5,241 2,544 2,697 10,014 5,464 4,550<br />

3,602 2,160 1,442 4,877 3,194 1,683 4,225 3,177 1,048<br />

Calculation of the Company approved by the<br />

In <strong>2006</strong>, the net income of OAO <strong>RAO</strong> <strong>“UES</strong> of<br />

up 25 percent of the Company’s capital. How-<br />

*interim dividends<br />

Board of Directors in 2005.<br />

Russia” according to the Russian Accounting<br />

ever, the dividend amount per preferred share<br />

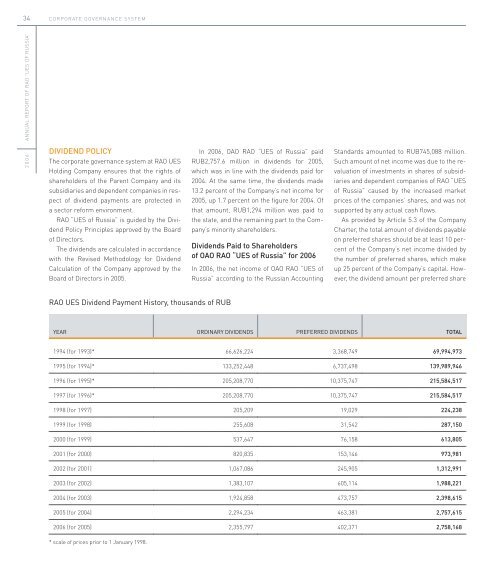

<strong>RAO</strong> UES Dividend Payment History, thousands of RUB<br />

should not be less than the dividend amount<br />

per ordinary share.<br />

pletely undermine the Company’s investment<br />

programme and adversely affect the financial<br />

Thus, the dividend amounts paid by the<br />

SDCs of <strong>RAO</strong> <strong>“UES</strong> of Russia” (taking into ac-<br />

In order to resolve that issue, it was pro-<br />

position of OAO <strong>RAO</strong> <strong>“UES</strong> of Russia”.<br />

count the interim dividends declared in <strong>2006</strong>)<br />

posed to shareholders at the EGM to make<br />

In light of that, the Board of Directors of<br />

increased 1.4-fold compared to 2005 (taking<br />

YEAR Ordinary dividends Preferred dividends TOTAL<br />

amendments and additions to the Company<br />

<strong>RAO</strong> <strong>“UES</strong> of Russia” recommended that the<br />

into account the interim dividends declared in<br />

Charter which would make it possible not to<br />

Annual General Meeting of shareholders vote<br />

2005) to RUB14,239 million.<br />

1994 (for 1993)* 66,626,224 3,368,749 69,994,973<br />

take into account the paper profit from revalu-<br />

to omit the dividend for <strong>2006</strong>.<br />

1995 (for 1994)* 133,252,448 6,737,498 139,989,946<br />

1996 (for 1995)* 205,208,770 10,375,747 215,584,517<br />

1997 (for 1996)* 205,208,770 10,375,747 215,584,517<br />

ation of equity investments when determining<br />

the amount of preferred dividends.<br />

Such decision required a three-thirds majority<br />

of votes of all preferred shareholders of<br />

<strong>RAO</strong> <strong>“UES</strong> of Russia”. However, the proposed<br />

Dividend Payments by SDCs<br />

of <strong>RAO</strong> "UES of Russia"<br />

In <strong>2006</strong>, the SDCs of <strong>RAO</strong> <strong>“UES</strong> of Russia”<br />

1998 (for 1997) 205,209 19,029 224,238<br />

amendments were not supported by the pre-<br />

continued to pay interim dividends. This was<br />

1999 (for 1998) 255,608 31,542 287,150<br />

ferred shareholders.<br />

In light of the need to ensure reliable and<br />

due to the possibility that, in connection with<br />

the restructuring and the organizational con-<br />

2000 (for 1999) 537,647 76,158 613,805<br />

uninterrupted electricity supply and ensure<br />

straints and legal constraints, the companies<br />

2001 (for 2000) 820,835 153,146 973,981<br />

balance of capacity in the UES of Russia, the<br />

Company needs to bring more generating<br />

faced the risk of default in payment of their<br />

final dividends for <strong>2006</strong> (WGCs, AO-power<br />

2002 (for 2001) 1,067,086 245,905 1,312,991<br />

capacity on line, which requires to increase<br />

plants, and regional generation companies).<br />

2003 (for 2002) 1,383,107 605,114 1,988,221<br />

investments in new generation construction<br />

projects on an annual basis. Implementation<br />

The amount of interim dividends declared<br />

by the SDCs of <strong>RAO</strong> <strong>“UES</strong> of Russia” for Q1,<br />

2004 (for 2003) 1,924,858 473,757 2,398,615<br />

of the investment programme is one of the key<br />

H1 and 9M <strong>2006</strong>, including the taxes, to-<br />

2005 (for 2004) 2,294,234 463,381 2,757,615<br />

drivers of the Company’s capitalization growth.<br />

This means that the dividend payment out of<br />

talled RUB5,597.6 million, which includes of<br />

RUB4,549.7 million payable on the shares<br />

<strong>2006</strong> (for 2005) 2,355,797 402,371 2,758,168<br />

the Company’s net income not fully supported<br />

owned by OAO <strong>RAO</strong> <strong>“UES</strong> of Russia”.<br />

* scale of prices prior to 1 January 1998.<br />

by actual receipts of funds would almost com-