Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Digital inclusion and mobile sector taxation<br />

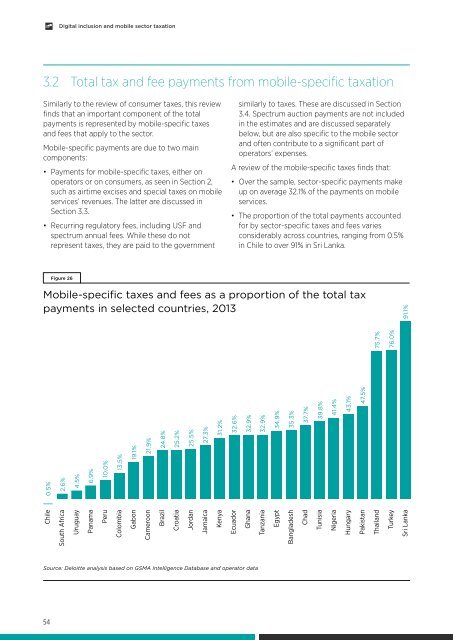

3.2 Total tax and fee payments from mobile-specific taxation<br />

Similarly to the review of consumer taxes, this review<br />

finds that an important component of the total<br />

payments is represented by mobile-specific taxes<br />

and fees that apply to the sector.<br />

Mobile-specific payments are due to two main<br />

components:<br />

• Payments for mobile-specific taxes, either on<br />

operators or on consumers, as seen in Section 2,<br />

such as airtime excises and special taxes on mobile<br />

services’ revenues. The latter are discussed in<br />

Section 3.3.<br />

• Recurring regulatory fees, including USF and<br />

spectrum annual fees. While these do not<br />

represent taxes, they are paid to the government<br />

similarly to taxes. These are discussed in Section<br />

3.4. Spectrum auction payments are not included<br />

in the estimates and are discussed separately<br />

below, but are also specific to the mobile sector<br />

and often contribute to a significant part of<br />

operators’ expenses.<br />

A review of the mobile-specific taxes finds that:<br />

• Over the sample, sector-specific payments make<br />

up on average 32.1% of the payments on mobile<br />

services.<br />

• The proportion of the total payments accounted<br />

for by sector-specific taxes and fees varies<br />

considerably across countries, ranging from 0.5%<br />

in Chile to over 91% in Sri Lanka.<br />

Figure 26<br />

Mobile-specific taxes and fees as a proportion of the total tax<br />

payments in selected countries, 2013<br />

Chile<br />

South Africa<br />

91.1%<br />

Uruguay<br />

Panama<br />

Peru<br />

Colombia<br />

Gabon<br />

Cameroon<br />

Brazil<br />

Croatia<br />

Jordan<br />

Jamaica<br />

Kenya<br />

Ecuador<br />

Ghana<br />

Tanzania<br />

Egypt<br />

Bangladesh<br />

Chad<br />

Tunisia<br />

Nigeria<br />

Hungary<br />

Pakistan<br />

Thailand<br />

Turkey<br />

Sri Lanka<br />

0.5%<br />

2.6%<br />

4.5%<br />

6.9%<br />

10.0%<br />

13.5%<br />

19.1%<br />

21.9%<br />

24.8%<br />

25.2%<br />

25.5%<br />

27.3%<br />

31.2%<br />

32.6%<br />

32.9%<br />

32.9%<br />

34.9%<br />

35.3%<br />

37.7%<br />

39.8%<br />

41.4%<br />

43.1%<br />

47.5%<br />

75.7%<br />

76.0%<br />

Source: Deloitte analysis based on GSMA Intelligence Database and operator data<br />

54