In Central And Eastern Europe - Microfinance Centre

In Central And Eastern Europe - Microfinance Centre

In Central And Eastern Europe - Microfinance Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

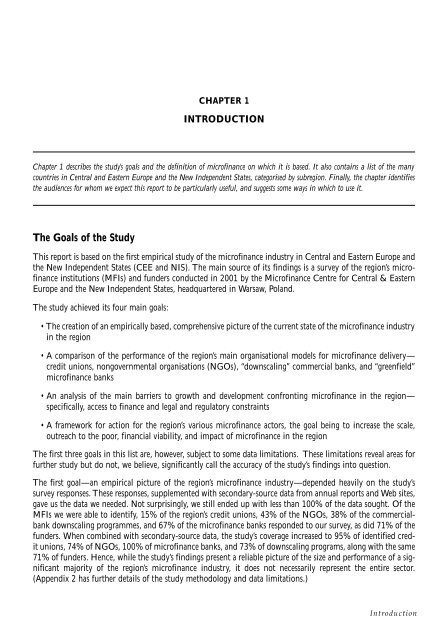

CHAPTER 1<br />

INTRODUCTION<br />

Chapter 1 describes the study’s goals and the definition of microfinance on which it is based. It also contains a list of the many<br />

countries in <strong>Central</strong> and <strong>Eastern</strong> <strong>Europe</strong> and the New <strong>In</strong>dependent States, categorised by subregion. Finally, the chapter identifies<br />

the audiences for whom we expect this report to be particularly useful, and suggests some ways in which to use it.<br />

The Goals of the Study<br />

This report is based on the first empirical study of the microfinance industry in <strong>Central</strong> and <strong>Eastern</strong> <strong>Europe</strong> and<br />

the New <strong>In</strong>dependent States (CEE and NIS). The main source of its findings is a survey of the region’s microfinance<br />

institutions (MFIs) and funders conducted in 2001 by the <strong>Microfinance</strong> <strong>Centre</strong> for <strong>Central</strong> & <strong>Eastern</strong><br />

<strong>Europe</strong> and the New <strong>In</strong>dependent States, headquartered in Warsaw, Poland.<br />

The study achieved its four main goals:<br />

• The creation of an empirically based, comprehensive picture of the current state of the microfinance industry<br />

in the region<br />

• A comparison of the performance of the region’s main organisational models for microfinance delivery—<br />

credit unions, nongovernmental organisations (NGOs), “downscaling” commercial banks, and “greenfield”<br />

microfinance banks<br />

• An analysis of the main barriers to growth and development confronting microfinance in the region—<br />

specifically, access to finance and legal and regulatory constraints<br />

• A framework for action for the region’s various microfinance actors, the goal being to increase the scale,<br />

outreach to the poor, financial viability, and impact of microfinance in the region<br />

The first three goals in this list are, however, subject to some data limitations. These limitations reveal areas for<br />

further study but do not, we believe, significantly call the accuracy of the study’s findings into question.<br />

The first goal—an empirical picture of the region’s microfinance industry—depended heavily on the study’s<br />

survey responses. These responses, supplemented with secondary-source data from annual reports and Web sites,<br />

gave us the data we needed. Not surprisingly, we still ended up with less than 100% of the data sought. Of the<br />

MFIs we were able to identify, 15% of the region’s credit unions, 43% of the NGOs, 38% of the commercialbank<br />

downscaling programmes, and 67% of the microfinance banks responded to our survey, as did 71% of the<br />

funders. When combined with secondary-source data, the study’s coverage increased to 95% of identified credit<br />

unions, 74% of NGOs, 100% of microfinance banks, and 73% of downscaling programs, along with the same<br />

71% of funders. Hence, while the study’s findings present a reliable picture of the size and performance of a significant<br />

majority of the region’s microfinance industry, it does not necessarily represent the entire sector.<br />

(Appendix 2 has further details of the study methodology and data limitations.)<br />

<strong>In</strong>troduction