Fidelity Security Life Insurance Company - Marketing Financial

Fidelity Security Life Insurance Company - Marketing Financial

Fidelity Security Life Insurance Company - Marketing Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

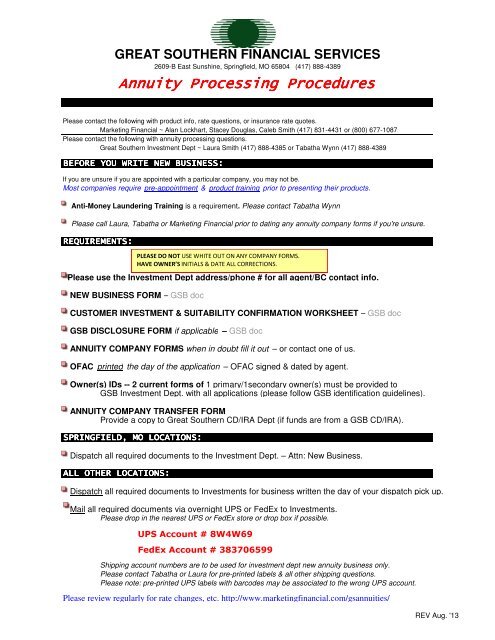

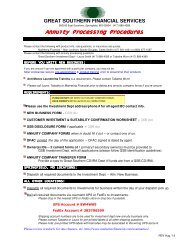

GREAT SOUTHERN FINANCIAL SERVICES<br />

2609-B East Sunshine, Springfield, MO 65804 (417) 888-4389<br />

Annuity Processing Procedures<br />

Please contact the following with product info, rate questions, or insurance rate quotes.<br />

<strong>Marketing</strong> <strong>Financial</strong> ~ Alan Lockhart, Stacey Douglas, Caleb Smith (417) 831-4431 or (800) 677-1087<br />

Please contact the following with annuity processing questions.<br />

Great Southern Investment Dept ~ Laura Smith (417) 888-4385 or Tabatha Wynn (417) 888-4389<br />

BEFORE YOU WRITE NEW BUSINESS:<br />

If you are unsure if you are appointed with a particular company, you may not be.<br />

Most companies require pre-appointment & product training prior to presenting their products.<br />

Anti-Money Laundering Training is a requirement. Please contact Tabatha Wynn<br />

Please call Laura, Tabatha or <strong>Marketing</strong> <strong>Financial</strong> prior to dating any annuity company forms if you're unsure.<br />

REQUIREMENTS:<br />

Please use the Investment Dept address/phone # for all agent/BC contact info.<br />

NEW BUSINESS FORM – GSB doc<br />

CUSTOMER INVESTMENT & SUITABILITY CONFIRMATION WORKSHEET – GSB doc<br />

GSB DISCLOSURE FORM if applicable – GSB doc<br />

ANNUITY COMPANY FORMS when in doubt fill it out – or contact one of us.<br />

OFAC printed the day of the application – OFAC signed & dated by agent.<br />

Owner(s) IDs -- 2 current forms of 1 primary/1secondary owner(s) must be provided to<br />

GSB Investment Dept. with all applications (please follow GSB identification guidelines).<br />

ANNUITY COMPANY TRANSFER FORM<br />

Provide a copy to Great Southern CD/IRA Dept (if funds are from a GSB CD/IRA).<br />

SPRINGFIELD, MO LOCATIONS:<br />

Dispatch all required documents to the Investment Dept. – Attn: New Business.<br />

ALL OTHER LOCATIONS:<br />

PLEASE DO NOT USE WHITE OUT ON ANY COMPANY FORMS.<br />

HAVE OWNER’S INITIALS & DATE ALL CORRECTIONS.<br />

Dispatch all required documents to Investments for business written the day of your dispatch pick up.<br />

Mail all required documents via overnight UPS or FedEx to Investments.<br />

Please drop in the nearest UPS or FedEx store or drop box if possible.<br />

UPS Account # 8W4W69<br />

FedEx Account # 383706599<br />

Shipping account numbers are to be used for investment dept new annuity business only.<br />

Please contact Tabatha or Laura for pre-printed labels & all other shipping questions.<br />

Please note: pre-printed UPS labels with barcodes may be associated to the wrong UPS account.<br />

Please review regularly for rate changes, etc. http://www.marketingfinancial.com/gsannuities/<br />

REV Aug. '13

2609-B East Sunshine, Springfield, MO 65804 (417) 888-4389<br />

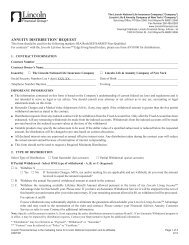

New Business Form<br />

Client Name(s): _________________________________<br />

Owner's age(s): _______________<br />

BC #/State: ____/______<br />

Writing Agent Name: _____________________________<br />

Split Commission with: (if applicable): ________________<br />

Referred by: _______________________________________<br />

Commission Split %: ________________________________<br />

Funds Info:<br />

Internal Funds (GSB)<br />

External Funds<br />

Check Enclosed: $_______________________________<br />

Qualified (CD/IRA, 401K, etc)<br />

Non-Qualified (Checking, CD, etc)<br />

Transfer(s) Approx: $_____________________________<br />

Qualified (CD/IRA, 401K, etc)<br />

Non-Qualified (Checking, Annuity, CD, etc)<br />

<strong>Company</strong> Name _________________________<br />

ex: Sagicor<br />

Product Name __________________________<br />

ex: Sage Choice SPDA<br />

Surrender Charge Period (years) ____________<br />

1035 Exchange (NQ life/annuity) Approx: $_______________________<br />

Agent Check List:<br />

New Business<br />

Non-Qualified - <strong>Life</strong>/Annuity to <strong>Life</strong>/Annuity<br />

Application<br />

1035 Exchange Form<br />

Disclosures<br />

State Replacement Form<br />

Owner's ID<br />

Original Policy or Lost Policy Affidavit<br />

Owner's OFAC<br />

Cashier's/Personal Check Payable to <strong>Company</strong> IRA Annuity to IRA Annuity<br />

IRA Trsf Form<br />

IRA Trsf/Rollover<br />

Replacement Form<br />

IRA Trsf Form<br />

Original Policy or Lost Policy Affidavit<br />

<strong>Company</strong> Specific Forms (401K) W-9 (funds coming from Lincoln Benefit <strong>Life</strong> )<br />

Agent's Report - Source of Funds: (MUST BE COMPLETED)<br />

1. Provide your detailed explanation regarding how this purchase meets the client's stated investment goal.<br />

Attach additional sheet if necessary.<br />

___________________________________________________________________________________________<br />

___________________________________________________________________________________________<br />

___________________________________________________________________________________________<br />

___________________________________________________________________________________________<br />

___________________________________________________________________________________________<br />

___________________________________________________________________________________________<br />

___________________________________________________________________________________________<br />

___________________________________________________________________________________________<br />

Agent Signature: ________________________________________<br />

Approver Signature (Laura M. Smith): _____________________________<br />

Date: _____________________<br />

Date: _____________________<br />

REV 05-2013

2609-B East Sunshine, Springfield, MO 65804 (417) 888-4389<br />

Date:<br />

Owner Name:<br />

Joint Owner Name:<br />

<strong>Company</strong>/Product:<br />

Owner(s) Initials<br />

Disclosures<br />

Not FDIC Insured.<br />

Not a deposit or other obligation of Great Southern Bank.<br />

It is understood that if the contract is prematurely ended by the client,<br />

surrender charges will apply for the first ______ years.<br />

Any money taken out of this contract in excess of the penalty free<br />

withdrawal amount provided in the contract during the surrender<br />

charge period will incur a penalty.<br />

The minimum guaranteed interest rate for the contract is ______%.<br />

The first year rate is ______ % which includes a bonus of ______%.<br />

(Does not apply to indexed annuities)<br />

If there are any surrender charges or penalties of any kind associated<br />

with the money used to purchase this annuity please list the amount of<br />

penalty: $______.<br />

This contract was purchased with Qualified or Non-Qualified funds.<br />

(Please circle which applies)<br />

Signatures<br />

Owner:<br />

Joint Owner:<br />

Representative:<br />

REV 05-2013

<strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong><br />

3130 Broadway, Kansas City, Missouri 64111-2406<br />

TaxVantage TM Annuity Application<br />

Underwritten by <strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong>, Kansas City, Missouri<br />

Plan Type:<br />

❏ Traditional IRA<br />

❏ Roth IRA<br />

Premium Type: ❏ Flexible Premium ❏ Single Premium<br />

Print Full Name__________________________________________________________________ SSN________________________<br />

Last First Middle<br />

Mailing Address_______________________________________________________________________________________________<br />

Street City State Zip<br />

Residential Address____________________________________________________________________________________________<br />

Street City State Zip<br />

E-Mail Address________________________________________________________________________________________________<br />

Home Phone _______________________________________<br />

Work Phone ____________________________________________<br />

Date of Birth ______/______/______ (Mo/Day/Yr) ❏ Male ❏ Female<br />

❏ Primary<br />

❏ Contingent<br />

❏ Primary<br />

❏ Contingent<br />

❏ Primary<br />

❏ Contingent<br />

❏ Primary<br />

❏ Contingent<br />

Beneficiary Allocation Relationship SS#<br />

___________________________________ ________ % ________________________ ______________________<br />

___________________________________ ________ % ________________________ ______________________<br />

___________________________________ ________ % ________________________ ______________________<br />

___________________________________ ________ % ________________________ ______________________<br />

Primary Beneficiary Allocation total must equal 100%. Contingent Beneficiary Allocation total must equal 100%.<br />

Do you have any existing annuity or life insurance contracts?<br />

❏ Yes ❏ No<br />

Is any annuity or life insurance contract being replaced with this purchase?<br />

❏ Yes ❏ No<br />

If Yes to either question, please provide the name of the insurance company(ies) and contract or policy number for each product<br />

being replaced. Please complete the replacement form.<br />

Owner Signature X______________________________________________________ Date ______/______/______ (Mo/Day/Yr)<br />

To your knowledge and belief does the applicant have any existing annuity or life insurance contracts?<br />

To your knowledge and belief is any annuity or insurance contract being replaced with this purchase?<br />

If yes, Replacement Notice must be completed.<br />

❏ Yes ❏ No<br />

❏ Yes ❏ No<br />

I have verified the applicant’s identity by viewing: ❏ Drivers License Drivers License # _______________________________<br />

❏ Other________________________________________________________<br />

Agent Signature X_______________________________________________________ Date ______/______/______ (Mo/Day/Yr)<br />

A-01142NE For Office Use Only 95-32524 #5533 0313

<strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong><br />

3130 Broadway, Kansas City, Missouri 64111-2406<br />

TaxVantage TM Annuity Application<br />

Underwritten by <strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong>, Kansas City, Missouri<br />

Plan Type:<br />

❏ Non-Qualified<br />

❏ Other _________________________<br />

Premium Type: ❏ Flexible Premium ❏ Single Premium<br />

OWNER INFORMATION (Natural Person):<br />

Print Full Name__________________________________________________________________ SSN________________________<br />

Last First Middle<br />

Mailing Address_______________________________________________________________________________________________<br />

Street City State Zip<br />

Residential Address____________________________________________________________________________________________<br />

Street City State Zip<br />

E-Mail Address________________________________________________________________________________________________<br />

Home Phone _______________________________________<br />

Work Phone ____________________________________________<br />

Date of Birth ______/______/______ (Mo/Day/Yr) ❏ Male ❏ Female<br />

❏ Primary<br />

❏ Contingent<br />

❏ Primary<br />

❏ Contingent<br />

❏ Primary<br />

❏ Contingent<br />

❏ Primary<br />

❏ Contingent<br />

Beneficiary Allocation Relationship SS#<br />

___________________________________ ________ % ________________________ ______________________<br />

___________________________________ ________ % ________________________ ______________________<br />

___________________________________ ________ % ________________________ ______________________<br />

___________________________________ ________ % ________________________ ______________________<br />

Primary Beneficiary Allocation total must equal 100%. Contingent Beneficiary Allocation total must equal 100%.<br />

OWNER INFORMATION: (Non-natural Person for Non-qualified plans only):<br />

Trust* Name_________________________________________________________________________________________________<br />

Mailing Address_______________________________________________________________________________________________<br />

Street City State Zip<br />

Tax ID Number _____________________________________ Date of Trust ___________________________________________<br />

Name of Trustee(s)____________________________________________________________________________________________<br />

Mailing Address_______________________________________________________________________________________________<br />

Street City State Zip<br />

Phone Number _____________________________ Email Address ___________________________________________________<br />

IMPORTANT: A copy of the Trust title page and signature page must be submitted with the application.<br />

A-01142NE For Office Use Only 95-32524 #5533 0313

JOINT OWNER INFORMATION:<br />

Print Full Name__________________________________________________________________ SSN________________________<br />

Last First Middle<br />

Mailing Address_______________________________________________________________________________________________<br />

Street City State Zip<br />

E-Mail Address________________________________________________________________________________________________<br />

Home Phone _______________________________________<br />

Work Phone ____________________________________________<br />

Date of Birth ______/______/______ (Mo/Day/Yr) ❏ Male ❏ Female<br />

ANNUITANT INFORMATION (if different from the Owner):<br />

Print Full Name__________________________________________________________________ SSN________________________<br />

Last First Middle<br />

Mailing Address_______________________________________________________________________________________________<br />

Street City State Zip<br />

E-Mail Address________________________________________________________________________________________________<br />

Home Phone _______________________________________<br />

Work Phone ____________________________________________<br />

Date of Birth ______/______/______ (Mo/Day/Yr) ❏ Male ❏ Female<br />

Do you have any existing annuity or life insurance contracts?<br />

❏ Yes ❏ No<br />

Is any annuity or life insurance contract being replaced with this purchase?<br />

❏ Yes ❏ No<br />

If Yes to either question, please provide the name of the insurance company(ies) and contract or policy number for each product<br />

being replaced. Please complete the replacement form.<br />

Owner Signature X______________________________________________________ Date ______/______/______ (Mo/Day/Yr)<br />

Joint Owner Signature X__________________________________________________ Date ______/______/______ (Mo/Day/Yr)<br />

To your knowledge and belief does the applicant have any existing annuity or life insurance contracts?<br />

To your knowledge and belief is any annuity or insurance contract being replaced with this purchase?<br />

If yes, Replacement Notice must be completed.<br />

❏ Yes ❏ No<br />

❏ Yes ❏ No<br />

I have verified the applicant’s identity by viewing: ❏ Drivers License Drivers License # _______________________________<br />

❏ Other________________________________________________________<br />

Agent Signature X_______________________________________________________ Date ______/______/______ (Mo/Day/Yr)<br />

A-01142NE For Office Use Only 95-32524 #5533 0313

<strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong><br />

3130 Broadway<br />

Kansas City, MO 64111<br />

Direct Rollover/Transfer Form<br />

Please read and complete sections 1 - 6 of this form, then sign and date where indicated. You may give the form to your agent or mail it directly to<br />

<strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> at the address shown at the top of this form. Make sure you first complete all forms required by the employer maintaining your plan.<br />

Part 1: Name and Address Information (Please Print)<br />

Name ____________________________________________________ Social <strong>Security</strong> Number ________________________________<br />

Address __________________________________________________ Your Home Phone ____________________________________<br />

City _____________________________ State ______ ZIP__________ Your Work Phone ____________________________________<br />

Part 2: Your Existing Account/Plan (Current <strong>Company</strong>/Custodian)<br />

Name of <strong>Company</strong> __________________________________________<br />

Address __________________________________________________<br />

________________________________________________________<br />

City _____________________________ State ______ ZIP__________<br />

Account/Plan Number __________________________________<br />

Plan Name __________________________________________<br />

Plan Administrator Name ________________________________<br />

Contact Number ______________________________________<br />

Part 3: FROM Account Type (check one): ❑ IRA ❑ 403(b) ❑ 401(k) ❑ 401(a) ❑ 457<br />

❑ Roth IRA ❑ Roth 403(b) ❑ Roth 401(k) ❑ Other____________________<br />

Part 4: TO Account Type (check one): ❑ IRA ❑ 403(b) ❑ 401(k) ❑ 401(a) ❑ 457<br />

❑ Roth IRA ❑ Roth 403(b) ❑ Roth 401(k) ❑ Other____________________<br />

Part 5: Select Type: ❑ Plan to Plan Transfer ❑ Direct Rollover ❑ Vendor to Vendor<br />

Qualification for Direct Rollover (check one):<br />

❑ Age 59 1 ⁄2 (70 1 ⁄2 for 457) ❑ Retirement ❑ Separation from Service<br />

Part 6: TO: (Resigning <strong>Company</strong>/Custodian) How Much to Rollover/Transfer:<br />

❑<br />

❑<br />

The entire balance of my account; or<br />

A partial surrender of $ ____________________ or ___________ % from my Account/Plan.<br />

Owner Signature X ________________________________________________________________ Date ____/____/_______<br />

Employer/Third Party Administrator X ____________________________________________________ Date ____/____/_______<br />

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

Part 7: Instructions to Current Carrier:<br />

Please make proceeds payable to:<br />

<strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong> FBO ________________________________________________________ and forward to:<br />

<strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong> • Attn: Annuity Department • P.O. Box 418131 • Kansas City, MO 64141-8131<br />

ACCEPTANCE BY FIDELITY SECURITY LIFE INSURANCE COMPANY (FSL)<br />

This is to certify that <strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong> (FSL) has an approved contract and that we hereby accept the Transfer or Direct<br />

Rollover of assets requested above. Please send the funds to the address listed directly above.<br />

Authorized (FSL) Signature X ____________________________________<br />

Title __________________________ Date ____/____/_______<br />

Agent/Advisor Signature<br />

X ____________________________________________________________________ Date ____/____/_______<br />

95-32284 #4347 1109

<strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong><br />

3130 Broadway<br />

Kansas City, MO 64111<br />

1035 Exchange Form<br />

(Non-Qualified Annuity to Annuity)<br />

Please read and complete sections 1 - 5 of this form, then sign and date where indicated. You may give the form to your agent or mail it directly to<br />

<strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> at the address shown at the top of this form. Make sure you first complete all forms required by the employer maintaining<br />

your plan.<br />

Part 1: Name and Address Information (Please Print)<br />

Name ____________________________________________________ Social <strong>Security</strong> Number ________________________________<br />

Address __________________________________________________ Your Home Phone ____________________________________<br />

City _____________________________ State ______ ZIP__________<br />

Part 2: Your Existing Account/Plan (Current <strong>Company</strong>/Custodian)<br />

Name of <strong>Company</strong> __________________________________________<br />

Address __________________________________________________<br />

________________________________________________________<br />

City _____________________________ State ______ ZIP__________<br />

Part 3: To (Resigning <strong>Company</strong>/Custodian):<br />

Please Liquidate:<br />

q<br />

q<br />

The entire balance of my account; or<br />

A partial surrender of $ ____________________ or ___________ % from my Account/Plan.<br />

Part 4: *If age 85 has been attained:<br />

q<br />

q<br />

Please process my Required Minimum Distribution prior to exchange.<br />

I will satisfy my Required Minimum Distribution from another non-qualified source.<br />

Your Work Phone ______________________________________<br />

Account/Plan Number __________________________________<br />

Plan Name __________________________________________<br />

Plan Administrator Name ________________________________<br />

Contact Number ______________________________________<br />

I hereby irrevocably assign the contract or certificate represented in exchange for a new non-qualified annuity contract or certificate issued by<br />

<strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong>, as part of a single integrated exchange of annuity contracts intended to satisfy the requirements under section 1035(a) of<br />

the Internal Revenue Code.<br />

Owner Signature X ________________________________________________________________ Date ____/____/_______<br />

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

Part 5: Instructions to Current Carrier:<br />

Please provide cost basis information and make proceeds payable to:<br />

<strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong> FBO ________________________________________________________ and forward to:<br />

(name of account holder)<br />

<strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong><br />

Attn: Annuity Administration Department<br />

P.O. Box 418131<br />

Kansas City, MO 64141-8131<br />

ACCEPTANCE BY FIDELITY SECURITY LIFE INSURANCE COMPANY<br />

This is to certify that <strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong> has an approved contract and hereby accept the assets requested above.<br />

Authorized Signature X ____________________________________________ Title ________________________________________<br />

Date ____/____/_______<br />

95-32283 #5529 611

<strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong><br />

3130 Broadway, Kansas City, Missouri 64111-2406<br />

TaxVantage TM Annuitization Request Form<br />

1 Please provide personal information: Please print in ink or type all answers.<br />

Name:<br />

________________________________________________________________________________________________________________<br />

First Middle Last<br />

Address:________________________________________________________________________________________________________________<br />

Street City State ZIP<br />

ID No. ______________________________________________________ Contract(s)________________________________________________<br />

Social <strong>Security</strong> No. ___________________________ Date of Birth ____/____/_______ Telephone No. ( ______ ) ________________________<br />

❑ Check here if this is a new address. If address is different from above, please indicate where you would like your payments mailed.<br />

Address:________________________________________________________________________________________________________________<br />

Street City State ZIP<br />

For direct bank deposits, please enclose a voided check from the account to which you would like payment deposited.<br />

Please be sure to complete the beneficiary designation information on the back of this form.<br />

In accordance with the terms of the Annuity Contract and with respect to the Annuity Option, I hereby request — in lieu of all benefits otherwise<br />

payable to me — the option checked below. If any prior request or election has been made as to optional retirement benefits, I hereby revoke and<br />

cancel any such prior request or election.<br />

2 Please check only one option:<br />

❑ <strong>Life</strong> Annuity — Annuity payable to the Annuitant for as long as he/she lives.<br />

❑ Certain Annuity — Annuity payable for 5 through 20 years certain. Upon death of the Annuitant prior to the end of the certain period, any<br />

payments for the balance of such period will be paid to his/her beneficiary. Number of years desired __________.<br />

❑ Certain and <strong>Life</strong> Annuity — annuity payable for 5, 10, 15, or 20 years certain as long thereafter as the Annuitant is living. Upon the death of the<br />

Annuitant prior to the end of the certain period, any payments for the balance of such period will be paid to his/her beneficiary. Number of years<br />

desired __________.<br />

❑ Survivorship Annuity — Annuity payable to the Annuitant for as long as he/she lives. Upon his/her death, payment will continue at 100%, 75%,<br />

or 50% to the contingent (second) Annuitant for the life of the contingent (second) Annuitant. Please complete the section on the back for<br />

contingent Annuitant information. Percentage desired __________.<br />

If you chose any annuity except the Certain Annuity, please enclose a certified or notarized copy of your birth certificate. If you chose the Survivorship Annuity,<br />

please enclose certified or notarized copies of both your birth certificate and that of the contingent Annuitant.<br />

3 Please complete this section:<br />

❑ Full ❑ Partial Annuitization. If Partial, indicate amount $___________ OR ______% Date to begin receiving first payment ____/____/_______<br />

If Full Annuitization, your last contribution will be for the payroll period ending ____/____/_______<br />

❑ Do<br />

❑ Do Not withhold federal income tax from any annuity payment I receive.<br />

Annuity Income to be Paid ❑ Monthly ❑ Quarterly ❑ Semiannually ❑ Annually

4 For the Survivorship Annuity, complete this section:<br />

Please provide information on the contingent (second) Annuitant, and enclose a certified or notarized copy of his/her birth certificate.<br />

Name:<br />

________________________________________________________________________________________________________________<br />

First Middle Last<br />

Address:________________________________________________________________________________________________________________<br />

Street City State ZIP<br />

Social <strong>Security</strong> No. ___________________________ Date of Birth ____/____/_______ Relationship<br />

Telephone No. ( _______ ) ___________________________________________<br />

__________________________________<br />

5 For all other annuity options (except <strong>Life</strong> or Survivorship), complete this section:<br />

Beneficiary Designation: Print full names and entire addresses.<br />

I hereby request the beneficiary under the numbered contract shown on the front to take effect in accordance with the contract provisions as follows:<br />

Primary Beneficiary: This beneficiary designation supersedes any and all other beneficiary designations.<br />

Name: ________________________________________________________________________________________________________________<br />

First Middle Last<br />

Address:________________________________________________________________________________________________________________<br />

Street City State ZIP<br />

Social <strong>Security</strong> No. ___________________________ Date of Birth ____/____/_______ Relationship __________________________________<br />

Contingent Beneficiary: This beneficiary designation supersedes any and all other beneficiary designations.<br />

Name: ________________________________________________________________________________________________________________<br />

First Middle Last<br />

Address:________________________________________________________________________________________________________________<br />

Street City State ZIP<br />

Social <strong>Security</strong> No. ___________________________ Date of Birth ____/____/_______ Relationship __________________________________<br />

It is understood and agreed that proceeds will be paid in equal shares, unless otherwise designated, to any surviving beneficiaries; but if none survives,<br />

proceeds will be paid in equal shares to any surviving contingent (second) beneficiaries.<br />

6 Please sign here:<br />

I agree that the benefits as elected above are accepted in full settlement and complete satisfaction of any and all rights and benefits with respect to<br />

me under said Annuity Contract.<br />

Owner Signature X ________________________________________________________________________________<br />

Date ____/____/_______<br />

Witness<br />

________________________________________________________________________________________<br />

Annuitant Spouse’s Signature if Community Property state ________________________________________________<br />

For <strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> Home Office Use Only:<br />

Completed by ____________________________________________________________________________________<br />

Date ____/____/_______<br />

Attention Annuitant: Notify <strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong> if this copy does not contain your desired requests or if it is incorrect in any way.<br />

As indicated by signature in this section, <strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> has recorded your requested changes.<br />

93-32131 #6136 1112

Exhibit I – Annuity Suitability Questionnaire<br />

Yes, I agree to answer the questions below and I understand that my responses will be used to evaluate the suitability of an<br />

annuity contract. I understand that FSL may elect not to issue the annuity contract being applied for based on a<br />

reasonable determination that the product may not be suitable for me.<br />

Proposed Annuitant Primary <strong>Financial</strong> Objectives (Check all that apply)<br />

Name: Preservation of Capital Future Income<br />

Address: Wealth Accumulation Charitable Giving<br />

Tax Deferral<br />

Education Planning<br />

Home Phone No.:<br />

Social <strong>Security</strong> No.:<br />

Age at Last Birthday:<br />

Immediate Income<br />

Inheritance<br />

Time Frame for this Investment<br />

When will you need the money you are investing in this<br />

Marital Status: Married Single annuity? (Circle One)<br />

Widowed<br />

Divorced<br />

1 year or less 7 – 10 years<br />

Occupation: 1 – 3 years 10 years or more<br />

3 – 7 years Never (money is for<br />

charity/inheritance)<br />

<strong>Financial</strong> Information<br />

Annual Household Income $<br />

Existing Accounts<br />

Are you considering using funds from existing life<br />

insurance policies, annuity contracts, or certificates of<br />

Liquid Net Worth $ deposit to purchase this annuity?<br />

(Excluding residence and furnishings) Yes No<br />

Source of Income: (Check all that apply)<br />

How long has that policy(ies), contract(s), or certificate<br />

Employment Retirement Plans of deposit(s) been in force?<br />

Investments Other # of Years<br />

Social <strong>Security</strong><br />

Are there any surrender charges associated with the<br />

Tax Bracket: (Check one)<br />

above-mentioned existing policy(ies), contract(s), or<br />

10% 15% 25% 28% 33% 35% certificates of deposit?<br />

Yes No Not Applicable<br />

Proposed Annuity represents % of Net my Worth<br />

Do you have any funds available to you in case of<br />

emergency?<br />

If yes, what is/are the current surrender charge(s)?<br />

Other relevant information (financial constraints, health<br />

concerns, long-term care considerations, etc.)<br />

OWNER ACKNOWLEDGEMENT<br />

By signing below, I acknowledge that I reviewed with my agent the product-specific disclosure form and that I<br />

understand the costs and features of the annuity I am purchasing. In addition, I acknowledge the information I<br />

provided is complete and accurate to the best of my knowledge. I further acknowledge that neither <strong>Fidelity</strong> <strong>Security</strong><br />

<strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong> nor its representatives offer legal or tax advice. I have been advised to consult my<br />

personal tax advisor or lawyer with any questions or concerns. I believe the annuity I am applying for is suitable<br />

based on my insurance needs and financial objectives.<br />

Owner Signature<br />

Date<br />

AGENT ACKNOWLEDGEMENT<br />

By signing below, I acknowledge that based on the information the Owner provided and based on all the<br />

circumstances known to me at the time the recommendation was made, the annuity being applied for is suitable<br />

based on insurance needs and financial objectives of the Owner. In addition, I have verified the identity of the<br />

Owner and believe that the identity information the Owner provided to me is true and accurate.<br />

Agent Signature<br />

Date<br />

N-00261 93-33293<br />

Shaded information indicates new material 08/01/12<br />

Page 7 SPM 100

Exhibit II A – Waiver of Annuity Suitability<br />

IMPORTANT!<br />

Your Coverage cannot be issued without your signature on either the Waiver below,<br />

or the attached Suitability Questionnaire.<br />

<strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong><br />

3130 Broadway, Kansas City, MO 64111<br />

Waiver of Annuity Suitability<br />

We appreciate your interest in an annuity contract from <strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong> ("FSL"). We are required<br />

by various states to ask for information that will help determine whether an annuity contract is suitable for your investment<br />

goals and financial situation. The questions pertain to your personal situation at the time of this application, and to your<br />

understanding of the features of the product for which you are applying. This information will not be used for any other<br />

purpose and will remain confidential.<br />

You have the legal right to decline to provide this information. If this is your wish, please read the following<br />

statement, sign, date, and return this form with your Application for Annuity.<br />

WAIVER of Annuity Suitability Questionnaire<br />

No, I will not answer the questions on the attached sheet, and I take full responsibility for determining whether the<br />

proposed annuity is suitable for me.<br />

(The Proposed Annuitant must sign in the "Signature" space below. Your policy cannot be issued without your signature on<br />

either this WAIVER or the attached Annuity Suitability Questionnaire.)<br />

Proposed Annuitant Signature<br />

Date<br />

N-00262 93-33294<br />

Shaded information indicates new material 08/01/12<br />

Page 9 SPM 100

Exhibit II B – Declination to Follow Recommendation<br />

IMPORTANT!<br />

Your Coverage cannot be issued without your signature on both the Declination below<br />

and the attached Suitability Questionnaire.<br />

<strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong><br />

3130 Broadway, Kansas City, MO 64111<br />

Declination to Follow Recommendation<br />

We appreciate your interest in an annuity contract from <strong>Fidelity</strong> <strong>Security</strong> <strong>Life</strong> <strong>Insurance</strong> <strong>Company</strong> ("FSL"). We are required<br />

by various states to ask for information that will help determine whether an annuity contract is suitable for your investment<br />

goals and financial situation. The questions pertain to your personal situation at the time of this application, and to your<br />

understanding of the features of the product for which you are applying. This information will not be used for any other<br />

purpose and will remain confidential.<br />

You also have the legal right to not follow any recommendation made. If this is your wish, please read the<br />

following statement, sign, date and return this form with your Application for Annuity.<br />

DECLINING to Follow Recommendation<br />

Based upon the information on the attached sheet, the annuity transaction was not recommended. I take full<br />

responsibility for determining whether the proposed annuity is suitable for me.<br />

(The Proposed Annuitant must sign in the "Signature" space below. Your policy cannot be issued without your signature on<br />

both this DECLINATION and the attached Annuity Suitability Questionnaire.)<br />

Proposed Annuitant Signature<br />

Date<br />

N-00260 93-33292<br />

Shaded information indicates new material 08/01/12<br />

Page 10 SPM 100