ARG COMPLIANCE MANUAL - Rathi Online

ARG COMPLIANCE MANUAL - Rathi Online

ARG COMPLIANCE MANUAL - Rathi Online

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>COMPLIANCE</strong><strong>MANUAL</strong>

INDEXSr.No Particulars Pg No1. Activity Schedule for Branch Opening 3-42. Display of Notice Board 5-113. Contract Notes & Appointment of Authorised Signatories 12-154. Allotment of Back office login ID 16-165. Allotment of Terminal ID 17-226. Client Information Sheet (One Pager) 23-237. CRF Procedure (KYC, Documentary Requirement, Checklist) 24-308. UCC Procedure & Client category 31-329. Shifting & Closure of Client 33-3510. Guidelines to be followed before trade 36-3711. RMS Process 38-54WEB RMSMargins and LimitsAuto Square off Procedure12. Grievance Redressal Mechanism 55-5513. Surveillance and Recovery Notice Performa Letter 56-6014. Office Management 61-65ChecklistDealing with ClientBank accountBalance Confirmation with ClientMiscellaneous Matters15. Insurance Claim Pre-requisites 66-6616. Trade Modification Undertaking 67-6817. Reporting of Bulk & Block Deal 69-6918. F&O Increased Position 70-7019. Useful Web Sites 71-7120. Branch Audit Self Certification 72-7321. Insider/ Employee Trading Policy 74-7622. Business Code of Conduct 77-8323. Compliance Exchange Deadlines 84-9124. Sub-broker Registration Checklist 92-10525. PMLA Policy 106-12326. Compliance Training 124-19427. Commodities 195-2082

ACTIVITY SCHEDULE FOR BRANCH OPENINGSr.No.1 Capex approved by Management2 Manpower planning approved by VC3 Sanctioned amount of Manpower4 Working structure done at the branchParticularsComputer & Printer installation/Wiring work doneFixing of DP(for fixing cables)outside and Inside for fixation of internet and telephone linesEarthing for VPNFlex installationSign board installationReliance phone (……… nos)2 BSNL / Other landline connectionsInternet Connection (serivce provider)5 Whether copy of Rent Agreement has been received - Not required incase of Regd. SB's office6 NOC copy received by the branch7 Intimation given to HECL8 Site survey Conducted9 Schduled date of the materail to reach the site10 Checklist for connectivity to HECL11 Connectivty done12 Whether details of NCFM Approved User alongwith copy of certificate has been received13 Board Resolution for -- For opening Branch- For opening Bank A/c- For signing Contracts/Bills14 Whether Clients Bank A/cs have been opened for NSE & BSE transactions separately. Pleasemention Bank A/c No.15 Whether DP A/cs have been opened with NSDL / CDSL. Please mention DP A/c No.16 Software installation & training at Branch location completed17 CTCL IDs uploaded/intimated to NSE18 Branch opening mail19 Whether SEBI Certification has been despatched for displaying20 Whether Notice Board has been despatched for displaying in the format as prescribed by NSE21 Whether Email Id of the Branch has been created. Please mention email id23 Prefix code22 IPO Code23 Mutual Fund Code24 Date of commencement of business3

ACTIVITY SCHEDULE FOR FRANCHISEE OPENINGSr.No.Particulars1 NOC copy received by the branch2 Intimation given to HECL3 Site survey Conducted4 Schduled date of the materail to reach the site5 Checklist for connectivity to HECL6 Connectivty done7 One pager info. Received alongwith MOU/AP agreement8 NCFM Approved User alongwith copy of certificate has been received9 Copy of Signed MOU and agreement sent to the branch along with the signing papers10 BSE & NSE DD nos submitted with the papers to the compliance11 Sub-broker/AP application has been prepared and sent to exchange for Regn.12 Whether Remisier/AP application has been prepared and sent to exchange for Regn.13 Board Resolution for -14 - For opening Bank A/c/CMS authority(seg to be mentioned) and from which bank15 - For signing Contracts/Bills16 Whether Clients Bank A/cs have been opened for NSE & BSE transactions separately. Pleasemention Bank A/c No.17 Whether DP A/cs have been opened with NSDL / CDSL. Please mention DP A/c No.18 Software installation & training at Branch location completed(backoffice,a/c's ,DP training)19 CTCL IDs uploaded/intimatedBSE /NSE /F&O/NCDEX/*MCX20 Whether SEBI Certification has been despatched for displaying21 Whether Notice Board has been despatched for displaying in the format as prescribed by NSE22 Whether Email Id of the Branch has been created. Please mention email id23 Prefix code23 IPO Code24 Mutual Fund Code25 Date of commencement of businessSignatures1 Business Development2 Operations3 Compliance4

DISPLAY OF NOTICE BOARDNote: 1. All the notice Board BSE/NSE/MCX-SX/MCX/NCDEX are a mandatory display inthe branch. The ideal size should be 4‟× 3‟ but due to space constraints it can be reducedbut in any case will not be in A4 size.2. Details that are blank (pertaining to branch) have to be filled by respective branch.3. To be displayed in the main / branch office of the trading member and office of the Subbroker/ Franchise of the trading memberSEBI Registration certificates to be displayed on the notice BoardAs per the Bye Laws of the Exchange all offices of the Broker have to display the SEBIRegistration certificates on their Notice Board.With regards to the same, all branches are instructed to make sure that the certificatesattached are displayed at their branch. The attached certificates are mentioned below:1. SEBI Registration for NSE Cash2. SEBI Registration for NSE F&O3. SEBI Registration for NSE CD4. SEBI Registration for BSE cash5. SEBI Registration for MCX-SX6. Registration for NCDEX7. Registration for MCX8. Registration for NMCE9. Registration for NSEL10. Registration for ICEX11. Notice Board for BSE12. Notice Board for NSE.13. Notice Board for MCX-SX14. Notice Board for MCX/NCDEX5

All the branches are required to take the printouts and laminate the certificates beforedisplaying on the notice board.6

NOTICE BOARD:BSE1. Name of the Trading Member ofBSE (SEBI Registration No.)2. Address & Tel. No. of the Mainoffice of the trading member (AlsoName & Tel. No of the contact personin the main officeAnand <strong>Rathi</strong> Share and Stock Brokers Limited4th Floor, Silver Metropolis,Jay CoachCompound, Opp. Bimbisar Nagar,Goregaon(E), Mumbai - 400 063.Jugal Mantri022-40013700INB011371557/INF0106769313. SEBI Registration No. of the tradingmember4. BSE Investor Service Cell Tel. No. 022 - 22721233/34Do’sa. Always deal with market intermediaries registered with SEBI/Exchanges.b. Give clear and unambiguous instructions to your broker/agent/depository participant.c. Always insist on contract notes for all the transactions from the main broker (name tobe specified) within 24 hours of the trade execution. In case of doubt of thetransactions, verify the genuineness of the same on the Exchange websitewww.bseindia.com.d. Always settle the dues through the normal banking channels with the marketintermediaries.e. Always make payment directly to the main broker (name to be specified).f. Always give delivery of shares directly to the main broker (name to be specified).g. Adopt trading/investment strategies commensurate with your Risk bearing capacityas all investments carry risk, the degree of which varies according to the investmentstrategy adopted.h. Always sign a Member-Client Agreement or the tripartite agreement with the tradingmember & SEBI registered sub-broker of the trading member of BSE as the casemay be.i. Please carry out due-diligence before registering as client with any Intermediary.Also, carefully read and understand the contents stated in the Risk DisclosureDocument, which foRMS the part of client registration for dealing throughintermediaries in the Stock Market.Don’tsa. Don‟t deal with unregistered brokers/sub-brokers, intermediaries.b. Don‟t leave the custody of your Demat Transaction slip book in the hands of anyIntermediary.c. Don‟t fall prey to promises of guaranteed returns.d. Don‟t blindly imitate investment decisions of others who may have profited from theirinvestment decisions.7

Anand<strong>Rathi</strong>DETAILS OF MCX-SX TRADING TERMINALName of theTrading Member ofMCX-SXAddress & Tel. No. of the Mainoffice of the trading memberSEBI Registration No. of thetrading memberAddress and Tel. No. of thebranch office where tradingterminal is locatedName & Designation of the personin-charge/managing themain/branch officeName, designation & Tel. No. ofthe contact person in the Mainoffice of the trading memberAnand <strong>Rathi</strong> Share and Stock brokersLimited4th Floor, Silver Metropolis,Jay CoachCompound, Opp. BimbisarNagar,Goregaon (E), Mumbai - 400 063.CD : INE 260676935Mr. Deepak Kedia - Compliance HeadTel. No.: 40013700Fax No.: 40013770Important points to be noted by constituents/investors‣ Please deal only through a SEBI registered trading member and ensure to carry out duediligence before registering as a constituent of any trading member‣ Please read carefully and then execute registration documents viz. Know Your Clientform, Member-Constituent Agreement and Risk Disclosure Document, before startingdealing with trading member‣ Insist on contract note of the trading member for all trades done by you, within 24 hoursand bring any discrepancies to the notice of trading member immediately‣ Please make payments by account payee cheque / DD in favour of trading member orfunds transfer through banking channel and do not involve in cash dealings‣ For further details on the rights and obligations of investors and other related issues,kindly contact the trading member or the Investor Service Centers of MCX StockExchange LimitedNOTICE BOARD:MCX9

1 Name of the Trading Member(Commodity Broker) of MCXM/s Anand <strong>Rathi</strong> Commodities Ltd2 Name of the Exchange Multi Commodity Exchange of IndiaLtd3 Address & Telephone No. of the Main 4th Floor, Silver Metropolis,Jay Coachoffice of the trading memberCompound, Opp. BimbisarNagar,Goregaon (E), Mumbai - 400 0634 Registration No. of the trading member FMC : MCX/TCM/CORP/ 0525MCX: 108755 Name & Designation of the contactperson in the Main office of the tradingmemberMr. Deepak Kedia – Compliance HeadAdditional details to be displayed in the Branch office1 Address of the Branch office wheretrading terminal is located2 Name & Designation of the person incharge/ managing the branch officeAdditional detail to be displayed in the Sub-broker / Franchise office1 Name of the Sub-broker /Franchise2 Address of the Sub-broker‟s /Franchise office, where tradingterminal of above TM is located10

NOTICE BOARD:NCDEX1 Name of the Trading Member(Commodity Broker) of MCXM/s Anand <strong>Rathi</strong> Commodities Ltd2 Name of the Exchange NATIONAL COMMODITY & DERIVATIVESEXCHANGE LIMITED3 Address & Telephone No. of theMain office of the trading member4th Floor, Silver Metropolis,Jay CoachCompound, Opp. Bimbisar Nagar,Goregaon(E), Mumbai - 400 0634 Registration No. of the tradingmember5 Name & Designation of thecontact person in the Main officeof the trading memberFMC : NCDEX/TCM/CORP/0178NCDEX : 00147Mr. Deepak Kedia – Compliance HeadAdditional details to be displayed in the Branch office1 Address of the Branch officewhere trading terminal is located2 Name & Designation of the personin-charge / managing the branchofficeAdditional detail to be displayed in the Sub-broker / Franchise office1 Name of the Sub-broker /Franchise2 Address of the Sub-broker’s /Franchise office, where tradingterminal of above TM is located11

CONTRACT NOTES (CN) & APPOINTMENT OF AUTHORISEDSIGNATORIES1. CN must be issued to ALL the clients within 24 hours.2. Duplicate acknowledged copy of CN to be maintained.3. CN No. must bear running serially no. by software starting with no. 1 everycalendar/financial year.4. PAN of the Client must be printed on the CN mandatory.5. Signature of client must be taken on duplicate copy/counterfoil of CN and Properrecords showing dispatch of CN be maintained.6. CN to be signed by an Authorised Signatory duly authorized with a Board Resolutionto be passed by HO and the same after being signed by the authorized signatory willbe submitted to the exchange for their records and approval and only after the sameis intimated by the HO the Authorised Signatory will start signing and issue contracts.Authorised Signatory would be appointed once the request is made by the branch, namingthe authorized person12

Authorised Signatory FormatNote: Print On respective letterheads (BSE – ARSSBL; NSE – ARSSBL; Commodities –Anand <strong>Rathi</strong>Commodities Ltd) -2 copies. Send original copies with specimen signatures to HO- NSE-AUTHORISATION FOR SIGNING CONTRACT NOTES, BILLS ETC.Pursuant to the resolution passed by the Board of Directors of Anand <strong>Rathi</strong> Share & Stock BrokersLtd. at their meeting held on 10 th January 2007 the undersigned persons are authorized to modify,add to and delete the list of authorized signatories for signing and issuing Contract Notes and Bills.APPOINTMENT OF AUTHORISED SIGNATORIESUnder the authority delegated by the said resolution we hereby authorize the following persons toSEVERALLY deal, sign, and execute the Agreements, Bills, Contract Notes, Debit Notes etc. onbehalf of the Company,with effect from (date)_______________ in respect of transactions executedon the National Stock Exchange of India Ltd. whereat the Company is a member.Branch Name Authorised Persons Specimen Signatures.....................Branch .......................... .................................REMOVAL OF AUTHORISED SIGNATORIES.....................Branch .......................... .................................For Anand <strong>Rathi</strong> Share & Stock Brokers Ltd.Deepak Kedia/ Narendra Jain.Authorised Signatories13

- BSE-AUTHORISATION FOR SIGNING CONTRACT NOTES, BILLS ETC.Pursuant to the resolution passed by the Board of Directors of Anand <strong>Rathi</strong> Share and Stock BrokersLtd . at their meeting held on 22 nd Mar 2010 the undersigned persons are authorized to modify, addto and delete the list of authorized signatories for signing and issuing Contract Notes and Bills.APPOINTMENT OF AUTHORISED SIGNATORIESUnder the authority delegated by the said resolution we hereby authorize the following persons toSEVERALLY deal, sign, and execute the Agreements, Bills, Contract Notes, Debit Notes etc. onbehalf of the Company, with effect from (date)_______________ in respect of transactionsexecuted on the Bombay Stock Exchange Ltd. whereat the Company is a member:Branch Name Authorised Persons Specimen Signatures.....................Branch .......................... .................................REMOVAL OF AUTHORISED SIGNATORIES.....................Branch .......................... .................................For Anand <strong>Rathi</strong> Share and Stock Brokers LtdDeepak Kedia/ Narendra Jain.Authorised Signatories14

ALLOTMENT OF TERMINAL ID1. Persons operating the trading terminal (NEAT/CTCL) must have compulsorilypassed the NCFM certification exam for Cash/ Derivatives/ Commodities.2. Prior approval of HO/NSE is required to be taken before allotment of NEAT/CTCLterminal Id‟s.3. Operation of trading terminal without passing NCFM exam leads to heavypenalty being charged by NSE including suspension.4. Change in person operating the NEAT/CTCL terminal required to be informed toHO/NSEBSE Ids Cash: Certificates to be providedAs per our earlier mail with reference to BSE Notice No.20070522-25 dated 22nd May 2007it has been made clear that all the BSE CASH Ids (BOLT TWS / IML(CTCL) IDS) running inrespective branches will have to provide the mandatory BCSM certificate for their respectiveUser Ids.Incase of failure to provide the same their respective Ids will be deactivated. All existing Iddetails in IML format available in Intra.rathi.com FAQ- Excel along with their relevantcertificate/marksheet should be mailed to krishnavenichava1@rathi.com ;rupalikadam@rathi.comThe details of registration and examination centre along with the contact details have beenprovided below.All are instructed to get in touch with their nearest centre and get their users registered andsend across the certificates/marksheet along with the said format before the due date. Thelist of your respective User Ids along with the User Names will be mailed to you shortly.17

Procedure to be followed by branches to get through BCSM ExamThere are 6 centers available all over India.Branches can directly co-ordinate with nearest center of that region.http://www.bseindia.com/training/zedca.asp1. Visit site bseindia.com/Bse Training institute/BTI Information/BCFMcertification/BCSM module/ at the end of page will see link for registration form andadmit cardhttp://www.bseindia.com/training/bccsmtest.asp2. Rs. 843/- as fees for each candidate/ cheque at payable at par or D. D. payable atMumbai for all over India candidates. (Member‟s cheque is acceptable)3. Group of 20 or more candidates can apply together with single cheque payment.4. Schedule for exam isa. Monday to Friday between 11 a.m. to 4 p.m.b. Saturday between 11 to 15. http://www.bseindia.com/training/faqcert.asp for more questions related to BCSMExam18

Connectivity LayoutONLINEBSE NSE MCX /NCDEXNESTOMNEYSISNESTOMNEYSISODINDIET- FTCTCLDEALERCLIENTCTCLDEALERCLIENTCTCLDEALERCLIENTONLINECLIENTSONLINECLIENTSONLINECLIENTSOFFLINEBSE NSE MCX NCDEXTWSBOLTVPNCTCLODINNEATUSER IDVPNCTCLODINUSER IDVPNCTCLODINUSER IDVPNCTCLODIN19

Trading terminals to be located at -LOCATION OF TRADING TERMINALS1. Members‟ Office -- Rented/Owned/Licensed premises2. Members‟ Branch Office3. Registered Sub-Brokers Office4. Terminal located at place other than above mentioned places, will be deemedto be office of MemberInternet trading terminals used by clients may be located at the clients place.TWS Bolt ID – Details to be provided1 TWS(0)2 PIN CODE3 TWS ID4 USER ID5 PROG-TRAD6 VENDOR-CODE7 BCSM Reg. No8 Validity of BCSM9 Reg Office Address10 Office City11 Office State12 Office Pin13 Nature of Office14 Phone/Fax No15 Employee Code/ Franchisee Code16 First Name17 Middle Name18 Last Name19 Mapin Id20 Sebi Reg No21 Relation with approved user22 Date of Birth23 Date of Activation24 Date of Deactivation25 Residence Address26 Residence City27 Residence Stat28 Residence Pin29 Active Terminal30 Mode of Connectivity20

NSE CTCL ID :- Details to be provided1. Market Segment2. NEAT User Id3. CTCL Terminal Id4. CTCL LogIn Id5. Purpose of CTCL6. Date of Allotment7. Date of Disablement8. Office Status9. Office Address110. Office Address211. Office Address312. State13. City14. Office Pin Code15. Telephone No.16. Connectivity Mode17. NCFM Reg. No.18. Employee Code/ Franchisee Code19. Approved Person Name20. Approved Person's Father Name21. Date of Birth22. validity Date23. MAPIN No.24. PAN No.25. Relation26. Sub-Broker SEBI code27. Sub-Broker name28. Authorised Person name29. CTCL Status21

NCDEX CTCL ID :- Details to be Provided1 SR NO2 RECORD TYPE3 SEGMENT4 VPN/LEASED LINE ID5 USER ID6 TERMINAL ADDRESS 17 TERMINAL ADDRESS 28 TERMINAL ADDRESS 39 CITY10 PIN CODE11 STATE12 TEL NO13 FAX NO14 EMAIL ID15 CONTACT PERSON16 DESIGNATION17 MODE18 Employee Code19 APPROVED PERSON20 FATHERS NAME21 DOB22 RES ADD 123 RES ADD 224 RES ADD 325 CITY26 PIN CODE27 PERMANENT ADD 128 PERMANENT ADD 229 PERMANENT ADD 330 CITY31 PIN CODE32 RELATIONSHIP with A P33 CTCL ID34 DATE OF ACTIVE35 DATE OF DISABLE36 PAYMENT37 NCFM REGN38 VALID UPTO39 PURPOSE40 AUTH PERSON41 VENDOR42 STATUS22

CLIENT INFORMATION SHEET (ONE PAGER)1. Branch to obtain information of client in one pager form i.e. Client Information Sheet (CIS).2. Client Code to be allotted based on the said information and respective prefix allotted to branch.Name of the ClientClient CodeStatus of the ClientClient AddressResidencePhone no Res.OfficeCLIENT INFORMATION SHEETExchanges Applicable: BSE NSE F&OIndividual/HUF/Firm/Corporates IndividualOffice no. / Mobile no.PAN No.EmailDate of Birth Passport No Date Of IssueExpiry DatePlace of IssueClient Bank DetailsClient DP DetailsBank NameName of the DPBranchDP IDBank A/c No.Client IDARSPL Bank DetailsNCSPL Bank DetailsName of the HDFC Bank Name of the HDFC BankBankBankBranch Mumbai Branch MumbaiBank A/c No. 0‟123200003 Bank A/c No. 0‟60034000509743Broker DP DetailsDP Name ARSPL NCSPLDP ID 10600(C IN301803(NS IN 301803DSL) DL)CM BP ID 030 IN651983(NS IN 559169(CMID) DL)Brokerage StructureSquare Up _______% _______MinDelivery _______ % ________Min(Both Sides / Single Side)+ Other Charges *+ Other Charges *Service Tax (as per applicable) presently 10.2%,(* Other charges include Turnover tax, Transaction Charges & Stamp duty )Specific Instructions for OperationsDate : Signature :Prepared by : Signature :Name of EDP dept person : Signature :Name of Authorised person : Signature :23

IF NOT SATISFIEDCRF PROCEDURE - OFFLINESTARTCRF to AOT fromBranchesWith Excel format of KYCmailed to AOT Dept.And Pending CRF statusFully checked withthe mandatory fieldsand proofs.IF SATISFIEDAOT . updated on dailybasis about the file no andthe CRF in that file.Entered in the system,CRF to be filed,Alloted a file no.For permanent recordFollow upwithBranchesFor proofs,completeddocumentsand pendingCRF statusEND24

CRF PROCEDURE1. CRF will be dispatched to branches / Franchisee out of Mumbai on the receipt of theirrequisition letter via e-mail. For Branches and Franchisee situated in Mumbai region,the respective branch office personnel‟ can collect the CRF from the HO onSaturday’s before 2.30 PM, on producing properly filled and duly signed [by thebranch head] requisition letter.2. CRF’s shall be dispatched by branches / Franchisee to HO on daily basis, to belowmentioned address with email of KYC format [ of those CRF‟s which are sent to usthrough courier ] at, krishnavenichava1@rathi.com ,and rupalikadam@rathi.comAddress to send CRF:Anand <strong>Rathi</strong> Share and Stock Brokers LimitedCompliance dept.4th Floor, Silver Metropolis,Jay Coach Compound, Opp. BimbisarNagar,Goregaon (E), Mumbai - 400 063Tel: (B) :+91-022-40013 700 (D) :+91-022-4001 3894/3752, (F) :+91-022-4001 37703. On the receipt of the CRF‟s, the confirmation will be made to the branch / Franchiseethrough the KYC mail received earlier by branch / Franchisee [ Without KYC Check]4. Kindly send CRF details in KYC format as ( soft copy and hard copy of KYC format),while sending it to HO.5. On the receipt of CRF at HO, it shall be franked [Without KYC Check]. Please ensurethat the client does not trade before the CRF gets franked at our ends.6. After franking, CRF KYC check shall take place. KYC checklist attached.7. For the CRF‟s completed in all respect, confirmation receipt [KYC Check] shall bemade to branches / Franchisee by the Account opening Team[AOT] via e-mail.8. Incomplete CRF‟s [ in any respect ] shall be returned by HO to the respective Branch/ Franchisee and the same shall be intimated via www.intrarathi.com.9. Follow up for the incomplete CRF‟s would be done by AOTAOT shall check, audit and keep a track on the CRF.You may find attached the CRF procedure, email audit format and KYC format, which will bepracticed at HO, Mumbai, by the AOT. Further, it is proposed that all the branches have toscan the CRF [KYC only] along with the supporting documents and upload it onwww.intrarathi.com as per the Unique Client code allotted.25

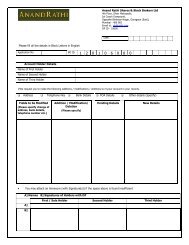

FORMAT FOR CRF REQUISITIONDate :To,Head OfficeCompliance DeptDear Sirs,Subject: Requisition Letter – Offline SegmentWe require Client Registration Form. The details are mentioned below.Particulars BSE NSE/CD/MCX-SX COMBINE BSE/NSE COMMODITYInd Non Ind Ind Non Ind IndStock as on date - NILLess: CRF sent to HOBalance CRF -Add : Requirement -Total Stock -Note: Kindly give BSE & NSE/CD/MCX-SX Franking forms separately.Kindly give the CRF‟s who holds this requisition letter.Regards,Name of the BranchName & Signature of Branch Manager26

KYC CHECKLIST1. The AOT shall check the CRF’s in totality with proofs. No mandatory field should beleft blank and necessary supporting documents should be attached. List of mandatoryfields and supporting documents attached.2. All the supporting documents shall be self attested by the client.3. NO CRF SHALL BE ACCEPTED WITHOUT COPY OF PAN CARD (both sides) [verified with the original by the branch / franchisee ]4 AOT shall audit and any incomplete CRF shall be returned back and be treated asnot received. Those branches sending incomplete CRF‟s will be kept a track of andthe management will take a strict action against the defaulting branches.5. AOT shall maintain KYC in excel format of all the completed CRF‟s.6. CRF‟s complete in all respect shall be allotted a file number and be placed in thesame for future references7. Follow up with branches for pending CRF‟s8. Monthly audit report shall also be sent to respective Branches / Franchisee9. Under mentioned are the mandatory fields:1. Name2. Date of Birth3. Residential Status4. Residential Address/Office Address(City & State, Country, Nationality, PinCode)5. Details of Bank Account (Bank Name, Address, Account No., Nature ofAccount)6. Details of Depository Participant7. Details of Introducing Client8. Check Signatures of the client wherever (x) is marked and also crosssignature on photograph9. Franked page should be fully filled up with date, name and address.10. Generally Branch manager‟s are being authorized to act and sign asauthorized signatory and thus should sign on the member – client agreement.In exceptional circumstances any other authorized signatory from the branchmay do so. Check Client‟s signature on the MCA. One witness each shouldsign from our side and client side.27

DOCUMENTARY REQUIREMENTS[ check the Supporting Documents as per the list ]For IndividualPAN card (2 Copies)[ both sides ]One color passport size photographBank Proof and Income ProofAddress proof [ List of documents acceptable as Add. Proof mentioned below ]For Sole ProprietorshipPAN card (2 Copies)Proof of Address [ List of documents acceptable as Add. Proof mentioned below ]One color passport size photograph of the ProprietorLetter from the banker, certifying the Account NumberFor Partnership Firm :PAN card copy of the firm and of atleast 2 partners (2 Copies each) [both sides]One color passport size photograph of atleast each of the two PartnersCopy of Partnership Deed. [ Duly certified ]Sharing pattern [revised to be submitted every six month ].Declaration on the letterhead of the Partnership firm, signed by all partners,agreeing to open a trading account with members and stating the authorizedSignatory to deal with membersCopies of Annual Report of last three years. [audited]Networth Certificate [of minimum two partners ]Letter from the banker, certifying the Account NumberCopy of Income Tax Return of the Firm and of minimum two partners.Personal Details of Partners [ to be filled in the CRF at the space provided ]Address proof of Office and Residence proof of minimum two partnersOther mandatory requirements for opening partnership accounts:1) Investment clause to invest in commodities [ in the partnership deed]2) Demat account in the name of the partner.28

For Corporate accounts:Copy of PAN card of company and of atleast two Directors(2 Copies each)One color passport size photograph of atleast each of the two DirectorsCopy of MOA and Copies of balance sheet for last 3 financial years.Share holding Pattern [ revised to be submitted every six month ]Copy of the resolution of board of directors approving participation in commoditytrading and naming authorized persons for dealing in commodities.Address proof of company and Residence proof of minimum two DirectorsLetter from the banker, certifying the AccountNetworth Certificate [of the company and of minimum two Directors.]Personal Details of Promoters/Directors [ to be filled in the CRF at the spaceprovided ]GENERAL INSTRUCTIONPlease ensure that the form is properly filled up, attached with the copies of therequired documents and complete in all respect [ please do not leave any columnblank ]Please check weather full signature are affixed where ever an “X” mark is found.Check initials where ever blank space is filled in by the hand in the “member-clientagreement”.Each client should use separate registration form.Individual has to affix 6 full signatures where “X” marks is found and 1 initial at thebeginning of the “Member-Client Agreement” where “X” mark is found i.e a total of 7signatures [ excluding signatures across the photograph ]Each Partner has to affix 7 full signatures where “X” marks is found and 1 initial atthe beginning of the “Member-Client Agreement” where “X” mark is found i.e a total of8 signatures [ excluding signatures across the photograph ]. Please put the rubberstamp of the Partnership on every full signatureEach Director has to affix 7 full signatures where “X” marks is found and 1 initial atthe beginning of the “Member-Client Agreement” where “X” mark is found i.e a total of8 signatures [ excluding signatures across the photograph ]. Please put the rubberstamp of the company on every full signature.29

List of documents approved as Address proof.ParticularsDriving License (name, address andphoto page)Passport (copy of name, address andphoto pages)Voter‟s Identity Card (front and back)Bank Passbook / Bank StatementRation CardElectricity BillTelephone BillLeave- License AgreementFlat Maintenance BillFlat AgreementAddressProofYesYesYesYesYesYesYesYesYesYesFORMAT FOR DISPATCH OF CRFDate of DispatchP.O.D No.Courier NameEmail Id:Total FormsBranch NameSr NoDateCRFSeriesNo.ClientCodeNameofClientPANNoBSE NSE F&O COMMODITYTRADEDATERemark30

UCC PROCEDURE & CLIENT CATEGORY1. NSE & BSE UCC will be uploaded at HO, branches will be required to upload properUCC details in Pradnya (Back Office) for the same. In addition the name of the clientshould be uploaded as per the name in PAN card , copy of the Pan card should be sentto HO.2. NCDEX & MCX UCC will also be uploaded from HO. Branch has to provide all therelevant UCC details while adding a clientTo make it a successful implementation, you all are requested/instructed to enter proper details of theclient at the time of adding the client into Pradnya. The following fields are to be entered compulsorilyand properly at the time of adding the client:1. Branch code2. Client type3. Party code4. Name (Long Name and Short Name)5. Residential Address (Permanent / correspondence) (City & State, Country, Pin Code)6. PAN Card No7. Sub broker code,8. Trader code9. Client Status10. Region code11. Area code12. Dealer code13. Details of Bank Account (Bank Name, Address, Account No., Type of Account)14. Details of Depository Participant15. Date of Birth16. Gender17. Introducer DetailsPlease note that getting successfile of the client codes uploaded at exchangelevel purely depends upon the data entered into Pradnya. Therefore branches willbe held responsible for rejection of the codes and the penalty levied by theexchange would thus be passed on to the defaulting branch.31

Appropriate UCI category to be allotted to client in PradnyaWith reference to the circular issued by National Stock Exchange (NSE/INVG/2006/32) ithas been made mandatory for displaying the appropriate UCI status of the client to theexchange. Acting on the same the necessary changes have been made in Pradnyasoftware.All the branches are required to upload the details of the client with the appropriate UCIcategory status of the client from the table mentioned below:CategoryCodeIndividuals 1Partnership Firms 2HUF 3Public & Private Companies / BodiesCorporate 4Trust / Society 5Mutual Funds 6Domestic Financial Institutions (Other thanBanks & Insurance companies) 7Banks 8Insurance Companies 9Statutory bodies 10NRIs 11FIIs 12Overseas Corporate Bodies 13The client mapping in Cash and F&O will not take place for all the branches failing to do soas the codes will be rejected by Exchange. Please comply with immediate effect.The queries in this regard can be addressed to the Compliance Department32

SHIFTING & CLOSURE OF CLIENTNote:1. Incase a client is shifting from one branch to other the formalities to be carried outby the branch is provided in this format. Account closure format must be collected in case ofclient shifting2. Branch manager in the Old as well as New has to make sure all the formalities arecompleted before shifting. Activation and deactivation will take place on the same day oncea mail is sent with the Old and New client codes along with the scan copy of the format toEDP; RMS and Settlement Dept.3. Printout on plain paper. CRF will be collected only if Old CRF is missing. All the fields inthe format are to be filled before submission of the scanned copy to all concerneddepts..(mapping@rathi.com (RMS); crcedp@rathi.com (EDP);crcsettlement@rathi.com (Settlement) and cc to accountopeningib@rathi.com ). Ifany field is empty the form will be rejectedFORMAT FOR APPLICATION FOR SHIFTING OF CLIENTDate :To,Anand <strong>Rathi</strong> Financial Services Ltd/ Anand <strong>Rathi</strong> Share & Stock Brokers Ltd/ Anand<strong>Rathi</strong> Commodities LtdDear Sir,I _________ (Name of Client) having trading account with you, _______ (Client Code) would like to shift mytrading account from your _______(Branch) to _______(Branch) dueto___________________________________________________(Reason for change).I authorize you to deactive my earlier account and issue a new client code________ as per _____Branch.Thanking You,(Name of Client & Signature)Branch Manager33

Checklist to be confirmed by Branch Manager before submission to compliance Dept:Sr NoParticularsConfirmFromYes /No1. CRF Confirmed by the Branch Branch2 Client code Deactive from Mapping RMS3Old Client Code & DP details Deactive inBack Office Software.EDP4 Letter from the Client for closing of Trading A/c Client5 Account must be Zero Branch6 Shares must be Transfer to Client A/c Branch7 New client Code ------------------ New BranchNote: If all the answers are not Yes the transfer will not be valid from Compliancepoint of view.34

ACCOUNT CLOSURENote: 1. Incase a client is closing his account the formalities to be carried out by the branch isprovided in this format.FORMAT FOR REQUEST LETTER FOR CLOSURE OF TRADING ACCOUNTToThe Branch ManagerBranch:Dear Sir,I am having a trading a/c with *(Anand <strong>Rathi</strong> Financial Services Ltd/ Anand <strong>Rathi</strong> Share & StockBrokers Ltd/Anand <strong>Rathi</strong> Commodities Ltd.) vide client code ____________ and D-Mat ID____________________. I would like to close my trading account asReasons:Unhappy with service.Moving residence, no Anand <strong>Rathi</strong> Branch near residence/ office.Moving from the city, no convenient branch in new city.OthersIf Others: --------------------------------------------------------------------I request to please close my account bearing client code __________ with immediate effect.Client DetailsNameAddressContact No.I certify that there are no dues pending w.r.t funds and securities in my account.Yours truly,Signature of Client:Verification by branch Manager:Branch:Dated:Remark On Date Confirmed by Yes/NoCRF Collected * BSE/NSE/F&O/Commodities BranchDeactivated from RMS & EDP By …………By …………RMS & EDPDept.Complaint pending (if any)Branch HeadLedger Balance Amount: Rs Branch HeadShares TransferredBranch HeadRemarks:Branch HeadIf Client shifting (New code)New BranchStrike out if not applicable.Note: If all the answers are not Yes the transfer will not be valid from Compliance point ofviewSignature & Name of branch manager:35

Guidelines to be followed before trade in Client CodesKind Attn: OPM/ Branch Managers Especially Dealers/ Backoffice StaffThe term „Branch‟ wherever mentioned includes own branch as well as franchisees.For NEAT(Direct terminal for NSE Cash & F&O Codes): Use F12 : Supplementarymenu/ Client Master Maintenance: Add all the active list of clients in NSE (or Fileupload facility)For BOLT (Direct terminal for BSE cash): Use Shift+F12: Add clients active in BSE (orFile upload facility)No trade should be carried out in codes which are not available in the list.Instructions:1. Ensure that all the data entered in Backoffice software (PRADNYA) & WEBX are crosschecked and verified with relevant supporting documents (self attested by client)accepted along with CRF (Registration/ Trading forms) (CRF should be completely filledin all respects) E.g. Verify Name of Client with PAN card; PAN details with the websitehttp://incometaxindiaefiling.gov.in/challan/enterpanforchallan.jsp.ORhttps://onlineservices.tin.nsdl.com/TIN/PANVerification.doIncome slab with Salary slip (for Individuals) / Net worth certified by CA(for Non-Individuals) every 6 months For more go through the circular folder available inintra.rathi.com / ComplianceAny discrepancies found at this level should be immediately reported.2. Mapping of clients to respective terminals should be carried out after success receivedfrom the respective Exchanges. Active list of clients should be checked before mapping.3. Any changes to be made in PRADNYA(to EDP..) or Exchange (to Compliance in UCCformat to pan@rathi.com ) will have to be sent in format already stipulated.4. No special request will be entertained to allow trade in a code that is not there in theactive list5. Any client who wants to discontinue his account and dispose his shares but has noproper mandatory details like PAN will have to rematerialize his shares. But no trademust be allowed in the client codes.6. Any shifting or account closure of client will be done as per procedure available inIntra.rathi.com / Compliance folder.7. Branches are requested to go through the attachments thoroughly before placing a callto HO. Also keep yourself updated on a daily basis with the circulars and details providedin Intra.rathi.com / Compliance folder as per the path mentioned below.36

Branches failing to comply to these instructions will be strictly dealt with byCompliance dept. including termination of BOLT & NEAT of defaulting brancheswithout any further notice. The action taken by the department will be binding.Guidelines to be followed for mapping Clients in commoditiesThis is to bring to your notice that all the clients in MCX & NCDEX that are sent to the EDPdept. for mapping will be taken for uploading on same day to the Exchange only if the detailsare received before 5 pm every day.Any client details received thereafter will be added for upload to the Exchange the next day.The success of all the codes is received by the Exchange in a day if not rejected byExchange.Thus any client details provided i.e fed in Pradnya before 5 pm will be activated thenext day in MCX & NCDEX following the Exchange success file received around11am.The reject codes will be intimated to branches. Inorder to reduce the rejection rates pleasenote the mandatory fields in Commodities as under:1. Segment2. Client Name3. Client Code4. Complete Address including STATE ;COUNTRY & PINCODE5. PAN details (without any special characters or space and after verification withIncome tax site. http://incometaxindiaefiling.gov.in/challan/enterpanforchallan.jsp.)6. Date of Birth incase of Individual and Registration date for Corporates along withPlace of registration.7. Select similar client Status & Category (e.g:If status Is HUF the category will bydefault be HUF)All Branches are instructed to follow procedure for smooth operation of the account openingprocess. No special request will be entertained for activation of new clients without propersuccess received from Exchange.37

RMS PROCESS FLOWM<strong>ARG</strong>INS AND LIMITSAUTOSQUAREOFF PROCEDURECOMMON RMSLimit Calculation for online client & offline clientAll exchange limit - Sum of Following (For all <strong>Online</strong> / Offline client)o Clear Cash balanceo 1/3 of unclear cheque and CMS in Cash segmento NSECDS and F&O Ledgero NSECDS and F&O Collateralo CMS in F&O and NSECDS segmento Minus Unsettle sale valueo Collateral benefit on holding lying in DP. Pool and BTSTNSECDS and F&O Limit – Only for NON LOA (Offline):Sum of Followingo NSECDS and F&O Ledgero NSECDS and F&O Collateralo NSECDS and CMS in F&O segmentSome point to be noted:o Non Loa client will able to take Cash market position on the basis of free F&O and CDSLimit.o Non LOA client couldn‟t take position in F&O or in CDS segment on the basis of freecash balance.o No separate F&O and CDS limit is calculated for LOA client.o Client can use free F&O and CDS deposit for additional buying in cash segment and viceversa.Summary of Limit StatusClient TypeLOA TypeCombined Limit( Cash + F&O + NSECDS ) F&O Limit CDS Limit<strong>Online</strong> LOA YES NO NO<strong>Online</strong> NON LOA YES NO NOOffline LOA YES NO NOOffline NON LOA YES YES YES38

o Limit consumption of online client will be same as per offline client..Proposed System of <strong>Online</strong> clientClient Type Scrip which is to be bought Intraday Limit Delivery LimitLOA Client / Non VAR +ELM < 25% 25% 25%LOA Client VAR +ELM > 25% Actual Margin % Actual Margin %Calculation of Collateral Benefit (<strong>Online</strong> / Offline)Collateral benefit will be available on the basis of scrips which are lying in Client DP, Pooland BTST. Hair cut will be actual VAR +ELM Margin but Minimum of 25 %.39

AUTO SQUARE OFF – BSE AND NSE CASH SEGMENT (AGEING BASED)Applicability1. Client having net debit balance on t+4 th working day will be squared off on t+5 th morning(irrespective of coverage).2. Minimum Ageing / Square off amount will be Rs. 5000.3. Auto Square off orders will be generated at 105% of required Square off/ Debit amount.However, actual square off amount could be less than or equal to the actual square offamount depending on market price.Criterion1. Will be considering F&O free ledger balance while calculation of square off amount.2. CMS entries entered in WEBRMS by branches until 8.15 a.m. on T+5 th day will be takeninto consideration while calculation of square off amount.3. Any shortfall amount remaining after square off has to be collected by the branches.Procedure:1. RMS will generate Square Off report at 6.30 pm on t+4 th day’ evening and Final Squareoff report will be generated on t+5 th day morning around 8.30 am. Simultaneously, thesereports shall be made available to front offices on WebRMS.2. Ho- RMS will carry-out square off as per final Square Off report between 9.00 am to 9.20am via file upload on direct terminal.3. Square off Client codes’ holding which is to be squared off will not be uploaded into theOmnesys.4. Scrip identification: Scrip identification for auto square off, will be on the basis of leastimpact cost ** with adequate quantity nearest to the square off amount. In case ofinsufficient value of scrip having least impact cost, the scrip having next least impact cost(nearest to the square off amount) will be selected for square off.5. Holding location :POA client- Order priority to square off will be Pool, DP and BTST respectively.Non POA Client: order priority to square off will be Pool and BTST respectively.Scrip identification process will be in the given order in each holding location.6. Pool and BTST holding will be squared off in respective exchange at which purchases aremade by the client. In case client having both segment rights then DP (POA) holding willbe squared off in NSE segment and otherwise DP (POA) will be squared off in thesegment where client has right to trade.**Meaning of Impact Cost =Impact cost is calculated by taking four snapshots in a day from the order book in the past six months. These foursnapshots are randomly chosen from within four fixed ten-minutes windows spread through the day.The impact cost is the percentage price movement caused by an order size of Rs.1 Lakh from the average of thebest bid and offer price in the order book snapshot. The impact cost is calculated for both, the buy and the sell sidein each order book snapshotThe buy side impact cost (or sell side impact cost) is the simple average of the buy side impact cost (or sell sideimpact cost) computed for all the snapshot observations in the past 6 months.Impact cost for the purpose of all computations shall be Mean of such buy side impact cost and sell side impact cost.40

AUTO SQUARE OFF – FUTURE & OPTION SEGMENT: (similar to present procedure inCommodity Market)POLICY CHART(A) (B) AUTO SQUARE OFF AMOUNTREPORTABLE M<strong>ARG</strong>IN(includes Ledger balance inF&O, ledger balance in BSECash Market, Ledger balancein NSE cash market,collaterals accepted by us,family a/c credits - mapped inback-office at the end of dayor CMS entries receivedbefore 8.15 a.m. on thesquare off day)REQUIRED M<strong>ARG</strong>IN(includes initial margin/exposure margin/ M TOM /any other Adhoc orspecial margin imposedby Exchange on time totime at the end of day)1. Reportable margin (A) is less than 30% of RequiredMargin (B) Auto Square will take place to the extent ofshortfall, in the morning between 9.00 a.m. to 10.00a.m. on next day2. Reportable margin (A) is below 75% of RequiredMargin (B) for 3 consecutive days ; Auto Square willtake place to the extent of 50% of shortfall in theafternoon between 2.00 p.m. to 2.45 p.m. on 4th dayType of Risk Reports:Square off Report – This report will include list of clients in Auto square-off categories.Priority & procedure:1. The branch has to enter CMS Slip No. in Webrms before the cut off time for square off.Additional collateral given by the client has to be confirmed by the branch via an email fornecessary exclusion of the client from the auto square off list.2. RMS will take out the square off report at around 9.00 a.m and 1.45 p.m once the collection ofcheques / Securities collateral is updated in the back office system.3. Square off will be done in morning and afternoon session on the Basis of F&O Square offreport.4. Scrips consuming higher margins will be squared off from OMNESYS Admin terminal to thenearest tradable lot size covering the shortfall amount.5. In case the overall margin required is short by Rs. 20000 or less then the client will beexcluded from the Square off list.6. The amount of square off will be the amount remaining after the difference of Reportablemargin and the Total Margin required.Information to the branches:1. Auto Square Report will be informed to Regional Director and Operation Manager at 8.30a.m.2. The squared off position will be informed to the branches after position squared off throughintranet.Format of Square off Report:Followings details will be provided in the reports –41

Square Off ReportOtherSegCreditTotalRepMarginTotalMarginRequiredMarginAvailability %PartyCodeRepMarginBSEBalNSEBalFamilyCreditShortfallClient A -88979 0 13626 13626 -5819 -75353 938196 -1013549 0 MorningClient C 193891 8227 20000 28227 0 222118 405902 -183784 54.72 Afternoon1. party code2. Rep. Margin - (ledger bal + cash collateral +non cash collateral )3. bse bal – ledger balance of bse segment4. nse bal – ledger balance of nse segment5. other segment Credit – col. 3+46. Family credit – sum of ledger balances of client’s familyNote: only family credit will be considered in calculation of shortfall.Family means – those clients which will exist in back office as family members andalso include his parentsBalances – as per above calculation for bse ,nse, fno, mcx, ncdex7. Total Rep .margin – col. 2+5 total available deposit of client against open position.8. total margin required – total margin consumed by open position of the client (initialmargin + exposures margin(if any))9. shortfall – (col. 7 minus col. 8) PLUS col. 610. margin availability % - (col. 7 plus col.6(if credit) / col.8 . total margin available againstthe margin requiredNOTE: if we click on any row than there is display of family members of that client with freebalances of the entire segment.Overall position Report --Above details regarding overall position of the clients, which are shown in square off clientreport –Overall Position ReportMorning/AfternooPartyCodeClient AClient ANo.OfLotsclosingValuePer LotMarginPerLotTotalMarginRequiredsymbolinstrument_typeoption_typeExpiryDateTradeable LotAvailableQuantityclosingRateContractValueMargin%MAHSEAM FUTSTK 29-Nov-07 600 13 7800 480 287850 3742050 20.31 58462 760010ORCHIDCH FUTSTK 29-Nov-07 1050 5 5250 224 235253 1176263 15.78 37123 185614Client A TOTAL 945624Client B CAIRN FUTSTK 29-Nov-07 2500 1 2500 210 524875 524875 18.54 97312 97312DIVISLAClient B B FUTSTK 29-Nov-07 310 1 310 1551 480717 480717 25.77 123881 123881Client B HCC FUTSTK 29-Nov-07 1400 1 1400 193 270760 270760 24.55 66472 66472Client B IDFC FUTSTK 29-Nov-07 2950 1 2950 173 511088 511088 24.67 126085 126085KTKBANClient B K FUTSTK 29-Nov-07 1250 1 1250 216 269375 269375 16.96 45686 45686Client B OMAXE FUTSTK 29-Nov-07 650 1 650 296 192205 192205 20.47 39344 39344Client B TOTAL 498780ESCORTClient C S FUTSTK 29-Nov-07 2400 1 2400 109 260640 260640 24.13 62892 62892Client C IDBI FUTSTK 29-Nov-07 2400 1 2400 152 363720 363720 25.22 91730 91730Client C RPL FUTSTK 29-Nov-07 3350 1 3350 210 704003 704003 35.96 253159 253159Client C TOTAL 4077811. party code42

2. symbol – scrip name3. Inst_type – futstk (future) or Optstk (option)4. Option type - ca/ce or pa/pe5. expiry date – expiry of the scrip6. trade able lot – minimum qty of scrip which can be trade7. no of lot – no of lot retain by clients ( net qty / tradable lot)8. Available qty – open position of the client in back office9. Closing rate – closing price of the respective scrip .10. closing value per lot – closing price of the scrip x tradable lot11. contract value – closing value of all contract12. margin % - margin % as per previous day Scrip wise margin report13. margin value per lot – col 11 x col. 1214. total margin required – col. 13 x col. 715. total rep. Margin – total reportable margin plus other segment credit(if credit)16. margin shortfall – total margin required minus total rep margin17. margin availability % - col. 15 / col.14 margin available against the margin requiredSquare off position Report – Followings details showing overall position of the clients withthe square off qty which will be square off by HO.Time of Display - beginning of the day -– 8.30 a.mSquare Off PositionPartyCode symbol inst_typeClient A MAHSEAMLES FUTSTKClient A ORCHIDCHEM FUTSTKOptiontypeExpirydateAvailableQuantityContractValueQtySq OffSquareOffValueMarginPercentageMarginvalue29-Nov-07 7800 3742050 7800 3742050 20.31 76001029-Nov-07 5250 1176263 5250 1176263 15.78 185614ShortFallClient A TOTAL 945624 -1013549Client B IDFC FUTSTK29-Nov-07 2950 511088 2950 511088 24.67 126085Client B DIVISLAB FUTSTK29-Nov-07 310 480717 310 480717 25.77 123881Client B TOTAL 249966-133653.5Client C RPL FUTSTK29-Nov-07 3350 704003 3350 704003 35.96 253159Client C TOTAL 253159 -918921. party code2. symbol – scrip name3. inst_type – position in future or option4. option type - option type index option(ce/pe) and stock option (ca/pa)5. expiry date – expiry of the scrip6. Available qty – open position of the client in back office7. contract value – closing value of all contract8. Qty square off - Qty which are to be square off later in the day (calculated as per shortfall ofthe clients)9. Square off value – square off qty x closing rate of the scrips10. margin % - margin % as per previous day Scrip wise margin report11. margin value – col. 9 x col. 1012. shortfall - shortfall of the client43

Final Auto Square Off Report - followings details will be shown regarding Actual qty square off by HOPartyCode symbolExpirydate Inst_type Option typeAvailableQuantitySquare OffQuantityActual Sq. OfQuantityClient A MAHSEAMLES FUTSTK 29-Nov-07 7800 7800 780Client A ORCHIDCHEM FUTSTK 29-Nov-07 5250 5250 525Client A TOTALClient B IDFC FUTSTK 29-Nov-07 2950 2950 295Client B DIVISLAB FUTSTK 29-Nov-07 310 310 31Client B CAIRN FUTSTK 29-Nov-07 2500 2500 250Client B TOTALClient C RPL FUTSTK 29-Nov-07 3350 3350 335Client C TOTAL1. party code2. symbol – scrip name3. expiry date – expiry of the scrip4. inst_type – position in future or option5. option type - option type index option(ce/pe) and stock option (ca/pa)6. Available qty – open position of the client in back office7. Qty square off - Qty which are to be square off later in the day (calculated as per shortfallof the clients)8. today‟s square off Qty – Actual square off qty by Ho9. shortfall - shortfall of the clientSome Points1. Calculation of scrip wise margin in overall position report is on the basis of FNO Daily margin reportuploaded on intra rathi.com. There could be a minor difference from actual total margin calculated by theexchange at the time of actual square off.2. Family includes member clients and parent.3. The clients whose trades have been executed on direct terminal due to connectivity problem will getsquared off on the direct terminal only.B. Square off PoliciesB. 1. AUTO SQUARE OFF – BSE AND NSE CASH SEGMENT:Category of client:4. Client having debit bal. more than 3 days will be squared off on 4 th day morning.Important terms:Square off Amount – Ageing bal. for more than 3 days OR Actual Debit Bal. 4th day (Which everis lower)44

Criteria & Condition4. Consideration of Free Ledger balance in F&O segment assessing the risk.5. Client having square off amount less than 5 thousand will be excluded.6. Loan against Shares (LAS) clients will be excluded.Priority & procedure:1. Respective branches/Region has to take up responsibility to clear up the debit of all suchclient whose debit is outstanding for more than 3 days within the period covered underthis report.2. RMS will take out the final square off report at around 9.30 am on 4 th days morning aftercollection status updated in the back office system upto 9.30 A.M3. Square off Client A/c will remain suspended from Odin up to 10.30 A.M. in morning andReactivate by 11.00 A.M.4. Scrip which will be picked up for auto square up balances will be calculated on the basisof highest value of shares held in our beneficiary.In case the shares are not sufficient tocover the square off amount then the scrips under BTST (unsettled) will be considered.5. The file updated on 3 rd day at night 10.00p.m will be considered finally for auto sq. at 4 thday Morning.6. The square off transaction will be done on the direct terminals via a file upload as theODIN system doesn’t provide any file upload facility at present.7. There will not be any buying limit available for the client on the day of square off.8. The square off report of the branches and their franchisees will be emailed to the regionalhead at the beginning of the day which will consist of the latest square off clients as wellas report. The entire square off reports for the next days consecutively will not beemailed to them.Information to the branches / Regions:3. Branches will be informed square off reports from 3 rd day to 4 th day for each day’s squareoff clients.4. The HO squared off position will be informed to the branches at around 11.15 p.m againabout the position squared off through intranet.Note:1. Square off report consist of the clients having a debit balance for more than 2 days whichremained unpaid till 4 th day. This report will reduce the amount of sell done by the branch on 3thday but before the square off day.2. CMS Entry against square off Client will be only considered up to 4 th day.3. Fake Cms entries will be considered seriously.4. The clients whose other segment balance is considered for the purpose of auto square off transfer.The fund of client will be directly moved by RMS.5. Further exposures to square off clients will be seriously monitored.B .2 AUTO SQUARE OFF – FUTURE & OPTION SEGMENTPOLICY CHART(A) (B) AUTO SQUARE OFF AMOUNT45

REPORTABLE M<strong>ARG</strong>IN(includes Ledger balance inF&O, ledger balance in BSECash Market, Ledger balancein NSE cash market,collaterals accepted by us,family a/c credits - mapped inback-office at the end of dayor CMS entries receivedbefore 9.30 a.m. on thesquare off day)REQUIRED M<strong>ARG</strong>IN(includes initial margin/exposure margin/ M TOM /any other Adhoc orspecial margin imposedby Exchange on time totime at the end of day)1. Reportable margin (A) is less than 30% of RequiredMargin (B) Auto Square will take place to the extent ofshortfall, in the morning between 9.55 a.m. to 10.30a.m.on next day2. Reportable margin (A) is between 30 to 60% ofRequired Margin (B); Auto Square will take place to theextent of 50% of shortfall in the afternoon between2.00 p.m. to 2.45 p.m.on next day3. Reportable margin (A) is below 75% of RequiredMargin (B) for 3 consecutive days ; Auto Square willtake place to the extent of 50% of shortfall in theafternoon between 2.00 p.m. to 2.45 p.m. on 4th dayType of Risk Reports:Square off Report – This report will include list of clients in Auto square-off categories.Priority & procedure:7. The branch has to enter CMS Slip No. in Webrms before the cut off time for square off.Additional collateral given by the client has to be confirmed by the branch via an email fornecessary exclusion of the client from the auto square off list.8. RMS will take out the square off report at around 9.30 a.m and 1.45 p.m once the collection ofcheques / Securities collateral is updated in the back office system.9. Square off will be done in morning and afternoon session on the Basis of FNO Square offreport.10. Client will be suspended from ODIN in FNO segment for 35 minutes in morning (Between9.55 – 10.30 a.m.) and 45 minutes in Afternoon. (Between 2:00 – 2.45 p.m.)11. Scrips consuming higher margins will be squared off from ODIN Admin terminal to thenearest tradable lot size covering the shortfall amount.12. In case the overall margin required is short by Rs. 20000 or less then the client will beexcluded from the Square off list.13. The amount of square off will be the amount remaining after the difference of Reportablemargin and the Total Margin required.14. The client will be reactivated again at 10.30 a.m and 2.45 p.m respectively.46

PartyCodeInformation to the branches:5. Branches and their business heads will be informed vide Auto Square Report at9.30 a.m.6. The squared off position will be informed to the branches at 3.00 p.m again about the positionsquared off through intranet.Format of Square off Report:Followings details will be provided in the reports –Square Off ReportRepMarginBSEBalClient A -88979 0-22197 19739 0Client BClient C193891 8227NSEBal13626OtherSegCreditFamilyCreditTotalRepMarginTotalMarginRequired13626 -5819 -75353 93819624590 4860 -68422000 28220 7 0MarginAvailability %Shortfall-1013549 0 MorningMorning/Afternoon226839 494146 -267307 45.91 Afternoon222118 405902 -183784 54.72 Afternoon11. party code12. Rep. Margin - (ledger bal + cash collateral +non cash collateral )13. bse bal – ledger balance of bse segment14. nse bal – ledger balance of nse segment15. other segment Credit – col. 3+416. Family credit – sum of ledger balances of client’s familyNote : only family credit will be considered in calculation of shortfall.Family means – those clients which will exist in back office as family members andalso include his parentsBalances – as per above calculation for bse ,nse, fno, mcx, ncdex17. total Rep .margin – col. 2+5 total available deposit of client against open position.18. total margin required – total margin consumed by open position of the client (initialmargin + exposures margin(if any))19. shortfall – (col. 7 minus col. 8) PLUS col. 620. margin availability % - (col. 7 plus col.6(if credit) / col.8 . total margin available againstthe margin requiredNOTE: if we click on any row than there is display of family members of that client with freebalances of all the segment.Overall position Report --Above details regarding overall position of the clients, which are shown in square off clientreport –47

PartyCodeClient AClient AOverall Position ReportsymbolMAHSEAMORCHIDCHinstrument_typeFUTSTKFUTSTKoption_typeclosingValuePer Lot48TotalMarginRequiredExpiryDateTradeable LotNo.OfLotsAvailableQuantityclosing RateContract ValueMargin %MarginPerLot29-Nov-07 600 13 7800 480 287850 3742050 20.31 58462 76001029-Nov-07 1050 5 5250 224 235253 1176263 15.78 37123 185614Client A TOTAL 94562429-Nov-Client B CAIRN FUTSTK07 2500 1 2500 210 524875 524875 18.54 97312 97312DIVISLA29-Nov-12388Client B B FUTSTK07 310 1 310 1551 480717 480717 25.77 1 12388129-Nov-Client B HCC FUTSTK07 1400 1 1400 193 270760 270760 24.55 66472 6647229-Nov-12608Client B IDFC FUTSTK07 2950 1 2950 173 511088 511088 24.67 5 126085KTKBAN29-Nov-Client B K FUTSTK07 1250 1 1250 216 269375 269375 16.96 45686 4568629-Nov-Client B OMAXE FUTSTK07 650 1 650 296 192205 192205 20.47 39344 39344TotalReportable_MarginShortFallMarginAvailability%Morning/Afternoon-75352.93 -1013549 0 MorningClient B TOTAL 498780 226838.9 -267307 46 AfternoonClient CESCORTS FUTSTK29-Nov-07 2400 1 2400 109 260640 260640 24.13 62892 62892Client C IDBI FUTSTK29-Nov-07 2400 1 2400 152 363720 363720 25.22 91730 91730Client C RPL FUTSTK29-Nov-07 3350 1 3350 210 704003 704003 35.96253159 253159Client C TOTAL 407781 222118 -183784 54 Afternoon18. party code19. symbol – scrip name20. Inst_type – futstk (future) or Optstk (option)21. Option type - ca/ce or pa/pe22. expiry date – expiry of the scrip23. trade able lot – minimum qty of scrip which can be trade24. no of lot – no of lot retain by clients ( net qty / tradable lot)25. Available qty – open position of the client in back office26. Closing rate – closing price of the respective scrip .27. closing value per lot – closing price of the scrip x tradable lot28. contract value – closing value of all contract29. margin % - margin % as per previous day Scrip wise margin report30. margin value per lot – col 11 x col. 12

31. total margin required – col. 13 x col. 732. total rep. Margin – total reportable margin plus other segment credit(if credit)33. margin shortfall – total margin required minus total rep margin34. margin availability % - col. 15 / col.14 margin available against the margin requiredSquare off position Report – Followings details showing overall position of the clients with the square off qty which will besquare off by HO.Time of Display - beginning of the day – 9.30 a.m- Before square off -- 1.45 p.m.Square Off PositionPartyCode symbol inst_typeClientA MAHSEAMLES FUTSTKOptiontypeExpirydateAvailableQuantityContractValueQtySq OffSquareOffValueMarginPercentage29-Nov-07 7800 3742050 7800 3742050 20.31 760010Marginvalue ShortFall Morning/AfternoonClientA ORCHIDCHEM FUTSTK29-Nov-07 5250 1176263 5250 1176263 15.78 185614ClientA TOTAL 945624 -1013549 MorningClientB IDFC FUTSTK29-Nov-07 2950 511088 2950 511088 24.67 126085ClientB DIVISLAB FUTSTK29-Nov-07 310 480717 310 480717 25.77 123881ClientB TOTAL 249966-133653.5 AfternoonClientC RPL FUTSTK29-Nov-07 3350 704003 3350 704003 35.96 253159ClientC TOTAL 253159 -91892 Afternoon13. party code14. symbol – scrip name15. inst_type – position in future or option16. option type - option type index option(ce/pe) and stock option (ca/pa)17. expiry date – expiry of the scrip18. Available qty – open position of the client in back office19. contract value – closing value of all contract20. Qty square off - Qty which are to be square off later in the day (calculated as per shortfall of the clients)49

21. Square off value – square off qty x closing rate of the scrips22. margin % - margin % as per previous day Scrip wise margin report23. margin value – col. 9 x col. 1024. shortfall - shortfall of the clientFinal Auto Square Off Report - followings details will be shown regarding Actual qty square off by HOTime Of Display – 3.00 p.m.PartyCode symbolExpirydate Inst_type Option typeAvailableQuantitySquare OffQuantityActual Sq. OffQuantity ShortFallClient A MAHSEAMLES FUTSTK 29-Nov-07 7800 7800 7800Client A ORCHIDCHEM FUTSTK 29-Nov-07 5250 5250 5250Client A TOTAL -1013549Client B IDFC FUTSTK 29-Nov-07 2950 2950 2950Client B DIVISLAB FUTSTK 29-Nov-07 310 310 310Client B CAIRN FUTSTK 29-Nov-07 2500 2500 2500Client B TOTAL -267307.1Client C RPL FUTSTK 29-Nov-07 3350 3350 3350Client C TOTAL -18378410. party code11. symbol – scrip name12. expiry date – expiry of the scrip13. inst_type – position in future or option14. option type - option type index option(ce/pe) and stock option (ca/pa)15. Available qty – open position of the client in back office16. Qty square off - Qty which are to be square off later in the day (calculated as per shortfall of the clients)17. today‟s square off Qty – Actual square off qty by Ho18. shortfall - shortfall of the clientSome Points1. Calculation of scrip wise margin in overall position report is on the basis of FNO Daily margin report uploaded on intra rathi.com. There could bea minor difference from actual total margin calculated by the exchange at the time of actual square off.2. Family includes member clients and parent.3. The clients whose trades have been executed on direct terminal due to connectivity problem will get squared off on the direct terminal only.50

B.3 AUTO SQUARE OFF – COMMODITY SEGMENT:Important terms:Reportable Margin = Ledger + Cash Collateral+ Non Cash CollateralTotal Margin = Initial Margin + Exposure MarginCriteria:1. Consideration of Ledger as well as securities balance in other segment & also family accounts forassessing the risk.Category of client:Category A:Reportable margin is less than 50% but not below 25% of the total margin required (Initial plus exposure)then the position of these clients will be squared off on T+2 day only if the Reportable margin of the clientis less than 75% of the total margin required.Category B:Reportable margin is less than 25% of the total margin required (Initial plus exposure) then the squareoff the position on the day when it occurs.Type of Risk Reports:Shortfall Report – This report will include the list of the clients available in Category A.Square off Report – This report will include the list of the clients who are from Category B as well as theCategory „A‟ clients who have not cleared their margin shortfall before T+2 day.Priority & procedure:1. The branch has to enter the cheque received from the clients in the back office system immediately.2. RMS will take out the square off report at around 3:45 p.m once the collection of cheque / Securitiescollateral is updated in the back office system.3. Client is to be suspended from ODIN for an hour. (Between 4-5 p.m.)4. Scrips consuming higher margins will be squared off from ODIN Admin terminal to the nearesttradable lot size covering the shortfall amount.5. The amount of square off will be the amount remaining after the difference of Reportable margin andthe Total Margin required.6. The client will be reactivated again at 5:15 p.m.Information to the branches:1. Branches will be informed certain reports at morning 9.30 a.m.2. The squared off position will be informed to the branches at around 5:15 p.m again about the positionsquared off through intranet.51

For e.g - Client AParticularsTradedayTrade day +2+1 Situation 1 Situation 2Reportable margin (a) Rs. 8,00,000 Rs. 10,00,000 Rs. 12,00,000Other segment credits (b) Rs. 1,50,000 Rs. 2,00,000 Rs. 2,00,000Total Margin Required (c) Rs. Rs. 20,00,000 Rs. 20,00,00020,00,000Additional fund deposit (d) Nil Rs. 2,00,000 Rs. 2,00,000Total Av. Rep. Margin (e) Rs. 9,50,000 Rs. 14,00,000 Rs. 16,00,000Margin Availability (%) (f) 47.50 70 80Auto square off (Yes/No) (g) Yes Yes NoAmount of Auto Square off (h) Nil Rs. 600000 NilFormat of Shortfall Report / Square off Report:Followings details will be provided in both the reports --PartyCodeRepMarginBSEBalNSEBalFNOBalMCXBalOtherSegCreditFamilyCreditTotalRepMarginTotalMarginRequired ShortfallMarginAvailability%ClientA -8643 0 0 0 15290 15290 0 6647 24641 -17994 26.98ClientB 8675 0 0 0-113059 0 0 8675 24779 -16104 35.01ClientC -40203 0 0 0 59775 59775 0 19572 53570 -33998 36.54ClientD 40383-120002 0 0 0 0 0 40383 105216 -64833 38.38ClientE 206656 -57713 0 63732 0 6019 49280 212675 645255 -383300 40.6ClientF 3596 0 0 0 2613 2613 0 6209 14793 -8584 41.97ClientG -12699 0 0 0 19900 19900 0 7201 15216 -8015 47.33ClientH 23549 0 0 0 0 0 0 23549 48876 -25327 48.18Client I 3978 -6220 0 0 18348 18348 0 22326 44755 -22429 49.881. party code2. Rep. Margin - (ledger bal + cash collateral +non cash collateral )3. bse bal – ledger balance of bse segment4. nse bal – ledger balance of nse segment5. fno bal - (ledger bal + cash collateral +non cash collateral ) minus (initial margin+ exposuresmargin)6. mcx / ncdex - (ledger bal + cash collateral +non cash collateral ) minus (initial margin+exposures margin)7. other segment total – col. 3+4+5+6(cash +fno+mcx/ncdex)8. Family credit – sum of ledger balances of client’s familyi. Note : only family credit will be considered in calculation of shortfall.ii. Family means – those clients which will exist in backoffice as family members andalso include his parentsiii. Balances – as per above calculation for bse ,nse,fno,mcx,ncdex9. total Rep .margin – col. 2+7+8 total available deposit of client against open position.52

10. total margin required – total margin consumed by open position of the client (initial margin +exposures margin(if any))11. shortfall – col. 9 minus (col. 7 PLUS col. 8)12. margin availability % - (col. 9 plus col.8(if credit) / col.10 . total margin available against themargin requiredNOTE : if we click on any row than there is display of family members of that client withfree balances of all the segment.Overall position Report --Followings details regarding overall position of the clients, which are shown in square off clientreport –1. party code2. symbol – scrip name3. expiry date – expiry of the scrips4. trade able lot – minimum qty of scrip which can be trade5. no of lot – no of lot retain by clients ( net qty / tradeable lot)6. Available qty – open position of the client in backoffice7. closing rate – closing price of the respective scrip .8. closing value per lot – closing price of the scrip x tradeable lot9. contract value – closing value of all contract10. margin % - margin % as per previous day Scripwise margin report11. margin value per lot – col 11 x col. 812. total margin required – col. 11 x col. 913. total rep. Margin – total reportable margin plus other segment credit(if credit)14. margin shortfall – total margin required minus total rep margin15. margin availability % - col. 13 / col.14 margin available against the margin requiredSquare off position Report – Followings details showing overall position of the clients with the squareoff qty which will be square off by HO.Time of Display - beginning of the day – 9.30 a.m- before square off -- 3.30 p.martyode symbol ExpirydateAvailableQuantityContractValueQtySqOffSquareOffValueMarginPercentageMarginvalueShortFalllient ASTLINGGZB 20-Mar-08 -30 835200 -10 278400 5.53 15396lient A TOTAL 15396 -11920COCUDClient B AKL 20-Mar-08 -100 863200 -40 345280 6.07 20960lient B TOTAL 20960 -1767553

lient CSYBEANIDR 20-Mar-08 -10 227450 -10 227450 6.53 14852lient C TOTAL 14852 -85841. party code2. symbol – scrip name3. expiry date – expiry of the scrips4. Available qty – open position of the client in backoffice5. contract value – closing value of all contract6. Qty square off - Qty which are to be square off later in the day (calculated as per shortfall of theclients)7. Square off value – square off qty x closing rate of the scrips8. margin % - margin % as per previous day Scripwise margin report9. margin value – col. 7 x col. 810. shotfall - shortfall of the clientFinal Auto Square Off Report - followings details will be shown regarding Actual qty square off by HO.Time Of Display -- 5.30 p.mPartyCode symbol ExpiryDate shortfallAvailableQuantitySquare OffQuantityTodays Square OffQuantityDSREL003 SILVERM 29-Feb-08 -28430 -10 -10 -5LU12P1 COPPER 30-Apr-08 -15079 -1 -1 -1PCHN0125 GOLD 05-Apr-08 -44676 -1 -1 -11. party code2. symbol – scrip name3. expiry date – expiry of the scrips4. shortfall - shortfall of the client5. Available qty – open position of the client in backoffice6. Qty square off - Qty which are to be square off later in the day (calculated as per shortfall of theclients)7. Todays square off quantity – Actual square off qty out of available qty54

GRIEVANCE REDRESSAL MECHANISMAll Exchange level grievances are being handled by Compliance Department. All Branch level Grievances arebeing handled by Branch Heads / Regional Heads and all telephonic grievances are being handled byCustomer support department, after going through the pros & cons of nature of the issues involved.All India Toll Free no. for Customer support : 1800 - 222 - 234Email ID for Grievance Redressal : grievance@rathi.comEmail ID for Customer support : customersupport@rathi.comIn the interest of justice, equity and good conscience, and as a organization,as we observe high standards ofcommercial honour of just and equitable commitment to business ethics,We are glad to announce that we are in the process of building a comprehensive investor grievancesmechanism to carry out the entire operations seamlessly at all levels towards a more systematic andprofessional service to customers.Kindly send us the copy of complaint register maintained at your ends alongwith pending grievances. Further,you are required to send this report on a bimonthly basis (as per format Attached) to ensure complete clientsatisfaction.Format for Grievance Register to be maintained by each BranchSR.NO.COMPLAINTDATERECEIPTDATESEGMENTCOMPLAINANT'SNAMENATURE OFGREVIANCEAMT OFCLAIMREPLYSENTREMARKS55

Undertaking to be procured from client as a Surveillance MeasureClient Code : _______From _____________Address :__________________________________________________________Date : ___________________To,Anand <strong>Rathi</strong> Share and Stock Brokers Ltd /4th Floor, Silver Metropolis,Jay Coach Compound,Opp. Bimbisar Nagar,Goregaon (E),Mumbai - 400 063Dear Sir / MadamSub. : Trades done in Scrip Name on trade dateI/ We hereby confirm that I / We, our associate(s), relatives, sister companies, Partner(s), Promoter(s) /relative(s) and / or directors are not in any manner counter party to the buy /sell trades of __________ shares inthe scrip of _____________________ listed on BSE – Cash Segment and / or NSE – Cash Segment nor I/weam/are acting on behalf of any third party and/ or purchase of the shares is from our own funds.I/We hereby confirm with, that we have complied with all the guidelines and circulars issued by SEBI andExchanges or any other regulatory authority in this regard.I/We also declare that I / We am / are not trading in above mentioned security for influencing any change inprice, but purely for the Investment purpose. The same is / was bought from my / our own funds.I/We further declare that I/We am/are not associated with the promoter of the aforesaid company.I/We furthermore assure you that the trading in the aforesaid scrip does not tantamount to any unfair tradingpractice and I/we am/are not involved in any circular trading and not trading with a view to create false marketI/We will be submitting you or concerned agency(s) any information asked within 24 hours of receipt ofnotice.I/We further agree to indemnify and keep indemnified Anand <strong>Rathi</strong> Share and Stock Brokers Ltd /Anand <strong>Rathi</strong>Financial Services Ltd. in case of any query / liability or action taken by the Exchange / SEBI or any otherregulatory authority in this matter.Yours Truly,Authorised Signatory56

Client Code : _______PERFORMA LETTER FOR DEBT RECOVERY FROM CLIENT(On letter head of ARSSBL / ARCL as the case may be)By Courier / By Hand DeliveryTo,M/s/Mr. / Ms.________Date: __ / __ / 10(Complete Name and Address of Client)Dear Sirs/Madam,Ref: Non- Payment of outstanding dues/ debit balances in yourunder client code No. ________=================================================account** strike whichever is not applicableYou are aware that pursuant to the Member – Client Agreement signed by you, we are operating your tradingaccount as per your instructions in ** shares / securities / contacts and other instruments through ** BSE / NSE /MCX / NCDX till ______ under your aforesaid client code. The contract notes/ bills in respect whereof havebeen delivered to you in due course, which you have received and accepted by you without anyobjection whatsoever.In respect of the aforesaid transactions, your ledger account is showing debit balance of Rs._________/- due and payable by you.You are therefore, requested to pay to us the aforesaid outstanding dues / debit balance of Rs. ______/-with in seven days from the date of receipt of this letter by you in order to maintain cordial businessrelations between us.Thanking you,Yours truly,For ** M/s. Anand <strong>Rathi</strong> Share and Stock Brokers LtdM/s. Anand <strong>Rathi</strong> Commodities Ltd(Authorised Signatory / Branch Manager)57

Under Certificate of PostingDate: __ / __ / 10To,M/s/Mr. / Ms.________(Complete Name and Address of Client)Dear Sirs/Madam,Sub. : Non- Payment of outstanding dues/ debit balances in youraccount under client code No ________=================================================** strike whichever is not applicablePlease refer to our letter dated ______________, on the captioned subject.We regret to note that in spite of sufficient time has since elapsed; you have failed and neglected to pay to us theoutstanding dues / balances lying in your aforesaid account till date.Our representative has made numerous (Check) visits and telephonic calls to you to pay and clear the said outstandingdues but you have failed and neglected to pay the amount of outstanding dues or any part thereof. It is, therefore, clearthat you had absolutely no intention ab initio to make the payment but to cheat us.You are therefore, once again called upon to pay to us the aforesaid outstanding dues / debit balance of Rs.______/- immediately on the receipt of this letter failing which we will adopt such legal proceedings againstyou as may be advised to us to recover the said outstanding dues, which please note.Yours truly,For ** M/s. Anand <strong>Rathi</strong> Share and Stock Brokers LtdM/s. Anand <strong>Rathi</strong> Commodities Ltd(Authorised Signatory / Branch Manager)58