EasyETF Stoxx Europe 600 - BNP Paribas Investment Partners

EasyETF Stoxx Europe 600 - BNP Paribas Investment Partners

EasyETF Stoxx Europe 600 - BNP Paribas Investment Partners

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

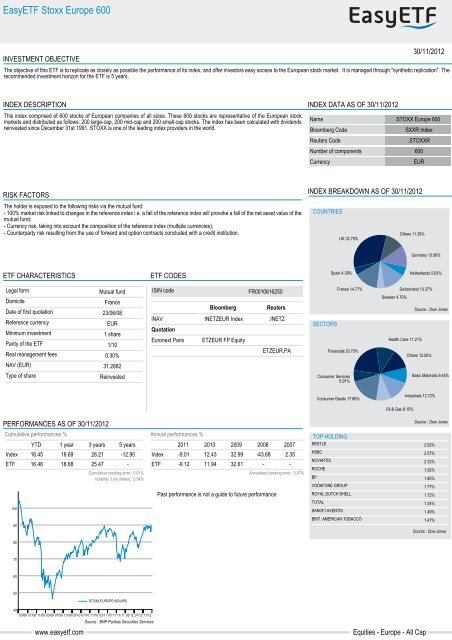

<strong>EasyETF</strong> <strong>Stoxx</strong> <strong>Europe</strong> <strong>600</strong>INVESTMENT OBJECTIVE30/11/2012The objective of this ETF is to replicate as closely as possible the performance of its index, and offer investors easy access to the <strong>Europe</strong>an stock market. It is managed through "synthetic replication". Therecommended investment horizon for the ETF is 5 years.INDEX DESCRIPTIONThis index comprised of <strong>600</strong> stocks of <strong>Europe</strong>an companies of all sizes. These <strong>600</strong> stocks are representative of the <strong>Europe</strong>an stockmarkets and distributed as follows: 200 large-cap, 200 mid-cap and 200 small-cap stocks. The index has been calculated with dividendsreinvested since December 31st 1991. STOXX is one of the leading index providers in the world.INDEX DATA AS OF 30/11/2012Name STOXX <strong>Europe</strong> <strong>600</strong>Bloomberg CodeSXXR IndexReuters Code.STOXXRNumber of components <strong>600</strong>CurrencyEURRISK FACTORSThe holder is exposed to the following risks via the mutual fund:- 100% market risk linked to changes in the reference index i.e. a fall of the reference index will provoke a fall of the net asset value of themutual fund;- Currency risk, taking into account the composition of the reference index (multiple currencies);- Counterparty risk resulting from the use of forward and option contracts concluded with a credit institution.INDEX BREAKDOWN AS OF 30/11/2012COUNTRIESOthers 11.39%UK 32.70%Germany 13.06%ETF CHARACTERISTICSETF CODESSpain 4.39%Netherlands 5.63%Legal formDomicileDate of first quotationReference currencyMinimum investmentParity of the ETFReal management feesNAV (EUR)Type of shareMutual fundFrance23/06/08EUR1 share1/100.30%31.2682ReinvestedISIN codeiNAVQuotationEuronext ParisBloombergINETZEUR IndexETZEUR FP EquityFR0010616250Reuters.INETZETZEUR.PASECTORSFrance 14.77%Financials 20.70%Consumer Services6.91%Switzerland 13.37%Sweden 4.70%Source : Dow JonesHealth Care 11.21%Others 12.00%Basic Materials 9.45%Consumer Goods 17.86%Industrials 12.72%Oil & Gas 9.15%PERFORMANCES AS OF 30/11/2012Source : Dow JonesCumulative performances %IndexETF10090YTD 1 year 3 years 5 years16.4516.4618.6918.6826.2125.47-12.90Cumulative tracking error : 0.01%Volatility 3 yrs (index) : 2.54%-Annual performances %2011 2010 2009 2008 2007Index -9.01 12.43 32.99 -43.68 2.35ETF -9.12 11.94 32.61 - -Annualised tracking error : 0.07%Past performance is not a guide to future performance.TOP HOLDINGNESTLEHSBCNOVARTISROCHEBPVODAFONE GROUPROYAL DUTCH SHELLTOTALSANOFI AVENTISBRIT. AMERICAN TOBACCO2.92%2.57%2.32%1.92%1.80%1.77%1.72%1.54%1.49%1.47%Source : Dow Jones80706050STOXX EUROPE <strong>600</strong> (NR)4003/08 07/08 11/08 03/09 07/09 11/09 03/10 07/10 11/10 03/11 07/11 11/11 03/12 07/12 11/12www.easyetf.comSource : <strong>BNP</strong> <strong>Paribas</strong> Securities ServicesEquities - <strong>Europe</strong> - All Cap

<strong>EasyETF</strong> <strong>Stoxx</strong> <strong>Europe</strong> <strong>600</strong>Approved for public sales inGermany, Austria, Chile, France, NetherlandsDelegated managerCustodianRecommended investment horizon (prospectus)Real management feesSubscription/redemption feesTransaction feesMarket makersAuthorised participantsTHEAM<strong>BNP</strong> PARIBAS SECURITIES SERVICES5 years0.30 %NilYes (brokerage fee of your financial intermediary)ALL SECURITIES B.V., <strong>BNP</strong> PARIBAS ARBITRAGEMORGAN STANLEY & CO. INTERNATIONAL LIMITED, TIMBER HILL (<strong>Europe</strong>) AG, FLOW TRADERS BV, UNICREDIT MARKETS& INVESTMENT BANKING, NYENBURGH BEHEER BV, OPTIVER, LABRANCHE STRUCTURED PRODUCTS EUROPE Lmt,NEWEDGE GROUP, NOMURA INTERNATIONAL PLC, IMC Trading BV,As a result of the partnership between <strong>BNP</strong> <strong>Paribas</strong> Asset Management and <strong>BNP</strong> <strong>Paribas</strong> Corporate& <strong>Investment</strong> Banking, <strong>EasyETF</strong> was developed from a shared ambition to create a major playerin the ETF market. The association of these two institutions ensures <strong>EasyETF</strong>’s access to a strong platform, integrating the various players indispensable in the development and trading of trackers:management companies, directors, trustees and market-makers. As a pioneer in numerous markets and asset classes, (the first tracker in the world with an index on commodity futures, the firsttracker in the world with a global index following Sharia guidelines, the first tracker in the world on Egypt, etc), <strong>EasyETF</strong> is equally recognised in <strong>Europe</strong> for its quality management and its capacityto be innovative, regularly offering new themes and asset classes.Institutional clients:- Asset Management: + 33 1 58 97 28 17- Execution: France & Benelux: + 33 1 57 43 86 05, Private Banking: + 33 1 40 14 30 63, Germany: + 49 69 71 93 31 08, Rest of <strong>Europe</strong>: + 44 207 595 8944Retail clients: France: 0 800 235 000, Italy: 800 92 40 43, Germany: 08000 267 267The <strong>Stoxx</strong> <strong>Europe</strong> <strong>600</strong> index is a brand of STOXX Limited, under licence to <strong>BNP</strong> <strong>Paribas</strong> Asset Management. <strong>EasyETF</strong> <strong>Stoxx</strong> <strong>Europe</strong> <strong>600</strong> is not sponsored, sold or promoted by STOXX Ltd. STOXXLtd does not provide any opinion on the advisability of investing in this product.This document has been produced for informational purposes only and does not constitute, and is not part of an offer to sell or subscribe, or a solicitation to buy or subscribe for shares of the fund;nor shall it form the basis of, or be relied upon in connection with, any contract or commitment whatsoever, nor be taken as investment advice.Noaction has been taken which would permit the publicoffering of the shares of the fund in any other jurisdiction other than those mentioned in the current document where such action would be required, including without limitation, in the United States,to US persons (as defined by Regulation S of the US Securities Act of 1933 as amended) or in the United Kingdom. This document should not be passed to any person for whom the fund is notauthorised for sale. We provide this document without knowledge of your situation. Prior to contracting with you, a suitability test will be performed. Prior to any subscription investors should verifythe conditions and all local legal constraints or restrictions theremaybe in connection with the subscription, purchase, possession or sale of the shares of the fund. Investors considering subscribingfor shares should read carefully the most recent prospectus of the fund and consult the fund's most recent financial reports. Applications may only be made on the terms and conditions contained inthe prospectus. The prospectus of the fund and the latest semi annual and annual reports are available on request from <strong>BNP</strong> <strong>Paribas</strong> Asset Management, TSA 47000, 75318 Paris Cedex 9 or fromthe website www.easyetf.com. Investors should consult their own legal and tax advisors prior to investing in the fund. Given the economic and market risks, there can benoassurance that the fundwill achieve its investment objectives. A decrease in the prices of stocks comprising the reference index may result in a decrease in the fund's net asset value, and accordingly the value of the sharesmay go down as well as up. The fund is only suitable for investors who understand the risks involved. Performance figures are shown gross of subscription and redemption fees if any as well as taxes.Past performance is not a guide to future performance.November 2012 - <strong>BNP</strong> <strong>Paribas</strong> Asset Management - Simplified joint-stock company with a capital of 62 845 552 euros - Registered office: 1, boulevard Haussmann 75009 Paris, France - RCS Paris 319 378 832www.easyetf.comEquities - <strong>Europe</strong> - All Cap