Secure 58 Brochure AW 26 08 09.cdr - Birla Sun Life Insurance

Secure 58 Brochure AW 26 08 09.cdr - Birla Sun Life Insurance

Secure 58 Brochure AW 26 08 09.cdr - Birla Sun Life Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

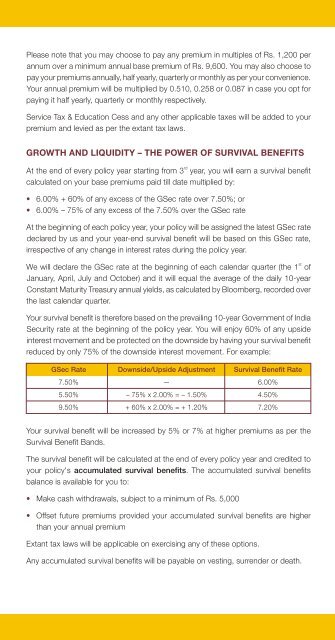

Please note that you may choose to pay any premium in multiples of Rs. 1,200 perannum over a minimum annual base premium of Rs. 9,600. You may also choose topay your premiums annually, half yearly, quarterly or monthly as per your convenience.Your annual premium will be multiplied by 0.510, 0.2<strong>58</strong> or 0.<strong>08</strong>7 in case you opt forpaying it half yearly, quarterly or monthly respectively.Service Tax & Education Cess and any other applicable taxes will be added to yourpremium and levied as per the extant tax laws.GROWTH AND LIQUIDITY – THE POWER OF SURVIVAL BENEFITSrdAt the end of every policy year starting from 3 year, you will earn a survival benefitcalculated on your base premiums paid till date multiplied by:••6.00% + 60% of any excess of the GSec rate over 7.50%; or6.00% – 75% of any excess of the 7.50% over the GSec rateAt the beginning of each policy year, your policy will be assigned the latest GSec ratedeclared by us and your year-end survival benefit will be based on this GSec rate,irrespective of any change in interest rates during the policy year.stWe will declare the GSec rate at the beginning of each calendar quarter (the 1 ofJanuary, April, July and October) and it will equal the average of the daily 10-yearConstant Maturity Treasury annual yields, as calculated by Bloomberg, recorded overthe last calendar quarter.Your survival benefit is therefore based on the prevailing 10-year Government of IndiaSecurity rate at the beginning of the policy year. You will enjoy 60% of any upsideinterest movement and be protected on the downside by having your survival benefitreduced by only 75% of the downside interest movement. For example:GSec Rate Downside/Upside Adjustment Survival Benefit Rate7.50% — 6.00%5.50% – 75% x 2.00% = – 1.50% 4.50%9.50% + 60% x 2.00% = + 1.20% 7.20%Your survival benefit will be increased by 5% or 7% at higher premiums as per theSurvival Benefit Bands.The survival benefit will be calculated at the end of every policy year and credited toyour policy's accumulated survival benefits. The accumulated survival benefitsbalance is available for you to:• Make cash withdrawals, subject to a minimum of Rs. 5,000• Offset future premiums provided your accumulated survival benefits are higherthan your annual premiumExtant tax laws will be applicable on exercising any of these options.Any accumulated survival benefits will be payable on vesting, surrender or death.