Accelerated Terminal Illness Rider - Birla Sun Life Insurance

Accelerated Terminal Illness Rider - Birla Sun Life Insurance

Accelerated Terminal Illness Rider - Birla Sun Life Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

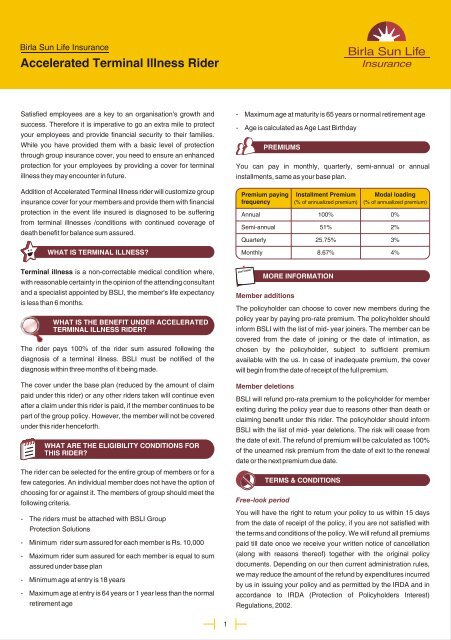

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> <strong>Insurance</strong><strong>Accelerated</strong> <strong>Terminal</strong> <strong>Illness</strong> <strong>Rider</strong>Satisfied employees are a key to an organisation's growth andsuccess. Therefore it is imperative to go an extra mile to protectyour employees and provide financial security to their families.While you have provided them with a basic level of protectionthrough group insurance cover, you need to ensure an enhancedprotection for your employees by providing a cover for terminalillness they may encounter in future.Addition of <strong>Accelerated</strong> <strong>Terminal</strong> <strong>Illness</strong> rider will customize groupinsurance cover for your members and provide them with financialprotection in the event life insured is diagnosed to be sufferingfrom terminal illnesses /conditions with continued coverage ofdeath benefit for balance sum assured.WHAT IS TERMINAL ILLNESS?- Maximum age at maturity is 65 years or normal retirement age- Age is calculated as Age Last BirthdayPREMIUMSYou can pay in monthly, quarterly, semi-annual or annualinstallments, same as your base plan.Premium paying Installment Premium Modal loadingfrequency (% of annualized premium) (% of annualized premium)Annual 100% 0%Semi-annual 51% 2%Quarterly 25.75% 3%Monthly 8.67% 4%<strong>Terminal</strong> illness is a non-correctable medical condition where,with reasonable certainty in the opinion of the attending consultantand a specialist appointed by BSLI, the member's life expectancyis less than 6 months.The rider pays 100% of the rider sum assured following thediagnosis of a terminal illness. BSLI must be notified of thediagnosis within three months of it being made.The cover under the base plan (reduced by the amount of claimpaid under this rider) or any other riders taken will continue evenafter a claim under this rider is paid, if the member continues to bepart of the group policy. However, the member will not be coveredunder this rider henceforth.The rider can be selected for the entire group of members or for afew categories. An individual member does not have the option ofchoosing for or against it. The members of group should meet thefollowing criteria.- The riders must be attached with BSLI GroupProtection Solutions- Minimum rider sum assured for each member is Rs. 10,000- Maximum rider sum assured for each member is equal to sumassured under base plan- Minimum age at entry is 18 years- Maximum age at entry is 64 years or 1 year less than the normalretirement ageWHAT IS THE BENEFIT UNDER ACCELERATEDTERMINAL ILLNESS RIDER?WHAT ARE THE ELIGIBILITY CONDITIONS FORTHIS RIDER?MORE INFORMATIONMember additionsThe policyholder can choose to cover new members during thepolicy year by paying pro-rate premium. The policyholder shouldinform BSLI with the list of mid- year joiners. The member can becovered from the date of joining or the date of intimation, aschosen by the policyholder, subject to sufficient premiumavailable with the us. In case of inadequate premium, the coverwill begin from the date of receipt of the full premium.Member deletionsBSLI will refund pro-rata premium to the policyholder for memberexiting during the policy year due to reasons other than death orclaiming benefit under this rider. The policyholder should informBSLI with the list of mid- year deletions. The risk will cease fromthe date of exit. The refund of premium will be calculated as 100%of the unearned risk premium from the date of exit to the renewaldate or the next premium due date.TERMS & CONDITIONSFree-look periodYou will have the right to return your policy to us within 15 daysfrom the date of receipt of the policy, if you are not satisfied withthe terms and conditions of the policy. We will refund all premiumspaid till date once we receive your written notice of cancellation(along with reasons thereof) together with the original policydocuments. Depending on our then current administration rules,we may reduce the amount of the refund by expenditures incurredby us in issuing your policy and as permitted by the IRDA and inaccordance to IRDA (Protection of Policyholders Interest)Regulations, 2002.1

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> <strong>Insurance</strong><strong>Accelerated</strong> <strong>Terminal</strong> <strong>Illness</strong> <strong>Rider</strong>About <strong>Sun</strong> <strong>Life</strong> Financial<strong>Sun</strong> <strong>Life</strong> Financial is a leading international financial servicesorganization providing a diverse range of protection and wealthaccumulation products and services to individuals and corporatecustomers. Chartered in 1865, <strong>Sun</strong> <strong>Life</strong> Financial and its partnerstoday have operations in key markets worldwide, includingCanada, the United States, the United Kingdom, Ireland, HongKong, the Philippines, Japan, Indonesia, India, China andBermuda. As of June 30, 2010, the <strong>Sun</strong> <strong>Life</strong> Financial group ofcompanies had total assets under management of $434 billion.For more information, please visit www.sunlife.com<strong>Sun</strong> <strong>Life</strong> Financial Inc. trades on the Toronto (TSX), New York(NYSE) and Philippine (PSE) stock exchange under the tickersymbol SLF.DISCLAIMERBSLI <strong>Accelerated</strong> <strong>Terminal</strong> <strong>Illness</strong> rider is underwritten by <strong>Birla</strong><strong>Sun</strong> <strong>Life</strong> <strong>Insurance</strong> Company Limited (BSLI). This is a nonparticipatingtraditional terminal illness rider. Unless otherwisespecifically stated all terms & conditions are guaranteed duringpolicy term. BSLI reserves the right to recover levies such as theService Tax and Education Cess levied by the authorities oninsurance transactions. If there be any additional levies, they toowould be recovered from you. This brochure contains only thesalient features of the rider. For further details please refer to thepolicy contract. <strong>Insurance</strong> is a subject matter of the solicitation.For more details and clarification call BSLI at 1-800-270-7000.Call: 1-800-270-7000 www.birlasunlife.com sms BSLI to 56161Regd. Office: <strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> <strong>Insurance</strong> Company Limited, One Indiabulls Centre, Tower 1, 15th & 16th Floor, Jupiter Mill Compound, 841, Senapati BapatMarg, Elphinstone Road, Mumbai - 400 013. Reg. No.109 Unique No.: 109B022V01 ADV/X/XX-XX/XXXX VER 1/March/20113