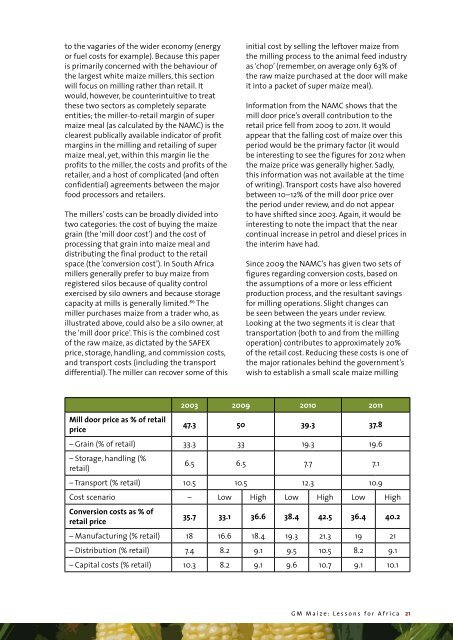

to the vagaries of the wider economy (energyor fuel costs for example). Because this paperis primarily concerned with the behaviour ofthe largest white maize millers, this sectionwill focus on milling rather than retail. Itwould, however, be counterintuitive to treatthese two sectors as completely separateentities; the miller-to-retail margin of supermaize meal (as calculated by the NAMC) is theclearest publically available indicator of profitmargins in the milling and retailing of supermaize meal, yet, within this margin lie theprofits to the miller, the costs and profits of theretailer, and a host of complicated (and oftenconfidential) agreements between the majorfood processors and retailers.The millers’ costs can be broadly divided intotwo categories: the cost of buying the maizegrain (the ‘mill door cost’) and the cost ofprocessing that grain into maize meal anddistributing the final product to the retailspace (the ‘conversion cost’). In South Africamillers generally prefer to buy maize fromregistered silos because of quality controlexercised by silo owners and because storagecapacity at mills is generally limited. 86 Themiller purchases maize from a trader who, asillustrated above, could also be a silo owner, atthe ‘mill door price’. This is the combined costof the raw maize, as dictated by the SAFEXprice, storage, handling, and commission costs,and transport costs (including the transportdifferential). The miller can recover some of thisinitial cost by selling the leftover maize fromthe milling process to the animal feed industryas ‘chop’ (remember, on average only 63% ofthe raw maize purchased at the door will makeit into a packet of super maize meal).Information from the NAMC shows that themill door price’s overall contribution to theretail price fell from 2009 to 2011. It wouldappear that the falling cost of maize over thisperiod would be the primary factor (it wouldbe interesting to see the figures for 2012 whenthe maize price was generally higher. Sadly,this information was not available at the timeof writing). Transport costs have also hoveredbetween 10–12% of the mill door price overthe period under review, and do not appearto have shifted since 2003. Again, it would beinteresting to note the impact that the nearcontinual increase in petrol and diesel prices inthe interim have had.Since 2009 the NAMC’s has given two sets offigures regarding conversion costs, based onthe assumptions of a more or less efficientproduction process, and the resultant savingsfor milling operations. Slight changes canbe seen between the years under review.Looking at the two segments it is clear thattransportation (both to and from the millingoperation) contributes to approximately 20%of the retail cost. Reducing these costs is one ofthe major rationales behind the government’swish to establish a small scale maize milling2003 2009 2010 2011Mill door price as % of retailprice47.3 50 39.3 37.8– Grain (% of retail) 33.3 33 19.3 19.6– Storage, handling (%retail)6.5 6.5 7.7 7.1– Transport (% retail) 10.5 10.5 12.3 10.9Cost scenario – Low High Low High Low HighConversion costs as % ofretail price35.7 33.1 36.6 38.4 42.5 36.4 40.2– Manufacturing (% retail) 18 16.6 18.4 19.3 21.3 19 21– Distribution (% retail) 7.4 8.2 9.1 9.5 10.5 8.2 9.1– Capital costs (% retail) 10.3 8.2 9.1 9.6 10.7 9.1 10.1<strong>GM</strong> <strong>Maize</strong>: Lessons for Africa 21

industry in South Africa (see box p.25).The power of the major milling companies toinfluence the price of maize was spectacularlyillustrated in 2003, when the Food PriceMonitoring Committee (FPMC) found‘asymmetric price transmission’ in the maizesector during the rapid price increases aroundthat time. Even though there should have beena four month lag between the SAFEX (spot)price and the retail price, millers responded bytransmitting price increases to the consumerimmediately. When spot prices started todecline, these lower costs to the millers werenot transmitted to consumers until muchlater. 87Today the industry for white maize milling inSouth Africa is still dominated by three firms:Tiger Brands, Premier Foods, and Pioneer Foods,who mill approximately 60% of the nation’swhite maize crop between them. 88 This levelof concentration is in stark contrast to othercountries with large, well developed agroprocessingindustries. The milling industryin the United States is fragmented, with thetop 25 companies accounting for 25% of theindustry’s revenue. In the UK there are around30 companies, with the top accounting forapproximately 40% of production and a further20 companies producing ‘significant quantities’of flour. In the European Union the numberof flour milling companies exceeds 3,000, ofwhich a large majority are small and mediumenterprises. 89The South African food retail sector isequally concentrated. The largest fivecompanies, Shoprite / Checkers, Pick n Pay,Spar, Woolworths, and Massmart (Wallmart)control 60% of the entire food retail market.In the formal market this is even morepronounced, with Shoprite (36%), Pick n Pay,and Spar (both 28%) controlling 92% of themarket. 90 Though the formal supermarketchains have only recently begun trading inSouth Africa’s townships, in competition withthousands of informal spaza shops, in a surveyconducted in Johannesburg, just over onethird of respondents purchased food fromsupermarkets at least once a week, leading thestudy’s authors to conclude that supermarketsare predominantly used by the urban poor topurchase staple items, including maize meal. 91During 2009 and 2010 the CompetitionCommission investigated the retail of keystaple foods, including maize, bread, poultry,and milk, by Pick n Pay, Shoprite/Checkers,Woolworths, and Spar, as well as thewholesale retailers, Massmart and Metcash.The investigation had been launched amidconcerns over rising food costs, increasingfarm-to-retail price spreads, high marketconcentration, significant barriers to entryand high profit margins of the major retailers.Though the Commission found insufficientevidence to show contraventions of theCompetition Act, it noted with concern theimpact that information exchange (via thirdpartymarket research companies such as ACNielsen and Synovate) could have upon thesupply level of the retail system. In addition,the investigation did little to alleviate theCommission’s concerns over barriers to entry ofsmall suppliers to supermarkets. 92As can be seen below, from 2009 to 2011 themiller-to-retail margin of super maize meal,even allowing for varying production costscenarios, has clearly been rising.Though no recent information on the millerto-retailmargin is available, recent pricemovements, together with the healthyoperating profits reported by the three majormillers (more below) suggest that thesemargins are unlikely to be falling. From July2012 to July 2013 the SAFEX white maize pricefell by 10.88%, yet the urban price of 5 kg ofsuper maize meal only fell by 0.08%. The priceof special maize meal actually rose, albeit byonly 0.79%. In rural areas from April 2012 to July2003 2009 2010 2011Cost scenario – Low High Low High Low HighMiller to retail margin(% of retail price)17 17 13.5 22.2 18.2 25.9 22.122 AFRICAN CENTRE FOR BIOSAFETY