Ralos New Energies AG

Ralos New Energies AG

Ralos New Energies AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Ralos</strong> <strong>New</strong> <strong>Energies</strong> <strong>AG</strong><br />

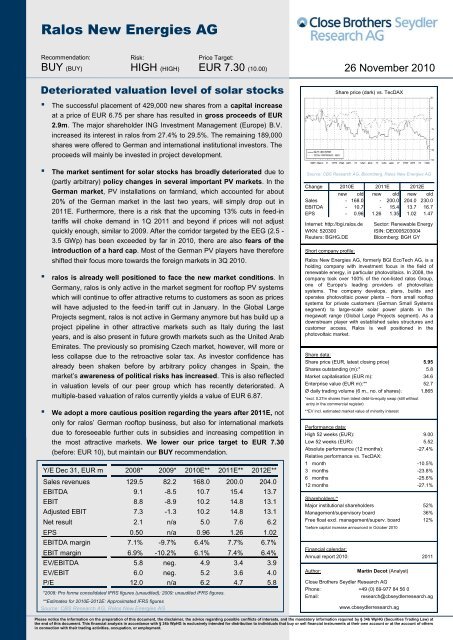

Recommendation:<br />

BUY (BUY)<br />

Risk:<br />

HIGH (HIGH)<br />

Price Target:<br />

EUR 7.30 (10.00)<br />

Deteriorated valuation level of solar stocks<br />

▪ The successful placement of 429,000 new shares from a capital increase<br />

at a price of EUR 6.75 per share has resulted in gross proceeds of EUR<br />

2.9m. The major shareholder ING Investment Management (Europe) B.V.<br />

increased its interest in ralos from 27.4% to 29.5%. The remaining 189,000<br />

shares were offered to German and international institutional investors. The<br />

proceeds will mainly be invested in project development.<br />

▪ The market sentiment for solar stocks has broadly deteriorated due to<br />

(partly arbitrary) policy changes in several important PV markets. In the<br />

German market, PV installations on farmland, which accounted for about<br />

20% of the German market in the last two years, will simply drop out in<br />

2011E. Furthermore, there is a risk that the upcoming 13% cuts in feed-in<br />

tariffs will choke demand in 1Q 2011 and beyond if prices will not adjust<br />

quickly enough, similar to 2009. After the corridor targeted by the EEG (2.5 -<br />

3.5 GWp) has been exceeded by far in 2010, there are also fears of the<br />

introduction of a hard cap. Most of the German PV players have therefore<br />

shifted their focus more towards the foreign markets in 3Q 2010.<br />

▪ ralos is already well positioned to face the new market conditions. In<br />

Germany, ralos is only active in the market segment for rooftop PV systems<br />

which will continue to offer attractive returns to customers as soon as prices<br />

will have adjusted to the feed-in tariff cut in January. In the Global Large<br />

Projects segment, ralos is not active in Germany anymore but has build up a<br />

project pipeline in other attractive markets such as Italy during the last<br />

years, and is also present in future growth markets such as the United Arab<br />

Emirates. The previously so promising Czech market, however, will more or<br />

less collapse due to the retroactive solar tax. As investor confidence has<br />

already been shaken before by arbitrary policy changes in Spain, the<br />

market’s awareness of political risks has increased. This is also reflected<br />

in valuation levels of our peer group which has recently deteriorated. A<br />

multiple-based valuation of ralos currently yields a value of EUR 6.87.<br />

▪ We adopt a more cautious position regarding the years after 2011E, not<br />

only for ralos’ German rooftop business, but also for international markets<br />

due to foreseeable further cuts in subsidies and increasing competition in<br />

the most attractive markets. We lower our price target to EUR 7.30<br />

(before: EUR 10), but maintain our BUY recommendation.<br />

Y/E Dec 31, EUR m 2008* 2009* 2010E** 2011E** 2012E**<br />

Sales revenues 129.5 82.2 168.0 200.0 204.0<br />

EBITDA 9.1 -8.5 10.7 15.4 13.7<br />

EBIT 8.8 -8.9 10.2 14.8 13.1<br />

Adjusted EBIT 7.3 -1.3 10.2 14.8 13.1<br />

Net result 2.1 n/a 5.0 7.6 6.2<br />

EPS 0.50 n/a 0.96 1.26 1.02<br />

EBITDA margin 7.1% -9.7% 6.4% 7.7% 6.7%<br />

EBIT margin 6.9% -10.2% 6.1% 7.4% 6.4%<br />

EV/EBITDA 5.8 neg. 4.9 3.4 3.9<br />

EV/EBIT 6.0 neg. 5.2 3.6 4.0<br />

P/E 12.0 n/a 6.2 4.7 5.8<br />

*2008: Pro forma consolidated IFRS figures (unaudited); 2009: unaudited IFRS figures.<br />

**Estimates for 2010E-2012E: Approximated IFRS figures<br />

Source: CBS Research <strong>AG</strong>, <strong>Ralos</strong> <strong>New</strong> <strong>Energies</strong> <strong>AG</strong><br />

26 November 2010<br />

Share price (dark) vs. TecDAX<br />

Source: CBS Research <strong>AG</strong>, Bloomberg, <strong>Ralos</strong> <strong>New</strong> <strong>Energies</strong> <strong>AG</strong><br />

Change 2010E 2011E 2012E<br />

new old new old new old<br />

Sales - 168.0 - 200.0 204.0 230.0<br />

EBITDA - 10.7 - 15.4 13.7 16.7<br />

EPS<br />

- 0.96 1.26 1.35 1.02 1.47<br />

Internet: http://bgi.ralos.de Sector: Renewable Energy<br />

WKN: 520300 ISIN: DE0005203004<br />

Reuters: BGHG.DE<br />

Bloomberg: BGH GY<br />

Short company profile:<br />

<strong>Ralos</strong> <strong>New</strong> <strong>Energies</strong> <strong>AG</strong>, formerly BGI EcoTech <strong>AG</strong>, is a<br />

holding company with investment focus in the field of<br />

renewable energy, in particular photovoltaics. In 2008, the<br />

company took over 100% of the non-listed ralos Group,<br />

one of Europe’s leading providers of photovoltaic<br />

systems. The company develops, plans, builds and<br />

operates photovoltaic power plants – from small rooftop<br />

systems for private customers (German Small Systems<br />

segment) to large-scale solar power plants in the<br />

megawatt range (Global Large Projects segment). As a<br />

downstream player with established sales structures and<br />

customer access, <strong>Ralos</strong> is well positioned in the<br />

photovoltaic market.<br />

Share data:<br />

Share price (EUR, latest closing price) 5.95<br />

Shares outstanding (m):*<br />

5.8<br />

Market capitalisation (EUR m): 34.6<br />

Enterprise value (EUR m):** 52.7<br />

Ø daily trading volume (6 m., no. of shares): 1,865<br />

*excl. 0.27m shares from latest debt-to-equity swap (still without<br />

entry in the commercial register)<br />

**EV incl. estimated market value of minority interest<br />

Performance data:<br />

High 52 weeks (EUR): 9.00<br />

Low 52 weeks (EUR): 5.52<br />

Absolute performance (12 months):<br />

Relative performance vs. TecDAX:<br />

-27.4%<br />

1 month -10.5%<br />

3 months -23.8%<br />

6 months -25.6%<br />

12 months -27.1%<br />

Shareholders:*<br />

Major institutional shareholders 52%<br />

Management/supervisory board 36%<br />

Free float excl. management/superv. board 12%<br />

*before capital increase announced in October 2010<br />

Financial calendar:<br />

Annual report 2010: 2011<br />

Author: Martin Decot (Analyst)<br />

Close Brothers Seydler Research <strong>AG</strong><br />

Phone: +49 (0) 69-977 84 56 0<br />

Email: research@cbseydlerresearch.ag<br />

www.cbseydlerresearch.ag<br />

Please notice the information on the preparation of this document, the disclaimer, the advice regarding possible conflicts of interests, and the mandatory information required by § 34b WpHG (Securities Trading Law) at<br />

the end of this document. This financial analysis in accordance with § 34b WpHG is exclusively intended for distribution to individuals that buy or sell financial instruments at their own account or at the account of others<br />

in connection with their trading activities, occupation, or employment.

<strong>Ralos</strong> <strong>New</strong> <strong>Energies</strong> <strong>AG</strong><br />

Appendix<br />

Changes in sales and earnings estimates<br />

Source: CBS Research <strong>AG</strong><br />

Valuation summary*<br />

Source: CBS Research <strong>AG</strong><br />

EURm<br />

*Nota bene: All cash of ralos, including the cash inflow from the recent capital<br />

increase, is assumed to be required for operations and therefore not considered as<br />

excess cash in our valuation.<br />

www.cbseydlerresearch.ag<br />

2010E 2011E<br />

2012E<br />

new old new old new old<br />

Sales - 168.0 - 200.0 204.0 230.0<br />

EBITDA - 10.7 - 15.4 13.7 16.7<br />

EBIT - 10.2 - 14.8 13.1 16.1<br />

Net income - 5.0 - 7.6 6.2 8.3<br />

EPS (EUR) - 0.96 1.26 1.35 1.02 1.47<br />

Weighting Fair value<br />

factor per share<br />

Peer group valuation 50.0% 6.87<br />

DCF valuation 50.0% 7.82<br />

Fair value per share (EUR) 7.35<br />

Close Brothers Seydler Research <strong>AG</strong> | 2

<strong>Ralos</strong> <strong>New</strong> <strong>Energies</strong> <strong>AG</strong><br />

Multiple-based valuation<br />

Company name<br />

*excl. 266,700 shares from latest debt-to-equity swap (still without entry in the commercial register); the correlating debt is included in the financial debt<br />

Source: CBS Research <strong>AG</strong>, Bloomberg<br />

Discounted Cash Flow Model<br />

* Net capital expenditure excluding cash outflow due from earn-out agreement (purchase of <strong>Ralos</strong>); the corresponding debt is included in the financial debt<br />

** All cash of ralos, including the cash inflow from the recent capital increase, is assumed to be required for operations and therefore not considered as<br />

excess cash in our valuation.<br />

***excl. 266,700 shares from latest debt-to-equity swap (still without entry in the commercial register); the correlating debt is included in the financial debt<br />

Source: CBS Research <strong>AG</strong><br />

www.cbseydlerresearch.ag<br />

P / E EV / EBIT EV / EBITDA<br />

2010E 2011E 2012E 2010E 2011E 2012E 2010E 2011E 2012E<br />

CENTROSOLAR Group <strong>AG</strong> 5.3 5.0 4.3 4.9 4.8 4.2 3.7 4.0 3.8<br />

Payom Solar <strong>AG</strong> 4.9 4.3 3.7 3.1 2.8 2.7 3.0 2.7 2.7<br />

Phoenix Solar <strong>AG</strong> 5.8 6.5 5.8 5.1 6.3 5.5 5.2 5.9 5.4<br />

S.A.G. Solarstrom <strong>AG</strong> 8.3 5.5 6.3 8.2 5.9 5.6 6.9 5.0 4.7<br />

Average 6.1 5.4 5.0 5.3 4.9 4.5 4.7 4.4 4.1<br />

Median 5.5 5.3 5.1 5.0 5.4 4.8 4.4 4.5 4.2<br />

Minimum 4.9 4.3 3.7 3.1 2.8 2.7 3.0 2.7 2.7<br />

Maximum 8.3 6.5 6.3 8.2 6.3 5.6 6.9 5.9 5.4<br />

EURm, except EPS (EUR)<br />

EPS EBIT EBITDA<br />

2010E 2011E 2012E 2010E 2011E 2012E 2010E 2011E 2012E<br />

<strong>Ralos</strong> <strong>New</strong> <strong>Energies</strong>: Financial estimates by CBSR <strong>AG</strong> 0.96 1.26 1.02 10.2 14.8 13.1 10.7 15.4 13.7<br />

Applied multiples: Median of the peer group multiples 5.5 5.3 5.1 5.0 5.4 4.8 4.4 4.5 4.2<br />

Fair Enterprise Value - - - 51.3 79.7 63.2 47.3 69.5 57.9<br />

- Net financial debt<br />

-13.4<br />

- Estimated market value of minority interest -4.7<br />

Fair value of equity derived from each multiple 30.8 38.6 30.1 33.1 61.5 45.0 29.1 51.4 39.8<br />

Average = Fair value of equity 39.9<br />

No. of shares outstanding (m)*<br />

5.8<br />

Fair value per share (EUR) 6.87<br />

PHASE 1 PHASE 2 PHASE 3<br />

EURm 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E<br />

Total output 168.0 200.0 204.0 214.2 224.9 236.2 245.6 253.0 259.3 264.5<br />

Y-o-Y growth 92.7% 19.1% 2.0% 5.0% 5.0% 5.0% 4.0% 3.0% 2.5% 2.0%<br />

EBIT 10.2 14.8 13.1 11.4 11.7 11.8 11.7 11.4 11.7 10.6<br />

EBIT margin 6.09% 7.41% 6.41% 5.30% 5.20% 5.00% 4.75% 4.50% 4.50% 4.00%<br />

Income tax on EBIT -2.9 -4.5 -4.0 -3.5 -3.6 -3.6 -3.6 -3.5 -3.6 -3.3<br />

Depreciation and amortisation 0.5 0.5 0.6 0.3 0.3 0.4 0.3 0.2 0.1 0.2<br />

Change in net working capital -5.0 -6.3 -2.1 -2.6 -2.7 -2.8 -2.4 -1.8 -1.6 -1.3<br />

Net capital expenditure* -0.3 -0.4 -0.4 -0.4 -0.5 -0.4 -0.3 -0.1 -0.2 -0.2<br />

Free cash flow 2.4 4.1 7.2 5.2 5.3 5.3 5.7 6.1 6.4 6.0<br />

Present values 2.4 3.7 5.8 3.8 3.5 3.2 3.1 3.0 2.8 2.4 30.0<br />

Present value Phase 1 11.9 Risk free rate 3.50% Target equity ratio 75.0%<br />

Present value Phase 2 21.7 Equity risk premium 6.00% Beta 1.40<br />

Present value Phase 3 30.0 Debt risk premium 3.50% WACC 10.13%<br />

Total present value 63.6 Tax shield (Phase 3) 30.9% Terminal growth 2.00%<br />

+ Excess cash** 0.0<br />

- Financial debt/Liab. to associated persons -13.4<br />

- Est. market value of minority interest -4.7 1.0% 1.5% 2.0% 2.5% 3.0%<br />

Fair value of equity 45.4 9.13% 8.51 8.90 9.35 9.87 10.48<br />

No. of shares outstanding (m)***<br />

Sensitivity analysis<br />

Terminal growth (Phase 3)<br />

9.63% 7.82 8.16 8.54 8.97 9.47<br />

5.8 WACC 10.13% 7.21 7.49 7.82 8.18 8.60<br />

10.63% 6.66 6.91 7.18 7.49 7.84<br />

Fair value per share (EUR) 7.82 11.13% 6.16 6.38 6.61 6.88 7.18<br />

Close Brothers Seydler Research <strong>AG</strong> | 3<br />

8

<strong>Ralos</strong> <strong>New</strong> <strong>Energies</strong> <strong>AG</strong><br />

Research<br />

Schillerstrasse 27 - 29<br />

60313 Frankfurt am Main<br />

Phone: +49 (0)69 – 977 8456-0<br />

Roger Peeters +49 (0)69 -977 8456- 12<br />

CEO Roger.Peeters@cbseydlerresearch.ag<br />

Martin Decot +49 (0)69 -977 8456- 13 Rabeya Khan +49 (0)69 -977 8456- 10<br />

Martin.Decot@cbseydlerresearch.ag Rabeya.Khan@cbseydlerresearch.ag<br />

Igor Kim +49 (0)69 -977 8456- 15 Ralf Marinoni +49 (0)69 -977 8456- 17<br />

Igor.Kim@cbseydlerresearch.ag Ralf.Marinoni@cbseydlerresearch.ag<br />

Manuel Martin +49 (0)69 -977 8456- 16 Enid Omerovic +49 (0)69 -977 8456- 19<br />

Manuel.Martin@cbseydlerresearch.ag Enid.Omerovic@cbseydlerresearch.ag<br />

Marcus Silbe +49 (0)69 -977 8456- 14 Veysel Taze +49 (0)69 -977 8456- 18<br />

Marcus.Silbe@cbseydlerresearch.ag Veysel.Taze@cbseydlerresearch.ag<br />

Institutional Sales<br />

a division of Winterflood Securities Limited<br />

Schillerstrasse 27 – 29 The Atrium Building / Cannon Bridge<br />

60313 Frankfurt am Main 25 Dowgate Hill<br />

London EC4R 2GA<br />

Phone: +49 (0)69 – 9 20 54-400 Phone: +44 20 3100 0281<br />

Raimar Bock +49 (0)69 -9 20 54-115<br />

Head of Sales Raimar.Bock@cbseydler.com<br />

Rüdiger Eich +49 (0)69 -9 20 54-119 Uwe Gerhardt +49 (0)69 -9 20 54-168<br />

(Germany, Switzerland) Ruediger.Eich@cbseydler.com (Germany, Switzerland) Uwe.Gerhardt@cbseydler.com<br />

Klaus Korzilius +49 (0)69 -9 20 54-114 Stefan Krewinkel +49 (0)69 -9 20 54-118<br />

(Austria, Benelux, Germany) Klaus.Korzilius@cbseydler.com (Execution, UK) Stefan.Krewinkel@cbseydler.com<br />

Markus Laifle +49 (0)69 -9 20 54-120 Bruno de Lencquesaing +49 (0)69 -9 20 54-116<br />

(Execution) Markus.Laifle@cbseydler.com (Benelux, France) Bruno.deLencquesaing@cbseydler.com<br />

Sales USA<br />

111 Town Square Place<br />

Suite 1500A<br />

Jersey City, NJ 07310<br />

Phone: +1 201 216 0100<br />

Tom Higgins +1 201 706 6013<br />

thiggins@hudsonsecurities.com<br />

www.cbseydlerresearch.ag<br />

Close Brothers Seydler Research <strong>AG</strong> | 4

<strong>Ralos</strong> <strong>New</strong> <strong>Energies</strong> <strong>AG</strong><br />

Disclaimer and statement according to § 34b German Securities Trading Act<br />

(“Wertpapierhandelsgesetz”) in combination with the provisions on financial analysis<br />

(“Finanzanalyseverordnung” FinAnV)<br />

This report has been prepared independently of the company analysed by Close Brothers Seydler Research <strong>AG</strong><br />

and/ or its cooperation partners and the analyst(s) mentioned on the front page (hereafter all are jointly and/or<br />

individually called the ‘author’). None of Close Brothers Seydler Research <strong>AG</strong>, Close Brothers Seydler Bank <strong>AG</strong> or<br />

its cooperation partners, the Company or its shareholders has independently verified any of the information given<br />

in this document.<br />

Section 34b of the German Securities Trading Act in combination with the FinAnV requires an enterprise preparing<br />

a security analysis to point out possible conflicts of interest with respect to the company that is the subject of the<br />

analysis.<br />

Close Brothers Seydler Research <strong>AG</strong> is a majority owned subsidiary of Close Brothers Seydler Bank <strong>AG</strong> (hereafter<br />

´CBS´). However, Close Brothers Seydler Research <strong>AG</strong> (hereafter ´CBSR´) provides its research work<br />

independent from CBS. CBS is offering a wide range of Services not only including investment banking services<br />

and liquidity providing services (designated sponsoring). CBS or CBSR may possess relations to the covered<br />

companies as follows (additional information and disclosures will be made available upon request):<br />

a. CBS holds more than 5% interest in the capital stock of the company that is subject of the analysis.<br />

b. CBS was a participant in the management of a (co)consortium in a selling agent function for the issuance of<br />

financial instruments, which themselves or their issuer is the subject of this financial analysis within the last<br />

twelve months.<br />

c. CBS has provided investment banking and/or consulting services during the last 12 months for the company<br />

analysed for which compensation has been or will be paid for.<br />

d. CBS acts as designated sponsor for the company's securities on the basis of an existing designated<br />

sponsorship contract. The services include the provision of bid and ask offers. Due to the designated<br />

sponsoring service agreement CBS may regularly possess shares of the company and receives a<br />

compensation and/ or provision for its services.<br />

e. The designated sponsor service agreement includes a contractually agreed provision for research services.<br />

f. CBSR and the analysed company have a contractual agreement about the preparation of research reports.<br />

CBSR receives a compensation in return.<br />

g. CBS has a significant financial interest in relation to the company that is subject of this analysis.<br />

In this report, the following conflicts of interests are given at the time, when the report has been published: d, f<br />

CBS and/or its employees or clients may take positions in, and may make purchases and/ or sales as principal or<br />

agent in the securities or related financial instruments discussed in this analysis. CBS may provide investment<br />

banking, consulting, and/ or other services to and/ or serve as directors of the companies referred to in this<br />

analysis. No part of the authors compensation was, is or will be directly or indirectly related to the<br />

recommendations or views expressed.<br />

Recommendation System:<br />

Close Brothers Seydler Research <strong>AG</strong> uses a 3-level absolute share rating system. The ratings pertain to a time<br />

horizon of up to 6 months:<br />

BUY: The expected performance of the share price is above +10%.<br />

HOLD: The expected performance of the share price is between 0% and +10%.<br />

SELL: The expected performance of the share price is below 0%.<br />

Recommendation history over the last 12 months for the company analysed in this report:<br />

Date Recommendation Price at change date Price Target<br />

13 January 2010 Buy EUR 8.19 EUR 14.60<br />

3 May 2010 Buy EUR 7.58 EUR 14.00<br />

30 July 2010 Buy EUR 7.31 EUR 14.00<br />

8 October 2010 Buy EUR 7.30 EUR 10.00<br />

26 November 2010 Buy EUR 5.95 EUR 7.30<br />

www.cbseydlerresearch.ag<br />

Close Brothers Seydler Research <strong>AG</strong> | 5

<strong>Ralos</strong> <strong>New</strong> <strong>Energies</strong> <strong>AG</strong><br />

Risk-scaling System:<br />

Close Brothers Seydler Research <strong>AG</strong> uses a 3-level risk-scaling system. The ratings pertain to a time horizon of up<br />

to 6 months:<br />

LOW: The volatility is expected to be lower than the volatility of the benchmark<br />

MEDIUM: The volatility is expected to be equal to the volatility of the benchmark<br />

HIGH: The volatility is expected to be higher than the volatility of the benchmark<br />

The following valuation methods are used when valuing companies: Multiplier models (price/earnings, price/cash<br />

flow, price/book value, EV/Sales, EV/EBIT, EV/EBITA, EV/EBITDA), peer group comparisons, historical valuation<br />

approaches, discounting models (DCF, DDM), break-up value approaches or asset valuation approaches. The<br />

valuation models are dependent upon macroeconomic measures such as interest, currencies, raw materials and<br />

assumptions concerning the economy. In addition, market moods influence the valuation of companies.<br />

The figures taken from the income statement, the cash flow statement and the balance sheet upon which the<br />

evaluation of companies is based are estimates referring to given dates and therefore subject to risks.<br />

These may change at any time without prior notice.<br />

The opinions and forecasts contained in this report are those of the author alone. Material sources of information<br />

for preparing this report are publications in domestic and foreign media such as information services (including but<br />

not limited to Reuters, VWD, Bloomberg, DPA-AFX), business press (including but not limited to Börsenzeitung,<br />

Handelsblatt, Frankfurter Allgemeine Zeitung, Financial Times), professional publications, published statistics,<br />

rating agencies as well as publications of the analysed issuers. Furthermore, discussions were held with the<br />

management for the purpose of preparing the analysis. Potentially parts of the analysis have been provided to the<br />

issuer prior to going to press; no significant changes were made afterwards, however. Any information in this<br />

report is based on data considered to be reliable, but no representations or guarantees are made by the author<br />

with regard to the accuracy or completeness of the data. The opinions and estimates contained herein constitute<br />

our best judgment at this date and time, and are subject to change without notice. Possible errors or<br />

incompleteness of the information do not constitute grounds for liability, neither with regard to indirect nor to direct<br />

or consequential damages. The views presented on the covered company accurately reflect the personal views of<br />

the author. All employees of the author's company who are involved with the preparation and/or the offering of<br />

financial analyzes are subject to internal compliance regulations.<br />

The report is for information purposes, it is not intended to be and should not be construed as a recommendation,<br />

offer or solicitation to acquire, or dispose of, any of the securities mentioned in this report. Any reference to past<br />

performance should not be taken as indication of future performance. The author does not accept any liabili ty<br />

whatsoever for any direct or consequential loss arising from any use of material contained in this report. The report<br />

is confidential and it is submitted to selected recipients only. The report is prepared for professional investors only<br />

and it is not intended for private investors. Consequently, it should not be distributed to any such persons. Also,<br />

the report may be communicated electronically before physical copies are available. It may not be reproduced (in<br />

whole or in part) to any other investment firm or any other individual person without the prior written approval from<br />

the author. The author is not registered in the United Kingdom nor with any U.S. regulatory body.<br />

It has not been determined in advance whether and in what intervals this report will be updated. Unless otherwise<br />

stated current prices refer to the closing price of the previous trading day. Any reference to past performance<br />

should not be taken as indication of future performance. The author maintains the right to change his opinions<br />

without notice, i.e. the opinions given reflect the author’s judgment on the date of this report.<br />

This analysis is intended to provide information to assist institutional investors in making their own investment<br />

decisions, not to provide investment advice to any specific investor.<br />

By accepting this report the recipient accepts that the above restrictions are binding. German law shall be<br />

applicable and court of jurisdiction for all disputes shall be Frankfurt am Main (Germany).<br />

This report should be made available in the United States solely to investors that are (i) "major US institutional<br />

investors" (within the meaning of SEC Rule 15a-6 and applicable interpretations relating thereto) that are also<br />

"qualified institutional buyers" (QIBs) within the meaning of SEC Rule 144A promulgated by the United States<br />

Securities and Exchange Commission pursuant to the Securities Act of 1933, as amended (the "Securities Act") or<br />

(ii) investors that are not "US Persons" within the meaning of Regulation S under the Securities Act and applicable<br />

interpretations relating thereto. The offer or sale of certain securities in the United States may be made to QIBs in<br />

reliance on Rule 144A. Such securities may include those offered and sold outside the United States in<br />

transactions intended to be exempt from registration pursuant to Regulation S. This report does not constitute in<br />

any way an offer or a solicitation of interest in any securities to be offered or sold pursuant to Regulation S. Any<br />

such securities may not be offered or sold to US Persons at this time and may be resold to US Persons only if such<br />

securities are registered under the Securities Act of 1933, as amended, and applicable state securities laws, or<br />

pursuant to an exemption from registration.<br />

This publication is for distribution in or from the United Kingdom only to persons who are authorised persons or<br />

exempted persons within the meaning of the Financial Services and Markets Act 2000 of the United Kingdom or<br />

any order made there under or to investment professionals as defined in Section 19 of the Financial Services and<br />

Markets Act 2000 (Financial Promotion) Order 2005 and is not intended to be distributed or passed on, directly or<br />

indirectly, to any other class of persons.<br />

www.cbseydlerresearch.ag<br />

Close Brothers Seydler Research <strong>AG</strong> | 6

<strong>Ralos</strong> <strong>New</strong> <strong>Energies</strong> <strong>AG</strong><br />

This publication is for distribution in Canada only to pension funds, mutual funds, banks, asset managers and<br />

insurance companies.<br />

The distribution of this publication in other jurisdictions may be restricted by law, and persons into whose<br />

possession this publication comes should inform themselves about, and observe, any such restrictions. In<br />

particular this publication may not be sent into or distributed, directly or indirectly, in Japan or to any resident<br />

thereof.<br />

Responsible Supervisory Authority:<br />

Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin, Federal Financial Supervisory Authority)<br />

Graurheindorferstraße 108<br />

53117 Bonn<br />

and<br />

Lurgiallee 12<br />

60439 Frankfurt<br />

Schillerstrasse 27 - 29<br />

60313 Frankfurt am Main<br />

www.cbseydlerresearch.ag<br />

Tel.: 0049 - (0)69 - 97 78 45 60<br />

www.cbseydlerresearch.ag<br />

Close Brothers Seydler Research <strong>AG</strong> | 7