You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

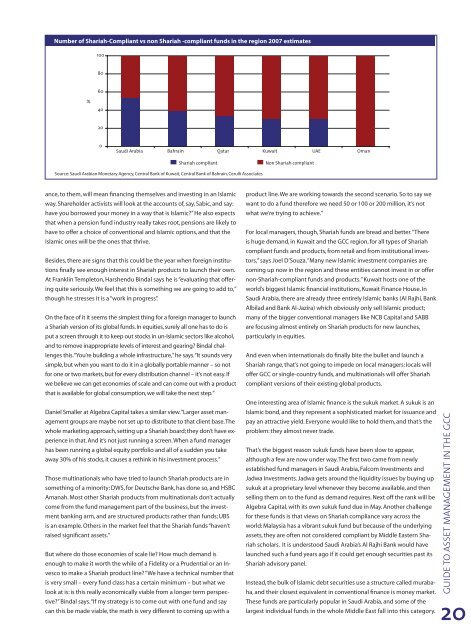

Number of Shariah vs non Shariah funds <strong>in</strong> <strong>the</strong> region 2007 estimatesNumber of Shariah-Compliant vs non Shariah -compliant funds <strong>in</strong> <strong>the</strong> region 2007 estimates1008060%40200Saudi Arabia Bahra<strong>in</strong> Qatar Kuwait UAE OmanShariah compliantNon Shariah compliantSource: Saudi Arabian Monetary Agency, Central Bank of Kuwait, Central Bank of Bahra<strong>in</strong>, Cerulli AssociatesSource: Saudi Stock Exchange (Tadawul), Central Bank of Bahra<strong>in</strong>, Zawya, Gulfbase, Cairo and Alexandria Stock Exchanges, Cerulli Associatesance, to <strong>the</strong>m, will mean f<strong>in</strong>anc<strong>in</strong>g <strong>the</strong>mselves and <strong>in</strong>vest<strong>in</strong>g <strong>in</strong> an Islamic product l<strong>in</strong>e. We are work<strong>in</strong>g towards <strong>the</strong> second scenario. So to say weway. Shareholder activists will look at <strong>the</strong> accounts of, say, Sabic, and say: want to do a fund <strong>the</strong>refore we need 50 or 100 or 200 million, it’s nothave you borrowed your money <strong>in</strong> a way that is Islamic?” He also expects what we’re try<strong>in</strong>g to achieve.”that when a pension fund <strong>in</strong>dustry really takes root, pensions are likely tohave to offer a choice of conventional and Islamic options, and that <strong>the</strong> For local managers, though, Shariah funds are bread and better. “ThereIslamic ones will be <strong>the</strong> ones that thrive.is huge demand, <strong>in</strong> Kuwait and <strong>the</strong> <strong>GCC</strong> region, for all types of Shariahcompliant funds and products, from retail and from <strong>in</strong>stitutional <strong>in</strong>vestors,”says Joel D’Souza. “Many new Islamic <strong>in</strong>vestment companies areBesides, <strong>the</strong>re are signs that this could be <strong>the</strong> year when foreign <strong>in</strong>stitutionsf<strong>in</strong>ally see enough <strong>in</strong>terest <strong>in</strong> Shariah products to launch <strong>the</strong>ir own. com<strong>in</strong>g up now <strong>in</strong> <strong>the</strong> region and <strong>the</strong>se entities cannot <strong>in</strong>vest <strong>in</strong> or offerAt Frankl<strong>in</strong> Templeton, Harshendu B<strong>in</strong>dal says he is “evaluat<strong>in</strong>g that offer<strong>in</strong>gquite seriously. We feel that this is someth<strong>in</strong>g we are go<strong>in</strong>g to add to,” world’s biggest Islamic f<strong>in</strong>ancial <strong>in</strong>stitutions, Kuwait F<strong>in</strong>ance House. Innon-Shariah-compliant funds and products.” Kuwait hosts one of <strong>the</strong>though he stresses it is a “work <strong>in</strong> progress”.Saudi Arabia, <strong>the</strong>re are already three entirely Islamic banks (Al Rajhi, BankAlbilad and Bank Al-Jazira) which obviously only sell Islamic product;On <strong>the</strong> face of it it seems <strong>the</strong> simplest th<strong>in</strong>g for a foreign manager to launch many of <strong>the</strong> bigger conventional managers like NCB Capital and SABBa Shariah version of its global funds. In equities, surely all one has to do is are focus<strong>in</strong>g almost entirely on Shariah products for new launches,put a screen through it to keep out stocks <strong>in</strong> un-Islamic sectors like alcohol, particularly <strong>in</strong> equities.and to remove <strong>in</strong>appropriate levels of <strong>in</strong>terest and gear<strong>in</strong>g? B<strong>in</strong>dal challengesthis. “You’re build<strong>in</strong>g a whole <strong>in</strong>frastructure,” he says. “It sounds very And even when <strong>in</strong>ternationals do f<strong>in</strong>ally bite <strong>the</strong> bullet and launch asimple, but when you want to do it <strong>in</strong> a globally portable manner – so not Shariah range, that’s not go<strong>in</strong>g to impede on local managers: locals willfor one or two markets, but for every distribution channel – it’s not easy. If offer <strong>GCC</strong> or s<strong>in</strong>gle-country funds, and mult<strong>in</strong>ationals will offer Shariahwe believe we can get economies of scale and can come out with a product compliant versions of <strong>the</strong>ir exist<strong>in</strong>g global products.that is available for global consumption, we will take <strong>the</strong> next step.”One <strong>in</strong>terest<strong>in</strong>g area of Islamic f<strong>in</strong>ance is <strong>the</strong> sukuk market. A sukuk is anDaniel Smaller at Algebra Capital takes a similar view. “Larger asset <strong>management</strong>groups are maybe not set up to distribute to that client base. The pay an attractive yield. Everyone would like to hold <strong>the</strong>m, and that’s <strong>the</strong>Islamic bond, and <strong>the</strong>y represent a sophisticated market for issuance andwhole market<strong>in</strong>g approach, sett<strong>in</strong>g up a Shariah board; <strong>the</strong>y don’t have experience<strong>in</strong> that. And it’s not just runn<strong>in</strong>g a screen. When a fund managerproblem: <strong>the</strong>y almost never trade.has been runn<strong>in</strong>g a global equity portfolio and all of a sudden you take That’s <strong>the</strong> biggest reason sukuk funds have been slow to appear,away 30% of his stocks, it causes a reth<strong>in</strong>k <strong>in</strong> his <strong>in</strong>vestment process.” although a few are now under way. The first two came from newlyestablished fund managers <strong>in</strong> Saudi Arabia, Falcom Investments andThose mult<strong>in</strong>ationals who have tried to launch Shariah products are <strong>in</strong> Jadwa Investments. Jadwa gets around <strong>the</strong> liquidity issues by buy<strong>in</strong>g upsometh<strong>in</strong>g of a m<strong>in</strong>ority: DWS, for Deutsche Bank, has done so, and HSBC sukuk at a proprietary level whenever <strong>the</strong>y become available, and <strong>the</strong>nAmanah. Most o<strong>the</strong>r Shariah products from mult<strong>in</strong>ationals don’t actually sell<strong>in</strong>g <strong>the</strong>m on to <strong>the</strong> fund as demand requires. Next off <strong>the</strong> rank will become from <strong>the</strong> fund <strong>management</strong> part of <strong>the</strong> bus<strong>in</strong>ess, but <strong>the</strong> <strong>in</strong>vestmentbank<strong>in</strong>g arm, and are structured products ra<strong>the</strong>r than funds; UBS for <strong>the</strong>se funds is that views on Shariah compliance vary across <strong>the</strong>Algebra Capital, with its own sukuk fund due <strong>in</strong> May. Ano<strong>the</strong>r challengeis an example. O<strong>the</strong>rs <strong>in</strong> <strong>the</strong> market feel that <strong>the</strong> Shariah funds “haven’t world: Malaysia has a vibrant sukuk fund but because of <strong>the</strong> underly<strong>in</strong>graised significant assets.”assets, <strong>the</strong>y are often not considered compliant by Middle Eastern Shariahscholars. It is understood Saudi Arabia’s Al Rajhi Bank would haveBut where do those economies of scale lie? How much demand islaunched such a fund years ago if it could get enough securities past itsenough to make it worth <strong>the</strong> while of a Fidelity or a Prudential or an Invescoto make a Shariah product l<strong>in</strong>e? “We have a technical number thatShariah advisory panel.is very small – every fund class has a certa<strong>in</strong> m<strong>in</strong>imum – but what we Instead, <strong>the</strong> bulk of Islamic debt securities use a structure called murabaha,and <strong>the</strong>ir closest equivalent <strong>in</strong> conventional f<strong>in</strong>ance is money market.look at is: is this really economically viable from a longer term perspective?”B<strong>in</strong>dal says. “If my strategy is to come out with one fund and say These funds are particularly popular <strong>in</strong> Saudi Arabia, and some of <strong>the</strong>can this be made viable, <strong>the</strong> math is very different to com<strong>in</strong>g up with a largest <strong>in</strong>dividual funds <strong>in</strong> <strong>the</strong> whole Middle East fall <strong>in</strong>to this category.GUIDE TO ASSET MANAGEMENT IN THE <strong>GCC</strong>20