Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

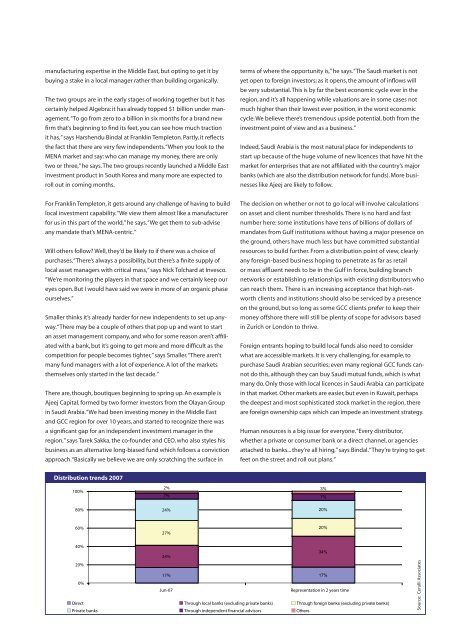

manufactur<strong>in</strong>g expertise <strong>in</strong> <strong>the</strong> Middle East, but opt<strong>in</strong>g to get it bybuy<strong>in</strong>g a stake <strong>in</strong> a local manager ra<strong>the</strong>r than build<strong>in</strong>g organically.The two groups are <strong>in</strong> <strong>the</strong> early stages of work<strong>in</strong>g toge<strong>the</strong>r but it hascerta<strong>in</strong>ly helped Algebra: it has already topped $1 billion under <strong>management</strong>.“To go from zero to a billion <strong>in</strong> six months for a brand newfirm that’s beg<strong>in</strong>n<strong>in</strong>g to f<strong>in</strong>d its feet, you can see how much tractionit has,” says Harshendu B<strong>in</strong>dal at Frankl<strong>in</strong> Templeton. Partly, it reflects<strong>the</strong> fact that <strong>the</strong>re are very few <strong>in</strong>dependents. “When you look to <strong>the</strong>MENA market and say: who can manage my money, <strong>the</strong>re are onlytwo or three,” he says. The two groups recently launched a Middle East<strong>in</strong>vestment product <strong>in</strong> South Korea and many more are expected toroll out <strong>in</strong> com<strong>in</strong>g months.terms of where <strong>the</strong> opportunity is,” he says. “The Saudi market is notyet open to foreign <strong>in</strong>vestors; as it opens, <strong>the</strong> amount of <strong>in</strong>flows willbe very substantial. This is by far <strong>the</strong> best economic cycle ever <strong>in</strong> <strong>the</strong>region, and it’s all happen<strong>in</strong>g while valuations are <strong>in</strong> some cases notmuch higher than <strong>the</strong>ir lowest ever position, <strong>in</strong> <strong>the</strong> worst economiccycle. We believe <strong>the</strong>re’s tremendous upside potential, both from <strong>the</strong><strong>in</strong>vestment po<strong>in</strong>t of view and as a bus<strong>in</strong>ess.”Indeed, Saudi Arabia is <strong>the</strong> most natural place for <strong>in</strong>dependents tostart up because of <strong>the</strong> huge volume of new licences that have hit <strong>the</strong>market for enterprises that are not affiliated with <strong>the</strong> country’s majorbanks (which are also <strong>the</strong> distribution network for funds). More bus<strong>in</strong>esseslike Ajeej are likely to follow.For Frankl<strong>in</strong> Templeton, it gets around any challenge of hav<strong>in</strong>g to buildlocal <strong>in</strong>vestment capability. “We view <strong>the</strong>m almost like a manufacturerfor us <strong>in</strong> this part of <strong>the</strong> world,” he says. “We get <strong>the</strong>m to sub-adviseany mandate that’s MENA-centric.”Will o<strong>the</strong>rs follow? Well, <strong>the</strong>y’d be likely to if <strong>the</strong>re was a choice ofpurchases. “There’s always a possibility, but <strong>the</strong>re’s a f<strong>in</strong>ite supply oflocal asset managers with critical mass,” says Nick Tolchard at Invesco.“We’re monitor<strong>in</strong>g <strong>the</strong> players <strong>in</strong> that space and we certa<strong>in</strong>ly keep oureyes open. But I would have said we were <strong>in</strong> more of an organic phaseourselves.”Smaller th<strong>in</strong>ks it’s already harder for new <strong>in</strong>dependents to set up anyway.“There may be a couple of o<strong>the</strong>rs that pop up and want to startan asset <strong>management</strong> company, and who for some reason aren’t affiliatedwith a bank, but it’s go<strong>in</strong>g to get more and more difficult as <strong>the</strong>competition for people becomes tighter,” says Smaller. “There aren’tmany fund managers with a lot of experience. A lot of <strong>the</strong> markets<strong>the</strong>mselves only started <strong>in</strong> <strong>the</strong> last decade.”There are, though, boutiques beg<strong>in</strong>n<strong>in</strong>g to spr<strong>in</strong>g up. An example isAjeej Capital, formed by two former <strong>in</strong>vestors from <strong>the</strong> Olayan Group<strong>in</strong> Saudi Arabia. “We had been <strong>in</strong>vest<strong>in</strong>g money <strong>in</strong> <strong>the</strong> Middle Eastand <strong>GCC</strong> region for over 10 years, and started to recognize <strong>the</strong>re wasa significant gap for an <strong>in</strong>dependent <strong>in</strong>vestment manager <strong>in</strong> <strong>the</strong>region,” says Tarek Sakka, <strong>the</strong> co-founder and CEO, who also styles hisbus<strong>in</strong>ess as an alternative long-biased fund which follows a convictionapproach. “Basically we believe we are only scratch<strong>in</strong>g <strong>the</strong> surface <strong>in</strong>The decision on whe<strong>the</strong>r or not to go local will <strong>in</strong>volve calculationson asset and client number thresholds. There is no hard and fastnumber here: some <strong>in</strong>stitutions have tens of billions of dollars ofmandates from Gulf <strong>in</strong>stitutions without hav<strong>in</strong>g a major presence on<strong>the</strong> ground, o<strong>the</strong>rs have much less but have committed substantialresources to build fur<strong>the</strong>r. From a distribution po<strong>in</strong>t of view, clearlyany foreign-based bus<strong>in</strong>ess hop<strong>in</strong>g to penetrate as far as retailor mass affluent needs to be <strong>in</strong> <strong>the</strong> Gulf <strong>in</strong> force, build<strong>in</strong>g branchnetworks or establish<strong>in</strong>g relationships with exist<strong>in</strong>g distributors whocan reach <strong>the</strong>m. There is an <strong>in</strong>creas<strong>in</strong>g acceptance that high-networthclients and <strong>in</strong>stitutions should also be serviced by a presenceon <strong>the</strong> ground, but so long as some <strong>GCC</strong> clients prefer to keep <strong>the</strong>irmoney offshore <strong>the</strong>re will still be plenty of scope for advisors based<strong>in</strong> Zurich or London to thrive.Foreign entrants hop<strong>in</strong>g to build local funds also need to considerwhat are accessible markets. It is very challeng<strong>in</strong>g, for example, topurchase Saudi Arabian securities; even many regional <strong>GCC</strong> funds cannotdo this, although <strong>the</strong>y can buy Saudi mutual funds, which is whatmany do. Only those with local licences <strong>in</strong> Saudi Arabia can participate<strong>in</strong> that market. O<strong>the</strong>r markets are easier, but even <strong>in</strong> Kuwait, perhaps<strong>the</strong> deepest and most sophisticated stock market <strong>in</strong> <strong>the</strong> region, <strong>the</strong>reare foreign ownership caps which can impede an <strong>in</strong>vestment strategy.Human resources is a big issue for everyone. “Every distributor,whe<strong>the</strong>r a private or consumer bank or a direct channel, or agenciesattached to banks... <strong>the</strong>y’re all hir<strong>in</strong>g,” says B<strong>in</strong>dal. “They’re try<strong>in</strong>g to getfeet on <strong>the</strong> street and roll out plans.”Distribution trends 2007100%2% 3%7% 7%80%24% 20%60%27%20%40%34%24%20%17% 17%0%Jun-07Representation <strong>in</strong> 2 years timeDirect Through local banks (exclud<strong>in</strong>g private banks) Through foreign banks (exclud<strong>in</strong>g private banks)Private banks Through <strong>in</strong>dependent f<strong>in</strong>ancial advisors O<strong>the</strong>rsSource: Cerulli Associates