Informe-Barclays-Capital-compra-BCE_TINFIL20120109_0007

Informe-Barclays-Capital-compra-BCE_TINFIL20120109_0007

Informe-Barclays-Capital-compra-BCE_TINFIL20120109_0007

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

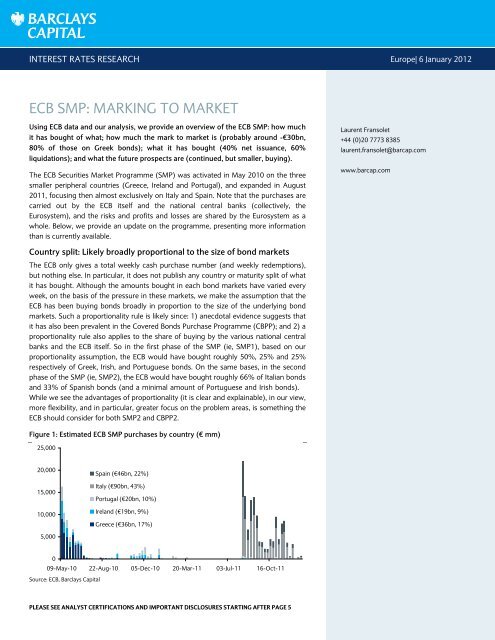

INTEREST RATES RESEARCH Europe| 6 January 2012ECB SMP: MARKING TO MARKETUsing ECB data and our analysis, we provide an overview of the ECB SMP: how muchit has bought of what; how much the mark to market is (probably around -€30bn,80% of those on Greek bonds); what it has bought (40% net issuance, 60%liquidations); and what the future prospects are (continued, but smaller, buying).The ECB Securities Market Programme (SMP) was activated in May 2010 on the threesmaller peripheral countries (Greece, Ireland and Portugal), and expanded in August2011, focusing then almost exclusively on Italy and Spain. Note that the purchases arecarried out by the ECB itself and the national central banks (collectively, theEurosystem), and the risks and profits and losses are shared by the Eurosystem as awhole. Below, we provide an update on the programme, presenting more informationthan is currently available.Laurent Fransolet+44 (0)20 7773 8385laurent.fransolet@barcap.comwww.barcap.comCountry split: Likely broadly proportional to the size of bond marketsThe ECB only gives a total weekly cash purchase number (and weekly redemptions),but nothing else. In particular, it does not publish any country or maturity split of whatit has bought. Although the amounts bought in each bond markets have varied everyweek, on the basis of the pressure in these markets, we make the assumption that theECB has been buying bonds broadly in proportion to the size of the underlying bondmarkets. Such a proportionality rule is likely since: 1) anecdotal evidence suggests thatit has also been prevalent in the Covered Bonds Purchase Programme (CBPP); and 2) aproportionality rule also applies to the share of buying by the various national centralbanks and the ECB itself. So in the first phase of the SMP (ie, SMP1), based on ourproportionality assumption, the ECB would have bought roughly 50%, 25% and 25%respectively of Greek, Irish, and Portuguese bonds. On the same bases, in the secondphase of the SMP (ie, SMP2), the ECB would have bought roughly 66% of Italian bondsand 33% of Spanish bonds (and a minimal amount of Portuguese and Irish bonds).While we see the advantages of proportionality (it is clear and explainable), in our view,more flexibility, and in particular, greater focus on the problem areas, is something theECB should consider for both SMP2 and CBPP2.Figure 1: Estimated ECB SMP purchases by country (€ mm)25,00020,00015,00010,000Spain (€46bn, 22%)Italy (€90bn, 43%)Portugal (€20bn, 10%)Ireland (€19bn, 9%)Greece (€36bn, 17%)5,000009-May-10 22-Aug-10 05-Dec-10 20-Mar-11 03-Jul-11 16-Oct-11Source: ECB, <strong>Barclays</strong> <strong>Capital</strong>PLEASE SEE ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES STARTING AFTER PAGE 5

<strong>Barclays</strong> <strong>Capital</strong> | ECB SMP: marking to marketThe ECB bought a total (in cash) of €218bn between May 2010 and end of December 2011,although about €7bn of bonds/bills have matured since the start of the SMP (€5bn inGreece and €2bn in Portugal, based on the ECB weekly announcements), putting thecurrent total ECB holdings at about €211bn (and probably close to €220-225bn in nominalterms). We would estimate, based on the weekly ECB purchases officially reported, theproportionality rule above and anecdotal evidence (the week-to-week pressure on thevarious markets) that of the current €211bn SMP holdings (in cash terms at time ofpurchases), Greek bonds account for around €36bn, Portuguese bonds €20bn, Irish bonds€19bn, Spanish bonds €46bn, and Italian bonds €90bn. Obviously, these numbers should betaken as rough guides rather than more definitive estimates.The Greek holdings are likely substantial in the context of the upcoming PSI: €36bn at purchaseprice and probably around €40bn in nominal terms. Still, the target amount of €100bn ofnominal debt reduction in the Greek PSI (assuming a 50% nominal haircut on €200bn of privatedebt holdings) implies that the ECB would not participate. Indeed, the ECB was very clear that itwould not participate in a PSI when the idea was initially floated. However, we note that it hasbeen fairly quiet on the topic since then, and other (presumably large) investors have beencalling for the ECB to participate in the PSI. In our view, the ECB holdings could eventually beincluded in the PSI, while the bonds are still on the Eurosystem balance sheet or after they havebeen transferred to another entity (eg EFSF/ESM).Mark-to-market: Big losses on Greece, but very little on the restNow that we have estimated a country split for each weekly purchase released by the ECB, wecan estimate how much the current mark-to-market on these purchases is, using total returnbond indices for each country (thus taking into account price moves as well as coupons, seeFigure 2). We have assumed that the average maturity of the bonds bought was around 5 yearsin most markets (maybe a bit longer in Ireland, due to the structure of the market), as the ECBdoes not seem to have bought bonds longer than 10 years, or very short-dated bonds.Figure 3 shows our estimate of the mark-to-market (MTM) for the Eurosystem’s purchasesbetween May 2010 and end 2011 – again, we would stress that these are only broadestimates, dependent on a number of assumptions. Roughly, we estimate the ECB has a‘paper loss’ of around €30bn, of which around 80% would likely be due to losses on thepurchases made in May and June 2010, at the inception of the programme. We wouldestimate that the MTM losses on Greek bonds are the biggest, at around €20-25bn (moreFigure 2: Total return indices for peripheral bond markets12010080Greece 3-5Yrs60Ireland All Maturities40Portugal 3-5YrsItaly 3-5Yrs20Spain 3-5Yrs0Jan-10 Jul-10 Jan-11 Jul-11 Jan-12Source: <strong>Barclays</strong> <strong>Capital</strong>Figure 3: Estimated Eurosystem mark-to-market on SMPpositions (€ mm)5,0000-5,000-10,000-15,000-20,000-25,000-30,000-35,000-40,000-45,000May10 Aug10 Nov10Source: <strong>Barclays</strong> <strong>Capital</strong>Greece (-€24bn)Portugal (-€5bn)Ireland (-€1bn)Italy (-€3bn)Spain (€1bn)Feb11 May11 Aug11 Nov116 January 2012 2

<strong>Barclays</strong> <strong>Capital</strong> | ECB SMP: marking to marketthan a 60% MTM loss, after coupon payments), with Portuguese losses at probably around€5bn (about a 23% MTM loss), Irish ones at around €1bn, Italian ones at around €2-3bn (-2%, or on average around a 50bp yield loss), and a small gain on Spanish bonds.Thus, our analysis suggests most of the MTM losses have been on the bonds bought in theinitial stages of SMP1, and in particular on Greek bonds. In contrast, we estimate that theMTM losses since the start of SMP2 could have been relatively small: probably less than€2bn. This is remarkable, since the total cash amount bought under the SMP2 is so muchlarger than under SMP1 (€140bn vs €77bn). In our view, at the margin, such a relativelybenign mark-to-market on Italian and Spanish SMP purchases facilitates ECB SMP activityto support the market going forward.Of course the ECB is also incurring the cost of sterilizing these purchases on a weekly basis:according to our calculations (on the basis of the weekly drain auction results), the totalcost up until now, over the life of SMP1 and SMP2, has amounted to about €1.1bn.Note that, according to the Eurosystem accounting rules, the gains and losses on the SMPpurchases are mutualised across the ECB and the national central banks (NCBs), inproportion to their share in the capital of the ECB (which itself is defined on the basis ofrelative GDP and population) – this is in contrast with the CBPP, the P/L of which resides ineach national central bank and the ECB. Note as well that the SMP purchases are notmarked to market as such on the Eurosystem balance sheet, but held at cost. The capitaland reserves of the Eurosystem amounted to €81.5bn and the revaluation accounts to€394bn as at the end of 2011 (up +€3.3bn and +€63bn, respectively, versus end 2010,mostly due to gold holdings).What did the ECB buy recently? 40% new issuance, 60% liquidationsThe large buying of Italian and Spanish bonds in the SMP2 raises the question: who has beenselling to the ECB? There are two potential sellers: existing investors (typically non domesticones) and the Italian and Spanish treasuries, as they increase the stock of bonds in the course oftheir regular auctions. To estimate the relative proportion between the two, one has to comparethe ECB SMP buying with the net issuance by the two treasuries (ie, the changes in the stock ofdebt). This is shown in Figure 4: if the SMP buying is higher than the net issuance, then the ECB isabsorbing the net amount liquidated by investors. Of course, there might also be some switchesbetween types of investors (eg, international and domestic investors), but only the residualwould have to be taken by the ECB (ie, the liquidations). Conversely, if ECB SMP buying is lowerthan the net issuance, investors are taking down the new supply in some way.Figure 4: The ECB SMP2 buying: absorbing investor liquidations or new issuance?8060€ bnECB SMPNet issuance (Italy & Spain)SMP minus net issuanceInvestors taking down thenew issuance4055200-20-401030-9Heavy investor liquidations17929SMP buying mostly on theback of new issuance20 234Aug Sep Oct Nov DecSource: ECB, Spanish and Italian treasuries, <strong>Barclays</strong> <strong>Capital</strong>6 January 2012 3

<strong>Barclays</strong> <strong>Capital</strong> | ECB SMP: marking to marketWe focus here only on bonds (BTP, Bonos, Obligaciones) and have excluded the supply inCTZ, CCTs and T-bills, which the ECB has typically not been buying. Given that someauctions and redemptions occur at the very end or very beginning of some months, wewould be careful in over interpreting the month by month data and prefer to focus oncombined periods. Note that the ECB does not buy in the primary market and typically, hasnot been active around auction bonds themselves, but that does not matter as such for theanalysis, since we are trying to estimate at an aggregate level how much all investors havebeen adding or shedding Italian and Spanish risk.Figure 4 illustrates that in both August and September (calendar months) there was limitednew net issuance (close to zero in fact) and most of the ECB buying (€55bn and €30bnrespectively in August and September) was on the back of large portfolio liquidations(€45bn and €39bn respectively, for Italy and Spain). In October and November, new netsupply was much heavier (€29bn combined, mostly coming from Italy), while SMP buyingwas lower (€17bn and €29bn respectively). Hence, during that period, the bulk of the ECBbuying was actually on the back of new issuance, while portfolio liquidations were(surprisingly) more modest (29+17-29=€17bn for October and November, almost equallysplit in time). In December, net issuance was remarkably heavy (€11bn in Italy, €12bn inSpain), while the SMP was barely active (less than €5bn), hence investors absorbed thesupply (at the price of still very high yields), likely helped to some extent by some shortcovering ahead of year-end and the early December summit, as well as buying related to theECB 3yr LTRO facility conducted at the very end of December. but announced on December8. In summary, looking at Figure 4 shows the heavy liquidations of August and Septemberhave faded and that more recently, the ECB SMP buying has been relatively limitedcompared with the issuance.Interestingly, the analysis also shows that in Italy, investor liquidations dominated (roughly2/3 vs 1/3 of new issuance). In contrast, in Spain, the split between liquidations and netissuance was closer to 50/50. In our view, this could be because a lot of investors werelarge outright and relative holders of Italy and liquidated positions once the spotlight turnedto Italy, while a lot of international investors have likely gradually been reducing theirSpanish holdings over the past two years.OutlookWe note that future gross issuance in Italian and Spanish bonds is likely to be around €26bnin January and €23.5bn in February, with net supply about €26bn lower (an Italian bond ismaturing on 1 Feb) – making up a total net supply of around 23.5bn for January andFebruary combined, ie, about half of the net issuance seen in November and December. Thetrue supply pressure will be somewhere between the gross and net issuance number, andwill probably be defined by how much existing investors (and in particular the foreign ones,who still own roughly 50% of the bonds) roll over their exposures to Italian and Spanishdebt. To the extent that the big first wave of liquidations (eg, by Japanese or US investors)seem to have taken place already, we would expect liquidations to remain smaller goingforward, other things being equal, and that supply might not be as difficult to digest as mostmarket participants expect. Of course there are still plenty of event risks (eg the Greek PSI,Italian yields being at 7%, rating agencies), and hence the ECB SMP needs to remain animportant backstop going forward. But our base case scenario would be that it will probablyremain less active than it has been in Q3 and the beginning of Q4, and given its trackrecord, the ECB will likely be willing still to intervene, with some confidence.6 January 2012 4

<strong>Barclays</strong> <strong>Capital</strong> | ECB SMP: marking to marketAppendix: Sterilization - Less of a problem than generally expectedCommentators have continued to focus on whether the ECB would succeed in sterilizing SMPpurchases. Our view has been that this was a bit of a red herring, to the extent that the ECBincreases the liquidity outstanding when it purchases bonds, it should not have any problem,theoretically, in draining that liquidity less than a week later (ie,. the sterilization does notcompete with other uses of liquidity as such). Still, there are operational risks in draining suchlarge amounts on a weekly basis: conditions might be more difficult in certain weeks (end ofquarters, etc), especially as the ECB is reliant on a fairly limited number of banks (around 100)that participate in the operations. Hence, there have been a number of times when the ECB failedto sterilize the full SMP, until the next drain operation (there was only one occasion when thesterilization partially failed in two consecutive weeks, in April last year, during London holidays).Overall, the sterilization operations have had good results recently (higher bid to cover,lower average rate vs EONIA and the deposit facility), despite the increase in the amounts tobe sterilized. We expect this to continue: in a context of abundant liquidity, the drains will beeasier, and we would expect the pick-up in the weekly rate vs the deposit facility (10bp) tomove down further. Still, the ECB might decide to alter slightly the modus operandi, forexample by offering sterilizations for longer periods, along with the weekly ones. It is alsopossible that the lower pick-up versus the deposit facility could start to reduce theattractiveness of the operations.Figure 5: ECB SMP sterilizations – Higher demand and lower rates recently120100806040200-20May-10 Aug-10 Nov-10 Feb-11 May-11 Aug-11 Nov-11Not drained amount (LHS, € bn)Demand in excess of target drain (LHS, € bn)Average rate vs deposit facility (RHS, bp)80706050403020100Source: ECB6 January 2012 5

Analyst Certification(s)I, Laurent Fransolet, hereby certify (1) that the views expressed in this research report accurately reflect my personal views about any or all of the subjectsecurities or issuers referred to in this research report and (2) no part of my compensation was, is or will be directly or indirectly related to the specificrecommendations or views expressed in this research report.Important DisclosuresFor current important disclosures regarding companies that are the subject of this research report, please send a written request to: <strong>Barclays</strong> <strong>Capital</strong> ResearchCompliance, 745 Seventh Avenue, 17th Floor, New York, NY 10019 or refer to http://publicresearch.barcap.com or call 212-526-1072.<strong>Barclays</strong> <strong>Capital</strong> does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that <strong>Barclays</strong> <strong>Capital</strong>may have a conflict of interest that could affect the objectivity of this report. Any reference to <strong>Barclays</strong> <strong>Capital</strong> includes its affiliates. <strong>Barclays</strong> <strong>Capital</strong> and/or anaffiliate thereof (the "firm") regularly trades, generally deals as principal and generally provides liquidity (as market maker or otherwise) in the debt securitiesthat are the subject of this research report (and related derivatives thereof). The firm's proprietary trading accounts may have either a long and / or shortposition in such securities and / or derivative instruments, which may pose a conflict with the interests of investing customers. Where permitted and subjectto appropriate information barrier restrictions, the firm's fixed income research analysts regularly interact with its trading desk personnel to determine currentprices of fixed income securities. The firm's fixed income research analyst(s) receive compensation based on various factors including, but not limited to, thequality of their work, the overall performance of the firm (including the profitability of the investment banking department), the profitability and revenues ofthe Fixed Income Division and the outstanding principal amount and trading value of, the profitability of, and the potential interest of the firms investingclients in research with respect to, the asset class covered by the analyst. To the extent that any historical pricing information was obtained from <strong>Barclays</strong><strong>Capital</strong> trading desks, the firm makes no representation that it is accurate or complete. All levels, prices and spreads are historical and do not representcurrent market levels, prices or spreads, some or all of which may have changed since the publication of this document. <strong>Barclays</strong> <strong>Capital</strong> produces a variety ofresearch products including, but not limited to, fundamental analysis, equity-linked analysis, quantitative analysis, and trade ideas. Recommendationscontained in one type of research product may differ from recommendations contained in other types of research products, whether as a result of differingtime horizons, methodologies, or otherwise. In order to access <strong>Barclays</strong> <strong>Capital</strong>'s Statement regarding Research Dissemination Policies and Procedures, pleaserefer to https://live.barcap.com/publiccp/RSR/nyfipubs/disclaimer/disclaimer-research-dissemination.html.DisclaimerThis publication has been prepared by <strong>Barclays</strong> <strong>Capital</strong>, the investment banking division of <strong>Barclays</strong> Bank PLC, and/or one or more of its affiliates as providedbelow. It is provided to our clients for information purposes only, and <strong>Barclays</strong> <strong>Capital</strong> makes no express or implied warranties, and expressly disclaims allwarranties of merchantability or fitness for a particular purpose or use with respect to any data included in this publication. <strong>Barclays</strong> <strong>Capital</strong> will not treatunauthorized recipients of this report as its clients. Prices shown are indicative and <strong>Barclays</strong> <strong>Capital</strong> is not offering to buy or sell or soliciting offers to buy orsell any financial instrument. Without limiting any of the foregoing and to the extent permitted by law, in no event shall <strong>Barclays</strong> <strong>Capital</strong>, nor any affiliate, norany of their respective officers, directors, partners, or employees have any liability for (a) any special, punitive, indirect, or consequential damages; or (b) anylost profits, lost revenue, loss of anticipated savings or loss of opportunity or other financial loss, even if notified of the possibility of such damages, arisingfrom any use of this publication or its contents. Other than disclosures relating to <strong>Barclays</strong> <strong>Capital</strong>, the information contained in this publication has beenobtained from sources that <strong>Barclays</strong> <strong>Capital</strong> believes to be reliable, but <strong>Barclays</strong> <strong>Capital</strong> does not represent or warrant that it is accurate or complete. Theviews in this publication are those of <strong>Barclays</strong> <strong>Capital</strong> and are subject to change, and <strong>Barclays</strong> <strong>Capital</strong> has no obligation to update its opinions or theinformation in this publication.The analyst recommendations in this publication reflect solely and exclusively those of the author(s), and such opinions were prepared independently of anyother interests, including those of <strong>Barclays</strong> <strong>Capital</strong> and/or its affiliates. This publication does not constitute personal investment advice or take into accountthe individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. <strong>Barclays</strong><strong>Capital</strong> recommends that investors independently evaluate each issuer, security or instrument discussed herein and consult any independent advisors theybelieve necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets(including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected.Past performance is not necessarily indicative of future results.This communication is being made available in the UK and Europe primarily to persons who are investment professionals as that term is defined in Article 19of the Financial Services and Markets Act 2000 (Financial Promotion Order) 2005. It is directed at, and therefore should only be relied upon by, persons whohave professional experience in matters relating to investments. The investments to which it relates are available only to such persons and will be entered intoonly with such persons. <strong>Barclays</strong> <strong>Capital</strong> is authorized and regulated by the Financial Services Authority ('FSA') and member of the London Stock Exchange.<strong>Barclays</strong> <strong>Capital</strong> Inc., U.S. registered broker/dealer and member of FINRA (www.finra.org), is distributing this material in the United States and, in connectiontherewith accepts responsibility for its contents. Any U.S. person wishing to effect a transaction in any security discussed herein should do so only bycontacting a representative of <strong>Barclays</strong> <strong>Capital</strong> Inc. in the U.S. at 745 Seventh Avenue, New York, New York 10019. Non-U.S. persons should contact andexecute transactions through a <strong>Barclays</strong> Bank PLC branch or affiliate in their home jurisdiction unless local regulations permit otherwise. This material isdistributed in Canada by <strong>Barclays</strong> <strong>Capital</strong> Canada Inc., a registered investment dealer and member of IIROC (www.iiroc.ca). Subject to the conditions of thispublication as set out above, Absa <strong>Capital</strong>, the Investment Banking Division of Absa Bank Limited, an authorised financial services provider (Registration No.:1986/004794/06), is distributing this material in South Africa. Absa Bank Limited is regulated by the South African Reserve Bank. This publication is not, noris it intended to be, advice as defined and/or contemplated in the (South African) Financial Advisory and Intermediary Services Act, 37 of 2002, or any otherfinancial, investment, trading, tax, legal, accounting, retirement, actuarial or other professional advice or service whatsoever. Any South African person orentity wishing to effect a transaction in any security discussed herein should do so only by contacting a representative of Absa <strong>Capital</strong> in South Africa, 15Alice Lane, Sandton, Johannesburg, Gauteng 2196. Absa <strong>Capital</strong> is an affiliate of <strong>Barclays</strong> <strong>Capital</strong>. In Japan, foreign exchange research reports are preparedand distributed by <strong>Barclays</strong> Bank PLC Tokyo Branch. Other research reports are distributed to institutional investors in Japan by <strong>Barclays</strong> <strong>Capital</strong> Japan Limited.<strong>Barclays</strong> <strong>Capital</strong> Japan Limited is a joint-stock company incorporated in Japan with registered office of 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131, Japan.It is a subsidiary of <strong>Barclays</strong> Bank PLC and a registered financial instruments firm regulated by the Financial Services Agency of Japan. Registered Number:Kanto Zaimukyokucho (kinsho) No. 143. <strong>Barclays</strong> Bank PLC, Hong Kong Branch is distributing this material in Hong Kong as an authorised institutionregulated by the Hong Kong Monetary Authority. Registered Office: 41/F, Cheung Kong Center, 2 Queen's Road Central, Hong Kong. This material is issued inTaiwan by <strong>Barclays</strong> <strong>Capital</strong> Securities Taiwan Limited. This material on securities not traded in Taiwan is not to be construed as 'recommendation' in Taiwan.<strong>Barclays</strong> <strong>Capital</strong> Securities Taiwan Limited does not accept orders from clients to trade in such securities. This material may not be distributed to the public

media or used by the public media without prior written consent of <strong>Barclays</strong> <strong>Capital</strong>. This material is distributed in South Korea by <strong>Barclays</strong> <strong>Capital</strong> SecuritiesLimited, Seoul Branch. All equity research material is distributed in India by <strong>Barclays</strong> Securities (India) Private Limited (SEBI Registration No: INB/INF231292732 (NSE), INB/INF 011292738 (BSE), Registered Office: 208 | Ceejay House | Dr. Annie Besant Road | Shivsagar Estate | Worli | Mumbai - 400 018 |India, Phone: + 91 22 67196363). Other research reports are distributed in India by <strong>Barclays</strong> Bank PLC, India Branch. <strong>Barclays</strong> Bank PLC Frankfurt Branchdistributes this material in Germany under the supervision of Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin). This material is distributed in Malaysiaby <strong>Barclays</strong> <strong>Capital</strong> Markets Malaysia Sdn Bhd. This material is distributed in Brazil by Banco <strong>Barclays</strong> S.A. This material is distributed in Mexico by <strong>Barclays</strong>Bank Mexico, S.A. <strong>Barclays</strong> Bank PLC in the Dubai International Financial Centre (Registered No. 0060) is regulated by the Dubai Financial Services Authority(DFSA). <strong>Barclays</strong> Bank PLC-DIFC Branch, may only undertake the financial services activities that fall within the scope of its existing DFSA licence. <strong>Barclays</strong>Bank PLC in the UAE is regulated by the Central Bank of the UAE and is licensed to conduct business activities as a branch of a commercial bank incorporatedoutside the UAE in Dubai (Licence No.: 13/1844/2008, Registered Office: Building No. 6, Burj Dubai Business Hub, Sheikh Zayed Road, Dubai City) and AbuDhabi (Licence No.: 13/952/2008, Registered Office: Al Jazira Towers, Hamdan Street, PO Box 2734, Abu Dhabi). <strong>Barclays</strong> Bank PLC in the Qatar FinancialCentre (Registered No. 00018) is authorised by the Qatar Financial Centre Regulatory Authority (QFCRA). <strong>Barclays</strong> Bank PLC-QFC Branch may only undertakethe regulated activities that fall within the scope of its existing QFCRA licence. Principal place of business in Qatar: Qatar Financial Centre, Office 1002, 10thFloor, QFC Tower, Diplomatic Area, West Bay, PO Box 15891, Doha, Qatar. This material is distributed in Dubai, the UAE and Qatar by <strong>Barclays</strong> Bank PLC.Related financial products or services are only available to Professional Clients as defined by the DFSA, and Business Customers as defined by the QFCRA.This material is distributed in Saudi Arabia by <strong>Barclays</strong> Saudi Arabia ('BSA'). It is not the intention of the Publication to be used or deemed asrecommendation, option or advice for any action (s) that may take place in future. <strong>Barclays</strong> Saudi Arabia is a Closed Joint Stock Company, (CMA License No.09141-37). Registered office Al Faisaliah Tower | Level 18 | Riyadh 11311 | Kingdom of Saudi Arabia. Authorised and regulated by the <strong>Capital</strong> MarketAuthority, Commercial Registration Number: 1010283024. This material is distributed in Russia by OOO <strong>Barclays</strong> <strong>Capital</strong>, affiliated company of <strong>Barclays</strong> BankPLC, registered and regulated in Russia by the FSFM. Broker License #177-11850-100000; Dealer License #177-11855-010000. Registered address in Russia:125047 Moscow, 1st Tverskaya-Yamskaya str. 21. This material is distributed in Singapore by the Singapore branch of <strong>Barclays</strong> Bank PLC, a bank licensed inSingapore by the Monetary Authority of Singapore. For matters in connection with this report, recipients in Singapore may contact the Singapore branch of<strong>Barclays</strong> Bank PLC, whose registered address is One Raffles Quay Level 28, South Tower, Singapore 048583. <strong>Barclays</strong> Bank PLC, Australia Branch (ARBN 062449 585, AFSL 246617) is distributing this material in Australia. It is directed at 'wholesale clients' as defined by Australian Corporations Act 2001.IRS Circular 230 Prepared Materials Disclaimer: <strong>Barclays</strong> <strong>Capital</strong> and its affiliates do not provide tax advice and nothing contained herein should be construedto be tax advice. Please be advised that any discussion of U.S. tax matters contained herein (including any attachments) (i) is not intended or written to beused, and cannot be used, by you for the purpose of avoiding U.S. tax-related penalties; and (ii) was written to support the promotion or marketing of thetransactions or other matters addressed herein. Accordingly, you should seek advice based on your particular circumstances from an independent taxadvisor.<strong>Barclays</strong> <strong>Capital</strong> is not responsible for, and makes no warranties whatsoever as to, the content of any third-party web site accessed via a hyperlink in thispublication and such information is not incorporated by reference.© Copyright <strong>Barclays</strong> Bank PLC (2012). All rights reserved. No part of this publication may be reproduced in any manner without the prior written permissionof <strong>Barclays</strong> <strong>Capital</strong> or any of its affiliates. <strong>Barclays</strong> Bank PLC is registered in England No. 1026167. Registered office 1 Churchill Place, London, E14 5HP.Additional information regarding this publication will be furnished upon request.

EU17857