Market intelligence and analysis on mobile content - Informa ...

Market intelligence and analysis on mobile content - Informa ...

Market intelligence and analysis on mobile content - Informa ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

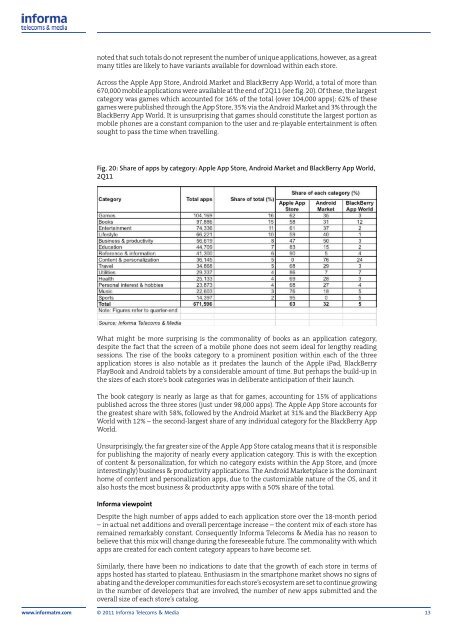

noted that such totals do not represent the number of unique applicati<strong>on</strong>s, however, as a greatmany titles are likely to have variants available for download within each store.Across the Apple App Store, Android <str<strong>on</strong>g>Market</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> BlackBerry App World, a total of more than670,000 <strong>mobile</strong> applicati<strong>on</strong>s were available at the end of 2Q11 (see fig. 20). Of these, the largestcategory was games which accounted for 16% of the total (over 104,000 apps): 62% of thesegames were published through the App Store, 35% via the Android <str<strong>on</strong>g>Market</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> 3% through theBlackBerry App World. It is unsurprising that games should c<strong>on</strong>stitute the largest porti<strong>on</strong> as<strong>mobile</strong> ph<strong>on</strong>es are a c<strong>on</strong>stant compani<strong>on</strong> to the user <str<strong>on</strong>g>and</str<strong>on</strong>g> re-playable entertainment is oftensought to pass the time when travelling.Fig. 20: Share of apps by category: Apple App Store, Android <str<strong>on</strong>g>Market</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> BlackBerry App World,2Q11What might be more surprising is the comm<strong>on</strong>ality of books as an applicati<strong>on</strong> category,despite the fact that the screen of a <strong>mobile</strong> ph<strong>on</strong>e does not seem ideal for lengthy readingsessi<strong>on</strong>s. The rise of the books category to a prominent positi<strong>on</strong> within each of the threeapplicati<strong>on</strong> stores is also notable as it predates the launch of the Apple iPad, BlackBerryPlayBook <str<strong>on</strong>g>and</str<strong>on</strong>g> Android tablets by a c<strong>on</strong>siderable amount of time. But perhaps the build-up inthe sizes of each store’s book categories was in deliberate anticipati<strong>on</strong> of their launch.The book category is nearly as large as that for games, accounting for 15% of applicati<strong>on</strong>spublished across the three stores (just under 98,000 apps). The Apple App Store accounts forthe greatest share with 58%, followed by the Android <str<strong>on</strong>g>Market</str<strong>on</strong>g> at 31% <str<strong>on</strong>g>and</str<strong>on</strong>g> the BlackBerry AppWorld with 12% – the sec<strong>on</strong>d-largest share of any individual category for the BlackBerry AppWorld.Unsurprisingly, the far greater size of the Apple App Store catalog means that it is resp<strong>on</strong>siblefor publishing the majority of nearly every applicati<strong>on</strong> category. This is with the excepti<strong>on</strong>of c<strong>on</strong>tent & pers<strong>on</strong>alizati<strong>on</strong>, for which no category exists within the App Store, <str<strong>on</strong>g>and</str<strong>on</strong>g> (moreinterestingly) business & productivity applicati<strong>on</strong>s. The Android <str<strong>on</strong>g>Market</str<strong>on</strong>g>place is the dominanthome of c<strong>on</strong>tent <str<strong>on</strong>g>and</str<strong>on</strong>g> pers<strong>on</strong>alizati<strong>on</strong> apps, due to the customizable nature of the OS, <str<strong>on</strong>g>and</str<strong>on</strong>g> italso hosts the most business & productivity apps with a 50% share of the total.<strong>Informa</strong> viewpointDespite the high number of apps added to each applicati<strong>on</strong> store over the 18-m<strong>on</strong>th period– in actual net additi<strong>on</strong>s <str<strong>on</strong>g>and</str<strong>on</strong>g> overall percentage increase – the c<strong>on</strong>tent mix of each store hasremained remarkably c<strong>on</strong>stant. C<strong>on</strong>sequently <strong>Informa</strong> Telecoms & Media has no reas<strong>on</strong> tobelieve that this mix will change during the foreseeable future. The comm<strong>on</strong>ality with whichapps are created for each c<strong>on</strong>tent category appears to have become set.Similarly, there have been no indicati<strong>on</strong>s to date that the growth of each store in terms ofapps hosted has started to plateau. Enthusiasm in the smartph<strong>on</strong>e market shows no signs ofabating <str<strong>on</strong>g>and</str<strong>on</strong>g> the developer communities for each store’s ecosystem are set to c<strong>on</strong>tinue growingin the number of developers that are involved, the number of new apps submitted <str<strong>on</strong>g>and</str<strong>on</strong>g> theoverall size of each store’s catalog.www.informatm.com © 2011 <strong>Informa</strong> Telecoms & Media 13