CHCGA - Coventry Health Care of Georgia

CHCGA - Coventry Health Care of Georgia

CHCGA - Coventry Health Care of Georgia

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TABLE OF CONTENTSWhat’s New for 2007? ...............................................2-3Associate Eligibility ...................................................... 4Dependent Eligibility ................................................... 4Changes During a Plan Year ....................................... 5Medical Plans .............................................................6-7Medical Plans Comparison .....................................8-10Prescription Drug Coverage ...................................... 11Dental Plans ................................................................ 12Vision <strong>Care</strong>................................................................... 13<strong>Health</strong>care Flexible Spending Account .................... 14Dependent <strong>Care</strong> Flexible Spending Account .... 14-15Life Insurance .............................................................. 15Other Valuable Benefits ............................................. 16Disability Income ....................................................... 16<strong>Health</strong>Quest ................................................................. 16Retirement Benefits .................................................... 16Paid Time Off and Extended Illness Bank .............. 17Benefits Contact Information .................................... 18Addendum .................................................................. 19This brochure is only an overview <strong>of</strong> our benefit plans. Completedescriptions <strong>of</strong> the plans and their provisions are available to you. Ifany information in this brochure conflicts with the detailed plandocuments, the plan documents are the authority. Though the Systemintends to continue providing these plans, the System reserves the rightto make changes at any time.

WHAT’S NEW FOR 2007Due to plan changes, all associates must review their benefits and participatein the on-line enrollment process.Medical Plan Changes• <strong>Coventry</strong> will administer the Patient Driven <strong>Health</strong> Plan, formerlyknown as the Definity Plan, effective January 1, 2007. Changes to theplan include:– A co-pay for prescription drugs will apply. Co-pay amounts will be $12 forgeneric drugs, $30 for brand name drugs, and $60 for non-formularydrugs. <strong>Care</strong>Mark will be the Pharmacy Benefit Manager.– The reimbursement process under the <strong>Health</strong> Reimbursement Account(HRA) will be enhanced, allowing you more choice in how you manageyour account.• There are some changes for the medical plan for 2007. Two <strong>of</strong> thechanges involve <strong>Coventry</strong> administering our two health plan choices.<strong>Coventry</strong> has made arrangements with Emory <strong>Health</strong>care to add the Emoryphysicians and hospitals to the <strong>Coventry</strong> HMO Network. Emory <strong>Health</strong>careincludes:- The Emory University Hospital- The Emory Clinic- Emory Crawford Long Hospital- Emory Children’s Center- Wesley Woods Center- Emory John’s Creek and- Emory Adventist Hospital.With the addition <strong>of</strong> these hospitals and physicians to <strong>Coventry</strong>’s HMO Network,you will now be able to access them as an In-Network provider for boththe HMO Plan and the new Patient Driven Plan. Please know that EmoryEastside and Emory Dunwoody are not Emory <strong>Health</strong>care facilities. These areHCA hospitals that purchased the rights to use the Emory name. Thesehospitals were already in the <strong>Coventry</strong> network. In addition, EmoryDunwoody has announced they will be closing to become Emory John’s Creekin early 2007.Dental Plan Changes• Delta Dental will be the new dental insurance provider for 2007. Theplan designs will remain the same with the following enhancements:– Plan One Delta<strong>Care</strong> DMO <strong>of</strong>fers more dentists from which to choose (noout-<strong>of</strong>-network benefits available).2– Plan Two Basic Delta Dental PPO and Plan Three Advance Delta DentalPPO Plan will have a provider network. You can use the dentist <strong>of</strong> yourchoice, but by selecting a Delta Dental network dentist, your out-<strong>of</strong>-pocketcosts will be reduced.

Vision Plan Changes• Beginning in 2007, you will be able to choose vision coverage separatelyfrom your medical coverage. The tier level for all coverage(medical, dental, vision) must be the same. For example, if you choosefamily medical coverage and you wish to have dental and/or visioncoverage, you are required to select family coverage for the dental and/or vision plans as well.Additional Important Information• Associate contributions (premiums) for the medical plans will increasefor 2007. However, Dental premiums will remain the same and Visionpremiums will decrease.• Benefit Counselors from Benefit Communications Inc. (BCI) will alsohelp associates enroll in Whole Life, Critical Illness, Short Term Disability,LTD Buy-Up and Accident Insurance.• BCI Counselors, AIG-VALIC and Lincoln Financial Group representativeswill help you enroll or make changes to your 403(b) Plan.HOW DO I ENROLL?All Associates MUST go through the benefits enrollment process this year duringthe Open Enrollment period. We strongly encourage each associate to meet with abenefit counselor to review your 2007 core benefit package and complete the onlineenrollment process. This year, you can even sign up on-line to participate inthe 403(b) plans and pick a vendor. Enrollment counselors as well as 403(b)Representatives will be on-site October 30, 2006 - November 17, 2006 to assist youin the enrollment process. Like last year, the opportunity to enroll on-line fromany personal computer with internet access is still available. However, if youwould like to review, change or enroll in any <strong>of</strong> the Voluntary Benefits, includingShort Term Disability, Long Term Disability Buy Up, Critical Illness, Accident orWhole Life coverage, you must meet with a BCI Counselor.To Enroll on-line, go to:www.electbenefits.com/GwinnettA personalized worksheet is provided to help you make your elections on-line.Your personalized log-in information is printed on your enrollment worksheetalong with detailed instructions for the enrollment system.If you do not have Internet access, please check with your manager for the location<strong>of</strong> a computer you can use, or visit with a Benefit Counselor during the openenrollment period.ENROLLMENT DEADLINE IS NOVEMBER 17, 2006!3

ASSOCIATE ELIGIBILITYBENEFIT FULL-TIME PART-TIME ELIGIBILITYGHS <strong>Health</strong> X X First day <strong>of</strong> month onand Dental Plansor after 30 days <strong>of</strong>continuous employmentReimbursement X X First day <strong>of</strong> monthAccountson or after 30 days <strong>of</strong>continuous employmentOptional Vision X X First day <strong>of</strong> monthInsuranceon or after 30 days <strong>of</strong>continuous employmentLong Term X First day <strong>of</strong> monthDisability Insuranceafter 365 days <strong>of</strong> continuousfull-time employmentBasic Life and X X First day <strong>of</strong> monthAD&D Insurancefollowing 365 days <strong>of</strong>continuous employmentOptional/Supplemental X X First day <strong>of</strong> monthLife Insurance forfollowing 30 days <strong>of</strong>Associates and Dependentscontinuous employmentRetirement Plan X X Frozen as <strong>of</strong>(Defined Benefit Plan) 12/31/06Supplemental Retirement X X See RetirementSavings Plan 403(b)Details Guide(Tax Deferred Annuity)Service-Based X X See RetirementContributionDetails GuidePaid Time Off (PTO) X X Accrued from employmentdate; accessible after 3 months<strong>of</strong> continuous employmentExtended Illness X X Accrued from employmentBank (EIB) date; accessible after 3 months<strong>of</strong> continuous employmentDEPENDENT ELIGIBILITYEligible dependents are defined as follows:I. Spouse: Must be the lawful spouse <strong>of</strong> the AssociateII. Children must:1. be related to you (e.g. son, daughter, stepson or stepdaughter, foster oradopted child)2. live with you for at least one-half <strong>of</strong> the calendar year3. not provide more the one-half <strong>of</strong> his or her own support for the calendar year4. satisfy certain age requirementsa. while under the age <strong>of</strong> nineteen; orb. if a full-time student, through the end <strong>of</strong> the month in which thechild attains age 26; orc. if totally and permanently disabled, regardless <strong>of</strong> age4

CHANGES DURING A PLAN YEARThe decisions you make now for next year’s benefits will remain in effect throughDecember 31, 2007. Under federal law, your selections for any benefits that youpay for with pre-tax dollars go into effect on every January 1 and remain for thefull plan year unless you experience a qualified change in family status. Theseinclude:• Marriage or divorce• Death <strong>of</strong> spouse or child, or loss <strong>of</strong> an eligible dependent for any reason• Birth, adoption, or legal change <strong>of</strong> custody• You or your eligible dependents lose or gain medical coverage under yourspouse’s group plan• Loss <strong>of</strong> eligible dependent status or status change• Change from FT to PT, PT to FT, PRN to FT, PRN to PT, or FT to PRNYou must notify your Human Resources Department within 31 days <strong>of</strong> a QualifiedFamily Status Change (QFSC), along with written documentation <strong>of</strong> theQFSC; otherwise, you will have to wait until the next annual openenrollment period. A change in the status may result in a change in the premiumlevel. It is the responsibility <strong>of</strong> the member to change their coverage levelby using the Enrollment /Change Form within 31 days <strong>of</strong> the QFSC.5

MEDICAL, DENTAL AND VISION PLANSWithin each plan option, GHS <strong>of</strong>fers four different coverage levels to better fitdiverse family situations:• Associate Only• Associate + Child(ren)• Associate + Spouse• Associate + FamilyYou choose a level based on the number and type <strong>of</strong> family members you want tocover, and each coverage level has a different cost. This way, you pay only for thelevel <strong>of</strong> coverage you need.Gwinnett Hospital System <strong>of</strong>fers full-time and part-time Associates <strong>Health</strong> andWelfare Benefits that include medical, dental, and vision care for you and yourfamily. You have multiple options for medical and dental coverage from which tochoose depending upon your needs. You can cover yourself and all <strong>of</strong> youreligible dependents for a low bi-weekly payroll deduction. Additionally, thesecontributions are deducted on a pre-tax basis, allowing you to lower your taxableincome and maximize your take home pay.The Cost <strong>of</strong> Your <strong>Health</strong>care BenefitsIn our efforts to help defray the increasing cost <strong>of</strong> insuring healthcare, the HospitalSystem will continue the group incentive for Associates enrolled in GHS healthplans. The Hospital System will share any savings in the healthcare benefitbudget for Fiscal Year 2007 with Associates in the form <strong>of</strong> a rebate to Associates’<strong>Health</strong> Reimbursement Accounts (HRA). Periodic updates will be providedthroughout the year so that Associates can track the budget and potential rebateat the end <strong>of</strong> the fiscal year. HRA distributions will be made as soon as the HospitalSystem’s annual audit is complete, which usually occurs in October. Thefollowing conditions must be met in order to receive the healthcare savings rebate:• Associates must have been in a GHS health plan for at least six months toqualify for the rebate.• Associates must be employed by GHS on the date <strong>of</strong> distribution <strong>of</strong> the rebate.6

Medical PlansGHS <strong>of</strong>fers two medical plans from which to choose: the HMO Plan and thePatient Driven <strong>Health</strong> Plan (formerly the Definity <strong>Health</strong> Plan). In 2007, both <strong>of</strong>the plans will be administered by <strong>Coventry</strong> <strong>Health</strong> <strong>Care</strong> <strong>of</strong> <strong>Georgia</strong>. Please referto pages 8-10 for a detailed comparison chart. Important additional informationabout each plan follows:<strong>Coventry</strong> HMO PlanThe <strong>Coventry</strong> HMO Plan <strong>of</strong>fers low co-pays for covered services and no annualdeductibles to meet. You must select a Primary <strong>Care</strong> Physician (PCP) from eitherthe GHS ASO Network or <strong>Coventry</strong> Network. Your PCP will manage and coordinateall <strong>of</strong> your health care. (Your choice <strong>of</strong> a PCP may be Family Practice,General Practice, Internal Medicine or Pediatrics). If necessary, your PCP willrefer you to a specialist within the networks. You do not need a referral forOB-GYN, Dermatology or Ophthalmology participating providers. There are noout-<strong>of</strong>-network benefits, except in certain urgent, emergency care situations. Youcan access a listing <strong>of</strong> network providers at the following <strong>Coventry</strong> web address:www.chcga.com or, upon request, in the Human Resources Department.<strong>Coventry</strong> Patient Driven <strong>Health</strong> PlanAnother healthcare option is the Patient Driven <strong>Health</strong> Plan, a consumer drivenplan designed to give you more control over your healthcare. GHS providesbenefit dollars to your <strong>Health</strong>care Reimbursement Account (HRA). The amountcontributed to your HRA depends upon your level <strong>of</strong> coverage. These dollars maybe used to pay for your covered medical needs and prescription drug co-pays. Ifyou use all <strong>of</strong> your HRA, then you must meet the remainder <strong>of</strong> a plan deductible,after which the plan begins sharing costs with you. If you don’t use all <strong>of</strong> yourHRA within the plan year, the remaining balance rolls over to the following year.For current members <strong>of</strong> the Definity <strong>Health</strong> Plan, if you have unused HRA dollarsleft in your account at the end <strong>of</strong> 2006, and if you elect to participate in the <strong>Coventry</strong>Patient Driven <strong>Health</strong> Plan for 2007, your HRA dollars will be rolled overand added to your 2007 HRA balances. You can access a listing <strong>of</strong> networkproviders at the following web address: www.chcga.com.The Patient Driven <strong>Health</strong> Plan emphasizes the importance <strong>of</strong> preventive care byproviding 100% coverage for well child and adult preventive care, includingannual routine physical, immunizations, annual Pap smear, and cancer screenings.You can find more details about the Patient Driven <strong>Health</strong> Plan in the Addendumsection.7

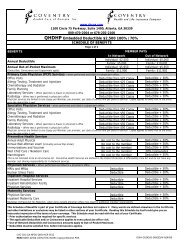

HEALTH PLANS COMPARISONSUMMARY HMO PLAN PATIENT DRIVEN HEALTH PLANGHS ASO Network You Pay <strong>Coventry</strong> In Network You Pay <strong>Coventry</strong> Out <strong>of</strong> Network You Pay*In Network You PayPreventive <strong>Health</strong> ServicesRoutine physical exams• PCP Office Visit $25 per visit $40 per visit $0 40% after HRA dollars• Specialist Office Visit $35 per visit $50 per visit used and deductible metRoutine vision exam $30 $50 Covered at 100% 40% after HRA dollars(limit 1 in 12 months) used and deductible metPhysician ServicesInpatient, extended care, No charge No charge 10% after HRA dollars 40% after HRA dollarsrehab/skilled nursing services and deductible met and deductible metby physician (includessurgeon, assistant surgeon,anesthesiologist, pathologist,and radiologist)Office visits & outpatientservices by PCP or specialistphysician:• PCP Office Visit $25 per visit $40 per visit 10% after HRA dollars 40% after HRA dollars• Specialist Office Visit $35 per visit $50 per visit and deductible met and deductible met• Lab, X-ray, diagnostics No charge No chargePregnancy & Maternity <strong>Care</strong>Prenatal & postnatal physician $400 per pregnancy $800 per pregnancy 10% after HRA dollars 40% after HRA<strong>of</strong>fice visits and delivery (includes all services) (includes all services) and deductible met dollars and deductible met(requires precertification in1 st trimester). All necessaryinpatient hospital services fornormal delivery, pr<strong>of</strong>ession fees,cesarean section, andcomplication <strong>of</strong> pregnancy.Midwife services must beperformed under directsupervision <strong>of</strong> a participatingobstetrician.Allergy Testing & TreatmentOffice visits, serum, & testing• PCP <strong>of</strong>fice visit $25 per visit $40 per visit 10% after HRA dollars 40% after HRA• Specialist <strong>of</strong>fice visit $35 per visit $50 per visit and deductible met dollars and deductible met• Allergy injections only $0 co-pay $0 co-payHospital ServicesInpatient services including $300 per admission $600 per admission 10% after HRA dollars 40% after HRAsemi-private room & board, and deductible met dollars and deductible metoperating room, ICU, generalnursing care, medications,oxygen, blood and bloodplasmaOutpatient hospital services $200 per admission $400 per admission 10% after HRA dollars 40% after HRAor surgery including and deductible met dollars and deductible metnecessary suppliesSpecialty FacilityServicesInpatient skilled nursing $300 per admission $400 per admission 10% after HRA dollars 40% after HRAservices, extended care and deductible met dollars and deductible metfacility services, rehabfacility services and othernecessary services(combined maximum <strong>of</strong> 100days per benefit year).Custodial care not covered.Hospice inpatient (maximum $300 per admission $400 per admission 10% after HRA dollars 40% after HRA180 hospital days) and deductible met dollars and deductible metOutpatient services and $200 per admission $400 per admission 10% after HRA dollars 40% after HRAsurgery including and deductible met dollars and deductible metnecessary supplies8* Patient Driven <strong>Health</strong> Plan out-<strong>of</strong>-network benefits pay at 60% <strong>of</strong> the out-<strong>of</strong>-network rate after the deductible has been met.Your provider may charge you more than the out-<strong>of</strong> network rate. You will be responsible for any charges over the out-<strong>of</strong>networkrate and these charges will not apply to your deductible, coinsurance maximum or maximum out-<strong>of</strong>-pocket.

HEALTH PLANS COMPARISONSUMMARY HMO PLAN PATIENT DRIVEN HEALTH PLANGHS ASO Network You Pay <strong>Coventry</strong> In Network You Pay <strong>Coventry</strong> Out <strong>of</strong> Network You Pay*In Network You PayMental <strong>Health</strong> &Chemical DependencySpecialist physician <strong>of</strong>fice $40 per visit $60 per visit 10% after HRA dollars and 40% after HRA dollarsvisit (outpatient) limited to 30 deductible met and deductible metvisits/plan yearInpatient care (up to 30 $300 per admission $600 per admission 10% after HRA dollars and 40% after HRA dollarsdays/plan year) deductible met and deductible metInpatient residential $300 per admission $600 per admission 10% after HRA dollars and 40% after HRA dollarstreatment (up to 90 deductible met and deductible metdays/plan year)Outpatient facility care $40 per visit $60 per visit 10% after HRA dollars and 40% after HRA dollarsspecialist (up to 30 deductible met and deductible metvisits/plan year). Outpatientevening program and partialhospital program (up to 90days/plan year).Alcoholism and chemical dependency treatment is limited to $25,000 lifetime maximum.Home <strong>Health</strong> <strong>Care</strong>Home health care services $30 per visit $50 per visit 10% after HRA dollars 40% after HRA dollarsincluding home visits by a and deductible met and deductible metnurse; physical, respiratory,or occupational therapist; orhospice care in the home byhome health care providers(combined maximum <strong>of</strong> 100visits/plan year).• Hospice outpatient $30 per visit $50 per visit 10% after HRA dollars 40% after HRA dollars<strong>of</strong>fice visit and deductible met and deductible met• Home visits by plan $30 per visit $50 per visit 10% after HRA dollars 40% after HRA dollarsphysician and deductible met and deductible met• Home IV therapy (after No charge No charge 10% after HRA dollars 40% after HRA dollarsinitial setup) and deductible met and deductible metShort-termRehabilitationTherapy (Outpatient)Rehab therapy by a $25 per visit $40 per visit 10% after HRA dollars 40% after HRA dollarsphysical, occupational, and deductible met and deductible metrespiratory, or speechtherapist for asingle illness or injury(limited to 20 medicallynecessary <strong>of</strong>fice visitsper condition per plan year)Reconstructive SurgeryInpatient or outpatient Inpatient: Inpatient: 10% after HRA dollars 40% after HRA dollarssurgery to repair or alleviate $300 per admission $600 per admission and deductible met and deductible metbodily damage caused byillness or injury that occurred Outpatient: Outpatient:to a member while covered $200 per surgery $400 per surgeryby this plan, within 12months <strong>of</strong> the illness orinjury and reconstructivesurgery incidental to amastectomy.Emergency ServicesEmergency room services $150 per visit $150 per visit 10% after HRA dollars 40% after HRA dollarswhen medically necessary and deductible met and deductible met(waived if admitted within24 hours)Urgent care facilities $50 per visit $50 per visit 10% after HRA dollars 40% after HRA dollarswhen medically necessary and deductible met and deductible metAmbulance for emergency No charge No charge 10% after HRA dollars 40% after HRA dollarsservices and deductible met and deductible met* Patient Driven <strong>Health</strong> Plan out-<strong>of</strong>-network benefits pay at 60% <strong>of</strong> the out-<strong>of</strong>-network rate after the deductible has been met.Your provider may charge you more than the out-<strong>of</strong> network rate. You will be responsible for any charges over the out-<strong>of</strong>networkrate and these charges will not apply to your deductible, coinsurance maximum or maximum out-<strong>of</strong>-pocket.9

HEALTH PLANS COMPARISONSUMMARY HMO PLAN PATIENT DRIVEN HEALTH PLANGHS ASO Network You Pay <strong>Coventry</strong> In Network You Pay <strong>Coventry</strong> Out <strong>of</strong> Network You Pay*In Network You PayOut-<strong>of</strong>-PocketOut-<strong>of</strong>-pocket expensesAnnual deductible = HRA + member responsibilityare the coinsurance,and/or deductibleamounts you areresponsible for paying.Annual deductible No deductible No deductible Associate Only: $1,250Associate + Child(ren): $1,875Associate + Spouse: $1,875Family: $2,500Annual out-<strong>of</strong>-pocket $2,000 ($4,000 family) $2,000 ($4,000 family) Annual out-<strong>of</strong>-pocket maximum =maximum (excludes total member responsibility +co-pays for alcoholism &coinsurance maximumchemical dependencytreatment, hospital co-pay,In-Network annual out-<strong>of</strong>-pocket maximum:and payment for non Associate Only: $2,000covered services) Associate + Child(ren): $3,000Associate + Spouse: $3,000Family: $4,000Out <strong>of</strong> Network annual out-<strong>of</strong>-pocket maximumAssociate Only: $5,000Associate + Child(ren): $7,500Associate + Spouse: $7,500Family: $10,000Lifetime BenefitsBenefits maximum for all Unlimited Unlimited $2,000,000 $2,000,000services. Alcoholism andchemical dependency havea combined lifetimemaximum <strong>of</strong> $25,000SUMMARY HMO PLAN PATIENT DRIVEN HEALTH PLANGHS ASO Network You Pay <strong>Coventry</strong> In Network You Pay <strong>Coventry</strong> Out <strong>of</strong> Network You PayIn Network You PayAdministered by Express ScriptsAdministered by <strong>Care</strong>MarkPrescription Drugs(includingself-injectibles)Outpatient Prescription Retail: Retail: Retail: Retail:Drug Co-pays: If you $12 Generic $12 Generic $12 Generic $12 Genericrequest a brand name $30 Brand $30 Brand $30 Brand $30 Branddrug when a generic $60 Non-formulary $60 Non-formulary $60 Non-formulary $60 Non-formularysubstitute is available(even if written “Dispense Mail Order: Mail Order: Mail Order: Mail Order:as Written”), you are $24 Generic $24 Generic $24 Generic $24 Genericresponsible for brand $60 Brand $60 Brand $60 Brand $60 Brandname co-pay plus cost $120 Non-formulary $120 Non-formulary $120 Non-formulary $120 Non-formularydifference betweenbrand drug and availablegeneric substitute. Youmust use participatingpharmacies on all plans.There are quantity limitson some medications.10* Patient Driven <strong>Health</strong> Plan out-<strong>of</strong>-network benefits pay at 60% <strong>of</strong> the out-<strong>of</strong>-network rate after the deductible has been met.Your provider may charge you more than the out-<strong>of</strong> network rate. You will be responsible for any charges over the out-<strong>of</strong>networkrate and these charges will not apply to your deductible, coinsurance maximum or maximum out-<strong>of</strong>-pocket.

PRESCRIPTION DRUG BENEFITIf you enroll in the <strong>Coventry</strong> HMO <strong>Health</strong>care plan, you may purchase prescriptiondrugs with a small co-pay. You must use a participating pharmacy or the mailorder program in order to receive prescription drug benefits. Express Scripts is thePharmacy Benefits Manager used for the <strong>Coventry</strong> HMO plan.If you have a chronic condition that requires ongoing medication, such as highblood pressure or diabetes, you may obtain a 90-day supply <strong>of</strong> medicationsthrough the mail service prescription program. You can order refills by mail,telephone or Internet. Some medications are not available through the mailservice program or require pre-approval. Our pharmacy service provider willnotify you if you place an order for one <strong>of</strong> these medications.If you participate in the Patient Driven <strong>Health</strong> Plan, you may use your HRA topay for prescription medication co-pays. After you have spent your HRA and metyour deductible (HRA dollars + member responsibility), the plans begins sharingthe cost <strong>of</strong> medications with you. <strong>Care</strong>Mark is the Pharmacy Benefits Managerused for the Patient Driven <strong>Health</strong> Plan administered by <strong>Coventry</strong>.More information about the pharmacy benefits will be available at the BenefitFairs.Gwinnett Hospital System and <strong>Health</strong>Quest continue to partner with<strong>Health</strong>Screen Disease Management, LLC to provide <strong>Health</strong> ManagementServices. This program is designed to assist you in managing certainchronic conditions and improve your self-management skills for chronicdisease(s).Learning to properly manage chronic conditions is one <strong>of</strong> the best ways toreduce future health complications. If you have health insurance throughGHS, you may be eligible for this wonderful health benefit. If you (or acovered family member) have diabetes ONLY or two or more <strong>of</strong> thefollowing disease states: asthma, diabetes, GERD (digestive disorder), highblood pressure, or high cholesterol, you may be able to BENEFIT NOW!Enrolling in the program means that you agree to take your medicationsas prescribed and you will accept a telephone call from a case managerevery 4-6 weeks so they can help you better control your disease. You willalso receive the following benefits:• Waiver <strong>of</strong> co-pay for condition-related prescriptions when obtainedthrough Mail Order only (for as long as you participate in the program)• Patient Driven <strong>Health</strong> Plan members will receive their credit in theform <strong>of</strong> a rebate.• $15 credit towards condition-related prescriptions obtained throughretail pharmacies only (for as long as you participate in the program)• FREE blood sugar monitor, blood pressure monitor, and/or peak flowmeter• FREE educational materials and access to case managersFor more information or to enroll, call 1-877-223-4325.11

DENTAL INSURANCEYou may elect one <strong>of</strong> the three dental options for you and your eligible dependents,regardless <strong>of</strong> whether or not you enroll for the medical coverage. If you elect dependentdental coverage, you and all <strong>of</strong> your eligible dependents must elect the same plan option.Plan options can only be changed at annual open enrollment, subject to plan limitations.Plan One – Delta<strong>Care</strong>Plan One is a dental managed care plan, which means that it is a prepaid plan andnot a policy <strong>of</strong> insurance. To be covered, you must seek treatment from a providercontracted by Delta Dental. There are no deductibles, no claims to file, no annualdollar maximums, no waiting periods, or pre-existing conditions. Most coveredprocedures require co-payments, which you must pay. Co-payments cover a widerange <strong>of</strong> preventative, basic, and major services, and there are no additional chargesfor lab fees. Orthodontic discount coverage for children and adults is supported bya large orthodontic network. You can access a listing <strong>of</strong> network providers at thefollowing web address: www.deltadentalins.com.Plan Two – Basic Delta Dental PPOThe Basic Delta Dental PPO is a traditional dental plan providing reimbursementsfor many procedures. Please be aware that Basic Delta Dental PPO does notcover major work or orthodontia. You have the freedom to choose any provider,including specialists or choose providers from Delta Dental’s large network to receivediscounts on services. Benefit amounts are the same for in or out-<strong>of</strong>-networkproviders and are paid after any applicable deductible has been met up to the annualmaximum. However, the greatest cost savings are achieved by using a networkdentist. Claim payments may be made to you or your dentist, whichever you prefer,unless benefits have been assigned to the provider.Plan Three – Advance Delta Dental PPOThe Advance Delta Dental PPO plan is similar to Plan Two, but includes coverage forType III and orthodontic expenses. You have the freedom to choose any provider, includingspecialists or choose providers from Delta Dental’s large network to receive discounts onservices. Benefit amounts are the same for in or out-<strong>of</strong>-network providers and are paidafter any applicable deductible has been met up to the annual maximum. However, thegreatest cost savings are achieved by using a network dentist. Claim payments maybe made to you or your dentist, whichever you prefer, unless benefits have been assignedto the provider. The following table compares the benefits <strong>of</strong> each plan.12Plan Design Plan One Plan Two Plan Three(Basic Option) (Advance Option)Annual Deductible $0 $50 per person $50 per personAnnual Benefit No annual $1,500 per person $1,500 per personMaximumdollar maximumCoinsurance for:· Co-payments apply forType I* Expenses· most covered services 100% (no deductible) 100% (no deductible)Type II* Expenses· provided by in-network 80% 80%Type III* Expenses dentists (there are no Not covered 25% first year in plan;out-<strong>of</strong>-network benefits)50% thereafterOrthodontics Orthodontic discount Not covered 50% coinsurancecoverage for children and$1,500 lifetime maximumadults supported by alarge orthodontic networkAll dental expense reimbursements under Plans Two and Three are based on Allowable Charges. Orthodontictreatment is available under Plan Three and is limited to covered dependents under the age <strong>of</strong> 19.Plan Three orthodontics also has a 12-month waiting period.You can find more details about the dental plan options in the Addendum section.

VISION CAREIf you enroll in the <strong>Coventry</strong> HMO Plan, you are allowed one annual routinevision exam by a participating ophthalmologist.If you enroll in the <strong>Coventry</strong> Patient Driven <strong>Health</strong> Plan, annual routine visionexams are covered at 100% In-Network. Out-<strong>of</strong>-Network you pay 40% afterHRA dollars and deductibles have been used.In addition to the vision benefits available through the medical plans, GHS is<strong>of</strong>fering two options for access to vision care through EyeMed.Option 1 – Vision Insurance PlanGHS will continue to <strong>of</strong>fer the ability to purchase vision insurance throughEyeMed. The vision insurance plan provides comprehensive benefits for yourvision care needs. You can choose from a nationwide network <strong>of</strong> optometrists,ophthalmologists and opticians, as well as the nation’s leading optical retailerssuch as LensCrafters, Sears, Target Optical, JC Penney Optical and Pearle Vision.See the Addendum Section for additional details. You can access a listing <strong>of</strong>EyeMed providers at the following web address:www.enrollwitheyemed.com/access or by calling toll-free at 1-866-723-0596.Option 2 – Vision Discount Program (For those enrolled in a Delta Dental plan)EyeMed <strong>of</strong>fers a vision discount program, to those who participate in a DeltaDental plan, at no additional cost. The discount plan provides significant savingsto you on eye care and eyewear as long as you seek care from an EyeMed provider.The EyeMed discount program <strong>of</strong>fers the same access to a nationwidenetwork and leading optical retailers as the Option 1-Vision Insurance Plan. Youcan obtain your discount just by showing your Delta Dental ID card to yourEyeMed provider. Remember, this is not an insurance plan and is only availableif you are enrolled in a Delta Dental plan. See the grid below to learn about some<strong>of</strong> the great discounts available to Delta Dental members.Vision <strong>Care</strong> ServicesExam with Dilation as necessaryFramesStandard Plastic Lenses$5 <strong>of</strong>f comprehensive exam$10 <strong>of</strong>f contact lens exam30% <strong>of</strong>f retail price*$75 Single; $95 Bifocal; $125 TrifocalConventional Contact Lenses15% <strong>of</strong>f retail price*Frame, lenses and lens options discounts & fees apply only if a complete pair <strong>of</strong> glasses is purchased in thesame transaction. If purchased separately, a 20% discount applies.To learn more about the EyeMed Vision <strong>Care</strong> Discount Program please visit:www.eyemedvisioncare.com/deltadental. Don’t have access to the internet?You can call EyeMed’s Discount Customer <strong>Care</strong> Center toll-free at 1-866-246-9041.13

HEALTHCARE AND DEPENDENT CARE FLEXIBLESPENDING/REIMBURSEMENT ACCOUNTS (FSA)14The <strong>Health</strong>care and Dependent <strong>Care</strong> Flexible Spending Accounts are designed tohelp you take home more <strong>of</strong> your earnings by allowing you to pay for certainmedical and dependent care expenses with pre-tax dollars (No Tax Due).<strong>Health</strong>care Flexible Spending AccountYou can set aside up to a maximum <strong>of</strong> $4,000 pre-tax dollars each year from yourpaycheck to cover eligible expenses not reimbursed by medical, dental or visioninsurance plans. When estimating the amount <strong>of</strong> your annual medical expenses thatare not reimbursed by medical insurance, you may also include expenses for familymembers claimed as dependents for federal income tax purposes. Generally, eligibleexpenses include those that are not covered by your medical plan, including deductibles,eligible over-the-counter medications, co-payments, and coinsurance.Dependent <strong>Care</strong> Flexible Spending AccountYou may use this account to pay for care <strong>of</strong> your eligible dependents so you (andyour spouse) can work or actively look for work. The maximum annual contributionis $5,000 ($2,500 if married but filing separate federal income tax returns).An eligible dependent is:• Your child under age 13 [as long as you are entitled (or your spouse) to theincome tax exemption for the child]• Your disabled spouse• A disabled dependent <strong>of</strong> any age living with you at least 8 hours per dayIn general, expenses eligible for reimbursement include:• Childcare at a day camp, nursery school or a private sitter• Expenses for preschool and after-school childcare• Cost <strong>of</strong> a housekeeper whose primary duties include care <strong>of</strong> a qualified dependent• Elder care for an incapacitated adult who lives with you at least eight hours per dayFor your convenience, it is possible to arrange for automatic weekly reimbursement<strong>of</strong> your dependent care expenses through your Dependent <strong>Care</strong> FlexibleSpending Account.Important: When you file your federal income tax return, you will be required tosupply the name, address and tax identification number <strong>of</strong> the individual or organizationproviding dependent care. If you are unable to supply this information, youshould not use the Dependent <strong>Care</strong> FSA to pay for dependent care services.Payment Method Choices for <strong>Health</strong>care and Dependent <strong>Care</strong> FlexibleSpending AccountsBenny Debit Card. You can use the Benny Debit Card to pay for manyservices. It works at qualified merchants such as doctors’ <strong>of</strong>fices, hospitals, pharmacies,opticians and optometrists, chiropractors and other healthcare providers, aswell as daycare providers. The funds will automatically be drawn from your account– you simply present the Benny Card at time <strong>of</strong> payment to make qualifiedpurchases. The provider will be paid and your account balance automaticallyadjusted. You will be required to provide copies <strong>of</strong> eligible expense receipts toBenefitOne for all charges except prescription drug co-pays or physician <strong>of</strong>fice visitco-pays, which generally qualify for automatic approval with no receipts required.Paper Claims: With this option, you will pay for eligible expenses out <strong>of</strong> yourpocket, then complete and submit a claim form with receipts for reimbursementby check. You can request that your reimbursement checks be directly depositedinto a checking or savings account.

Other Important Information• IRS regulations do not allow money to be transferred between flexible spendingaccounts. You cannot transfer unused funds from <strong>Health</strong>care Accounts toDependent <strong>Care</strong> Accounts or vice versa.• You must plan carefully to take advantage <strong>of</strong> these reimbursementaccounts. Make sure you do not put more into the accounts than youwill use during the plan year, because unused funds cannot be returnedto you. “Use it or lose it.”LIFE INSURANCEGHS provides an amount <strong>of</strong> basic term life insurance equal to one and one-halftimes your annual base pay, up to $500,000, at no cost to you. This basic coveragealso includes Accidental Death & Dismemberment coverage in an amountequal to your basic term life insurance.Supplemental life insurance is also available to you and your dependents. Duringopen enrollment, you can purchase or make changes to this coverage. If youalready have supplemental life coverage and desire to increase your coverageamount, you may do so, up to a maximum <strong>of</strong> four (4) times your annual basesalary. Requesting an increase <strong>of</strong> more than one (1) times your base annual salarywill require you to provide Evidence <strong>of</strong> Insurability. For example, if you currentlyhave two (2) times and increase to three (3) times base annual salary, youwill not have to provide pro<strong>of</strong> <strong>of</strong> good health.If you did not elect supplemental life insurance coverage when you first becameeligible (at hire or change <strong>of</strong> employment status), but now desire to participate,you will also be required to complete an Evidence <strong>of</strong> Insurability form.The Evidence <strong>of</strong> Insurability form will be available for you to download on ourenrollment web site. One will also be mailed to you with your confirmationstatement, or you can obtain one from the Human Resources Department.*Failure to provide required Evidence <strong>of</strong> Insurability will result in denial <strong>of</strong>requested supplemental life insurance coverage.Two options for dependent life insurance are available if you purchase supplementalcoverage on yourself:Eligible Family Members Option 1 Option 2Spouse One-half <strong>of</strong> Associate amount, up to $100,000 $15,000($150,000 with Evidence <strong>of</strong> Insurability)Children $10,000 $5,000If Associate and spouse are both employed by GHS, they cannot be both an insuredperson and dependent, and only one eligible spouse may cover eligible children.It is imperative that your Human Resources <strong>of</strong>fice has current beneficiaryinformation on file for each full-time and part-time Associate. Even if you donot enroll in the supplemental life insurance, please complete the BeneficiaryDesignation form to update beneficiary information for your companypaid basic life insurance plan. This form will be available for download onour enrollment web site, or you can obtain one from Human Resources.15

OTHER VALUABLE BENEFITSSome <strong>of</strong> your important benefits are not affected by annual open enrollment;however, it is an excellent time to review and assess your personal financial goals.Disability Income ProtectionLong Term Disability coverage is provided at no cost to full-time Associates with atleast one complete year <strong>of</strong> continuous full-time employment. If you become sick orhurt and unable to work due to an illness or injury, and remain so for 90 days, theplan pays up to 60% <strong>of</strong> your base pay, up to $16,000 per month. Benefits maycontinue for the duration <strong>of</strong> your disability, up to age 65. Monthly benefit paymentsmay be reduced by other income replacement benefits you receive for thesame disability, such as benefits from Social Security or Workers’ Compensation.BENEFITS FOR YOUR HEALTH<strong>Health</strong>Quest<strong>Health</strong>Quest is our GHS wellness program providing you with the informationand resources needed in your pursuit <strong>of</strong> living a healthy lifestyle and well-being.<strong>Health</strong>Quest <strong>of</strong>fers the following programs, many <strong>of</strong> them free <strong>of</strong> charge:Bring Your Lunch and Learn monthly educational sessionsFrom the Heart newsletterAnnual calendarTrailblazersFitness classes<strong>Health</strong> screeningIncentive programsSee Addendum for more details.BENEFITS FOR YOUR RETIREMENTA new retirement program will be <strong>of</strong>fered January 1, 2007. The new retirementprogram will give you control and flexibility to better meet your financial needs.Details on this program will be mailed to you, under separate cover, during OpenEnrollment. Listed below is what’s changing at a glance:16Retirement Plan (Defined Benefit Plan)As <strong>of</strong> December 31, 2006, the benefits you’ve earned under the GHS Pension Planwill be frozen. You will keep any benefit you have earned so far under theGHS Pension Plan and begin earning additional benefits under the newprogram.New! GHS Service-Based ContributionBeginning in 2007, GHS will make an additional contribution to your 403(b) Planaccount — 2% to 5% <strong>of</strong> your pay — based on your years <strong>of</strong> service. If you are notcurrently participating in the Plan, an account will be set up in your name todeposit your service-based contribution.Supplemental Retirement Savings Plan (Tax-Deferred Annuity Matching)In addition to the new service-based contribution, GHS will increase the 403(b)Plan employer matching contribution starting on January 1, 2007. Take advantage<strong>of</strong> the match by contributing to the plan and receive these additional contributionsfrom GHS:

• $1 per $1 on the first 1% <strong>of</strong> pay you contribute, plus• $0.50 per $1 on the next 5% <strong>of</strong> pay you contribute.This represents a total matching opportunity <strong>of</strong> 3.5% <strong>of</strong> pay, as compared to thecurrent GHS matching contribution <strong>of</strong> $0.50 per $1 on the first 4% <strong>of</strong> pay for atotal matching opportunity <strong>of</strong> 2% <strong>of</strong> pay.Be sure to attend an educational session on the new retirement benefits. Multiplesessions will be <strong>of</strong>fered throughout Open Enrollment. A schedule is included inyour Open Enrollment packet.PAID TIME OFF (PTO) AND EXTENDED ILLNESSBANK (EIB)The PTO program allows full-time and part-time Associates to earn paid time <strong>of</strong>ffor personal use, such as vacation, holidays, or sick leave. PTO accrual is basedupon your length <strong>of</strong> service and is calculated from the hours worked each payperiod.PTO Accrual ScheduleFull-time and PTO Accrual Rate Maximum PTOPart-time Service (Factor per paid hour) (8 hour day)Less than 4 years .0885 23 days per year5-14 years .1077 28 days per year15-19 years .1230 32 days per year20+ years .1269 33 days per yearThe maximum accrual is 400 hours, and at certain times, you will be able to cashin any unused PTO above 40 hours.All 80-hour Associates must use at least 120 hours (prorated for all other Associates)during the calendar year. If the Associate does not use the required hours,then the Associate must cash in the balance <strong>of</strong> required usage. (This requirementhas been waived for 2006)Full-time and part-time Associates also accumulate paid time <strong>of</strong>f for an extendedillness through the Extended Illness Bank (EIB) program. The maximum EIBaccrual is 520 hours. EIB is for Associate illness only.EIB Accrual ScheduleFull-time and EIB Accrual Rate Maximum EIBPart-time Service (Factor per paid hour) (8 hour day)Less than 4 years .0193 5 days per year5+ years .0270 7 days per yearEIB may be used after 32 consecutive hours <strong>of</strong> PTO (4 eight-hour days) or may beused on the first day <strong>of</strong> inpatient hospitalization, surgery or approved workerscompensation injury.For additional information regarding PTO and EIB, please refer to Policy 300-409on the intranet under Human Resources Department.17

BENEFITS CONTACT INFORMATIONAIG-VALICJim Riley .............................................................800-892-5558, Ext. 88348Kate Olsson ........................................................800-892-5558, Ext. 88344<strong>Care</strong>Mark (Pharmacy Benefit Manager for Patient Driven <strong>Health</strong> Plan)*Patient Driven <strong>Health</strong> Plan members with questions related to<strong>Care</strong>Mark Pharmacy should call the <strong>Coventry</strong> Customer ServiceOffice at .................................................................................. 866-732-1017<strong>Coventry</strong>Customer Service(For both HMO & Patient Driven <strong>Health</strong> Plan) ............... 866-732-1017Mental <strong>Health</strong> (APS <strong>Health</strong>care) ........................................ 877-488-5488Pre-certification ................................................................... 866-738-9683www.chcga.comDelta DentalCustomer Service Plan One Delta<strong>Care</strong> ............................. 800-422-4234Customer Service Basic Delta Dental PPO and Advance Delta Dental PPO:(Plans Two and Three) ........................................................ 800-616-3631www.deltadentalins.comEmployee Assistance Plan (EAP)................................................................................................ 678-985-5599EyeMedCustomer <strong>Care</strong> Center for Option 1 .................................. 866-723-0596www.enrollwitheyemed.com/accessCustomer <strong>Care</strong> Center for Option 2 (Vision Discount Program throughDelta Dental) ......................................................................... 866-246-9041www.eyemedvisioncare.com/deltadentalExpressScripts (Pharmacy Benefit Manager for <strong>Coventry</strong> HMO Plan)Patient Contact Center ....................................................... 877-486-5984www.expressscripts.comFlexible Spending AccountsBenefitOne ............................................................................. 888-862-6272www.benefitone.com/participants<strong>Health</strong>Quest................................................................................................ 678-442-3751www.healthquest@ghsnet.org<strong>Health</strong>Screen Disease Management, LLC................................................................................................ 877-223-4325Human ResourcesBina Barreto .......................................................................... 678-442-2552Kay Greene ............................................................................ 678-442-2529Angie Hix (Leave <strong>of</strong> Absence) ............................................. 678-442-3852Tifanee Moon ........................................................................ 678-442-2139Open Enrollment Benefits Hotline..................................... 678-442-343818Lincoln Financial GroupTara Bailey ............................................................................ 770-948-9982Cowan Financial Group ..................................................... 770-962-2082

ADDENDUM<strong>Coventry</strong> Patient Driven <strong>Health</strong> PlanWelcome to the Patient Driven <strong>Health</strong> Plan ........................................ 20How the HRA Plan Works ................................................................ 20-23Frequently Asked Questions .................................................................. 24Express Scripts Prescription Drug Plan ............................... 25-262007 Dental Plan OptionsAt a Glance Summary ............................................................................. 27Plan One - Delta<strong>Care</strong> ......................................................................... 28-35Plan Two - Basic Delta Dental PPO ................................................. 36-37Plan Three - Advance Delta Dental PPO ........................................ 36-37Flexible Spending AccountsWe Get It Done document ................................................................. 38-39FSA Tax Savings chart ............................................................................. 40EyeMed Vision Plan ............................................................................... 41<strong>Health</strong>screen Disease Management .............................................. 42<strong>Health</strong>Quest ............................................................................................... 4319

Patient Driven <strong>Health</strong> Plan continued...22

Patient Driven <strong>Health</strong> Plan continued...23

Patient Driven <strong>Health</strong> Plan continued...24

ExpressScripts Prescription Drug Plan (for HMO Members only)25

Prescription continued...26

Dental Plan One continued...29

Dental Plan One continued...30

Dental Plan One continued...31

Dental Plan One continued...32

Dental Plan One continued...33

Dental Plan One continued...34

Dental Plan One continued...35

For Dental Plans Two and Three36

For Dental Plans Two and Three continued...37

BenefitOne Flexible Spending Account continued...39

42Note: Patient Driven <strong>Health</strong> Plan members will receive their credit in the form <strong>of</strong> a rebate.

<strong>Health</strong>Quest ServicesI. What is <strong>Health</strong>Quest?<strong>Health</strong>Quest is your GHS Associate Wellness ProgramII.III.Describe <strong>Health</strong>Quest mission:<strong>Health</strong>Quest is part <strong>of</strong> your associate benefits and our mission is to provide you with theinformation and resources you need to continue on your personal quest for wellness.<strong>Health</strong>Quest Programs:<strong>Health</strong>Quest <strong>of</strong>fers programs (most are free <strong>of</strong> charge) for both your body and your brain.Programs for your brain include:• Free monthly “Bring Your Lunch and Learn” sessions on a variety <strong>of</strong> topics <strong>of</strong>fered throughthe hospital system• Articles on health topics and <strong>Health</strong>Quest events in the From the Heart Newsletter• Wellness minutes: You or your manager can invite us to your staff meeting for a “wellnessminute”, a brief talk or activity on a health topic.• “Best <strong>of</strong> <strong>Health</strong>” newsletter mailed to your home 4x year• Annual Calendar• <strong>Health</strong>Quest Baby: Associates who have or adopt a child can contact <strong>Health</strong>Quest for a freebaby giftPrograms for your body include:• TrailBlazers: A free fitness incentive program-you track your physical activity, send HQ amonthly record, we send you prizes!• Fitness Classes: Aerobics, Pilates and Yoga. Offered on the Lawrenceville campus andDuluth Hudgens Pr<strong>of</strong>essional Building (HPB).• <strong>Health</strong> Screenings: Annual <strong>Health</strong> Risk Assessment (receive free blood work and a personalhealth pr<strong>of</strong>ile)• <strong>Health</strong>Quest Incentive Programs: <strong>Health</strong>Quest <strong>of</strong>fers special incentive programsthroughout the year to motivate you to make small changes to improve your health. Anexample <strong>of</strong> one such program is the Sizzlin’ Summer Shape-Up in which you accrue pointsfor eating fruits and vegetables and drinking water.IV.How will you know about <strong>Health</strong>Quest programs/activities?There are several places to go to find out about <strong>Health</strong>Quest programs. Many <strong>of</strong> the break roomsthroughout the GHS system have <strong>Health</strong>Quest bulletin boards. <strong>Health</strong>Quest Ambassadors,associate volunteers, post <strong>Health</strong>Quest information monthly on these boards. Other ways to get<strong>Health</strong>Quest information are on the intranet (<strong>Health</strong>Quest page) or in the From the Heart newsletters.Call <strong>Health</strong>Quest at 678-442-3751 or email <strong>Health</strong>Quest@ghsnet.org for more information about<strong>Health</strong>Quest programs and services.43

44NOTES