1Q13 Results - MZ Brazil

1Q13 Results - MZ Brazil

1Q13 Results - MZ Brazil

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

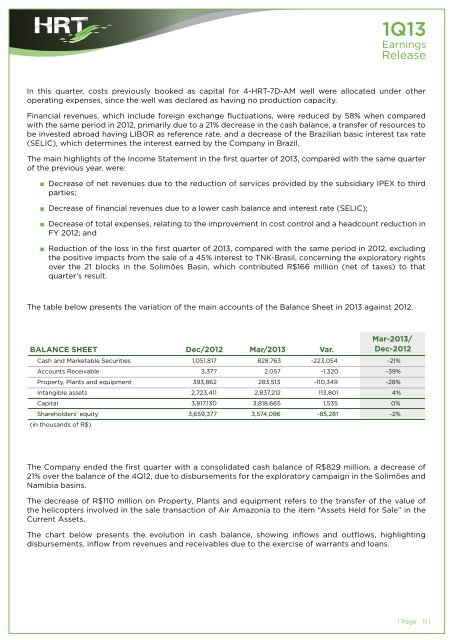

<strong>1Q13</strong>In this quarter, costs previously booked as capital for 4-HRT-7D-AM well were allocated under otheroperating expenses, since the well was declared as having no production capacity.Financial revenues, which include foreign exchange fluctuations, were reduced by 58% when comparedwith the same period in 2012, primarily due to a 21% decrease in the cash balance, a transfer of resources tobe invested abroad having LIBOR as reference rate, and a decrease of the <strong>Brazil</strong>ian basic interest tax rate(SELIC), which determines the interest earned by the Company in <strong>Brazil</strong>.The main highlights of the Income Statement in the first quarter of 2013, compared with the same quarterof the previous year, were:■ Decrease of net revenues due to the reduction of services provided by the subsidiary IPEX to thirdparties;■ Decrease of financial revenues due to a lower cash balance and interest rate (SELIC);■ Decrease of total expenses, relating to the improvement in cost control and a headcount reduction inFY 2012; and■ Reduction of the loss in the first quarter of 2013, compared with the same period in 2012, excludingthe positive impacts from the sale of a 45% interest to TNK-Brasil, concerning the exploratory rightsover the 21 blocks in the Solimões Basin, which contributed R$166 million (net of taxes) to thatquarter’s result.The table below presents the variation of the main accounts of the Balance Sheet in 2013 against 2012.BALANCE SHEET Dec/2012 Mar/2013 Var.Mar-2013/Dec-2012Cash and Marketable Securities 1,051,817 828,763 -223,054 -21%Accounts Receivable 3,377 2,057 -1,320 -39%Property, Plants and equipment 393,862 283,513 -110,349 -28%Intangible assets 2,723,411 2,837,212 113,801 4%Capital 3,817,130 3,818,665 1,535 0%Shareholders' equity 3,659,377 3,574,096 -85,281 -2%(in thousands of R$)The Company ended the first quarter with a consolidated cash balance of R$829 million, a decrease of21% over the balance of the 4Q12, due to disbursements for the exploratory campaign in the Solimões andNamibia basins.The decrease of R$110 million on Property, Plants and equipment refers to the transfer of the value ofthe helicopters involved in the sale transaction of Air Amazonia to the item “Assets Held for Sale” in theCurrent Assets.The chart below presents the evolution in cash balance, showing inflows and outflows, highlightingdisbursements, inflow from revenues and receivables due to the exercise of warrants and loans.| Page 11 |