CLT Jargon Buster (pdf) - Community Land Trusts

CLT Jargon Buster (pdf) - Community Land Trusts

CLT Jargon Buster (pdf) - Community Land Trusts

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

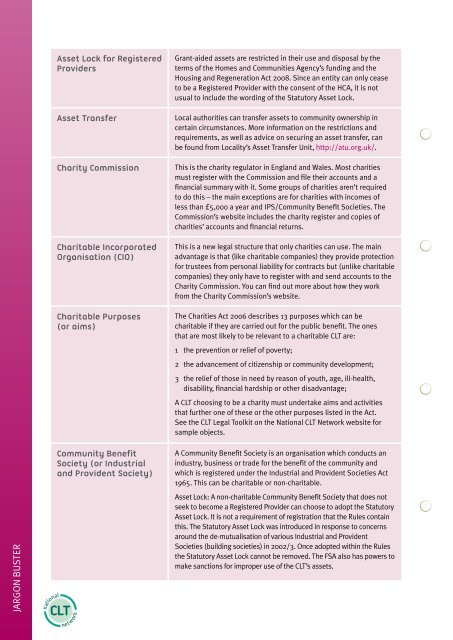

Asset Lock for RegisteredProvidersAsset TransferCharity CommissionCharitable IncorporatedOrganisation (CIO)Charitable Purposes(or aims)Grant-aided assets are restricted in their use and disposal by theterms of the Homes and Communities Agency’s funding and theHousing and Regeneration Act 2008. Since an entity can only ceaseto be a Registered Provider with the consent of the HCA, it is notusual to include the wording of the Statutory Asset Lock.Local authorities can transfer assets to community ownership incertain circumstances. More information on the restrictions andrequirements, as well as advice on securing an asset transfer, canbe found from Locality’s Asset Transfer Unit, http://atu.org.uk/.This is the charity regulator in England and Wales. Most charitiesmust register with the Commission and file their accounts and afinancial summary with it. Some groups of charities aren’t requiredto do this – the main exceptions are for charities with incomes ofless than £5,000 a year and IPS/<strong>Community</strong> Benefit Societies. TheCommission’s website includes the charity register and copies ofcharities’ accounts and financial returns.This is a new legal structure that only charities can use. The mainadvantage is that (like charitable companies) they provide protectionfor trustees from personal liability for contracts but (unlike charitablecompanies) they only have to register with and send accounts to theCharity Commission. You can find out more about how they workfrom the Charity Commission’s website.The Charities Act 2006 describes 13 purposes which can becharitable if they are carried out for the public benefit. The onesthat are most likely to be relevant to a charitable <strong>CLT</strong> are:1 the prevention or relief of poverty;2 the advancement of citizenship or community development;3 the relief of those in need by reason of youth, age, ill-health,disability, financial hardship or other disadvantage;A <strong>CLT</strong> choosing to be a charity must undertake aims and activitiesthat further one of these or the other purposes listed in the Act.See the <strong>CLT</strong> Legal Toolkit on the National <strong>CLT</strong> Network website forsample objects.JARGON BUSTER<strong>Community</strong> BenefitSociety (or Industrialand Provident Society)A <strong>Community</strong> Benefit Society is an organisation which conducts anindustry, business or trade for the benefit of the community andwhich is registered under the Industrial and Provident Societies Act1965. This can be charitable or non-charitable.Asset Lock: A non-charitable <strong>Community</strong> Benefit Society that does notseek to become a Registered Provider can choose to adopt the StatutoryAsset Lock. It is not a requirement of registration that the Rules containthis. The Statutory Asset Lock was introduced in response to concernsaround the de-mutualisation of various Industrial and ProvidentSocieties (building societies) in 2002/3. Once adopted within the Rulesthe Statutory Asset Lock cannot be removed. The FSA also has powers tomake sanctions for improper use of the <strong>CLT</strong>’s assets.