CLT Jargon Buster (pdf) - Community Land Trusts

CLT Jargon Buster (pdf) - Community Land Trusts

CLT Jargon Buster (pdf) - Community Land Trusts

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

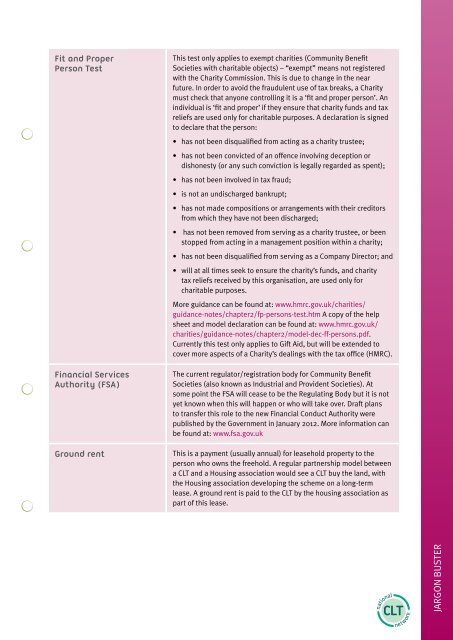

Fit and ProperPerson TestFinancial ServicesAuthority (FSA)Ground rentThis test only applies to exempt charities (<strong>Community</strong> BenefitSocieties with charitable objects) – “exempt” means not registeredwith the Charity Commission. This is due to change in the nearfuture. In order to avoid the fraudulent use of tax breaks, a Charitymust check that anyone controlling it is a ‘fit and proper person’. Anindividual is ‘fit and proper’ if they ensure that charity funds and taxreliefs are used only for charitable purposes. A declaration is signedto declare that the person:• has not been disqualified from acting as a charity trustee;• has not been convicted of an offence involving deception ordishonesty (or any such conviction is legally regarded as spent);• has not been involved in tax fraud;• is not an undischarged bankrupt;• has not made compositions or arrangements with their creditorsfrom which they have not been discharged;• has not been removed from serving as a charity trustee, or beenstopped from acting in a management position within a charity;• has not been disqualified from serving as a Company Director; and• will at all times seek to ensure the charity’s funds, and charitytax reliefs received by this organisation, are used only forcharitable purposes.More guidance can be found at: www.hmrc.gov.uk/charities/guidance-notes/chapter2/fp-persons-test.htm A copy of the helpsheet and model declaration can be found at: www.hmrc.gov.uk/charities/guidance-notes/chapter2/model-dec-ff-persons.<strong>pdf</strong>.Currently this test only applies to Gift Aid, but will be extended tocover more aspects of a Charity’s dealings with the tax office (HMRC).The current regulator/registration body for <strong>Community</strong> BenefitSocieties (also known as Industrial and Provident Societies). Atsome point the FSA will cease to be the Regulating Body but it is notyet known when this will happen or who will take over. Draft plansto transfer this role to the new Financial Conduct Authority werepublished by the Government in January 2012. More information canbe found at: www.fsa.gov.ukThis is a payment (usually annual) for leasehold property to theperson who owns the freehold. A regular partnership model betweena <strong>CLT</strong> and a Housing association would see a <strong>CLT</strong> buy the land, withthe Housing association developing the scheme on a long-termlease. A ground rent is paid to the <strong>CLT</strong> by the housing association aspart of this lease.JARGON BUSTER