Download the Time to Take Stock Brochure - Franklin Templeton ...

Download the Time to Take Stock Brochure - Franklin Templeton ...

Download the Time to Take Stock Brochure - Franklin Templeton ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

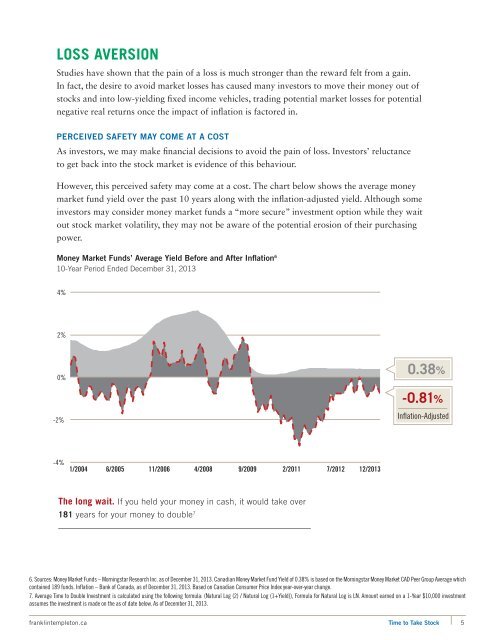

Loss AversionStudies have shown that <strong>the</strong> pain of a loss is much stronger than <strong>the</strong> reward felt from a gain.In fact, <strong>the</strong> desire <strong>to</strong> avoid market losses has caused many inves<strong>to</strong>rs <strong>to</strong> move <strong>the</strong>ir money out ofs<strong>to</strong>cks and in<strong>to</strong> low-yielding fixed income vehicles, trading potential market losses for potentialnegative real returns once <strong>the</strong> impact of inflation is fac<strong>to</strong>red in.PERCEIVED SAFETY MAY COME AT A COSTAs inves<strong>to</strong>rs, we may make financial decisions <strong>to</strong> avoid <strong>the</strong> pain of loss. Inves<strong>to</strong>rs’ reluctance<strong>to</strong> get back in<strong>to</strong> <strong>the</strong> s<strong>to</strong>ck market is evidence of this behaviour.However, this perceived safety may come at a cost. The chart below shows <strong>the</strong> average moneymarket fund yield over <strong>the</strong> past 10 years along with <strong>the</strong> inflation-adjusted yield. Although someinves<strong>to</strong>rs may consider money market funds a “more secure” investment option while <strong>the</strong>y wai<strong>to</strong>ut s<strong>to</strong>ck market volatility, <strong>the</strong>y may not be aware of <strong>the</strong> potential erosion of <strong>the</strong>ir purchasingpower.Money Market Funds’ Average Yield Before and After Inflation 610-Year Period Ended December 31, 20134%2%0%0.38%-0.81%-2%Inflation-Adjusted-4%1/2004 6/2005 11/2006 4/2008 9/2009 2/2011 7/2012 12/2013The long wait. If you held your money in cash, it would take over181 years for your money <strong>to</strong> double 76. Sources: Money Market Funds – Morningstar Research Inc. as of December 31, 2013. Canadian Money Market Fund Yield of 0.38% is based on <strong>the</strong> Morningstar Money Market CAD Peer Group Average whichcontained 189 funds. Inflation – Bank of Canada, as of December 31, 2013. Based on Canadian Consumer Price Index year-over-year change.7. Average <strong>Time</strong> <strong>to</strong> Double Investment is calculated using <strong>the</strong> following formula: (Natural Log (2) / Natural Log (1+Yield)), Formula for Natural Log is LN. Amount earned on a 1-Year $10,000 investmentassumes <strong>the</strong> investment is made on <strong>the</strong> as of date below. As of December 31, 2013.franklintemple<strong>to</strong>n.ca <strong>Time</strong> <strong>to</strong> <strong>Take</strong> S<strong>to</strong>ck 5