killed Saab Automobile? - Business School - University of Edinburgh

killed Saab Automobile? - Business School - University of Edinburgh

killed Saab Automobile? - Business School - University of Edinburgh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

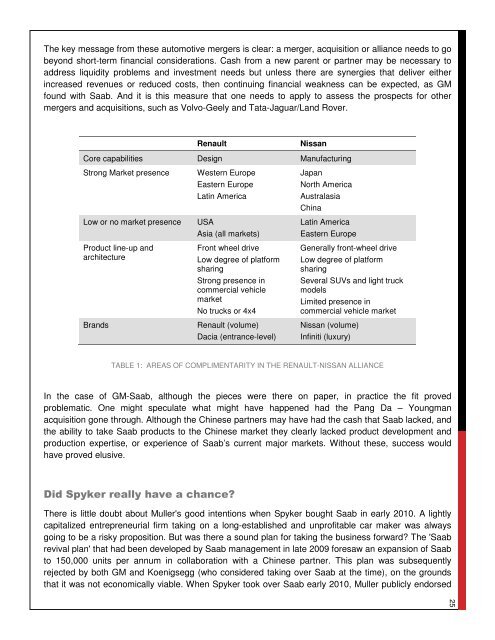

The key message from these automotive mergers is clear: a merger, acquisition or alliance needs to go<br />

beyond short-term financial considerations. Cash from a new parent or partner may be necessary to<br />

address liquidity problems and investment needs but unless there are synergies that deliver either<br />

increased revenues or reduced costs, then continuing financial weakness can be expected, as GM<br />

found with <strong>Saab</strong>. And it is this measure that one needs to apply to assess the prospects for other<br />

mergers and acquisitions, such as Volvo-Geely and Tata-Jaguar/Land Rover.<br />

Renault Nissan<br />

Core capabilities Design Manufacturing<br />

Strong Market presence Western Europe<br />

Low or no market presence USA<br />

Product line-up and<br />

architecture<br />

Eastern Europe<br />

Latin America<br />

Asia (all markets)<br />

Front wheel drive<br />

Low degree <strong>of</strong> platform<br />

sharing<br />

Strong presence in<br />

commercial vehicle<br />

market<br />

No trucks or 4x4<br />

Brands Renault (volume)<br />

Dacia (entrance-level)<br />

Japan<br />

North America<br />

Australasia<br />

China<br />

Latin America<br />

Eastern Europe<br />

Generally front-wheel drive<br />

Low degree <strong>of</strong> platform<br />

sharing<br />

Several SUVs and light truck<br />

models<br />

Limited presence in<br />

commercial vehicle market<br />

Nissan (volume)<br />

Infiniti (luxury)<br />

TABLE 1: AREAS OF COMPLIMENTARITY IN THE RENAULT-NISSAN ALLIANCE<br />

In the case <strong>of</strong> GM-<strong>Saab</strong>, although the pieces were there on paper, in practice the fit proved<br />

problematic. One might speculate what might have happened had the Pang Da – Youngman<br />

acquisition gone through. Although the Chinese partners may have had the cash that <strong>Saab</strong> lacked, and<br />

the ability to take <strong>Saab</strong> products to the Chinese market they clearly lacked product development and<br />

production expertise, or experience <strong>of</strong> <strong>Saab</strong>’s current major markets. Without these, success would<br />

have proved elusive.<br />

Did Spyker really have a chance?<br />

There is little doubt about Muller's good intentions when Spyker bought <strong>Saab</strong> in early 2010. A lightly<br />

capitalized entrepreneurial firm taking on a long-established and unpr<strong>of</strong>itable car maker was always<br />

going to be a risky proposition. But was there a sound plan for taking the business forward? The '<strong>Saab</strong><br />

revival plan' that had been developed by <strong>Saab</strong> management in late 2009 foresaw an expansion <strong>of</strong> <strong>Saab</strong><br />

to 150,000 units per annum in collaboration with a Chinese partner. This plan was subsequently<br />

rejected by both GM and Koenigsegg (who considered taking over <strong>Saab</strong> at the time), on the grounds<br />

that it was not economically viable. When Spyker took over <strong>Saab</strong> early 2010, Muller publicly endorsed<br />

25