download - Celerant Consulting

download - Celerant Consulting

download - Celerant Consulting

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Down on the ground helping to drive results upDriving Change34 Leaving My Mark On The World<strong>Celerant</strong>’s Pamela Griffin leaves her mark inIpalamwa, Tanzania with Global Volunteers.48 A New Beginning At The End Of The WorldClients don’t usually ask Consultants to helpthem totally change people’s lives, but that’sexactly what Technoserve did in Mozambique.Closework ® Global Review is a magazinepublished by <strong>Celerant</strong> Publishingon behalf of <strong>Celerant</strong> <strong>Consulting</strong> Ltd.Edition Four: June 2012.Publication DirectorThibaut BatailleChief EditorLisa SmithEditorsUS & EMEA Marketing TeamsEditorial conception and realisationPatrick Keating5668Mining For Knowledge<strong>Celerant</strong> sponsors the Prospectors &Developers Association of Canada (PDAC)2012 International Convention in Toronto.After Working At Our Desks All DayWe Decided To Stretch Our LegsClient and Consultant create a winningpartnership at the Rome Marathon.Design conception and realisationAndrew Barnes-JonesContributors<strong>Celerant</strong> <strong>Consulting</strong> thanks all its Clients,Friends of the business and <strong>Celerant</strong> teamsfor sharing their exceptional experiencesand knowledge with us.The words, photos and images in thispublication cannot be used without theexpress consent of <strong>Celerant</strong> <strong>Consulting</strong> Ltd.For more information on business solutions, 70 C-Cube Opens More Doorssector expertise, service lines and insights<strong>Celerant</strong>’s unique club for Masters of Changementioned in this magazine, please visit:is now open in Paris, Doha and Dusseldorf.celerantconsulting.com68162036404254Driving ResultsRiding The Wind Of ChangeHelping Siemens Wind Power expand from anambitious entrepreneur to a genuine global player.The Harbour Consultants:Bright Lights. Booming Future.Mad traffic, mosquitoes and a midnightbreak-in are all part of working life for<strong>Celerant</strong> Consultants Maxime B, Cyril F,Mickaël S and Antonio F on a majorOil Service Centre project in West Africa.Global Project SnapshotsConstruction, Financial services,Manufacturing, Energy.Turning Uncertainty into Global Results<strong>Celerant</strong> <strong>Consulting</strong> Supply ChainGlobal ExperienceGlobal Project SnapshotsManufacturing, Chemicals,Life Sciences, Government Services.Leading The FieldGetting down on the ground in Europe to helpdrive results up for Irish Dairy Board.Creating Global Value Acceleration<strong>Celerant</strong> <strong>Consulting</strong> OperationalTransformation Global ExperienceGlobal Project SnapshotsFMCG, Energy, Manufacturing,Construction.

agenda1422245052Driving InsightsAn Optimised Supply Chain Doesn’t JustAlign Plans, It Also Aligns PracticeTranslating a global SC strategy into consistentglobal action means engaging people at everylevel of your organisation.Unlocking CreativityAlternatives to traditional brainstorming.Changing The Way GovernmentSpends Taxpayer DollarsLooming budget challenges mean therelationship between the US Governmentand the Contracting community must befundamentally redefined. Performance BasedCost Management is the way forward.LEAN In Financial Services: Money MightMake The World Go Around, But PeopleAnd Processes Make The Money Go AroundResearch by the Lean Enterprise ResearchCentre shows that improvement potentialis greater in a services environment thana manufacturing one. Our global financialclients would agree.Meet In The MiddleWhat’s the best strategy for demand drivenSupply Chains that don’t look like Dell’s?586266122630Compelling asset management to driveshareholder value in the midst of a NorthAmerican Chemical Renaissance.The North American chemical sector is in the midst ofan exciting renaissance, but Operational Excellenceis essential to build long term shareholder value.THE GRANITE CITY: It’s been a home fromhome for almost 20 years.<strong>Celerant</strong> <strong>Consulting</strong> has established itself as amajor partner for Oil & Gas companies in theNorth Sea, helping them improve performanceand implement change. Our sector experts givetheir views on what now lies ahead.The Bottom Line Is That ChangeImproves The Bottom LineWhen we partner with Private Equity firms andtheir portfolio companies we help managementteams boldly change the way their business runs.Driving IdeasSurviving The Storm CloudsThe French CEO Challenges 2012 Barometer.Switching To A ‘Can Do’ Mindset.Niko dominates its home market in Belgium.Now it wants to dominate internationally. CEOPeter Watteeuw explains how the companywas galvanised into real Behavioural Change.Nordic Productivity<strong>Celerant</strong> <strong>Consulting</strong>’s 2011 Survey details thefacts, the fiction and the future.38444660The Formula For A Successful Change ProgramDrawing on his 30+ years career, Paul DeVivo,CEO of Houghton shares ‘10 Learnings’ that serveas a project implementation tutorial.Managing Growth In A High Growth Region– From Supply Chain Nightmare To SupplyChain WonderlandMany Latin American companies are nowregional or global players, but they need tobalance their rapid growth with sustainableinternal change.Entrepreneur Is A French Word, But JustHow Entrepreneurial Are French Companies?Collaborative, cross-disciplinary organisationsare still few and far between, says FrançoiseBerthier, Head of Change Support/HumanResources at Sanofi. Yet compared to traditionalpyramid structures, they allow more roomfor innovation.<strong>Consulting</strong> – Quo Vadis?Greg Baranszky and JJ Sendelbach of Doublejay<strong>Consulting</strong> LLC look at the unprecedentedchanges sweeping the industry.32Rediscovering Our Hunger: Working HarderAnd Smarter To Improve Nordic ProductivityHard work and ingenuity created our present.Now they must protect our future.Printed by Corelio PrintingCLOSEWORK® GLOBAL REVIEW 2012 5

Driving ResultsAll thoughts must be distilled into action and action that brings results.RIDING THEWIND OF CHANGE.When Siemens Wind Power wanted toexpand from an ambitious entrepreneur toa genuine global player it appointed <strong>Celerant</strong><strong>Consulting</strong> to help it resolve 3 spiky issues.‘ This project fostered cross-continent collaboration whichwas essential to prepare our organisation for futuregrowth.’ Ingrid Jaegering, CFO Siemens Wind Power, EMEA.6CLOSEWORK® GLOBAL REVIEW 2012

iemens Wind Power is one of theSworld’s largest providers of completewind power solutions for offshore,onshore and service projects.Rapid global growth had created inefficienciesin its Corporate and Operational processes, soit decided to launch the LEAPFROG Project andchose <strong>Celerant</strong> <strong>Consulting</strong> to help it analyseand resolve 3 key issues: Inadequate alignmentbetween Operational and Financial forecasting;insufficient transparency in Operational businessperformance; the lack of SOPS and tools in itsProject Acquisition and Execution phases.Virtual collaboration. Real progress.3 work streams were established at boththe company’s Corporate and AmericasHeadquarters and collaborated virtually todesign and pilot new ways of working to deliver:Integrated Planning: New set-up of the Load(S&OP) Plan. Planning & forecasting processeswere aligned between Corporate Headquartersand the regions to ensure faster response timesto Sales and less change requests to existingplans. New order forecast, sales planning andcapacity demand processes & tools were installedto support more regionalised operations.A new Management System:A new MCRS ® Management System with aKPI navigator was designed and implementedfor Corporate Management (Level 1-2) andRegional Management (Level 2-4) and factbased performance meetings with clearroles and responsibilities for operationalimprovements were established.Regional Interfaces: New tools and processeswere designed and implemented for all SalesAcquisition and Project Execution phases.Continuous Improvement was guaranteedthrough root cause analysis and consistentprocesses and interfaces were installedright across the global organisation.RAPID RESULTSRAPID BUY- IN• The company quickly moved to a factbased performance culture.• Operational performance and deviations toplan are now fully visible in the KPI navigatorand used to deliver Continuous Improvement.• Changes to the Load Plan have beensubstantially reduced which enablesbetter planning and forecasting.• The projects standardised, aligned toolsand processes enabled the AmericasSales organisation to gain a perfectscore in an internal audit.CLOSEWORK® GLOBAL REVIEW 2012 7

The Harbour ConsultantsBright Lights.Booming Future.Mad traffic, mosquitoes and a midnight break-inare all part of working life for <strong>Celerant</strong> ConsultantsMaxime B, Cyril F, Mickaël S and Antonio F ona major Oil Service Centre project in West Africa.8CLOSEWORK® GLOBAL REVIEW 2012

The Harbour ConsultantsAround 15 vessels use this one every day,including giant ocean going ships, complexoffshore pipe laying vessels, supply vesselsand crew ships that travel back and forth tothe platforms. The company is responsible formoving everything within the OSC and our roleis to help them increase client satisfaction tothe levels of other OSCs across the globe byinstalling Operational Excellence and coachingtheir workforce. We’re also working withProcurement, Finance and HR.The long and winding roadBy law every company that wants to do businesshere has to have a local partner, so this OSCis a joint venture with a local oil company. Itwas carved out of nothing, expanded incrediblyfast and is now so vast that the only way to getaround it is by car. We arrive on site at 7.00am and work through till around 7.30 pm. It’sincredibly hot, 30 o C every day, and very dusty.In fact, there’s so much dust that there’s actually ateam of people who regularly sweep the roads.The site entrance is a long and bumpy, dirt roadwith a sign on the gate that says: ‘No Guns.No Alcohol.’ Container trucks rumble up it dayand night and it’s so bumpy that once a truckflipped over. Our biggest problem in getting toand from work is the traffic. In the last 10 years,hundreds of thousands of people have pouredinto the cities from the countryside, but at themoment there simply isn’t the infrastructureto handle all these people. There’s very littlepublic transport, so everyone gets around bycar and they all drive really fast, which meansthat the only option is to take your life in yourhands and force your way through. It’s crazy.Some days it takes us 2 hours to get from thebase to our guesthouse – and that’s only 6km.Zinho, Pépé and ZézéThere are 4 <strong>Celerant</strong> consultants on site, 3from the French office and a Portuguese-SouthAfrican colleague. There’s also a VP who comesout once a month to oversee the project. Wecompleted our analysis in October 2011 andbegan the project in November with the aim ofintroducing a totally new culture of performance.We began by putting in place a visual managementsystem which allows Managers to see exactlywhat’s happening across the OSC at any givenpoint. We also implemented a planning systemthat listed each worker’s full name and detailedall the tasks that needed to be done. At firstthough, the Manager in charge of planning eachday’s activities was reluctant to put names againsteach task. We couldn’t understand why he didn’tknow who was supposed to be doing what,until finally he told us. It was because nearlyevery member of the team has a nickname,just like Brazilian footballers. People only knowyou by your nickname, Zinho, Pépé, Zézé andso on, so it was almost impossible for him toput a face to their correct name.Missing parts and ever present mosquitoesAround 800 people work at the OSC, plusall the clients from the Oil & Gas companies.‘ Everywhere youlook there areskylines of cranesand new publicworks racing tocreate a moderninfrastructure inrecord time.’10CLOSEWORK® GLOBAL REVIEW 2012

5. Among the following external factors,which ones are you most concerned about for 2012?The biggest concerns are the continuingeconomic slowdown and political instability.7. What are the main challenges facingyour company in 2012?The Top 3 Challenges are cost reduction,productivity and innovation.The pursuit of the economic slowing downThe political instability within the EurozoneGeopolitical crisesBank failure in EuropeCompetition from AsiaFailures from customersIncrease in interest ratesEuro/dollar exchange rateFrench presidential electionsSocial and fiscal constraints in France42%42%37%37%37%32%26%26%26%68%Cost reductionProductivityInnovationConquer new marketsManaging talentOrganic growth8. What are your priority actions for 2012?42%37%32%53%74%63%6. which are the main internal threats in your company?The No.1 internal threat is resistance to change.The Top 3 Planned Actions are to improveproductivity, develop innovative solutions andrationalise processes, systems and structures.Resistance to change53%Reliability of forecasting system42%Growing number of simultaneous projects 42%Production costs too high42%Lack of Human resources on growing markets 37%Loss of skills/competencies35%Improve productivityDevelop new products or servicesRationalise processes, structuresReduce overheardsReduce purchasing costsInvestments on the production tool39%33%28%56%50%78%The initiative was led by <strong>Celerant</strong> <strong>Consulting</strong>’s Paul Pinto,Senior Vice President, supported Sabrina Laborde,Capital investments will be saved at all costs.Unlike 2008, there is no question of sacrificing investment projectsthat involve future competitiveness. CEOs know that, once again,they will have to drive transformation initiatives to create deeperflexibility and adaptability within their organisations.Marketing Manager. The full article appeared inL’Expansion, January 2012. L’Expansion is one ofFrance’s Top 3 Monthly Economic & Businessmagazines with a circulation of 800,000and a web visibility of 1.8m uniquevisitors per month.CLOSEWORK® GLOBAL REVIEW 2012 13

Driving InsightsSuccess always demands a greater effort.Translating a global SupplyChain strategy into consistentreality means engagingpeople at every level of yourorganisation, says AdelOuederni, European SupplyChain Service Line Leaderat <strong>Celerant</strong> <strong>Consulting</strong>.You have to power your SCwith efficient humanwareand a clear, shared roadmap.An optimisedSupply Chaindoesn’t justalign plans,it also alignspractice.n many organisations today there’sIa serious disconnect between theflow charts that show how theirSupply Chain is supposed to workand what’s actually happening out in the field.<strong>Celerant</strong> <strong>Consulting</strong>’s global Supply Chainexperience has uncovered two main reasonsfor this. The first is a significant disconnectbetween what many companies believe they haveas processes and organisational models andwhat they really have in practice. The second isthat supply chains tend to have hidden bricks,sort of ‘black boxes’, too complex for theorganization to recognize, analyze and align.Working with companies across the globein various sectors, we see how these ‘blackboxes’ impact performance and derail overallsupply chain alignment.Supply Chains’ disjointed organizational structures,combined with increasing complexity and cumbersomeIT systems make these black boxesharder to identify and fix. For instance, some ITsystems, with obsolete or unsuited rules, canbecome a problematic rigidifying factor.Our view is that to develop an efficient, agileSupply Chain you need to recognize these blackboxes in order to realign the Supply Chain andhave it fully under control. This can be achievedonly by putting enabled ‘humanware’ back inthe driving seat, which supposes revisiting theorganisation, as well as the policies and leversit’s running with. This is why we put a strongfocus on the organisational dimension (people,roles & responsibilities, skills and capabilities,change management, etc.) when analyzing,then transforming supply chain performance.Also, the objective of any Supply Chain transformationshould not to be to fix a new staticmodel, but to redefine an adaptive, agile one.For this purpose, Supply Chain organisationshave to question the way they operate ona regular basis to discover how their realityis changing and how they can optimize theway the business produces, procures anddistributes. We see for example, that somecompanies use exactly the same logic in theirproduction with 20 customers as they did 10or 15 years ago with just few ones, leading tosignificant inefficiencies and a damagingdisconnect. Their business, product mix, supplybase, etc. has changed, so their Supply Chainmust be revisited to adapt to the new reality.14 CLOSEWORK® GLOBAL REVIEW 2012

In today’s dynamic, globalised markets complexityis increasing, visibility is decreasing and theparadigms that were adopted in the 90s and 20sare no longer enough to ensure performance.You have to satisfy the market, reduce costs,become more efficient and avoid permanentfire-fighting in dealing with new environmentsand constraints. The only way to achieve all thisis to become adaptable, agile and permanentlyin control of your Supply Chain. This can onlybe achieved by aligning all Supply Chaindimensions (Organization & People, Processes,Systems and tools, Footprint and infrastructure),end-to-end, from strategy to daily practice.In <strong>Celerant</strong>, we have a unique capability to movefrom Operations Strategy down to day-to-dayexecution where individuals make a hugedifference in putting together the full picture.We work alongside people at every level of thebusiness, because whatever your plans are intheory, if people running them don’t have themeans and capabilities to ensure that ideassuccessfully cascade from the CEO to the sharpend, your Supply Chain can fail. This also meansbeing able to take into account local facetsand cultures at every stage of Supply Chaintransformation projects. Then, needless to saythat in today’s complex environment, efficienthumanware is the foremost differentiator inbusiness adaptability.An efficient Supply Chain is the backbone ofevery successful business, but it has to be aflexible backbone, which means having robust,rather than rigid foundations. It must be able toregularly adapt to new trends and changes inthe market, as well as internal and externalnetwork mutations. This supposes to constantlycapture the influencing factors on the business.Supply Chain adaptability has to become anembedded gene within the business so that itcan follow a continuous evolution, instead ofhaving to undergo a perilous deep transformationevery couple of years or just be reshaped anderoded by the environment.The Six Pillars Of Supply ChainAdaptability Excellence<strong>Celerant</strong> <strong>Consulting</strong> believe that Supply Chainadaptability excellence is built on:An Aligned and Integrated Organisation at AllLevels: Not just internally, but also with keysuppliers and customers to ensure that all differentparts in the value chain have the same targets,work together smoothly and can collaborate toadapt collectively to the changing environment.Supply Chain is primarily about Organisationand People. In broad numbers, it’s 60% aboutpeople and organisation, 30% about processesand how value chain components are operated,and 10% about information systems and otherenabling tools. Organisation remains the key,but you cannot simply focus on one component:you have to focus on all three at the same time.An Adaptable Supply Chain Footprint: Regularlyreviewing and adapting your Supply Chainfootprint is essential to control costs and risks.It may currently make sense to buy componentsfrom China for example, but if this means reducingunit cost while significantly increasing leadtimes or quality issues, it will decrease youradaptability. So all key factors need to be inbalance. Footprint review is also about howmuch capacity you want to have in-house(‘base’ capacity) and how much you need to beable to trigger to adapt to variations (‘surge’capacity) for an optimal response to demand.Key Customer & Supplier Intelligence &Collaboration: In today’s fast moving environment,active customer and Supply Chain intelligenceis vital to help a business detect trends and pickup any signals which might mean additional risksor opportunities. This means going far beyondtransactional exchange, through EDI or otherforms of data communication; it means workingclosely with your suppliers and customers toanalyse the risks and opportunities and jointlycome up with timely, effective plans.Integrated Visibility & Planning: The mosteffective Supply Chains have the best visibility,from strategic planning, to tactical planning, toexecution. A business must then be able to revisitthese plans at any time and adapt to any changesin the environment based on a structured andoptimal Supply Chain response mode. IntegratedVisibility & Planning enables internal and externalalignment and collaboration, so that a businesscan anticipate issues and seize opportunities,not in a fire fighting manner, but with informeddecisions and robust rules.A Direct Link between Operational Excellence &Supply Chain Management: Businesses mighttalk about LEAN and Operational Excellencein general, but what is sometimes missing isthe link between Operational Excellence andoverall Supply Chain optimisation and agility.In our experience the two aren’t always hand inhand which is counter-productive. A businessmight have optimised sites or production lines,but that doesn’t necessarily mean its overallSupply Chain is synchronized and aligned.That’s why it’s vital to have a consistent linkbetween the way the overall Supply Chain isbeing operated and the way the execution ishappening at each individual node.A Back to Basics Overview: Many businesseshave been reshaped by acquisitions or mergers,or extended into new geographies or new marketsegments, and these additional layers can oftencorrode the existing Supply Chain rules or makethem irrelevant. Unfortunately, many rules areembedded and hidden in IT systems or otherforms of what we call black boxes, areas thatnobody controls or questions but which canmislead a business. So it’s key that in strategic,tactical and short term Supply Chain planning,existing policies are revisited to make sure thatthe business is being run according to optimisedrules and current reality, not the rules thatwere set 10 or 15 years ago, or uncontrolledderivatives of those outdated rules.‘ Supply Chain is primarilyabout Organisation and ChangeManagement. In broad numbers,60% of it is about people.’CLOSEWORK® GLOBAL REVIEW 2012 15

The Sky’s The LimitMore Power More ParticipationBUSINESS CHALLENGE The client is one of Europe’s leading solar moduleproducers in Germany. It’s a vertically integrated company, producingfinal product modules, cells and basic wafers, but it’s a growth story withparticular challenges. The company faced increasing and fluctuating demandand greatly increased competition. So to protect its position and prepareits production platform for the future, it decided to launch a comprehensiveOperational Transformation programme. <strong>Celerant</strong> <strong>Consulting</strong> was broughtin to help because of its extensive experience and its unique Closework ®approach to implementation and behavioural change.CELERANT SOLUTION The programme’s aim was to significantly increasecapacity in the short and long term by just over 30%, reduce cost perpeak watt and right size the headcount. Working closely with ClientManagement, <strong>Celerant</strong> confirmed the original productivity target and amultimillion Euro business case was in sight. The entire workforce wasmobilised and aligned to drive beyond the performance limit. Actionplans were immediately implemented to address the extensive use ofcontract employees and detailed plans were designed and implementedto optimise a complex production line. Using LEAN and 6 Sigma methodsand tools, <strong>Celerant</strong> helped the workforce build Process Excellence andcreate a culture of Continuous Improvement.RESULTS Long term targets became short term targets. The long termbusiness case was doubled and increased capacity of over 30% was insight. •Significant yield and throughput improvements were achievedwithin the first 3 months. •Full project tracking with standardisedtemplates was implemented to professionalise the approach.•Key people trained by <strong>Celerant</strong> in soft and hard tools to enablethem to continuously improve the company and train others.‘<strong>Celerant</strong> gave us valuable drive and supportfrom analysis all the way through to implementation.’Head of Wafer ProductionBUSINESS CHALLENGE The client is a global leader in the Nuclear Powerindustry. Due to recent events the industry is facing tougher regulations,but performance objectives remain the same. Internal resources at its plantsare finite because of hiring restrictions, an aging workforce and the timeneeded to train new people. The challenge for each plant was thereforeto achieve its targets with roughly the same resources. <strong>Celerant</strong> <strong>Consulting</strong>was brought in to help make this happen because of the successfulOrganisational improvements it had achieved at other client plants.CELERANT SOLUTION The project’s objective was to identify areas tofacilitate, simplify and improve employees’ way of working. <strong>Celerant</strong> didan extensive scoping with more than 10% of the workforce and narrowedtheir comments down to 60 focused areas. Top management were thenengaged to weigh and eliminate irrelevant areas and data analysis,process critics, design workshops and focus interviews were used tofurther define the selected areas of improvement. The goal was to gaineveryone’s participation and belief in the process and identified solutions,so they could carry out the required changes in the near future.RESULTS More than 800 improvement areas were identified. •From 60selected areas, 18 were validated by top management as key to overallsite performance - maintenance planning of secondary equipment, workauthorisation permits process in controlled zones, spare parts managementand delivery process to work stations etc. •Each selected area wasstructured as a typical <strong>Celerant</strong> project with a MCRS ® ManagementSystem, Client project manager, team structure and agreed milestones.•Final deliverables were to: work with the 18 client project managers ondetailed Steps to Milestones and ensure buy in as they would have topresent it and deliver it to the plant director; provide the plant director withthe tools and MCRS ® to drive and manage those 18 individual projects.ManufacturingEnergyCLOSEWORK® CELERANT GLOBAL REVIEW 2011 2012 XX 17

Driving ChangeChange is the constant, the signal for rebirth, the egg of the phoenix.2012 marks <strong>Celerant</strong><strong>Consulting</strong>’s 25thyear of helping clientsturn complexity intoopportunity.18CLOSEWORK® GLOBAL REVIEW 2012

CLOSEWORK® GLOBAL REVIEW 2012 19

Driving ResultsAll thoughts must be distilled into action and action that brings results.Turning Uncertainty into Global Results<strong>Celerant</strong> <strong>Consulting</strong> Supply Chain Global ExperienceIn today’s uncertain times, companiesare looking for Supply Chain flexibility,efficiency and visibility. <strong>Celerant</strong><strong>Consulting</strong> turns complexity intoopportunities, helping clients to designtheir supply chain as a key driver forgrowth and value. We focus on yourpeople for successfully transformingyour supply chain operating model,globally and end-to-end, in allindustries & services.Golden RulesGet results as a way-of-working,not as a one-off programme:• Make your Supply Chain asustainable competitive advantage.• Engage leaders own and inspiresupply chain excellence.• Implement a lean, safe and cleansupply chain operating model.• Work 360°: top-down,bottom-up and end-to-end.5Net inventory and DSOsignificantly reduced(two-digit %) across5 regional business units.EXPERIENCE 1Challenge: Generating truly effectiveWorking Capital improvementLocation: Asia PacificSector: Manufacturing‘<strong>Celerant</strong> helped us reduce our WorkingCapital position significantly in a veryshort time span, and by engaging localprocess owners heavily in the project theylearn a lot of methods and concepts.’Managing Directoraverageincreased15OEEEXPERIENCE 2Challenge: A Pan-European Improvementplan to deliver the targeted savingsLocation: Europe (7 countries)Sector: FMCG‘<strong>Celerant</strong> has a special capability that otherconsultants companies do not have – you’rereally good at going into the details fromshop floor to senior management leveland you are able to truly solve the issues.’Supply Chain DirectorNo.1expert benchmark levelat managing externalmanufacturing partnersin the least time possible.EXPERIENCE 3Challenge: Making External Manufacturingwork for youLocation: US, China, IndiaSector: Pharma‘Success means an assured, flexible andpartner based supply chain. We will buildtrust and grow benefits forward.’Global Vice President20CLOSEWORK® GLOBAL REVIEW 2012

Driving InsightsSuccess always demands a greater effort.UnlockingCreativityAlternativesto traditionalbrainstorming.Innovative problem solving can only occurwhen traditional, ineffective techniquesare challenged, argues Greg Kinsey,SeniorVice President at <strong>Celerant</strong><strong>Consulting</strong>. Sometimes youhave to turn the establishedthinking upside down.22 CLOSEWORK® GLOBAL REVIEW 2012

Driving InsightsSuccess always demands a greater effort.Only a few times in our nation’s historyhas the need for profound change in theway Government spends taxpayer dollarsbeen as apparent as it is today.Looming budget challenges mean that the relationship between Government andthe Contracting community must be fundamentally redefined, argue James BiereMarceau, President and Matthew Jankowski, Vice President, <strong>Celerant</strong> GovernmentServices. It’s the only way to drive greater performance from both sides.he US Government faces a futureTwhere more or better work willhave to be done for the same orless dollars. That means the risk- reward relationship between Governmentofficials and the Contracting community willhave to change. It sounds simple, but given thecultural and behavioural changes that will berequired to break the current legacy processesthat influence how taxpayer dollars are spent,it could prove difficult without the catalyst of afresh perspective. With a 95% success rate invalue-based consulting for commercial clientsand a track record of successfully changingbehaviours, <strong>Celerant</strong> <strong>Consulting</strong> can providethat perspective.We believe that not only can the current levelsof performance be met within shrinking budgetcycles, they can be dramatically improved.Think differently Act differentlyThe process by which Government officialsmanage congressionally approved budgetsis complex and often fraught with politics.They must remain vigilant on how taxpayer’sdollars are spent, but the Federal AcquisitionRegulation procedures they have to follow tomanage budgets, continuing-resolution budgetdelays and fiscal-year constraints create anatural conflict between what they should doin order to be more efficient - and what theyactually do to meet their expenditure andprogram objectives. With pronounced longtermbudget challenges now facing our nation,<strong>Celerant</strong> <strong>Consulting</strong> believes that a much greateremphasis must be placed on significantlyincreasing the probability of success forGovernment contracting so that it can achievegreater efficiencies that are both understoodand measurable.Current thoughts within the U.S. Federal spaceon acquisition and programmatic efficienciesalready indicate some willingness to considernew ways of approaching contracting. For example,contracts that provide smaller incrementalpayouts to ensure that success is consistentlydemonstrable and measurable , or longercontract terms to minimize the workload on thecontracting community, have begun to appearthroughout the U.S. Federal and military space.Unfortunately, such changes fundamentally donothing to ensure that the officials managingthese billion dollar contracts will receive valuefor what they have acquired.Revamp the risk – reward modelWhat’s needed is a way of changing collectivethinking towards increasing the probability of24CLOSEWORK® GLOBAL REVIEW 2012

success of projects throughout the Contractingcommunity. <strong>Celerant</strong> <strong>Consulting</strong> believes this newparadigm can only succeed if it is accompaniedby a change in risk versus reward expectationsacross the Federal Government and its contractedsupport teams. This must start with a Federalcommunity that is motivated to reduce costsand maximize efficiency. While the Governmentdoes not operate like a profit-driven entity, it isworthwhile asking why, unlike in the corporateworld, there has been no historical quest forproactive measures to reduce costs in up, aswell as down years. The simple truth is that thecurrent budgetary process does not motivateU.S. Government organizations to create one.The current model is: Spend it, or lose it in nextyear’s budget request.This is not to imply that U.S. Government workersare complacent within the current environment.The opposite is true. Well intentioned, patrioticand hard working Government employees whoare bogged down performing activities that addlittle value simply don’t have the luxury of tryingsomething different, unless it’s driven top-downthrough the organization. What’s more, manyGovernment agencies are extremely risk-averse,so it’s virtually impossible to implement a cultureof taking risks with new processes or conceptsin an effort to maximize efficiencies. In contrast,commercial sector industry partners would notaccept, nor even prevail, if such conservativepractices were the mainstay in their environments.Incentivize to change behavioursSo how do you motivate people to spend lesswhen they’re under no external pressure to doso? The challenge lies in first incentivizing theContracting Officer community with rewardsfor giving money back or optimising budgetaryspends. From there, this change in behaviourwill permeate the Contractor base at large,whose members can quickly be expected toadopt a fresh perspective.In Contracting, as in any business, incentivesmotivate certain behaviours. Business executivesas a group, motivated by promotions andbonuses, will strive for greater profits, usuallyachieved by driving down costs and increasingmargins. Incentives do exist in the currentGovernment contracting environment, but they’renot aligned to drive the right behaviours intoday’s budget and programmatic climate.Another, perhaps greater flaw in the currentprocess is that it also fails to provide theGovernment with sufficient time to clearlyarticulate what is realistically needed, andto award contracts to companies that canrealistically deliver.The use of incentives in the U.S. Federal market isnot new. A form of Performance Based Contractingthat has already been embraced by the U.S.Department of Defense (DoD) is Performance-Based Logistics (PBL), which gave AcquisitionProgram Managers an opportunity to reducecosts without compromising operational systemreadiness. By getting the contractor to committo a performance level, rather than contractingfor goods and services, the Government effectivelyshifted its cost risk to the contractor, which inturn saw the opportunity for a greater profit.Based on the same core principle as PBC, PBLis now gaining wider popularity and attentionwithin the DoD at large.As a further example, energy-conservationcontracts propose fees based on a PBC modelwhere compensation is tied to energy savings.When the annual savings in energy bills exceedsthe amortized costs of the services, the customerhas little need or desire to be concerned withcontractor profits. With the promise of dramaticallyreduced utility bills, particularly for sizeable,aging Government buildings, these contractsrepresent a strong proof-of-concept for expandingthe use of PBCs into other types of services and arecurrently in use within some U.S. Federal agencies.<strong>Celerant</strong> <strong>Consulting</strong> believes it is now time toexamine how Performance Based Contracting canbe applied within all Government organizationsto create an ideal environment for:• Greater collaboration across the Governmentand the Contractor community.• Motivating the Government workforce to sharein the agency’s overall efficiency objectives.• Motivating the Contractor to exceedexpectations - as profit margins increase.• A greater sharing of the risks and rewardsof achieving cost savings.• A tighter management and measurementof expectations within shorter intervals.Reciprocal trust is paramountIn our experience, the recurring theme that hasdriven successful PBCs is trust. With both theGovernment and the Contractor having skinin the game, trust is paramount to successfulimplementation. This in and of itself may be thegreatest barrier to implementing what has beenproposed because trust can’t be achieved overnight;it develops as a result of an expectedand consistent set of outcomes that are tied tothe human behaviours of both sides engagingthe contract.American taxpayers are demanding that theirgovernment maintain and even increase levelsof performance with decreasing budgets. It’sclear that this goal has quickly risen to top ofmind for several leading acquisition officials.The time is right for Government organisationsto increase accountability, enhance operations,drive cultural change and demand better results.At a grass roots level, the fundamental questionwhich is driving fiscal change in both the publicand private sectors is: ‘If the dollars the contractingcommunity spent were coming directly fromtheir personal wallets, would they spend thebudgets the same way?’‘ Historically, the onlytime governmentbecomes innovativein cost cutting iswhen the budget iscut. There’s littlemotivation whenbudgets areexpanding.’Greg Rothwell,former Senior Acquisition Executive, DHS.CLOSEWORK® GLOBAL REVIEW 2012 25

Continuous ImprovementWhat was the burningplatform that made youstart this programme?Niko has been hugely successful in Belgium forover 90 years, mainly with sockets and switches.We’re the dominant player in terms of turnover,margins and market share. But we came to realisethat while this dominant position was a goodthing, it was not so good that we couldn’t growother products groups in this market. That wasalso our situation internationally. We were notas successful internationally as we were at home,mainly because the type of products we wereoffering were not as easy to differentiate from thecompetition. There was nobody outside of Belgiumjust waiting for Niko switches and sockets.The characteristics you need to become inter-nationally successful are also very different fromthose you need to be nationally successful.Being a market challenger is totally differentto being a market leader and the whole DNA atNiko was that of a market leader, so we didn’thave the right attitude to grow our internationalbusiness in the most successful way. This led usto the situation in 2010 where we decided that wewanted to double our international sales within3 years and at the same time maintain our marketleadership in Belgium. We wanted to take thatcash flow and invest it in international growth.Now we quickly realised that to be successful itwould not only be a matter of good sales andmarketing efforts, in terms of understanding theneeds of the different markets and providingsolutions, knowing the right players in thosemarkets and so on, it would also be a matter ofimproving our operations - and by that I meanour operations and Supply Chain. We neededto make a major shift because for a long timethe company has been an extremely productionoriented company. So we needed to shift to amore customer centric company.Also more specifically in Operations, it meantthat where the focus was oriented in a ‘pushorder’ model, we now had to make sure that wecould handle what I call ‘any kind of order.’ Ifwe wanted to grow the business outside Belgium,certainly at the beginning, orders would comein at unexpected times and in the volumes thatwere not as high as we would have liked to make,or as we were used to making in our Belgianmarket. So we needed to create an Operationsorganisation that could react quickly and flexiblyto all the different types of orders from thedifferent markets. On the other hand it wasabsolutely imperative that our quality, costsand service levels remained the same.Why did you decide ona LEAN programme?To be honest, we didn’t deliberately chooseLEAN. We chose <strong>Celerant</strong> <strong>Consulting</strong>. TheOperations Manager had a vision of LEAN andwas articulating what it would mean in terms ofthe programme, so it was a good fit and clearlywhat we implemented is covered under LEAN -the need for change was there, we had tocreate an Operations organisation that coulddo everything I described earlier and to makethat shift we quickly came up with the mainpriorities: We had to increase productionefficiency, we had to maximise production flowto decrease waste and so on, and we had tolook at our Supply Chain model. What we soonrealised however, was that to be really successfulthis Change Programme would have to go muchfurther than the technical aspects. We wouldhave to shift the whole mentality of the factory.As I said, Niko has been very successful for avery long time, so most people here live prettymuch in their comfort zone, including lower andmiddle management. We had to create a realsense of urgency for change and we wanted touse an outside party to help us do this. A partnerthat could not just help in terms of content,but also with the whole Behavioural Changeprocess. And that’s basically why we chose<strong>Celerant</strong>. When we had our first contacts withthem and after they conducted the analysis wefelt that the way <strong>Celerant</strong> operates is by goingdeep into the change process, working on thementality in the company and creating a senseof urgency for change.Has your appreciationof LEAN changed?I had no experience of LEAN implementation untilthen and I basically saw it as a method to make anoperational department more efficient. So thefirst and most important thing that I’ve learnedabout LEAN is that it’s a general businessphilosophy that helps you better define yourwhole vision and company strategy. It’s notjust focused on Operations, it’s much widerand deeper than that. The whole concept ofLEAN is to focus on the customer. You have tothink how you can create extra value for yourcustomer and what the impact will be. So LEANhelped me fine tune our vision and overallstrategy. That’s the most important thing thatchanged throughout the programme.CLOSEWORK® GLOBAL REVIEW 2012 27

Driving IdeasIdeas move fast when their time has come.‘ When we had our firstcontacts with <strong>Celerant</strong>we felt that the waythey operate is by goingdeep into the changeprocess, working on thementality in the companyand creating a sense ofurgency for change.’I also learned that LEAN is not a one-off project. The third success factor was changing the cultureOnce you start you’ll never stop. It’s Continuous and the mentality, and here I’m specificallyImprovement and this is what I now see happening talking about changing the management mentality.on the shop floor. People are driven and they’re We had to become more action driven, moregetting this extra motivation because they have disciplined and we also had to learn a lot morean impact on the process. My main concern about fact based decision making. We werehad been how would we keep this going after working a lot, doing a lot, but it didn’t always<strong>Celerant</strong> left us? Now I see that my own people correspond to the three things I’ve just described.are very motivated and it is going very well.My main concern and my impact on this projectThe third thing that impressed me is what has been creating the sense of urgency. CreatingI would call the power of visualisation. We the awareness that there is a need for changehad no experience with a lot of the tools that and changing the operational clock speed, not<strong>Celerant</strong> brought us, so visualising all these only in the beginning to motivate people tothings was so powerful and effective for this get started, but also in how we continue thatprogramme. It also taught us how to better by doing things in a more effective way withvisualise our other plans and bring them to the a higher sense of urgency.floor. We worked very closely with <strong>Celerant</strong> andwhenever they asked for help or wanted usHow easy was it to bring themake a decision we immediately responded.Voice of the Customer deeperYou said that many people into the organisation?were set in their ways. Was To be honest, there are areas where we arestill struggling with that. The things we’veit difficult to change them? changed on the Supply Chain, they’ve workedIt was the major effort. Three things needed to well, but the Voice of the Customer has tohappen for the programme to be successful: come through our commercial people andthe first was convincing people there was an that’s one of the areas where I feel we mosturgent need for change - and that wasn’t easy have room for improvement. The wholewhen the company has been doing so well and programme worked well in the Operationspeople believed there was a direct relationship Department, but with Niko being the companybetween that success and how they did things. that it is, we were pretty much organised insilos. It was top down communication inThe second was transmitting our ambition most departments, with some bottom upand objectives to everyone. In the Operations communication in other departments, butDepartment it was clear that we wanted to there was very little communication betweenchange something, but the Operations Manager departments and that was something we hadneeded some help in defining and translating to break through. I think we only partlywhat exactly we wanted to achieve and how succeeded in doing that last year with thewe were going to achieve it.project. There’s more work to be done.28 CLOSEWORK® GLOBAL REVIEW 2012

Continuous ImprovementHow are you continuingyour change journey?The programme has succeeded in Operationsand Supply Chain. Now we need to keep upthe sense of urgency and take it to the otherdepartments which weren’t so much of apriority in the beginning.Was it difficult to makepeople understand thiswasn’t a one-off, it’s nowthe way we work?Not in Operations, Supply Chain or the technicaldepartments like engineering. That’s one of thegreat things I discovered walking around theorganisation. People are now self motivated,they’re proud that they can contribute andthey want to continuously improve.I would like to add one more thing. When<strong>Celerant</strong> left us just before Christmas 2011 itwas clear to me that our biggest challengewould be keeping this process of change goingwithout them. I had a fear that we would fallback into the old habits, but what happenedwas the complete opposite. From January ourBelgian market has been extremely strong andthis demand continued throughout February.We had sales that exceeded by 25 – 30% ourbudget and all forecasts by 25 – 30% whichmeant we quickly reached our capacity levels,had backlogs and our service levels weredropping. People in the Belgian market knowthat they can order and we will always supplywithin 24 hours, but this unexpectedly strongdemand built up a very serious backlog, soreaction in the market was pretty strong andit was impacting our reputation.I asked for a crisis meeting to figure out howwe were going to handle this. I wanted us tobe back at historical levels of backlogs withinthree weeks. The people in Operations tookthat challenge on and within three weeks weended up at a level that was lower than thelowest day in 2011!This was a tremendous success and severalpeople here have said that they’re convincedthat it would have never been possible beforethis Change Programme. And it’s not justbecause of the tools and tricks they leanedfrom <strong>Celerant</strong>, it’s because of the total shift inmentality that <strong>Celerant</strong> had helped us create.Everybody took it very seriously, they created asystem whereby every morning at 10 am representativesof all the departments got together togo over the plans, see what problems there were,then follow up on that and monitor everything- that was also something we’d learned from<strong>Celerant</strong>. There was also a very clear commandstructure which was one of the things we lackedpreviously in this kind of situation. These meetingswere run very efficiently because they were factbased and action driven, there was no discussionsaround things, people just got straight to thefacts. I attended some of those meetings andthey were very impressive.Anything you’d havedone differently?I wish we had done this earlier.‘ People are driven andthey’re getting this extramotivation becausethey have an impacton the process.CLOSEWORK® GLOBAL REVIEW 2012 29

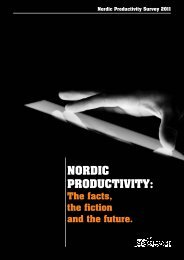

Driving IdeasIdeas move fast when their time has come.NORDIC PRODUCTIVITY:The facts, the fictionand the future.‘In Nordic society,the incentive to work isdiminishing and the urgeto put in extra effort isdisappearing. This is in sharpcontrast to foreign competition.’CEO Global Transportation.Last year <strong>Celerant</strong> <strong>Consulting</strong> carried out amajor online survey of 175 Nordic Business Leadersto establish the bottom line on Nordic productivity.Profile: 30% Top Executives, 70% Senior Executives.12 sectors with 50% from Manufacturing & FMCG.15 functions with 36% from Operations &Production, 28% from General Management.‘People arecreative and fullof ideas. If you havethe right staff, you get goodinput and good productivity.’CEO Consumer Goods & Services.1 The Nordic Perspective I 2 The Global Reality IDo you believe productivity levelsin the country where you work arecomparable with other countries?Productivity levels in Nordic countriesare all below the OECD average.Slovakia120South Korea118USA10626%35%39%Ireland106OECD Avg103Finland101NOProbablyYESSweden99Denmark97Norway95AVERAGE LABOUR PRODUCTIVITY 2009 INDEX: 2005 = 10. SOURCE OECD3 The Global Reality IIProductivity increases are significantly lowerin Denmark and Norway – a worrying trend.4 The Nordic Perspective IIHow much has productivity increased in yourbusiness unit/department in the last year?Slovakia5.1%South Korea4.3%Ireland2.5%5-10%USA2%Finland1.9%Sweden1.8%0-5%5%Don’t KnowOECD Avg1.7%Norway1.2%Denmark0.3%20%+AVERAGE ANNUAL PRODUCTIVITY INCREASE 2000-2008 (%). SOURCE OECD23% 25% 34% 6% 11%30CLOSEWORK® GLOBAL REVIEW 2012

Nordic Productivity Survey5 Productivity Levers 6 Improving Value Chain ProductivityWhat do you think are the mostimportant levers for productivity?Where do you see the biggest productivityincreases coming from in your value chain?90%84%69% 69% 67%54%75%58%48%34%OTHER(SUPPLY CHAIN)SALES & MKGR & DmanufacturingTECHNOLOGY/INVESTMENTWORKFORCETRAININGCOMMUNICATIONBETTER PROCESSES/SYSTEMSMANAGEMENT7 The Power Of ProductivityHow do you classify productivity gains?CONTINUOUSIMPROVEMENTPREREQUISITETO SURVIVALCompetitiveadvantageOTHER48 % 33 % 16 % 3 %8 2011-12 Nordic Productivity TargetsWhat is your target for improving productivity in your business unit/department this year?8% 22% 51% 10% 3% 6%0-5% 5% 5-10% 20%+ DON’T KNOW NON REQUIRED9 Measuring Personal ProductivityHow do youmeasure yourown productivity?48% 25% 13% 11% 3%FINANCIAL VALUEI CREATEI DON’TMEASURE ITTASKS I COMPLETEPER DAYOTHERSPEED OF TASKSI COMPLETE PER DAYCLOSEWORK® GLOBAL REVIEW 2012 31

Driving InsightsSuccess always demands a greater effort.REDISCOVERINGOUR HUNGER.Working harderand smarter to raiseNordic Productivity.Productivity figures for all Nordic countries are consistentlybelow OECD average. Business leaders know this must change,says Hans Lindeman, Head of <strong>Celerant</strong> <strong>Consulting</strong> Nordic andwith the right leadership and the right vision it can.hat did we learn from our NordicWProductivity Survey detailed onthe two previous pages? Whenasked the question: Do you thinkproductivity levels in the country where youwork are comparable to other countries? only39% of respondents agreed and even theywere wrong. Nordic productivity generally lagsbehind many 1st world countries.* In addition,the Nordic workforce generally works less thanmany other developed countries, productivityis rising more slowly and the gap to countriesthat we typically compete with is growing.Business leaders know this must change and51% have a target of improving productivity by5-10% in their business unit or department thisyear. They also believe that change will taketime and this is underlined by the fact that forsome, ‘The Nordic Model’ is seen as a block ora challenge to improving productivity.The bottom line is that all Nordic countries aregoing to have to work harder, smarter and addmore value to everything they do in order to staycompetitive on the global stage. The positiveresults of the survey however, suggest that our32CLOSEWORK® GLOBAL REVIEW 2012

Nordic Productivity Surveyrespondents believe that we have many of thetraits that are necessary to improve such ashigh education, political stability, creativityand global experience.Increasing Value Added workSo how do you create a performance basedbusiness culture? One that is continuallychallenging people to learn, to grow, toimprove productivity, freeing up information,democratising problem solving and givingpeople the autonomy to be successful? A criticallever is to work smarter. And the quickest wayto work smarter to improve productivity is toget everyone in the organisation to increasetheir Value Added work - and stop doing thingsthat don’t Add Value.The <strong>Celerant</strong> <strong>Consulting</strong> Workforce ImpactabilityStudy 2011 demonstrated the dramatic impactthis can have. It tracked the daily activities of200 middle managers from 6 different industriesin the US and after assessing more than 11,000work hours, demonstrated that operators generatea stunning 50% more value than supervisors.It also showed that 43.5% of a supervisor’sdaily work load can be effectively impacted,so to really drive productivity companies mustreview supervisor activities in detail anddetermine which portions of their day can bealtered to improve the value add they generate.This also means examining specific roles toensure that the right employees are performingthe right tasks. Loosely defined roles andineffective practices create a frustrating dailywork experience, with a great deal of lost time.Implementing a simple architecture with clearroles and responsibilities is the first step inbreaking this cycle and improving productivity.<strong>Celerant</strong> <strong>Consulting</strong>’s Operational TransformationService Line has a track record of improvingproductivity by changing behaviours - and whatchanges behaviours is simultaneously addressingmanagement systems, processes, people andskills. Our robust MCRS ® Management Systemcreates alignment from the boardroom all the waydown to the lowest person on the floor and backagain. This enables an organisation to createaccountability at the lowest possible level.Creating this holistic perspective and processallows Managers to make the right decisions,improve communication and reduce the negativeeffects of errors from one department or functionto the next. In addition, a team that understandsits contributions and feels connected to theentire programme is more motivated toimprove performance.Doing more with lessAll Nordic countries are well placed to improve.They have high levels of education, stablepolitical models and their citizens are not yetexposed to the type of extreme short-termmeasures that the Greeks are. Over the lastdecade Sweden has demonstrated its abilityto change and improve its competitivenessand financial strength, and along with Finlandis reasonably placed in terms of productivityand hours worked compared to the rest of theworld’s high-productivity countries. Howeverboth countries must continue their focus onimproving productivity growth and building onpast strengths, especially Finland which is facingincreased national fiscal challenges in 2012.Norway is in a special category due to its relianceand income from fossil fuels. However, consideringthat its workforce work fewer hours than anyother country in Europe, it should invest and focuson productivity to provide a back-up plan to itsreliance on oil and gas and take a leadershipposition in sustainable development. Clearly atthe back of the pack is Denmark, which is facinga very bleak future if it does not do somethingdrastic soon. It has very low levels of productivitygrowth coupled with a workforce that workscomparatively few hours. In addition, it carriesthe burdens of a very cost intensive welfaresystem and a growing budget deficit. Faced withincreasing corporate taxes a growing numberof corporations are considering moving theworkforce out of Denmark. If this imbalance isnot changed very quickly, the long term effectscould be devastating. It is a negative spiral thatcould take many years to get out of.Back to the futureDeveloping a culture of working harder andsmarter is the biggest challenge facing Nordicbusiness leaders today and our survey shows thatthey believe that the Top 6 drivers to achievingthis are management, better processes andsystems, better communication and training,an engaged and motivated workforce andinvestment and the overall economy.At <strong>Celerant</strong> <strong>Consulting</strong>, we believe that moremanagement won’t help, but better managementwill – and when it’s combined with bettersystems and processes it will actually have aprofound effect. There is also no doubt thatin the medium to long term, communicationand education will have a very positive andlasting effect.Many people in the Nordic region appear tohave become complacent about competition,believing that somehow because our companiesand corporations have been world leaders ininnovative practices, technological advances andvalue creation we’re immune to the challenges ofglobal competition. Such complacency has been seenbefore. Take for example, the Japanese economy.From the 60s to the 80s the Japanese led theworld in innovation, technology and improvingproductivity. Today, that advantage has all butdisappeared as the country has stagnated.The Nordic region is definitely not immune toglobal competition and we’re going to have torediscover our ambition and drive. We’re going tohave to work much harder and much smarter tokeep all the benefits that we enjoy in our societies.Involving, motivating, leading and above allrekindling the hunger in our employees hasnever been more important.‘ Hard work and ingenuitycreated our present. Nowthey must protect our future.’* AVERAGE LABOUR PRODUCTIVITY 2009 INDEX: 2005 = 10. SOURCE OECDCLOSEWORK® GLOBAL REVIEW 2012 33

Driving ChangeChange is the constant, the signal for rebirth, the egg of the phoenix.<strong>Celerant</strong> <strong>Consulting</strong> changes business for good.<strong>Celerant</strong> employees can also change lives for good.Just like Pamela Griffin in Tanzania.Leaving my mark onve been asked many times by manyI’people why I keep going back toIpalamwa, Tanzania with GlobalVolunteers? My answer is thatthese pictures speak a thousand words.My answer is also in the words of Antoine DeSaint-Exupery: ‘A rock pile ceases to be a rockpile the moment a single man contemplates it,bearing within him the image of a cathedral.’I see more than a broken down school and avillage with none of the basic infrastructure thatwe take for granted. I see potential in every child,student, teacher and villager. They know educationwill help provide them with a better future andI want to be there side by side helping them tobuild their cathedral, just as I work side by sidewith my clients.My personal motto is ‘Everyone Reach the Moonand Stars.’ It’s about dreams and making them areality, similar to Global Volunteers motto ‘Leaveyour mark on the world.’ I love that everyoneI meet in Tanzania cherishes the moment wevolunteers arrive and are there teaching themEnglish, Math and Geography in the classroom,as well as providing our personal expertise. I usemy business planning skills to help the local GlobalVolunteer staff with their many projects: buildinga clean water system, reconstructing the schooldormitories, building a new out-house, cultivatingthe land to plant next year’s crops of maize andbeans, organizing donated books into a usablelibrary and so on.Besides the structured time, I cherish just walkingthrough the village talking to the students, sharingour beliefs, dreams, and fears. It’s amazing whatyou can learn sitting outside a little shop, drinkinga warm coca and talking with your rafiki (friends).So far, I have chosen Tanzania as my home awayfrom home, but Global Volunteers has programsall over the world. If you are interested, pleasevisit them at globalvolunteers.org or contact medirect: pamela.griffin@<strong>Celerant</strong><strong>Consulting</strong>.com34CLOSEWORK® GLOBAL REVIEW 2012

globalvolunteers.orgthe world.Global Volunteers’ unique philosophy ofservice requires volunteers to work at theinvitation and under the direction of localcommunity partners and one-on-one withlocal people. Somewhere in the world a childneeds your help. As a Global Volunteer you’llput your personal skills to work nurturing,teaching, feeding, planting, building,shaping - and often, saving children.CLOSEWORK® GLOBAL REVIEW 2012 35

Driving ResultsAll thoughts must be distilled into action and action that brings results.Feeding A Demand For MexicanSafety First. Safety Last.BUSINESS CHALLENGE The client is a major North American food company.Demand for its Mexican frozen food was booming, so it needed to maximizeplant production to guarantee customer satisfaction. The facility presenteda number of challenges, including an inexperienced group of operators andmechanics, a lack of structured processes and a divided managementteam with poor management practices. Equipment was showing signsof deterioration because of poor reliability and maintenance and therewas limited visibility into where and why bottlenecks were forming andthe best way to correct them. To further complicate things, the existingtortilla bakery section was to be decoupled from the rest of the productionline and a new one built in an adjacent building. Product quality and foodsafety were an absolute priority, so <strong>Celerant</strong> <strong>Consulting</strong> was appointed tohelp the company transform the site.CELERANT SOLUTION To ‘regain control’ of the production process the<strong>Celerant</strong> Team installed a cross-functional problem solving system tofix the root causes of recurring issues and used Closework ® to teachimproved methods on the line, facilitate clear communication and createa cohesive working environment. They also trained people for the separatebaking facility and integrated them into the new processes. Then whena sister production site was fire damaged and its production transferredover, <strong>Celerant</strong> supported the conversion of one line to include eggrolls,an entirely different process from anything existed. At senior managementlevel, <strong>Celerant</strong> also coached selected managers to promote fact baseddecision making and a real results focus.RESULTS The plant made a profit made for the first time in 3 years.•Overall OEE improved significantly and labor costs and materialwaste were reduced. •Emergency maintenance was halved andschedule compliance dramatically increased. •Preventive maintenanceprocedures, reliability SOPs and a new MCRS ® Management System todrive Continuous Improvement were installed.ManufacturingBUSINESS CHALLENGE The client, a leading North American chemicalscompany, first appointed <strong>Celerant</strong> <strong>Consulting</strong> for a major project at oneof its biggest plants that focused on waste water excursions, overallequipment effectiveness and operating budget improvement. Withsuccess in all areas, including a reduction in waste water excursionsto zero, Senior Management now wanted to use the momentum fromthat project to improve personal safety at the facility.CELERANT SOLUTION <strong>Celerant</strong> conducted a safety assessment and asa result partnered with the site leadership team to execute a safetyimprovement project to raise safety awareness and develop a culture andapproach that would drive sustainable safety performance improvement.To execute the project, the joint Taskforce focused its efforts on: SafetyStrategy including integration of site goals to corporate initiatives; SafetyInitiative Management with a focus on effectively managing executionof selected improvement initiatives; The Management Control andReporting System incorporating leading safety performance indicatorsin site safety performance review; Plant Safety Communications to raiseawareness on the job as well as awareness of new safety initiatives;Environmental Health & Safety Employee Councils to increase workforceengagement in safety improvement; Incident Investigation ProcessImprovement that included the consistent utilization of structuredproblem solving to identify and address root cause. The execution teamwas supported by an overall steering team that helped expedite decisionmaking and issue resolution.RESULTS The entire organization was successfully engaged throughoutthe project. •All project deliverables were completed. •The new systems,processes and behaviors that were implemented for a sustainablesafety culture meant that the organization could drive continuous safetyimprovement once the project was complete.‘I actually feel that we’re making a big contribution to the long termsuccess of the plant. I’ve never before worked on a project where I feltI was having that kind of impact.’ Client Co-Project LeadChemicals36 CLOSEWORK® GLOBAL REVIEW 2012

The Prescription For SuccessEnabling Core GrowthBUSINESS CHALLENGE The client, a major pharma company, was presentedwith an opportunity to gain a significant edge with one of its specializeddrugs. Setbacks among its competitors had created an open field for adominant prescription which was the clear favorite. A contractmanufacturer ran the primary production facility and was expected tomeet the incoming spike in demand, however, the company’s 2 facilitiesin the Caribbean were not up to the challenge. One had been earmarkedfor closure, calling for consolidation of all production to the remainingplant. Inadequate equipment and the short time frame made this impossible,so the plant previously earmarked for closure had to be brought back tolife to lead the way for production. <strong>Celerant</strong> <strong>Consulting</strong> was brought in tohelp make it happen.CELERANT SOLUTION The <strong>Celerant</strong> Team implemented a 24 week crossfacilityplan, focusing on rapid design and installation at the first plant,followed by replication at the second. The assessment pointed to subparequipment effectiveness and non-conforming behaviors that slowedthe process. The Team looked at 2 areas of concern: manufacturing andquality. In manufacturing, they focused on improving throughput byidentifying major bottlenecks and establishing short interval control tomonitor and correct the flow. The quality workstream focused on thecritical path of record review and disposition to level load the monthand shorten the lead time to shipment. They also focused on dynamicscheduling and short interval control to reduce lab errors and cycletime. In addition, the team recorded the process, implementing visualmanagement and active feedback loops for operators to help reducedocumentation errors.RESULTS Over 120 batches consistently produced. •Overall assetutilization was significantly improved. •Active supervision was doubled.•QC lab cycle time, overall record review and disposition cycle time andQA record review cycle time were all improved. •Client record reviewcycle time was also improved by one third.Life SciencesBUSINESS CHALLENGE Following <strong>Celerant</strong> Government Service’s successwith a sister organization, a U.S. Army Program Office asked us to conductan in-depth analysis of its operations following a Base Realignment andClosure (BRAC) move. A resource drain due to the move, service level drops,funding concerns and other related issues showed that improvements wereurgently needed. Objectives for the analysis included: review management’sstrategy and imperatives, understand the current organization and capabilities,assess the BRAC status and implications and lay out an objective courseof action for improvement.CELERANT SOLUTION The <strong>Celerant</strong> team launched an analysis to understandthe current state and capability of the client’s organization. It examined theroot cause and drivers of the current level of organizational performance thatare process, system and structure driven; the organization’s performancepotential; quick win improvement opportunities and an integrated implementationplan to identify any support required to achieve a sustainablestate. As a result of this analysis, <strong>Celerant</strong> was awarded a follow-on contractto: develop key focus areas and contact points to provide real-time dataand information to facilitate required work product output; conduct a postBRAC organizational workshop; complete a Fiscal Year 12 staff tax forecastand develop a logistics cost breakdown and program management reportingstructure; develop detailed schedules and cost breakdown estimates forPBL; develop future state organizational design and master documentationto include concept plans for military, core, matrix and contractor personnel;establish battle rhythms (MCRS ® ) that will include a management system,meeting structure in calendar format and a key report structure; develop andnegotiate Functional Support Agreements with all supporting organizations.RESULTS A new, proactively oriented organizational structure, well suitedto the demands of the current operating environment is now in place.•Functional support groups with clearly identified requirements andexpectations have also been installed. •The client is now prepared toenter the Performance Based Logistics (PBL) arena fully confident intheir ability to be successful.Government ServicesCLOSEWORK® CELERANT GLOBAL REVIEW 2011 2012 XX 37

oughton Chemical CEO, Paul DeVivo, recently spoke to <strong>Celerant</strong>H<strong>Consulting</strong> Americas about his experience implementing Change Programs.Drawing on real-world examples from his 30+ year career with organizationslike Unitor, Valspar, Ashland and Houghton, he shared his ‘10 Learnings’ that serveas a project implementation tutorial for Clients and Consultants alike.These Learnings have helped Paul and his Management Teamsexecute a great number of successful programs over the years.Houghton is one of the world’s largestand longest established suppliers ofspecialist industrial metalworking fluidsand fluid management services.In all significant projects metrics should bedeveloped for measuring the success of theproject. ‘Before measurements’ compared with‘After measurements’ should clearly indicatethe project’s success or failure. Choose and5Rewards and recognition of resultsmay take time to be realized andappreciated. Be patient.4agree on the right metrics. Take frequent‘During Measurements’ to ensure that you aretracking toward targets and to determine ifadjustments need to be made while you stillhave time. Waiting until the end of a projecttime line is too late to make adjustments.Enjoy the challenges, celebrateeven the smallest victories, sharepraise, stay positive, smile often andengage the entire team to enjoy theeffort. If this seems too much likehard work -look for another career.1Be patient forthe pay-off onyour efforts.Take measurementsbefore, during andafter all projects.This is worth repeating. Manyprojects are carve-outs from a muchbigger project vision. It is too easyto expand the current definedHave fun alongthe way.project scope with elements thatbelong in future projects.Limit scope creep.Every project should add toyour skills if you are opento process improvementsalong the way. Sometimesthe improvement ideas cancome from the least expectedsource. Stay open for learning.Recognize thatContinuous ProcessImprovement buildsskills for futureengagements.3Limit projectscope creep.Stay focusedon the projectat hand.2CLOSEWORK® GLOBAL REVIEW 2012 39

Driving ResultsAll thoughts must be distilled into action and action that brings results.‘ In only 30 weeks we haveexceeded our targets. We havethe right structure in place,a skilled team and the fullengagement of our staff onsite to sustain and driveContinuous Improvement.’Sean McHugh, Group CI Manager.40CLOSEWORK® GLOBAL REVIEW 2012

LEADING THE FIELD.When Irish Dairy Board wanted to create a culture of ContinuousImprovement at 3 plants in Europe, it asked <strong>Celerant</strong> <strong>Consulting</strong>to get down on the ground and help drive results up.rish Dairy Board was looking toIimprove operational efficiency inanticipation of the increase in dairyoutput forecast from the removalof milk quotas in 2015. The Executive ManagementTeam therefore decided to launch a LEAN Initiativeto align operations and introduce a culture ofContinuous Improvement into the business,starting with three key locations in Europe.After a competitive bid process, they identified<strong>Celerant</strong> <strong>Consulting</strong> as the ideal partner to makethis happen by introducing the new behavioursthat would be needed to create this culture ofContinuous Improvement.Rising to the topThe project started with the deployment of anOperations Excellence initiative across the threeEuropean sites to develop new ways of workingbased on LEAN Principles and internal best practice.<strong>Celerant</strong> focused on standardising OperatingProcedures and installed Short Interval Controlsto improve process stability. Kaizen events wereperformed with Operators and Team Leaders whichfocused on standardising operating proceduresand improving product flow.<strong>Celerant</strong> also introduced a comprehensive MCRS ®Management System that enabled the three sitesto standardise their performance measures andimplemented a Root Cause Analysis and escalationprocess to eliminate production issues.LEAN training and behaviour coaching at alllevels of the organisation, from Plant Managersto Operators, helped to embed these newchanges and create the culture of ContinuousImprovement that was evident by the improvedOEE and Yield KPI’s.SUSTAINABLERESULTS• The project was completed in 30 weeksand rolled out across all three sites.• 5S audit scores measuring workplaceefficiency and effectiveness improvementsrose from 60%- 85%.• System Implementation Status auditsachieved a level of 80% at all sites, whichmeans that real behavioural change hastaken place and a culture of ContinuousImprovement has been created.• By project end more than 40 ProductionTeam Leaders were trained and certifiedin LEAN, led by Continuous Improvementchampions at each site, with ownershipfor sustaining these results.CLOSEWORK® GLOBAL REVIEW 2012 41

Driving ResultsAll thoughts must be distilled into action and action that brings results.Creating Global Value Acceleration<strong>Celerant</strong> <strong>Consulting</strong> Operational Transformation Global ExperienceIn today’s fast changing environment,companies faced with unprecedentedand unpredictable change, may chooseto seek shelter and ride out the storm.However, times of market turmoil alsocreate significant opportunities to createsustainable competitive advantage. At<strong>Celerant</strong> <strong>Consulting</strong> our aim is to partnerwith clients on their LEAN journey,helping them to create more effective,nimble and flexible organizations andtake advantage of these opportunities.<strong>Celerant</strong> <strong>Consulting</strong> focuses on all criticalelements for successfully transformingclients business operating model, globallyand end-to-end, in all industries & services.Golden RulesGet results as a way-of-working,not as a one-off programme:• Emphasize LEAN thinking,not lean tools.• Make leaders own and inspirelean thinking.• Work top-down, bottom-upand end-to-end.• Think big, start small.• Focus on reducing wasteand invest in growth.7countries wherethe programmewas implemented.EXPERIENCE 1Challenge: A Pan-European Improvementplan to deliver the targeted savingsLocation: Nordic and EasternEuropean countriesSector: FMCG‘I have seen many projects but this isdefinitively one of the best ones. Therigour in multi-site project managementis clearly one of the key success factors.’CEO50 % higher financialbenefits thantargetedEXPERIENCE 2Challenge: A comprehensive changeprogramme to ramp up operational efficiencyLocation: Canada & EuropeSector: Chemicals‘The good thing about <strong>Celerant</strong> wasthat they delivered on their commitment.’Managing Director35 % call wait timereductionEXPERIENCE 3Challenge: Developing a lean efficiencyorganisation and a strong platform for growthLocation: EuropeSector: Financial Services‘All the evidence shows that we’re nowachieving best practice in healthcareinsurance. I can honestly say I don’tremember another project which achievedso much so quickly and within soundfinancial parameters. I wholeheartedlyrecommend <strong>Celerant</strong>.’Director42CLOSEWORK® GLOBAL REVIEW 2012