dsrawat, fca intangible assets

dsrawat, fca intangible assets

dsrawat, fca intangible assets

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

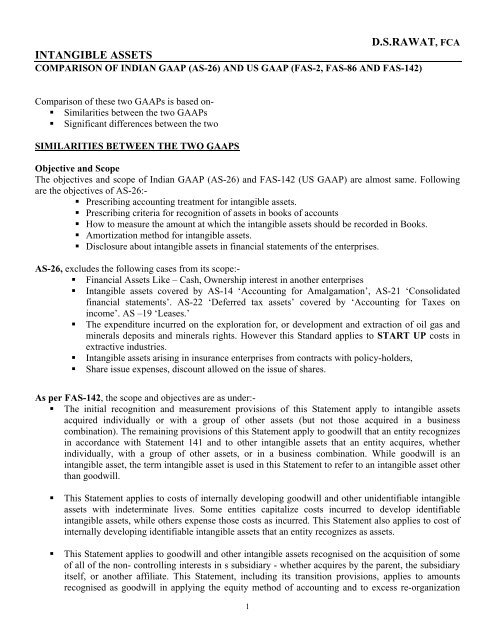

D.S.RAWAT, FCAINTANGIBLE ASSETSCOMPARISON OF INDIAN GAAP (AS-26) AND US GAAP (FAS-2, FAS-86 AND FAS-142)Comparison of these two GAAPs is based on-• Similarities between the two GAAPs• Significant differences between the twoSIMILARITIES BETWEEN THE TWO GAAPSObjective and ScopeThe objectives and scope of Indian GAAP (AS-26) and FAS-142 (US GAAP) are almost same. Followingare the objectives of AS-26:-• Prescribing accounting treatment for <strong>intangible</strong> <strong>assets</strong>.• Prescribing criteria for recognition of <strong>assets</strong> in books of accounts• How to measure the amount at which the <strong>intangible</strong> <strong>assets</strong> should be recorded in Books.• Amortization method for <strong>intangible</strong> <strong>assets</strong>.• Disclosure about <strong>intangible</strong> <strong>assets</strong> in financial statements of the enterprises.AS-26, excludes the following cases from its scope:-• Financial Assets Like – Cash, Ownership interest in another enterprises• Intangible <strong>assets</strong> covered by AS-14 ‘Accounting for Amalgamation’, AS-21 ‘Consolidatedfinancial statements’. AS-22 ‘Deferred tax <strong>assets</strong>’ covered by ‘Accounting for Taxes onincome’. AS –19 ‘Leases.’• The expenditure incurred on the exploration for, or development and extraction of oil gas andminerals deposits and minerals rights. However this Standard applies to START UP costs inextractive industries.• Intangible <strong>assets</strong> arising in insurance enterprises from contracts with policy-holders,• Share issue expenses, discount allowed on the issue of shares.As per FAS-142, the scope and objectives are as under:-• The initial recognition and measurement provisions of this Statement apply to <strong>intangible</strong> <strong>assets</strong>acquired individually or with a group of other <strong>assets</strong> (but not those acquired in a businesscombination). The remaining provisions of this Statement apply to goodwill that an entity recognizesin accordance with Statement 141 and to other <strong>intangible</strong> <strong>assets</strong> that an entity acquires, whetherindividually, with a group of other <strong>assets</strong>, or in a business combination. While goodwill is an<strong>intangible</strong> asset, the term <strong>intangible</strong> asset is used in this Statement to refer to an <strong>intangible</strong> asset otherthan goodwill.• This Statement applies to costs of internally developing goodwill and other unidentifiable <strong>intangible</strong><strong>assets</strong> with indeterminate lives. Some entities capitalize costs incurred to develop identifiable<strong>intangible</strong> <strong>assets</strong>, while others expense those costs as incurred. This Statement also applies to cost ofinternally developing identifiable <strong>intangible</strong> <strong>assets</strong> that an entity recognizes as <strong>assets</strong>.• This Statement applies to goodwill and other <strong>intangible</strong> <strong>assets</strong> recognised on the acquisition of someof all of the non- controlling interests in s subsidiary - whether acquires by the parent, the subsidiaryitself, or another affiliate. This Statement, including its transition provisions, applies to amountsrecognised as goodwill in applying the equity method of accounting and to excess re-organization1

value recognised by entities that adopt fresh-start reporting in accordance with AICPA Statement ofPosition 90-7, Financial Reporting by Entities in Reorganization under the Bankruptcy Code. Thisexcess reorganization value shall be reported as goodwill and accounted for in the same manner asgoodwill.Subsequent Expenditures on Intangible AssetsEnterprises may incur the expenditure on <strong>intangible</strong> asset after these <strong>intangible</strong> is recognized/recorded in thebook. It is just like that if any tangible asset i.e. Plant is purchased on 01.01.2002 the cost of Plant shall becapitalized/ recognized in books on 01.01.2002 expenditure after the purchase of this Plant once it becomeready for use are not capitalized and debited to expenses account, however if any major expenditure isincurred on plant which increases its productivity or future benefit then certainly such expenses arecapitalized. Same is the case with the <strong>intangible</strong> AS-26 prescribes the conditions when such expenses shouldbe capitalized or included in cost of <strong>intangible</strong>s.• Subsequent expenses increase the future economic benefits of <strong>intangible</strong>s.• Subsequent expenses can be attributed to asset and measured reliably.If above two conditions are not full filled the subsequent expenses after initial recognition shall be expensedi.e. to be debited in Expenses A/c and not to be capitalized.In general, US GAAP does not provide explicit criteria on which to capitalize subsequent expenditures on an<strong>intangible</strong> asset. Common practice in the United States for identifiable tangible <strong>assets</strong> is to capitalizeexpenditures that extend the useful life of the asset.Carrying Amount of IntangiblesUnder both GAAPs the <strong>intangible</strong>s shall be carried at its cost less any accumulated amortization and anyaccumulated impairment losses in the financial statements of the enterprises. As under the US GAAP, initialrecognition of <strong>intangible</strong>s sometimes is don on fair value basis, the carrying amount of <strong>intangible</strong>s shall befair value less accumulated amortization and any accumulated impairment losses.Amortization MethodAmortization is the process of allocating an amount (in the case of <strong>intangible</strong> <strong>assets</strong>) to expense over theperiod of benefited. We provide depreciation on the fixed <strong>assets</strong> whereas in the case of <strong>intangible</strong> we call itamortization.The Accounting Standard-26, states that the depreciable amount of an <strong>intangible</strong> asset should be allocatedon a systematic basis over the best estimates of its useful life. Amortization should start when the <strong>assets</strong> isavailable for use.What is depreciable amount- Cost of <strong>intangible</strong> asset less residual value. The residual value of <strong>intangible</strong>s isgenerally taken as zero, unless it is evident that at the end of useful life third party will purchase it at certainamount or there is active market for <strong>intangible</strong> where it can be sold at the end of useful life and market valuecan be reasonably estimated.Next question comes of useful life - can we estimate the useful life of <strong>intangible</strong>s? There is lot of debate onthis point, take a case of goodwill, there are views that goodwill has infinite life.If it has infinite life why the amortization of goodwill should be done, if we decide to amortize what usefullife shall be taken for it? The Accounting Standard has tried to resolve the controversy by suggesting 10years as useful life. Until and unless there is clear evidence that useful life is longer than 10 years.2

Now the controversy of amortization or not amortization has been put to rest and as per the accountingstandard the <strong>intangible</strong> asset should be carried at cost less accumulated amortization.If economic benefits from <strong>intangible</strong> asset are achieved through legal right granted for finite period theuseful life of <strong>intangible</strong> should not exceeded legal right period unless the legal right is renewable andrenewal is almost certain.What method of amortization should be followed the answer mainly comes from the matching concept whichrequires that the benefit derived (consumed) from the <strong>intangible</strong> in the form of increased profitability shouldbe matched with the cost (Depreciation/amortization expenses).If the pattern of benefit and cost can be determined, reliably, then the enterprises should amortize the<strong>intangible</strong> as per the pattern. However if no pattern of benefit consumed can be determined reliably thenStraight-line method should be followed.Amortization is generally recorded as an expense in financial statement. However sometimes economicbenefits consumed of <strong>intangible</strong> asset is used to produce other asset, in this case the amortization expenses isadded in the cost of other asset rather than showing it as an expenses AS-2 ‘valuation of Inventory’.As per FAS-142 (US GAAP) <strong>intangible</strong> <strong>assets</strong> which are subject to amortization are treated almost in thesame way as under Indian GAAP (AS-26). FAS-142 prescribes the following principles/rule foramortization:-• A recognised <strong>intangible</strong>s asset shall be amortized over its useful life to the reporting entity unless thatlife is determined to be indefinite. If an <strong>intangible</strong>s asset has a finite useful life, but the precise lengthof that life is not known, that <strong>intangible</strong>s asset shall be amortized over the best estimate of its usefullife. The method of amortization shall reflect the pattern in which the economic benefits of the<strong>intangible</strong>s asset are consumed or otherwise used up. If that pattern cannot be reliably determined, astraight-line amortization method shall be used. An <strong>intangible</strong>s asset shall not be written down or offin the period of acquisition unless it becomes impaired during that period.• The amount of an <strong>intangible</strong>s asset to be amortized shall be the amount initially assigned to that assetless any residual value. The residual value of an <strong>intangible</strong> asset shall be assumed to be zero unless atthe end of its useful life to the entity the asset is expected to continue to have a useful life to anotherentity and (a) the reporting entity has a commitment from a third party to purchase the asset at the endof its useful life or (b) the residual value can not be determined by reference to an exchangetransaction in an existing market for that asset and that market is expected to exist at the end of theasset’s useful life.Review of Amortization MethodAs per Accounting Standard-26, the amortization method should be reviewed at the end of each financialyear and if-• The expected useful life of the <strong>intangible</strong> asset has significantly changed,• The pattern of future economic benefit has significantly changed.The amortization method should be changed accordingly. Significant change in useful life of asset may bedue to subsequent improvement in <strong>intangible</strong> asset, on account of subsequent expenditure on <strong>intangible</strong>s.FAS-142 also, laid down the same principles as in Indian GAAP. Para 14 of FAS-142 states as under forreview of amortization method3

An entity shall evaluate the remaining useful life of an <strong>intangible</strong> asset that is being amortized each reportingperiod to determine whether events and circumstances warrant a revision to the remaining period ofamortization. If the estimate of an <strong>intangible</strong> asset’s remaining useful life is changed, the remaining carryingamount of the <strong>intangible</strong> asset shall be amortized prospectively over that revised remaining useful life. If an<strong>intangible</strong> asset that is being amortized is subsequently determined to have an indefinite useful life, the <strong>assets</strong>hall be tested for impairment an accordance with Para 17. That <strong>intangible</strong> asset shall no longer be amortizedand shall be accounted for in the same manner as other <strong>intangible</strong>s <strong>assets</strong> that are not subject to amortization.Impairment LossesUnder the Indian GAAP there is separate accounting standard (AS-28) “Impairment of Assets” which alsoprescribes the principles for calculating the impairment losses on <strong>intangible</strong>s. However, under the US GAAP(FAS-142), it prescribes the principles for impairment of <strong>intangible</strong>s. Broadly the principles laid down underboth GAAPs are the same.DisclosureThese are the disclosures required under both the GAAPs in the financial statements:-• Useful life or amortization rate• Amortization method.• Gross carrying amount, accumulated amortization and impairment loss at the beginningand at the end of the period.• Reconciliation of carrying amount at the beginning and at the end of the period.Revaluation of IntangiblesRevaluation of <strong>intangible</strong>s is permitted neither under US GAAP nor under Indian GAAP.SIGNIFICANT DIFFERENCES BETWEEN THE TWO GAAPSSeparate Requirement for Some IntangiblesThe scope of AS-26 covers a number of <strong>intangible</strong> <strong>assets</strong> that are scattered across several pronouncementsunder US GAAP. US GAAP has separate requirements for some of those items, which includes Researchand development costs, computer software, motion picture films, licenses, customer lists, mortgage servicingrights and franchisesTreatment of R &D ExpensesAS-26 addresses research and development as separate components of internally generated <strong>intangible</strong>s<strong>assets</strong>, like FASB statement No.-2 Accounting for Research and Development Costs, AS-26 requires thatcosts incurred for research is charged to expenses. Unlike US GAAP, AS-26 requires capitalization ofdevelopment costs, provided certain criteria are met; otherwise they must be expensed.FAS-2 requires all development costs to be expensed. FASB-86 however makes an exception in relation tosoftware development expenses, which should be capitalized only after technology feasibility is established.FASB had four options to consider whilst preparing FAS-2 i.e. (a) charge all cost to expenses when incurred(b) capitalized all cost when incurred (c) capitalize costs when incurred if specific conditions are fulfilledand charge all other costs to expense (d) accumulate all costs in s special category until the existence offuture benefits can be determine. FASB concluded that all R &D expenses should be charged to expenseswhen incurred, for reasons discussed below.4

There is normally a high degree of uncertainty about the future benefits of individual research anddevelopment projects, although the element of uncertainty may diminish as the project progresses. Estimatesof the rate of success of R & D projects vary markedly-depending in part on how narrowly one defines a‘project’ and how one defines ‘success’ – but such estimates indicate a high failure rate. For example, onestudy of a number of industries found that an average of less than 2% of new product ideas and less than15% of product development projects were commercially successful. Even after a project has passed beyondthe R & D stage, and a new or improved product or process is being marketed or used, the failure rate high.Estimates of new product failure range from 30-90% depending on the definition of failure used. One studyconcludes that ‘four about every three’ products emerging from R&D department as technical successes,there is average of only one commercial success. That study goes on to say that’ of all the dollars of newproduct expenses, almost 3/4 th go to unsuccessful products.A direct relationship between R&D costs and specific future revenue generally has not demonstrated, evenwith the benefit of hindsight. For example, three empirical research studies, which focus on companies inindustries intensively involved in R&D activities, generally failed to find a significant correlation betweenR&D expenditures and increased future benefits.The criterion of measurability would require that a resource not be recognised as an asset for accountingpurpose unless at the time it is acquired or developed its future economic benefits can be identified andobjectively measured. Due to the uncertainty involved, there is no indication that an economic resource hasbeen created. Moreover, even if at some point in the progress of an individual R&D project the expectationof future benefits becomes sufficiently high to indicate that an economic resource has been created, thequestion remains whether that resource should be recognised as an asset for accounting purposes. Althoughfuture benefits from a particular R&D project may be foreseen, they generally cannot be measured with areasonable degree of certainty. R&D costs therefore fail to satisfy the suggested measurability teat foraccounting recognition as an asset.Some costs are recognised as expenses on the basis of a presumed direct association with specific revenue;recognizing them as expenses accompanies recognition of the revenue. This is known as cause and effect. Ifan asset provides benefits for several periods its cost is allocated to the periods in a systematic and rationalmanner in the absence of a more direct basis for associating cause and effect. Some costs are associated withthe current accounting periods expenses because (a) costs incurred during the period provide no discerniblefuture benefits (b) costs recorded as <strong>assets</strong> in prior periods no longer provide discernible benefits, or (c)allocating costs either on the basis of association with revenue or among several accounting periods isconsidered to serve no useful purpose. The principles of immediate recognition also requires that itemscarried as <strong>assets</strong> in prior periods that are discovered to have no discernible future benefit be charges toexpense, for example, patent that is determined to worthless. Since evidence of direct casual relationshipbetween R&D expenditure and future benefits ha snot been found and due to high degree of uncertainty onfuture economic benefits, R&D expenses should be charged to expense immediately. The notion of‘matching’ – when used to refer to the process of recognizing cots as expenses on any sot of cause and effectbasis – cannot be applied to R&D costs. Indeed the general lack of discernible future benefits at the time thecosts are incurred indicates that the ‘immediate recognition’ principles of expense recognition should apply.Certain costs are immediately recognised as expense because allocating them to several accounting periods isconsidered to serve no useful purpose. The FASB interviews with selected bankers and analysts suggestedthat the relationship between current R&D expenses and future benefits is so uncertain that capitalization ofany R&D costs is not useful in assessing the earning potential of the enterprise. Therefore, it is unlikely thatone’s ability to predict the return on an investment and the variability of that return would be enhances by thecapitalization.5

The board believes that it is not appropriate to consider accounting for R& D on an aggregate or totalenterprise basis for several reasons. For accounting purpose the expectation of future benefits generally is notevaluated in relation to broad categories of expenditures on an enterprise-wide basis but rather in relation toindividual or related transactions or projects. Also, an enterprise’s total R&D programme may consist of anumber of projects at varying stages of completion and with varying degrees of uncertainty as to theirultimate success. If R&D were capitalized on an enterprise –wide basis, a meaningful method ofamortization could not be developed because the period of benefit could not be determined. Moreover, 90%of the respondents to a survey reported in AICPA indicated that their company’s philosophy is that R&Dexpenditures are intended to be recovered by current revenues rather than by revenue from new products.Selective capitalization - capitalizing R&D when incurred if specified conditions are fulfilled and charging toexpense all other R&D costs –requires establishment of conditions that must be fulfilled before R&D costsare capitalized. The board considered a number of factors on which prerequisite conditions might be based,including the following:Definitions of a product or progress: - the new or improved product or process must be defined.Technology feasibility: - the new or improved product or process must be determined to be technologyfeasible.Marketability/usefulness: - the marketability of the product or process or, if it is to be used internally ratherthan sold, its usefulness to the enterprise must be substantially assured.Economic feasibility: - Probability of the future economic benefits sufficient to recover all capitalized costsmust be high. Encompassed by the notion of economic feasibility is measurability of future benefits. Alsoimplicit is the ability to associates particular future benefits with particular costs.Management action: - Management must have definitely decided to produce and market or use the newproduct or process or to incorporate the significant improvement into an existing product or process.Distortion of net income comparison: - capitalization or immediate charging to expanse of R&D costs mustbe determined on the basis of whether inter-period comparisons of net income would be materially distorted.None of the above factors, however, lends itself to establishing a condition that could be objectively andcomparably applied by all enterprises. Considerable judgement is required to identify the point in theprogress of a R&D project at which a new or improved product or process is defined or is determined to be‘technologically feasibility’, marketable or useful. Nor can the probability of future benefits be readilyassessed. A management decision to improve with production does not necessarily assure future benefits.The board does not believe that distortion of net income comparisons is an operable criterion by which todecide whether research and development costs should be capitalized because the point at which net incomecomparisons might be distorted cannot be defined. Moreover, in assessing risk financial statement users haveindicates that they seek information about the variability of earnings. The board concluded that no set ofconditions that might be established for capitalization of costs could achieve the comparability amongstenterprises that proponents of ‘selective capitalization’s cite as a primary objective of that approach. Ifselective capitalization were applied only to cost incurred after fulfillment of the specified conditions, only aportion of the total costs of a particular R&D project would be capitalized and amortised. Thus thecapitalized amount would not indicate the total costs incurred to produce future benefits, nor would theamount of periodic amortization of capitalized costs represent a ‘matching’ of costs and benefits. Selectivecapitalization might involve retrospective capitalization of previously incurred costs in addition tocapitalization of costs incurred after fulfillment of the specified conditions. However, many R&D costsincurred before fulfillment of the conditions are not likely to be directly identifiable with the particular new6

or improved product or process for which costs would be capitalized. Moreover, retrospective capitalizationof the costs previously charged to expense is contrary to present accounting practice for other transactionswhose initial accounting is not altered as a result of hindsight. The preparation of periodic financialstatements requires many estimates and judgement for which restatement are not made in retrospectIntangibles <strong>assets</strong> not subject to AmortizationFAS-142, prescribes that if an <strong>intangible</strong> asset is determine to have an indefinite useful life, it shall not beamortized until its useful life is determined to be no longer indefinite. An entity shall evaluate the remaininguseful life of an <strong>intangible</strong> asset that is not being amortized, each reporting period to determine whetherevents and circumstances continue to support an indefinite useful life. If an <strong>intangible</strong> asset that is not beingamortized is subsequently determined to have a finite useful life, the asset shall be tested for impairment inaccordance with Para 16 that <strong>intangible</strong> asset shall then be amortized prospectively over its estimatedremaining useful life and accounted for in the same manner as other <strong>intangible</strong> <strong>assets</strong> that are subject toamortization.Under the Indian GAAP (AS-26) goodwill is also subject to amortization in spite of the fact that goodwillhas indefinite useful life. A rebuttable presumption of the useful life of goodwill under AS-26 is 10 year.Subsequent ExpenditureIt is unknown whether that approach is commonly extended to <strong>intangible</strong> <strong>assets</strong> under US GAAP as the FAS-142 is silent about subsequent expenditures. To the extent that US enterprises do not capitalize subsequentexpenditures, AS-26, guidance on subsequent expenditures constitutes another difference between Indian ASand US GAAP.Equity Method InvestmentsFAS-142, prescribes that the portion of the difference between the cost of an investment and the amount ofunderlying equity in net <strong>assets</strong> of an equity method investee that is recognised as goodwill in accordancewith Para 19(b) of APB Opinion No. 18, The Equity Method of Accounting for Investment in Common Stock(equity method goodwill) shall not be amortized. However, equity method goodwill shall not be reviewed forimpairment in accordance with this Statement. Equity method investment shall continue to be reviewed forimpairment an accordance with Para 19 (h) of Opinion18.Goodwill arising under the Equity Method of Accounting for Investment is not recognised under the IndianGAAP but only determined/identified for the purpose of disclosure in the consolidated financial statementsof the investor (AS-23).Financial Statement PresentationAs per FAS-142, all <strong>intangible</strong> <strong>assets</strong> shall be aggregated and presented as a separate line item in thestatement of financial position. However, that requirement does not preclude presentation of individual<strong>intangible</strong>s <strong>assets</strong> or classes of <strong>intangible</strong>s <strong>assets</strong> as separate line items. The amortization expenses andimpairment losses for <strong>intangible</strong> <strong>assets</strong> shall be presented in income statement line items within continuingoperations as deemed appropriate for each entity .Para 14 and16 require that an <strong>intangible</strong> asset be tested forimpairment when it is determined that the asset should no longer be amortized or should begin to beamortized due to a reassessment of its remaining useful life. An impairment loss resulting from thatimpairment test shall not be recognised as a change in accounting principles.The aggregate amount of goodwill shall be presented as a separate line item in the statement of financialposition. The aggregate amount of goodwill impairment losses shall be presented as a separate line item inthe income statement before the subtotal income from continuing operations (or similar caption) unless agoodwill impairment loss is associated with a discontinuing operation. A goodwill impairment loss7

associated with a discontinuing operation shall be included (on a net-of-tax basis) within the result ofdiscontinuing operation.Under the Indian GAAP, Balance Sheet format as prescribed in schedule VI of the Indian Companies Act,1956 which classify the <strong>intangible</strong>s like, goodwill, patents, trademark under the heading “Fixed Assets”.Further it provides for separate disclosure of “Development Expenditure not adjusted” under the head“Miscellaneous Expenditure”.Sources:1) Accounting Standard -26 “Intangible Assets” issued by ICAI, New Delhi (India).2) www.fasb.org (Site of Financial Accounting Standards Board- FAS- 2, 86, 142,)8