May 2005 - PAHU

May 2005 - PAHU

May 2005 - PAHU

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Message From the President continued from page 2expanded to six issues and now includes an Editorial Board.A new ‘Questions Asked and Answered’ column, devoted toinsurance carriers CEO comments on industry and legislativeissues in response to questions submitted by the EditorialBoard, is a welcomed addition. Carriers are invited toparticipate cementing the bond between carriers, producers,and our association.The <strong>PAHU</strong> websites, as wellas local chapter web sites,continue to be an outstandingmember resource forissues and events. Additionally,<strong>PAHU</strong> was fortunateto have a number of Op-Edand other articles featured inpublications throughout theState that focused media attentionon <strong>PAHU</strong>’s mission.Although we have come a long way - it is just a start. Unlesswe continue to build on the momentum of the past, refocus onour strengths and weaknesses, and embrace and implementnew ideas, we are always in danger of stagnation. However,I am personally confident that your new leadership will notallow this to happen.In closing, I want to thank you as members for the privilegeof serving as your president and for your constant support.In addition to our <strong>PAHU</strong> Officers, Committee Chairs andChapter Leaders, I want to personally thank our Trustees,Bill Daggett, Jr., Mike Guscott, Ron Hoffman, Bob Fountain,Mark Shaffer and Scott Kranzel for their “behind the scenes”support and invaluable advice.I urge all of you to become involved and support your newBoard and Committee Chairs in the future and KEEP UPTHE GOOD WORK!Remember, I will be looking over your shoulder! Thanksagain. It’s been a very successful and enjoyable two years.Sincerely,Charles A. NeimanPresidentEditor’s Note: This column will feature insurance carrierexecutives answering questions posed by the editorialstaff of the Pennsylvania Health Underwriter Magazine.We invite insurance carriers who would like to participatein the ‘Questions Asked and Answered’ column tocontact us at editor@pahu.org or phone 800-622-2411.Questions Askedand AnsweredWith Robert L. DawsonPresident and CEO,HealthAmerica andHealthAssuranceWhat is HealthAmerica’sposition on community ratingfor small groups?The challenge facing us is to increasethe availability of affordable health insurance by spreadingcosts among the sick and the well, while keeping prices lowenough for healthier people to retain coverage. The experienceof several states has shown that community rating doesnot accomplish this goal. Instead, their outcomes suggesthigher costs, reduced competition and choice of insurer, anddecreased attention to lifestyle management, thus underminingone of the key tools we have to maintain good healthand lower costs. Therefore, we agree with the National Associationof Health Underwriters that rating methodologies,which include consideration of health status, create a healthy,competitive environment.What is HealthAmerica’s position onAssociation Health Plans?We do not support Association Health Plans (AHP) becausefederal legislation will circumvent state laws and regulations.The AHP plan would allow associations to offer their membergroups health insurance coverage options that are exemptfrom many state consumer protection laws, fair trade practiceguidelines, solvency requirements, and rating rules. Not onlywould consumers lose the protection of the state insurancedepartment, but the Commonwealth would also be faced witha market that has some benefit designs regulated at the statelevel and others at the federal level, increasing the chance foradverse selection.continued on page 64

URL FINANCIAL GROUPThank you for your continued support of thePennsylvania Association of Health Underwriters. 5

Questions Asked and Answered continued from page 4What is HealthAmerica’s marketing focuscurrently - and for the future? What marketingareas are you concentrating on…. new productintroductions?Geographically, we are now in 63 of the 67 Pennsylvaniacounties and growing. While our core markets have been doingvery well, our goal is to increase our market share in theLehigh Valley and southeastern Pennsylvania.In addition, the recent acquisition of First Health by our parentcompany expands our national service opportunities.Through the First Health Network ® , members have accessto the nation’s largest network of health care professionals.This national network capability, combined with the medicalcost advantages of our local presence, will enable us to bettermanage unit costs, providing stronger discounts and morecompetitive pricing to our customers.Legislatively, what are HealthAmerica’scurrent priorities?HealthAmerica’s legislative priorities are to introduce legislationaddressing the issue of invisible providers, improperbilling of medical devices, and small group reform.Invisible providers are doctors who refuse to contract withhealth plans although they provide services at hospitals thatare part of the health plan’s network. Some examples of invisibleproviders include anesthesiologists, radiologists, and,in some cases, emergency room physicians. These noncontractedphysicians are able to bill health plan members at anyrate, which is usually significantly higher than the contractedfee. The rate is ultimately paid by the health plan, which furtheradds to the rising cost of health care.Would limited tort and medical malpracticereform legislation really help rising healthinsurance premiums?Yes. HealthAmerica believes that addressing the medicalmalpractice challenge will help control the overall issue ofrising health insurance premiums. Capping the non-economicdamages that an individual could receive may put an end tothe runaway jury verdicts which will help reduce the cost ofmedical malpractice insurance and help Pennsylvania retainphysicians, especially obstetricians and orthopedic surgeons.Specifically, what steps is HealthAmericataking to control premiums?HealthAmerica is trying to stabilize costs in several ways.First, we offer important medical care review services thatuse an evidence-based medicine strategy to help eliminateunnecessary care by using current, best practices to make decisionsabout health care services.Second, we are managing both unit cost and frequency ofhealth care services. Health plans that only scrutinize one ofthese cost components are only doing half the job.Third, everyday we try to educate consumers on cost andtheir role in managing their health.Fourth, we try to rein in pharmacy costs through variousdrug benefit plan designs that have coinsurance rather thanflat copayments, require use of generic medicines and priorauthorization for some drugs, and encourage the use of overthe-countermedications, to name a few.And last, but not least, is that we take a consultative approachwith employer customers. We become strategic partners withthem to plan long-term solutions that help keep costs in checkwithout sacrificing quality.What is your view of the HSA/HDHP concept?And target markets?High deductible health plans and HSAs are good conceptsthat will help to control costs in the system. They are not foreveryone, however. Health insurance purchasing decisionsare very complex and vary by market.The target markets for HSA/HDHPs are the individual marketand small and mid-sized employer groups who understand thetax benefit of these plans. For our small group employers, wesee HDHPs as a good way to structure their benefit program.However, large employers are also showing an increase in interestin these plans. It’s too early to tell if employees understandthe value. The education of the consumer is importantand the consumer may not be ready to do the research.What approach will HealthAmerica take to helpeducate consumers so they understand andembrace the HDHPs?We recognize that this type of plan design represents changefor employees – in some cases, a significant change. Themore prepared they are for the change, the better. We’ve beenworking with many of our constituents to educate them onhigh deductible health plans and how HSAs and HRAs canwork to their advantage. Our particular focus has been onthe broker and employer communities. Most recently, we’veconducted intensive training sessions for our brokers thatincluded experts in the field, and we have similar sessionsplanned for large employers in the community this <strong>May</strong>.6

We will be releasing a white paper in the next several weeksthat provides employers with even more information. Asmore employers test the waters of consumer-directed healthcare, experience is showing that three major issues need attentionto improve the odds that employees will embrace thisdifferent type of health plan. So, in our white paper, we’veprovided employers with instructions on how and when tocommunicate changes, their role in supporting a change toa high-deductible plan, and how cost incentives can help theswitch become more attractive.What specific services are you offering for the topsix chronic ailments: asthma, obesity, congestiveheart failure, neo-natal, COPD, and coronaryheart disease?Through our Disease Management and Complex Case ManagementPrograms, we use predictive modeling to identifymembers who have one of these conditions or who are at highrisk of developing one.Once we identify these members, we offer them educationalmaterial about their disease and provide comprehensive,coordinated services that emphasize ways to prevent complications.For those members who require more intensive,one-on-one management of a chronic condition, we providespecially trained nurse case managers who work directly withaffected members and their doctors to assure quality of care,compliance with ongoing treatment, and to help manage theirservices cost-effectively. The goal is to help members getback on a healthy track and to prevent medical problems inthe future.As an example, our Cardiac Case Management Program hassignificantly reduced hospital admissions and ER visits formembers with heart ailments. This has saved more than $3million in health care costs over a three-year period from2000 to 2003. In 2003 alone, the program saved nearly $2.5million.When do you anticipate rates being availablefor the individual product? How strong isHealthAmerica’s commitment to the individualHSA product marketplace?HealthAmericaOne, our product targeted to individuals andfamilies, is pending approval by the state insurance departmentso the rates are not yet final.continued on next pageMAXIMIZE YOUR SALESSUCCESS!Bill NiermannMarketing Officer800-217-5746bill.niermann@companiongroup.comCompanion Life’s Strong Product Portfolio and DirectUnderwriter Access Will Help You Close More Sales!All Companion Sales in 2004 help you qualify forour <strong>2005</strong> Leaders Conference -- Dublin, Ireland!• Group Life, STD, LTD and Dental• Voluntary Life, STD, LTD and Dental• Small Group Trust (2-9)DIRECT PROPOSAL FAX HOTLINE1-800-836-5433 7

Reducing PrescriptionDrug Costs Shouldn’tBe Hard to SwallowPeter VillanoStrategic Accounts ExecutiveAs prescription benefit program costshave escalated at a rate in excess of thenational inflationary trend for severalyears now, benefit managers need to lookat the options that are available to helpcontain the cost of the benefit. Many benefit managers andfinance officers are scratching their heads and looking forsolutions as to how they can manage the cost, yet maintainbenefits for their employees. There are many options that areavailable, however some options depend upon the level ofdisruption a plan sponsor may be able to endure.The reality is that dramatic cost reductions can be achievedthrough plan design modification. It is possible to implementchanges that can literally cut costs in half if your client iswilling, or perhaps desperate enough, to consider such dramaticchanges. Modifications can be incorporated in a varietyof ways, ranging from intrusive processes such as steptherapy and aggressive formulary programs to co-pay adjustments,or even more passive approaches. Programs such asstep therapy, or restrictive formulary programs, usually resultin service issues at the pharmacy counter. Often a prescriptionorder for a particular medication is rejected triggering achain of phone calls from pharmacist to physician and sometimeseven the pharmacy benefit manager, until a mutuallyacceptable, appropriately covered medication can be identified.During the hours or days that this authorization processmay take, the patient must sit anxiously awaiting a solution.All of us who have serviced these types of cost managementprograms are familiar with the fallout. The inherent flaw withsuch programs is that coverage issues are not addressed untilafter the prescription order is written and presented at thepharmacy counter. Although, presently very inconvenient toplan participants, there is a solution to this dilemma loomingon the horizon. Requirements being placed upon MedicarePart D benefit program providers are requiring movement towarddeveloping a process referred to as “e-prescribing.”continued on next page 13

E-prescribing is a mechanism by which physicians will submitprescriptions electronically from their offices, allowingfor immediate feedback regarding coverage, formulary, copay,etc., so that the prescription can be changed if necessaryto a covered drug, while the patient is still in the physician’soffice. Once this is universally available, many point-of-saledispensing delays at the pharmacy counter will disappear.For your clients who want to consider cost management optionswith fewer surprises, the following quick-referencelaundry list of options is available for consideration. Increasingco-pays is still the first line of consideration. It resultsin immediate savings and forces participants to share in theinflationary trend normally born disproportionately by theplan sponsor. We recommend serious consideration be givento a percentage “co-insurance” cost sharing structure in placeof fixed co-payment levels, because it automatically adjustswith inflation and heightens the cost awareness of plan participants.<strong>PAHU</strong>-PAC: ANOTHER ADVOCACY TOOLThe purpose of the Pennsylvania Association of Health UnderwritersPolitical Action Committee (<strong>PAHU</strong>-PAC) is to support Pennsylvaniastate legislators and legislative candidates who identify withand support the aims of our Association. Its purpose is not to “buy”votes. Rather, it is designed to cultivate a health insurance friendlylegislature by assisting worthy incumbents and candidates.<strong>PAHU</strong> members, families, employees and friends within the industryinvest in <strong>PAHU</strong>-PAC with their individual contributions. Theseindividual contributions add up and are disbursed by decision ofthe Board of Directors.<strong>PAHU</strong>-PAC disbursements are made when a majority of theBoard agrees that a legislator or candidate is worthy of support.The Board is elected yearly and must have representation fromeach local association. Criteria for support include a number ofthe following:• Insurance background or licensed insurance producer• Demonstrated vote or committee vote record• Support from local <strong>PAHU</strong> members• Leadership of House or Senate; member of a relevant committeesuch as the House Insurance Committee or Senate Banking& Insurance Committee• Dynamics of a particular race of district; Is it winnable?• Preference is given to having local members attend local legislativedistrict events versus higher-priced Harrisburg politicalfundraisers.• Disbursements are made to both Democrats and Republicans.Only individual investments in <strong>PAHU</strong>-PAC may be accepted. Itis against Pennsylvania state law for <strong>PAHU</strong>-PAC to receive corporatemoney. PAC contributions are not tax deductible. <strong>PAHU</strong>-PAC’s Operating Rules may be viewed at www.pahu.org.Generic equivalent drugs do cost one-third to one-fifth theprice of their brand-name counterparts; so any benefit designthat motivates use of generic equivalent drugs is effective.If you cannot mandate generic drug use, consider broadeningthe co-pay spread between brands and generics, even if itmeans lowering the generic co-pay level recognizing that theplan, at present rates, could save approximately $30 to $50for each generic conversion. When a preferred medicationlist is properly developed, three-tiered co-pay structures thatcharge the higher co-pay for “non-preferred” or “non-formulary”drugs can effectively reduce program costs, while keepingthe non-preferred items available to patients without thecumbersome prior authorization processes. As baby boomersage, “lifestyle” drugs such as Viagra, wrinkle creams, agingcounteringhormones, etc. are being developed and marketedheavily by manufacturers.Paying for these drugs is draining plan resources and ultimatelytaking dollars intended to pay for drugs associatedwith acute care and serious medical conditions. Many plansponsors now exclude or restrict coverage of these drugs, orhave in place a higher co-pay tier that can be added just for“lifestyle” drugs.Other simple ways to help share in prescription drug costs areto set mail order co-pay levels to at least 2 to 2½ times thelevel of retail co-pays assuming that the days’ supply availablethrough mail order is 3 times retail. Limit the quantitydispensed through a retail pharmacy to 30 days supply or less,instead of “34 days,” or “the greater of 34 days or 100 units.”This reduces waste and enables collection of additional copays.Another option is to enforce a coordination-of-benefitstructure, especially if spousal employment levels are high.Of course, the value of each option varies in terms of savingsgenerated depending on your client’s participant utilizationpatterns and present benefit and co-pay structures. Alternativesshould be evaluated in conjunction with projected costsavings under various scenarios in order to construct a mosteffective benefit change. This review may also be helpful duringa negotiation process.One last and important point, voluntary mechanisms such asthe distribution of informative literature rarely accomplishesmuch. The dollar still rules; so to be effective, you willneed to institute plan changes that cause program participantsto participate financially in their drug utilization decisions.A few years back, one of our clients who had the ability toinstitute dramatic plan changes moved from a fixed co-paystructure to a high percentage co-insurance structure with anannual spending cap on the benefit for brand medications.Nothing was mandated, step therapy was not implementedand no formulary was in place.14

Within a few months, the plan participantsvoluntarily and very dramaticallyshifted their drug usagepatterns toward generic and lowercost brand medications. The combinedtotal of participant and plansponsor drug spending dropped byabout 11% the first year, when normaltrends projected an increase of about 19%. This equatedto about a 30% reduction in drug spending and an even moredramatic reduction in the sponsor’s costs. All this was drivenby plan participants’ recognition of the “real” cost of theirmedications for the first time. This recognition led to a voluntarytransition to the lower cost generic drugs whenever possible,or to lower cost brand drugs when generic alternativeswere not available.This minimized their out-of-pocket expenses and simultaneouslyreduced the sponsor’s costs without a reduction in thelevel of care or intrusive cost management programs. Veryfew plan participants actually reached the spending cap as aresult of their conservative spending habits. Although yourclients may not be in a position to make such dramatic planchanges, this case study does serve as a good example of theresultant impact of plan changes that enlist the participationof the plan participants in their own drug purchasing decisions.Many major consultants and PBMs predict continued upwardpressure on the cost of prescription drugs and continued increasesin utilization in the foreseeable future. The only reasonableresponse is for plan sponsors to carefully considercost management programs and plan design changes that willbetter manage costs. Your prescription program administratorshould be able to identify options, predict the cost savingsand most importantly tell you what member disruptionis likely to be for each option. To help you serve your clientsbest, a prediction of potential member disruption should beconsidered and addressed directly with your client as well assuggested ways to best communicate the program changesplanned and why their health should not be compromised bythese plan adjustments. Peter Villano is a Strategic Accounts Executive at BenecardServices, Inc. in Lawrenceville, New Jersey. He canbe reached at 800-737-1208 or peter.villano@benecard.com.BeneCard specializes in the custom development and servicingof prescription benefi t and vision care programs for programsponsors of all sizes throughout the United States.PENNSYLVANIA’S PACEA Model PrescriptionDrug Program For 21YearsVince Phillips<strong>PAHU</strong> LobbyistCelebrating its 21st Anniversary thePharmaceutical Assistance Contractfor the Elderly, or PACE, was createdby Act 63 of 1983 and beganoperation July 1, 1984. An innovationat the time, it used PennsylvaniaLottery revenue to fund prescriptiondrug costs for elderly residents below a certain income level.PACE was augmented by PACENET in 1996 to assist olderPennsylvanians whose income level was slightly above thePACE threshold.Department of Aging statistics show that as of March 18,<strong>2005</strong>, 194,717 people receive PACE benefits and 104,178 areon PACENET. The programs are currently serving 298,895older Pennsylvanians. This marks an increase of about 80,000since legislation expanded both programs, passed the GeneralAssembly in 2003, and took effect on January 1, 2004.According to one of the new law’s architects, Rep. ToddEachus (D-Luzerne), this expansion was brought about at noincreased cost to taxpayers “because of innovative cost containmentmeasures.”In addition to program growth, the PA Department of Aginghas touted the program as a national model. In a press statementcommemorating the program’s 20th anniversary, Secretaryof Aging Nora Dowd Eisenhower stated, “Twenty yearsago, Pennsylvanians had the imagination, determination,and bipartisan spirit to launch a prescription drug programfor older residents that has become a model for other statesacross the nation…(providing) access to life-sustaining medicationsto more than one million Pennsylvanians.”The bipartisan support referenced in Secretary Dowd’s statementis evidenced by the fact that Eachus, a Democrat, andCumberland County Republican Rep. Pat Vance were givencontinued on next page 15

A Model Prescription Drug Program For 21 Years continued from previous pageauthority to forge a bipartisan agreement on how to expandthe program by their respective caucuses. Vance is now theelected Senator from Pennsylvania’s 31st district. PACE/PACENET Program Director Tom Snedden pointed out that,“We were not the first.” New Jersey and Maryland alreadyhad programs in place but, “We are the best known becauseof our technological innovations, leading edge drug utilizationand research output,” he said. Other states that have utilizedthe Pennsylvania model in shaping their programs areConnecticut, Missouri, and Michigan.ELIGIBILITYIn order to qualify, a resident must live in Pennsylvania for 90days. New adjusted income eligibility levels follow.ProgramAgeSingle IncomeMarried CoupleCo-PayPACE 65 up to 14,500 up to 17,700 $6 generic $9 brandPACENET* 65 14,500-23,500 17,700-31,500 $8 generic $15 brand*Subscribers must meet a $40 monthly deductible but the deductible is cumulativeif it is not met each month.The same application form is used for both PACE andPACENET and is available on-line at www.aging.state.pa.us. The programs use a person’s previous calendar year’sincome as its basis for eligibility, and will verify age, income,and residence with the U.S. Social security Administration,Railroad Retirement Board, State Employees’ RetirementSystem, PA Department of Revenue, etc. Applicants need notprovide their documentation when submitting the application.Assistance in filling out applications may also be obtainedby calling (800) 225-7223. For those seeking detailedinformation on the pharmacy manual, provider bulletins,regulations etc., the Department of Aging has this informationon its website or someone may call (717) 787-7313 torequest copies.OTHER RESOURCESAlthough most people think of PACE or PACENET whenthey think of prescription assistance, there are a number ofother programs designed to help Pennsylvanians, includingmany for people who are younger than 65 years of age.• HIV/AIDS or a DSM V diagnosis for schizophrenia patientsmay receive help from the Department of PublicWelfare (DPW) under its Special Pharmaceutical BenefitsProgram. Clients fill out an application at their countyassistance office. Eligibility means that a person is a PAresident with annual income of less than $30,000 for theindividual with an allowance of an additional $2,480 foreach additional applicable family member. Call (800) 922-9384 or (717) 772-6228.• DPW and the local APPRISE Programs (800-783-7067)provide Rx assistance to Medicare Supplement Plans H-I-Jenrollees providing for a 50% reimbursement after a $250annual deductible.• Veterans’ Affairs (877-222-8387) provides veterans withprescriptions from VA formulary with a $7 fee for a 30-day supply. Another veterans program is Tri-Care for Life(888-999-5195).• There is a drug industry assistance program called PharmaceuticalResearch and Manufacturers’ Association, orPhRMA, available through local APPRISE Offices (800-783-7067). Income and need-based, it can provide drugson a free or reduced fee basis. It depends on the individualsituation for eligibility as well as the specific drug manufacturer’spolicy on providing such help.• Individual drug companies may have their own programs.These may be drug specific and supply discounts or reducedfees. Some of them are listed below:- Eli Lilly & Company877-795-4559, www.lilly.com (Lilly( Answers Card))- Pfizer800-717-6005, www.pfizer.com (Pfi zer Share Card)- GlaxoSmith Kline888-672-6436, www.gsk.com (Orange Card)- Novartis866-974-2273, www.novartis.com (Novartis( Care Card))- Together Rx800-865-7211, www.Together-Rx.com providesdiscounts for eight or so drug manufacturers’products (Together Rx Card).In addition to all of these, the marketplace is awash in Medicaredrug discount cards stemming from the offering of prescriptionbenefits for the elderly by the Federal Government.People with rare diseases may also get help from the NationalOrganization for Rare Diseases (NORD) 203-746-6518 www.rarediseases.org or the Pennsylvania Department of Health’sChronic Renal Disease Program 717-783-5436 for kidney dialysisor transplant related illnesses. One last program to notein this article is the Pennsylvania Patient Assistance ProgramClearinghouse (PAP). PAP works with PhRMA and APPRISEbut also aids in settlements brought forward by the PennsylvaniaAttorney General.The author would like to thank the Pennsylvania Departmentof Aging for its assistance in researching this article.16

awarrd-winning relationshipsfinancial strengthmore than 1,000,000 insured employeesmore than 84,000 policyholdersrated A– by A.M. Best Companyrated A– by Standard & Poor’soutstanding relationships withindependent brokers & agentsCompany of the Year 2000 (CIBGNY)Company of the Year 2003 (PIANY Long Island RAP)firstrehablifeThe First Rehabilitation Life Insurance Company of America800- 9516-8 0 www.firstrehab.comgroup products available in PAShort-Term DisabilityVisionDental CareExecutive MedicalReimbursement(The 100% Solution)Excess Major Medical31 years • 16 statesrated A– (excellent)A–by A.M. Best Company 17

12 Ways To ControlPrescription Drug Costsby Institutedc.org$ $Article Disclaimer: The following is for informational purposes only and none of it should be considered medical advice inany way. Please take the time to discuss all the information with a medical professional to confi rm if the information is appropriatefor your specific circumstances before acting upon anything written in this article.You <strong>May</strong> Qualify for a Free Drug program: There are over1,100 drugs that are made by 100 manufacturers who havefree drug programs. Most major drug companies provide freemedications, but rarely, if ever publicize their programs. Anestimated two billion dollars of free medication is given awayannually.There are five free discount cards for senior citizens. The discountcards cover over 200 popular medications.1. Save Up to 93% by Asking for a Generic: Use genericswhenever they are available. Both brand name and genericdrugs contain the same active ingredients, are the same instrength and dosage, meet the same government quality controlstandards.According to one Pharmacy Director, cost savings on brandname vs. generic will vary from drug to drug and pharmacyto pharmacy but can be significant. For instance: Prozac brand 20mg, 100 tablets cost $280.19and generic sells for $29.99 (Savings 89%) Vasotec brand 5mg, 100 tablets costs $103.59and generic sells for $18.19 (Savings 82%) Zantac brand 150mg 100 tablets costs $173.39and generic sells for $10.99 (Savings 93%) Zestril brand 10mg 100 tablets costs $96.29and generic sells for $39.99 (Savings 58%)2. Veterans Now Qualify for More Benefits: Recent lawshave changed that grant veterans medical benefits for certainillnesses like diabetes and hypertension, provided the veteranis subject to qualifying conditions like agent orange exposure.See if you qualify for benefits by checking with the Veteran’sAdministration.3. Cut Your Costs in Half… by Using a Pill Splitter: Mostpharmacies should stock pill splitters. Sometimes, medicationscan be broken in half and save you 50%. The reason isbecause several pharmaceutical manufacturers price some oftheir medications the same for all strengths.Lipitor is essentially the same price for all strengths. It is possibleto save as much as $100 on a one month supply of Lipitorjust by getting the larger strength and cutting in half. Askyour pharmacist.This method may not be appropriate for all medications andcould be dangerous if used with the wrong medication.Begin by asking your doctor or pharmacist if your medicationis available in a dose double your normal dosage (ex, ifyou usually take a 20 mg. pill, is a 40 mg. pill available?). Ifit is, ask whether there would be any problems with splittingthe tablets or capsules.Now, do a cost comparison between the two dosages. If thehigher dose is less than double the cost for your regular dosethen you will be saving money by having your doctor prescribethe higher dose and then splitting it. For precision pillsplitters visit precisionpillsplitters.com. Cost savings is typically32% to 50%.Viagra is another medication that lends itself to being split inhalf or quarters to save 50% to 75% depending upon the dosagerequired. The average Viagra user who uses two dosesper week can save over $400.00 per year. For informationabout a specially designed precision splitter for Viagra, visitv2pillsplitter.com.This method is not appropriate for all medications. Checkwith your pharmacist. Some easily split medications include:Ambien, Aricept, Buspar, Effexor, Lipitor, Luvox, Paxil,Remeron, Risperidal, Seroquel, Serzone, Viagra, Zoloft, Zyprexa.(Ask your pharmacist about others)4. Save by Buying a 90- vs. 30-Day Supply: Most pharmacieshave higher savings on a longer days supply. In addition,18

when it comes to people who have insurance prescriptioncoverage, there may be other savings by getting a larger daysupply.For instance, if you have a $10 co-pay, the insurance companywill let you get only a 30 days supply in general for that$10. A 90-day supply bought with out insurance may onlycost you $18.This would be much cheaper than paying $10 per month ($30for 90 days). It would also save you two trips to the pharmacy.5. Ask For an Older Medication That is Just as Effective:Many pharmacists agree, that antibiotics are probably themost over prescribed, or incorrectly prescribed medications.Often, the physician will prescribe a newer antibiotic that hasbeen promoted as more effective. What this really means isthat it is considerably more expensive.The newer antibiotics are often no more effective than theolder antibiotics. However, they are new and covered by patentprotection. Therefore, the newer medication is more effectivein ensuring a nice profit for the drug manufacturer formany years.Since many generics are made in the same factory as thebrand name ones, make sure you ask your doctor for a genericantibiotic. A great generic broad-spectrum antibioticcosts 80% less than a new antibiotic. In dollars, it costs you$20 instead of $100.6. Over-the-Counter Drugs <strong>May</strong> Be as Effective as the PrescriptionDrug: Many doctors still prescribe Pepcid 20mgto their patients. A one-month supply of Pepcid 20mg costapproximately $60. Pepcid AC, over-the-counter in 10mgstrength, taking double the dose costs approximately $23.Most prescription cold medications average $20 to $60 for aone month supply and contain the same decongestant that isavailable over-the-counter for less than $2.7. Get Only a 7-day Supply of New Medication: If the doctordoes not have a sample, ask your pharmacist to give youonly a one-week supply to try. It is a federal law that medicinescan’t be returned once they are dispensed. If you get amonth’s supply and can’t tolerate the medicine, you have justlost that money.8. Stop Using Drugs You No Longer Need: Review all yourprescriptions with your doctor at each visit. You may be payingfor some drugs you no longer need.Doctor-run rxaminer.com provides a custom analysis of yourmedications to save you money. You can get a free, no obligation,Cost Screening to find out how much you can save.Also ask your pharmacist to review your medications in additionto your doctor. Here is why. A pharmacist’s valuableservices and knowledge are free. He may also find somethingyour doctor missed.Don’t hesitate to ask your pharmacist questions, their adviceis free and can often save you money and aggravation. Askquestions about side effects, and drug interactions.9. Order Your Prescription Drugs by Phone: You can save20%-50% by ordering prescription drugs over the phone. Bonus,you do not have to pick them up at the pharmacy.Make a list of your medications, including strength and numbertaken daily. Then list at least six pharmacies you are goingto call. Consider discount mail order sources and Internetsources too. Then call and get prices, ask if this is their bestprice available. Compare the costs.10. Pay Attention to the Quantity: Find out how muchmedication you really may need, and make sure your doctordoesn’t order you more medicine than is necessary to treatyour condition.Ask your doctor for samples at every visit. They usually haveplenty.11. Take Only Those Drugs You Really Need: When yourdoctor prescribes medication for you, understand exactly whatit’s meant to do and for how long. If you are prescribed twodrugs for the same symptom, ask if you really need both.12. Buy Home Test Kits: Kits for determining ovulation,pregnancy and colorectal cancer, can be purchased as hometests instead of paying twice as much for similar kits at yourdoctor’s office.AARP members are eligible for many discounts, includingmail-order pharmacy discounts. Ask for an AARP discount.If you have questions about these tips or your medication askyour doctor and pharmacist. 19

LEGISLATIVE UPDATEDay on the Hill <strong>2005</strong>Bill Raab, <strong>PAHU</strong> Legislative Chair<strong>PAHU</strong>’s Day on the Hill <strong>2005</strong> was ourmost successful ever. It could also beour most memorable ever. The legislative calendar was busyenough--both House and Senate were in session, and therewere several Committee Hearings. Meanwhile, the Capitolbuilding was absolutely swarming with visitors.There were at least four or five interest groups besides theHealth Underwriters vying for the legislators’ attention: a coalitionof groups opposed to domestic violence, the FutureFarmers of America, a high school choral group, a groupadvocating for mandatory benefits for colo-rectal screening,plus a group of high school athletes. There were so manydisplay booths in the Rotunda that they were interfering withthe cafeteria line. The Capitol steps were the scene of onemedia event after another—the place was packed with lightand sound equipment, reporters and cameramen, and therewere so many people in the audience that it was difficult tomove. Of course, delegations from all these groups werelined up outside legislators’ offices like planes stacked upover O’Hare. Controlled chaos…Into the melee went 35 Health Underwriters,proudly wearing bright yellow stickerson our lapels that read “CITIZEN LOBBY-IST” (Nice touch, Vince). We moved frommeeting to meeting at a frenetic pace, visit-Visit NAHU’s website for the latest updates that facethe industry and your profession. Get the latest newson Medicare, Association Health Plans, the Trade AdjustmentAct of 2002, The Uninsured, Long Term Care,Genetic Discrimination, Managed Care, and muchmore.Also, take advantage of NAHU’s “Operation Shout”feature that provides a “Legislative Action Center”complete with Action Alerts, guides to your local electedofficials, ongoing election coverage in your area,plus daily updated schedules for the state and nationalLegislature.For more information, visit www.NAHU.org!ing not just our own Senators and Representatives, but alsothe Leadership of both the majority and minority parties, andthe leadership of both insurance committees.So the question is, given the atmosphere and hurried pace,“Do we accomplish anything besides making an appearance?”Actually, the meetings were very effective, includingserious discussions of the issues important to us. In a veryreal sense these are sales presentations, and in this marketplaceof ideas the best sales presentations are made face-toface.Also, it is imperative that a special-interest group likeours be highly visible, very vocal, and capable of turning outlarge numbers. This helps establish us as a credible force thatcan’t be ignored. Besides, legislators need and want to hearus, to get information on the needs of constituents, and theimpact of legislation at the “street level.”And that is what they got on March 15. Legislation Introduced onSmall Group RatingThere are two bills (HB 1201 and HB 1240) that have recentlybeen introduced in the General Assembly. Both are currentlyin the House Insurance Committee. The bills are very similar,requiring modified demographic rating for small groupsunder 50 lives. Permitted rating factors would be: geographicarea, industry, age, gender, and family composition. Rate adjustmentsof plus or minus 35% would be permissible for ageand gender, and plus or minus 10% for industry. HB 1201would permit adjustments of plus or minus 20% for medicalunderwriting; HB 1240 would prohibit medical underwriting.Our Legislative Committee will make a recommendation tothe <strong>PAHU</strong> Board as to what the position of our Associationshould be on these bills. The complete draft ofeach Bill is located on the <strong>PAHU</strong> website atwww.<strong>PAHU</strong>.org.20 Pennsylvania Health Underwriter

WELCOME NEW <strong>PAHU</strong> MEMBERSNEW MEMBERS FROM FEBRUARY 25, <strong>2005</strong> THROUGH APRIL 6, <strong>2005</strong>Matthew BarrettHealth America/Health AssuranceErie – PANORTHWESTBrad Arthur Behanna, Jr., MBAUPMC Health PlanPittsburgh – PAPITTSBURGHIrene Brooks, CFCAFLACShoemakersville – PANORTHEASTMichael V. CavanaughAlternative Benefits CorporationPhiladelphia – PAPHILADELPHIADerek M. ChastainAFLACSecane – PAPHILADELPHIARonald CristHBKW, Inc.Erie – PANORTHWESTAllison FinnertyCBIZ Benefits & Insurance ServicesPlymouth Meeting – PAPHILADELPHIADavid HagerAssurantPittsburgh – PAPITTSBURGHDeb HarerState Farm InsuranceTroy – PACENTRALSallie Humphries, HIAColonial Life & AccidentNew Tripoli – PANORTHEASTAmy Rebecca IkeAetnaKing of Prussia – PAPHILADELPHIASteven JohnsWachovia Insurance ServicesCollingswood – PAPHILADELPHIAJames Laughlin, CLU, ChFC, RHUThe Bert CompanyErie – PANORTHWESTKathy LawsCIGNA Group InsurancePhiladelphia – PAPHILADELPHIAEmily Eunhee LeeState Farm InsuranceEssington – PAPHILADELPHIARob LordAetnaKing of Prussia – PAPHILADELPHIAR. Carl Martz, RHUHart, McConahy & Martz, Inc.Erie – PANORTHWESTMichael McCormackMetLifeKing of Prussia – PAPHILADELPHIAJames N. McKibben, CLULillis, McKibben & CompanyErie – PANORTHWESTDena McVickerColonial Supplemental InsuranceExton – PAPHILADELPHIAThomas M. OlejarFlexible Benefit Plans, Inc.Valley Forge – PAPHILADELPHIAMaureen PearsonPearson Insurance Assoc.Wyndmoor – PAPHILADELPHIAKenneth E. Plummer, ChFCKenneth E. Plummer Associates, Inc.Chester Springs – PANORTHEASTDebbie PoppertAFLACHavertown – PAPHILADELPHIAGary A. RoesingRoesing Financial, Inc.Warminster – PAPHILADELPHIATony Schufreider, Sr.Advanced Insurance Concepts, Inc.Langhorne – PAPHILADELPHIARichard J. SentnerRogers Benefit Group, Inc.Cranberry Twp – PAPITTSBURGHDaniel Severo, LUTCFThe DJB Group, Inc.Meadville – PANORTHWESTSigne SpraginsAFLACFolcroft – PAPHILADELPHIADavid StraightBenefits Network, Inc.Wexford – PAPITTSBURGHLinda Ann Swanson-NewboldEdward N. Swanson & CompanyPhiladelphia – PAPHILADELPHIAJanice WasheleskiAetnaKing of Prussia – PAPHILADELPHIAKathleen WestCLA Agency, Inc.Newtown Square – PAPHILADELPHIADavid G. WinansWinans Insurance & Employee BenefitsWarren – PANORTHWESTEric F. ZeeRadnor Benefits Group, Inc.Wayne – PAPHILADELPHIAJoseph KloeckerC. H. Reams & Associates, Inc.Erie – PANORTHWESTSteve PreskiCustom Benefits PlansWillow Grove – PAPHILADELPHIAA Membership Application canbe found on page 23.Pennsylvania Health Underwriter 21

WELCOME ‘FREE TRIAL’ <strong>PAHU</strong> MEMBERSSIGNED UP THROUGH MARCH 31, <strong>2005</strong>Deborah D. AdamsAFLACGenesee - PACTRLHIGHLANDSJoyce AitkenAFLACMeadville – PANORTHWESTRobert A. AndersonAFLACDenver – PACENTRALCarl BanksAFLACHarrisburg – PANORTHEASTBryan C. BarradaleAFLACPittsburgh – PAPITTSBURGHNathan BennettAFLACPittsburgh – PAPITTSBURGHJames F. BennettAFLACBrentwood – PAPITTSBURGHBarbara BrodieAFLACRoaring Branch – PACTRLHIGHLANDSLynn BrownAFLACPittsburgh – PAPITTSBURGHAvinash ChainaniAFLACDowningtown – PAPITTSBURGHWanda ChaseAFLACPhiladelphia – PAPHILADELPHIAGregg W. CollinsAFLACYork – PACTRLHIGHLANDSBill CrainAFLACBrookville – PAPITTSBURGHRuth CurryAFLACFord City – PACENTRALLydia DankoAFLACBrookville – PACTRLHIGHLANDSThomas DavisAFLACFort Washington – PAPHILADELPHIAKathy DaxAFLACPittsburgh – PAPITTSBURGHGaile DelbaughAFLACMount Gretna – PACENTRALBob FriedmanAFLACWescosville – PACTRLHIGHLANDSAlan Gallagher, CESAFLACLemoyne – PACENTRALKen GoodAFLACYork – PACENTRALDiane L. HarknessAFLACGillett – PASWAndrew Junikiewicz, CPAAFLACFort Washington – PAPHILADELPHIAQuentin C. Kent, Sr.AFLACAllentown – PANORTHEASTChristie KerrAFLACLancaster – PACENTRALKenneth E. KingAFLACGreensburg – PAPITTSBURGHRob KreiderAFLACPhiladelphia – PAPHILADELPHIASusan LiberaceAFLACNorristown – PAPHILADELPHIAChris LuppAFLACHarrisburg – PACENTRALDianne MerskyAFLACHarrisburg – PANORTHEASTDave MinderAFLACNew Providence – PACENTRALEd MrowkaAFLACSchnecksville – PAPHILADELPHIAJody MuthAFLACDu Bois – PAPITTSBURGHDonald E. MyersAFLACErie – PANORTHWESTJerry PflugAFLACBaden – PAPITTSBURGHDaisie RakasAFLACPittsburgh – PAPITTSBURGHRichard SabolAFLACWest Chester – PACENTRALMary Lee Saulnier Ebert, SPCAFLACReading – PAPHILADELPHIAKevin M. SmithAFLACRichboro – PAPHILADELPHIAJoe SnavelyAFLACManheim – PACENTRALArthur M. SybellAFLACKennett Square – PAPHILADELPHIARobert E. Thorsen, SPHR, CBCColonial LifeExton – PAPHILADELPHIARobert TorresAFLACLansdale – PAPHILADELPHIAMark TriboneAFLACNew Brighton – PAPITTSBURGHJim TrumboAFLACChester Springs – PAPHILADELPHIAGlenn WatersAFLACPittsburgh – PAPITTSBURGHRobert WertzAFLACCarlisle – PACTRLHIGHLANDSCalvin C. WiseAFLACMarion Center – PAPITTSBURGHDiane WorleyAFLACMeadville – PANORTHWESTMarilyn WymanAFLACMeadville – PANORTHWESTPaul E. YoungAFLACPittsburgh - PAPITTSBURGH22

NAHU Membership Application__________________________________________________________________________________________________________Last Name First Name Designation__________________________________________________________________________________________________________Company Title Referral/Sponsor__________________________________________________________________________________________________________Mailing Street Address City State Zip__________________________________________________________________________________________________________Telephone Fax E-Mail Address__________________________________________________________________________________________________________Home Street Address (for legislative purposes) City State Zip____________________________________________________________________________________________________________Local Association (see other side of this application)Form of Payment Enclosed:Amount:_____________[ ] Monthly Draft (please select one) [ ] Checking Account [ ] Credit Card[ ] Check (payable to NAHU)[ ] Annual Credit Card (please select one) [ ] Visa [ ] MasterCard [ ] Am Ex [ ] DiscoverBankdraft / Credit Card Authorization Form:I (we) hereby authorize NAHU to initiate debit entries to my (our) account as indicated.- Monthly debits will equal one-twelfth of any current applicable national, state or local dues.- (Please include a voided check from the account to be drafted, or write credit card number below)____________________________________________________________________________Name (as it appears on the check or credit card) Signature____________________________________________________________________________Account NumberExpiration DatePlease Mark the Box or Boxes For The Areas of Your Practice: Long Term Care Disability Managed Care Retirement Individual Large Group Small Group Worksite Mktg. TPA Self Insured Medicare Supplement DentalMail To: NAHU, 2000 N. 14th Street, Suite 450, Arlington, VA 22201Fax to: 703 841-7797If you have questions, please contact Illana Maze,NAHU VP of Membership, at 703-276-3810 23

A SUMMARY OF NEWS & RESOURCESEmployee Benefits Specialist PositionThe Pittsburgh offi ce of TBG Consultants, an employee benefi ts consulting fi rm has a full time position to assist with clientmanagement, analysis and delivery of employee benefi ts services. We serve our clients through offi ces in Pittsburgh,Richmond, and the Metro New York City area. Duties include fi nancial analysis, risk assessment and implementation. Meetwith clients and assist with report preparation, benchmarking, communications materials and documentation. Identify opportunitieswith new and existing clients. 5-10 years of related experience, U/W for large insurance carrier, health care deliverysystem or large corp. benefi t department. A comprehensive salary and benefi t package is available. Send your resume totbgcareers@tbgconsulting.net. Posted 04/08/<strong>2005</strong>.2004 Health Coverage SurveyA news release from the New Jersey Business and Industry Association (NJBIA) said its 2004 survey found that 90% ofrespondents said they had health coverage - down from 94% in 2003. The drop was most pronounced among small fi rms(fewer than 20 workers) where 87% provided employee health coverage, down sharply from 92% in 2003. According to thesurvey, the average price of employee health coverage climbed by 11% in 2004 to a record $7,307 per worker - the thirdconsecutive year of double-digit cost hikes. That amount is equal to 16% of reported average wages, according to the survey.In 1998, the cost of health coverage represented 11% of reported average wages. Survey participants said they expect theiremployee health benefi ts costs to rise by 12 % in <strong>2005</strong>. Posted 04/08/<strong>2005</strong>.404(c) Compliance Guide For Retirement Plan SponsorsSPRINGFIELD, Mass., March 31 /PRNewswire/ - In an effort to help plan sponsors fulfi ll their fi duciary obligations and reducetheir fi duciary liability, MassMutual Retirement Services has published a guide to complying with Section 404(c) of theEmployee Retirement Income Security Act (ERISA). The 24-page publication contains a helpful explanation of Section 404(c),suggests guidelines for complying and reducing fi duciary liability exposure, and provides a useful, detailed checklist to assistplan sponsors in making sure they have taken all appropriate steps. www.massmutual.com. Posted 04/08/<strong>2005</strong>Insurance commissioners, agents air concerns about SMART ActInsurance commissioners and agents recently blasted a reform proposal meant to balance federal and state regulation. “Ourconcerns are deeply rooted in the basic structure of the SMART Act that mandates federal preemption of state laws andregulations, federal supervision of state regulation, and complete rate de-regulation for all states,” Diane Koken, presidentof the National Association of Insurance Commissioners, wrote to Reps. Michael Oxley (R-Ohio) and Richard Baker (R-La.),the architects of the State Modernization and Regulatory Transparency Act. Although a bill has not yet been introduced, theSMART Act has undergone great scrutiny by insurers and brokers. A draft circulated last year addresses 15 regulatory areas,including market conduct, licensing, life and health insurance, commercial and personal lines property/casualty insurance, reinsuranceand antifraud data exchanges. Reprinted with permission from The Adviser March 30, <strong>2005</strong> e-mail edition producedby Employee Benefi t News. Posted 03/30/<strong>2005</strong>Companies Working to Slow Rate of Healthcare Spending, Survey FindsA new survey by benefi ts consulting fi rm Watson Wyatt Worldwide and the National Business Group on Health found that thecost of employee healthcare increased 10 percent in <strong>2005</strong>. Ted Chien, global director of group and healthcare consulting forWatson Wyatt, said that companies not only are increasing the amount employees pay for healthcare coverage but are alsoboosting efforts to examine the health of their workers and to change unhealthy habits.http://bcbshealthissues.com/proactive/newsroom/release.vtml?id=153303. Posted 03/30/<strong>2005</strong>Who Are The Internet Innovators in Insurance?Competition is underway for the 2nd Annual Insurance Innovators Award -- created to recognize the use of Internet technologiesto improve business relationships in the insurance industry. Friday, March 28, is the deadline for applications for theaward, created by InSystems, Celent, and Insurance & Technology. The winner will be announced at the IASA Annual Conference& Business Show, June 1-4, 2003, in Denver. For the full story, visit http://update.insurancetech.com/cgi-bin4/flo/y/eLB20Ctwzn0tL0BsKN0AJ. Posted 03/12/<strong>2005</strong>24

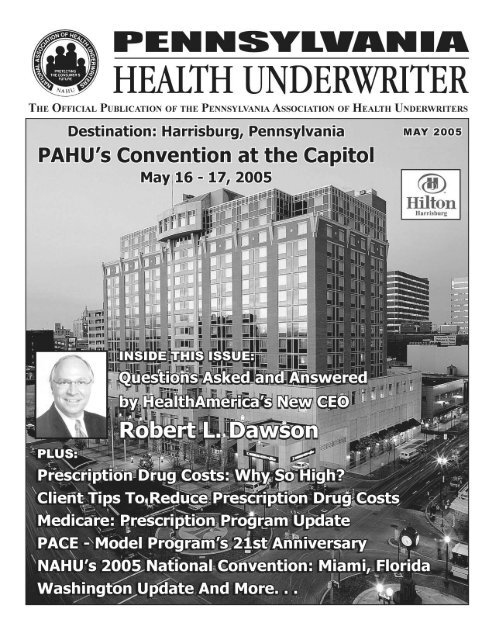

Destination Harrisburg – <strong>PAHU</strong> <strong>2005</strong> State ConventionPENNSYLVANIA ASSOCIATION OF HEALTHUNDERWRITERSHarrisburg Hilton Towers, Harrisburg, Pennsylvania<strong>May</strong> 16 – 17, <strong>2005</strong>Convention At A GlanceSUMMARY OF THE EVENTThis is the Annual Meeting of the Pennsylvania Association of Health Underwriters (<strong>PAHU</strong>), anassociation whose members are insurance producers specializing in health insurance andemployee benefits. In addition to the Annual Luncheon, there will be Continuing Education, Golf(on <strong>May</strong> 16), Legislative and Political Updates, and honored guest NAIC President and PAInsurance Commissioner Hon. M. Diane Koken at our Luncheon <strong>May</strong> 17.REGISTRATION INFORMATIONRegistration for the complete Annual Meeting is $ 100.00 including Reception on <strong>May</strong> 16, CEseminars, breakfast and lunch on <strong>May</strong> 17 and admission to the exhibition area. State-mandatedContinuing Education filing fees are included. Spouse registration of $ 25.00 includes mealsand the tour. Day registrations for Continuing Education only are accepted at $ 50.00. Golfregistration is handled separately but will be held at the Felicita Golf Resort north of Harrisburgat $ 125.00 per person or $ 450.00 per foursome.EXHIBITOR INFORMATIONA maximum of 25 exhibitors will be accepted for the <strong>PAHU</strong> Convention. Each exhibitor receivesa draped table with access to electricity if requested and two registrations to the AnnualMeeting. Exhibitors also receive recognition in the Program Book and appropriate signage.Exhibitor fee is $ 500.00. A separate registration form is required. It will have full details.SPONSOR INFORMATIONThere are several sponsorship levels.PLATINUM ($3,000) GOLD ($2,500) SILVER ($1,500) BRONZE ($1,000)BREAK SPONSOR ($500)PLATINUMFull Page Ad4 GolfersHole Sponsor Recognition4 Full Registrations4 Spouse RegistrationsExhibit BoothRecognitionGOLDFull Page Ad2 GolfersHole Sponsor3 Full RegistrationsExhibit BoothRecognitionSILVERFull Page Ad2 GolfersHole Sponsor2 Full RegistrationsRecognitionBRONZEFull Page AdOne GolferOne Full RegistrationSignageHOTEL REGISTRATION INFORMATIONThe Harrisburg Hilton and Towers is located at the corner of Second and Market Streets indowntown Harrisburg. A block of rooms has been reserved in <strong>PAHU</strong>’s name (Use the groupname ‘<strong>PAHU</strong>’) when registering to receive the discounted rate of $ 114.00 per single or doubleoccupancy. 717/233-6000 or 1(800)445-8667. Cut off date for the group rate is April 16, <strong>2005</strong>.At this time, reservations will be accepted upon availability at prevailing hotel rates.Overnight parking is available in the connecting Walnut Street garage at a reduced rate of $6.00(unlimited exits) or $4.00 per day for day-only attendees.126

GOLF TOURNAMENT INFORMATIONA Golf Outing at Felicita Golf Resort has been scheduled for Monday <strong>May</strong> 16 at 11:00 a.m.shotgun start with box lunches provided.If you decide to go to the hotel first, you can take a limited space shuttle to the course at 9:45and 10:15 a.m.. Alternatively, E-mail your request for directions to xenobun@aol.com andinclude a fax number. Shuttle returning to the hotel leaves the golf course at 3:30 and 4:00 p.m.Cost is $ 125.00 per golfer or $ 450.00 for a foursome. It includes greens fees, cart fee,beverages, and the luncheon. Hole sponsorships are available at a cost of $ 150.00. Holesponsors receive free Mulligans and appropriate signage. Additional Mulligans are available onsitefor $ 5.00 each. There will also be skill contests including a Hole in One. (Contest sign-upwill take place on-site) Lunch only is $ 20.00.CONTINUING EDUCATION INFORMATIONYou may receive three PA Continuing Education credits at the <strong>PAHU</strong> Annual Meeting. Theseinclude courses on the Uninsured Population, Ethics, and Consumer-Driven Health Care. Inaddition, there will be a non-credit course on Worksite Marketing.SPOUSE PROGRAMSpouses and guests will also have opportunities to relax with a walking tour of the classicallybeautiful Capitol in the morning and a riverboat ride on the Pride of the Susquehanna in midafternoon.SCHEDULESunday <strong>May</strong> 157:00 p.m. <strong>PAHU</strong> Board and <strong>PAHU</strong>-PAC Board meetingsMonday <strong>May</strong> 1611:00 a.m. Golf at Felicita Golf ResortShuttle from hotel to golf site leaves at 9:45 and 10:15a.m.3:00 p.m. Awarding of Golf PrizesApproximate return time to hotelShuttle from golf site to hotel at 3:30 and 4:00 p.m.5:00 p.m. Picnic at City Island with Harrisburg Senators Minor League Baseball gameagainst New Britain’s Rock Cats (MN Twins) at 6:05 p.m.8:30 p.m. Informal Reception in the Exhibit HallOpen to all attendeesTuesday <strong>May</strong> 177:00 a.m. Informal Exhibitor Time Seating begins for breakfast at 7:30 a.m.8:00 a.m. Pledge of AllegiancePatriotic Medley: Abby Snook and Katie WoodburyWelcome from HarrisburgInvocationHonorable Gib Armstrong (R-Lancaster)Legislative and <strong>PAHU</strong>-PAC ReportsMorning Remarks and Q&A by Hon. Jeff Piccola.(R-Dauphin)PA Senate Majority Whip and leading advocate for tort reformcontinued 2on next page 27

Convention at a Glance continued from previous page9:00 a.m. Exhibit Time9:00 a.m. Exhibit Time9:30 a.m. Morning Continuing Education9:30 “Ethics a.m. 101” (one Morning hour) Continuing Education“Ethics 101” (one hour)9:50 a.m. Morning Break9:50 a.m. Morning Break10:50 a.m. Morning Continuing Education10:50 “Who a.m. Are the Morning Uninsured?” Continuing NAHU Research Education Findings (one hour)“Who Are the Uninsured?” NAHU Research Findings (one hour)11:45 a.m. Seating Begins for Lunch; Informal Exhibitor Time11:45 a.m. Seating Begins for Lunch; Informal Exhibitor Time12:00 p.m. Luncheon and Program12:00 Invocation: p.m. Ross Luncheon Schriftman and ProgramInstallation of Invocation: Officers Ross SchriftmanHonorable M. Installation Diane Koken of OfficersInsurance CommissionerHonorable M. Diane KokenRemarks Insurance CommissionerCharles ‘Chub’ Remarks Neiman, <strong>PAHU</strong> PresidentNational Report Charles ‘Chub’ Neiman, <strong>PAHU</strong> PresidentMark Shaffer, National NAHU Region Report 1 Vice PresidentRemarks Mark Shaffer, NAHU Region 1 Vice PresidentErica Hain, <strong>PAHU</strong> Remarks President-ElectErica Hain, <strong>PAHU</strong> President-Elect1:30 p.m. Luncheon ends1:30 p.m. Luncheon ends1:45 p.m. Afternoon Continuing Education (concurrent choices)1:45 "Future p.m. of Consumer-Driven Afternoon Continuing Health Care" Education (one hour) (concurrent choices)OR"Future of Consumer-Driven Health Care" (one hour)"Worksite Marketing" OR (non- credit)"Worksite Marketing" (non- credit)2:45 p.m. CE concludes; Afternoon Break3:15 p.m.2:45 p.m. CE concludes; Afternoon BreakHonorable Robert Casey (INVITED)3:15 Pennsylvania p.m. Honorable State Treasurer Robert Casey (INVITED)4:00 p.m.Pennsylvania State TreasurerGeneral Meeting and Presentation of Exhibitor Prizes4:00 Two p.m. additional General cash Meeting prizes of and $500 Presentation will be awarded of Exhibitor but winner Prizes must bepresent. Two additional cash prizes of $500 will be awarded but winner must be4:30 p.m.present.Convention concludes4:30 p.m. Convention concludes2/24/05Please Make Your Reservations Early and Join Us!Please Make Your Reservations Early and Join Us!For more information visit the <strong>PAHU</strong> website atFor http://www.pahu.org/meetingsmore information visit the <strong>PAHU</strong> website athttp://www.pahu.org/meetings2/24/0528 33

Destination Harrisburg – <strong>PAHU</strong> <strong>2005</strong> State ConventionPENNSYLVANIA ASSOCIATION OF HEALTHUNDERWRITERSHarrisburg Hilton Towers, Harrisburg, Pennsylvania<strong>May</strong> 16 – 17, <strong>2005</strong>REGISTRATION FORMNAME _________________________________ DESIGNATION(S) _____________________FIRST NAME OR NICKNAME FOR BADGE ________________________________________AGENCY/COMPANY __________________________________________________________ADDRESS____________________________________________________________________________________________________________________PHONE/FAX _____________________________ / _________________________________E-MAIL________________________________________________________________Please register me as follows:____ Full Registration $100.00 $ _________(Includes all meal and break functions on 5/16 and 5/17/05. It includes CE andstate-mandated Continuing Education filing fees.)____ Spouse Registration Name: __________________ $ 25.00(Includes evening reception 5/15/05, all meals and spouse tour on 5/16/05)$ _____________ Lunch Only Registration $ 30.00 $ _____________ Continuing Education AM and PM sessions $ 50.00 $ _________(Includes courses, breaks, and state-mandated CE filing fees but no meals)____ GOLF on 5/16/05 Your Handicap ______ $125.00 / $450.00 $ _________Single Foursome__________________ ___ __________________ ___ __________________ ___2nd Player Hdcp 3rd Player Hdcp 4th Player HdcpTOTAL$ _________Please make checks payable to <strong>PAHU</strong> and remit to PHILLIPS ASSOCIATES, 3610 KentDrive, Mechanicsburg, PA 17050. FAX 717/732-7255 Questions? 717/728-1217.Payment is by Check: ____ Enclosed ____ Being Mailed Separately ____ Will Pay On-SitePayment is by Credit Card: (Please Circle): Visa or MasterCard or AmexCardNumber:-Exp. Date 29

Destination Harrisburg – <strong>PAHU</strong> <strong>2005</strong> State ConventionPENNSYLVANIA ASSOCIATION OF HEALTHUNDERWRITERSHarrisburg Hilton Towers, Harrisburg, PennsylvaniaGolf Outing Registration FormMonday, <strong>May</strong> 16, <strong>2005</strong> @ 10:00 a.m.Felicita Golf Resort in Harrisburg, PAHeld in conjunction with <strong>PAHU</strong>’s Annual Convention11:00 a.m. Shotgun StartCOST:TYPE OF EVENT:PRICE INCLUDES:$ 125.00 Per Person$ 450.00 Per Foursome$ 20.00 For Lunch OnlyFlorida Scramble at 11:00 a.m. (Box Lunch on carts)Par 3’s - Everyone plays their own ballPar 4’s - Take best tee ball, everyone plays own ballPar 5’s - Take best 1 st and second ball, everyone plays own ballTeam PrizesIndividual Prizes and skill contestsLunchOpportunity to participate in a Hole in OneCONTACTS: Todd Chronister 717-541-6178 or Vince Phillips 717-728-1217****REGISTRATIONPLAYER 1 _____________________________________ HANDICAP _______________PLAYER 2 _____________________________________ HANDICAP _______________PLAYER 3 _____________________________________ HANDICAP _______________PLAYER 4 _____________________________________ HANDICAP _______________Luncheon Only ________ TOTAL number of guests ________Please make checks payable to <strong>PAHU</strong> and remit to PHILLIPS ASSOCIATES, 3610 KentDrive, Mechanicsburg, PA 17050. FAX 717/732-7255 Questions? 717/728-1217.Payment is by Check: ____ Enclosed____ Being Mailed SeparatelyPayment is by Credit Card: (Please Circle): Visa or MasterCard or AmexCardNumber:-Exp. DateThank you for supporting the Pennsylvania Association of Health Underwriters!30

Golf Sponsorship FormDestination Harrisburg – <strong>PAHU</strong> <strong>2005</strong> State ConventionPENNSYLVANIA ASSOCIATION OF HEALTHUNDERWRITERSHarrisburg Hilton Towers, Harrisburg, PennsylvaniaMonday <strong>May</strong> 16, <strong>2005</strong> @ 10:00 a.m. – – 11:00 a.m. Shotgun StartPLEASE INDICATE YOUR LEVEL OF SPONSORSHIP:Lunch Sponsor $ 700.00Beverage Cart Sponsor$ 300.00 TAKENHole Sponsor $ 150.00Prize Sponsor____________________________________Please Describe Prize DonationFOR YOUR SUPPORT, YOU WILL RECEIVE:A sincere thank you from <strong>PAHU</strong> with public recognition at the ConventionName listing in the Program BookFree MulligansAppropriate signage at the Golf OutingThe Lunch Sponsor receives a foursome.Please list your information below as you would like it to appear. We would also appreciate anyother donations/prizes so that each golfer may receive individual prizes and giveaways.NAMECOMPANYADDRESS____________________________________________________________________________________________________________________________________________________PHONEE-MAIL_________________________ FAX ________________________________________________Please make checks payable to <strong>PAHU</strong> and remit to PHILLIPS ASSOCIATES, 3610 KentDrive, Mechanicsburg, PA 17050. FAX 717/732-7255 Questions? 717/728-1217.Payment is by Check: ____ Enclosed____ Being Mailed SeparatelyPayment is by Credit Card: (Please Circle): Visa or MasterCard or AmexCardNumber:-Exp. DateThank you for supporting the Pennsylvania Association of Health Underwriters! 31

National Association of Health UnderwritersWashington UpdateWashington Update2000 N. 14 th Street, Suite 450, Arlington, VA 22201March 28, <strong>2005</strong>Association Health PlansSenator Olympia Snowe (R-ME) has introduced S. 406, the Small Business Health Fairness Act of <strong>2005</strong>.This bill is similar to H.R. 525, sponsored by Congressman Sam Johnson (R-TX) and CongresswomanNydia Velasquez (D-NY). It would create association health plans under the authority of the Departmentof Labor. The House Education and Workforce Committee held a work session to mark up the bill onMarch 16 and the bill was passed by the committee by a 25-22 vote. The bill still must be passed by theHouse, and the odds of Senate passage are still very small.Medical LiabilityThe Help Efficient Accessible, Low-Cost Timely Healthcare Act of <strong>2005</strong> (HEALTH) has been introducedby Senator John Ensign (R-NV). S. 354 is a companion to H.R. 534, which has been introduced on theHouse side. The bill would create a $250,000 cap on non-economic damages, limit punitive damages to amaximum of $250,000, create a statute of limitations for medical malpractice claims and allocate damagesin proportion to a party’s degree of fault. House passage is expected but passage in the Senate is againpredicted to be difficult.Genetic NondiscriminationCongresswomen Judy Biggert (R-IL) and Louise Slaughter (D-NY) introduced H.R. 1227, the GeneticInformation Nondiscrimination Act of <strong>2005</strong>. The bill is identical to S. 306, which passed the SenateFebruary 17 with a 98-0 vote. H.R. 1227 would prohibit health insurers from using genetic information forenrollment purposes and provides individuals with a civil right of action. It also includes language onemployer discrimination and would allow employers to be sued for discrimination. While these bills arepreferable to previous versions, it is still questionable whether there is actually any reason for them to bepassed, as no problem has been identified in this area.Other NewsThe National Association of Insurance Commissioners (NAIC) met March 12-15 in Salt Lake City, Utah.NAHU staff attended the meeting and participated in discussions related to broker compensation issues.The NAIC has not determined whether there will be a Section B added to the amendment to the ProducerLicensing Model Act, which passed December 29, 2004. We continue to monitor state activity on thisissue. NAHU has submitted comments for each step of the process and they can be viewed on the website:http://www.nahu.org/government/NAIC_Comp_Disclosure.htmFormer Indiana Association of Health Underwriters President, Carol Cutter, has been appointed to theposition of Deputy Commissioner of Health for the Indiana Department of Insurance.Recent information released by the Canadian Taxpayers Federation indicates that nearly 48% of Canadianresident’s annual income, in part, goes to pay for the health care system. The Federation is calling forfinancing reform. For additional information: http://www.taxpayer.com/main/index.phpIf you have questions about any of these issues please contact:Janice Kupiec, Legislative Director of State Affairs, jkupiec@nahu.orgJanet Stokes Trautwein, Vice President of Government Affairs, at jtrautwein@nahu.orgTom Bruderle, Vice President of Congressional Affairs, at tbruderle@nahu.orgJessica Waltman, Legislative Director of Policy Research, at jwaltman@nahu.org;John Greene, Legislative Director of Federal and Regulatory Affairs, at jgreene@nahu.org; JenniferBoulware, Legislative Manager of Grassroots Initiatives, at jboulware@nahu.orgMegan Mamarella, Legislative Manager of State Affairs, at mmamarella@nahu.org32

NAHU’s <strong>2005</strong> ANNUAL CONVENTIONJoin us in Miami Beach, Florida,June 26-29 for NAHU’s 75th Annual ConventionAccommodationsThe headquarters hotel for the <strong>2005</strong> Convention is the Sheraton BalHarbour Beach Resort. The room rate is $197 single or double occupancy.Check-in time is 3:00 p.m. Reservations can be made directly with thehotel (305-865-7511) or through Sheraton’s central reservation office at 1-800-999-9898. RESERVATIONS MUST BE MADE BY MAY 23rd.Nestled on ten acres of tropical gardens and sandy beaches, theSheraton Bal Harbour is a deluxe, four-diamond resort located right on theAtlantic Ocean in the exclusive Bal Harbour Village. The hotel is a short drivefrom South Beach, the Art Deco District and many other South Florida attractions.Located just across the street are the world famous Bal HarbourShops, home to the finest retailers, restaurants, cafes and lounges. Thehotel has a water fantasypool complex, including waterfalls,waterslide, lap pool,wading pools, kids pool,jacuzzis and more.Each guest room isequipped with a mini-bar,hairdryer, iron & board, coffeemaker, safe, voice mailand laptop computer accesswith data port. You’ll alsohave access to a fullystaffedbusiness center. TheLifestyle & Fitness Club offersstate-of-the-art exercise equipment, yoga and aerobic classes, personaltraining sessions, sauna, jacuzzi and spa services. Daily passes are $12. Thetennis facility has two outdoor lighted tennis courts. The hotel has four diningoptions, from pool-side casual to a full-service restaurant.Bringing the family? Children under 18 stay free in their parent’s room.The hotel offers Harbour Kids Club, offering full-day or half-day sessions forchildren ages 5 to 12 years for a nominal fee. The Harbour Kids Club professionalstaff organizes a wide range of activities, including arts & crafts,kite flying, pool games, scavenger hunts, movie time, and more. Contactthe Sheraton Bal Harbour for more information.After a day of conventionactivities,you’ll want to explorethe variety of restaurants,clubs andnightspots in thegreater Miami area.Dining options rangefrom Asian, Cuban and“Floribbean” to All-American fare. InMiami Beach’s famed restaurants,celebrity chefs work their magic.TransportationAmerican Airlines has been selected as the Official Airline of NAHU’s <strong>2005</strong>Annual Convention. American is offering zone fares (which do not require aSaturday night stayover) as well as a 5% discount off the lowest available fare.The Sheraton Bal Harbour Resort is located halfway between the Miamiand Fort Lauderdale airports. American’s discounts are available whether youchoose to fly into the Miami, Fort Lauderdale or Palm Beach airports.To take advantage of these discounted fares, call 1-800-433-1790 andrefer to Authorization Code 7665AH. We suggest you “fare shop” to findthe lowest fare, as a number of discount airlines now offer service intoFort Lauderdale. 33

NAHU <strong>2005</strong> ANNUAL CONVENTION AND EXHIBITION • MIAMI, FLOur keynote speaker will be Mike Abrashoff, author of the best selling book It’s Your Ship: ManagementTechniques from the Best Damn Ship in the Navy. Performance on the ship Mike Abrashoff inherited wasdreadful, but he didn’t have the option to hire, fire and promote personnel. What he could do was change theculture to elevate performance—and that’s exactly what he did. In the process, his ship became the Navy’stop performer. Publications from Fast Company to The Harvard Business Review have heralded the remarkableturnaround of the USS Benfold and business schools have made it a case study in organizational success.His latest book is Get Your Ship Together.LPRT qualifiers will have the opportunity to meet Mike Abrashoff at a private continental breakfast preceding hispresentation. Attendance at the breakfast is limited to LPRT qualifiers and their registered convention guests.Education WorkshopsEducation workshops will be offered on Sunday and Monday. We plan to offer 11 sessions. Tentative workshop topics include:Selling HSA Plans, Senior Care—Retirement and End-of-Life Issues, Where the Future of Health Care is Going, AgencyPractice Management, Selling Disability Income Insurance with Conviction, Sales in the Customer Advocate Culture andCreating Lifetime Value for both the Customer and Agent. You will be required to register in advance to attend education workshops.If you wish to obtain continuing-education credits while attending the educational workshops; you must do the following:NAHU <strong>2005</strong> AnnualConvention and ExhibitionTentative AgendaFRIDAY, JUNE 24SUNDAY, JUNE 26MONDAY, JUNE 27TUESDAY, JUNE 28WEDNESDAY, JUNE 29Convention Highlights8:00 a.m. - 5:00 p.m. Board of Trustees Meeting8:00 a.m. - 8:30 a.m. First Timers’ Meeting8:30 a.m. - 10:30 a.m. Opening General Session10:30 a.m. - 12:30 p.m. Exhibit Hall Open1:30 p.m. - 3:45 p.m. Educational Workshops4:00 p.m. - 6:00 p.m. Regional Meetings6:00 p.m.- 7:30 p.m. President’s Reception7:30 a.m. - 9:30 a.m. Awards Breakfast9:30 a.m. - 12:00 p.m. Exhibit Hall Open12:00 p.m. - 1:30 p.m. Lunch On Your Own1:30 p.m. - 3:00 p.m. Eductional Workshops3:15 p.m. -5:45 Town Hall Meeting8:00 a.m. - 9:30 a.m. Continental Breakfastwith Exhibitors9:45 a.m. - 11:45 a.m. General Session11:45 p.m. - 1:15 p.m. Lunch On Your Own1:15 p.m. - 3:00 p.m. Leadership Workshops3:00 p.m. - 6:00 p.m. Free Time!6:00 p.m. - 7:00 p.m. Gordon Memorial Award Reception7:00 p.m. - Midnight Gordon Memorial Award Dinnerand Dance8:00 a.m. - 10:00 a.m. Regional Meetings10:00 a.m. - 1:00 p.m. House of Delegates2:30 p.m. - 4:00 p.m. Board of Trustees Meeting• In advance, select the sessions you will be attending.• Identify your local chapter representative(www.nahu.org/chapters/Index.htm) and have them contactfross@nahu.org or (703) 276-3825.The NAHU education department will forward all required materialsto your chapter representative for requesting approval oftopics through your state’s Department of Insurance. Note: Eachstate’s DOI will vary on the required amount of time given for submittingrequests for approval (30, 60 or 90 days).Gordon Memorial Award DinnerAlways a highlight of the Annual Convention, the GordonMemorial Award Dinner will be held on Tuesday, June 28th. Thehighlight of this black-tie event is the presentation of the Harold R.Gordon Memorial Award, the industry’s most prestigious accolade.The Award presentation will be followed by dancing until midnight.This is always one of the most popular and well-attended conventionevents. You will be able to reserve tables on site; however, thenames of table occupants will not be posted. If you wish to setup a full table for 10, you will need to exchange your vouchers together,or have one person collect your group’s 10 vouchers andexchange them for tickets at the same table. Please note that individualtickets for this event will not be sold. If you wish to bringa spouse/guest to the dinner, they will need to be a fully registeredguest.Special meal requirements should be indicated by checking the“special needs or special services” box on your registration form,and attaching a written specification of what you need in order tofully participate in the Convention. Please note that these requirementsreflect needs and not preferences. Special requirementsMUST be confirmed at the time you select your seat. The hotelstaff will not be able to handle special requests made at the dinner.What’s New This Year?Please take a look at the agenda to see the exciting changeswe’ve made in the schedule for Monday and Tuesday. By makinga few adjustments, we’ve built some free time into the agenda toallow you to enjoy the resort. Educational workshops have beenadded on Monday, and a workshop has been added on Tuesdayfor incoming chapter treasurers. You won’t want to miss Tuesday’scontinental breakfast with exhibitors. We’ll be holding drawings forsome wonderful prizes, and you must be present to win!34

NAHU’s <strong>2005</strong> ANNUAL CONVENTION AND EXHIBITIONMiami Beach, Florida • June 26–29HOW TO REGISTERYOU CAN ALSO REGISTER ONLINE AT www.NAHU.org1. Please complete all sections of the registration form, including education workshop selection and on-site emergency notificationinformation. We will not be able to process incomplete registration forms.2. Fax this completed 2-page registration form with credit card information to 1-703-841-7797. You may only register via fax ifyou are paying the entireamount via credit card. Registrations using NAHU Bucks or paid by check must be mailed. If youare faxing, please do not mail the original registration form.3. Mail this completed registration form with check or credit card information and NAHU Bucks (if using) to:NAHU Convention Registration, 2000 N. 14th Street, Suite 450, Arlington, VA 22201Registration deadline information:Mailed registration forms must by postmarked by the deadline date. Faxed registration forms (with credit card information) mustbe received by NAHU by 9:00 p.m. Eastern Time on the deadline date.STEP 1— REGISTRATION INFORMATIONFirst Name (Please print) Last Name DesignationsNickname for BadgeCompany NameBusiness AddressCity, State, ZipTelephone Fax E-mailChapter Name (no acronyms, please)Leadership Position in ChapterSpouse/Guest Registration(Guests may not be health insurance professionals or NAHU members. Fee required for guests 17 and older. Food functions not included for guests under 17.)Guest’s First Name Last Name Nickname for BadgeIn case of on-site emergency, NAHU should notify:Name: __________________________________________ Daytime Phone: __________________ Evening Phone: _________________ Please check here if you have any special needs or require special services to fully participate in NAHU’s <strong>2005</strong> Convention. Please attach a list of your specific needs.STEP 2—SELECT BREAKOUT SESSIONSPlease indicate which breakout sessions you plan to attend. Choose only one for each time period.Sunday, June 26 1:30 – 2:30 p.m. (Select one) Selling HSA Plans (advising clients) Senior Care—Retirement and End-of-Life Issues Where the Future of Health Care is Going (rates and plan designs) Agency Practice Management Will not attend a breakout session from 1:30-2:30 p.m.Sunday, June 26 2:45 – 3:45 p.m. (Select one) Selling HSA Plans (advising clients) (repeat) Senior Care—Retirement and End-of-Life Issues (repeat) Where the Future of Health Care is Going (rates and plan designs)(repeat) Agency Practice Management (repeat) Will not attend a breakout session from 2:45-3:45 p.m.Monday, June 27 1:30 – 3:00 p.m. (Select one) Selling Disability Income Insurance with Conviction Sales in the Customer Advocate Culture Creating Lifetime Value for both the Customer and Agent Will not attend a breakout session from 1:30-3:00 p.m.Tuesday, June 28 1:15 – 3:00 p.m. (Select one) Incoming Chapter Presidents Workshop Incoming Membership Chairs Workshop Incoming Legislative Chairs Workshop Incoming Education/Program Chairs Workshop Incoming Chapter Treasurers Workshop – New! Working with the Media Will not attend a breakout session from 1:15-3:00 p.m. 35