Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

Recommendation:<br />

BUY (-)<br />

Risk:<br />

MEDIUM (-)<br />

<strong>GoYellow</strong> is in the fast lane<br />

Price Target:<br />

EUR 10.50 (-)<br />

Promising growth prospects in the mid-term<br />

▪ <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong> is one of Germany‟s leading information service<br />

provi<strong>de</strong>rs. The subsidiaries of <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong> inclu<strong>de</strong> the wholly<br />

owned PeterPays <strong>AG</strong>, 118000 Telefonvermittlung GmbH, and <strong>GoYellow</strong><br />

GmbH, 90% of which is owned by <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong>, with the remaining<br />

10% being held by a total of 16 German Yellow Pages publishers. The<br />

company was up to now solely engaged in the media portal business<br />

within Germany.<br />

▪ The company will launch a switchboard service using the number 118000<br />

in December 2009. At 118000, callers can get in touch with people whose<br />

contact <strong>de</strong>tails are not available on public directories. 118000 treats all<br />

data highly confi<strong>de</strong>ntially and does not forward them to third parties.<br />

Despite the promising potentials for <strong>GoYellow</strong> in its operational business<br />

some risks are still on the agenda. In case the directory assistance will not<br />

be as successful as planned this would stress the margins in the group.<br />

▪ The group will start a marketing campaign (EUR 5m) for the launch of the<br />

118000 service. Despite next year‟s financial figures will fall out of line it is<br />

a start into a new growth level as a result of the success of this newly<br />

established service. We expect 118000 to generate revenues of EUR<br />

3.5m in 2010E and already be profitable on quarterly basis in 2H 2009E.<br />

▪ Given the growth potential in the product portfolio of <strong>GoYellow</strong> we expect<br />

the group to achieve revenues of EUR 17.6m in 2009 which will continue<br />

over the next years to came in at EUR 30.3m in 2011. We estimate the<br />

EPS of <strong>GoYellow</strong> to be EUR 0.57 in 2009E, EUR 0.26 in 2010E and EUR<br />

1.00 in 2011E.<br />

▪ The share of <strong>GoYellow</strong> already shows a strong momentum and supported<br />

by positive corporate news this trend could endure for a while. However,<br />

<strong>de</strong>spite the positive stock <strong>de</strong>velopment, the company still has to proof its<br />

ability to sustain its profitiability in the long run.<br />

▪ We applied a multiple valuation based on a peer group and a Discounted<br />

Cash Flow (DCF) mo<strong>de</strong>l. Given the long-term growth prospects we weight<br />

the DCF with 75% in our valuation approach. Our price target is EUR<br />

10.50 per share. We initiate our coverage with a BUY recommendation,<br />

indicating an upsi<strong>de</strong> potential of about 48% for <strong>GoYellow</strong>‟s stock.<br />

Key data<br />

Source: <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong>, CBS Research <strong>AG</strong><br />

30 October 2009<br />

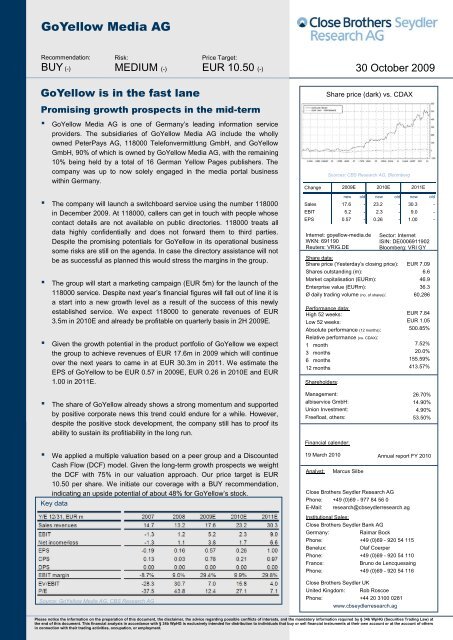

Share price (dark) vs. CDAX<br />

Sources: CBS Research <strong>AG</strong>, Bloomberg<br />

Internet: goyellow-media.<strong>de</strong><br />

WKN: 691190<br />

Reuters: VRIG.DE<br />

Share data:<br />

Share price (Yesterday‟s closing price):<br />

Shares outstanding (m):<br />

Market capitalisation (EURm):<br />

Enterprise value (EURm):<br />

Ø daily trading volume (no. of shares):<br />

Performance data:<br />

High 52 weeks:<br />

Low 52 weeks:<br />

Absolute performance (12 months):<br />

Relative performance (vs. CDAX):<br />

1 month<br />

3 months<br />

6 months<br />

12 months<br />

Sharehol<strong>de</strong>rs:<br />

Management:<br />

albiservice GmbH:<br />

Union Investment:<br />

Freefloat, others:<br />

Financial calen<strong>de</strong>r:<br />

19 March 2010<br />

Analyst: Marcus Silbe<br />

EUR 7.09<br />

6.6<br />

46.9<br />

36.3<br />

60,286<br />

EUR 7.84<br />

EUR 1.05<br />

500.85%<br />

7.52%<br />

20.0%<br />

155.59%<br />

413.57%<br />

26.70%<br />

14.90%<br />

4.90%<br />

53.50%<br />

Annual report FY 2010<br />

Close Brothers Seydler Research <strong>AG</strong><br />

Phone: +49 (0)69 - 977 84 56 0<br />

E-Mail: research@cbseydlerresearch.ag<br />

Institutional Sales:<br />

Close Brothers Seydler Bank <strong>AG</strong><br />

Germany: Raimar Bock<br />

Phone: +49 (0)69 - 920 54 115<br />

Benelux: Olaf Coerper<br />

Phone: +49 (0)69 - 920 54 110<br />

France: Bruno <strong>de</strong> Lencquesaing<br />

Phone: +49 (0)69 - 920 54 116<br />

Close Brothers Seydler UK<br />

United Kingdom: Rob Roscoe<br />

Phone: +44 20 3100 0281<br />

www.cbseydlerresearch.ag<br />

Sector: Internet<br />

ISIN: DE0006911902<br />

Bloomberg: VRI GY<br />

Please notice the information on the preparation of this document, the disclaimer, the advice regarding possible conflicts of interests, and the mandatory information required by § 34b WpHG (Securities Trading Law) at<br />

the end of this document. This financial analysis in accordance with § 34b WpHG is exclusively inten<strong>de</strong>d for distribution to individuals that buy or sell financial instruments at their own account or at the account of others<br />

in connection with their trading activities, occupation, or employment.<br />

Change<br />

2009E 2010E<br />

2011E<br />

new old new old new old<br />

Sales 17.6 - 23.2 - 30.3 -<br />

EBIT 5.2 - 2.3 - 9.0 -<br />

EPS 0.57 - 0.26 - 1.00 -

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

Table of content:<br />

Investment thesis ...................................................... 3<br />

SWOT analysis ........................................................... 5<br />

www.cbseydlerresearch.ag<br />

Strengths ...................................................................................................... 5<br />

Weaknesses ................................................................................................. 5<br />

Opportunities................................................................................................. 6<br />

Threats .......................................................................................................... 6<br />

Valuation.................................................................... 7<br />

Valuation summary ....................................................................................... 7<br />

Peer group valuation ..................................................................................... 8<br />

DCF ............................................................................................................ 11<br />

The company ........................................................... 13<br />

Company profile .......................................................................................... 13<br />

Company structure ...................................................................................... 13<br />

Management ............................................................................................... 13<br />

Sharehol<strong>de</strong>r structure ................................................................................. 14<br />

Company history ......................................................................................... 14<br />

Business mo<strong>de</strong>l........................................................ 16<br />

<strong>GoYellow</strong> GmbH ......................................................................................... 17<br />

<strong>GoYellow</strong>.<strong>de</strong> ............................................................................................. 17<br />

Peter Pays <strong>AG</strong> ............................................................................................ 19<br />

PeterZahlt.<strong>de</strong>............................................................................................ 19<br />

Cheap Calls ............................................................................................. 20<br />

118000 Telefonvermittlung GmbH .............................................................. 20<br />

Strategy ................................................................... 21<br />

Strategic premises ...................................................................................... 21<br />

Growth strategy ........................................................................................... 21<br />

<strong>GoYellow</strong>.<strong>de</strong> ............................................................................................. 22<br />

PeterZahlt.<strong>de</strong>............................................................................................ 23<br />

118000 ..................................................................................................... 23<br />

Distribution and marketing .......................................................................... 24<br />

Future projects ............................................................................................ 24<br />

Market <strong>de</strong>velopment ................................................ 25<br />

Local search & directory assistance ............................................................ 25<br />

Online advertising ....................................................................................... 25<br />

Competition ............................................................. 28<br />

Financials ................................................................ 30<br />

Historical financial <strong>de</strong>velopment.................................................................. 30<br />

Outlook ....................................................................................................... 32<br />

Appendix .................................................................. 37<br />

Close Brothers Seydler Research <strong>AG</strong> | 2

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

Investment thesis<br />

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong> is one of Germany‟s leading information service provi<strong>de</strong>rs.<br />

The subsidiaries of <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong> inclu<strong>de</strong> the wholly owned PeterPays <strong>AG</strong>,<br />

118000 Telefonvermittlung GmbH, and <strong>GoYellow</strong> GmbH, 90% of which is owned<br />

by <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong>, with the remaining 10% being held by a total of 16 German<br />

Yellow Pages publishers. The company was up to now solely engaged in the media<br />

portal business within Germany.<br />

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong> has established a business in the area of information services<br />

that ensures a fast <strong>de</strong>velopment process for new innovations, while remaining<br />

highly productive without jeopardising the working processes. Over the years the<br />

group managed to attain a strong market position in several promising sectors of<br />

the e-commerce business.<br />

One of the key elements of <strong>GoYellow</strong>‟s strategy is the extension of the product<br />

portfolio with innovations that allow to expand the market share as the company will<br />

benefit from its first-mover-advantage not only in the business mo<strong>de</strong>l of<br />

PeterZahlt.<strong>de</strong> in Germany, but also in particular with the new switchboard service<br />

118000 which is currently a unique business mo<strong>de</strong>l in the whole European market<br />

and leads to strong entry barriers for new market entrants.<br />

After a long transformation phase, the company has stabilised its operative<br />

performance over the last five quarters, as a consequence of restructuring the<br />

business mo<strong>de</strong>l and tightening the strategic goals of the group. Over the period 1Q<br />

2008 – 3Q 2009 the company experienced a top line growth of C<strong>AG</strong>R 14% and<br />

managed to becoming profitable. Along with steady improvement in net income and<br />

EBIT margin, the company pushed ahead with implementing a more focused<br />

business mo<strong>de</strong>l with the main focus on its goyellow.<strong>de</strong> segment.<br />

Taking into account that the fourth quarter will be as profitable as the first nine<br />

months 2009 this fiscal year will end very positively. Overall, we expect the group to<br />

achieve total revenues of EUR 17.64m, indicating a 33.9% growth yoy. Therefore,<br />

4Q revenues will amount to EUR 4.41m. The estimated gross profit margin of<br />

91.8% leads to a margin for full year of 89.9%, corresponding to EUR 15.86m.<br />

Similarly to the revenue growth in 2009E, the EBIT also will further rise. In<br />

comparison to the previous year the group should achieve an EBIT of EUR 5.2m in<br />

2009E, corresponding to an EBIT-margin of 29.4%. Despite the increasing<br />

marketing expenses in 2010E we are confi<strong>de</strong>nt that <strong>GoYellow</strong> will also be able to<br />

keep its cost structure manageable in the mid-term. In the long run we are<br />

convinced that the top line growth of <strong>GoYellow</strong> will further continue and the EBITmargin<br />

will settle down in the range of 25% in 2018E, which is in our opinion a<br />

conservative assumption.<br />

The significant growth momentum which <strong>GoYellow</strong> has achieved over the last two<br />

years should also sustain in the course of the fiscal year 2009E. In addition,<br />

consi<strong>de</strong>ring the current product portfolio (including the new units 118000 and<br />

Cheap Calls) we are convinced that <strong>GoYellow</strong> is favourably positioned for the mid-<br />

and long-term.<br />

Generally speaking this new service line will bring <strong>GoYellow</strong> up to a new level of<br />

operational performance. Additionally, as the group is the first mover on this service<br />

the chances of success are very promising. According to the management,<br />

revenues in the range of EUR 5 – 10m seems a realistic scenario for 2010. We<br />

www.cbseydlerresearch.ag<br />

<strong>GoYellow</strong> is a leading<br />

information service<br />

provi<strong>de</strong>r<br />

Fast <strong>de</strong>veloped<br />

processes for new<br />

innovations<br />

Strategic premises are<br />

the remo<strong>de</strong>lling of<br />

PeterZahlt and the<br />

establishment of<br />

118000<br />

The group managed to<br />

perform a C<strong>AG</strong>R of<br />

14% over seven<br />

quarters<br />

4Q will confirm the<br />

positive momentum in<br />

the current fiscal year<br />

Further growth<br />

potential over the next<br />

few years<br />

EBIT-margin 25% in<br />

the long run<br />

Favourable positioned<br />

for the mid- and longterm<br />

118000 will boost the<br />

performance of the<br />

group<br />

Close Brothers Seydler Research <strong>AG</strong> | 3

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

<strong>de</strong>ci<strong>de</strong>d to chose a conservative assumption for the revenue growth and expect in<br />

our estimation EUR 3.5m in 2010E and EUR 4.03m in 2011E. By doing so,<br />

revenues of EUR 3.5m indicate about 1.75m calls, as we expect a price of EUR 2<br />

per call. For 2011E this would correspond to 2.1m caller, indicating a growth of<br />

about 15% yoy.<br />

Based on the expected figures for 2009E the EV/EBIT-Multiple is about 7.0 and<br />

about 15.8 for 2010E. Based on our forecasts for 2011E, currently the share is<br />

tra<strong>de</strong>d with a P/E-ratio of about 7.1.<br />

We applied a multiple valuation based on a peer group and a Discounted Cash<br />

Flow (DCF) mo<strong>de</strong>l. Given the long-term growth prospects we weight the DCF with<br />

75% in our valuation approach. Our multiple valuation on the basis of P/E and EV<br />

multiples indicates a market-<strong>de</strong>rived value of EUR 6.25 per share. Our DCF mo<strong>de</strong>l<br />

yields a fair value of EUR 12.02 per share. On the basis of both results this<br />

approach resulted in a fair value of EUR 10.58 per share. Our price target per<br />

share is at EUR 10.50. We initiate our coverage with a BUY recommendation.<br />

www.cbseydlerresearch.ag<br />

P/E 7.1 for 2011E<br />

BUY recommendation<br />

with price target of<br />

EUR 10.50 per share<br />

Close Brothers Seydler Research <strong>AG</strong> | 4

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

SWOT analysis<br />

Strengths<br />

▪ Strong market position: The company is one of the leading business assistance<br />

companies in the German market<br />

▪ The company provi<strong>de</strong>s through its highly experienced and well-known<br />

management board strong expertise by offering high-quality in all of its product<br />

portfolios<br />

▪ High entry barriers in the core market <strong>GoYellow</strong>.<strong>de</strong> as well as the newly<br />

established switchboard service 118000<br />

▪ Solid sharehol<strong>de</strong>r structure: The management has been steadily committed to<br />

the stock with a current share of about 26.7%<br />

▪ With a sophisticated IT-infrastructure the company is able to fulfil its strategic<br />

growth targets by new products with EBIT-margins of about 30%<br />

▪ Strong positioning on the product si<strong>de</strong>: <strong>GoYellow</strong> has achieved an excellent mix<br />

between existing products that have been installed in the market which already<br />

generate significant sales volumes and promising margin levels<br />

▪ Balance sheet: The group is not affected by liability payments to banks and<br />

managed to turnaround over the last few years<br />

Weaknesses<br />

▪ Low geographic business diversification: The company generates its revenues<br />

in Germany. Therefore, the growth potential <strong>de</strong>pends on the consumer<br />

behaviour of its home market<br />

▪ Low revenue diversification: The company still generates between 70% - 80%<br />

of its revenues in the <strong>GoYellow</strong>.<strong>de</strong> business<br />

▪ High <strong>de</strong>pen<strong>de</strong>ncy on the distribution channels of the yellow pages publishers as<br />

most of its revenues amounts to this segment<br />

▪ The company has just become profitable after several years of losses.<br />

Therefore, the group has to proof whether this profitability is sustainable<br />

▪ As the switchboard service is unique in the German market the risk of failure is<br />

not yet fully foreseeable<br />

▪ No divi<strong>de</strong>nd payments: As long as the group has retained losses in the balance<br />

sheet the group is not able to pay divi<strong>de</strong>nds<br />

www.cbseydlerresearch.ag<br />

Close Brothers Seydler Research <strong>AG</strong> | 5

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

Opportunities<br />

▪ Promising growth prospects in emerging new directory assistance service:<br />

Resulting from a first-mover-advantage in this new kind of directory assistance<br />

the group can built up high market entry barriers and boost up its top and<br />

bottom lines by this new segment<br />

▪ Organic growth potential resulting from new pricing mo<strong>de</strong>l at <strong>GoYellow</strong>.<strong>de</strong>: In<br />

August 2008 the group changed its pricing mo<strong>de</strong>l for <strong>GoYellow</strong>.<strong>de</strong> from its<br />

“offline-related pricing mo<strong>de</strong>l” towards the online-related pricing mo<strong>de</strong>l similar to<br />

general search engines like Google, which have already shown a big impact on<br />

the financial statement, and the prospects for further growth seems promising<br />

▪ Expansion of business to new geographic markets as well as business<br />

opportunities arising in the business segment of PeterZahlt and the newly<br />

established services<br />

▪ The growth strategy is not bur<strong>de</strong>ned by one specific business unit: The<br />

business mo<strong>de</strong>l of <strong>GoYellow</strong> does not <strong>de</strong>pend on the growth ability of one<br />

segment as every segment can be seen as a stand-alone<br />

▪ In case the <strong>de</strong>velopment of the iPhone application Cheap Calls will exceed the<br />

“low” expectations, this business might be enhance in the future<br />

Threats<br />

▪ Negative impacts from current economic slowdown: As the segment<br />

<strong>GoYellow</strong>.<strong>de</strong> <strong>de</strong>pends on acquiring new customers the current stressed market<br />

sentiment could hit the top line performance of the group<br />

▪ Given that up to now no <strong>de</strong>tails concerning the business mo<strong>de</strong>l of the<br />

switchboard service are published it is difficult to forecast planning figures for<br />

the company as well as the success rate as it is not known if this new service<br />

will be accepted by the customers<br />

▪ The group will start a campaign in 2010 with a marketing budget of about EUR<br />

5m. In case the company is not able to refinance this expense the financial<br />

statement as well as the cash flow situation might be stressed by this effect<br />

▪ The remo<strong>de</strong>ling of PeterZahlt towards a “German Skype service” could miss the<br />

customer <strong>de</strong>mand and therefore, the group‟s financial situation would be<br />

stressed and in the worst case scenario another restructuring/remo<strong>de</strong>ling has to<br />

be provi<strong>de</strong>d to justify the going concern without bur<strong>de</strong>ning the bottom line and<br />

cash flows in a disproportional manner<br />

▪ Certain companies inclu<strong>de</strong>d in consolidation were sued for damages by<br />

Deutsche Telekom <strong>AG</strong> for using subscriber data. Despite the fact, that<br />

<strong>GoYellow</strong> already consi<strong>de</strong>rs bringing charges against Deutsche Telekom <strong>AG</strong> a<br />

possible compensation payment could harm the financial figures of the group<br />

<strong>de</strong>spite the risks are insignificant, according to the company<br />

www.cbseydlerresearch.ag<br />

Close Brothers Seydler Research <strong>AG</strong> | 6

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

Valuation<br />

Valuation summary<br />

We applied a multiple valuation and a discounted cash flow (DCF) mo<strong>de</strong>l to <strong>de</strong>rive<br />

the company´s fair value. Our peer group comparison indicates a fair value of EUR<br />

6.25 per share. We focused on the multiples for 2009E to 2011E to have more<br />

certainty in consi<strong>de</strong>ring the estimates for the peer group-companies. Our DCF<br />

mo<strong>de</strong>l results in a fair value of EUR 12.02 per share.<br />

We weighted the DFC valuation with 75% and the Peer group valuation with only<br />

25%, because of the limited informative value of the slightly heterogeneous peer<br />

group. We believe that the DCF mo<strong>de</strong>l better indicates the long term perspectives<br />

of this growing company. We <strong>de</strong>rive a final fair value of EUR 10.58. We start our<br />

coverage with a BUY recommendation and a price target of EUR 10.50 per share.<br />

Consolidation of valuation methods<br />

Source: CBS Research <strong>AG</strong><br />

On the basis of our <strong>de</strong>rived fair enterprise value (EV) we calculated an EV/EBIT<br />

multiple of 11.5 for 2009E and an EV/EBIT multiple for 2011E of 6.6. EV/EBITDA<br />

for 2009E and 2011E on basis of the <strong>de</strong>rived fair value is about 10.9 and 6.4.<br />

Furthermore, we calculated the multiples based on the current stock market price,<br />

which are stated in the last row of the table below.<br />

Multiples of <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong> on basis of fair value per share<br />

Source: CBS Research <strong>AG</strong><br />

www.cbseydlerresearch.ag<br />

Weighting Fair value<br />

factor per share (EUR)<br />

Peer group valuation 25.0% 6.25<br />

DCF valuation 75.0% 12.02<br />

Fair value per share (EUR) 10.58<br />

Valuation on basis of a<br />

DCF mo<strong>de</strong>l and a peer<br />

group comparison<br />

Fair Value per share is<br />

EUR 10.58<br />

Price target of EUR<br />

10.50 per share<br />

Current multiples<br />

Close Brothers Seydler Research <strong>AG</strong> | 7

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

Peer group valuation<br />

From our point of view <strong>GoYellow</strong>‟s equity story is very special in the German stock<br />

market. In or<strong>de</strong>r to inclu<strong>de</strong> a market-oriented approach in our valuation, we used a<br />

multiple valuation based on a peer group. Our peer group comprises six listed<br />

companies related to with similar business mo<strong>de</strong>ls operating in European markets.<br />

We <strong>de</strong>ci<strong>de</strong>d to build two peer groups. One group should exclusively composed of<br />

stocks, which have a high proportion of revenue generated in the Yellow pages<br />

business (off- and online). The second peer group is composed of companies,<br />

which have a high share of revenues generated in the area of (online) advertising<br />

and subscriber payments (XING). Overall, all chosen companies have a focus on<br />

the online business.<br />

As indicated in the table below, the company´s market cap of EUR 46.9m is still<br />

relatively low compared to its relevant peers, although <strong>GoYellow</strong> is in Germany one<br />

of the few companies within this specific sector.<br />

Peer groups: Company data<br />

Source: CBS Research <strong>AG</strong>, Bloomberg<br />

Peer group – short overview<br />

ad pepper media <strong>AG</strong> is an in<strong>de</strong>pen<strong>de</strong>nt international online advertising marketer.<br />

The company offers individual and efficient solutions for media agencies,<br />

advertisers and websites in display, performance, email and affiliate marketing,<br />

covering practically the whole range of online advertising. The ad pepper media<br />

group offers trailblazing solutions in their fields, including: Emediate (ad serving),<br />

ad.agents (search engine marketing) and Globase (email marketing technology).<br />

Source: ad pepper media <strong>AG</strong>, Bloomberg, CBS Research <strong>AG</strong><br />

AdLINK Group is a European supplier of online performance-based marketing<br />

solutions. The AdLINK Group reaches over 100m unique users around the world<br />

via its brands affilinet (www.affili.net) and Sedo (www.sedo.com). Over 6m internet<br />

www.cbseydlerresearch.ag<br />

<strong>GoYellow</strong>’s investment<br />

story is promising<br />

All chosen companies<br />

have focus on the<br />

online business<br />

ad pepper media <strong>AG</strong><br />

AdLINK Group<br />

Close Brothers Seydler Research <strong>AG</strong> | 8

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

domains and websites are converted into sales leads and customers. In its<br />

operating business, the AdLINK Group will focus on the performance-based<br />

advertising mo<strong>de</strong>ls of its specialist‟s affilinet (Affiliate Marketing) and Sedo (Domain<br />

Marketing).<br />

Source: ADLINK Group, Bloomberg, CBS Research <strong>AG</strong><br />

Eniro AB is a Swe<strong>de</strong>n-based company engaged in the provision of search and<br />

directory services. Its search database connects sellers to buyers and helps to find<br />

people using Online, Voice and Offline <strong>Media</strong> channels. The Online business unit<br />

inclu<strong>de</strong>s Eniro‟s Internet services, comprising the local search Websites in all the<br />

Nordic countries, as well as mobile services in Swe<strong>de</strong>n, Norway, Denmark and<br />

Finland. The Offline <strong>Media</strong> business unit inclu<strong>de</strong>s the Company‟s production of<br />

directories and other printed media, such as map books in Denmark.<br />

Source: Eniro AB, Bloomberg, CBS Research <strong>AG</strong><br />

telegate <strong>AG</strong> is a multichannel-provi<strong>de</strong>r of local search with approx. 3,000<br />

employees across the group. The majority interest in telegate MEDIA <strong>AG</strong> (former<br />

klickTel <strong>AG</strong>) was an important milestone with regard to the strategic new orientation<br />

on the German core market. The company supplies consumers in Germany with<br />

high-quality information via the internet portals 1880.com and klickTel.<strong>de</strong>, the<br />

telephone directory assistance 11880, the klickTel CD-ROMs and -software<br />

solutions as well as via the directory assistance services for mobile <strong>de</strong>vices.<br />

www.cbseydlerresearch.ag<br />

Eniro AB<br />

telegate <strong>AG</strong><br />

Close Brothers Seydler Research <strong>AG</strong> | 9

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

Source: telegate <strong>AG</strong>, Bloomberg, CBS Research <strong>AG</strong><br />

XING <strong>AG</strong> is a Germany-based company engaged in the provision and maintenance<br />

of online business communication services. By providing the Internet platform<br />

xing.com the group aims at business professionals, offering discovery capability<br />

and contact management tools. The Company divi<strong>de</strong>s its operations into three<br />

business divisions: Subscriptions, e-commerce and Advertising.<br />

Source: XING <strong>AG</strong>, Bloomberg, CBS Research <strong>AG</strong><br />

Yell Group plc (Yell) is an international directories business operating in the<br />

advertising market, through the printed, online and phone-based media in the<br />

United Kingdom, the United States, Spain and Latin America. During the fiscal year<br />

en<strong>de</strong>d March 31, 2009 (fiscal 2008), the Company completed the acquisition of the<br />

Adworks businesses in the United Kingdom, the United States, Spain and India.<br />

Source: Yell Group plc, Bloomberg, CBS Research <strong>AG</strong><br />

www.cbseydlerresearch.ag<br />

XING <strong>AG</strong><br />

Yell Group plc<br />

Close Brothers Seydler Research <strong>AG</strong> | 10

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

Valuation<br />

As already mentioned, we applied the median of both peer group multiples for<br />

2009E to 2011E to our financial forecasts for <strong>GoYellow</strong>. However, consi<strong>de</strong>ring the<br />

marketing campaign costs of about EUR 5m the financial figures of <strong>GoYellow</strong> are<br />

distorted in 2010E to a large extent, as the income statement-related effects will<br />

follow-up this campaign for the newly established switchboard service 118000.<br />

Consequently, the fair value per share is not as accurate as the long-term approach<br />

of the DCF mo<strong>de</strong>l which led us to the <strong>de</strong>cision to weigh the peer group valuation<br />

only with 25% (DCF 75%) in the overall company valuation.<br />

Our multiple valuation of <strong>GoYellow</strong> resulted in a fair value of equity of EUR 41.4m.<br />

Because of the sufficient comparability of the peer group in regards to <strong>GoYellow</strong> we<br />

did not use any premium or discount. According to our multiple valuation, the fair<br />

value per share amounts to EUR 6.25.<br />

Peer Group Valuation: Multiples and <strong>de</strong>rived valuation<br />

Source: CBS Research <strong>AG</strong>, Bloomberg<br />

DCF<br />

Our Discounted Cash Flow (DCF) mo<strong>de</strong>l is based on the following assumptions:<br />

Weighted average cost of capital (WACC): On the basis of the current long-term<br />

yields of German fe<strong>de</strong>ral bonds, we set the risk-free rate at 3.0%. We assumed an<br />

equity risk premium of 6.5%, and a <strong>de</strong>bt risk premium of 2.5%. We did not use<br />

<strong>GoYellow</strong>‟s historical beta for the WACC calculation due to the recent volatility in<br />

stock markets and the strong momentum in the share of <strong>GoYellow</strong>. We <strong>de</strong>ci<strong>de</strong>d to<br />

use a Beta of about 1.4, which is a very conservative assumption. We furthermore<br />

assumed a long-term target equity ratio at market values of 80%, which is also a<br />

conservative assumption. These premises lead to a WACC of 10.53%.<br />

www.cbseydlerresearch.ag<br />

We applied the median<br />

of the peer group<br />

multiples<br />

Our multiple valuation<br />

of <strong>GoYellow</strong> resulted in<br />

a fair value per share<br />

of EUR 6.25<br />

WACC calculation<br />

Close Brothers Seydler Research <strong>AG</strong> | 11

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

Phase 1 (2008-10E): We estimated the free cash flows (FCF) of phase 1 according<br />

to our <strong>de</strong>tailed financial forecasts for this period stated in the financials section.<br />

Phase 2 (2011-17E): For Phase 2, we started out from more general assumptions.<br />

We allowed annual sales growth to <strong>de</strong>crease successively to 3.0% in 2018E. In the<br />

long run we incorporated a stabilisation of the EBIT margin to 25.0% in 2018E into<br />

our mo<strong>de</strong>l.<br />

Phase 3: For the calculation of the terminal value, we applied a long-term FCF<br />

growth rate of 2.0% which equals the estimated long-term inflation rate. This<br />

assumption theoretically corresponds to a real-term zero growth since we use a<br />

nominal discount rate (WACC).<br />

Based on these assumptions, we calculated a fair value of the operating business<br />

of EUR 71.8m. We ad<strong>de</strong>d <strong>GoYellow</strong>‟s net cash and inclu<strong>de</strong>d the estimated market<br />

value of minority interests. The resulting fair value of equity is EUR 79.6m. The fair<br />

value per share amounts to EUR 12.02, according to our DCF mo<strong>de</strong>l.<br />

DCF<br />

Source: CBS Research <strong>AG</strong><br />

www.cbseydlerresearch.ag<br />

Phase 1: Detailed<br />

forecasts<br />

We allowed annual<br />

sales growth to<br />

<strong>de</strong>crease successively<br />

to 3% in 2018E<br />

Long-term FCF growth<br />

rate of 2.0%<br />

Fair value per share of<br />

EUR 12.02<br />

Close Brothers Seydler Research <strong>AG</strong> | 12

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

The company<br />

Company profile<br />

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong> is one of Germany‟s leading information service provi<strong>de</strong>rs.<br />

The subsidiaries of <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong> inclu<strong>de</strong> the wholly owned PeterPays <strong>AG</strong>,<br />

118000 Telefonvermittlung GmbH, and <strong>GoYellow</strong> GmbH, 90% of which is owned<br />

by <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong>, with the remaining 10% being held by a total of 16 German<br />

Yellow Pages publishers. The Company is up to now solely engaged in the media<br />

portal business within Germany. With the scheduled launch date for the 118000<br />

switchboard services in December 2009, the company offers a broad range of<br />

valuable services that intelligently and efficiently combine telephony services and<br />

the Internet. Additionally, by establishing the new 118000 service the company<br />

plans to close the existent gap between directory assistance and Internet search<br />

engine. Currently, the group employs 58 people and is managed by Dr. Klaus<br />

Harisch and Peter Wünsch.<br />

Company structure<br />

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong> purely acts as a management holding that has key<br />

subsidiaries, each of them covering a specific strategic direction: <strong>GoYellow</strong> GmbH<br />

(90%), Peter Pays <strong>AG</strong> (100%), and 118000 Telefonvermittlung GmbH (100%)<br />

which was established in September 2009. The remaining 10% share in <strong>GoYellow</strong><br />

GmbH is held by the publishing group of the yellow pages.<br />

Company structure<br />

<strong>GoYellow</strong> GmbH<br />

90%<br />

Source: <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong>, CBS Research <strong>AG</strong><br />

Management<br />

The management board of <strong>GoYellow</strong> <strong>Media</strong> currently consists of two members - Dr.<br />

Klaus Harisch and Peter Wünsch.<br />

Dr. Klaus Harisch is Chief Executive Officer of <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong> and is<br />

responsible for strategy, finance and corporate communication. He has been CEO<br />

of the group since 01 January 2004. Prior to his engagement at <strong>GoYellow</strong> he was<br />

one of the three foun<strong>de</strong>r of telegate <strong>AG</strong> on 07 August 1996, a company which grew<br />

un<strong>de</strong>r his lea<strong>de</strong>rship as CEO to employ 3,000 professionals and occupy a<br />

prominent position in the directory services branch. As studied physicist Dr. Harisch<br />

started his career 1992 as a technical project manager at Schwarz-Schilling &<br />

Partner GmbH, based in Munich.<br />

Peter Wünsch is as board member of <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong> responsible for the<br />

operational business of <strong>GoYellow</strong>.<strong>de</strong> and the telephony services. Since 2004 he<br />

www.cbseydlerresearch.ag<br />

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

Peter Pays <strong>AG</strong><br />

100%<br />

118000<br />

Telefonvermittlung<br />

GmbH<br />

100%<br />

<strong>GoYellow</strong> is a leading<br />

information service<br />

provi<strong>de</strong>r<br />

Dr. Klaus Harisch is<br />

CEO<br />

Peter Wünsch<br />

Close Brothers Seydler Research <strong>AG</strong> | 13

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

has been a board member of <strong>GoYellow</strong> (till Juni 2006 varetis <strong>AG</strong>). Mr. Peter<br />

Wünsch is one of the four foun<strong>de</strong>rs of varetis and a co-foun<strong>de</strong>r of telegate <strong>AG</strong>. Mr.<br />

Wünsch had studied information technology and after that he worked as system<br />

analyst at Dr. Henk-Unternehmensberatung, Munich.<br />

Sharehol<strong>de</strong>r structure<br />

As shown in the following chart, the company‟s sharehol<strong>de</strong>r structure as published<br />

by <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong> on 09 October 2009 mainly consists of free float (43.30%).<br />

Sharehol<strong>de</strong>r structure<br />

BW Invest<br />

4.80%<br />

Union<br />

Investment<br />

4.90%<br />

Günther Baierl<br />

5.40%<br />

albiservice<br />

GmbH 14.90%<br />

Source: <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong>; CBS Research <strong>AG</strong><br />

As seen in the chart above, the <strong>GoYellow</strong> management (Dr. Klaus Harisch, Peter<br />

Wünsch) has been steadily committed (current share ~26.7%) for a long time. This<br />

is, in our opinion, a proof the management is trust to the company.<br />

Company history<br />

The corporate history of <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong> started with the foundation of the<br />

pre<strong>de</strong>cessor company pc-plus GmbH in 1983. In 1989 the company <strong>de</strong>veloped a<br />

gateway system for access to international databases (IDIS) and one year later the<br />

<strong>de</strong>veloped software (IDIS) had been <strong>de</strong>ployed in Germany, Switzerland, the UK<br />

and Finland.<br />

In the course of the founding of pc-plus INFORMATIK GmbH & Co. KG in 1992 the<br />

company became a global player in the field of international telephone directory<br />

assistance systems. Resulting from the internationalisation the company launched<br />

subsidiaries in several countries, like USA, Switzerland, the UK and Singapore.<br />

At the company‟s 15th Year anniversary pc-plus enhanced its product portfolio<br />

towards internet telephone information systems, automatic directory assistance and<br />

the expansion of all call center applications. In the same year company changed<br />

into pc-plus INFORMATIK <strong>AG</strong>. But already one year later the company name<br />

changed to varetis <strong>AG</strong> and since 2000 the share has been listed at the Frankfurt<br />

Stock Exchange.<br />

The internet searches for local addresses (Goyellow.<strong>de</strong>) had been <strong>de</strong>veloped in<br />

2004 resulting from the know-how of varetis in the field of data search technologies.<br />

www.cbseydlerresearch.ag<br />

Peter Wünsch<br />

12.10%<br />

Free float<br />

43.30%<br />

Dr. Klaus<br />

Harisch 14.60%<br />

Sharehol<strong>de</strong>r structure<br />

mainly consist of<br />

freefloat<br />

Management has been<br />

steadily committed<br />

Foun<strong>de</strong>d in 1983 as pcplus<br />

GmbH<br />

IPO as varetis <strong>AG</strong> in<br />

2000<br />

Close Brothers Seydler Research <strong>AG</strong> | 14

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

Asi<strong>de</strong> local searches, the company acquired on 4 November 2004 Telix <strong>AG</strong>, whose<br />

services inclu<strong>de</strong>d carrying out a number of functions for provi<strong>de</strong>rs of value-ad<strong>de</strong>d<br />

telephone services. However, at 31 Dec 2007 this service was discontinued by the<br />

group. At the end of 2005 varetis <strong>AG</strong> sold its subsidiary varetis solutions GmbH to<br />

one of its main competitor Volt Delta Resources LLC.<br />

Since 2006 the group has been firmed as <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong>. In addition, the<br />

group started a new telephony platform in 2006, called PeterZahlt.<strong>de</strong>. In October<br />

2007 the online e-commerce platform peterzahltaus.<strong>de</strong> has been launched.<br />

Due to strategic changes in the business mo<strong>de</strong>l of <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong> the group<br />

sold 10% of <strong>GoYellow</strong> GmbH to the publishing group of the yellow pages in 2007.<br />

Likewise the group changed its payment structure of goyellow.<strong>de</strong> towards a<br />

pagerank payment system. The modification of the subscriber commissions has<br />

positively affected the income statement.<br />

www.cbseydlerresearch.ag<br />

Since 2006 <strong>GoYellow</strong><br />

<strong>Media</strong> <strong>AG</strong><br />

Close Brothers Seydler Research <strong>AG</strong> | 15

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

Business mo<strong>de</strong>l<br />

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong> has established a business in the area of information services<br />

that ensures a fast <strong>de</strong>velopment process for new innovations, while remaining<br />

highly productive without jeopardising the working processes. Over the years the<br />

group managed to attain a strong market position in several promising sectors of<br />

the e-commerce business. Besi<strong>de</strong>s, the group is able to focus on its core strategic<br />

plan and <strong>de</strong>velopment progresses, as well as relatively low fixed costs and capital<br />

expenditures which lead to a higher margin level. As a consequence, <strong>GoYellow</strong><br />

benefits from its highly scalable and effective production capacity within the<br />

business segments.<br />

The company has three core business units: <strong>GoYellow</strong>.<strong>de</strong>, PeterZahlt.<strong>de</strong> and the<br />

recent established 118000 service. Overall, the services of <strong>GoYellow</strong> play an<br />

important role within the strategic orientation implemented by the group.<br />

Business mo<strong>de</strong>l<br />

<strong>GoYellow</strong> GmbH<br />

Goyellow.<strong>de</strong><br />

Source: <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong>, CBS Research <strong>AG</strong> *PeterZahltaus.<strong>de</strong> discontinuation already initiated<br />

The company currently generates most of its revenue from the <strong>GoYellow</strong>.<strong>de</strong><br />

segment. However, the present focus and the introduction of new products are<br />

expected to play a more important role over the next few years. The group‟s<br />

portfolio of online advertising options is unique and special in the German market<br />

which enables ads to be broadcasted to specific target groups online without any<br />

waste coverage.<br />

The main focus of the company‟s business mo<strong>de</strong>l is to further strengthen the shift<br />

in the revenue structure to a more balanced level. The bilateral enhancement of<br />

<strong>GoYellow</strong>.<strong>de</strong> and other e-commerce business units should bring the company to a<br />

Pareto situation. On basis of this wi<strong>de</strong>-ranged business mo<strong>de</strong>l, <strong>GoYellow</strong> has built<br />

up a sophisticated product portfolio comprising the local search segment as well as<br />

the telephony segment.<br />

www.cbseydlerresearch.ag<br />

Peter Pays <strong>AG</strong><br />

Peterzahlt.<strong>de</strong><br />

Peterzahltaus.<strong>de</strong><br />

Cheap Calls<br />

118000<br />

Telefonvermittlung<br />

GmbH<br />

118000 service<br />

Business mo<strong>de</strong>l<br />

enables fast process<br />

for new innovations<br />

Three core business<br />

units<br />

Biggest revenues<br />

percentage<br />

corresponding to<br />

<strong>GoYellow</strong>.<strong>de</strong><br />

Main focus is further<br />

strengthen the revenue<br />

structure to a more<br />

balanced level<br />

Close Brothers Seydler Research <strong>AG</strong> | 16

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

<strong>GoYellow</strong> GmbH<br />

<strong>GoYellow</strong>.<strong>de</strong><br />

The <strong>GoYellow</strong> segment reflects the benchmark figures of the internet portal<br />

<strong>GoYellow</strong>.<strong>de</strong>, which was introduced on 15 October 2004, offering small and<br />

medium-sized shops a platform for an individual presentation of their business or<br />

scopes of services. The site provi<strong>de</strong>s currently contact <strong>de</strong>tails for around 34m<br />

private individuals and businesses throughout Germany, real-time public<br />

transportation schedules for all of Germany, weather information, opening hours,<br />

seasonal data on swimming lakes and ski areas, and a great <strong>de</strong>al of other useful,<br />

clearly categorized information. Over the past five years, <strong>GoYellow</strong>.<strong>de</strong> has become<br />

one of the Germany‟s most frequently visited websites.<br />

Homepage <strong>GoYellow</strong>.<strong>de</strong><br />

Source: www.goyellow.<strong>de</strong><br />

The <strong>GoYellow</strong>.<strong>de</strong> directory assistance service became one of the most popular<br />

online addresses in Germany. The ability to search for individuals and businesses<br />

using dynamic aerial images and the incomparably large pool of current local<br />

information has ma<strong>de</strong> the portal an important everyday reference tool. Besi<strong>de</strong>s, the<br />

online portal is an i<strong>de</strong>al way for small and medium-sized companies to present<br />

themselves to a large number of potential customers throughout Germany in an<br />

economical, up-to-date and attractive way. Thereby, businesses can place their ads<br />

themselves online or book them through a yellow pages media consultant in their<br />

region.<br />

Product overview<br />

Along with regularly updated contact information for private individuals and<br />

businesses, <strong>GoYellow</strong>.<strong>de</strong> offers timetables for public transportation, weather<br />

forecasts, traffic reports and a variety of seasonal recreational tips. The portal has<br />

ad<strong>de</strong>d over 150,000 listings for restaurants, hotels, tra<strong>de</strong>smen, doctors and service<br />

provi<strong>de</strong>rs throughout Germany which have been reviewed by customers and<br />

www.cbseydlerresearch.ag<br />

<strong>GoYellow</strong>.<strong>de</strong> is an<br />

online directory<br />

assistance service and<br />

one of the top player<br />

Broad product portfolio<br />

un<strong>de</strong>r one roof<br />

Close Brothers Seydler Research <strong>AG</strong> | 17

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

patients. The search engine also inclu<strong>de</strong>s map searching with route planning.<br />

According to the company, this stage of expansion is still extendable.<br />

Besi<strong>de</strong>s the general extension of the contact information database, it is planned to<br />

enlarge the map search engine in conjunction with a partner company in 2010.<br />

<strong>GoYellow</strong> also wants to support the sales activity by launching a new marketing<br />

campaign as well as arrangements to boost up the revenue level.<br />

Distribution<br />

In contrary to the distribution channels of existing internet portals <strong>GoYellow</strong>.<strong>de</strong> is<br />

not only limited to the sales approach via internet. In addition to the current<br />

measurements by promoting the platform via online advertising the company also<br />

has the opportunity to access the full potential of the yellow pages publishers,<br />

which have a big reputation and potential to canvass new customers. <strong>GoYellow</strong><br />

started an open-end sales cooperation with the yellow pages publishers, whose<br />

stake in <strong>GoYellow</strong> GmbH is currently 10%.<br />

Overall, the publishing companies are fully responsible for the active distribution of<br />

the internet platform. The service in return is a commission for every new payer. As<br />

the company did not provi<strong>de</strong> any information about the <strong>de</strong>tailed percentage for the<br />

publishers, we assume that about 40% of the monthly fee is related as commission,<br />

corresponding to about EUR 12 per paying customer.<br />

Pricing mo<strong>de</strong>l<br />

In 2008 the group changed its pricing mo<strong>de</strong>l. In the course of that <strong>GoYellow</strong>.<strong>de</strong> has<br />

significantly expan<strong>de</strong>d the options for its free basic listings for businesses<br />

(GoBasic). In contrast to the past the businesses have more freedom to <strong>de</strong>sign<br />

their hit list (company profile).<br />

GoBasic benefits at zero costs<br />

GoBasic<br />

�Full company <strong>de</strong>scription<br />

�40 individual key words for<br />

search optimisation<br />

�Continual search engine<br />

optimisation atGoogle<br />

�Customer enquiry matched<br />

for regional focus<br />

�Notation on Goyellow maps<br />

Source: <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong>, CBS Research <strong>AG</strong><br />

The shift from the old pricing mo<strong>de</strong>l in which the users have to pay for the <strong>de</strong>sign<br />

as a whole the companies can now <strong>de</strong>sign a multi-page web presence and yet will<br />

pay only for prioritised display in the search results listings (GoTop). The current<br />

charge for the GoTop mo<strong>de</strong>l is according to the annual contract EUR 29.90 per<br />

month excluding VAT.<br />

Users of <strong>GoYellow</strong>.<strong>de</strong> will therefore benefit from the significantly higher proportion<br />

of qualified hits. As well as adding value to the service through more content,<br />

<strong>GoYellow</strong>.<strong>de</strong> also expects that companies will be more willing to pay for the<br />

prominent placing of an advertising presence that is already online. For comparison<br />

www.cbseydlerresearch.ag<br />

Further enlargement<br />

plans for 2010<br />

Distribution channels<br />

are outsourced to<br />

Yellow pages<br />

publishers<br />

<strong>GoYellow</strong>.<strong>de</strong> pays 40%<br />

commission for the<br />

distribution effort<br />

GoBasic mo<strong>de</strong>l<br />

GoTop mo<strong>de</strong>l<br />

Close Brothers Seydler Research <strong>AG</strong> | 18

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

only, major search engines like Google have already been successfully employing<br />

this strategy for many years.<br />

GoTop benefits at EUR 29.90 per month<br />

Source: <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong>, CBS Research <strong>AG</strong><br />

Peter Pays <strong>AG</strong><br />

The PeterPays <strong>AG</strong> operates and markets the successful Internet portals<br />

PeterZahlt.<strong>de</strong> and PeterZahltAus.<strong>de</strong>, as well as the recently <strong>de</strong>veloped iPhone<br />

application Cheap Calls. PeterPays <strong>AG</strong> is a 100% subsidiary of <strong>GoYellow</strong> <strong>Media</strong><br />

<strong>AG</strong> and currently employs nearly 20 employees.<br />

PeterZahlt.<strong>de</strong><br />

GoTop<br />

�All GoBasic services<br />

�Positioning at top of the<br />

ranking<br />

�Highlighted illustration<br />

�Ad free<br />

�Database entry in up to 8<br />

industries<br />

�Locating is optimised for<br />

regional tracking<br />

According to the group, PeterZahlt.<strong>de</strong> is the world's first telephony portal through<br />

which you can make free domestic and international phone calls. Through<br />

PeterZahlt.<strong>de</strong>, customers can make free national and international calls to 30<br />

countries every day between 6:00 am and midnight and talk for up to 30 minutes on<br />

any conventional telephone. Users with a DSL broadband connection, for example,<br />

do not incur any costs for making calls to the USA or China. This service is<br />

financed through advertising that is displayed during the interview on the screen.<br />

Due to the very high mobile phone costs PeterZahlt only provi<strong>de</strong>s calls to mobile<br />

phones of 30 seconds in length.<br />

Homepage PeterZahlt.<strong>de</strong><br />

Source: www.PeterZahlt.<strong>de</strong><br />

www.cbseydlerresearch.ag<br />

Peter Pays consists of<br />

three in<strong>de</strong>pen<strong>de</strong>nt<br />

units<br />

World first telephony<br />

portal<br />

Close Brothers Seydler Research <strong>AG</strong> | 19

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

Processing<br />

The call duration is limited to 30 minutes and it is <strong>de</strong>man<strong>de</strong>d that during the<br />

conversation the caller conforms its own personal interests at the displayed<br />

information program. To use the call free of charge service through PeterZahlt.<strong>de</strong>,<br />

the caller has to enter the number of the interlocutor in the first box and the own<br />

phone number in the second field. In case the preferred country (overseas calls) is<br />

listed in the "supported countries", an international call is also possible. To start the<br />

conversation the caller can choose between PeterZahlt.<strong>de</strong> Classic and Autodial.<br />

PeterZahlt.<strong>de</strong> Classic<br />

Using the service PeterZahlt.<strong>de</strong> Classic the caller has just to click after entering the<br />

phone number to "now", and the provi<strong>de</strong>r will call the prompted number: First, the<br />

caller‟s phone rings, then that of the dialed interlocutor. After both have withdrawn,<br />

PeterZahlt.<strong>de</strong> will turn up the connections.<br />

Autodial<br />

For the Autodial service not PeterZahlt.<strong>de</strong> calls you at your own phone number, but<br />

the user calls PeterZahlt on a normal German landline number. This fixed number<br />

is calling back and therefore, the caller can still phone for free. The process of<br />

autodial is very simple. As many of the German users have a flat rate to the<br />

German fixed network, but must pay high fees for international calls. From<br />

PeterZahlt‟s perspective this service is less expensive, because the call-in to the<br />

users are not required anymore.<br />

Cheap Calls<br />

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong> <strong>de</strong>veloped an iPhone application, called CheapCalls, to<br />

significantly save money on overseas calls. Currently, for a total of 40 countries<br />

every call costs EUR 0.29 per minute. Calls can even be ma<strong>de</strong> to cell phone<br />

networks at the same low rate. The application is free to download from the Apple<br />

Store as well as on the homepage (www.cheapcalls.<strong>de</strong>). Up to now the service is<br />

only available for iPhone users, but the company plans to provi<strong>de</strong> this new service<br />

tool for all smart-phones, which should be realized within the next year. According<br />

to the company, the launch of this application was successful as within the first few<br />

days already more than 10,000 users downloa<strong>de</strong>d the application. However, a first<br />

indication about the consumer acceptance is not expected until 1Q 2010E.<br />

PeterZahltaus.<strong>de</strong><br />

The created bonus online portal will be shortly discontinued from the group‟s<br />

operating business and the database of PeterZahltaus.<strong>de</strong> has already been sold to<br />

AdiCash GmbH. Therefore, we will not <strong>de</strong>fine the business mo<strong>de</strong>l of<br />

PeterZahltaus.<strong>de</strong> as this unit is no longer important for the strategic targets of the<br />

group.<br />

118000 Telefonvermittlung GmbH<br />

The company will launch a switchboard service using the number 118000 in<br />

December 2009. At 118000, callers can get in touch with people whose contact<br />

<strong>de</strong>tails are not available on public directories. 118000 treats all data highly<br />

confi<strong>de</strong>ntially and does not forward them to third parties. If the requested person<br />

cannot be reached, the caller can leave a message. The new service will thus close<br />

the gap between directory assistance and Internet search engine. As this service is<br />

not yet fully <strong>de</strong>veloped, not enough data has been available to give a <strong>de</strong>tailed<br />

overview.<br />

www.cbseydlerresearch.ag<br />

Processing consists of<br />

two calling<br />

opportunities<br />

PeterZahlt.<strong>de</strong> classic<br />

Autodial<br />

Newly established<br />

iPhone application<br />

showed already a good<br />

start<br />

Discontinued within<br />

the next 12 months<br />

This service<br />

construction is unique<br />

in the European<br />

market and therefore<br />

promising<br />

Close Brothers Seydler Research <strong>AG</strong> | 20

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

Strategy<br />

Strategic premises<br />

Overall, the company has several strategic objectives, which <strong>GoYellow</strong> plans to<br />

fullfil in the next year. Firstly, the company intends to increase its paying customer<br />

base at <strong>GoYellow</strong>.<strong>de</strong>. Besi<strong>de</strong>s, the group will improve its earnings situations in the<br />

segments of PeterZahlt.<strong>de</strong> and the newly established services of the directory<br />

assistance 118000 and the iPhone application CheapCalls.<br />

As already mentioned by <strong>GoYellow</strong>, the company has plans to restructuring the<br />

business mo<strong>de</strong>l of PeterZahlt.<strong>de</strong> to a “German-Skype”. In case this can be realised<br />

without bigger financial exposure the group should be able to achieve positive<br />

earnings at PeterZahlt.<strong>de</strong> for the first time.<br />

For 4Q 2009 and 1Q 2010 the group will establish the already announced<br />

switchboard service 118000 which is currently unique in the German and European<br />

market. With a manageable expenses structure the service should already be<br />

profitable on operative level within its first year (2010E). <strong>GoYellow</strong> plans to<br />

establish a switchboard service in or<strong>de</strong>r to achieve outcome quality in the directory<br />

assistance market and, as a result, be able to influence the existent market<br />

environment.<br />

In addition, the group has already published an iPhone application called Cheap<br />

Calls which enables the German mobile phone users to save money on<br />

international calls up to 87% of the postpaid price per minute (T-Mobile). As the<br />

software has been <strong>de</strong>veloped in-house the group can provi<strong>de</strong> solid margins at this<br />

new service which is expected to be around the target EBIT-margin of 30%.<br />

Growth strategy<br />

We expect <strong>GoYellow</strong>‟s growth story to continue over the next years as the change<br />

in the pricing mo<strong>de</strong>l of <strong>GoYellow</strong> will further boost the company‟s earnings situation<br />

in short- to mid-term as well as the remo<strong>de</strong>ling of PeterZahlt.<strong>de</strong> will be supportive<br />

for the bottom line. In addition, the new switchboard service 118000 and the iPhone<br />

application CheapCalls should boost the company to a higher level both on top and<br />

bottom line. Combined with promising innovations with the switchboard service the<br />

equity story should continue positively for <strong>GoYellow</strong> in short- and on mid-term<br />

perspective.<br />

One of the key elements of <strong>GoYellow</strong>‟s strategy is the extension of the product<br />

portfolio with innovations that allows increase the market share as the company will<br />

benefit from its first-mover-advantage. These benefits can not only be realised in<br />

the business mo<strong>de</strong>l of PeterZahlt.<strong>de</strong> in Germany but also in particular with the new<br />

switchboard service 118000 which is currently a unique business mo<strong>de</strong>l in the<br />

whole European market and leads to strong entry barriers for new market entries<br />

as <strong>GoYellow</strong> will settle all key factors (from pricing to supply of services).<br />

Although <strong>GoYellow</strong> will continue to absorb the growth potential in its existent<br />

segments, the company has the ability to move ahead by expanding the business<br />

activities or even restructure the business mo<strong>de</strong>l to improve the earnings situation<br />

(general company target: EBIT margin ~30%) and to comply with the fast-moving<br />

markets in the internet-related areas.<br />

www.cbseydlerresearch.ag<br />

The group plans to<br />

fullfill a strategic focus<br />

within the next years<br />

PeterZahlt.<strong>de</strong> will be<br />

remo<strong>de</strong>lled to a<br />

German Skype service<br />

118000 is ready to<br />

start within the next<br />

months and the margin<br />

situation seems very<br />

promising<br />

Cheap Calls provi<strong>de</strong>s a<br />

market adavantage<br />

resulting from the firstmover-advantage<br />

in<br />

Germany<br />

General growth<br />

strategy<br />

Overall target EBITmargin<br />

for new<br />

products is at about<br />

30%<br />

Close Brothers Seydler Research <strong>AG</strong> | 21

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

<strong>GoYellow</strong> also aims to maintain sustainable profitability by further focusing on its<br />

sales activities at <strong>GoYellow</strong>.<strong>de</strong> and emerging the planned VoIP-service at<br />

PeterZahlt.<strong>de</strong> (likewise to a German type of Skype) as well as establishing a<br />

switchboard service called 118000 as the new growth driver in <strong>GoYellow</strong>‟s<br />

balanced business mo<strong>de</strong>l.<br />

By extending the portfolio of products <strong>GoYellow</strong> intends to handle the increasing<br />

<strong>de</strong>mand for directory enquiries without divulging multiple contact data to public<br />

directories which the company will build up within 4Q 2009 and 1Q 2010. Overall,<br />

the company plans to achieve a higher revenue and customer diversification by<br />

expanding its portfolio of standard products and at the same time lower its<br />

expenses on a favourable level to maintain a sustained profitability at solid margin<br />

levels.<br />

<strong>GoYellow</strong>.<strong>de</strong><br />

The company has already achieved a substantial market penetration in <strong>GoYellow</strong>‟s<br />

segments. With the introduction of new software configuration and improved search<br />

engine applications such as map routing or company vi<strong>de</strong>os, the group should be<br />

able to expand its market share. Overall, <strong>GoYellow</strong> addresses with its distribution<br />

channels via the yellow pages publishers nearly all relevant customer bases. The<br />

still emerging market is expected to <strong>de</strong>liver solid growth prospects over the next<br />

years as can be seen in the chart below. Furthermore, to improve the traffic and<br />

sales, the group also <strong>de</strong>ci<strong>de</strong>d to increase its activities within the social media<br />

communities like Facebook and Twitter.<br />

Customer base <strong>GoYellow</strong>.<strong>de</strong><br />

Source: <strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong>, CBS Research <strong>AG</strong><br />

By adjusting the pricing mo<strong>de</strong>l towards a similar paying structure as at general<br />

search engines like Google the group was able to improve its top- and bottom lines<br />

as this new structure was quickly accepted by the existing customers and the newly<br />

acquired customers which overall boosted the customer base to a higher level. The<br />

prospects for maintaining the current growth in paying customer (GoTop mo<strong>de</strong>l) are<br />

very promising as the already in its first “real” year the customer acceptance was<br />

very high. According to the company, the churn rate should settle down to about<br />

10% per year. With its new growth drivers the company should target revenue<br />

which we expect to achieve a size of EUR 13.44m and EUR 15.41m in 2009E and<br />

2010E respectively.<br />

<strong>GoYellow</strong> intends to extend its customer base by leveraging on competencies to<br />

expand the market share of its portfolio. In the last fiscal year the group ma<strong>de</strong> good<br />

progress from transitioning its product portfolio mix.<br />

In an industry that continually produces customer-<strong>de</strong>man<strong>de</strong>d technology, while<br />

performing on volatile business mo<strong>de</strong>ls the expenses are becoming increasingly a<br />

key competitive factor as it allows the company to remain highly innovative without<br />

www.cbseydlerresearch.ag<br />

Further focus on<br />

expanding the<br />

customer base at<br />

<strong>GoYellow</strong>.<strong>de</strong><br />

Adjusting the pricing<br />

mo<strong>de</strong>l came in at the<br />

right time<br />

<strong>GoYellow</strong> plans to<br />

expand the market<br />

share<br />

Close Brothers Seydler Research <strong>AG</strong> | 22

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

tying up financial resources. <strong>More</strong>over, the company achieved a faster time-tomarket<br />

for its innovations like CheapCalls and the planned remo<strong>de</strong>ling of<br />

PeterZahlt.<strong>de</strong> as more resources can be utilised in product <strong>de</strong>velopment and<br />

commercialisation.<br />

PeterZahlt.<strong>de</strong><br />

As already mentioned the group will remo<strong>de</strong>l the business mo<strong>de</strong>l of PeterZahlt.<strong>de</strong><br />

to a kind of “German Skype service” within the first half year of 2010. As well as at<br />

Skype the user can use the VoIP telephony service within the service for free.<br />

However, telephone calls to external numbers will partially costs. In doing so, the<br />

group also noted to generate co-operations with other VoIp provi<strong>de</strong>rs but no further<br />

<strong>de</strong>tails has been released up to now.<br />

Overall, by implementing a VoIP service at PeterZahlt.<strong>de</strong> the business mo<strong>de</strong>l will<br />

become more scalable and enables further growth without major capital<br />

expenditures. This combined with streamlining the expenses structure should result<br />

in further productivity improvements. Cost saving potential at current stage at<br />

PeterZahlt.<strong>de</strong> are related to the telephony costs, which will be after implementing<br />

the VoIP service at almost zero costs (0.00 – 0.01 EURcents). However, since the<br />

advertising market is still on a lower level than in the previous years the upsi<strong>de</strong><br />

potential on top line is currently rather limited. Despite the limited top line growth<br />

the group should be able to get profitable within 2010E.<br />

In the past, <strong>GoYellow</strong> had a strong strategic emphasis on the expansion of its<br />

current business mo<strong>de</strong>l and neglected, to a limited extent, to utilise the full<br />

potentials arising from a highly fragmented market environment. However, over the<br />

last year this strategy focus changed towards a customer-friendly and highly-quality<br />

approach in its core-competencies with sustainable success.<br />

118000<br />

In or<strong>de</strong>r to address the needs from all social levels in Germany the group starts to<br />

implement a directory assistance service, called 118000, which will not provi<strong>de</strong> any<br />

contact data to the caller. For now, <strong>GoYellow</strong> will build up a comprehensive call<br />

centre in Greifswald which coordinates the working processes of the calls and<br />

internet applications. The group‟s focus on building up substantial capacity in this<br />

segment over the next years should make this problem of providing too much<br />

private contact <strong>de</strong>tails in public directories much more aware in Germany. Besi<strong>de</strong>s,<br />

this <strong>de</strong>velopment within this segment strategically fits into the business mo<strong>de</strong>l of<br />

<strong>GoYellow</strong>.<br />

Despite the promising potentials for <strong>GoYellow</strong> in its operational business some<br />

risks are still on the agenda. In case the directory assistance will be not successful<br />

as planned this would stress the margin situation in the group as well on the<br />

financial resources building up this service. To prevent such a scenario the<br />

company has already announced that the cost situation in this segment is on a low<br />

level and, therefore, the flop expectations are rather limited as the group has a solid<br />

margin situation on the calls (expected EUR 2 per call) and the break even calls are<br />

achievable. Up to now, we are confi<strong>de</strong>nt that <strong>GoYellow</strong> will establish this service<br />

with success to achieve profits already within the first year.<br />

www.cbseydlerresearch.ag<br />

German version of<br />

Skype<br />

After the remo<strong>de</strong>lling<br />

the business mo<strong>de</strong>l<br />

becomes more<br />

scalable<br />

In the past the<br />

expansion i<strong>de</strong>as have<br />

been neglected<br />

The build up of the<br />

switchboard service<br />

displays a USP in the<br />

market<br />

Some risks are still on<br />

the agenda for 118000<br />

Close Brothers Seydler Research <strong>AG</strong> | 23

<strong>GoYellow</strong> <strong>Media</strong> <strong>AG</strong><br />

Distribution and marketing<br />

The company‟s operational future will <strong>de</strong>pend on its capability to materalise on its<br />

strong technological expertise by monetarising its sophisticated products in an<br />