Annual Report 2003-04 - Hero MotoCorp

Annual Report 2003-04 - Hero MotoCorp

Annual Report 2003-04 - Hero MotoCorp

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:30 PM Page 4HIGHLIGHTS OF THE YEAR <strong>2003</strong>-20<strong>04</strong>4 COMPLETION OF 20 GLORIOUS YEARS of Growth,Leadership and Value Creation.THE NO.1 two wheeler company in the world for thethird year in a row.2.07 MILLION <strong>Hero</strong> Honda motorcycles soldduring the year.OPBT GREW by 14.6 % from Rs.792 Crore to Rs.907Crore. Operating margin (OPBT as a percentage ofnet sales) increased from 15.5%in 2002-03 to15.6% in <strong>2003</strong>-<strong>04</strong>.HERO HONDA SPLENDOR continues to be the largestselling two-wheeler model in the world for the fourthyear in a row.MARKET SHARE INCREASEDTO 48% in motorcycles, 4%gain over the previous year.OVER 1 MILLION UNITS OFSPLENDOR sold during FY<strong>2003</strong> - <strong>04</strong>SALES VOLUMETOTAL INCOME PROFIT AFTER TAX ROACEIn Lacs In Rs. Crores In Rs. Crores In %

FIG. 3. Waveforms of the stimuli for experiments II CPH and III APHand SPH.B. Method1. StimuliThree phase relationships were used. In the first condition,all components were in cosine phase CPH as in experimentII. This configuration produces the largest possiblepeak factor for a harmonic complex. The repetition rate isclearly visible in the stimulus waveform Fig. 3, top panel.In the second condition, every other component was shifted/2 radians. This alternating phase APH; Patterson, 1987produces a stimulus with a periodic Hilbert envelope atdouble the repetition rate, 2R rep , although the repetition rateof the fine-structure is still R rep Fig. 3, middle panel. Thelast phase configuration was derived using the formula proposedby Schroeder 1970. This reduces the amplitude peakfactor of the waveform markedly Fig. 3, bottom panel. Thesign of the phase in the Schroeder formula does not changethe waveform peak factor. It does change the direction of thechirp in the waveform fine structure. An upward-chirpingtone was chosen because evidence exists to indicate that thiscondition reduces the peak factor of the internal representationof the signal after auditory filtering Smith et al., 1986.This last condition will be referred to as Schroeder phaseSPH.2. Procedure and listenersThe thresholds for each combination of filter conditionand phase were obtained in separate adaptive runs. The procedure,apparatus and listeners were those of experiment II.The CPH conditions were not repeated; the results weretaken directly from experiment II. All thresholds for theother two phase conditions were measured in an identicalmanner as for the CPH thresholds; the order was variedacross subjects.C. ResultsThe results are shown in Fig. 2. The CPH and SPHconditions produce very similar results. A Wilcoxon ranksumtest was applied to the raw data for all filter conditionsand there were no significant differences (p0.2). This appearsto be at variance with the results of Houtsma andSmurzynski 1990 who reported differences in rate discriminationthreshold for CPH and SPH harmonic complexes.However, the combinations of F c and R rep associated withthe LLMP in the current experiment are different from thecombinations where Houtsma and Smurzynski found reliabledifferences between the RDTs of CPH and SPH tones—200Hz at a cutoff frequency of 3.2 kHz or higher. These parameterswould produce a stimulus that falls below the pitchregion revealed by the current study 270 Hz when F c is 3.2kHz. Another difference is that Houtsma and Smurzynskiused wideband masking noise that might have interferredwith the perception of the stimulus. Lowpass noise was usedin the current experiment to avoid interference. Finally, thissmall discrepancy could reflect a difference between theRDT and LLMP tasks.In the two lower filter conditions, performance is betterfor APH stimuli than for CPH or SPH stimuli, and the differenceis significant p0.01, Wilcoxon rank-sum test onthe raw data. AsF c increases, the LLMP increases faster forthe APH stimuli than for the CPH and SPH stimuli, and nothreshold could be measured with the adaptive procedure forthe highest filter condition. Perceptually, for a given repetitionrate, the pitch increases one octave for unresolved APHtones Patterson, 1987; Carlyon and Shackleton, 1994. Nooctave shift has been reported for SPH tones.V. SPECTRAL RESOLVABILITYTwo analyses were performed to determine whether theincrease in the LLMP with frequency region reflected thetransition from resolved to unresolved components. The hypothesisis that a clear pitch is required to do the melodytask, and it can only be produced by resolved harmonics.One definition of resolvability is that the transition occurs ata constant harmonic number Plomp, 1964. The precisevalue of this number varies from 6 to 12 between authors andaccording to the experimental task. Nevertheless, it shouldbe a fixed value. The number of the lowest harmonic in thestimulus associated with each LLMP value was computedfor all combinations of F c and phase. The results are presentedin Fig. 4 upper panel, which shows that the LLMPdoes not correspond to a fixed harmonic number. Moreover,the lowest harmonic is the 14th or 15th in some cases.Shackleton and Carlyon 1994 have proposed modifyingthe ‘‘constant harmonic number’’ rule to introduce a‘‘constant number of components per auditory filter’’ rule.They suggest that the transition region between resolved andunresolved complexes occurs when there are 2 to 3.25 componentswithin the 10-dB bandwidth of the auditory filter, asdefined by Glasberg and Moore 1990. The number of componentsin the auditory filter centered on F c was computedfor stimuli at the LLMP, for each experimental condition.The results are presented in Fig. 4 lower panel whichshows that number of components per filter at the LLMPvaries with F c , and that most of the observed values occur inthe ‘‘unresolved’’ region as defined by Shackleton and Carlyon1994.In summary, these two analyses, which involve relativelylarge estimates of the upper limit of spectral resolution,nevertheless indicate 1 that the LLMP does not correspondto the loss of spectral resolution for either criterion,and 2 the LLMP is typically associated with stimuli havingno resolved components. Further support for these conclu-2078 J. Acoust. Soc. Am., Vol. 109, No. 5, Pt. 1, May 2001 Pressnitzer et al.: Lower limit of melodic pitch 2078

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:30 PM Page 6HERO HONDA<strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>–20<strong>04</strong>6Dear Members,CHAIRMAN’S LETTERBRIJMOHAN LALLCHAIRMANIHAVE BEEN USING the annual reportas an appropriate medium tocommunicate the performance andprogress of your Company and alsounveil the future plans of theCompany.Making sustained progress throughinvestments and improvements inits functioning is the hallmark of acompany, which is well managedand is committed to its vision andpurpose. In this regard, I ampleased to inform you that <strong>Hero</strong>Honda in the year <strong>2003</strong>–20<strong>04</strong>completed 20 years of its existenceand during the year added newmilestones to its already existinglong list of achievements so far.In the year under review, <strong>Hero</strong>Honda sold over 2 millionmotorcycles and recorded a 23%growth over last years' 1.68 millionsales. Not only that, yourCompany's sales growth was higherthan the industry average of 14%.Your company also improved itsmarket share to 48% and 37% inmotorcycles and two–wheelersrespectively. What is more importantto note is that for the third year in arow, the Company retained itsnumber one position as the singlelargest two–wheeler manufacturer inthe world. Splendor, the world'slargest selling brand, for the fourthconsecutive year not only retainedits position but also achieved the 1million sales mark. With 5 newlaunches during the year, the entireproduct range gave a fresh andcontemporary image to thecustomers.It is equally satisfying to note thatthe financial results, which areconsidered to be the best in theindustry for the year, reflect both thesides of the Company'sperformance. That is, they reflectthe revenue earned through salesand also the efficiency with whichresources were managed in theprocess of creating wealth forshareholders.<strong>Hero</strong> Honda's sales increased by

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:30 PM Page 720YEARSWe are proud of the fact that <strong>Hero</strong> Honda is one of the mostsuccessful two-wheeler joint ventures of Honda world wide. Notonly will the 20 years of relationship be cemented further, Hondais committed to providing full support to <strong>Hero</strong> Honda. Be itadvance engine technology, new product introductions or anyother related area of the partnership.S. TOSHIDAMANAGING DIRECTOR, CEO REGIONAL OPERATIONS (ASIA OCEANIA)HONDA MOTORS CO. LTD, JAPANJune 2, 20<strong>04</strong>7FOR THE THIRD YEAR IN A ROW, THECOMPANY RETAINED ITS NUMBERONE POSITION AS THE SINGLELARGEST TWO–WHEELERMANUFACTURER IN THE WORLD.SPLENDOR, THE WORLD'S LARGESTSELLING BRAND, FOR THE FOURTHCONSECUTIVE YEAR NOT ONLYRETAINED ITS POSITION BUTACHIEVED THE 1 MILLION SALESMARK14.3 per cent from Rs.5,102Crore in 2002–03 to Rs.5,832Crore in <strong>2003</strong>–<strong>04</strong>. Cost of rawmaterials as a percentage oftotal sales increased from 68.0per cent in 2002–03 to 69.1percent in <strong>2003</strong>–<strong>04</strong>, owing to achange in sales mix and highersteel prices (during the latterpart of the fiscal year).A continuous focus on costmanagement and operatingefficiency has enabled thecompany to marginally improveits OPBDIT margin from 16.7per cent in 2002–03 to 16.8 percent in <strong>2003</strong>–<strong>04</strong>. Operatingprofit (PBT before other income)grew by 14.6 per cent fromRs.792 Crore in 2002–03 toRs.907 Crore in <strong>2003</strong>–<strong>04</strong>.Operating profit marginimproved marginally from 15.5per cent in 2002–03 to 15.6percent in <strong>2003</strong>–<strong>04</strong>. Profit aftertax (PAT) went up by 25.4 percent from Rs.581 Crore in2002–03 to Rs.728 Crore in<strong>2003</strong>–<strong>04</strong>. Other Income rose fromRs.92.9 Crore in 2002–03 toRs.165.0 Crore in <strong>2003</strong>–<strong>04</strong>.Return on average capitalemployed (ROACE) of theCompany was 92.8 percent in<strong>2003</strong>–<strong>04</strong>, while return on averageequity (ROAE) was 72.9 per centin <strong>2003</strong>–<strong>04</strong>. Above all, yourCompany continues to be a debtfree company.We feel quite happy at theseresults. At the same time we aremaking continuous efforts toreduce costs further throughefficiency and productivity, so thatwe are able to offer products at areasonable price and realize betterprofits. We are not alone in thisendeavour. All the vendors,suppliers and dealers and otherassociates have been contributingtheir bit to achieve the goals of theCompany and we acknowledgetheir continuous co-operation insustaining our leadership position.Most important of all is the support

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:30 PM Page 8Chairman’s LetterHERO HONDA<strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>–20<strong>04</strong>8THE COMBINATION OF BUSINESSUNDERSTANDING OF HEROHONDA AND TECHNOLOGY OFHONDA MOTOR COMPANY WILLCERTAINLY PROVIDE US ACOMPETITIVE ADVANTAGEPASSPORT HOLDERS ARE IN AWAY SPECIAL MEMBERS OF THEHERO HONDA EXTENDED FAMILY;THEY WILL HAVE ANOPPORTUNITY TO PROMOTE HEROHONDA PRODUCTS AND IN TURNREAP THE BENEFITS OF THEIRRELATIONSHIP WITH THECOMPANYand co-operation we have beenrecieving from our JV Partner,Honda Motor Co., Japan and <strong>Hero</strong>Cycles, Ludhiana, from time totime. You will be pleased to knowthat the technical collaborationbetween Honda and <strong>Hero</strong> Hondahas been extended for another 10years, that is, up to 2014, whichwill ensure continuous flow ofworld class technology andtechnical assistance for ourproducts and processes. As in thepast, the combination of businessunderstanding of <strong>Hero</strong> Honda andtechnology of Honda MotorCompany will certainly provide usa competitive advantage.Customer is the purpose of ourenterprise. In order to build alasting relationship with customers,<strong>Hero</strong> Honda started what is nowpopularly known as the “<strong>Hero</strong>Honda Passport Program”. Underthis scheme, every customer of<strong>Hero</strong> Honda, past or present iseligible to enroll as a member.Passport holders are in a wayspecial members of the <strong>Hero</strong>Honda extended family; they willhave an opportunity to promote<strong>Hero</strong> Honda products and in turnreap the benefits of theirrelationship with the companyunder the scheme. They can sendreferrals to purchase our products,buy components at authorizeddealers and accumulate points.Every transaction makes themeligible for incentives and giftsdepending on aggregate scores. Asof date, there are about 1.5 millionpassport holders, which is 50%higher than last year's enrolment.In order to serve the customer inevery nook and corner of thecountry, the Company has beenexpanding its network ofdealerships and service points.Today a customer has over 1700contact points for enquiry,purchase, and service of <strong>Hero</strong>Honda products that include 545dealers and 385 SSPs. In thecoming years, we would like toextend this facility at Taluq levelsalso. For the last few years, spareparts business has beendeveloped as a profit center, whichfor the year under reviewcontributed a turnover of Rs.275Crores. In order to establish on lineconnection with the dealers andcommunicate with them on realtime basis, network infrastructureis being put in place.Similarly your Company has 256suppliers that include 36ancillaries. They work with us intandem and have been deliveringsupplies without hiccups for ourexpanding capacities, which istoday rated at 2.8 million vehiclesper annum. The continuousexpansion in quick succession

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:30 PM Page 920YEARS9would not have been possible forus without their solid support.<strong>Hero</strong> Honda has been able toachieve direct on line facility with15 vendors to begin with and wehave plans to achieve 50%coverage in the current fiscal itself.In order to increase efficiency,supply chain management,supplier relationship managementmodules of SAP ERP are extendedto our suppliers. Initially a fewsuppliers (ten) have been chosenfor this purpose, and the schemewill be extended to others in aphased manner. We have alsobeen continuously extendingtechnical assistance to oursuppliers to enable better qualitycompliance and for effecting costreduction.We are very much aware of yourunstinted support all along for thisorganization and its efforts, whichare directed at creating wealth andprofit. We do not believe in holdingthe surplus beyond requirementand thus have been distributingthem in the form of dividend. Weare happy that we have been ableto declare every year an increasingrate of dividend for ourshareholders. For the fiscal year<strong>2003</strong>–<strong>04</strong>, your Board of Directorshas recommended a total of1000% dividend, including the500% Special Interim Dividendalready paid to the Share holders.It gives me great satisfaction toshare with you the fact that ouremployees are quite committed toorganizational growth and theorganization treats them and theirfamilies as stakeholders. Ourproductivity has been showingsteady improvement from our4000 plus member strong team. Ithas been our endeavour to trainthem for better productivity andskill improvements.<strong>Hero</strong> Honda as a corporate citizenis engaged in community andsocial development activitiesaround its plants. It has been asatisfying experience to see themarked changes in the quality ofpeople of the region due to theseprograms.Coming to the perspective, we feelthat <strong>Hero</strong> Honda has a great roleto play in the Indian two–wheelerindustry, the second largest in theworld. Current macro economictrends and demographic factorspromise sustained growth indemand. No doubt there arechallenges of increasedcompetition, rising prices of rawmaterials and services anddiscerning choice of customers,which need continuous attention.There is a need to think and act inan innovative manner to discovernew avenues of growth andefficiency. With our capabilitiesbuilt over the years and with theassistance of Honda MotorCompany, we will be able to facethese challenges and create newmilestones as we march ahead.Once again, thank you for yourcontinuous support, for which weall at <strong>Hero</strong> Honda are trulygrateful.Yours SincerelyBrijmohan LallCHAIRMAN HERO HONDA MOTORS LTD.

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:31 PM Page 10Managing Director’s MessageHERO HONDA<strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>–20<strong>04</strong>10Dear Members,THE POWER OF PARTNERSHIPPAWAN MUNJALMANAGING DIRECTORIT HAS BEEN AN EVENTFUL TWENTYYEARS since the day Honda MotorCo. of Japan and <strong>Hero</strong> Group ofIndia entered into a Joint Ventureagreement. <strong>Hero</strong> Honda hastraversed many milestones tobecome the World's No.1 Two-Wheeler Company. Powered bypartnerships - between Honda and<strong>Hero</strong> Group to begin with, theCompany has extended thecollaborative spirit to its ancillaries,vendors, suppliers, distributors,shareholders, employees and otherstakeholders.Management of partnerships hasbeen our strength. This is borne outby the fact that <strong>Hero</strong> Honda hasemerged as one of the bestperforming companies in thecountry. Honda considers <strong>Hero</strong>Honda amongst its most thrivingventures across the world. Ourrelationship with our collaboratorhas been excellent throughout. It isappropriate to recount that thispartnership has been responsiblefor the introduction of India's firstfour-stroke motorcycle CD-100,which even today is a legend. It is amatter of great pleasure to informyou that Honda has renewed itstechnical collaboration with <strong>Hero</strong>Honda for another 10 years, that is,up to 2014.From the very beginning, <strong>Hero</strong>Honda created ancillaries tomanufacture critical components formotorcycles to ensure overallefficiency. In today's modernmanufacturing system, companiesare increasingly dependent onoutsourcing and thus partnershipshave become all the moreimportant. As a result of our goodsupply chain policies, ancillaries arenow able to supply componentsdirectly on-line for assembly.Our customer interface highlightsanother dimension of successfulpartnership. Dealers as our partnerscarry on the spirit of <strong>Hero</strong> Honda tothe customers. With many of them,we enjoy a special relationshipbecause they have been associated

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:31 PM Page 1120YEARS<strong>Hero</strong> Honda is an example of an ideal partnershipwhere core competencies of two organizations havecome together to create a world leader. With ourcombined strengths and the resolve for constantimprovement, <strong>Hero</strong> Honda will continue to dominatethe two-wheeler market.BRIJMOHAN LALLCHAIRMAN, HERO HONDA MOTORS LTD11with us for generations. Throughthem we extend the "Joy of Selling"experience to the customer for ourproducts. In terms of customersatisfaction and relationshipmanagement, our PassportProgram has been unique increating a feeling of privilege aswell as loyalty among our valuedcustomers.People working for the organizationare our creative assets. They arethe "lifeline" of the organization, asthey run our plants, and overseeevery aspect of the corporatefunction. If our company isefficient, it can be attributed to thecapability and dedication of ourpeople. We partner with them andtheir families to make theenterprise a happy work place.The Customer is our valuedpartner. In interacting with himand in trying to provide productsand services to him we have learnta great deal about the market'sneeds. His preference of ourproducts has been a continuousinspiration for us to do even betterin terms of creating technologicallyand performance-wise superiorproducts - one after another.Our partnership with thecommunity around ourmanufacturing facilities is in theshape of projects covering ruraldevelopment, education andhealth to raise the quality of life ofpeople. Under the aegis of RamanMunjal Grameen Vikas Kendra<strong>Hero</strong> Honda has established amodern hospital and a seniorsecondary school and vocationaltraining center in Dharuhera toserve the community.Finally our efforts have beencontinuous in creating wealth forinvestors. This, after all, is thepartnership that underwrites andunderlines all our corporaterelationships. Our record in thisregard is very noteworthy that thecompany has almost always paiddividends, which are increasing onyear-to-year basis. Ourperformance and consistentgrowth has resulted in a marketcap of over Rs.10000 Croresduring <strong>2003</strong>-<strong>04</strong> for your Company.It is our firm belief thatpartnerships are capable ofmeeting challenges that may comein the way of realizing the vision oforganization. They tend to pool theskills, spread the ownership of thetask and reduce the risk.Partnerships have achievedunbelievable feats and won thehearts of millions. The key tosuccess is being together as onespirit. The two-decade track recordof your Company just proves thatpoint.I take this opportunity to thank allof you for reposing yourconfidence in <strong>Hero</strong> Honda, whichhas prospered through an array ofmeaningful partnerships. Yourcompany would like to devote itsexperience and energy to takingthe organization to new heightsand make <strong>Hero</strong> Honda a World-Class Enterprise - a symbol ofgreat partnership.Pawan MunjalMANAGING DIRECTORHERO HONDA MOTORS LTD.

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:31 PM Page 12Joint Managing Director’s MessageHERO HONDA<strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>–20<strong>04</strong>12CUSTOMER ISTRUE VALUEAKIO KAZUSAJOINT MANAGING DIRECTORDear Members,IT IS A GREAT PLEASURE for me toaddress all of you on the occasionof successful completion of 20years of <strong>Hero</strong> Honda.Honda follows a time-testedphilosophy of being closer to thecustomer. That is Honda wants totake production to wherever there isa market. Where customer exists -markets exist. On this principleHonda came to India and enteredinto a Joint Venture with <strong>Hero</strong>Group in 1984. It was conceived asthe best combination of Honda'stechnology and manufacturingprocesses and <strong>Hero</strong> Group'sexceptional work culture andunderstanding of Indian market. Itis a matter of great satisfaction thatthe JV today is considered to be agreat success story.A major thrust of Honda in India isto promote indigenization of not onlycomponents and parts but also tocreate managerial capabilities for it.This process would create jobs inthe society and through training weraise the skills. In this respect <strong>Hero</strong>Honda has done quite well.Following the indigenization ofparts, the effort now is to indigenisethe technology. In other words, weneed to create technologiesappropriate for Indian condition andIndian customer. For this purposelocal Honda R&D and <strong>Hero</strong> Hondafacilities are strengthened. It hasenabled us to respond to themarket requirements quickly andcome up with the launch of modelsin quick succession. We are alsoable to continuously observe theneeds of Indian customer andtranslate them into productfeatures.For <strong>Hero</strong> Honda, a customer is notjust an end user but also includesall other stakeholders such asdealers, vendors, employees etc.Our goal has always been to exceedthe customer expectation in termsof performance, quality, service,safety and welfare. <strong>Hero</strong> Hondaemployees know who is thecustomer for them. They are quite

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:31 PM Page 1320YEARS<strong>Hero</strong> Honda has been accorded thestatus of Superbrand in the Motorcyclecategory in India.13motivated. That is why thecompany is able to become No.1two wheeler company in India.Our next step is to work forrecognition of <strong>Hero</strong> Honda in Asiaand Globally. Honda would like topromote this objective of <strong>Hero</strong>Honda and make it truly worldclass,not just in terms of volumebut also in terms of quality, costand management.Corporate governance is a wellrecognizedvalue in <strong>Hero</strong> Honda.The code of transparency inwhatever we do will help build thetrust of all our associates. Anotherarea where our focus is high iscorporate social responsibility. It isan obligation, which <strong>Hero</strong> Hondahas proactively taken up. Forexample, we produce products,which are environment friendly.We promote safety education andalso social innovation. This isHonda Motors global strategy aswell.Completion of 20 years is a greatoccasion to celebrate. It is also atime-point to look back at our pastperformance and reassess ourfuture goals. In the coming yearsHonda and <strong>Hero</strong> Honda will worktogether in the area of technology,quality and cost in making theenterprise a World No. 1 in allrespects. Honda's recent renewaltechnical understanding is areassurance to our long-standingcordial relationship with <strong>Hero</strong>Honda in all its endeavors.With best wishes,Akio KazusaJOINT MANAGING DIRECTORHERO HONDA MOTORS LTD

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:31 PM Page 14HERO HONDA<strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>–20<strong>04</strong>1420 Yearsof Growth, Leadershipand Value Creation<strong>Hero</strong> Honda Motors Limited1992HONORARY MEMBERSHIPINDIAN INSTITUTE OF INDUSTRIALENGINEERINGAWARDS &RECOGNITIONSTO MR. BRIJMOHAN LALL,CHAIRMANWHILE THE RANKINGS, PERFORMANCEINDICATORS BACKED BY FIGURES AND SPATEOF RECOGNITIONS AMPLY INDICATE OURCURRENT STANDING, IT IS THE BUILT-UPBRAND STRENGTHS AND THE SIZEABLE BASEOF LOYAL CUSTOMERS THAT ENSURE US ASTRONG FOUNDATION FOR OUR FUTURESUCCESS.It is a fulfilling experience to present aportrayal of an outstanding performance,especially so as it coincides with the 20thfounding anniversary of the Company.<strong>Hero</strong> Honda is today one of the country's“Most Trusted and Admired AutomotiveBrands”.There are three distinct areas where <strong>Hero</strong>Honda's performance can be regarded asa benchmark, namely technology, growthand wealth creation. Since 1991 thecompany has shared the wealth it createdwith investors in a continuously increasingmanner. From 1999-2000, it has steadilydeclared three-digit dividends, and in<strong>2003</strong>-<strong>04</strong>, <strong>Hero</strong> Honda would be proposinga total dividend of 1000%. Is any furtherstatement at all required, one may wellquery. While the rankings, performanceindicators backed by figures and spate ofrecognitions amply indicate our currentstanding, it is the built-up brand strengthsand the sizeable base of loyal customersthat ensure us a strong foundation for ourfuture success.

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:31 PM Page 1527th May ‘85FIRST MOTORCYCLEROLLS OUT1994BUSINESSMAN OF THE YEARBUSINESS INDIA GROUP OF PUBLICATIONSMAJORMILESTONES9th June ‘87100,000TH MOTORCYCLE1995NATIONAL AWARDOUT STANDING CONTRIBUTION TO THEDEVELOPMENT OF INDIAN SMALL SCALEINDUSTRY24th August ‘88200,000TH MOTORCYCLE15On the occasion of completing two decades,a nostalgic stroll down the memory lanewould help us to recall the zeal, respect thevalues and reaffirm the policies that havetaken the organisation past many impressivemilestones.A QUICK REWINDWhen a Company takes less than twodecades to become the World's Largest Two-Wheeler Manufacturing Company ( on 1stApril, 2002), then it's a history that's worthrecounting. More so, when it has stayed asWorld No. 1 for three consecutive years!The first page of this history got written on24th January, 1984 when a collaborationagreement brought together two worldleaders: Honda, the international automotiveleader from Japan, and the <strong>Hero</strong> Group, anestablished volume-manufacturingconglomerate and the world's leadingbicycle makers. This partnership of twodecades, marked by cordial ties and mutualunderstanding, has recently been renewedup to the year 2014.WHILE IT CONTINUES TOBE VERY MUCH ACONCERN EVEN TODAY,SPIRALLING PETROLEUMCOSTS HAD CAUSED ANALARM IN THE 1980S.ONLY BETTER FUELECONOMY COULDPROVIDE THE MUCH-SOUGHTSOLUTION. THE LAUNCHOF THE FOUR-STROKE,FUEL-EFFICIENT, 100CCMOTORCYCLE MADE APERCEPTIBLE IMPACT INTHE COUNTRY.On the Baisakhi day of 13th April, '84, theFoundation Stone was solemnly placedfollowing a havan and prayers at the site.Towards the end of November 1984, thepublic issue of shares was oversubscribed byover ten and half times. In February 1985,there were over seven and a half lakh bookingsfor India's first 100 cc 4-stroke motorcycles.Commencement of commercial productiontook place on 27th May, 1985, the day the firstmotorcycle rolled out. It is a matter of pridethat within a year of starting work on the Plant,the first delivery could take place on 14thJune. The CD 100 soon became the soughtafter bike made famous by itsmemorable campaign with its inimitable by-line"Fill it. Shut it. Forget it." By the end of 1985,the plant was producing well over 6000motorcycles a month.While it continues to be very much a concerneven today, spiralling petroleum costs hadcaused an alarm in the 1980s. Only better fueleconomy could provide the much-soughtsolution. The launch of the four-stroke, fuel

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:31 PM Page 16Chronicle of 20 yearsHERO HONDA<strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>–20<strong>04</strong>1630th Sept ‘89300,000TH MOTORCYCLE20th Aug ‘9<strong>04</strong>00,000TH MOTORCYCLE29th May ‘91500,000TH MOTORCYCLE1997DISTINGUISHEDENTREPRENEURPHD CHAMBERS OF COMMERCE & INDUSTRY1998BUSINESS LEADER OF THEYEARBUSINESS BARON2000SIR JEHANGIR GHANDY MEDALINDUSTRIAL PEACEXLRI, JAMSHEDPURefficient, 100 cc motorcycle made aperceptible impact in the country. Ridingstrongly on its proven fuel economy andperformance, <strong>Hero</strong> Honda was expandingdistribution network and at the same timerapidly adding to its plant infrastructure.The brand was well on its way to theposition of market leadership.ROLL CALL OF HONOURSAs a true industry leader, it has numerousand diverse achievements in its portfolio.Besides being the first 100 cc motorcycleto enlist in the BSF ( on 27th October,1988) and the Air Force (29th October,1991), and to serve with numerous StatePolice forces, <strong>Hero</strong> Honda holds recordsamong others, the World's Largest SellingModel for four successive years for theSplendor since 2000.WHILE ITS PRODUCTSHAVE BEEN WINNINGACCLAIM, THECOMPANY HAS ALSOWON EQUALLYSIGNIFICANTRECOGNITION IN MANYSOFTER AREAS THATARE ASSOCIATED WITHITS PEOPLE, THEIRSAFETY AND WELFARE,QUALITY ANDPRODUCTIVITY ANDENVIRONMENT.On 9th May, 1991, the Company baggedthe coveted Economic Times - HarvardBusiness School award for Good CorporatePerformance coinciding with economicliberalization initiative in the country.

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:31 PM Page 17L23rd Nov. ‘941 MILLIONTHMOTORCYCLEROLLS OUTThe Company's Chairman, Mr.Brijmohan Lallhas received dozens of prestigious awards,and notable among the recent honours havebeen Ernst & Young's Entrepreneur of theYear (2001), MMA-Business LeadershipAward(2002) and the AIMA's LifetimeAchievement Award for Management(<strong>2003</strong>), all indicative of quality ofmanagement and its leadership.While its products have been winningacclaim, the Company has also won equallysignificant recognition in many softer areasthat are associated with its people, theirsafety and welfare, quality and productivityand environment. These awards include, forIndustrial Safety ( longest accident freeperiod - Haryana State Labour Dept.), BestWorking Conditions, Best First AidArrangements, Best Maintenance ofEnvironment, Best Performance inAutomobile Sector ( National SafetyCouncil), National Productivity Award fromthe Vice President of India (24th August,2000)and the National Trophy on QualityCircles ( Confederation of Indian Industry -CII ). Quality Circles had been inauguratedat the Plant in 1986 and the same year, theButterfly Circle of Paint Shop had baggedthe World Convention Trophy at Japan.Other laurels such as the 3 Leaves Award ofthe Centre for Science and Environment(CSE) and Outlook Magazine's `Value Creatorof the Year Award <strong>2003</strong>' speak for <strong>Hero</strong>17th April ‘982 MILLIONTHMOTORCYCLE2001ENTREPRENEUR OF THE YEARERNST & YOUNG13th Dec. ‘993 MILLIONTHMOTORCYCLEHonda's corporate sensitivity and responsiblecitizenship.WELL REMEMBEREDIn the course of this journey, there has alsobeen anguish, the poignant times. Mid-1991was such a time when Mr.Raman Kant Munjaldeparted and in early August, Mr.SoichiroHonda passed away. Both of them had playeda pivotal role in the strengthening and successof the partnership. Their zeal and beliefproduced results and has been inspiration tous all, over the years. Raman Kant VidyaMandir (school) opened on 2nd July '92,Raman Munjal Charitable Hospital inauguratedby Mr.Satyanand Munjal on the same date in1999, the Raman Munjal Lecture Seriesorganised in August 2002, all cherish hismemory. And indeed all the Company'smilestones are but monuments in tribute totheir spirit.WE SIMPLY MADE IT !2002ENTREPRENEUR OF THEYEARBUSINESS STANDARDThe priority given and investments made insafety, standards and environmental conditionshave been directly translating into productivityaccomplishment as well as production records.17

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:31 PM Page 18Chronicle of 20 yearsHERO HONDA<strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>–20<strong>04</strong>1820th Dec. ‘2000SPLENDOR SINGLE LARGESTSELLING TWO WHEELER IN THE WORLD27th April ‘01#1 IN INDIATWO WHEELER COMPANY1ST APRIL ‘02WORLD #1TWO WHEELER COMPANYOn 9th June, '87, the 1,00,000th motorcyclewas produced.AS THE COMPANYEMBARKS ON ITSTHIRD DECADE, MOREINTERESTINGDEVELOPMENTS AREON THE ANVIL. TWONEW BIKES WILL BELAUNCHED DURINGTHE CURRENT FISCAL,HERALDING THE ENTRYOF THE NEXTGENERATIONMOTORCYCLES IN THECOUNTRY.The 2,00,000th motorcycle was produced on24th August, 1988, within fifteen months ofthe first lakh, indeed a remarkable rise!Bhoomi Poojan ceremony for the Second Plantwas performed on 13th April, 1995, and thedaily production fast progressed to touch athousand bikes daily within a year.In the year <strong>2003</strong>-<strong>04</strong>, Two Million <strong>Hero</strong> HondaMotorcycles were rolled out in a single year, anew production record.Along the journey, the volumes have beenescalating steadily as the <strong>Hero</strong> Honda brand isdiscerning towards changing customer trendsand offers contemporary features andaesthetics in its every new offering. Today, itcan speak of a 54% motorcycle market share(42% of the Two-wheeler market). Together,<strong>Hero</strong> Honda and Honda's Indian subsidiary,HMSI are targeting a share of over fifty percentof the Indian two-wheeler market.As the Company embarks on its third decade,more interesting developments are on theanvil. Two new bikes will be launched duringthe current fiscal, heralding the entry of thenext generation motorcycles in the country.CORPORATE EXCELLENCEWith the commissioning of the 2nd plant inGurgaon, in early 1997, <strong>Hero</strong> Honda now hasthe capacity to manufacture more than Two

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:31 PM Page 1915TH JAN. ‘03CROSSES OVER CUMULATIVE 7MILLION SALES MARK FIRSTINDIAN COMPANYNOV. ‘03SELLS OVER 2 LAC UNITS IN ASINGLE MONTHWORLD RECORD192002GIANT’S INTERNATIONALAWARDBUSINESS & INDUSTRYGIANTS INTERNATIONAL2002BUSINESS LEADERSHIP AWARDMADRAS MANAGEMENT ASSOCIATIONMillion units. Keeping abreast of globaltechnological advancements, the Gurgaonplant is among the most modern motorcyclemanufacturing facilities in the world. <strong>Hero</strong>Honda has earned the ISO 9001 qualitymanagement certification, the ISO 14001 forenvironmental systems and OHSAS 18001 forwork safety ( Occupational Health and SafetyAssessment Series).ERP-based decision making implementedacross HHML serves as an industrybenchmark. We are one of the Asian referralsfor ERP-SAP modules.Small wonder then that these initiatives haveresulted in <strong>Hero</strong> Honda being voted as theMost Respected Automobile Company in theBusinessWorld magazine's poll, and also inreceiving the "Company of the Year" award forCorporate Excellence from The EconomicTimes! The customer's verdict reigns supreme.Customers too have voted in the NFO TotalCustomer Satisfaction Awards <strong>2003</strong>, withSplendor and CD 100 respectively winning inthe entry and executive segments.WHETHER RAISINGSERVICE STANDARDSOR EXTENDING THEINFLUENCE OF HEROHONDA'S CUSTOMERRELATIONSHIPPROGRAMMES IN THEIRREGION, THEY PLAY AKEY ROLE IN RETENTIONOF MARKET-SHARE.While the Company gains wide recognition forits product and service quality, a lesser knownfacet is its community activities. Providinghand-pumps to villages of the vicinity in waterscarcesouthern Haryana, establishing ofschools and hospitals, conduct of specialisedhealth camps etc. have been some of them.HERO HONDA'S COMMONWEALTHMany among our large and growing fraternityof Dealers have had a long association with us,and they equally cherish the Company's historyand share our values. Spanning across thenation, they number over 1000, includingSales and Service Points. With their respectiveService extensions also taken into account, theservice points would add up to over 1700.Whether raising service standards or extendingthe influence of <strong>Hero</strong> Honda's CustomerRelationship programmes (HH Passport) intheir region, they play a key role in retention ofmarket-share. It is a matter of pride to statethat the Passport Programme, which wentnational in 2001, has crossed the One and halfmillion membership mark. This initiative offersunique privileges to <strong>Hero</strong> Honda customers

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:32 PM Page 20Chronicle of 20 yearsHERO HONDA<strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>–20<strong>04</strong>20<strong>2003</strong>BIKE MAKER OF THE YEAROVERDRIVE MAGAZINEMarch ‘<strong>04</strong>WORLD #1 COMPANY FORTHE 3RD CONSECUTIVEYEAR20<strong>04</strong>GVC LEVEL 1CORPORATE GOVERNANCECRISILand strives to maintain an enduringrelationship with them.THE BRAND'SASSOCIATION WITHYOUNG CHARISMATICPERSONALITIES SUCHAS INDIA'S MOSTSUCCESSFUL CRICKETCAPTAIN, SOURAVGANGULY AND THEDASHING CINE FIGUREOF HRITHIK ROSHANALSO TARGET THEIMAGINATION OF THEYOUTH.If customer is viewed as queen bee, the entirevalue chain represents the beehive- acollective effort of all the stakeholders withuniform structure and uniform essence.However it is worthwhile to mention thatmaximum cell count is of our vendors andsuppliers who form the major portion of thevalue chain and have been the foundation tothe size <strong>Hero</strong> Honda has grown in these 20glorious years.YOUTHFUL AND FUTURE-ORIENTEDIndia's first premium sports motorcycle,Karizma launched on 15th May '03, has wonthe BBC Wheels `Bike of the Year <strong>2003</strong>'Award. Two more motorcycles with the newtechnology from Honda will be launchedduring this fiscal. In addition, a scooter is to belaunched in the niche segment, again withtechnology provided by Honda.The brand's association with young charismaticpersonalities such as India's most successfulcricket captain, Sourav Ganguly and thedashing cine figure of Hrithik Roshan alsotarget the imagination of the youth. TeamAmbition comprising Saurav, Kaif, Yuvraj, andSehwag is in sync with young aspirations andcommunicate the brand's values among thisaudience.HERO HONDAMOTORCYCLES HAVEMADE A SPECTACULARDEBUT IN MOTORSPORT.KARIZMA SET NEWNATIONAL RECORDS INSPEED, WHICH WERECERTIFIED BY THEFEDERATION OFMOTORSPORT CLUBS OFINDIA. THESELANDMARKS WEREACHIEVED DURING A 24HOUR NON-STOP TRACKRUN PILOTED BY ANINTREPID TEAM FROMOVERDRIVE MAGAZINE,WHICH INCLUDED ITSEDITOR.Other ways to bond with the youth segment

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:32 PM Page 2120<strong>04</strong>BEST VALUE CREATOROUTLOOK MONEY2120<strong>04</strong>LIFETIME ACHIEVEMENTAWARD FOR MANAGEMENTAIMAhave been to sponsor and be associated withmajor cricketing events including ICC cricketevents as global partner. In Nov.'93, the fivenation<strong>Hero</strong> Cup was to mark just thebeginning. <strong>Hero</strong> Honda is also extensivelyinvolved in promoting golf, soccer, hockey andother games in the country. In fact, thedomestic golfing circuit has been named the<strong>Hero</strong> Honda Golf Tour and <strong>Hero</strong> HondaMasters, a premium golf tournament is animportant event on the Asian PGAChampionship.<strong>Hero</strong> Honda motorcycles have made aspectacular debut in Motorsport. Karizma setnew national records in speed, which werecertified by the Federation of Motorsport Clubsof India. These landmarks were achievedduring a 24 hour non-stop track run piloted byan intrepid team from Overdrive magazine,which included its Editor.NEW CHAPTERSThus, the pursuit of Excellence has taken ustowards new terrains on which <strong>Hero</strong> Hondamust script its further success in the comingdecades.History will continue to be made by those whoshare the spirit of enterprise and look forwardto the sheer excitement, novelty and challengethat's ahead. The success in the marketplace,in managing products and logistics, inrelationships with customers and associates,has always reflected in gains made by variousstakeholders and in even better yields to <strong>Hero</strong>Honda’s investors. <strong>Hero</strong> Honda thanks itsstakeholders for their continuous support andfaith, and for sharing in the dreams as well asits effective realisation.

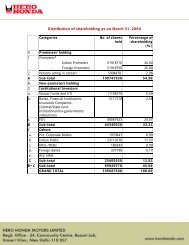

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:32 PM Page 22HERO HONDA<strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>–20<strong>04</strong>22MANAGEMENT DISCUSSION &ANALYSISHERO HONDA MOTORS LIMITED,since its inception hasconsistently created value andmaximized the returns to its shareholders. Table 1 gives the 5–yeartrend in the Company's income,profit after tax (PAT), andprofitability as measured by theratios of PAT to total income, returnon average equity [ROAE] andreturn on average capital employed[ROACE]. Such consistentperformance is rare in a market thatcan be fluctuating and highlycompetitive.In the medium term, our businessfocus will continue to be on growthin sales and profitability therebyensuring gainful returns to theshareholders' funds. For the year<strong>2003</strong>–<strong>04</strong>, the company continuedits leadership stance by being theworld's largest two–wheelermanufacturer for the third year in arow. And with it, your Company'sincome nearly reached Rs.6,000Crore.In the domestic arena, yourCompany has further consolidatedits market share, which went upfrom 33% and 44% in 2002–03 to37% and 48% in <strong>2003</strong>–<strong>04</strong> intwo–wheelers and motorcyclesrespectively. The gap between yourCompany's sale of motorcycles andthat of the nearest competitor hasrisen to over one million. The mostsuccessful model, Splendor and itsTABLE 1 KEY FINANCIALS—INCOME, PROFIT, ROAE AND ROACEIn Rs. Crore1999–00 2000–01 2001–02 2002–03 <strong>2003</strong>–<strong>04</strong>Total income 2269 3191 4539 5195 5997PAT 192 247 463 581 728PAT as % of total income 8% 8% 10% 11% 12%ROAE 52% 47% 72% 76% 73%ROACE 66% 65% 95% 99% 93%

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:32 PM Page 2320YEARSIndian two wheeler industry went through aquiet and almost an unnoticed change during1998-99. Motorcycles overtook scooters toemerge as the largest product segmentTHE ECONOMIC TIMESJUNE 30, 199923new version, Splendor+ togetherhave sold over a million in the yearunder review.During the year <strong>2003</strong>–<strong>04</strong>, theCompany's sales exceeded the 2million mark and posted a sale of2.07 million against 1.68 millionlast year – as a consequence thecustomer base has accumulatedup to nearly 10 million, which is arecord for the Indian industry. Thetotal population of two–wheelers inthe country is estimated to beabout 45 million.All these salient achievementsresulted in robust financialperformance all across. We arepleased to present some of the keyfinancial performance parametersof <strong>2003</strong>–<strong>04</strong>.• Total sales grew by 14.3 per centfrom Rs.5,102 Crore in 2002–03 toRs.5,832 Crore in <strong>2003</strong>–<strong>04</strong>.• Ratio of operating profit beforedepreciation, interest and tax(OPBDIT) to net sales increasedfrom 16.7 per cent in 2002–03 to16.8 percent in <strong>2003</strong>–<strong>04</strong>.• OPBDIT grew by 14.7 per cent fromRs.854 Crore in 2002–03 toRs.979 Crore in <strong>2003</strong>–<strong>04</strong>.• Post–tax profit (PAT) grew by 25.4per cent from Rs.581 Crore in2002–03 to Rs.728 Crore in<strong>2003</strong>–<strong>04</strong>.• Return on average equity (ROAE),measured as a ratio of PAT toaverage equity during the year, wasat 72.9 per cent in <strong>2003</strong>–<strong>04</strong>.• Return on average capitalemployed (ROACE), measured as aratio of PBIT to average capitalemployed during the year, was at92.8% in <strong>2003</strong>–<strong>04</strong>.This impressive performance hasbeen possible despite intensecompetition in the market, and risein the prices of steel in latter partof the financial year. Following isthe analysis of the two–wheelermarket in <strong>2003</strong>–<strong>04</strong> and theperformance of <strong>Hero</strong> Honda interms of marketing, operations andfinancial administration and otherfunctions.

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:32 PM Page 2520YEARS25deluxe segment with morepowered bikes [125cc]. <strong>Hero</strong>Honda is keenly observing themarket and will take necessarysteps to protect its growth,market share and leadershipposition.HERO HONDA’S PERFORMANCE<strong>Hero</strong> Honda had a market shareof 48% in motorcycles and 37%in two–wheelers for the year<strong>2003</strong>–<strong>04</strong>. It has added another 4percentage points to regain itsmarket share to 2001–02 levelsin motorcycles and has furtherconsolidated its position intwo–wheelers. Chart B shows themarket shares of <strong>Hero</strong> Honda intwo–wheelers and motorcycles inthe last 5 years.We have continued our strategy ofbroad–basing our product portfoliobased on a series of marketsurveys. Accordingly in the year<strong>2003</strong>–<strong>04</strong>, we have launched 5models basically to provideadditional features and also coverniche markets. Our largest sellingmodels i.e. Splendor and Passionput together constitutes a majorportion of our total sales. The onusof providing volume is taken overby other models. The year alsosaw a handsome volume of half amillion sale realized from ournewly launched CD Dawn. Spareparts business, an initiative, whichwe started to ensure genuine partssupply, has yielded a revenue ofRs 275 Crores for the financialyear <strong>2003</strong>–<strong>04</strong>.In the year <strong>2003</strong>–<strong>04</strong>, <strong>Hero</strong>Honda recorded a sale of 2.07million and registered a growth of23% as compared to all Indiasales growth of 14% inmotorcycles. The company forthe first time crossed the annualsale of 2 million vehicles (ChartC). At the same time, the gapbetween nearest competitors and<strong>Hero</strong> Honda is over 1 millionmotorcycles and we believe thatour strategy of remaining closerto the customers and providingproducts of their choice hasprovided this advantage.In the coming days, thecompetition may adopt newstrategy of bringing bikes withincremental power that is over100cc to take on our successfulmodels. Your Company is veryconscious about the futurechallenges of Indian market andtherefore, will continuously strive tostay ahead with the introduction ofnew products, technology, andservices.PRODUCT LAUNCHESAs mentioned earlier, the Companylaunched 5 new models coveringall the three segments namely

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:32 PM Page 26Management Discussion & AnalysisHERO HONDA<strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>–20<strong>04</strong>26HERO HONDA HAS ALREADYLINED UP MODELS FOR THENEXT FIVE YEARS. IN20<strong>04</strong>–05 TWO NEW MODELSWILL BE INTRODUCED IN THEMARKET. AT AN APPROPRIATETIME, YOUR COMPANY ALSOHAS PLANS TO ENTER THESCOOTER MARKET AS WELL.price, deluxe and premiumsegments.• In April <strong>2003</strong>, we launchedCD–Dawn, targeted for entrysegment and enabled customers tohave a very viable transportalternative to public transport witha byline "Public ka NayaTransport". The model in the yearof launch itself has done nearlyhalf a million sales – which is arecord in itself.• In May <strong>2003</strong>, we launched afuturistic, power+sport segmentbike, Karizma. The "Jet Set Go"bike is a brilliant aspiration –fulfilling bike – positioned asIndia's first premium sportsmotorcycle. The product hascreated its own niche.• In September <strong>2003</strong>, Passion pluswas launched primarily to inspirethe customers with improvedstyling. Originally the product wasintroduced as a style product but todifferentiate from look–alikes thatcame later, the styling has beengreatly modified to lookcontemporary.• In October <strong>2003</strong>, the largest sellingand most trusted brand Splendorwas launched with new styling andadditional features. It was receivedwith lot of enthusiasm in themarket.• And in January 20<strong>04</strong>, Ambition 135was launched to strengthen thepremium segment, which is alsocovered by CBZ* (launched later inApril 20<strong>04</strong>).Together, these five models nowrepresent the entire range of <strong>Hero</strong>Honda motorcycles with fresh look,additional features and aremeeting the aspirations of thecustomer class.The result of our new launcheswas quite rewarding. YourCompany now leads in price anddeluxe segments. <strong>Hero</strong> Honda has14% market share in the premiumsegment.<strong>Hero</strong> Honda has already lined upmodels for the next five years. In20<strong>04</strong>–05 two new models will beintroduced in the market. At anappropriate time, your Companyalso has plans to enter the scootermarket as well.CUSTOMER FOCUSThe philosophy of <strong>Hero</strong> Honda isto delight the customer withproducts and services. Every yearnew set of initiatives is taken toserve the customer even betterand be closer to him. Some ofthese initiatives are proactive andsome are based on feedback fromthe customers.In 2001–02, we were the first oneto introduce two– year warrantyfrom six months. We continue withthat scheme.

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:33 PM Page 2720YEARSIt (<strong>Hero</strong> Honda) is a clear brand andvolume leader in motorcycle segment." WHEEL OF FORTUNE"ET AWARDS FOR COPORATE EXCELLENCE - COMPANY OF THE YEARTHE ECONOMIC TIMESAUGUST 21, 200227THE HERO HONDA PASSPORTPROGRAMME, WHICH IS ONEOF THE MOST SUCCESSFULCUSTOMER RELATIONSHIPPROGRAMME CONTINUES TOBE HIGHLY POPULAR ANDSUCCESSFUL. TODAY OVER1.5 MILLION CUSTOMERSHAVE ENROLLED INTO THISPROGRAMMEThe <strong>Hero</strong> Honda PassportProgramme, which is one of themost successful customerrelationship programmecontinues to be highly popularand successful. Today over 1.5million customers have enrolledinto this programme. Under thisprogramme, customers of <strong>Hero</strong>Honda products are eligible toenroll at a nominal fee againstwhich they get not only discountson purchase of spare parts,accessories and services but alsoget incentive (bonus) points.Incentive points are given againstreferrals as well. <strong>Hero</strong> Hondapassport holder is eligible for giftsand special awards, dependingon total accumulated points.The idea of this programme is tocreate nation–wide customerloyalty, make them members of<strong>Hero</strong> Honda family, who in turnwill become brand ambassadorsto help build up sales andservice through referrals andgood will. Our experience withthe program has been that it hasmore than met our objective andis regarded as a reference casestudy in customer relationshipmanagement.It is our endeavour to have <strong>Hero</strong>Honda customer as the mostsatisfied customer. Several stepshave been taken in the past toenhance customer satisfaction,which is reflected in the MTCS20<strong>04</strong> – a survey conducted byTNS Automotive. According to thesurvey, <strong>Hero</strong> Honda has recordeda customer satisfaction level of 83.CD Dawn has been rated as thebest bike in the Price segment. CDDawn, Splendor and Passion havea satisfaction score of 84 out ofmaximum 100 points.Many more initiatives have beenplanned for improving thesatisfaction level, which amongothers include expansion ofcurrent reach to small towns /taluq level, legal action againstnon–genuine parts dealers,training of local mechanics forbetter service. In order to spreadthe awareness on safety andenvironment we are planningexpansion of "Safety Riding" toapproximately 150 locations andalso are promoting soundenvironmental practices through'Green dealership' concept.We plan to conduct acomprehensive CustomerSatisfaction study again this yearin partnership with CSMM tounderstand our delivery againstthe customer expectations.OPERATIONS<strong>Hero</strong> Honda has an annual totalinstalled capacity of 2.8 million

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:33 PM Page 28Management Discussion & AnalysisHERO HONDA<strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>–20<strong>04</strong>28IN THE AREA OFMANUFACTURING, YOURCOMPANY HAS BEENATTEMPTING IMPROVEMENTSAND INNOVATIONS ON ACONTINUOUS BASIS TOACHIEVE EFFICIENCIES ANDPRODUCTIVITY GAINS. DUALTONE PAINTING TECHNOLOGYON MOTORCYCLES WASINTRODUCED FOR THE FIRSTTIME IN INDIA BY HEROHONDA IN <strong>2003</strong>–<strong>04</strong>.from its two plants at Dharuheraand Gurgaon. Both the plants areadvanced manufacturing units. Bymaking additional investments inflexible CNC machines andautomation, the capacity at theseplants is now expanded to 2.8million vehicles per annum. In thelast three years, the productionfrom these plants has doubledfrom 1 million to 2 millionmotorcycles per year, besidesproviding for flexibility tomanufacture many models andtheir variants.The Company’s first plant atDharuhera is engaged in theexclusive manufacture of modelslike CD100, CD100 SS andCD–Dawn, while the second plantat Gurgaon produces more diverserange of motorcycles that cater todeluxe and premium segments.The largest selling model Splendoris produced at both the plants.Dharuhera plant has thedistinction of producing its5 millionth bike on June 17, 20<strong>04</strong>and both the plants togetherachieved a new milestone ofproducing 10 million bikes. In viewof continuously increasing need forcapacity, your Company isconsidering a third plant, whichwhen happens will be a realizationof our mandate of creating aworld–class manufacture. Locationand viability study are underprogress.In the area of manufacturing, yourCompany has been attemptingimprovements and innovations ona continuous basis to achieveefficiencies and productivity gains.Dual tone painting technology onmotorcycles was introduced for thefirst time in India by <strong>Hero</strong> Hondain <strong>2003</strong>–<strong>04</strong>. In order to improveupon our plant efficiencies, theCompany has taken a majorinitiative to implement "Just inTime concept (JIT)". For this"Online vendor connectivity"program was implemented. Andunder this, in <strong>2003</strong>–<strong>04</strong>, directonline supplies to assembly lineswere established with 40 vendors.A major learning from thecompetitive market is the effort theCompany had to make in the areaof cost rationalization on acontinuous basis. Cost optimizationwas achieved through various costimprovement projects, use ofalternate fuels and by cutting downon our overheads. A reduction of8.24% was achieved inmanufacturing variable cost in<strong>2003</strong>–<strong>04</strong> over last year.The Company is also a majorcampaigner for safety in factoriesand establishments. For its effortsand event free records, <strong>Hero</strong>Honda has won National Safety

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:33 PM Page 2920YEARS29Awards 2001 & 2002. Similarlyfor clean environment practicesadopted by us, Tata EnergyResearch Institute (TERI) hadawarded Corporate EnvironmentAward in June this year. Twoyears ago, <strong>Hero</strong> Honda bagged3–Leaves Award from Centre forScience and Environment (CSE)for our clean practices at theplant level – the highest awardfor any two–wheeler Company inthe country.VENDOR MANAGEMENTVendor management is verycritical to <strong>Hero</strong> Honda as68–70% of the cost ofproduction is accounted bymaterial cost. 256 vendorsincluding 36 ancillaries spreadacross the country are thebackbone of our successfuloperations at both the plants.Our excellent long–termrelationship has beenresponsible for trouble freeproduction and sustainedexpansion for capacity,increasing localization, efficientoutsourcing and cost andinventory control.In terms of efficiency, theCompany is able to access 70%of the materials by value atzero– inventory. For the balancematerial, the average inventoryis about 3–4 days. As ameasure of rationalization ofvendors, the Company is resortingto system purchases and is alsolooking at the possibilities of goingglobal to procure materials. Wefeel enterprises have to adoptthese techniques to become costeffective and price competitive inthe market.Our interaction with our suppliershas been one of partnership. Wehave been helping them withsystems so that, vitalcommunication with the supplychannel is in place. With the helpof the IT division, the Companyhas implemented Supply ChainManagement (SCM) and SupplierRelationship Manangement (SRM)system. Secondly, we also providethem with technical assistance atvarious levels, including qualityaudit visits to ensure even qualityand quality improvements in theirsupplies.Our supply management strategyhas enabled us to achieve costoptimization and also containinflation to bare minimum of lessthan one percent from the year<strong>2003</strong>–<strong>04</strong>. This is one area whichmanagement will increasingly havefocus to achieve cost and qualitycompetitiveness for the enterprise.RESEARCH AND DEVELOPMENTYour Company has access to

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:33 PM Page 30Management Discussion & AnalysisHERO HONDA<strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>–20<strong>04</strong>30THE COMPANY IS CURRENTLYIMPLEMENTING SAP'SSUPPLIER RELATIONSHIPMANAGEMENT (SRM)MODULE & CUSTOMERRELATIONSHIP MANAGEMENT(CRM) TO CONNECT OURDEALERS AND VENDORS FORCARRYING ON BUSINESSELECTRONICALLY. THECOMPANY IS AMONG THEFIRST ONES TO IMPLEMENTTHESE SOLUTIONS ANDCONTINUES TO BE A MODELREFERENCE SITE FOR SAP.Honda R&D, which has worldwideexperience in automobiles and isconsidered to be the best intwo–wheeler technology. Further,<strong>Hero</strong> Honda has a huge databasefrom market feedback, henceunderstands the Indian conditionsand the requirements of Indiancustomers very well. <strong>Hero</strong> Hondamarket intelligence combined with<strong>Hero</strong> Honda and Honda R&D hasbeen greatly responsible forbringing out best performing andmost acceptable products in themarkets.At its own R&D center, <strong>Hero</strong>Honda has put in place thenecessary infrastructure anddeveloped competencies for doingimportant base–work, which helpsconceptualization of the productand later material selection,localization of components andtesting for various launches as perHonda specifications. Anothermajor objective for investing inlocal R&D is to cut down ondevelopment and launch time forthis growing and highly competitivemarket. You may be pleased toknow that your Company's R&D isnow connected to Honda (Japan)online to help design data transferinstantly. All these efforts haveenabled your Company to reduceproduct development time. Thus,the company was able to havelarge number of launches in thelast fiscal year, namely, CD–Dawn,Karizma, Splendor / Passion DiscVersion, Splendor+, Passion Plus,Ambition 135, CBZ* and needlessto mention that many newlaunches are in pipeline.Regulations, is another area whereR&D support is increasinglyrequired. Environment and safetyissues require a lot of R&D inputsto ensure that the products complywith all the necessary norms laiddown by the government from timeto time. Your Company played aconstructive role in working withthe government (MashelkarCommittee) to understand andformulate regulations in the areasof safety, emissions and fuelquality for the automobile sector.INFORMATION TECHNOLOGY<strong>Hero</strong> Honda continues to adoptand implement informationtechnology (IT) for enhancing theoverall efficiencies of theorganization. In keeping with theplans, the Company is currentlyimplementing SAP's SupplierRelationship Management (SRM)module & Customer RelationshipManagement (CRM) to connectour dealers and vendors forcarrying on business electronically.The Company is among the firstones to implement these solutionsand continues to be a modelreference site for SAP. With this

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:33 PM Page 3120YEARSIt is not every two wheeler manufacturerthat is able to create the best-selling bikein the world. <strong>Hero</strong> Honda with its 100 CCSplendor holds that distinction.BUSINESS STANDARDJANUARY 25, 200131YOUR COMPANY ISCONTINUOUSLY UPGRADINGTHE IT INFRASTRUCTURE TOMEET THE BUSINESS NEEDS.THE IT INFRASTRUCTURE ISSTATE–OF–THE–ART ANDAIMS AT HIGH THROUGHPUT,HIGH AVAILABILITY, ANDCAPABLE OF SCALING UP TOACCOMMODATE THECOMPANY'S GROWTH. NEWTECHNOLOGY SOLUTIONSARE EVALUATED AND PUT INPLACE DELIVERING HIGHVALUE TO BUSINESS. YOURCOMPANY CONTINUES TO BEA PIONEER IN THE ADOPTIONOF VARIOUS TECHNOLOGIESAND REMAINS A REFERENCESITE IN THE ASIA PACIFICREGION FOR VARIOUSTECHNOLOGY VENDORS WHOWORK WITH THE COMPANY.implementation, our supplychain solution moves from thecurrent mode of one waysharing of information to acollaborative framework, whichwould enable dealers andvendors to carry out on–linetransaction through a secureInternet connection.As a part of continuousimprovement, the SAP HRmodule was extended to cover'Employee Self Service System'(ESS) where employees directlyaccess their personalinformation related to theirsalaries and other particulars.The same facility has also beenextended to the workers throughkiosk–based systems (touchscreen). Bar coding wasintroduced for automaticrecording of material receipt andproduction data leading togreater accuracy and efficiency.Various other initiatives takenduring the year have gonetowards process improvements,cost reductions and improvingefficiencies.Yet another major initiative takenduring the year was to movetowards electronic storage ofdocuments. Frequentlyaccessed documents are storedcentrally using a documentmanagement software and usersaccess them based on the rolesand rights assigned to them. Otherdocuments are being microfilmedand stored separately. This hasmade document storage simple,saved considerable space, and hasmade access very easy.With the spread of information andextension of connectivity evenoutside the Company, varioussteps have been taken to secureits data and networks. TheCompany has formulated an ITsecurity policy and put it intoaction throughout the organization.Security monitoring exists both atthe technical level (firewalls,intrusion detection & other tools)and at the user level (informationclassification, access rights,defining responsibilities etc).Your Company is continuouslyupgrading the IT infrastructure tomeet the business needs. The ITinfrastructure is state–of–the–artand aims at high throughput, highavailability, and capable of scalingup to accommodate theCompany's growth. Newtechnology solutions are evaluatedand put in place delivering highvalue to business. Your Companycontinues to be a pioneer in theadoption of various technologiesand remains a reference site in theAsia Pacific region for varioustechnology vendors who work with

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:33 PM Page 32Management Discussion & AnalysisHERO HONDA<strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>–20<strong>04</strong>32IN LINE WITH OURORGANIZATIONAL MANDATE OFBECOMING A "WORLD CLASSMANUFACTURER", WE HAVEMANAGED TO CREATEAWARENESS ON ITSCONCEPTS, TOOLS ANDTECHNIQUES AMONGWORKFORCE ANDEMPLOYEES. WE ARE ALSOENCOURAGING LINEMANAGERS TO PLAY A LEADROLE IN PEOPLEDEVELOPMENT.the Company. Many technologymagazines carry the <strong>Hero</strong> Hondacase study at regular intervals.This year our offices including thetwo Plants have been connectedthrough Video conferencing. In thecoming year the Company plans toset up an alternate IT site as adisaster recovery site, to take careof any eventuality that may causefailure of the main data centre.HUMAN RESOURCE MANAGEMENTThe Human Resources functionhas concentrated all its effortsunder the broad banner of"Organisation Capability Building";through key initiatives such asDevelopment of Knowledge, Skills& Attitudes (KSA), KnowledgeManagement, Building a learningculture within the organization andseveral more – all aimed atproviding a more futuristic andmatured outlook to the keyresource in <strong>Hero</strong> Honda, it'sPeople. Parallel to developinginternal people capability, we arealso consciously trying to sourceexceptional talent in core areas ofSales & Marketing, Research &Development and Supply ChainManagement. This effort has bornefruit in terms of infusion of around60 bright, young professionals intothe mainstream activity of theorganization.There is a conscious effort on thepart of the management tocontinuously develop theKnowledge, Skills & Attitudes of itspeople through a variety of Traininginterventions specifically aimed atan individual's need with a specialthrust on enhancingfunctional/domain knowledgeacross disciplines. In line with ourorganizational mandate ofbecoming a "World ClassManufacturer", we have managedto create awareness on itsconcepts, tools and techniquesamong workforce and employees.We are also encouraging linemanagers to play a lead role inPeople Development.In collaboration with IT, HR hasimplemented the SAP Payroll and"Employee Self–Service" (ESS)modules. We are also in theprocess of launching the PeopleDevelopment (PD) & Training andDevelopment (T&D) modules inthe ensuing financial year.There have been several initiativestaken on the employee welfarefront through specific programmesdesigned for the spouses and thechildren of our employees viz:Employee's Spouse programme"Apka Shaandar Humsafar",career–counseling sessions for thechildren. These programmes haveenabled us to reach out to thefamilies of our employees and

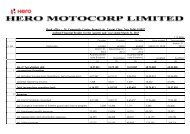

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:33 PM Page 3320YEARS33provide them with a uniqueopportunity to know about thecompany and its values. It hasalso helped the children of ouremployees in making certainimportant decisions with regardto their career.Best Employers Study <strong>2003</strong>conducted by Hewitt Associates.In the financial year 20<strong>04</strong>–05, weaim to focus our efforts in the areaof fostering creativity & innovationthroughout the organization.TABLE 2 HERO HONDA’S ABRIDGED PROFIT AND LOSS STATEMENTThe efforts of all these need–feltresulted in "EmployeeEngagement" of about 70 percent (considered to be fairlyhigh) for <strong>Hero</strong> Honda in theIn Rs. Crore03–<strong>04</strong> 02–03Net Sales from Operations 5832.43 5101.71Material Costs 4030.61 3470.77Rates and Taxes 6.54 9.75Manufacturing Expenses 119.35 108.66Employee Costs 231.52 201.63Selling & Distribution Expenses 338.38 314.84Other expenses and provisions 125.93 132.47Financial expenses –1.35 –1.02Misc. expenditure written off 0.7 9.53Depreciation 73.33 63.39Total Expenditure 4925.01 4310.02OPBDIT 979.40 854.06OPBT 907.42 791.69Other Income 165.<strong>04</strong> 92.87PBIT 1071.11 883.54PBT 1072.46 884.56Current tax 331.07 298.19Deferred Tax 13.07 5.61PAT 728.32 580.76Note: In order to get a more accurate picture of the Company’s operational performance, OPBDIT has beencalculated net of “other income’’FINANCIALSTable 2 gives a summary of <strong>Hero</strong>Honda's financial performance for<strong>2003</strong>–<strong>04</strong>.Net sales of the Companyincreased by 14.3 per cent fromRs.5,102 Crore in 2002–03 toRs.5,832 Crore in <strong>2003</strong>–<strong>04</strong>. Costof raw materials as a percentage oftotal sales increased from 68.0 percent in 2002–03 to 69.1 percentin <strong>2003</strong>–<strong>04</strong>, owing to a change insales mix and higher steel prices(during the latter part of the fiscalyear).However, despite this, acontinuous focus on costmanagement and operatingefficiency has enabled theCompany to marginally improve itsOPBDIT margin from 16.7 percent in 2002–03 to 16.8 per centin <strong>2003</strong>–<strong>04</strong>. Operating profit (PBTbefore other income) grew by 14.6per cent from Rs.792 Crore in2002–03 to Rs.907 Crore in<strong>2003</strong>–<strong>04</strong>. Operating profit marginimproved marginaly from 15.5 percent in 2002–03 to 15.6 percent

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:33 PM Page 34Management Discussion & AnalysisHERO HONDA<strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>–20<strong>04</strong>34TABLE 3 KEY INDICATORS OF PROFITABILITY03–<strong>04</strong> 02–03OPBDIT/Sales 16.8% 16.7%OPBT/Sales 15.6% 15.5%PBIT/Sales 18.4% 17.3%PBT/Sales 18.4% 17.3%PAT/Sales 12.5% 11.4%ROACE 92.8% 98.9%ROAE 72.9% 75.6%TABLE 4 EVA & ROACE (POST–TAX)03–<strong>04</strong> 02–03EVA (Rs. Crores) 569 481EVA/%of cap employed) 49.3% 53.8%ROACE(post tax) 63.2% 65.1%Note: Details of the above calculations have been given in theEVA Statement.in <strong>2003</strong>–<strong>04</strong>. Profit after tax (PAT)went up by 25.4 per cent fromRs.581 Crore in 2002–03 toRs.728 Crore in <strong>2003</strong>–<strong>04</strong>. OtherIncome rose from Rs.92.9 Crore in2002–03 to Rs.165.0 Crore in<strong>2003</strong>–<strong>04</strong>. Return on averagecapital employed (ROACE) of theCompany was 92.8 percent in<strong>2003</strong>–<strong>04</strong>, while return on averageequity (ROAE) was 72.9 per centin <strong>2003</strong>–<strong>04</strong>.Table–3 shows that the keyindicators of profitability improvedduring the year under review.Moreover, both fixed asset andcurrent asset turnover of theCompany improved during thefinancial year <strong>2003</strong>–<strong>04</strong>. Net fixedassets turnover (sales/average netfixed assets) increased from 10.1in 2002–03 to 10.5 in <strong>2003</strong>–<strong>04</strong>;while current assets turnover(sales/average current assets)increased from 10.2 to 11.8.ECONOMIC VALUE ADDED (EVA)EVA, a measure of corporate valuecreation, indicates whether themanagement of a Companygenerates returns that cover theweighted average cost of capital.By explicitly including the cost ofequity, EVA recognizes that capitalis scarce and investors, who claimthe residual share of a firm'searnings, need to be compensatedadequately for assuming the risk ofinvesting. As Table 4 shows, theEVA has increased from Rs.481Crore in 2002–03 to Rs.569 Crorein <strong>2003</strong>–<strong>04</strong>.DEBT STRUCTURE<strong>Hero</strong> Honda continues to be adebt free company. The unsecuredloan of Rs.175 Crore from thestate government of Haryana onaccount of sales tax deferment, isinterest free, and has no holdingcosts. Net interest payment by theCompany has been negativeduring the last three years.DIVIDEND POLICYMaximising shareholders valuenecessitates that the capitalemployed by a company is usedefficiently and earns a return morethan its cost. Keeping this in mind,your Company has anunambiguous dividend policy –funds in excess of what is neededfor capital investments and relatedstrategic expenses will bedistributed to the shareholders.This is the philosophy that has ledto high dividend payouts for thelast several years. The Companypaid a total dividend of 900 percent in 2002–03 and the Boardhas recommended a TotalDividend of 1000 per cent in<strong>2003</strong>–<strong>04</strong>, including a "SpecialInterim Dividend" of 500 per cent– already paid. It may be pertinentto note that the % dividend has

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:33 PM Page 3520YEARSIt is tough to break into top ranks of oursurvey of corporate India. ...Maintainingthe third place is <strong>Hero</strong> Honda Motors,India’s largest maker of Motorcycles.FAR EASTERN ECONIOMIC REVIEWDECEMBER 25, <strong>2003</strong>35TABLE 5 WORKING CAPITAL MANAGEMENT & LIQUIDITY RATIOS03–<strong>04</strong> 02–03Inventory Period 14.4 16.1Operating Cycle 19.2 23.2Cash Cycle –28.3 –16.3Current Ratio 0.51 0.70Acid Test Ratio 0.32 0.40Note: The average of inventory, receivables and payables have beentaken for the above calculations of inventory period,operating and cash cycle.always exceeded the previousyear’s % dividend, for any givenyear since 1991.WORKING CAPITAL MANAGEMENT<strong>Hero</strong> Honda has aimed atcontinuous improvement in itsworking capital management. AsTable 5 shows, inventory periodfor the Company has decreasedfrom 16.1 days in 2002–03 to14.4 days in <strong>2003</strong>–<strong>04</strong>. TheCompany initiated a newreceivables policy during theyear, which has helped inbringing down the level ofreceivables. Receivables havedecreased from 7.2 days in2002–03 to 4.8 days in<strong>2003</strong>–<strong>04</strong>. Operating cycle of theCompany has decreased from23.2 days in 2002–03 to 19.2days in <strong>2003</strong>–<strong>04</strong>, while Cashcycle has decreased from(–)16.3 days in 2002–03 to(–)28.3 days in <strong>2003</strong>–<strong>04</strong>. Thus,<strong>Hero</strong> Honda continues to beone of the most efficiententerprises in terms of workingcapital management.CASH FLOWSEfficient working capitalmanagement, coupled withprofitable growth has translatedinto healthy net cash flows fromoperations for the Company.Chart E plots the trend in netcash flow from operations overthe last 5 years.INTERNAL CONTROL & ADEQUACY<strong>Hero</strong> Honda has a proper andadequate system of internal controlto ensure that all assets aresafeguarded and protected againstloss from unauthorized use ordisposition and those transactionsare authorized, recorded andreported correctly.RISKS AND CONCERNSAs the market leader, a possibleslowdown in the two–wheeler, andmotorcycle market constitutes arisk factor for <strong>Hero</strong> Honda.Growing competition in theindustry, both in terms of newmodels, and price undercutting,too, is a matter of concern, as bothsales realizations and operatingmargins may come underpressure. At the higher end of themarket, imports could constitute athreat, if import duties fall down inthe future. Rising steel prices andother input costs pose a threat tomargins.OUTLOOKThe medium term (three years)outlook for the two–wheelerindustry is positive but volatile. Weanticipate double–digit growth inthe two wheeler and motorcyclemarkets over the next three years.Of course, we believe that GDPand per capita incomes grow at

ND_L18fontscorrected FIN.qxd 7/26/20<strong>04</strong> 5:33 PM Page 36Management Discussion and AnalysisHERO HONDA<strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>–20<strong>04</strong>36ROBUST AGRICULTURALGROWTH SUPPORTING RURALCONSUMPTION, PROSPECT OFGOOD MONSOON IN THECURRENT YEAR, UPAGOVERNMENTS' PROGRAMMETO PROSPER RURAL AREASAND INFRASTRUCTURE,FAVOURABLE DEMOGRAPHICTRENDS ARE THE FACTORSTHAT ARE MUTUALLYREINFORCING AND WILLINFLUENCE A HANDSOMEGROWTH IN TWO–WHEELERS.THERE WILL BE EXPANSION INTHE CONSUMER CREDIT BYBANKS AND FINANCIALINSTITUTIONSover 7% and 5% respectively. Theestimated average percapitaincome level ranging between550–700 US$ during FY20<strong>04</strong>–FY2006 is conducive toadoption of two wheelers aspersonal transport mode byhouseholds. Once it reaches US$1000+, then the preference couldbegin to shift towards cars. Lastyear's robust agricultural growthsupporting rural consumption,prospect of good monsoon in thecurrent year, UPA Governments'programme to prosper rural areasand infrastructure, favourabledemographic trends are the factorsthat are mutually reinforcing andwill influence a handsome growthin two–wheelers. There will beexpansion in the consumer creditby banks and financial institutionsbut interest rates may haveupward pressure depending oninflation, which is currently ataround 6%.wheelers is limited. As the marketleader, <strong>Hero</strong> Honda tooendeavours to achieve adouble–digit growth in sales.CAUTIONARY STATEMENTStatements in this managementdiscussion and analysis describingthe Company's objectives,projections, estimates andexpectations may be 'forwardlooking statements' within themeaning of applicable laws andregulations. Actual results mightdiffer substantially or materiallyfrom those expressed or implied.Important developments that couldaffect the Company's operationsinclude a both, significant changesin political and economicenvironment in India or keymarkets abroad, tax laws, litigation,labour relations and interest costs.We expect the motorcycle marketto grow by about 12–15 per centduring 20<strong>04</strong>–05. While this is lessthan the growth experienced bythe industry in the last few years, itis important to remember that thevolumes in the industry haveincreased significantly. At present,motorcycles account for over 77per cent of the two–wheelermarket and the scope to growfurther in terms of its share in two