October 2007.indd - Southwest Neighborhoods, Inc.

October 2007.indd - Southwest Neighborhoods, Inc.

October 2007.indd - Southwest Neighborhoods, Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PAGE 8<br />

OCTOBER 2007<br />

Crime Prevention Through<br />

Environmental Design (C.P.T.E.D.)<br />

What is C.P.T.E.D.?<br />

C.P.T.E.D. practices incorporate aspects of<br />

safe design and retrofitting of our homes, businesses,<br />

schools and communities. “Defensible<br />

space” is a design concept which puts control,<br />

both actual and perceived, in the control of the<br />

people who are supposed to be using the area,<br />

and exposes those who are up to no good. There<br />

are three primary principles of defensible space:<br />

natural surveillance, territoriality, and access<br />

control.<br />

Primary Aspects<br />

#1 Natural<br />

Surveillance<br />

This allows intruders and offenders<br />

to be easily seen by<br />

people using the property and<br />

people passing by the property.<br />

Another way to explain this is<br />

“visual control.” Carefully designed<br />

buildings, appropriately<br />

placed lighting and well chosen<br />

(and maintained) landscaping<br />

encourages natural surveillance.<br />

Identity Theft<br />

#2 Territoriality<br />

This strategy is used to create<br />

the perception that someone is<br />

in control of the area. Another<br />

way to explain it is a “sense of<br />

turf.” This can be done by distinguishing<br />

private space from<br />

semi-private and public through<br />

the use of signs, landscaping,<br />

pavement designs or fencing.<br />

#3 Access Control<br />

Access control safeguards<br />

by denying access to or escape<br />

How Identity Theft Occurs<br />

HOW IDENTITY THIEVES GET YOUR PERSONAL<br />

INFORMATION<br />

•They get information from business or other institutions by stealing records<br />

or information while they’re on the job, bribing an employee who has access to<br />

these records, hacking these records, or conning information out of employees.<br />

•They may steal your mail, including bank statements, credit card offers, and new<br />

unused checks.<br />

•They may steal your wallet or personal information from your home.<br />

Skimming, Phishing, Pretexting, and Dumpster Diving<br />

ID Thieves may steal your credit or debit card numbers by capturing the information<br />

in a data storage device attached to an ATM in a practice known as “skimming.”<br />

They may steal personal information from you through email (“phishing”)<br />

or phone (“pretexting”) by posing as legitimate companies and claiming that you<br />

have a problem with your account. ID thieves will<br />

rummage through your trash in a practice known<br />

as “dumpster diving.”<br />

How to Prevent Identity Theft<br />

ACCOUNT SECURITY<br />

• Place passwords on your credit card, bank, and<br />

phone accounts. Avoid using easily available information<br />

like your mother’s maiden name, your birth<br />

date, the last four digits of your SSN or your phone<br />

number, or a series of consecutive numbers.<br />

• Secure personal information in your home, especially<br />

if you have roommates, employ outside help,<br />

or are having work done in your home.<br />

• Ask about information security procedures in<br />

your workplace or at businesses, doctor’s offices,<br />

or other institutions that collect your personally<br />

identifying information. Find out how your information<br />

will be shared with anyone else.<br />

• Don’t give out personal information on the<br />

phone, through the mail, or on the Internet unless you’ve initiated the contact<br />

or are sure you know whom you’re dealing with. Before you share any personal<br />

information, confirm that you are dealing with a legitimate organization.<br />

• Deposit outgoing mail in post office collection boxes or at your local post office,<br />

rather than in an unsecured mailbox.<br />

• Tear or shred your charge receipts, copies of credit applications, insurance<br />

forms, physician statements, checks and bank statements, expired charge cards<br />

that you’re discarding, and credit offers you get in the mail. To opt out of receiving<br />

credit offers in the mail call 1-888-5-OPTOUT.<br />

• Don’t carry your Social Security card; leave it in a secure place.<br />

• Give your Social Security Number (SSN) only when absolutely necessary. If<br />

someone asks for your SSN, ask: Why do you need it? How will it be used?<br />

How do you protect it from being stolen? What will happen if I don’t give you<br />

my SSN?<br />

from a location, and increasing<br />

the perception of risk to<br />

the offender. This involves placing<br />

barriers between the area<br />

to be protected and the outside<br />

world. One-way turnstiles<br />

at hotly contested basketball<br />

games or gating off all but one<br />

entrance which passes by the<br />

front windows of the elementary<br />

school office during school<br />

hours would be examples of<br />

access control. Others include<br />

strong door frames and good<br />

locks on doors and windows.<br />

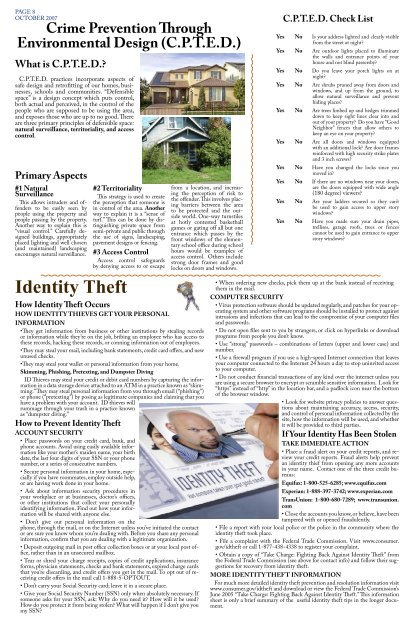

C.P.T.E.D. Check List<br />

Yes No Is your address lighted and clearly visible<br />

from the street at night?<br />

Yes No Are outdoor lights placed to illuminate<br />

the walls and entrance points of your<br />

house and not blind passersby?<br />

Yes No Do you leave your porch lights on at<br />

night?<br />

Yes No Are shrubs pruned away from doors and<br />

windows, and up from the ground, to<br />

allow natural surveillance and prevent<br />

hiding places?<br />

Yes No Are trees limbed up and hedges trimmed<br />

down to keep sight lines clear into and<br />

out of your property? Do you have “Good<br />

Neighbor” fences that allow others to<br />

keep an eye on your property?<br />

Yes No Are all doors and windows equipped<br />

with an additional lock? Are door frames<br />

reinforced with high security strike plates<br />

and 3 inch screws?<br />

Yes No Have you changed the locks since you<br />

moved in?<br />

Yes No If there are no windows near your doors,<br />

are the doors equipped with wide angle<br />

(180 degree) viewers?<br />

Yes No Are your ladders secured so they can’t<br />

be used to gain access to upper story<br />

windows?<br />

Yes No Have you made sure your drain pipes,<br />

trellises, garage roofs, trees or fences<br />

cannot be used to gain entrance to upper<br />

story windows?<br />

• When ordering new checks, pick them up at the bank instead of receiving<br />

them in the mail.<br />

COMPUTER SECURITY<br />

• Virus protection software should be updated regularly, and patches for your operating<br />

system and other software programs should be installed to protect against<br />

intrusions and infections that can lead to the compromise of your computer files<br />

and passwords.<br />

• Do not open files sent to you by strangers, or click on hyperlinks or download<br />

programs from people you don’t know.<br />

• Use “strong” passwords – combinations of letters (upper and lower case) and<br />

number.<br />

• Use a firewall program if you use a high-speed Internet connection that leaves<br />

your computer connected to the Internet 24 hours a day to stop uninvited access<br />

to your computer.<br />

• Do not conduct financial transactions of any kind over the internet unless you<br />

are using a secure browser to encrypt or scramble sensitive information. Look for<br />

“https” instead of “http” in the location bar, and a padlock icon near the bottom<br />

of the browser window.<br />

• Look for website privacy policies to answer questions<br />

about maintaining accuracy, access, security,<br />

and control of personal information collected by the<br />

site, how the information will be used, and whether<br />

it will be provided to third parties.<br />

If Your Identity Has Been Stolen<br />

TAKE IMMEDIATE ACTION<br />

• Place a fraud alert on your credit reports, and review<br />

your credit reports. Fraud alerts help prevent<br />

an identity thief from opening any more accounts<br />

in your name. Contact one of the three credit bureaus:<br />

Equifax: 1-800-525-6285; www.equifax.com<br />

Experian: 1-888-397-3742; www.experian.com<br />

TransUnion: 1-800-680-7289; www.transunion.<br />

com<br />

• Close the accounts you know, or believe, have been<br />

tampered with or opened fraudulently.<br />

• File a report with your local police or the police in the community where the<br />

identity theft took place.<br />

• File a complaint with the Federal Trade Commission. Visit www.consumer.<br />

gov/idtheft or call 1-877-438-4338 to register your complaint.<br />

• Obtain a copy of “Take Charge: Fighting Back Against Identity Theft” from<br />

the Federal Trade Commission (see above for contact info) and follow their suggestions<br />

for recovery from identity theft.<br />

MORE IDENTITY THEFT INFORMATION<br />

For much more detailed identity theft prevention and resolution information visit<br />

www.consumer.gov/idtheft and download or view the Federal Trade Commission’s<br />

June 2005 “Take Charge: Fighting Back Against Identity Theft.” This information<br />

sheet is only a brief summary of the useful identity theft tips in the longer document.