info - Family Business Australia

info - Family Business Australia

info - Family Business Australia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHAIRMAN’S REPORT…a word from thechairmanGreetings, family business owners, operators,valued advisers and sponsors. Another year isupon us, bringing fresh challenges.For the first time, <strong>Family</strong> <strong>Business</strong> <strong>Australia</strong>will be raising awareness of family businessissues through a national <strong>Family</strong> <strong>Business</strong>Week, in the first week of May.All around the country, FBA will be hosting avariety of events, including a Women’s Program, talkback radioprograms with panels of advisers and family business operatorsanswering your questions.Queensland, Tasmania, South <strong>Australia</strong> and West <strong>Australia</strong> will behosting half day events, with presentations on the issues you, themembers, have flagged as being important to you.This year, for the first time, the awards program is supported bythe Federal Government and <strong>Business</strong> Review Weekly.I know that many family businesses tend to prefer to keep a lowprofile, but I urge you to consider the benefits to your business ofbeing announced as a winner in your state or even nationally. With theservices of our three PR companies; SOCOM in Victoria, KardanConsulting in NSW and Star PR in Queensland – we will ensure thatour winners receive the publicity they deserve – and who can find faultwith more customers knowing about your business!If you hate paperwork, there are arrangements in place to have agraduate business student interview you and put your entry together.Past entrants have expressed their appreciation at how the process hasgiven them a chance to reflect on their business and where they areheaded. Come on – give it a go!FAMILY BUSINESS AUSTRALIANATIONAL OFFICEChief Executive Officer - Philippa TaylorConference and Events Manager - Jenny McCreeryEmail jmccreery@fambiz.com.auNational Chairman - Jason LeaLevel 2, 568 St Kilda RoadMelbourne Victoria 3004Telephone (03) 9529 6177Freecall 1800 249 357Facsimile (03) 9529 6744Email <strong>info</strong>@fambiz.com.auWebsite www.fambiz.com.auExecutive Officer ContactsWESTERN AUSTRALIAKerry ClarkePO Box 132Floreat WA 6014Telephone 08 9284 0792Facsimile 08 9284 0196Mobile 0438 120 396Email fbawa@fambiz.com.auNEW SOUTH WALESKaren DoyleLevel 101 Market StreetSydney NSW 2000Telephone 02 9372 0552Facsimile 02 9592 3483Mobile 0402 050 595Email fbansw@fambiz.com.auVICTORIAGita CohenLevel 2, 568 St Kilda RoadMelbourne Victoria 3004Telephone 03 9529 6177Facsimile 03 9529 6744Mobile 0425 817 252Email ptaylor@fambiz.com.auQUEENSLANDSandra SpartiLevel 18300 Queen StreetGPO Box 457Brisbane QLD 4001Telephone 07 3839 5625Facsimile 07 3221 9227Mobile 0419 023 077Email fbaqld@fambiz.com.auSOUTH AUSTRALIAJackie Schmidt22 Williams AvenueDulwich SA 5065Telephone 08 8364 4869Facsimile 08 8364 1720Mobile 0425 817 259Email fbasa@fambiz.com.auTASMANIAJenny McCreeryLevel 2, 568 St Kilda RoadMelbourne Victoria 3004Telephone 03 9529 6177Facsimile 03 9529 6744Mobile 0425 797 139Email jmccreery@fambiz.com.auBRW will be developing their list of the fastest growing familybusinesses in <strong>Australia</strong>, using data collected from those entrants whoindicate their willingness for their <strong>info</strong>rmation to be shared withthe publication.I sign off with the good news that FBA head office is now back in St KildaRoad after fire devastated the offices in July last year. On behalf of thestaff and National Board, I would like to express my sincereappreciation to Horwath for their hospitality to FBA over the pastmonths. Horwath extended a helping hand when it was most needed,and generously accommodated and supported our Melbourne staffin their city premises. Thank you Vin Brown and Bruce McMenaminand all the Horwath team in Victoria.National Silver SponsorsJason LeaChairman4 GENERATIONS - FEBRUARY 2005

NEWSMission possible:EXPORTINGTHE FAMILY BUSINESSNew research shows that family businesses are less likely to take advantage of Free Trade Agreements.Researcher CHRISTOPHER GRAVES explains.While family and non-family businesses have similar attitudes towardsgrowth and innovation, research shows that family businesses are lesslikely to take advantage of the spate of Free Trade Agreements (FTA) thatthe <strong>Australia</strong>n Government has negotiated around the world.This is because many family businesses (FBs) are more averse to risk,have a preoccupation with the domestic market, and lack the resourcesrequired for expansion into the international marketplace. However,Christopher Graves, PhD candidate from the Adelaide Graduate Schoolof <strong>Business</strong> at the University of Adelaide, says FBs that are exporting doit as successfully as their non-family counterparts.“Because family-owned enterprises make up approximately 70% of allbusinesses in <strong>Australia</strong>, the ability of the <strong>Australia</strong>n economy to benefitfrom these FTAs is dependent upon family businesses exploiting theircompetitive advantages internationally,” Graves said. Of the FBs involvedin this study, 55% were first generation firms, 35% were secondgeneration and 10% third generation or later generation firms.With his supervisor Dr Jill Thomas, Graves is looking at how familybusinesses, particularly those in the manufacturing sector, are adapting tothe challenges brought about by globalisation. The study is supported bythe <strong>Australia</strong>n Research Council’s linkage grant program, with the SAChapter of <strong>Family</strong> <strong>Business</strong> <strong>Australia</strong> as the linkage partner.“The more we can understand about what makes family businesses takethe step to export and how they ensure their ongoing success, the betterchance there will be to boost <strong>Australia</strong>’s overall export performance.”Many family businesses are considered hidden champions in that they areleaders in what they do and have export potential, but lack the marketing andmanagerial capabilities to translate this expertise and potential into theinternational marketplace.Graves research clearly shows that compared to non-family businesses, FBsthat have already expanded internationally lag behind in building managerialcapabilities, particularly at the ‘advanced’ stage of internationalisationThe study also suggests that if the <strong>Australia</strong>n Government wants to assistthe international expansion of small to medium sized businesses, itshould provide some targeted support for the family business sector.“Because FBs can be reluctant to seek outside advice, the Governmentcan play a role in nurturing FB networks and bring quality FB advisersand FBs together.” Graves said.STORY CONTINUED ON PAGE 6Dr John Spoehr, Dr Jill Thomas and Christopher GravesGENERATIONS - FEBRUARY 2005 5

NEWSHOW WILL THE ADOPTION OF INTERNATIONALFINANCIAL REPORTING STANDARDS AFFECTSMALL AND MEDIUM-SIZED ENTITIES?International Financial Reporting Standards (IFRS) apply to all companies and other entities, applying toreporting periods beginning on or after 1 January 2005. PETER KIDD from Horwath Melbourne explains.SO… TO WHOM DOES IFRS APPLY? OR AFFECT?…EVERY COMPANY!For most <strong>Australia</strong>n entities IFRS will first apply to financial reports foryears ending 30 June 2006.IFRS represents an enormous change – the biggest accounting changein a decade – for <strong>Australia</strong>n financial reporting with every existingAccounting Standard being changed in some way. This comes at thesame time as other significant corporate reporting changes such as theCLERP requirements are implemented.The clear messages that we want to leave are:> Don’t underestimate what’s involved; and> Don’t leave it until too late.The <strong>Australia</strong>n Accounting Standards Board (AASB) is adopting IFRS by issuingit as <strong>Australia</strong>n equivalents, hereafter referred to as A-IFRS. Compliance withA-IFRS will ensure compliance with international standards.SO HOW WILL A-IFRS AFFECT YOU?The major areas of impact of A-IFRS include:> Financial Instruments (Recognition and Measurement) (AASB 139)> Income Tax (AASB 112)> <strong>Business</strong> Combinations (AASB 3)> Intangible Assets (AASB 138)> Impairment of Assets (AASB 136)> Share-Based Payment (AASB 2)> Investment Property (AASB 140)> First-Time Adoption (AASB 1).While some of these standards may not be relevant to many small andmedium-sized entities, the areas of impact can easily be more substantialthan is initially apparent.For example, the definition of financial instruments in AASB 139 is verybroad and requires different accounting treatments to what <strong>Australia</strong>nentities are familiar with, such that it will affect most entities.The general principle is that all international standards in force, as at thedate of the financial report, must be applied retrospectively to the entirefinancial statements, including interim reports, comparatives and theopening balance sheet.This will require a full restatement of comparative <strong>info</strong>rmation,with certain limited exceptions.For June balancers an opening balance sheet in accordance with the newrequirements will be prepared for 1 July 2004, which is considered the‘date of transition’. This differs from previous <strong>Australia</strong>n requirementswhere changes in accounting policies did not require the restatementof the income statement and balance sheet of the preceding period.One small bit of good news is that, amongst the many changes interminology involved in A-IFRS, there is a return to some familiarterms for the main financial statements, including balance sheet andincome statement.Reporting entities that are required to prepare general purpose financialreports under the Corporations Act, will have to comply with A-IFRSin its entirety. There will be only limited legally mandatory application tonon-reporting entities. All entities that are required to prepare financialreports under the Corporations Act 2001 will have to fully comply with:> AASB 101: Presentation of Financial Statements> AASB 107: Cash Flow Statements> AASB 108: Accounting Policies, Changes in AccountingEstimates and Errors.AASB 1: First-time Adoption of <strong>Australia</strong>nEquivalents to International FinancialReporting Standards is only mandatoryfor reporting entities.However, the preface to each of the three above listed new standards,that are mandatory for all companies, includes a comment that therequirements of AASB 1 must be observed. In particular, these explainthat AASB 1 requires prior period <strong>info</strong>rmation, presented as comparative<strong>info</strong>rmation, to be restated as if the requirements of this Standard hadalways applied and that this differs from previous <strong>Australia</strong>n requirementswhere changes in accounting policies did not require the restatement ofthe income statement and balance sheet of the preceding period.ASIC has previously expressed the view that non-reporting entitieswhich are required to prepare financial reports under the CorporationsAct should comply with the recognition and measurement criteria of allAccounting Standards and this view is unlikely to change.STORY CONTINUED ON PAGE 8GENERATIONS - FEBRUARY 2005 7

NEWSSTORY CONTINUED FROM PAGE 7However, it should be noted that this does not have the force of law andthat many accountants do not agree with this view.There has, for a long time, been concern in <strong>Australia</strong> that generalpurpose financial reports prepared in accordance with all the standardsare overkill for small business and this will only become more complexwith A-IFRS.The International Accounting Standards Board (IASB) has issued adiscussion paper titled Preliminary Views on Accounting Standards forSmall and Medium-sized Entities. This is supported by the <strong>Australia</strong>naccounting bodies, but has had no impact on Accounting Standards so far.One small bit of good news is that,amongst the many changes in terminologyinvolved in A-IFRS, there is a return tosome familiar terms for the main financialstatements, including balance sheetand income statement.The Institute of Chartered Accountants has also prepared the <strong>Business</strong>Practice Guide: Financial Statements of Non-Reporting Entities. Inpreparing this Guide the Institute has acknowledged the users of financialstatements for small and medium-sized entities are not generally highlyfinancially literate, and able to cope with all the complex <strong>info</strong>rmation thatis contained in general purpose financial reports, prepared in accordancewith A-IFRS.Whilst this relates to existing Accounting Standards we understand thatthe Institute is proposing to update the document to incorporatechanges related to A-IFRS.For more <strong>info</strong>rmation please contact Peter Kiddat Horwath on 03 9529 53558 GENERATIONS - FEBRUARY 2005

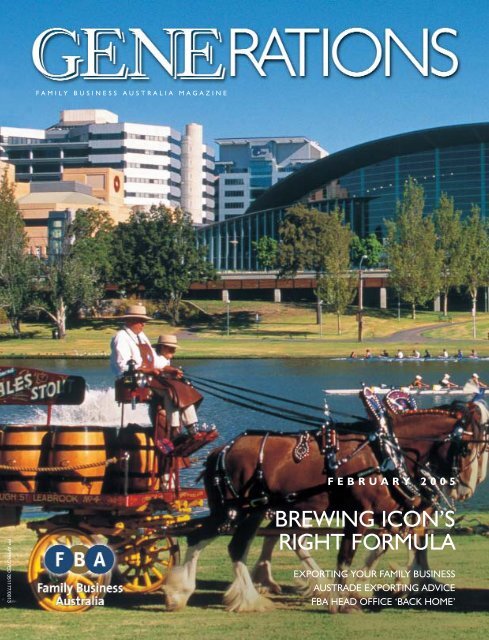

COVER STORYRIGHTCHEMISTRYFOR A BREWING ICONBy PETER WATERSis marketing manager and Tim Cooper, 48, (from “side B”)runs the brewery.But according to an unwritten family edict: “You don’t automaticallycome into Coopers because your name is Cooper.”Glenn and Tim pursued other paths before they entered the familybusiness. According to Glenn, times were tough in the brewing industrywhen it was time for him and Tim to leave school.“Tim and I were both told that it was unlikely the brewery would survive,”he said. “In the late ’60s, early ’70sthere appeared to be no future forthe business. There were newbeer taxes, we were operating a lotechold brewery, lagers were a hotitem and our Sparkling Ale was justplodding along.Coopers Brewery, 1862.“We are now in the brewing industry”…These are the immortal words of Thomas Cooper in a letter to hisbrother John after establishing a brewing enterprise in South <strong>Australia</strong>in 1862.Since Thomas Cooper began his one-man operation more than 140years ago, 27 descendants from four succeeding generations havecontributed to the business as partners, directors and employees.Today Coopers is the only remaining family owned brewery in <strong>Australia</strong>.In the early days, Coopers was not without plenty of stiff competition.By 1868 there were 10 metropolitan and 33 country breweries inSouth <strong>Australia</strong> alone. Of course today the bulk of <strong>Australia</strong>’s beerproduction is carried out by just a few multi-national companies.Thomas, a stonemason, discovered his brewing talents by accident.His wife Ann asked him to brew up a batch of ale from an old familyrecipe to help cure an illness. It wasn’t long before Thomas wasdelivering his Sparkling Ale and Extra Stout by horse and cart to a bandof loyal customers.Thomas was married twice – to Ann Brown in 1849 and to SarahPerry in 1874 – and it is the descendants of “both families” who run thebrewery today. Glenn Cooper, 54, (from “side A” of the family)Sir Thomas CooperTim, left, and Glenn Cooper“Home brewing tended to savethe brewery. Uncle Maxdeveloped technology to putsterile wort into a bag and that wasthe start of home brewing.”STORY CONTINUED ON PAGE 11GENERATIONS - FEBRUARY 2005 9

COVER STORYCoopers Brewery, 2001.BUSINESSMENTORINGWE provide and support <strong>Business</strong>Mentors for Directors, <strong>Business</strong>Owners, CEOs and Senior Executives.For further <strong>info</strong>rmation, please contact:CHRIS CARTNEY1st Floor, 123 Camberwell RdEast Hawthorn,VIC 3123T: 03 9811 6817E: ibmentors@bigpond.comW: www.International<strong>Business</strong>Mentors.com10 GENERATIONS - FEBRUARY 2005

STORY CONTINUED FROM PAGE 9When Glenn left school in the late sixties he went intoauto electronics. Tim studied medicine.According to Glenn, he received some sage advice early in his studies, notfrom a senior family member, but from a lecturer at the South <strong>Australia</strong>nInstitute of Technology (now part of the University of South <strong>Australia</strong>).“He told me I wasn’t a very good engineer but ‘you’ve got a bigmouth, you should go into sales’. It was the best advice I’ve ever had.”Glenn followed that advice and within a few years was running hisown computer company.Tim had graduated in medicine at the University of Adelaide and wentto England for more experience. He worked in London, Bristol andCardiff where he became hospital registrar in cardiology.In the late ’80s both were encouraged to join the family business.The brewery at that time was being run by the fourth generation ofCoopers – Bill (Tim’s father), Max and Ken (Glenn’s father).“I was put under the marketing manager and Tim answered to thebrewing manager,” Glenn said. “We were watched over by the olderCoopers and there were no favours given.”In the late ’90s the decision was made to establish a new brewery and$40 million was spent establishing Regency Park. Max had retired in98/99.Bill stayed on until the new brewery was established and retiredin 2000.The new brewery was opened in 2001 with output 21/2 times thatof the original operation at Leabrook.“We changed our PR and advertising company and the new blood reallystarted to show,” Glenn said.They made the decision to: “Take this bottle and put it in frontof people’s faces.”“Output has doubled in the past five to seven years. It is now a $100million a year business that employs 103 people. In the old days weemployed 150 people with much less turnover.”Coopers is firmly established as a South <strong>Australia</strong>n business and familyicon, what of the sixth generation taking the reins?(Glenn has two children – Rachel, 24 and Andrew, 21, and Timhas three: Louise 16, Sarah, 15 and Iain 11).Do Coopers have a succession plan in place?“We do and we don’t,” Glenn said. “It’s not fully documented, butit’s not urgent at the moment. I’m 54 and Tim’s 48 and we would liketo select the appropriate people from the sixth generation when thetime comes.”Helping you achieveyour goalsHLB Mann Judd is committed to helping yourbusiness grow successfully so that it providesfinancial security for you and your family.Our style is personal, attentive and solution oriented.Speak to us on any family business matter including:■ <strong>Business</strong> succession planning■ Achieving the best return from your business■ Strategic business advice and valuation■ <strong>Business</strong> and personal taxation■ Financial and superannuation planning■ <strong>Business</strong> and investment structures■ Audit services.Contact:Tony Fittler – HLB Mann Judd, Sydneytfittler@hlbnsw.com.au Tel (02) 9020 4000Bruce Rose – HLB Mann Judd, Sydneybrose@hlbnsw.com.au Tel (02) 9020 4000www.hlb.com.auOffices in Sydney, Melbourne, Adelaide, Brisbane, Cairns, Perth,Canberra and HobartGENERATIONS - FEBRUARY 2005 11

FEATUREGenerational ChangeAT ZUPPSWhen company founder Percy Zupp died last year, Terri Zupp and her father John realised changeswould need to be made to prepare for the future.TERRI Zupp always said she wouldnever enter the family businesswhich was established more than57 years ago.However, things can change.After six years and just twelvemonths as Dealer Principal at the MtGravatt branch of Queensland’sbiggest privately-owned motorvehicle group she took thedealership to the best selling Holdenoutlet in <strong>Australia</strong> for 2004.Percy ZuppThis was up from fifth, twelve months earlier.Following in her grandfather’s and father’s footsteps will not be easy butit has been a calculated move grooming Terri for the opportunity tohead the group.Managing Director Gary Gooding said that Terri had made great stridesand there will be a smooth transition when that time comes.Terri joined Zupps upon completion of a human resources degree,which was undertaken after studies in travel and tourism.John Zupp said there were to be changes in the business and HR wouldbe a serious component. Terri has now worked in a number ofareas of the business, which she sees as a vital strategy in understandingthe company properly. She spent eighteen months in fixed operationsof parts and services.“Dad came from the old school, he wasa bit more autocratic – you can expectthat as he grew the firm from nothing.We have very much an open door policy”.“For the first couple of years of me being here, dad and I probablythought that I would say ‘that’s it I am off’,” Terri told the Queensland<strong>Business</strong> Review.“Then my grandfather died and that made us realise we had no plan inplace in case dad died.”John ZuppJohn sat down with Terri and discussed succession planning. She movedinto the position of deputy managing director, to work under GaryGooding, and her father as Chairman.“That’s given me an arm’s distance from dad, but access to all hislearning”, she said.“It gives me an opportunity to make it all fit together, and (taking on amanagement role) frees up my time a bit to learn more and visitdealerships.“We want to ensure a seamless progression for our dealers.The next few years will be a serious learning exercise”, she said.She said she would not be as passionate about the business if it was apublic company or if anyone else owned shares, and she hoped to beable to pass the business on to the fourth generation.12 GENERATIONS - FEBRUARY 2005

The old Zupp Dealership office.Zupps has grown from the small garage opened by Percy in Ipswich– which expanded to a Land Rover franchise after John joinedthe business – to a 13-site 620-staff strong group of companies.The seven directors of Zupps pride themselves on their strategyof visiting dealers every few weeks and knowing employees’ names.She said the management style of the business had changed overthe years, just as the dynamics of the industry had changed.“Dad came from the old school, he was a bit more autocraticTerri Zupp– but you can expect that, he grew the business from nothing,” she said.The future of Zupps will involve continued expansion within thesouth-east Queensland region.Terri said her motivation for staying with and improving the businesshad never been money.“I am more satisfied with the fact that I can sit here at the end of the dayand say: ‘we’re strong, we’re financially viable, our staff numbersare growing – we’re employing 620 people’,” she said.Build, manage and protect your personal wealthRecognising the specific values, needs and circumstances of their clients, the experienced consultants at theGodfrey Pembroke 356 Collins Street Melbourne Practice are well positioned to offer local people andlocal businesses a comprehensive financial planning service on a wide range of financial matters including:• Wealth management and protection strategies• Retirement and pension planning including foreign pensions• Direct and managed investment portfolio construction• Superannuation RBL excess benefit management strategies• Superannuation business CGT exemptions when selling• Succession planning• Estate Planning and intergenerational wealth management• Charitable giving and family foundationsThe consultants at the 356 Collins St Melbourne Practice specialise in providing advice to businessowners and executives and seek out personalised financial solutions to financial planning and wealthmanagement problems. They build the bridge between lifestyle and living standards.MGO Private Financial Services Pty Ltd with ABN 52 140 255 284, are authorised representatives of GodfreyPembroke Limited registered address, 105-153 Miller Street, North Sydney, NSW, 2060. To find out morecontact Mark O’Toole, Practice Principal on 9672 5111 or mark.otoole@godfreypembroke.com.au for acomplimentary, obligation free consultation.Godfrey Pembroke – Level 10, 356 Collins Street Practice – A Wealth of Ideas ©GODFREY PEMBROKE LIMITED ABN 23 002 336 254AUSTRALIAN FINANCIAL SERVICES LICENSEE AND INSURANCE BROKERA member of the National group of companiesMark O’TooleGENERATIONS - FEBRUARY 2005 13

FOCUSTIME FOR FAMILY BUSINESSESTo Shine!IT’S that time again! <strong>Family</strong> <strong>Business</strong> <strong>Australia</strong> Awards program is underway and we are looking for your entry in any one of the four categories.In the only business award program to categorise its entrants bygeneration, we are seeking those first generation start-ups, those whohave successfully transferred to the second generation and all those whohave survived three or more generations.We know that family business is by far the largest sector in the <strong>Australia</strong>neconomy, and it is time now to honour those who deal successfully withthe issues of family and work under the same roof.The awards are open to all <strong>Australia</strong>n businesses that are substantiallyowned and operated by a family or group of families. Only those winnerswho have won the national award in any one category are disqualified fora period of four years, unless of course, they have successfully movedinto the succeeding generation and enter again in a new category!Hear what past winners have had to say. Winner of the <strong>Family</strong> <strong>Business</strong>of the Year, 2nd Generation in 2002, Adele Levinge, Director of Dennis<strong>Family</strong> Corporation said:"Winning the awards provided the family with a real buzz andconfirmation that what we were doing and where we were taking thebusiness was right."We shared the award with our staff, clients and business associates andit has proven to be a fantastic benefit to the organisation as a whole."We were so proud of our achievement that we displayed replicas of theaward at all our point-of-sale opportunities and also put the FBA awardwatermark on our letterhead and envelopes. Feedback from new andexisting clients has been very positive.14 GENERATIONS - FEBRUARY 2005

"The FBA awards program is a great opportunity to showcase theachievements of your family business and most importantly gives youthe opportunity to record and reflect milestones that the family businesshas achieved."This year, <strong>Business</strong> Review Weekly (BRW) will interview those winnerswilling to be featured and will compile a list of the Fastest 100 <strong>Family</strong><strong>Business</strong>es in <strong>Australia</strong>, to be featured in a bumper, bound, flagshipissue in July.The entry form is designed to assist you, the business owner, to assesshow you measure up in areas that will ensure success, like <strong>Family</strong><strong>Business</strong> Best Practice and Performance and Professionalism.The Federal Government’s Department of Small <strong>Business</strong> and Tourismis co-sponsoring the awards, and the national winners will beannounced at the 7th National Conference in Adelaide, in August.To enter, call your FBA office or email <strong>info</strong>@fambiz.com.au.<strong>Family</strong> <strong>Business</strong> <strong>Australia</strong> State Offices:NSW & ACT - Karen Doyle 02 9372 0552VIC - Gita Cohen 03 9529 6177QLD - Sandra Sparti 07 3839 5625SA - Jackie Schmidt 08 8364 4869WA - Kerry Clarke - 08 9284 0792WANT TOADVERTISE INGENERATIONS?Don’t miss out on this excitingopportunity for your companyin the next edition of Generations.We have very competitive rates for all displayadvertisements. Also, our Trade section features9 advertisements to a page, and provides a lowcost option for companies to highlight theirproducts or services.For further <strong>info</strong>rmation please contactNick Mountstephen on (03) 9885 4676or EMAIL nick@mountstephen.com.auSHAPING YOUR BUSINESS FOR TOMORROWAC CONSULTANCY GROUP HAS NEGOTIATED A DEAL WITH UNIDIAL PTY LTD TO PROVIDE INDEPENDENTADVICE ON DISCOUNTED TELECOMMUNICATION LANDLINE SERVICES THEREBY PROVIDING CLIENTSWITH PHONE RATES NOT GENERALLY AVAILABLE TO THE BUSINESS COMMUNITY.AC Consultancy Group will provide you with an obligation free estimate of savings (which currently rangebetween 20-40% of your phone bill). The service and equipment agreement on your current telephonelines remains with your current supplier (Telstra is preferred), thereby making this changeover“seamless” and without any obligations or contract period constraints.HOW DO I GET A NO OBLIGATION FREE PHONE ANALYSIS?Take a photocopy of your latest phone account (all pages) and either mail or fax the <strong>info</strong>rmation to:PO BOX 7007WPWATTLE PARK, VICTORIA 3128FAX: (03) 9808 0017For further <strong>info</strong>rmation please contact Angelo Muraca on 0425 769 647 to discuss otheravailable options/products in building and maximising your business wealth management strategies.GENERATIONS - FEBRUARY 2005 15

ADVISORY<strong>Family</strong> <strong>Business</strong> IssuesImpair GrowthFor years accountants have been telling us that family business issues are pivotal to the growthand success of owner managed businesses. Well finally there is some proof that these issuesare as pertinent to regional businesses as the cities.In recent reviews of small businesses undertaken by Grant Thornton aspart of the <strong>Business</strong> Improvement Pipeline Program (BIPP) offered bythe Queensland Department of State Development and Innovation inMaryborough, family business issues were identified as being a majorinhibitor to growth in nearly every business reviewed.The BIPP is a new program conducted by the Department to assistbusinesses in achieving growth, and is designed to provide assistance tolocal family owned businesses that are experiencing growth or have thepotential for growth, but may lack the necessary skills and resources toassess their current business position, or formulate growth strategies.The program, first run in October 2004, included the engagement ofGrant Thornton, specialists in the owner managed business sector, toconduct a half day seminar followed by a full day of individualconsultation regarding the current issues facing the participatingbusinesses. A strategic action plan was formulated for each.Tony Markwell of Grant Thornton cited that “the individual sessions areprimarily focused on drawing out the strengths, weaknesses,opportunities and threats of each business and then focusing on the coreissues of concern to owners. Once the issues are identified, an actionplan is developed which, if followed, will put the businesses on the pathto achieving their growth goals. What was not too surprising was that asignificant majority of the businesses that participated in the program hadat least one significant family issue which was impairing growth.”Despite the differences, and differing stages of development betweenthe businesses, most businesses encountered some common barriersand restraints that were restricting them from achieving the growth anddevelopment they sought. The program found that most businesses didnot consider there to be particular or significant technical challenges orproblems with their manufacturing processes or products, and most didnot identify the market for their products or servicing as a majorrestricting factor. Rather internal issues were dominant in theirconsiderations. Specific issues identified as being barriers to futuregrowth included:> Resources:> Premises;> Accounting, management and <strong>info</strong>rmation systems;> <strong>Family</strong> issues; and> Structure.The results of the program indicated that approximately 80% ofparticipating businesses had family issues that were paramount. Further,50% of all businesses participating highlighted a family issue as theirnumber one concern for the future. The family issues identified included:> Succession issues;> Remuneration planning;> Retirement and estate planning;> Introducing and rewarding non-family executives;> Resolving conflict;> Dealing with family members not involved in the business; and> Equity ownership by family members.From the sessions undertaken Grant Thornton discovered thatsuccession planning was the most common issue for these businesses,as several participants were either in or approaching their secondgeneration of ownership. The specific questions asked included:> Which child or family member is to take over management andpotentially ownership of the business?> How will we effect the transfer?> What if my children can’t afford to buy the business at marketvalue?> Is the business to be given to the new family member, but if sohow do senior family members extract wealth for retirement?Some participants not yet facing succession issues had conflict issuesbetween family members. These family related matters distractedmanagement, causing the business to lose customers, employees andowner focus. Alternatively, other businesses faced the obstacle ofinterfering family members, who no longer worked full time in thebusiness but maintained an ownership and management interest as theyhad established the business from inception.The remuneration of non family executives was another often commonissue discussed. It was often found that family members were trying tomaintain total control and be all things to all people, instead of engagingsuitably qualified non family executive staff.Tony Markwell advised that “the strategies developed for each businesswere not necessarily technical, financially challenging, or complex, butconsisted of several practical steps managers could undertake to resolveissues and achieve growth.16 GENERATIONS - FEBRUARY 2005

Prudent practice for owner operated enterprises is to discuss thesefamily issues, and engage the proper consultants from the outset. Takinga proactive approach is the best answer as is studying the success storiesof others who have effectively managed family related contentions.”It is apparent that as family businesses grow they will all need to addressat some point, various family related matters which may prevent boththe people and the business from reaching their potential.SEEKING IMPORT& DISTRIBUTIONBUSINESSESHGL has investments in 11 businesseswith management as part owners. Aftertwo acquisitions in 2003 totalling $14mHGL still has $30m to invest and weare seeking to buy more niche importand distribution businesses withpre-tax profit of $1.5m or greater.If your family owns a business of thistype and is interested in developingan exit strategy then HGL could bea potential buyer or equity partner.Grant Thornton’s team: Tony Markwell, Ian Judson & Michael McCannContact Andrew Bath on (02) 9221 7155or andrewbath@hgl.com.au Also referwww.hgl.com.au or ASX code: HNG.We can make it easy.<strong>Family</strong> owned and managed businesses can be complicated and generate uniquescenarios, often too difficult for the family to manage by themselves.Bentleys MRI specialises in providing accounting and management solutionsfor this complex sector.Bentleys MRI has become a trusted advisor to many families in business,offering the best in personal service in all areas critical to business success.Bentleys MRI is the missing link that most families in business do not have in-house.Bentleys MRI - the superior choice!Call Greg Lay or Philip Herbert on (03) 9274 0600 toarrange an appointment with a Bentleys MRI professional.114 William Street, Melbourne Victoria 3000Facsimile: (03) 9274 0660 Email: market@melb.bentleys.com.auWebsite: www.bentleys.com.auA member of Moores Rowland International, an association of independent accounting firms throughout the world. Associated in all States of <strong>Australia</strong>,the firms practising as Bentleys MRI and Moores Rowland are independent. They are affiliated and not in partnership.GENERATIONS - FEBRUARY 2005 17

ADVISORYAUSTRADE’SSIMPLE GUIDE FOR POTENTIAL EXPORTERSYou don’t have to be big to be an exporter. Last financial year in Queensland alone, Austrade helped morethan 200 local companies export for the first time. Many of them were small or medium-sized businesses andmost of them were family owned. By CAMERON MACMILLAN, State Manager – Austrade Queensland.“THIS financial year, we’re expecting a 25 to 30percent growth in numbers and once again, theevidence, in Queensland, and across the country, isclear – size doesn’t matter when it comes toexporting“, said Cameron MacMillan.But good planning and analysis are crucial. Austraderecommends that when businesses explore theirexport potential, they should first review their productsor services and current clients and then considerwhether their products or services are exportable.If businesses are interested in exporting, Cameronsuggests they work through the following check list tosee if they are ready to take the first steps towards asuccessful global future:Cameron MacMillanThe program, as a first step, helps firms assess theirexport capability and evaluate their export readiness.It also identifies potential target markets and providesadvice on international business issues.After determining which marketappears to have the best prospects,Austrade will provide eligiblecompanies with up to 20 hours freeservices in that market. Thesein-market services will be tailored tothe specific needs of the company.> Are my current products/services able to be marketed overseas?> Are my products/services unique in <strong>Australia</strong> and overseas?> Am I selling successfully interstate?> Are my products/services competitive without protection(tariffs or regulations)?> Can my products/services be used overseas?> Do existing customers buy my products/services for quality, price,brand, uniqueness or after-sales service?> Why do customers buy from me, rather than my competitors?> What is my value proposition?> Can I modify my products/services to suit overseas markets?> Must I repackage my products/services for overseas markets?> Can I transport my products/services overseas at a reasonable cost?> Are there seasonal trends overseas that provide opportunities?> Do I provide warranties, guarantees or service contracts?> Can I increase production to meet greater overseas demand?Once a market has been selected, Austrade export advisers can: adviseon international marketing strategies and marketing plans; providefeedback on promotional material; provide <strong>info</strong>rmation on economicconditions and commercial practices in the chosen market and evaluatethe suitability of particular products or services for the chosen market.This might include detailed research into the best market entry strategy,identifying a potential partner, representation on the company’s behalfto the local regulatory authorities, or making appointments for during amarket visit.The simple fact is there are plenty of <strong>Australia</strong>n companies – largeand small – with export potential. It’s just a matter of working closelywith them to find the right market in order the maximise theirchances of success.Austrade is an <strong>Australia</strong>n Government agency that assists companies of allsizes to develop their businesses overseas. For additional <strong>info</strong>rmation aboutexporting and training events visit www.austrade.gov.au/newexporter.Austrade has a New Exporter Developmentprogram, which provides eligible businesseswith practical assistance to develop theirbusiness into a successful exporting business.18 GENERATIONS - FEBRUARY 2005

KLIGER FILEAsset Protection without theTAX TEARSPETER DONOVAN of Kliger Partners explains to Nick Mountstephen the benefits of ContractualSecuritisation for family businesses.What do you mean by “Contractual Securitisation”?Contractual Securitisation is a package of documentsthat we have tailored for clients, many of whomrepresent family businesses, who hold assets in theirown name who wish to protect their accumulatedwealth from potential creditors.Why is Contractual Securitisation so important?The beauty of Contractual Securitisation is twofold.First, it allows a client to protect the accumulated wealththat they hold personally without having to transfer their Peter Donovanassets to another party such as a spouse, child orrelated entity. Second, there are no adverse taxationconsequences that arise. This can be contrasted to the significant capitalgains tax and often stamp duty liabilities that arise when a client transferstheir assets to another person or entity.As a result of this, the client does not lose or diminish control over theirwealth which may otherwise occur if they decide to transfer their assetsto a related person or entity.How does Contractual Securitisation work?The attraction of Contractual Securitisation lies in its simplicity. To protectyour wealth from creditors all you need to do is to sign two shortdocuments. The following example illustrates how the process works.Example of Contractual SecuritisationJohn has built up his trucking business over the last 10 years. He is thesole director and shareholder of the business. John’s accountant has toldhim that his shareholding in the business is worth $1.5 million.As all of the shares in the business are held by John personally, theywould be available to a trustee in bankruptcy to apply againstoutstanding debts in the event that John is successfully pursued by acreditor. In other words, even though the business is operated througha company, the accumulated wealth of the business can be attacked bycreditors through John’s shareholding.To minimise the prospect of this potential disaster occurring, John signsthe following two documents:Deed of CovenantUnder this Deed, John makes a promise to his wife, Mary, that on hisdeath his estate will be worth $1.5 million. John has complete freedomunder the Deed to do a number of things including varying the $1.5million amount and cancel the Contractual Securitisation processwhenever he desires.Hence, John is able to secure his assets but does notlose any of the freedom that is usually associated withentering into general security type arrangements.Deed of MortgageUnder this Deed, John secures his promise to Mary bymortgaging his shares to her. This is the securitisationprocess. Without this step, Mary would simply be anunsecured creditor. We need to elevate Mary to theposition of a secured creditor so that all unsecuredcreditors rank behind Mary in terms of asset distributionin the event of John’s bankruptcy.What are the tax implications of Contractual Securitisation?As discussed above, absolutely none.What if some of your assets are already subject to mortgages, etc?This has never presented a problem to me. All you need to do is to sitdown with your financier or other security holder and explain to themthe Contractual Securitisation process. Once they understand thearrangements they are usually more than happy to allow you to take afurther security interest over the relevant assets i.e. shares, real estate.What signal does Contractual Securitisation send to potential creditors?Contractual Securitisation signals to potential creditors in no uncertainterms that a client’s accumulated wealth is secured and is not available tothem to opportunistically “cherry pick”. By way of analogy, the process ofContractual Securitisation is akin to erecting a barbed wire fence arounda client’s assets, posting an “ENTER AT OWN RISK” sign on each side ofthe fence and guarding the perimeter with an aggressive dog.How relevant is this process to <strong>Family</strong> <strong>Business</strong>es?It is especially relevant to family businesses as many family businessproprietors focus solely on building their business and forget to divestthemselves of their assets before they increase in value.Of course, once the business is successful and the particular familymember has generated significant wealth in his or her name, it is too lateto transfer that wealth to a safer place away from the reach of potentialcreditors without triggering a significant taxation liability.For more <strong>info</strong>rmation please contact Peter Donovan, Tax Counsel atKliger Partners on (03) 8600 8882, or email: pdonovan@kligers.com.auGENERATIONS - FEBRUARY 2005 19

ADVISORYPlan for Succession– Before it is too lateWhile many family business owners would love their children to take over the business, often theyfind they have other careers or are just not interested. DENNIS MATTISKE looks at the problem.Others come to realise that the next generation is notsuited to running the business or they won’t workwell together.Often the most sensible solution is to sell the businesswhile it’s strong and vibrant, but that can be a difficult,and emotional, decision.What ever the solution, often when the time comes, thebusiness owner can find that there are many moreproblems than they envisaged, mainly because theyhave left it too late.Sometimes problems arise because the business ownerhas talked about his or her children taking over thebusiness for many years but has held on and held on, not giving themcontrol and creating resentment. Sometimes it is because an ownerdoesn’t have confidence in the ability of their offspring to run thebusiness. Sometimes it is simply because the owner can’t let go.Succession planning can manage and minimise such problems. It is a processthat must start many years before the hand-over takes place. Only with suchan approach is it likely a harmonious hand-over will be achieved and theexpectations of all family members – including those of the owner – met.Complications can always arise when itcomes to disposing of a family business. Forexample, some children might expect morethan the owner thinks they are entitled toIn setting up the plan, all affected family members need to be consulted so thattheir views and ambitions can be considered. It may be that family membersare already involved in the business one way or another. Some may beshareholders who have no desire to be involved in running the business.Some could already be working within the business and may feel hurt if theyare passed over when the new CEO is selected. Some may want to get anyentitled capital out of the business to start their own business.These differing family needs can be complex and difficult to satisfy, andcan lead to conflict without good succession planning.The benefits of a succession plan are numerous, and include:> Safeguarding all parties and reducing potential disputes;Peter Donovan> Providing remaining owners an opportunity topurchase the balance of the business at a fair price;> Ensuring continuity of the business in the face ofadversity i.e. ‘business as usual’;> Protecting the business – for example, from theloss of major customers;> Ensuring that the necessary funding mechanismsare pre-determined if a pay-out is required;> Highlighting the trigger events that may lead to atransfer of equity and control;> Providing a degree of financial security and stabilityto all involved family members.Putting off decisions on the future of thebusiness may reduce its value when itbecomes apparent an external sale is thefamily’s only alternative.No matter what your preferred options are in exiting the business,succession planning for all the key positions within the organisations is amust – not just your own. As we continually say to our clients – you musthave your business investor ready at all times. In doing so you will bestrengthening the business and increasing its value for when you do wishto sell or wind down your own involvement. Such an approach takes intoaccount your exit plan, making it more achievable and rewarding.Typically a family succession plan will need to answer a numberof questions such as:> Is the family involved in managing the business? Are they capableor do they need further development, training or other support?> Does the owner need to take money out of the business to helpfund his or her retirement?> Will the family be able to finance this?> Are there arrangements in place to look after the entitlementsor expectations of family members who are not actively involvedin the business?> Will some management positions need to be strengthened?STORY CONTINUED ON PAGE 23GENERATIONS - FEBRUARY 2005 21

BACKGROUNDThe Role OfPrivate EquityIN FAMILY BUSINESSPrivate equity is still a relatively new concept in the family business arena but it can offer a solutionto a number of problems commonly encountered by family businesses. PHILIP LATHAM, ManagingDirector, RMB Ventures, takes us through it.What is private equity?Private equity refers to funding that is available from professional investorsand institutions for investment in private organisations, and is a veryflexible form of finance. Literally, “private” means not publicly traded, and”equity” means non-debt. Private equity investors typically have a longterminvestment horizon (typically between three and six years butsometimes longer), and because their return is linked to the performanceof the organisation, they generally support the growth of the organisationthrough board representation, strategic corporate introductions andassistance with Marketing and Advertising opportunities.In addition, since private equity investors are incentivised to grow value,they typically do not require their investee companies to provide arunning yield via dividends or interest payments; therefore cash ispreserved and reinvested within the business.There is a small but established number of private equity financiers in<strong>Australia</strong>, but there are a number of differences between them:> Industry preference – for example, some are unwilling to invest inagricultural or resources companies;> Stage of the business – some will only invest in mature businesses,whilst others prefer earlier stage opportunities;> Size of the business – for example, RMB will typically only invest inbusinesses that have a minimum EBIT of $5m;> Involvement – some are more ‘hands-on’ whilst others are‘hands-off’; and> Amount of funding required.What role can private equity play in family businesses?Almost all family businesses face the following challenges at some stage:> Succession issues;> Growth beyond the family capital base;> Creating incentives to attract and keep strong professionalmanagers; and> Wealth diversification.The role of private equity in addressing these challenges is discussedbelow, along with two case studies.Succession issues and exitA private equity financier can be a source of funding for the nextgeneration to purchase the business from the previous one. Also, if thenext generation is unwilling or unsuitable to take over the business, orindeed if there is no next generation, private equity can provide a cleanexit for cash without the risk of disclosing sensitive commercial<strong>info</strong>rmation to competitors during due diligence. The sale of thebusiness to private equity investors often provides an opportunity forexisting management to purchase equity in the business via a“management buy-out”. Also, because private equity firms usually donot have synergies with their existing business, the employees generallyfare better under a sale to a private equity buyer than a trade buyer.Finally, private equity firms are often willing to structure a transaction toinclude “earn-outs” or minority equity stakes for owners wanting toretain some upside to the future growth of the business.Raising expansion capital without losing controlA common issue faced by family businessesis the strain placed on family finances bythe rapid growth of a business, whether tofund working capital or an acquisition ofa competitor or complementary businessthat is “too good to miss”.Private equity funds are experienced in creating structures to provideexpansion capital to businesses without causing the family to losecontrol. This could include investing capital as shareholder loans ratherthan equity to avoid excessive dilution to the family owners. Privateequity investors can often obtain bank financing on better terms thanthose available should the business attempt to raise capital on its own.As an example, in some of its investments, RMB has insisted that thebank does not demand a personal guarantee from the family. Once inpartnership with the family owners, private equity investors can providestrategic support, access to networks, deal sourcing and transactionadvice for growth opportunities, including acquisitions.22 GENERATIONS - FEBRUARY 2005

Attracting and retaining strong professional management<strong>Family</strong> businesses sometimes have issues with attracting and retainingstrong professional managers because they are often reluctant to partwith the equity in the business. It is very important that professionalmanagers’ interests are aligned with those of the family owners, andequity ownership by managers is the most powerful way to do this. Thedilution in equity by selling equity to the management team is almost alwayscompensated for many times over by the increased value of the business.The introduction of a private equity investor can provide the opportunityfor existing senior management to acquire an equity stake. Private equityinvestors maintain extensive networks of contacts with both potentialsenior managers and executive recruiters, so can assist the family with thesearch for a suitable individual. Also, private equity investors can advise thefamily owners on structuring appropriate incentive packages for seniormanagement (including salary, bonus, equity investment and options).Wealth diversificationMany family business owners wish to diversify their wealth whilstretaining control of their business. We have found that an excessiveconcentration of the family’s wealth in the business often leads todecision-making that is overly conservative and therefore notwealth maximising.Private equity can purchase a minority stake in the family business forcash, thereby providing capital for owners to pursue other businessopportunities without causing the family to lose involvement, control ora share in the future upside of the business.Case study: David Martin, Hastie GroupBernard Hastie & Co was established in the 1880s in the UK, and is nowin its fourth generation. David Martin, then Hastie’s London manager,expanded Hastie’s air-conditioning and ductwork business by openingHastie <strong>Australia</strong> in 1970, and in 1988 David and his partner completedthe acquisition of shares from the Hastie parent.In 2001, RMB invested equity in Hastie <strong>Australia</strong> to assist with theacquisition of West <strong>Australia</strong>n competitor Direct Engineering Services,giving Hastie a national presence. In addition, David sold some of hisshareholding to RMB enabling David to diversify his wealth, resulting inRMB owning 50% of the Hastie group. Since then, RMB has workedwith Hastie to make seven further acquisitions, transforming Hastie intothe largest provider of air-conditioning installation and services in<strong>Australia</strong> – Hastie’s turnover has grown from $100m in 2001 to over$330m in 2004.How can you learn more about Private Equity?The <strong>Australia</strong>n industry association site is at www.avcal.com.au.In addition to listing contact <strong>info</strong>rmation for its members, it also providesdetails to help you choose the private equity financer that best suitsyour needs.Philip Latham is the managing director of RMB Ventures, an <strong>Australia</strong>nprivate equity fund and a sponsor of <strong>Family</strong> <strong>Business</strong> <strong>Australia</strong>.He can be contacted on philip.latham@rmb.com.au or (02) 9256 6245.PLAN FOR SUCCESSION STORY CONTINUED FROM PAGE 21> Are there key employees who may be unsettledwith any change in ownership?> Are there key clients that need to be looked after?Complications can always arise when it comes to disposing of afamily business. For example, some children might expect morethan the owner thinks they are entitled to, or the owner may wishto reward and retain key employees through equity participation.There is also the issue of management succession (some childrenmight not be as ready to manage as they or the owner believes).There are a number of ways of selling the business to externalsources, including public listing, or selling to employees, as well aspassing it on to the family. Indeed, a business owner often feels anobligation to the staff to ensure continuity and may have madesuch a commitment to them in earlier years.So maybe a combination – such as some public ownership, somestaff ownership with diminishing family control – becomes theowner’s preferred option.All these considerations need to be addressed in the successionplan. Objective advice and professional assistance is of paramountimportance here. The emotional influences and pressures thatfamily can place on the business owner must be balanced with anobjective and realistic business-like approach.Handing over at retirement shouldalso balance the interest ofchildren who will not participatein the business.An essential element in the selling process is to ensure that thereis a deadline for the old owners and managers to cease theirinvolvement in the business. Continued involvement rarely worksunless there is a set exit date. The old owners have years ofexperience and always think that they know best and that the oldways are the right ways. The new owners no longer want to hearthis from older family members and want to be given theirindependence.There may also be special issues to be resolved if there is a largeextended or complex family structure involved, or if it is a sizeableand unique business that is largely dependent on the input of thecurrent owner. All businesses are different, as are the owner’scircumstances, so different and flexible approaches are needed. Allsuch issues should be seen as resolvable, but will always requiretime and almost certainly outside help to get the best result.Dennis Mattiske is a partner with accountants, business and financialadvisers HLB Mann Judd Sydney on 02 9020 4000GENERATIONS - FEBRUARY 2005 23

ADVISORYThe <strong>Family</strong> <strong>Business</strong>Goalkeeper“Who works with family business people to re-focus and then keeps them on track to achieve theirgoals?” PAUL SMITH, from Carnegie Management Group, walks us through the issues…Having a rough time at the office? Many <strong>Family</strong> <strong>Business</strong> owners,executives and managers are having a horrible time in their work. Somewould like to resign, many are frustrated by their lack of satisfaction andothers simply want to “give up”.This is a common experience of the “coach and mentor” who finds thatin a one-to-one setting, many business owners and executives feelcomfortable in confessing how they are really feeling about their jobs.Big pay packets and titles are no buffer to human needs and emotions.It’s a cliché, but life at the top really can be lonely or isolating, becausefew employees can imagine that their “superiors” might sometimes feelvulnerable and bewildered.Few employees, including relatives, realise that they might lock theirbosses into a projection in which they become a figment of someoneelse’s imagination. Leaders can be ascribed all sorts of motives andcircumstances that they just don’t want to have.Owners and executives feeling this way can benefit from contact with an‘business goalkeeper’ who can be a “deep, tough friend” with whomthey can develop enough trust and rapport to allow them to navigatethe issues of leadership – both personally and professionally.Executives under pressure can benefit by getting stuff off their chest.If they can talk about an issue and then isolate the source of the problemthen it can be worked on.Such individual mentoring can also deal with how to bring moremeaning, more heart, into a working life, particularly where ownershave been suddenly elevated into tough new roles. Not everyone isimmediately perfect for a new job, so an “external friend” can help themto get the job under their belt.The ultimate objectives of personal executive goalkeeping are toestablish goals and milestones and to commit to ongoing review –particularly important in an ever-changing world.Executives and managers seeking development do have to be willing tofumble and to get to the fuzzy edges where they discover somethingand create new models and potentials. Also they may need to be ableto embrace new mindsets and behaviours.A common difficulty facing modern <strong>Family</strong> <strong>Business</strong> owners is that withincorporate <strong>Australia</strong> there has developed a rather adolescent workingculture that is under-confident and that still emphasises skill-basedcompetency above all else.It is not uncommon for executives to relate that their organization is onlyinterested in their competencies, when what they really want to feel ismore purpose in their work: to bring more of their heart to work. Theywant to know how to breathe life into their work.This can happen if an organisation permits and nurtures whole humanbeings at work. When that occurs, and an individual starts to seek moremeaning, they become more creative, passionate, engaged andempathetic. They are happier and more fulfilled.This is an adult working culture where there is a balance between workand culture. The baby boomers (owners and executives) are movinginto adulthood (parenthood) at work and they are beginning to dealwith issues of “generativity” and care.“Generativity” means rather than producing everything oneself, the aimis to help others to be more productive. To encourage and develop thenext generation – with a plan. Hence there must also be a positivecommercial outcome at the end of the day.So therefore the initial focus is to identify what they really want to doand then make it happen with the appropriate strategies – succession,wealth creation, marketing, management and career development andbusiness re-engineering amongst many.It is a broader sense of membership and yet a lot of organisations hereare still based on competency and tribalism. Also hand-in-hand with this,the business community, as a whole, does not seem to encouragea learning culture for the next generation of leaders.Therefore it’s all about people - strategy development and execution forboth the individual and the organisation.When organisations allow individuals to become fully focused andengaged, words like productivity become redundant.<strong>Family</strong> <strong>Business</strong> goalkeepers don’t kick thegoals – they guide people on how to kick.Owners, executives and managers then willtranscend their job descriptions and kickthe ball right out of the park!Paul Smith, Principal, Carnegie Management GroupInternet: www.carnegiemg.com.au Contact Paul direct on 0407 503 46524 GENERATIONS - FEBRUARY 2005

NUTS AND BOLTSMEDIA INFORMATION<strong>Family</strong> <strong>Business</strong> <strong>Australia</strong>contactsWe welcome you to “Generations”, the magazine of <strong>Family</strong> <strong>Business</strong> <strong>Australia</strong>.The newly formatted magazine will help give voice to the interests andaspirations of a large and vital sector of the <strong>Australia</strong>n economy.‘Generations’ has a quarterly readership of 5,000 people critical torunning and managing family businesses in <strong>Australia</strong>.Research conducted by the National Mutual <strong>Family</strong> <strong>Business</strong> ResearchUnit shows that:> 80% of <strong>Australia</strong>n firms can be regarded as family businesses> they collectively have an estimated overall wealth of $1.3 trillion> they represent three times the capitalisation of the entire StockExchange of listed domestic companiesThese are compelling statistics.The composition of the members of <strong>Family</strong> <strong>Business</strong> <strong>Australia</strong> are:> owners and operators 83.5% and> professionals who advise family businesses 16.5%.There are many definitions of family business and FBA believes that twoor more members of the family, actively involved in the operations ormanagement of the business, are required to achieve classification as afamily business.FBA members are businesses of all sizes, in all types of industry sectorsand range from first generation to fifth generation.Over 50% of the membership is involved with the following Industries:> Insurance> Transport> Building Construction> Engineering> Timber/Hardware> Real Estate, Property Development & Investment> Legal Services> Finance> Management Consulting> Retail/Wholesale> Manufacturing> Accounting ServicesThe remaining 50% cover over 93 different industries including FuneralDirectors, Optometry, Textile Clothing and Footwear Industry, FoodManufacturing, Building Supply Services, Printing, Farms, Plumbing,Furniture Manufacturing, Scientific Industries, Sportsfield Manufacturing,Retirement Villages, Telecommunications, Electrical ApplianceManufacturing, Automotive Industries, Ceramic, Plastics, Rubber andChemical Products Manufacturing.On behalf of <strong>Family</strong> <strong>Business</strong> <strong>Australia</strong>Publisher and Advertising ManagerNick MountstephenMountstephen Communications Pty Ltd1706 Malvern Road,Glen Iris Victoria 3146T: (03) 9885 4676 F: (03) 9885 0350M: 0407 682 792E: nick@mountstephen.com.auAdvertising RepresentativeGita CohenC/- <strong>Family</strong> <strong>Business</strong> <strong>Australia</strong>Level 2, 568 St Kilda RoadMelbourne Vic 3004T: (03) 9529 6177 F: (03) 95296744E: gcohen@fambiz.com.auEditor and Production Co-ordinatorPeter WatersSuite 620, 370 St Kilda RoadMelbourne Vic 3004T: (03) 9686 0700 F: (03) 9686 2962M: 0411 033 227E: peter@headlinemedia.com.au<strong>Family</strong> <strong>Business</strong> <strong>Australia</strong>Level 1, 568 St Kilda RoadMelbourne Vic 3004T: (03) 9529 6177 F: (03) 9529 6744E: ptaylor@fambiz.com.auW: www.fambiz.com.auAll email correspondencefor Mountstephen Communicationsor Nick Mountstephen should be sentto the following address:nick@mountstephen.com.auINFORMATION CONTINUED ON PAGE 26GENERATIONS - FEBRUARY 2005 25

NUTS AND BOLTSINFORMATION CONTINUED FROM PAGE 26Vital StatisticsTurnover% of Member Companies with1 Under 1 million 18%2 1 - 5 million 35%3 6 - 10 million 4%456 711 1 - 25 employees 50%2 26 - 50 employees 23%3 51 - 100 employees 14%34 514 11 - 50 million 24%324 100 - 500 employees 13%25 51 - 100 million 9%5 500 plus employees 0%6 101 million plus 6%7 unknown 4%Issue, Dates & Deadlines 2005/06ADVERT. BOOKINGS& EDIT. SUBMISSIONS ADVERTISING MATERIAL PUBLICATION DATEEdition 10 (February 05) January 28 February 11 February 25Edition 11 (May 05) April 29 May 13 May 27Edition 12 (August 05) July 29 August 5 August 19Edition 13 (November 05) October 28 November 11 November 25Edition 14 (February 06) January 20 February 3 February 17Edition 15 (May 06) April 14 April 28 May 12Edition 16 (August 06) July 14 July 28 August 11Edition 17 (November 06) October 20 November 3 November 24SpecificationsFull PageHalf PageHorizontalHalf PageVerticalQuarter PageVerticalBLEED AREA220 x 285 mmBLEED AREANo BleedBLEED AREANo BleedBLEED AREANo BleedTYPE AREA190 x 255 mmTYPE AREA180 x 122 mmTYPE AREA86.5 x 240 mmTYPE AREA86.5 x 122 mmTRIM SIZE210 x 275 mmTRIM SIZE–TRIM SIZE–TRIM SIZE–26 GENERATIONS - FEBRUARY 2005

TRADEMaterial on diskAll advertising material is to be supplied ondisk and must be accompanied by a colourprintout of the advertisement and all necessaryfonts required for output (ie. SCREEN andPRINTER fonts). Under no circumstances|will separated printing film be accepted.The printing process does not allow the useof separated printing film. To ensurecorrect output of your advertisement, onlyMACINTOSH FILES created from, or usingthe following programs can be accepted:QUARKXPRESS: ensure your files are inseparated CMYK mode when creatingcolours and that ‘process separation’ isselected from the ‘edit colour’ menu. Pleasedelete all unused colours from the file.ADOBE ILLUSTRATOR: Please ensure thatif fonts are not converted to outlines, theappropriate fonts are supplied. Please deleteall unused colours from the file.ADOBE PHOTOSHOP: Files should be ingrayscale or CMYK mode (RGB notaccepted) and the resolution of the image isat 300 dpi at 100% output size, with theexception of bitmap files or black & white lineart which should be at 600 dpi at 100%output size.PC ARTWORK: If MACINTOSH files arenot achievable, we will accept high resolution(300 dpi) at 100% output size TIF, JPEG orEPS (rasterised or vector) files. If vectorbased EPS files, please outline all fonts.IMAGES/ILLUSTRATIONS/SCANS: Colourscreated in all documents from the aboveprograms must be made up of ProcessColours (ie. Cyan, Magenta, Yellow and Black).Please delete all unused colours from the file.Please note: Spot Colour refers to use of aProcess Colour not a PMS (Pantone) Colour.FILE COMPRESSION: Please try to avoidcompressing any files, but if compressed filesare supplied please include the necessarysoftware to decompress them.DISK TYPES: Please supply your advertisementon a MACINTOSH format CD-ROM. AnyCD’s that need to be returned will be done soat additional postage costs upon completion ofprinting.SPECIALISTS IN WAREHOUSING,TRANSPORT AND DISTRIBUTIONAUSTRALIA WIDEKAGAN BROS.CONSOLIDATED PTY. LTD.71-73 PIPE ROAD, LAVERTON NORTHVICTORIA 3026 AUSTRALIATelephone: +61 3 9369 2688Email: <strong>info</strong>@kagan.com.auInternet: www.kagan.com.auFacsimileAdministration: +61 3 9931 6466Operations: +61 3 9931 6467A.B.N. 56 006 444 355Want to advertise inGenerations at a reduced rate?Our Trade section features 9 advertisementsto a page providing a lower cost option forcompanies to highlight their products or services.advertisement size: 75 x 55mmDon’t miss out on advertising your companyin the next edition of Generations.For further <strong>info</strong>rmation please contact Nick Mountstephenon (03) 9885 4676 or EMAIL nick@mountstephen.com.auBUSINESSPARTNERSHIPChartered Accountant and FBAmember, with over 30 yearsexperience consulting to mediumsized businesses, would like toacquire an interest in a successfulbusiness where he can contributecapital and expertise, with a view toan ongoing partnership or ultimatecomplete buyout. Also available asan independent board member.Please call ROBERT LENTINon 0419 802 135 or 03 9827 7791.BRAND DEVELOPMENT.CORPORATE IDENTITY.BROCHURES.CATALOGUES.PACKAGING.SIGNAGE / POINT OF SALE.EXHIBITION DISPLAY.WEB DEVELOPMENTMAKE SOMEwww.rednoise.com.auLevel 1, 568 St Kilda RoadMelbourne Vic 3004T: (03) 9529 6177 F: (03) 9529 6744E: <strong>info</strong>@fambiz.com.auW: www.fambiz.com.auGENERATIONS - FEBRUARY 2005 27

Socom understands theneeds of family business…we’re a family business ourselvesWe have the ‘know how’ and the people to assistwith all your communications needs:• Public Relations• Media Relations• Government Relations• Community and stakeholder consultation• Issues management• Writing, editing and publications• Corporate capitalSocom has won many national and international awards – for victories won for our clients.Call David Hawkins, Managing Director on 03 8317 0111Level 2, 377 Lonsdale Street, Melbourne, VIC 3000Telephone 03 8317 0111 Fax 03 8317 0110www.socom.com.au