What Makes for Peace? - Berea College

What Makes for Peace? - Berea College

What Makes for Peace? - Berea College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

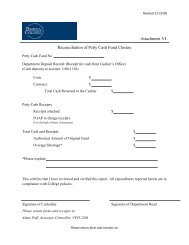

M. Elizabeth Culbreth, ‘64Chair of the Board, VirginiaMartin A. CoyleVice Chair of the Board, Cali<strong>for</strong>niaLarry D. ShinnPresident of the <strong>College</strong>, KentuckyVance E. Blade, ’82, KentuckyNancy E. Blair, ConnecticutAnn Bowling, ConnecticutRobert N. Compton, ’60, TennesseeJanice ”Jan” Hunley Crase, ’60, KentuckyChella S. David, ’61, MinnesotaPhilip D. DeFeo, ConnecticutGlenn R. Fuhrman, New YorkJim Gray, KentuckyWilliam R. Gruver, PennsylvaniaHeather Sturt Haaga, Cali<strong>for</strong>niaDonna S. Hall, Kentucky<strong>Berea</strong> <strong>College</strong> Board of Trustees2005-2006 Statements of ActivitiesHonorary TrusteesAlberta Wood Allen, MarylandJohn Alden Auxier, ’51, TennesseeJames T. Bartlett, OhioBarry Bingham, Jr., Kentucky *Jack W. Buchanan, ’46, KentuckyFrederic L. Dupree, Jr., Navy V-12’45, KentuckyKate Ireland, FloridaJuanita M. Kreps, ’42, North CarolinaAlice R. Manicur, MarylandThomas H. Oliver, South CarolinaKroger Pettengill, OhioWilma Dykeman Stokely, North CarolinaR. Elton White, ‘65, Florida*deceased April 2, 2006Other <strong>College</strong> OfficersOperating RevenueYears Ended June 30, 2006 and 20052006 2005Spendable return from long-term investments $ 32,879,062 $ 32,312,908Gifts and donations 4,925,708 5,549,914Federal and state grants 10,430,749 6,991,547Fees paid by students 1,119,222 1,071,613Other income 4,737,541 3,077,817Residence halls and food service 6,558,263 6,111,063Student industries and rentals 2,895,208 2,943,911Net assets released from restrictions 5,025,297 4,197,239Gross operating revenue 68,571,050 62,256,012Less: Student aid (3,328,559) (2,744,542)Net Operating Revenue 65,242,491 59,511,470Operating ExpensesProgram ServicesEducational and general 42,358,005 35,825,356Residence halls and food service 6,705,055 5,805,420Student industries and rentals 3,760,311 4,228,100Marian L. Heard, MassachusettsGeneva Bolton Johnson, WisconsinShawn C. D. Johnson, MassachusettsLucinda Rawlings Laird, KentuckyBrenda Todd Larsen, South CarolinaEugene Y. Lowe, Jr., IllinoisElissa May-Plattner, KentuckyHarold L. Moses, M.D., ’58, TennesseeJames E. Nevels, PennsylvaniaWilliam B. Richardson, KentuckyCharles Ward Seabury, II, Cali<strong>for</strong>niaDavid E. Shelton, ’69, North CarolinaMark Stitzer, New YorkDavid S. Swanson, MaineTyler S. Thompson, ’83, KentuckyDavid O. Welch, ’55, KentuckyDawneda F. Williams, VirginiaDrausin F. Wulsin, OhioRobert T. Yahng, ’63, Cali<strong>for</strong>niaJeffrey AmburgeyVice President <strong>for</strong> FinanceStephanie P. BrownerDean of the FacultyE. Diane Kerby, ‘75Vice President <strong>for</strong> Business and AdministrationWilliam A. LarameeVice President <strong>for</strong> Alumni and <strong>College</strong> RelationsCarolyn R. NewtonAcademic Vice President and ProvostJudge B. Wilson, II, ‘78General Counsel and SecretaryGail Wol<strong>for</strong>dVice President <strong>for</strong> Labor and Student LifeTotal program services 52,823,371 45,858,876Support Services 11,064,778 10,850,210Interest Expense 5,167,361Total Operating Expenses 63,888,149 61,876,447Operating revenue in excess of (less than) operatingexpenses from continuing operations 1,354,342 (2,364,977)Other Changes in Net AssetsGain on disposal of property, plant and equipment 323,069 126,539Gain on valuation of interest rate swaps 2,956,300Income from discontinued operations 1,297,418Cumulative effect of change in accounting principle (871,420)Investment return in excess of (less than) amountsdesignated <strong>for</strong> current operations 69,431,717 52,068,807Gifts and bequests restricted or designated <strong>for</strong> longterminvestments 14,641,749 20,605,731Restricted gifts <strong>for</strong> property, plant and equipment andother specific purposes 1,631,755 2,233,516Restricted spendable return on endowment investments 4,929,934 3,735,022Reclassification of net assets released from restrictions (5,025,297) (4,197,239)Net adjustment of annuity payment and deferred givingliability 1,290,452 1,107,141Total Change in Net Assets $ 90,662,601 $ 74,611,95812 13