IRS Determination / 501(c)(3) Letter - Mayor's Alliance for NYC's ...

IRS Determination / 501(c)(3) Letter - Mayor's Alliance for NYC's ...

IRS Determination / 501(c)(3) Letter - Mayor's Alliance for NYC's ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

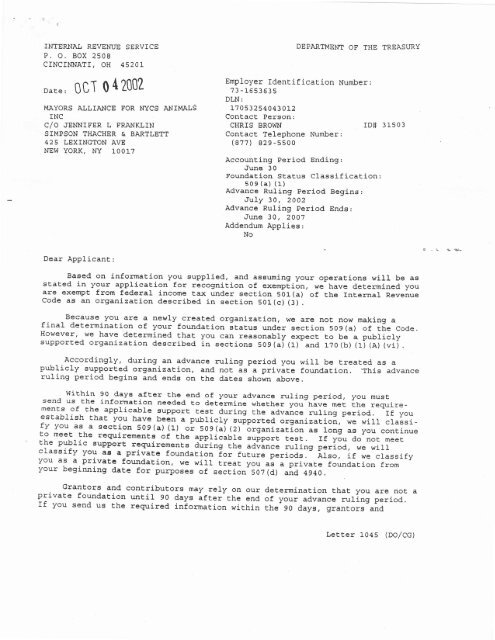

INTERNAI REVENUE SERVICEP. O. BOX 2508CINCINNATI, OH 4520LDaEe: OCT 042002I'IAYORS AIJLIANCET rtdFOR NYCS ANII4ALSc/o JEIETTFER L FRANKLTNSIMPSON THACHER & BARTLETT425 LEXINGTON AVENEW YORK, NY 10017DEPARTMENf OF THE TREASURYEmployer IdenEificaEion Number :73 -r653535DLN:17053254043012ConEact Pergon:CHRIS BROWNrD# 3rs03ConE,act Telephone Number:(87?) S29-ss00Account,ing Perlod Ending:,June 30Foundatlon Stat,us Classif ication :s09 (a) (1)Advance Ruling perlod Begins:.Tuly 30 , 2002Advance Ruling period Ends r.Tune 30 , 2007Addendum Applies:NoDear Appl.icanE,:Baeed on inf,ormation you supplied, and aseuming your operaEione will be aestaEed in your applicaEion <strong>for</strong> recognltion of exempt.ion, we have d,etermined youare exempt from federal income Eax under section <strong>501</strong> (a) of the Internal- RevenueCode as an organization described in section SOl(c) (3).Because you.are a newly creaEed organizaElon, we are nog norrr making afinal determination of your found.aEion itatus under secEion 509(a) of, the code.However, we have det,ermined E,haE you can reasonably expect to be a publiclysupported organizaE.i-on described in sectione 509(ai (l) and 1?o(b) (1) (A) (vi).. - Accordingly, during an advance ruling period you will be treated as apublicly supported organizaEion, and. noE, is-a privite foundaEion, Thls advanceruling period begins and ends on the daE,es ghown above.wiEhln 90 daye afEer the end of your advance ruring period, you musEsend us the in<strong>for</strong>matsion needed to detlrmine wheEher you have met trhemencsrequire-of Ehe applicalrJ-e supporc test, during Ehe ad,vance ruling period. rf youesEablish EhaE you have been a pu-blicIy suiported, organizatioi, wefy youwilr cLassi-as a section 509(a) (1) oi sog(ai tz)'Lrganizatlon ae tong as youlnut!-conE,inuei."the requiremenlE of the applicabl"Eest. rf youEhe pIblicdo nog meeEsupport requi.remente auiing Ehe "..ipo.truling period, weclassifywilryou aE a privatc found.aEion <strong>for</strong> future "Jil".u periods. ALso,youif we crassifyas a privatc foundation, we will E,reat yor, ." a privaEe foundat.ionyourfrombeginning date <strong>for</strong> purpoees of secEion 50? (d) and 4940.Grantors and contributors may rely on ourprivate foundabion until 90 days aft,er the endIf you send us the required iniormaEion withindeterminat,ion Ehat, you are not, aof your advance ruling period.the 90 days, grantors andLett,er1045 (DOlCc)

MAYORS AIJIJIAI{CE FOR NYCS ANIMALScont,ribugors may conEinud Eo rely on Ehe advance deEermination unEil we makea final det.erminaEion of your foundation sEatus'If we publish a not,ice in Ehe Internal Revenue Bulletin sEating thaE wewiLl no longer EreaE you as a publicly supported organizaEion, granEors andcont.ribut,ors may not rely on ELis aetlrminltion afEir the daEe we publish thenoEice. In addiEion, if you lose your sEaEuE as a publicly supported organizabion, and a grangor or contribuEor wag re3pgnSibll <strong>for</strong>, Or was aware of' EheacE or failure Eo act,, Ehat, regulced in your loes of such status' Chat personmay nots rely on thj.s determination from Ehe daEe of t.he act, or failure to acE 'Rlso, if a graneor or contribuEor learned thac we had given notlce trhats youwould be removed from claeslficatsion ae a publicly supportsed organlzatsion, tshentshac perEon may nots rely on bhie deEerminaElon aE of Ehe daEe he or Eheacquired such knowledge.If you change your sources of supporE, your purposes, character' or methodof operation, please le! us know so we can consider Ehe effecE of Ehe change onyour exempt stat,us and foundation status. If you amend your organizationaldocumenE or bylaws, please send us a copy of the amended document or bylaws.Also, let us know all changes in your name or address -!...: : =As of Januarl 1, L984, you are liable <strong>for</strong> social securiEy Eaxes underEhe Federal fnsurance Contrlbutione Ac! on amourlEe of $100 or more you Pay Eoeach of your employeee durlng a calendar year. You are noE liable <strong>for</strong> Ehe taximposed under the Federal Unemployment, Tax Act, (F"UTA).organizations that, are noE private foundat,ions are not, subJect go Ehe privaEefoundation excise Eaxes under Chapter 42 ot, the InEernal Revenue Code.However, you are noc automatically exempt from oEher federal excise Eaxea, Ifyou have any questions abouE exciee, emplo)rment, or oEher federal Eaxeg, pleaseIet us know.Donors may deduct contribuEions Eo you as provided in section 170 of theInternal- Revenue Code, Bequest,B, Iegaciee, devises, transfere, or gifEs to youor <strong>for</strong> your uae are deductible <strong>for</strong> Federal estaEe and gift tilc purPoseg if Eheymeet, E.he applicable provisione of eecEione 2055, 2106, and 2522 of Uhe Code.Donora may dcduce cantributlonB !o you only Eo lhe exEent, EhaE theirconEributiong are glfte, with no coneideraEion receiyed. Ticket purchaeee andsimiLar PaymentE in eonJunction wit,h fundraising event,e may noc neceeearilygualify as deductible contributiona, depending on the circumetances. RevenueRuling 67-246, publiehed in cumulat,ive Bulletin tg6"t-2, on page 104, givesgruidelines regarding when taxpayerE may deduct payment.s <strong>for</strong> admission Eo, oroEher participalion in, fundraising activities <strong>for</strong> chariEy.You are not reguired t,o file Form 990, Return of Organizat,ion ExempE FromIncome Tax, if your grogs receipts eaeh year are normally $25,000 or leee, Ifyou recej.ve a Form 990 package in the mail, slmply aEtach the label provided,check the box in Ehe heading to indicate EhaE your annual grose receipts arerrormally $25,000 or leEe, and sign Ehe return, Because you will be treated asa public charity <strong>for</strong> return filing purposes during your enEire advance rulingLeEEer 1045 (DOlCG)

-4-MAYORS ALLIAI{CEFOR IIYCS AI.TIMALSIf we said in.t,he heading of t,his IeEE.er E,hat an addendum applies, Eheaddendum encloeed is an inE,egral parE of Ehis letter.Because this let,ter could help us resolve any quesEions about your exempEstatus and foundat.ion st.atus, you should keep ie in your permanenE records.If you have any guestions, please cont,acE Ehe pereon whoee name andteJ.ephone number are shown in the heading of E,his let,ter.EncLoEure (s) :Form 8?2-CSlncerelyyours,dt- ?.d,^'*Loig G. u{tn"tDlrector, ExempE, Organizatione<strong>Letter</strong>1045 (DOICG)

Consent Fixing Period of Limitation UponAssessment of Tax Under Section 4940 of thelnternal Revenue Code(See instructions.)OMB No. 1545'0056To bc urcd wtthForm 1023. SubmttIn duPllcstc.Under section G5O1(cX4) of the lnternal Revenue Code, and as part of a?equest f iled, with Form 1023 that theorqanization named below be treated as a publicly supported organization under section 170(bXlXAXvi) orseition 509(aX2) during an advance ruling period,<strong>Mayor's</strong> <strong>Alliance</strong> <strong>for</strong> <strong>NYC's</strong> Animais, Inc' ,ent)244Suite New York 10001-7sttel cily or tom, stat., and ZIP coda)and theDistrict Director ollnternal Revenue' orAssistantCommissioner(EmPloYee Plans andExemPt Organizations)consent and agree that the period lor assessing ta,r (imposed under section 4940 of the Code) <strong>for</strong> any of 5 "thetax years in the advance ruiing period will extend g years,4 months, and 15 days beyond the end of the lirst ta,ryear.Hou,ever, if a notice of deficiency in tax <strong>for</strong> any of these years is sent to the organization be<strong>for</strong>e the p€riodexpires, tne iime <strong>for</strong> making an ass€ssment will be f urther e-xtendod by the number ol days the assessment isprohibited, plus 60 days.Ending date of first tax year June 30. 2003(Month, day, etd yetilName of organization (as shown in organizing document)Data<strong>Mayor's</strong> <strong>Alliance</strong> <strong>for</strong> NY Inc. ola Au&Officer or trust€€Type or print narne and titleJarre Hoftnan\lChair and PresidentFor <strong>IRS</strong> us€ onulstnct tJirector or Assistant Commissioner (Employeetans and Exernpt Oganizattons)Lois G. LemerDirebtoi, Exempt OrganizationsGroup llaragcr0cT 0\m2FOrRedustlon Acl Notlcc, scc pagc 7 of thc Form 1 023 lnstrucilons.STF FEOI585F