petrowest energy services trust announces $94.2 million of ... - BMIR

petrowest energy services trust announces $94.2 million of ... - BMIR

petrowest energy services trust announces $94.2 million of ... - BMIR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

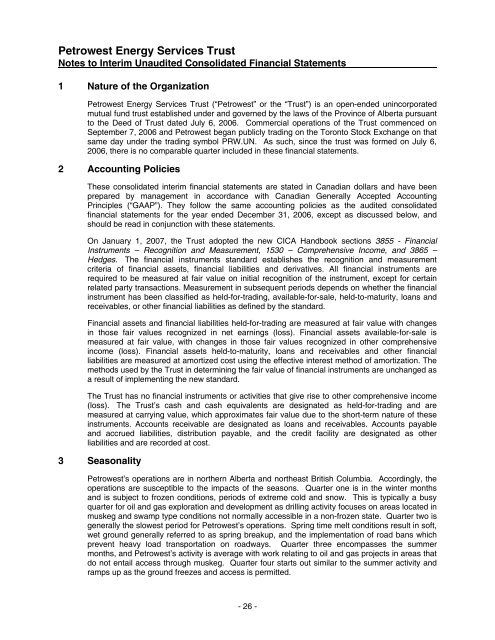

Petrowest Energy Services TrustNotes to Interim Unaudited Consolidated Financial Statements1 Nature <strong>of</strong> the OrganizationPetrowest Energy Services Trust (“Petrowest” or the “Trust”) is an open-ended unincorporatedmutual fund <strong>trust</strong> established under and governed by the laws <strong>of</strong> the Province <strong>of</strong> Alberta pursuantto the Deed <strong>of</strong> Trust dated July 6, 2006. Commercial operations <strong>of</strong> the Trust commenced onSeptember 7, 2006 and Petrowest began publicly trading on the Toronto Stock Exchange on thatsame day under the trading symbol PRW.UN. As such, since the <strong>trust</strong> was formed on July 6,2006, there is no comparable quarter included in these financial statements.2 Accounting PoliciesThese consolidated interim financial statements are stated in Canadian dollars and have beenprepared by management in accordance with Canadian Generally Accepted AccountingPrinciples (“GAAP”). They follow the same accounting policies as the audited consolidatedfinancial statements for the year ended December 31, 2006, except as discussed below, andshould be read in conjunction with these statements.On January 1, 2007, the Trust adopted the new CICA Handbook sections 3855 - FinancialInstruments – Recognition and Measurement, 1530 – Comprehensive Income, and 3865 –Hedges. The financial instruments standard establishes the recognition and measurementcriteria <strong>of</strong> financial assets, financial liabilities and derivatives. All financial instruments arerequired to be measured at fair value on initial recognition <strong>of</strong> the instrument, except for certainrelated party transactions. Measurement in subsequent periods depends on whether the financialinstrument has been classified as held-for-trading, available-for-sale, held-to-maturity, loans andreceivables, or other financial liabilities as defined by the standard.Financial assets and financial liabilities held-for-trading are measured at fair value with changesin those fair values recognized in net earnings (loss). Financial assets available-for-sale ismeasured at fair value, with changes in those fair values recognized in other comprehensiveincome (loss). Financial assets held-to-maturity, loans and receivables and other financialliabilities are measured at amortized cost using the effective interest method <strong>of</strong> amortization. Themethods used by the Trust in determining the fair value <strong>of</strong> financial instruments are unchanged asa result <strong>of</strong> implementing the new standard.The Trust has no financial instruments or activities that give rise to other comprehensive income(loss). The Trust’s cash and cash equivalents are designated as held-for-trading and aremeasured at carrying value, which approximates fair value due to the short-term nature <strong>of</strong> theseinstruments. Accounts receivable are designated as loans and receivables. Accounts payableand accrued liabilities, distribution payable, and the credit facility are designated as otherliabilities and are recorded at cost.3 SeasonalityPetrowest’s operations are in northern Alberta and northeast British Columbia. Accordingly, theoperations are susceptible to the impacts <strong>of</strong> the seasons. Quarter one is in the winter monthsand is subject to frozen conditions, periods <strong>of</strong> extreme cold and snow. This is typically a busyquarter for oil and gas exploration and development as drilling activity focuses on areas located inmuskeg and swamp type conditions not normally accessible in a non-frozen state. Quarter two isgenerally the slowest period for Petrowest’s operations. Spring time melt conditions result in s<strong>of</strong>t,wet ground generally referred to as spring breakup, and the implementation <strong>of</strong> road bans whichprevent heavy load transportation on roadways. Quarter three encompasses the summermonths, and Petrowest’s activity is average with work relating to oil and gas projects in areas thatdo not entail access through muskeg. Quarter four starts out similar to the summer activity andramps up as the ground freezes and access is permitted.- 26 -