SUNSHINE S CORPORATION - Drake Software Support

SUNSHINE S CORPORATION - Drake Software Support

SUNSHINE S CORPORATION - Drake Software Support

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

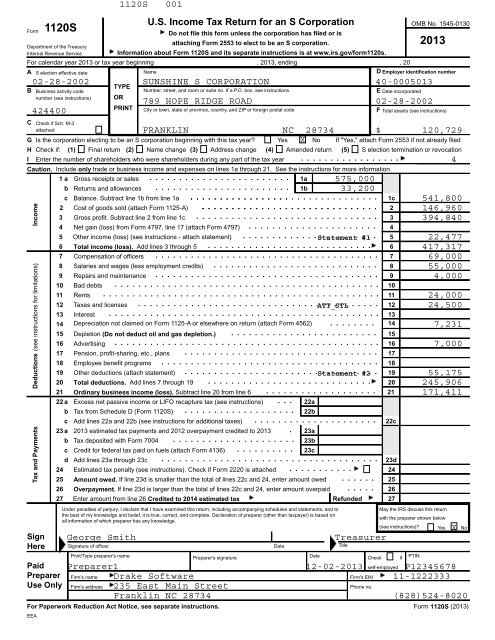

SignHere1120SPaidPreparerUse OnlyU.S. Income Tax Return for an S CorporationOMB No. 1545-0130FormDo not file this form unless the corporation has filed or isattaching Form 2553 to elect to be an S corporation.2013Department of the TreasuryInternal Revenue ServiceInformation about Form 1120S and its separate instructions is at www.irs.gov/form1120s.For calendar year 2013 or tax year beginning , 2013, ending , 20A S election effective dateNameD Employer identification numberBTYPEBusiness activity codeNumber, street, and room or suite no. If a P.O. box, see instructions.E Date incorporatednumber (see instructions)424400ORPRINT789 HOPE RIDGE ROADCity or town, state or province, country, and ZIP or foreign postal code02-28-2002F Total assets (see instructions)C Check if Sch. M-3attachedFRANKLIN NC 28734 $ 120,729G Is the corporation electing to be an S corporation beginning with this tax year? Yes X No If "Yes," attach Form 2553 if not already filedH Check if: (1) Final return (2) Name change (3) Address change (4) Amended return (5) S election termination or revocationI Enter the number of shareholders who were shareholders during any part of the tax year . . . . . . . . . . . . . . . . .4Caution. Include only trade or business income and expenses on lines 1a through 21. See the instructions for more information.1a Gross receipts or sales . . . . . . . . . . . . . . . . . . . . . . . . 1a 575,000b Returns and allowances . . . . . . . . . . . . . . . . . . . . . . . 1b 33,200c Balance. Subtract line 1b from line 1a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c 541,8002 Cost of goods sold (attach Form 1125-A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 146,9603 Gross profit. Subtract line 2 from line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 394,8404 Net gain (loss) from Form 4797, line 17 (attach Form 4797) . . . . . . . . . . . . . . . . . . . . . . 45 Other income (loss) (see instructions - attach statement) . . . . . . . . . . . . . Statement . . . . . . . .#1. . 5 22,4776 Total income (loss). Add lines 3 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 417,3177 Compensation of officers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 69,0008 Salaries and wages (less employment credits) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 55,0009 Repairs and maintenance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 4,00010 Bad debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1011 Rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 24,00012 Taxes and licenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ATT_STL . . . . . . . . . . 12 24,50013 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1314 Depreciation not claimed on Form 1125-A or elsewhere on return (attach Form 4562) . . . . . . . . 14 7,23115 Depletion (Do not deduct oil and gas depletion.) . . . . . . . . . . . . . . . . . . . . . . . . . 1516 Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 7,00017 Pension, profit-sharing, etc., plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1718 Employee benefit programs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1819 Other deductions (attach statement) . . . . . . . . . . . . . . . . . . . . . . . Statement . . . . . . . #2 . . . 19 55,17520 Total deductions. Add lines 7 through 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 245,90621 Ordinary business income (loss). Subtract line 20 from line 6 . . . . . . . . . . . . . . . . . . . 21 171,41122 a Excess net passive income or LIFO recapture tax (see instructions) . . . 22ab Tax from Schedule D (Form 1120S) . . . . . . . . . . . . . . . . . . . 22bc Add lines 22a and 22b (see instructions for additional taxes) . . . . . . . . . . . . . . . . . . . . . 22c23 a 2013 estimated tax payments and 2012 overpayment credited to 2013 . 23ab Tax deposited with Form 7004 . . . . . . . . . . . . . . . . . . . . . 23bc Credit for federal tax paid on fuels (attach Form 4136) . . . . . . . . . . 23cd Add lines 23a through 23c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23d24 Estimated tax penalty (see instructions). Check if Form 2220 is attached . . . . . . . . . . .2425 Amount owed. If line 23d is smaller than the total of lines 22c and 24, enter amount owed . . . . . . 2526 Overpayment. If line 23d is larger than the total of lines 22c and 24, enter amount overpaid . . . . . 2627 Enter amount from line 26 Credited to 2014 estimated taxRefunded 27Income(see instructions for limitations)DeductionsTax and PaymentsUnder penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and tothe best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based onall information of which preparer has any knowledge.For Paperwork Reduction Act Notice, see separate instructions.EEA1120S 00102-28-2002 <strong>SUNSHINE</strong> S <strong>CORPORATION</strong> 40-0005013George SmithTreasurerMay the IRS discuss this returnSignature of officerDateTitlePrint/Type preparer's name Preparer's signature Date Check if PTINself-employedFirm's nameFirm's EINFirm's addressPhone no.with the preparer shown below(see instructions)? Yes NoPreparer1 12-02-2013 P12345678<strong>Drake</strong> <strong>Software</strong> 11-1222333235 East Main StreetFranklin NC 28734 (828)524-8020XForm 1120S (2013)

<strong>SUNSHINE</strong> S <strong>CORPORATION</strong> 40-0005013Schedule B Other Information (see instructions)Check accounting method: Cash X AccrualForm 1120S (2013) Page 21 a b Yes Noc Other (specify)2 See the instructions and enter the:a Business activity WHOLESALEb Product or service FOOD3 At any time during the tax year, was any shareholder of the corporation a disregarded entity, a trust, an estate, or anominee or similar person? If "Yes," attach Schedule B-1, Information on Certain Shareholders of an S Corporation4 At the end of the tax year, did the corporation:a Own directly 20% or more, or own, directly or indirectly, 50% or more of the total stock issued and outstanding of anyforeign or domestic corporation? For rules of constructive ownership, see instructions. If "Yes," complete (i) through (v)below. . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .X(i)Name of Corporation(ii) Employer Identification Number (iii) Country of (iv) Percentage of Stock(if any) Incorporation Owned(v) If Percentage in (iv) is 100%, Enter theDate (if any) a Qualified Subchapter SSubsidiary Election Was MadebOwn directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in the profit, loss, orcapital in any foreign or domestic partnership (including an entity treated as a partnership) or in the beneficial interest of atrust? For rules of constructive ownership, see instructions. If "Yes," complete (i) through (v) below. . . . . . . . . . . . .X(i)Name of Entity(ii) Employer Identification Number (iv) Country of (v) Maximum Percentage Owned in Profit,(iii) Type of Entity(if any) Organization Loss, or Capital5ab678910ab111213 abEEAAt the end of the tax year, did the corporation have any outstanding shares of restricted stock?If "Yes," complete lines (i) and (ii) below.. . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . .(i) Total shares of restricted stock(ii) Total shares of non-restricted stockAt the end of the tax year, did the corporation have any outstanding stock options, warrants, or similar instruments?If "Yes," complete lines (i) and (ii) below.(i) Total shares of stock outstanding at the end of the tax year(ii) Total shares of stock outstanding if all instruments were executedHas this corporation filed, or is it required to file, Form 8918, Material Advisor Disclosure Statement, to provideinformation on any reportable transaction?Check this box if the corporation issued publicly offered debt instruments with original issue discountIf checked, the corporation may have to file Form 8281, Information Return for Publicly Offered Original Issue DiscountInstruments.If the corporation: (a) was a C corporation before it elected to be an S corporation or the corporation acquired anasset with a basis determined by reference to the basis of the asset (or the basis of any other property) inthe hands of a C corporation and (b) has net unrealized built-in gain in excess of the net recognized built-in gainfrom prior years, enter the net unrealized built-in gain reduced by net recognized built-in gain from prior years (seeinstructions) . . . . . . . . . . . . . . . . . . . . . . . $Enter the accumulated earnings and profits of the corporation at the end of the tax year. $Does the corporation satisfy both of the following conditions?The corporation's total receipts (see instructions) for the tax year were less than $250,000The corporation's total assets at the end of the tax year were less than $250,000If "Yes," the corporation is not required to complete Schedules L and M-1.During the tax year, did the corporation have any non-shareholder debt that was canceled, was forgiven, or had theterms modified so as to reduce the principal amount of the debt?If "Yes," enter the amount of principal reduction $During the tax year, was a qualified subchapter S subsidiary election terminated or revoked? If "Yes," see instructionsDid the corporation make any payments in 2013 that would require it to file Form(s) 1099?If "Yes," did the corporation file or will it file all required Forms 1099?. . . . . . . . . . . . . . .. . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . .. . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . .. . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . .XForm 1120S (2013)

<strong>SUNSHINE</strong> S <strong>CORPORATION</strong> 40-0005013Schedule K Shareholders' Pro Rata Share Items Total amount1 Ordinary business income (loss) (page 1, line 21) . . . . . . . . . . . . . . . . . . . . . . . . . 1 171,411Form 1120S (2013) Page 3AlternativeIncome (Loss)DeductionsCreditsForeign Transaction(AMT) ItemsMinimum TaxItems AffectingShareholderBasisEEA. . . . . . . . . . . . . . . . . . . . . .2 Net rental real estate income (loss) (attach Form 8825)23a Other gross rental income (loss) . . . . . . . . . . . . . . . . . . 3ab Expenses from other rental activities (attach statement) . . . . . . . 3bc Other net rental income (loss). Subtract line 3b from line 3a . . . . . . . . . . . . . . . . . . . . 3c4 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45 Dividends: a Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5ab Qualified dividends . . . . . . . . . . . . . . . . . . 5b6 Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67 Net short-term capital gain (loss) (attach Schedule D (Form 1120S)) . . . . . . . . . . . . . . . . 78a Net long-term capital gain (loss) (attach Schedule D (Form 1120S)) . . . . . . . . . . . . . . . . 8ab Collectibles (28%) gain (loss) . . . . . . . . . . . . . . . . . . . . 8bc Unrecaptured section 1250 gain (attach statement) . . . . . . . . . 8c9 Net section 1231 gain (loss) (attach Form 4797) . . . . . . . . . . . . . . . . . . . . . . . . . . 910 Other income (loss) (see instructions) . . Type1011 Section 179 deduction (attach Form 4562) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1112a Charitable contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12ab Investment interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12bc Section 59(e)(2) expenditures (1) Type (2) Amount12c(2)d Other deductions (see instructions) . . . Type12d13a Low-income housing credit (section 42(j)(5)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13ab Low-income housing credit (other) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13bc Qualified rehabilitation expenditures (rental real estate) (attach Form 3468) . . . . . . . . . . . . . . 13cd Other rental real estate credits (see instructions) . . Type13de Other rental credits (see instructions) . . . . . . . Type13ef Biofuel producer credit (attach Form 6478) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13fg Other credits (see instructions) . . . . . . . . . . Type13g14a Name of country or U.S. possessionb Gross income from all sources . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14bc Gross income sourced at shareholder level . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14cForeign gross income sourced at corporate leveld Passive category . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14de General category . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14ef Other (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14fDeductions allocated and apportioned at shareholder levelg Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14gh Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14hDeductions allocated and apportioned at corporate level to foreign source incomei Passive category . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14ij General category . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14jk Other (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14kOther informationl Total foreign taxes (check one): Paid Accrued . . . . . . . . . . . . . . . . . . . 14lm Reduction in taxes available for credit (attach statement) . . . . . . . . . . . . . . . . . . . . . . 14mn Other foreign tax information (attach statement)15a Post-1986 depreciation adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15ab Adjusted gain or loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15bc Depletion (other than oil and gas) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15cd Oil, gas, and geothermal properties-gross income . . . . . . . . . . . . . . . . . . . . . . . . . . 15de Oil, gas, and geothermal properties-deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . 15ef Other AMT items (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15f16a Tax-exempt interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16ab Other tax-exempt income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16bc Nondeductible expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16cd Distributions (attach statement if required) (see instructions) . . . . . . . . . . . . . . . . . . . . 16de Repayment of loans from shareholders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16e(354)176,000Form 1120S (2013)

Form 1120S (2013) Page 4Schedule K Shareholders' Pro Rata Share Items (continued)Total amount17 a Investment income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17ab Investment expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17bc Dividend distributions paid from accumulated earnings and profits . . . . . . . . . . . . . . . . 17cd Other items and amounts (attach statement)OtherInformationReconciliation<strong>SUNSHINE</strong> S <strong>CORPORATION</strong> 40-000501318 Income/loss reconciliation. Combine the amounts on lines 1 through 10 in the far rightcolumn. From the result, subtract the sum of the amounts on lines 11 through 12d and 14I . . . . 18 171,411Schedule L Balance Sheets per BooksBeginning of tax yearEnd of tax yearAssets (a) (b) (c) (d)1 Cash . . . . . . . . . . . . . . . . . .35,222 35,1142a Trade notes and accounts receivable . . . 5,000 6,000b Less allowance for bad debts . . . . . . ( ) 5,000 ( ) 6,0003 Inventories . . . . . . . . . . . . . . . .17,000 20,0004 U.S. government obligations . . . . . . .5 Tax-exempt securities (see instructions) . .6 Other current assets (attach statement) . .7 Loans to shareholders . . . . . . . . . .8 Mortgage and real estate loans . . . . . .9 Other investments (attach statement) . . .10 a Buildings and other depreciable assets . . 363,000 363,000b Less accumulated depreciation . . . . . . ( 296,154 ) 66,846 ( 303,385 ) 59,61511 a Depletable assets . . . . . . . . . . . .b Less accumulated depletion . . . . . . . . ( ) ( )12 Land (net of any amortization) . . . . . .13 a Intangible assets (amortizable only) . . . .b Less accumulated amortization . . . . . . ( ) ( )14 Other assets (attach statement) . . . . . .15 Total assets . . . . . . . . . . . . . . . .124,068 120,729Liabilities and Shareholders' Equity16 Accounts payable . . . . . . . . . . . .2,350 3,60017 Mortgages, notes, bonds payable in less than 1 year . .18 Other current liabilities (attach statement) .19 Loans from shareholders . . . . . . . . .20 Mortgages, notes, bonds payable in 1 year or more . .21 Other liabilities (attach statement) . . . . .22 Capital stock . . . . . . . . . . . . . . .5,000 5,00023 Additional paid-in capital . . . . . . . . .24 Retained earnings . . . . . . . . . . . .116,718 112,12925 Adjustments to shareholders' equity (attach statement)26 Less cost of treasury stock . . . . . . . .( ) ( )27 Total liabilities and shareholders' equity . .124,068 120,729EEAForm 1120S (2013)

1125A 001Form1125-A Cost of Goods Sold(Rev. December 2012)Department of the TreasuryInternal Revenue ServiceNameAttach to Form 1120, 1120-C, 1120-F, 1120S, 1065, or 1065-B.Information about Form 1125-A and its instructions is at www.irs.gov/form1125a.OMB No. 1545-2225Employer identification number<strong>SUNSHINE</strong> S <strong>CORPORATION</strong> 40-0005013. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .17,000135,96014,0001 Inventory at beginning of year12 Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 Cost of labor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34 Additional section 263A costs (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . 45 Other costs (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56 Total. Add lines 1 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6166,9607 Inventory at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 720,0008 Cost of goods sold. Subtract line 7 from line 6. Enter here and on Form 1120, page 1, line 2 or theappropriate line of your tax return (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . 8146,9609a Check all methods used for valuing closing inventory:(i) X Cost(ii) Lower of cost or market(iii) Other (Specify method used and attach explanation.)b Check if there was a writedown of subnormal goods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .c Check if the LIFO inventory method was adopted this tax year for any goods (if checked, attach Form 970) . . . . . . . . . . . .d If the LIFO inventory method was used for this tax year, enter amount of closing inventory computedunder LIFO . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9de If property is produced or acquired for resale, do the rules of section 263A apply to the entity (see instructions)? . . . . Yes X Nof Was there any change in determining quantities, cost, or valuations between opening and closing inventory? If "Yes,"attach explanation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes NoXFor Paperwork Reduction Act Notice, see instructionsEEAForm 1125-A (Rev. 12-2013)

Schedule K-1(Form 1120S)2013For calendar year 2013, or taxDepartment of the TreasuryInternal Revenue Serviceyear beginning , 2013ending , 20Shareholder's Share of Income, Deductions,Credits, etc.See page 2 of form and separate instructions.Part I Information About the CorporationA Corporation's employer identification number40-0005013B Corporation's name, address, city, state, and ZIP code<strong>SUNSHINE</strong> S <strong>CORPORATION</strong>Part IIIShareholder's Share of Current Year Income,Deductions, Credits, and Other Items1 Ordinary business income (loss) 13 Credits671112Final K-1 Amended K-1 OMB No. 1545-013024,48723Net rental real estate income (loss)Other net rental income (loss)4 Interest income5a Ordinary dividends5b Qualified dividends14 Foreign transactions789 HOPE RIDGE ROADFRANKLIN NC 2873467RoyaltiesNet short-term capital gain (loss)C IRS Center where corporation filed returnCINCINNATIPart II Information About the Shareholder8a8bNet long-term capital gain (loss)Collectibles (28%) gain (loss)DEShareholder's identifying number400-00-2091Shareholder's name, address, city, state, and ZIP codeGEORGE SMITH8c9Unrecaptured section 1250 gainNet section 1231 gain (loss)10 Other income (loss)15Alternative minimum tax (AMT) items444 REDBIRD LANE A (51)FRANKLIN NC 28734FShareholder's percentage of stockownership for tax year. . . . . . . . . .14.28571%11 Section 179 deduction16 Items affecting shareholder basis12 Other deductionsD 25,142For IRS Use Only17Other information* See attached statement for additional information.For Paperwork Reduction Act Notice, see Instructions for Form 1120S. IRS.gov/form1120SSchedule K-1 (Form 1120S) 2013EEA

Schedule K-1 (Form 1120S) 2013This list identifies the codes used on Schedule K-1 for all shareholders and provides summarized reporting information for shareholders whofile Form 1040. For detailed reporting and filing information, see the separate Shareholder's Instructions for Schedule K-1 and theinstructions for your income tax return.CodeReport on1. Ordinary business income (loss). Determine whether the income (loss) isM Credit for increasing researchpassive or nonpassive and enter on your return as follows:activitiesReport onN Credit for employer socialSee the Shareholder's InstructionsPassive lossSee the Shareholder's Instructionssecurity and Medicare taxesPassive incomeSchedule E, line 28, column (g)O Backup withholdingNonpassive lossSchedule E, line 28, column (h)P Other creditsNonpassive incomeSchedule E, line 28, column (j)14. Foreign transactions2. Net rental real estate income (loss)See the Shareholder's InstructionsA Name of country or U.S.possession3. Other net rental income (loss) B Gross income from all sourcesForm 1116, Part INet income Schedule E, line 28, column (g) C Gross income sourced atNet lossSee the Shareholder's Instructionsshareholder level4. Interest incomeForm 1040, line 8aForeign gross income sourced at corporate level5a. Ordinary dividendsForm 1040, line 9aD Passive categoryE General categoryForm 1116, Part I5b. Qualified dividendsForm 1040, line 9bF Other6. RoyaltiesSchedule E, line 4Deductions allocated and apportioned at shareholder level7. Net short-term capital gain (loss)Schedule D, line 5G Interest expenseForm 1116, Part IH OtherForm 1116, Part I8a. Net long-term capital gain (loss)Schedule D, line 12Deductions allocated and apportioned at corporate level to foreign source8b. Collectibles (28%) gain (loss)28% Rate Gain Worksheet, line 4 income(Schedule D instructions)I Passive category8c. Unrecaptured section 1250 gainSee the Shareholder's InstructionsJ General categoryForm 1116, Part IK Other9. Net section 1231 gain (loss)See the Shareholder's InstructionsOther information10. Other income (loss) L Total foreign taxes paidForm 1116, Part IICodeM Total foreign taxes accruedForm 1116, Part IIA Other portfolio income (loss)See the Shareholder's InstructionsN Reduction in taxes available forB Involuntary conversionsSee the Shareholder's Instructionscredit Form 1116, line 12C Sec. 1256 contracts & straddles Form 6781, line 1O Foreign trading gross receipts Form 8873D Mining exploration costs recapture See Pub. 535P Extraterritorial income exclusion Form 8873E Other income (loss)See the Shareholder's InstructionsQ Other foreign transactionsSee the Shareholder's Instructions15. Alternative minimum tax (AMT) items11. Section 179 deductionSee the Shareholder's InstructionsA Post-1986 depreciation adjustment12. Other deductions See theB Adjusted gain or lossA Cash contributions (50%)Shareholder'sC Depletion (other than oil & gas)B Cash contributions (30%)Instructions andD Oil, gas, & geothermal - gross incomeC Noncash contributions (50%)the Instructions forE Oil, gas, & geothermal - deductionsD Noncash contributions (30%)See the Shareholder's Form 6251F Other AMT itemsE Capital gain property to a 50%Instructionsorganization (30%)16. Items affecting shareholder basisF Capital gain property (20%)A Tax-exempt interest incomeForm 1040, line 8bG Contributions (100%)B Other tax-exempt incomeH Investment interest expense Form 4952, line 1C Nondeductible expensesI Deductions - royalty income Schedule E, line 19D DistributionsSee the Shareholder'sJ Section 59(e)(2) expendituresSee the Shareholder's InstructionsE Repayment of loans fromInstructionsK Deductions - portfolio (2% floor) Schedule A, line 23shareholdersL Deductions - portfolio (other) Schedule A, line 2817. Other informationM Preproductive period expensesSee the Shareholder's InstructionsA Investment incomeForm 4952, line 4aN Commercial revitalization deductionB Investment expenses Form 4952, line 5from rental real estate activitiesSee Form 8582 instructionsC Qualified rehabilitation expendituresO Reforestation expense deductionSee the Shareholder's Instructions(other than rental real estate)See the Shareholder's InstructionsP Domestic production activitiesD Basis of energy propertySee the Shareholder's InstructionsinformationSee Form 8903 instructionsE Recapture of low-income housingQ Qualified production activities income Form 8903, line 7b credit (section 42(j)(5)) Form 8611, line 8R Employer's Form W-2 wages Form 8903, line 17 F Recapture of low-income housingS Other deductions See the Shareholder's Instructions credit (other) Form 8611, line 8G Recapture of investment credit See Form 425513. CreditsH Recapture of other creditsSee the Shareholder's InstructionsA Low-income housing credit (sectionI Look-back interest - completed42(j)(5)) from pre-2008 buildings long-term contracts See Form 8697B Low-income housing credit (other) fromJ Look-back interest - income forecastpre-2008 buildings method See Form 8866C Low-income housing credit (sectionK Dispositions of property withSee the Shareholder's42(j)(5)) from post-2007 buildingssection 179 deductionsInstructionsD Low-income housing credit (other) L Recapture of section 179from post-2007 buildingsdeductionE Qualified rehabilitation expendituresM Section 453(I)(3) information(rental real estate)N Section 453A(c) informationF Other rental real estate creditsO Section 1260(b) informationG Other rental creditsP Interest allocable to productionSee the Shareholder'sH Undistributed capital gains credit Form 1040, line 71, box a expendituresInstructionsI Alcohol and cellulosic biofuel fuelsQ CCF nonqualified withdrawalscreditR Depletion information - oil and gasJ Work opportunity creditSee the Shareholder'sS Amortization of reforestationK Disabled access credit Instructions costsL Empowerment zone and renewalT Section 108(i) informationcommunity employment creditU Other informationPage 2EEAN

Stock basisDebt BasisShareholder's Adjusted Basis WorksheetKeep for your records.Shareholder Number: TIN: Tax year ending: Ownership %:Shareholder Name: GEORGE SMITHCorporation Name:EIN1 Stock basis, beginning of year (Not less than zero) 12 Additional Capital Contributions of Stock Purchased 23 Increases for income and gain items:a Ordinary Income (Sch K-1, Line 1) a 24,487b Real Estate Rental Income (Sch K-1, Line 2) bc Other Rental Income (Sch K-1, Line 3c) cd Interest, Dividends & Royalties (Sch K-1, Lines 4, 5 & 6) de Capital Gain (Sch K-1, Lines 7 & 8a) ef Other Portfolio Income (Sch K-1, Line 10a) fg Section 1231 Gain (Sch K-1, Line 9) gh Other Income (Sch K-1, Line 10) hTotal Income and Gain Items (Total lines 3a-3h) 3a-h 24,487i Increase for Non-Taxable Income (Sch K-1, Lines 16a & b) 3ij Increase for Excess Depletion Adjustment 3jk Increase from Recapture of Business Credits (See IRC 49(a), 50(a), 50(c)(2) & 1371(d)) 3kl Gain from 179 asset disposition 3l4 Stock Basis Before Distributions (Add lines 1 through 3) 45 Reduction for Non-Taxable Distributions (Sch K-1, Line 16d) 56 Stock Basis Before Non-Ded. Expense & Depletion (Cannot be negative) 67a Decrease for Non-Deductible Expense/Credit Adj (Sch K-1. Line 16c & 13) ab Decrease for Depletion (Sch K-1, Line 17r) b 78 Stock Basis Before Allowable Losses & Deductions (Cannot be negative) 89 Decreases for Loss and Deduction itemsa Ordinary Loss (Page 2, Col e, Line 9a) ab Real Estate Rental Loss (Page 2, Col e, Line 9b) bc Other Rental Loss (Page 2, Col e, Line 9c) cd Capital Loss (Page 2, Col e, Line 9d) de Other Portfolio Loss (Page 2, Col e, Line 9e) ef Section 1231 Loss (Page 2, Col e, Line 9f) fg Other Loss (Page 2, Col e, Line 9g) gh Charitable Contributions (Page 2, Col e, Line 9h) hi Section 179 Expense (Page 2, Col e, Line 9i) ij Portfolio Income Expenses (Page 2, Col e, Line 9j) jk Other Deductions (Page 2, Col e, Line 9k) kl Interest Expense on Investment Debt (Page 2, Col e, Line 9l) lm Total Foreign Taxes Paid/Accrued (Page 2, Col e, Line 9m) mn Section 59(e) Expenditures (Page 2, Col e, Line 9n) nTotal Loss and Deduction Items (Total Lines 9a-9n) 9a-no Other decreases (Page 2, Col e, Line 9o) 9op Loss from 179 asset disposition (Page 2, Col e, Line 9n) 9pTotal Decrease for Loss and Deductions Items and Business Credits 910 Less: net increase applied to debt basis 1011 Stock Basis at End of Year (Cannot be negative) 1112 Debt basis at beginning of year (not less than zero) 1213 New loans to corporation during year 1314 Restoration of Debt Basis (Line 10) 1415 Less: Loans repaid by corporation during the year 1516 Less: Applied against excess loss and deductions / non-deductible items 1617 Debt basis at the end of tax year (combine lines 12-16) (not less than zero) 1718 Shareholder's total basis at end of tax year (combine lines 11 and 17) 18CarryoverTotalDebt Basis AppliedDisallowedAgainst ExcessLossesLosses and Deductions19 Total Beginning of year20 Add: Losses and deductions this year21 Less: Applied this year22 End of year (Not less than zero)2013400-00-2091 12-31-2013 14.285714<strong>SUNSHINE</strong> S <strong>CORPORATION</strong> 40-000501370,95995,44625,14270,30470,30470,30470,304WK_SBAS.LD

Allocation of Losses and DeductionsShareholder Number: TIN: Year Ended: Ownership %:Shareholder Name:GEORGE SMITHCorporation Name:Keep for your records.400-00-2091 12-31-2013 14.285714<strong>SUNSHINE</strong> S <strong>CORPORATION</strong> 40-0005013EIN2013(a) (b) (c) (d) (e) (f)Beginning of Current Year Total Losses % Allocable DissallowedYear Losses and and Losses and Losses andLosses and Deductions Deductions Deductions in DeductionsDeductions Current Year (Carryover toNext Year)9a Ordinary losses from trade or business (Sch K, Line 1)b Net losses from rental real estate activities (Sch K, Line 2)c Net losses from other rental activities (Sch K, Line 3c)d Net short-term capital losses (Sch K, Lines 7 & 8a)d Net long-term capital lossese Other portfolio losses (Sch K, Line 10a)f Net losses under Section 1231 (Sch K, Line 9)g Other losses (Sch K, Line 10e)h Charitable contributions(Sch K, Line 12a-g)i Section 179 expense deduction (Sch K, Line 11)j Portfolio income expenses (Sch K, Line 12l)k Other deductions(Sch K, Ln 12, i,m-o,s)l Interest expense on investment debts (Sch K, Line 12h)m Foreign taxes paid or accrued (Sch K, Line 14I & m)n Section 59(e) expenditures (Sch K, Line 12j)o Other decreasesp Loss from 179 assetTotal deductible losses and deductions7a Nondeductible expenses & credit adj (Sch K, Line 16c & 13)b Oil and gas depletion (Sch K, Line 17r)Total nondeductible losses and deductionsTotalsWK_SBAS~.LD2

Schedule K-1(Form 1120S)2013For calendar year 2013, or taxDepartment of the TreasuryInternal Revenue Serviceyear beginning , 2013ending , 20Shareholder's Share of Income, Deductions,Credits, etc.See page 2 of form and separate instructions.Part I Information About the CorporationA Corporation's employer identification number40-0005013B Corporation's name, address, city, state, and ZIP code<strong>SUNSHINE</strong> S <strong>CORPORATION</strong>Part IIIShareholder's Share of Current Year Income,Deductions, Credits, and Other Items1 Ordinary business income (loss) 13 Credits671112Final K-1 Amended K-1 OMB No. 1545-013073,46223Net rental real estate income (loss)Other net rental income (loss)4 Interest income5a Ordinary dividends5b Qualified dividends14 Foreign transactions789 HOPE RIDGE ROADFRANKLIN NC 2873467RoyaltiesNet short-term capital gain (loss)C IRS Center where corporation filed returnCINCINNATIPart II Information About the Shareholder8a8bNet long-term capital gain (loss)Collectibles (28%) gain (loss)DEShareholder's identifying number400-00-2092Shareholder's name, address, city, state, and ZIP codeFRED SMITH8c9Unrecaptured section 1250 gainNet section 1231 gain (loss)10 Other income (loss)15Alternative minimum tax (AMT) items333 SUNNY LANE A (152)FRANKLIN NC 28734FShareholder's percentage of stockownership for tax year. . . . . . . . . .42.85714%11 Section 179 deduction16 Items affecting shareholder basis12 Other deductionsD 75,428For IRS Use Only17Other information* See attached statement for additional information.For Paperwork Reduction Act Notice, see Instructions for Form 1120S. IRS.gov/form1120SSchedule K-1 (Form 1120S) 2013EEA

Schedule K-1 (Form 1120S) 2013This list identifies the codes used on Schedule K-1 for all shareholders and provides summarized reporting information for shareholders whofile Form 1040. For detailed reporting and filing information, see the separate Shareholder's Instructions for Schedule K-1 and theinstructions for your income tax return.CodeReport on1. Ordinary business income (loss). Determine whether the income (loss) isM Credit for increasing researchpassive or nonpassive and enter on your return as follows:activitiesReport onN Credit for employer socialSee the Shareholder's InstructionsPassive lossSee the Shareholder's Instructionssecurity and Medicare taxesPassive incomeSchedule E, line 28, column (g)O Backup withholdingNonpassive lossSchedule E, line 28, column (h)P Other creditsNonpassive incomeSchedule E, line 28, column (j)14. Foreign transactions2. Net rental real estate income (loss)See the Shareholder's InstructionsA Name of country or U.S.possession3. Other net rental income (loss) B Gross income from all sourcesForm 1116, Part INet income Schedule E, line 28, column (g) C Gross income sourced atNet lossSee the Shareholder's Instructionsshareholder level4. Interest incomeForm 1040, line 8aForeign gross income sourced at corporate level5a. Ordinary dividendsForm 1040, line 9aD Passive categoryE General categoryForm 1116, Part I5b. Qualified dividendsForm 1040, line 9bF Other6. RoyaltiesSchedule E, line 4Deductions allocated and apportioned at shareholder level7. Net short-term capital gain (loss)Schedule D, line 5G Interest expenseForm 1116, Part IH OtherForm 1116, Part I8a. Net long-term capital gain (loss)Schedule D, line 12Deductions allocated and apportioned at corporate level to foreign source8b. Collectibles (28%) gain (loss)28% Rate Gain Worksheet, line 4 income(Schedule D instructions)I Passive category8c. Unrecaptured section 1250 gainSee the Shareholder's InstructionsJ General categoryForm 1116, Part IK Other9. Net section 1231 gain (loss)See the Shareholder's InstructionsOther information10. Other income (loss) L Total foreign taxes paidForm 1116, Part IICodeM Total foreign taxes accruedForm 1116, Part IIA Other portfolio income (loss)See the Shareholder's InstructionsN Reduction in taxes available forB Involuntary conversionsSee the Shareholder's Instructionscredit Form 1116, line 12C Sec. 1256 contracts & straddles Form 6781, line 1O Foreign trading gross receipts Form 8873D Mining exploration costs recapture See Pub. 535P Extraterritorial income exclusion Form 8873E Other income (loss)See the Shareholder's InstructionsQ Other foreign transactionsSee the Shareholder's Instructions15. Alternative minimum tax (AMT) items11. Section 179 deductionSee the Shareholder's InstructionsA Post-1986 depreciation adjustment12. Other deductions See theB Adjusted gain or lossA Cash contributions (50%)Shareholder'sC Depletion (other than oil & gas)B Cash contributions (30%)Instructions andD Oil, gas, & geothermal - gross incomeC Noncash contributions (50%)the Instructions forE Oil, gas, & geothermal - deductionsD Noncash contributions (30%)See the Shareholder's Form 6251F Other AMT itemsE Capital gain property to a 50%Instructionsorganization (30%)16. Items affecting shareholder basisF Capital gain property (20%)A Tax-exempt interest incomeForm 1040, line 8bG Contributions (100%)B Other tax-exempt incomeH Investment interest expense Form 4952, line 1C Nondeductible expensesI Deductions - royalty income Schedule E, line 19D DistributionsSee the Shareholder'sJ Section 59(e)(2) expendituresSee the Shareholder's InstructionsE Repayment of loans fromInstructionsK Deductions - portfolio (2% floor) Schedule A, line 23shareholdersL Deductions - portfolio (other) Schedule A, line 2817. Other informationM Preproductive period expensesSee the Shareholder's InstructionsA Investment incomeForm 4952, line 4aN Commercial revitalization deductionB Investment expenses Form 4952, line 5from rental real estate activitiesSee Form 8582 instructionsC Qualified rehabilitation expendituresO Reforestation expense deductionSee the Shareholder's Instructions(other than rental real estate)See the Shareholder's InstructionsP Domestic production activitiesD Basis of energy propertySee the Shareholder's InstructionsinformationSee Form 8903 instructionsE Recapture of low-income housingQ Qualified production activities income Form 8903, line 7b credit (section 42(j)(5)) Form 8611, line 8R Employer's Form W-2 wages Form 8903, line 17 F Recapture of low-income housingS Other deductions See the Shareholder's Instructions credit (other) Form 8611, line 8G Recapture of investment credit See Form 425513. CreditsH Recapture of other creditsSee the Shareholder's InstructionsA Low-income housing credit (sectionI Look-back interest - completed42(j)(5)) from pre-2008 buildings long-term contracts See Form 8697B Low-income housing credit (other) fromJ Look-back interest - income forecastpre-2008 buildings method See Form 8866C Low-income housing credit (sectionK Dispositions of property withSee the Shareholder's42(j)(5)) from post-2007 buildingssection 179 deductionsInstructionsD Low-income housing credit (other) L Recapture of section 179from post-2007 buildingsdeductionE Qualified rehabilitation expendituresM Section 453(I)(3) information(rental real estate)N Section 453A(c) informationF Other rental real estate creditsO Section 1260(b) informationG Other rental creditsP Interest allocable to productionSee the Shareholder'sH Undistributed capital gains credit Form 1040, line 71, box a expendituresInstructionsI Alcohol and cellulosic biofuel fuelsQ CCF nonqualified withdrawalscreditR Depletion information - oil and gasJ Work opportunity creditSee the Shareholder'sS Amortization of reforestationK Disabled access credit Instructions costsL Empowerment zone and renewalT Section 108(i) informationcommunity employment creditU Other informationPage 2EEAN

Stock basisDebt BasisShareholder's Adjusted Basis WorksheetKeep for your records.Shareholder Number: TIN: Tax year ending: Ownership %:Shareholder Name: FRED SMITHCorporation Name:EIN1 Stock basis, beginning of year (Not less than zero) 12 Additional Capital Contributions of Stock Purchased 23 Increases for income and gain items:a Ordinary Income (Sch K-1, Line 1) a 73,462b Real Estate Rental Income (Sch K-1, Line 2) bc Other Rental Income (Sch K-1, Line 3c) cd Interest, Dividends & Royalties (Sch K-1, Lines 4, 5 & 6) de Capital Gain (Sch K-1, Lines 7 & 8a) ef Other Portfolio Income (Sch K-1, Line 10a) fg Section 1231 Gain (Sch K-1, Line 9) gh Other Income (Sch K-1, Line 10) hTotal Income and Gain Items (Total lines 3a-3h) 3a-h 73,462i Increase for Non-Taxable Income (Sch K-1, Lines 16a & b) 3ij Increase for Excess Depletion Adjustment 3jk Increase from Recapture of Business Credits (See IRC 49(a), 50(a), 50(c)(2) & 1371(d)) 3kl Gain from 179 asset disposition 3l4 Stock Basis Before Distributions (Add lines 1 through 3) 45 Reduction for Non-Taxable Distributions (Sch K-1, Line 16d) 56 Stock Basis Before Non-Ded. Expense & Depletion (Cannot be negative) 67a Decrease for Non-Deductible Expense/Credit Adj (Sch K-1. Line 16c & 13) ab Decrease for Depletion (Sch K-1, Line 17r) b 78 Stock Basis Before Allowable Losses & Deductions (Cannot be negative) 89 Decreases for Loss and Deduction itemsa Ordinary Loss (Page 2, Col e, Line 9a) ab Real Estate Rental Loss (Page 2, Col e, Line 9b) bc Other Rental Loss (Page 2, Col e, Line 9c) cd Capital Loss (Page 2, Col e, Line 9d) de Other Portfolio Loss (Page 2, Col e, Line 9e) ef Section 1231 Loss (Page 2, Col e, Line 9f) fg Other Loss (Page 2, Col e, Line 9g) gh Charitable Contributions (Page 2, Col e, Line 9h) hi Section 179 Expense (Page 2, Col e, Line 9i) ij Portfolio Income Expenses (Page 2, Col e, Line 9j) jk Other Deductions (Page 2, Col e, Line 9k) kl Interest Expense on Investment Debt (Page 2, Col e, Line 9l) lm Total Foreign Taxes Paid/Accrued (Page 2, Col e, Line 9m) mn Section 59(e) Expenditures (Page 2, Col e, Line 9n) nTotal Loss and Deduction Items (Total Lines 9a-9n) 9a-no Other decreases (Page 2, Col e, Line 9o) 9op Loss from 179 asset disposition (Page 2, Col e, Line 9n) 9pTotal Decrease for Loss and Deductions Items and Business Credits 910 Less: net increase applied to debt basis 1011 Stock Basis at End of Year (Cannot be negative) 1112 Debt basis at beginning of year (not less than zero) 1213 New loans to corporation during year 1314 Restoration of Debt Basis (Line 10) 1415 Less: Loans repaid by corporation during the year 1516 Less: Applied against excess loss and deductions / non-deductible items 1617 Debt basis at the end of tax year (combine lines 12-16) (not less than zero) 1718 Shareholder's total basis at end of tax year (combine lines 11 and 17) 18CarryoverTotalDebt Basis AppliedDisallowedAgainst ExcessLossesLosses and Deductions19 Total Beginning of year20 Add: Losses and deductions this year21 Less: Applied this year22 End of year (Not less than zero)2013400-00-2092 12-31-2013 42.857143<strong>SUNSHINE</strong> S <strong>CORPORATION</strong> 40-000501319,06592,52775,42817,09917,09917,09917,099WK_SBAS.LD

Allocation of Losses and DeductionsShareholder Number: TIN: Year Ended: Ownership %:Shareholder Name:FRED SMITHCorporation Name:Keep for your records.400-00-2092 12-31-2013 42.857143<strong>SUNSHINE</strong> S <strong>CORPORATION</strong> 40-0005013EIN2013(a) (b) (c) (d) (e) (f)Beginning of Current Year Total Losses % Allocable DissallowedYear Losses and and Losses and Losses andLosses and Deductions Deductions Deductions in DeductionsDeductions Current Year (Carryover toNext Year)9a Ordinary losses from trade or business (Sch K, Line 1)b Net losses from rental real estate activities (Sch K, Line 2)c Net losses from other rental activities (Sch K, Line 3c)d Net short-term capital losses (Sch K, Lines 7 & 8a)d Net long-term capital lossese Other portfolio losses (Sch K, Line 10a)f Net losses under Section 1231 (Sch K, Line 9)g Other losses (Sch K, Line 10e)h Charitable contributions(Sch K, Line 12a-g)i Section 179 expense deduction (Sch K, Line 11)j Portfolio income expenses (Sch K, Line 12l)k Other deductions(Sch K, Ln 12, i,m-o,s)l Interest expense on investment debts (Sch K, Line 12h)m Foreign taxes paid or accrued (Sch K, Line 14I & m)n Section 59(e) expenditures (Sch K, Line 12j)o Other decreasesp Loss from 179 assetTotal deductible losses and deductions7a Nondeductible expenses & credit adj (Sch K, Line 16c & 13)b Oil and gas depletion (Sch K, Line 17r)Total nondeductible losses and deductionsTotalsWK_SBAS~.LD2

Schedule K-1(Form 1120S)2013For calendar year 2013, or taxDepartment of the TreasuryInternal Revenue Serviceyear beginning , 2013ending , 20Shareholder's Share of Income, Deductions,Credits, etc.See page 2 of form and separate instructions.Part I Information About the CorporationA Corporation's employer identification number40-0005013B Corporation's name, address, city, state, and ZIP code<strong>SUNSHINE</strong> S <strong>CORPORATION</strong>Part IIIShareholder's Share of Current Year Income,Deductions, Credits, and Other Items1 Ordinary business income (loss) 13 Credits671112Final K-1 Amended K-1 OMB No. 1545-013048,97523Net rental real estate income (loss)Other net rental income (loss)4 Interest income5a Ordinary dividends5b Qualified dividends14 Foreign transactions789 HOPE RIDGE ROADFRANKLIN NC 2873467RoyaltiesNet short-term capital gain (loss)C IRS Center where corporation filed returnCINCINNATIPart II Information About the Shareholder8a8bNet long-term capital gain (loss)Collectibles (28%) gain (loss)DEShareholder's identifying number400-00-2093Shareholder's name, address, city, state, and ZIP codeMARLIN MAXWELL8c9Unrecaptured section 1250 gainNet section 1231 gain (loss)10 Other income (loss)15Alternative minimum tax (AMT) items555 SMITHSON ROAD A (101)FRANKLIN NC 28734FShareholder's percentage of stockownership for tax year. . . . . . . . . .28.57143%11 Section 179 deduction16 Items affecting shareholder basis12 Other deductionsD 50,286For IRS Use Only17Other information* See attached statement for additional information.For Paperwork Reduction Act Notice, see Instructions for Form 1120S. IRS.gov/form1120SSchedule K-1 (Form 1120S) 2013EEA

Schedule K-1 (Form 1120S) 2013This list identifies the codes used on Schedule K-1 for all shareholders and provides summarized reporting information for shareholders whofile Form 1040. For detailed reporting and filing information, see the separate Shareholder's Instructions for Schedule K-1 and theinstructions for your income tax return.CodeReport on1. Ordinary business income (loss). Determine whether the income (loss) isM Credit for increasing researchpassive or nonpassive and enter on your return as follows:activitiesReport onN Credit for employer socialSee the Shareholder's InstructionsPassive lossSee the Shareholder's Instructionssecurity and Medicare taxesPassive incomeSchedule E, line 28, column (g)O Backup withholdingNonpassive lossSchedule E, line 28, column (h)P Other creditsNonpassive incomeSchedule E, line 28, column (j)14. Foreign transactions2. Net rental real estate income (loss)See the Shareholder's InstructionsA Name of country or U.S.possession3. Other net rental income (loss) B Gross income from all sourcesForm 1116, Part INet income Schedule E, line 28, column (g) C Gross income sourced atNet lossSee the Shareholder's Instructionsshareholder level4. Interest incomeForm 1040, line 8aForeign gross income sourced at corporate level5a. Ordinary dividendsForm 1040, line 9aD Passive categoryE General categoryForm 1116, Part I5b. Qualified dividendsForm 1040, line 9bF Other6. RoyaltiesSchedule E, line 4Deductions allocated and apportioned at shareholder level7. Net short-term capital gain (loss)Schedule D, line 5G Interest expenseForm 1116, Part IH OtherForm 1116, Part I8a. Net long-term capital gain (loss)Schedule D, line 12Deductions allocated and apportioned at corporate level to foreign source8b. Collectibles (28%) gain (loss)28% Rate Gain Worksheet, line 4 income(Schedule D instructions)I Passive category8c. Unrecaptured section 1250 gainSee the Shareholder's InstructionsJ General categoryForm 1116, Part IK Other9. Net section 1231 gain (loss)See the Shareholder's InstructionsOther information10. Other income (loss) L Total foreign taxes paidForm 1116, Part IICodeM Total foreign taxes accruedForm 1116, Part IIA Other portfolio income (loss)See the Shareholder's InstructionsN Reduction in taxes available forB Involuntary conversionsSee the Shareholder's Instructionscredit Form 1116, line 12C Sec. 1256 contracts & straddles Form 6781, line 1O Foreign trading gross receipts Form 8873D Mining exploration costs recapture See Pub. 535P Extraterritorial income exclusion Form 8873E Other income (loss)See the Shareholder's InstructionsQ Other foreign transactionsSee the Shareholder's Instructions15. Alternative minimum tax (AMT) items11. Section 179 deductionSee the Shareholder's InstructionsA Post-1986 depreciation adjustment12. Other deductions See theB Adjusted gain or lossA Cash contributions (50%)Shareholder'sC Depletion (other than oil & gas)B Cash contributions (30%)Instructions andD Oil, gas, & geothermal - gross incomeC Noncash contributions (50%)the Instructions forE Oil, gas, & geothermal - deductionsD Noncash contributions (30%)See the Shareholder's Form 6251F Other AMT itemsE Capital gain property to a 50%Instructionsorganization (30%)16. Items affecting shareholder basisF Capital gain property (20%)A Tax-exempt interest incomeForm 1040, line 8bG Contributions (100%)B Other tax-exempt incomeH Investment interest expense Form 4952, line 1C Nondeductible expensesI Deductions - royalty income Schedule E, line 19D DistributionsSee the Shareholder'sJ Section 59(e)(2) expendituresSee the Shareholder's InstructionsE Repayment of loans fromInstructionsK Deductions - portfolio (2% floor) Schedule A, line 23shareholdersL Deductions - portfolio (other) Schedule A, line 2817. Other informationM Preproductive period expensesSee the Shareholder's InstructionsA Investment incomeForm 4952, line 4aN Commercial revitalization deductionB Investment expenses Form 4952, line 5from rental real estate activitiesSee Form 8582 instructionsC Qualified rehabilitation expendituresO Reforestation expense deductionSee the Shareholder's Instructions(other than rental real estate)See the Shareholder's InstructionsP Domestic production activitiesD Basis of energy propertySee the Shareholder's InstructionsinformationSee Form 8903 instructionsE Recapture of low-income housingQ Qualified production activities income Form 8903, line 7b credit (section 42(j)(5)) Form 8611, line 8R Employer's Form W-2 wages Form 8903, line 17 F Recapture of low-income housingS Other deductions See the Shareholder's Instructions credit (other) Form 8611, line 8G Recapture of investment credit See Form 425513. CreditsH Recapture of other creditsSee the Shareholder's InstructionsA Low-income housing credit (sectionI Look-back interest - completed42(j)(5)) from pre-2008 buildings long-term contracts See Form 8697B Low-income housing credit (other) fromJ Look-back interest - income forecastpre-2008 buildings method See Form 8866C Low-income housing credit (sectionK Dispositions of property withSee the Shareholder's42(j)(5)) from post-2007 buildingssection 179 deductionsInstructionsD Low-income housing credit (other) L Recapture of section 179from post-2007 buildingsdeductionE Qualified rehabilitation expendituresM Section 453(I)(3) information(rental real estate)N Section 453A(c) informationF Other rental real estate creditsO Section 1260(b) informationG Other rental creditsP Interest allocable to productionSee the Shareholder'sH Undistributed capital gains credit Form 1040, line 71, box a expendituresInstructionsI Alcohol and cellulosic biofuel fuelsQ CCF nonqualified withdrawalscreditR Depletion information - oil and gasJ Work opportunity creditSee the Shareholder'sS Amortization of reforestationK Disabled access credit Instructions costsL Empowerment zone and renewalT Section 108(i) informationcommunity employment creditU Other informationPage 2EEAN

Stock basisDebt BasisShareholder's Adjusted Basis WorksheetKeep for your records.Shareholder Number: TIN: Tax year ending: Ownership %:Shareholder Name: MARLIN MAXWELLCorporation Name:EIN1 Stock basis, beginning of year (Not less than zero) 12 Additional Capital Contributions of Stock Purchased 23 Increases for income and gain items:a Ordinary Income (Sch K-1, Line 1) a 48,975b Real Estate Rental Income (Sch K-1, Line 2) bc Other Rental Income (Sch K-1, Line 3c) cd Interest, Dividends & Royalties (Sch K-1, Lines 4, 5 & 6) de Capital Gain (Sch K-1, Lines 7 & 8a) ef Other Portfolio Income (Sch K-1, Line 10a) fg Section 1231 Gain (Sch K-1, Line 9) gh Other Income (Sch K-1, Line 10) hTotal Income and Gain Items (Total lines 3a-3h) 3a-h 48,975i Increase for Non-Taxable Income (Sch K-1, Lines 16a & b) 3ij Increase for Excess Depletion Adjustment 3jk Increase from Recapture of Business Credits (See IRC 49(a), 50(a), 50(c)(2) & 1371(d)) 3kl Gain from 179 asset disposition 3l4 Stock Basis Before Distributions (Add lines 1 through 3) 45 Reduction for Non-Taxable Distributions (Sch K-1, Line 16d) 56 Stock Basis Before Non-Ded. Expense & Depletion (Cannot be negative) 67a Decrease for Non-Deductible Expense/Credit Adj (Sch K-1. Line 16c & 13) ab Decrease for Depletion (Sch K-1, Line 17r) b 78 Stock Basis Before Allowable Losses & Deductions (Cannot be negative) 89 Decreases for Loss and Deduction itemsa Ordinary Loss (Page 2, Col e, Line 9a) ab Real Estate Rental Loss (Page 2, Col e, Line 9b) bc Other Rental Loss (Page 2, Col e, Line 9c) cd Capital Loss (Page 2, Col e, Line 9d) de Other Portfolio Loss (Page 2, Col e, Line 9e) ef Section 1231 Loss (Page 2, Col e, Line 9f) fg Other Loss (Page 2, Col e, Line 9g) gh Charitable Contributions (Page 2, Col e, Line 9h) hi Section 179 Expense (Page 2, Col e, Line 9i) ij Portfolio Income Expenses (Page 2, Col e, Line 9j) jk Other Deductions (Page 2, Col e, Line 9k) kl Interest Expense on Investment Debt (Page 2, Col e, Line 9l) lm Total Foreign Taxes Paid/Accrued (Page 2, Col e, Line 9m) mn Section 59(e) Expenditures (Page 2, Col e, Line 9n) nTotal Loss and Deduction Items (Total Lines 9a-9n) 9a-no Other decreases (Page 2, Col e, Line 9o) 9op Loss from 179 asset disposition (Page 2, Col e, Line 9n) 9pTotal Decrease for Loss and Deductions Items and Business Credits 910 Less: net increase applied to debt basis 1011 Stock Basis at End of Year (Cannot be negative) 1112 Debt basis at beginning of year (not less than zero) 1213 New loans to corporation during year 1314 Restoration of Debt Basis (Line 10) 1415 Less: Loans repaid by corporation during the year 1516 Less: Applied against excess loss and deductions / non-deductible items 1617 Debt basis at the end of tax year (combine lines 12-16) (not less than zero) 1718 Shareholder's total basis at end of tax year (combine lines 11 and 17) 18CarryoverTotalDebt Basis AppliedDisallowedAgainst ExcessLossesLosses and Deductions19 Total Beginning of year20 Add: Losses and deductions this year21 Less: Applied this year22 End of year (Not less than zero)2013400-00-2093 12-31-2013 28.571429<strong>SUNSHINE</strong> S <strong>CORPORATION</strong> 40-00050139,74558,72050,2868,4348,4348,4348,434WK_SBAS.LD

Allocation of Losses and DeductionsShareholder Number: TIN: Year Ended: Ownership %:Shareholder Name:MARLIN MAXWELLCorporation Name:Keep for your records.400-00-2093 12-31-2013 28.571429<strong>SUNSHINE</strong> S <strong>CORPORATION</strong> 40-0005013EIN2013(a) (b) (c) (d) (e) (f)Beginning of Current Year Total Losses % Allocable DissallowedYear Losses and and Losses and Losses andLosses and Deductions Deductions Deductions in DeductionsDeductions Current Year (Carryover toNext Year)9a Ordinary losses from trade or business (Sch K, Line 1)b Net losses from rental real estate activities (Sch K, Line 2)c Net losses from other rental activities (Sch K, Line 3c)d Net short-term capital losses (Sch K, Lines 7 & 8a)d Net long-term capital lossese Other portfolio losses (Sch K, Line 10a)f Net losses under Section 1231 (Sch K, Line 9)g Other losses (Sch K, Line 10e)h Charitable contributions(Sch K, Line 12a-g)i Section 179 expense deduction (Sch K, Line 11)j Portfolio income expenses (Sch K, Line 12l)k Other deductions(Sch K, Ln 12, i,m-o,s)l Interest expense on investment debts (Sch K, Line 12h)m Foreign taxes paid or accrued (Sch K, Line 14I & m)n Section 59(e) expenditures (Sch K, Line 12j)o Other decreasesp Loss from 179 assetTotal deductible losses and deductions7a Nondeductible expenses & credit adj (Sch K, Line 16c & 13)b Oil and gas depletion (Sch K, Line 17r)Total nondeductible losses and deductionsTotalsWK_SBAS~.LD2

Schedule K-1(Form 1120S)2013For calendar year 2013, or taxDepartment of the TreasuryInternal Revenue Serviceyear beginning , 2013ending , 20Shareholder's Share of Income, Deductions,Credits, etc.See page 2 of form and separate instructions.Part I Information About the CorporationA Corporation's employer identification number40-0005013B Corporation's name, address, city, state, and ZIP code<strong>SUNSHINE</strong> S <strong>CORPORATION</strong>Part IIIShareholder's Share of Current Year Income,Deductions, Credits, and Other Items1 Ordinary business income (loss) 13 Credits671112Final K-1 Amended K-1 OMB No. 1545-013024,48723Net rental real estate income (loss)Other net rental income (loss)4 Interest income5a Ordinary dividends5b Qualified dividends14 Foreign transactions789 HOPE RIDGE ROADFRANKLIN NC 2873467RoyaltiesNet short-term capital gain (loss)C IRS Center where corporation filed returnCINCINNATIPart II Information About the Shareholder8a8bNet long-term capital gain (loss)Collectibles (28%) gain (loss)DEShareholder's identifying number400-00-2094Shareholder's name, address, city, state, and ZIP codeMANNY LOPEZ8c9Unrecaptured section 1250 gainNet section 1231 gain (loss)10 Other income (loss)15Alternative minimum tax (AMT) items1234 WETS GREEN PL A (50)FRANKLIN NC 28734FShareholder's percentage of stockownership for tax year. . . . . . . . . .14.28571%11 Section 179 deduction16 Items affecting shareholder basis12 Other deductionsD 25,144For IRS Use Only17Other information* See attached statement for additional information.For Paperwork Reduction Act Notice, see Instructions for Form 1120S. IRS.gov/form1120SSchedule K-1 (Form 1120S) 2013EEA

Schedule K-1 (Form 1120S) 2013This list identifies the codes used on Schedule K-1 for all shareholders and provides summarized reporting information for shareholders whofile Form 1040. For detailed reporting and filing information, see the separate Shareholder's Instructions for Schedule K-1 and theinstructions for your income tax return.CodeReport on1. Ordinary business income (loss). Determine whether the income (loss) isM Credit for increasing researchpassive or nonpassive and enter on your return as follows:activitiesReport onN Credit for employer socialSee the Shareholder's InstructionsPassive lossSee the Shareholder's Instructionssecurity and Medicare taxesPassive incomeSchedule E, line 28, column (g)O Backup withholdingNonpassive lossSchedule E, line 28, column (h)P Other creditsNonpassive incomeSchedule E, line 28, column (j)14. Foreign transactions2. Net rental real estate income (loss)See the Shareholder's InstructionsA Name of country or U.S.possession3. Other net rental income (loss) B Gross income from all sourcesForm 1116, Part INet income Schedule E, line 28, column (g) C Gross income sourced atNet lossSee the Shareholder's Instructionsshareholder level4. Interest incomeForm 1040, line 8aForeign gross income sourced at corporate level5a. Ordinary dividendsForm 1040, line 9aD Passive categoryE General categoryForm 1116, Part I5b. Qualified dividendsForm 1040, line 9bF Other6. RoyaltiesSchedule E, line 4Deductions allocated and apportioned at shareholder level7. Net short-term capital gain (loss)Schedule D, line 5G Interest expenseForm 1116, Part IH OtherForm 1116, Part I8a. Net long-term capital gain (loss)Schedule D, line 12Deductions allocated and apportioned at corporate level to foreign source8b. Collectibles (28%) gain (loss)28% Rate Gain Worksheet, line 4 income(Schedule D instructions)I Passive category8c. Unrecaptured section 1250 gainSee the Shareholder's InstructionsJ General categoryForm 1116, Part IK Other9. Net section 1231 gain (loss)See the Shareholder's InstructionsOther information10. Other income (loss) L Total foreign taxes paidForm 1116, Part IICodeM Total foreign taxes accruedForm 1116, Part IIA Other portfolio income (loss)See the Shareholder's InstructionsN Reduction in taxes available forB Involuntary conversionsSee the Shareholder's Instructionscredit Form 1116, line 12C Sec. 1256 contracts & straddles Form 6781, line 1O Foreign trading gross receipts Form 8873D Mining exploration costs recapture See Pub. 535P Extraterritorial income exclusion Form 8873E Other income (loss)See the Shareholder's InstructionsQ Other foreign transactionsSee the Shareholder's Instructions15. Alternative minimum tax (AMT) items11. Section 179 deductionSee the Shareholder's InstructionsA Post-1986 depreciation adjustment12. Other deductions See theB Adjusted gain or lossA Cash contributions (50%)Shareholder'sC Depletion (other than oil & gas)B Cash contributions (30%)Instructions andD Oil, gas, & geothermal - gross incomeC Noncash contributions (50%)the Instructions forE Oil, gas, & geothermal - deductionsD Noncash contributions (30%)See the Shareholder's Form 6251F Other AMT itemsE Capital gain property to a 50%Instructionsorganization (30%)16. Items affecting shareholder basisF Capital gain property (20%)A Tax-exempt interest incomeForm 1040, line 8bG Contributions (100%)B Other tax-exempt incomeH Investment interest expense Form 4952, line 1C Nondeductible expensesI Deductions - royalty income Schedule E, line 19D DistributionsSee the Shareholder'sJ Section 59(e)(2) expendituresSee the Shareholder's InstructionsE Repayment of loans fromInstructionsK Deductions - portfolio (2% floor) Schedule A, line 23shareholdersL Deductions - portfolio (other) Schedule A, line 2817. Other informationM Preproductive period expensesSee the Shareholder's InstructionsA Investment incomeForm 4952, line 4aN Commercial revitalization deductionB Investment expenses Form 4952, line 5from rental real estate activitiesSee Form 8582 instructionsC Qualified rehabilitation expendituresO Reforestation expense deductionSee the Shareholder's Instructions(other than rental real estate)See the Shareholder's InstructionsP Domestic production activitiesD Basis of energy propertySee the Shareholder's InstructionsinformationSee Form 8903 instructionsE Recapture of low-income housingQ Qualified production activities income Form 8903, line 7b credit (section 42(j)(5)) Form 8611, line 8R Employer's Form W-2 wages Form 8903, line 17 F Recapture of low-income housingS Other deductions See the Shareholder's Instructions credit (other) Form 8611, line 8G Recapture of investment credit See Form 425513. CreditsH Recapture of other creditsSee the Shareholder's InstructionsA Low-income housing credit (sectionI Look-back interest - completed42(j)(5)) from pre-2008 buildings long-term contracts See Form 8697B Low-income housing credit (other) fromJ Look-back interest - income forecastpre-2008 buildings method See Form 8866C Low-income housing credit (sectionK Dispositions of property withSee the Shareholder's42(j)(5)) from post-2007 buildingssection 179 deductionsInstructionsD Low-income housing credit (other) L Recapture of section 179from post-2007 buildingsdeductionE Qualified rehabilitation expendituresM Section 453(I)(3) information(rental real estate)N Section 453A(c) informationF Other rental real estate creditsO Section 1260(b) informationG Other rental creditsP Interest allocable to productionSee the Shareholder'sH Undistributed capital gains credit Form 1040, line 71, box a expendituresInstructionsI Alcohol and cellulosic biofuel fuelsQ CCF nonqualified withdrawalscreditR Depletion information - oil and gasJ Work opportunity creditSee the Shareholder'sS Amortization of reforestationK Disabled access credit Instructions costsL Empowerment zone and renewalT Section 108(i) informationcommunity employment creditU Other informationPage 2EEAN

Stock basisDebt BasisShareholder's Adjusted Basis WorksheetKeep for your records.Shareholder Number: TIN: Tax year ending: Ownership %:Shareholder Name: MANNY LOPEZCorporation Name:EIN1 Stock basis, beginning of year (Not less than zero) 12 Additional Capital Contributions of Stock Purchased 23 Increases for income and gain items:a Ordinary Income (Sch K-1, Line 1) a 24,487b Real Estate Rental Income (Sch K-1, Line 2) bc Other Rental Income (Sch K-1, Line 3c) cd Interest, Dividends & Royalties (Sch K-1, Lines 4, 5 & 6) de Capital Gain (Sch K-1, Lines 7 & 8a) ef Other Portfolio Income (Sch K-1, Line 10a) fg Section 1231 Gain (Sch K-1, Line 9) gh Other Income (Sch K-1, Line 10) hTotal Income and Gain Items (Total lines 3a-3h) 3a-h 24,487i Increase for Non-Taxable Income (Sch K-1, Lines 16a & b) 3ij Increase for Excess Depletion Adjustment 3jk Increase from Recapture of Business Credits (See IRC 49(a), 50(a), 50(c)(2) & 1371(d)) 3kl Gain from 179 asset disposition 3l4 Stock Basis Before Distributions (Add lines 1 through 3) 45 Reduction for Non-Taxable Distributions (Sch K-1, Line 16d) 56 Stock Basis Before Non-Ded. Expense & Depletion (Cannot be negative) 67a Decrease for Non-Deductible Expense/Credit Adj (Sch K-1. Line 16c & 13) ab Decrease for Depletion (Sch K-1, Line 17r) b 78 Stock Basis Before Allowable Losses & Deductions (Cannot be negative) 89 Decreases for Loss and Deduction itemsa Ordinary Loss (Page 2, Col e, Line 9a) ab Real Estate Rental Loss (Page 2, Col e, Line 9b) bc Other Rental Loss (Page 2, Col e, Line 9c) cd Capital Loss (Page 2, Col e, Line 9d) de Other Portfolio Loss (Page 2, Col e, Line 9e) ef Section 1231 Loss (Page 2, Col e, Line 9f) fg Other Loss (Page 2, Col e, Line 9g) gh Charitable Contributions (Page 2, Col e, Line 9h) hi Section 179 Expense (Page 2, Col e, Line 9i) ij Portfolio Income Expenses (Page 2, Col e, Line 9j) jk Other Deductions (Page 2, Col e, Line 9k) kl Interest Expense on Investment Debt (Page 2, Col e, Line 9l) lm Total Foreign Taxes Paid/Accrued (Page 2, Col e, Line 9m) mn Section 59(e) Expenditures (Page 2, Col e, Line 9n) nTotal Loss and Deduction Items (Total Lines 9a-9n) 9a-no Other decreases (Page 2, Col e, Line 9o) 9op Loss from 179 asset disposition (Page 2, Col e, Line 9n) 9pTotal Decrease for Loss and Deductions Items and Business Credits 910 Less: net increase applied to debt basis 1011 Stock Basis at End of Year (Cannot be negative) 1112 Debt basis at beginning of year (not less than zero) 1213 New loans to corporation during year 1314 Restoration of Debt Basis (Line 10) 1415 Less: Loans repaid by corporation during the year 1516 Less: Applied against excess loss and deductions / non-deductible items 1617 Debt basis at the end of tax year (combine lines 12-16) (not less than zero) 1718 Shareholder's total basis at end of tax year (combine lines 11 and 17) 18CarryoverTotalDebt Basis AppliedDisallowedAgainst ExcessLossesLosses and Deductions19 Total Beginning of year20 Add: Losses and deductions this year21 Less: Applied this year22 End of year (Not less than zero)2013400-00-2094 12-31-2013 14.285714<strong>SUNSHINE</strong> S <strong>CORPORATION</strong> 40-000501316,94941,43625,14416,29216,29216,29216,292WK_SBAS.LD

Allocation of Losses and DeductionsShareholder Number: TIN: Year Ended: Ownership %:Shareholder Name:MANNY LOPEZCorporation Name:Keep for your records.400-00-2094 12-31-2013 14.285714<strong>SUNSHINE</strong> S <strong>CORPORATION</strong> 40-0005013EIN2013(a) (b) (c) (d) (e) (f)Beginning of Current Year Total Losses % Allocable DissallowedYear Losses and and Losses and Losses andLosses and Deductions Deductions Deductions in DeductionsDeductions Current Year (Carryover toNext Year)9a Ordinary losses from trade or business (Sch K, Line 1)b Net losses from rental real estate activities (Sch K, Line 2)c Net losses from other rental activities (Sch K, Line 3c)d Net short-term capital losses (Sch K, Lines 7 & 8a)d Net long-term capital lossese Other portfolio losses (Sch K, Line 10a)f Net losses under Section 1231 (Sch K, Line 9)g Other losses (Sch K, Line 10e)h Charitable contributions(Sch K, Line 12a-g)i Section 179 expense deduction (Sch K, Line 11)j Portfolio income expenses (Sch K, Line 12l)k Other deductions(Sch K, Ln 12, i,m-o,s)l Interest expense on investment debts (Sch K, Line 12h)m Foreign taxes paid or accrued (Sch K, Line 14I & m)n Section 59(e) expenditures (Sch K, Line 12j)o Other decreasesp Loss from 179 assetTotal deductible losses and deductions7a Nondeductible expenses & credit adj (Sch K, Line 16c & 13)b Oil and gas depletion (Sch K, Line 17r)Total nondeductible losses and deductionsTotalsWK_SBAS~.LD2

Form4562Department of the TreasuryInternal Revenue Service (99)Name(s) shown on returnDepreciation and Amortization(Including Information on Listed Property)See separate instructions. Attach to your tax return.Business or activity to which this form relates2013<strong>SUNSHINE</strong> S <strong>CORPORATION</strong> FORM 1120S 40-0005013Part I Election To Expense Certain Property Under Section 179Note: If you have any listed property, complete Part V before you complete Part I.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1 Maximum amount (see instructions)12 Total cost of section 179 property placed in service (see instructions) . . . . . . . . . . . . . . . . . . 23 Threshold cost of section 179 property before reduction in limitation (see instructions) . . . . . . . . . . 34 Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter -0- . . . . . . . . . . . . . . . 45 Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -0-. If married filingseparately, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56(a) Description of property (b) Cost (business use only) (c) Elected costOMB No. 1545-0172AttachmentSequence No.Identifying number1797 Listed property. Enter the amount from line 2978 Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 789 Tentative deduction. Enter the smaller of line 5 or line 8910 Carryover of disallowed deduction from line 13 of your 2012 Form 45621011 Business income limitation. Enter the smaller of business income (not less than zero) or line 5 (see instructions) 1112 Section 179 expense deduction. Add lines 9 and 10, but do not enter more than line 111213 Carryover of disallowed deduction to 2014. Add lines 9 and 10, less line 1213Note: Do not use Part II or Part III below for listed property. Instead, use Part V.Part II14Part IIIPart IVSpecial Depreciation Allowance and Other Depreciation15 Property subject to section 168(f)(1) election1516 Other depreciation (including ACRS)16MACRS DepreciationSummarySection A17 MACRS deductions for assets placed in service in tax years beginning before 2013171819abcdefghi20abc21 Listed property. Enter amount from line 28212223Special depreciation allowance for qualified property (other than listed property) placed in serviceduring the tax year (see instructions)For Paperwork Reduction Act Notice, see separate instructions.EEA(Do not include listed property.) (See instructions.)If you are electing to group any assets placed in service during the tax year into one or more generalasset accounts, check here(Do not include listed property.) (See instructions.)Section B - Assets Placed in Service During 2013 Tax Year Using the General Depreciation System(b) Month and year (c) Basis for depreciation(d) Recovery(a) Classification of property placed in (business/investment use(e) Convention (f) Method (g) Depreciation deductionservice only-see instructions)period3-year property5-year property7-year property10-year property15-year property20-year property25-year property 25 yrs. S/LResidential rental 27.5 yrs. MM S/Lproperty 27.5 yrs. MM S/LNonresidential real 39 yrs. MM S/Lproperty MM S/LSection C - Assets Placed in Service During 2013 Tax Year Using the Alternative Depreciation SystemClass lifeS/L12-year 12 yrs. S/L40-year 40 yrs. MM S/L(See instructions.)Total. Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21. Enterhere and on the appropriate lines of your return. Partnerships and S corporations - see instructionsFor assets shown above and placed in service during the current year, enter theportion of the basis attributable to section 263A costs. . . . . . . . . . . . . . . .. . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . .. . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . .. .14222,6001,2503,3817,23123Form 4562 (2013)

Form 4562 (2013) Page 2Part V Listed Property (Include automobiles, certain other vehicles, certain computers, and property used forentertainment, recreation, or amusement.)24a Do you have evidence to support the business/investment use claimed?Yes No 24b If "Yes," is the evidence written? Yes No25262728 Add amounts in column (h), lines 25 through 27. Enter here and on line 21, page 12829 Add amounts in column (i), line 26. Enter here and on line 7, page 1 . . . . . . . . . . . . . . . . . . . . . . . . . 29Section B - Information on Use of Vehicles34 Was the vehicle available for personalYes No Yes No Yes No Yes No Yes No Yes Nouse during off-duty hours? . . . . . . . . . . .35 Was the vehicle used primarily by a morethan 5% owner or related person? . . . . .36 Is another vehicle available for personal use?Section C - Questions for Employers Who Provide Vehicles for Use by Their Employees37 Do you maintain a written policy statement that prohibits all personal use of vehicles, including commuting, byYes Noyour employees? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .38 Do you maintain a written policy statement that prohibits personal use of vehicles, except commuting, by youremployees? See the instructions for vehicles used by corporate officers, directors, or 1% or more owners . . . . . . . . . .39 Do you treat all use of vehicles by employees as personal use? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .40 Do you provide more than five vehicles to your employees, obtain information from your employees about theuse of the vehicles, and retain the information received? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .41 Do you meet the requirements concerning qualified automobile demonstration use? (See instructions.) . . . . . . . . . . . .Note: If your answer to 37, 38, 39, 40, or 41 is "Yes," do not complete Section B for the covered vehicles.Part VI<strong>SUNSHINE</strong> S <strong>CORPORATION</strong> 40-0005013Note: For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a,24b, columns (a) through (c) of Section A, all of Section B, and Section C if applicable.Section A - Depreciation and Other Information (Caution: See the instructions for limits for passenger automobiles.)(c) (e) (i)(a) (b) (d) (f) (g) (h)Business/Basis for depreciationType of property (list Date placed Cost or other basis Recovery Method/ Depreciation Elected section 179investment use(business/investmentvehicles first) in service period Convention deduction costpercentageuse only)Special depreciation allowance for qualified listed property placed in service duringthe tax year and used more than 50% in a qualified business use (see instructions)Property used more than 50% in a qualified business use:%%%Property used 50% or less in a qualified business use:% S/L-% S/L-% S/L-Complete this section for vehicles used by a sole proprietor, partner, or other "more than 5% owner," or related person. If you provided vehiclesto your employees, first answer the questions in Section C to see if you meet an exception to completing this section for those vehicles.30 Total business/investment miles driven duringthe year (do not include commuting miles)31 Total commuting miles driven during the year32 Total other personal (noncommuting)miles driven33 Total miles driven during the year. Addlines 30 through 32. . . . . . . . . . . . . . . .Answer these questions to determine if you meet an exception to completing Section B for vehicles used by employees who are notmore than 5% owners or related persons (see instructions).Amortization. . . . . . . . . . . ... . . . . . . . . .TRUCK 04132009100.0 66,000 66,000 5 200 DB-HY 1,775Automobile 01012010100.0 25,000 13,940 5 200 DB-HY 1,606. . . . . . . . . .(a) (b) (c) (d) (e) (f)Vehicle 1 Vehicle 2 Vehicle 3 Vehicle 4 Vehicle 5 Vehicle 6253,38142(b) (c) (d) (e)(f)(a)AmortizationDate amortization Amortizable amount Code section Amortization for this yearDescription of costsperiod orbeginspercentageAmortization of costs that begins during your 2013 tax year (see instructions):43 Amortization of costs that began before your 2013 tax year4344 Total. Add amounts in column (f). See the instructions for where to report44EEA. . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . .Form 4562 (2013)