Taxation and Operating Costs for the Caribbean Hotel Sector

Taxation and Operating Costs for the Caribbean Hotel Sector

Taxation and Operating Costs for the Caribbean Hotel Sector

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

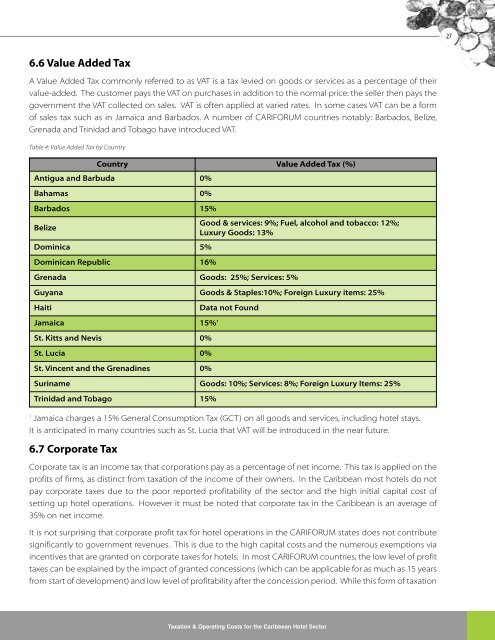

276.6 Value Added TaxA Value Added Tax commonly referred to as VAT is a tax levied on goods or services as a percentage of <strong>the</strong>irvalue-added. The customer pays <strong>the</strong> VAT on purchases in addition to <strong>the</strong> normal price: <strong>the</strong> seller <strong>the</strong>n pays <strong>the</strong>government <strong>the</strong> VAT collected on sales. VAT is often applied at varied rates. In some cases VAT can be a <strong>for</strong>mof sales tax such as in Jamaica <strong>and</strong> Barbados. A number of CARIFORUM countries notably: Barbados, Belize,Grenada <strong>and</strong> Trinidad <strong>and</strong> Tobago have introduced VAT.Table 4: Value Added Tax by CountryCountry Value Added Tax (%)Antigua <strong>and</strong> Barbuda 0%Bahamas 0%Barbados 15%BelizeGood & services: 9%; Fuel, alcohol <strong>and</strong> tobacco: 12%;Luxury Goods: 13%Dominica 5%Dominican Republic 16%Grenada Goods: 25%; Services: 5%Guyana Goods & Staples:10%; Foreign Luxury items: 25%HaitiData not FoundJamaica 15% 1St. Kitts <strong>and</strong> Nevis 0%St. Lucia 0%St. Vincent <strong>and</strong> <strong>the</strong> Grenadines 0%Suriname Goods: 10%; Services: 8%; Foreign Luxury Items: 25%Trinidad <strong>and</strong> Tobago 15%1Jamaica charges a 15% General Consumption Tax (GCT) on all goods <strong>and</strong> services, including hotel stays.It is anticipated in many countries such as St. Lucia that VAT will be introduced in <strong>the</strong> near future.6.7 Corporate TaxCorporate tax is an income tax that corporations pay as a percentage of net income. This tax is applied on <strong>the</strong>profits of firms, as distinct from taxation of <strong>the</strong> income of <strong>the</strong>ir owners. In <strong>the</strong> <strong>Caribbean</strong> most hotels do notpay corporate taxes due to <strong>the</strong> poor reported profitability of <strong>the</strong> sector <strong>and</strong> <strong>the</strong> high initial capital cost ofsetting up hotel operations. However it must be noted that corporate tax in <strong>the</strong> <strong>Caribbean</strong> is an average of35% on net income.It is not surprising that corporate profit tax <strong>for</strong> hotel operations in <strong>the</strong> CARIFORUM states does not contributesignificantly to government revenues. This is due to <strong>the</strong> high capital costs <strong>and</strong> <strong>the</strong> numerous exemptions viaincentives that are granted on corporate taxes <strong>for</strong> hotels. In most CARIFORUM countries, <strong>the</strong> low level of profittaxes can be explained by <strong>the</strong> impact of granted concessions (which can be applicable <strong>for</strong> as much as 15 yearsfrom start of development) <strong>and</strong> low level of profitability after <strong>the</strong> concession period. While this <strong>for</strong>m of taxation<strong>Taxation</strong> & <strong>Operating</strong> <strong>Costs</strong> <strong>for</strong> <strong>the</strong> <strong>Caribbean</strong> <strong>Hotel</strong> <strong>Sector</strong>