Taxation and Operating Costs for the Caribbean Hotel Sector

Taxation and Operating Costs for the Caribbean Hotel Sector

Taxation and Operating Costs for the Caribbean Hotel Sector

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

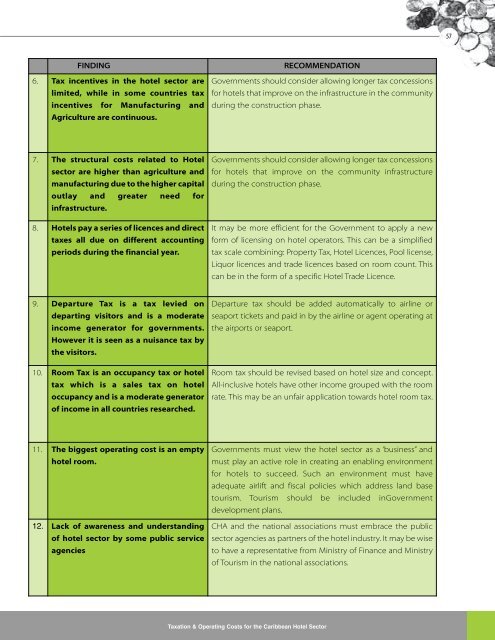

57FINDING6. Tax incentives in <strong>the</strong> hotel sector arelimited, while in some countries taxincentives <strong>for</strong> Manufacturing <strong>and</strong>Agriculture are continuous.RECOMMENDATIONGovernments should consider allowing longer tax concessions<strong>for</strong> hotels that improve on <strong>the</strong> infrastructure in <strong>the</strong> communityduring <strong>the</strong> construction phase.7. The structural costs related to <strong>Hotel</strong>sector are higher than agriculture <strong>and</strong>manufacturing due to <strong>the</strong> higher capitaloutlay <strong>and</strong> greater need <strong>for</strong>infrastructure.8. <strong>Hotel</strong>s pay a series of licences <strong>and</strong> directtaxes all due on different accountingperiods during <strong>the</strong> financial year.Governments should consider allowing longer tax concessions<strong>for</strong> hotels that improve on <strong>the</strong> community infrastructureduring <strong>the</strong> construction phase.It may be more efficient <strong>for</strong> <strong>the</strong> Government to apply a new<strong>for</strong>m of licensing on hotel operators. This can be a simplifiedtax scale combining: Property Tax, <strong>Hotel</strong> Licences, Pool license,Liquor licences <strong>and</strong> trade licences based on room count. Thiscan be in <strong>the</strong> <strong>for</strong>m of a specific <strong>Hotel</strong> Trade Licence.9. Departure Tax is a tax levied ondeparting visitors <strong>and</strong> is a moderateincome generator <strong>for</strong> governments.However it is seen as a nuisance tax by<strong>the</strong> visitors.10. Room Tax is an occupancy tax or hoteltax which is a sales tax on hoteloccupancy <strong>and</strong> is a moderate generatorof income in all countries researched.Departure tax should be added automatically to airline orseaport tickets <strong>and</strong> paid in by <strong>the</strong> airline or agent operating at<strong>the</strong> airports or seaport.Room tax should be revised based on hotel size <strong>and</strong> concept.All-inclusive hotels have o<strong>the</strong>r income grouped with <strong>the</strong> roomrate. This may be an unfair application towards hotel room tax.11. The biggest operating cost is an emptyhotel room.12. Lack of awareness <strong>and</strong> underst<strong>and</strong>ingof hotel sector by some public serviceagenciesGovernments must view <strong>the</strong> hotel sector as a ‘business” <strong>and</strong>must play an active role in creating an enabling environment<strong>for</strong> hotels to succeed. Such an environment must haveadequate airlift <strong>and</strong> fiscal policies which address l<strong>and</strong> basetourism. Tourism should be included inGovernmentdevelopment plans.CHA <strong>and</strong> <strong>the</strong> national associations must embrace <strong>the</strong> publicsector agencies as partners of <strong>the</strong> hotel industry. It may be wiseto have a representative from Ministry of Finance <strong>and</strong> Ministryof Tourism in <strong>the</strong> national associations.<strong>Taxation</strong> & <strong>Operating</strong> <strong>Costs</strong> <strong>for</strong> <strong>the</strong> <strong>Caribbean</strong> <strong>Hotel</strong> <strong>Sector</strong>