Individual Disclosure Statement - ASB Securities

Individual Disclosure Statement - ASB Securities

Individual Disclosure Statement - ASB Securities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

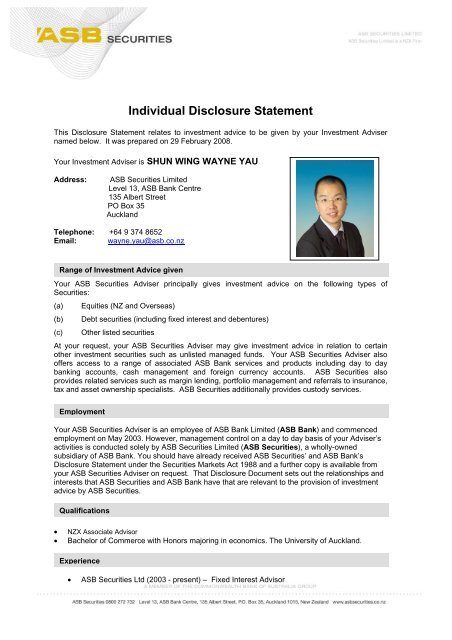

<strong>Individual</strong> <strong>Disclosure</strong> <strong>Statement</strong>This <strong>Disclosure</strong> <strong>Statement</strong> relates to investment advice to be given by your Investment Advisernamed below. It was prepared on 29 February 2008.Your Investment Adviser is SHUN WING WAYNE YAUAddress:<strong>ASB</strong> <strong>Securities</strong> LimitedLevel 13, <strong>ASB</strong> Bank Centre135 Albert StreetPO Box 35AucklandTelephone: +64 9 374 8652Email: wayne.yau@asb.co.nzRange of Investment Advice givenYour <strong>ASB</strong> <strong>Securities</strong> Adviser principally gives investment advice on the following types of<strong>Securities</strong>:(a) Equities (NZ and Overseas)(b) Debt securities (including fixed interest and debentures)(c) Other listed securitiesAt your request, your <strong>ASB</strong> <strong>Securities</strong> Adviser may give investment advice in relation to certainother investment securities such as unlisted managed funds. Your <strong>ASB</strong> <strong>Securities</strong> Adviser alsooffers access to a range of associated <strong>ASB</strong> Bank services and products including day to daybanking accounts, cash management and foreign currency accounts. <strong>ASB</strong> <strong>Securities</strong> alsoprovides related services such as margin lending, portfolio management and referrals to insurance,tax and asset ownership specialists. <strong>ASB</strong> <strong>Securities</strong> additionally provides custody services.EmploymentYour <strong>ASB</strong> <strong>Securities</strong> Adviser is an employee of <strong>ASB</strong> Bank Limited (<strong>ASB</strong> Bank) and commencedemployment on May 2003. However, management control on a day to day basis of your Adviser’sactivities is conducted solely by <strong>ASB</strong> <strong>Securities</strong> Limited (<strong>ASB</strong> <strong>Securities</strong>), a wholly-ownedsubsidiary of <strong>ASB</strong> Bank. You should have already received <strong>ASB</strong> <strong>Securities</strong>’ and <strong>ASB</strong> Bank’s<strong>Disclosure</strong> <strong>Statement</strong> under the <strong>Securities</strong> Markets Act 1988 and a further copy is available fromyour <strong>ASB</strong> <strong>Securities</strong> Adviser on request. That <strong>Disclosure</strong> Document sets out the relationships andinterests that <strong>ASB</strong> <strong>Securities</strong> and <strong>ASB</strong> Bank have that are relevant to the provision of investmentadvice by <strong>ASB</strong> <strong>Securities</strong>.Qualifications• NZX Associate Advisor• Bachelor of Commerce with Honors majoring in economics. The University of Auckland.Experience• <strong>ASB</strong> <strong>Securities</strong> Ltd (2003 - present) – Fixed Interest Advisor

• <strong>ASB</strong> <strong>Securities</strong> Ltd (2003-2006) – Online Discount Broker• <strong>ASB</strong> BANK Ltd (2002-2003) – Personal BankingBasis of RemunerationI am remunerated on a salary only basis. My salary is paid by <strong>ASB</strong> <strong>Securities</strong> Ltd. I am alsoentitled to receive an annual bonus. However, this bonus is entirely at the discretion of thecompany and the amount cannot be predetermined.Fees and Remuneration of <strong>ASB</strong> <strong>Securities</strong> Limited<strong>ASB</strong> <strong>Securities</strong> and <strong>ASB</strong> Bank (as applicable) charge fees to their clients for certain of theservices referred to in this <strong>Disclosure</strong> <strong>Statement</strong>. Attached is a document showing thesefees as at the date of distribution of this <strong>Disclosure</strong> <strong>Statement</strong><strong>ASB</strong> <strong>Securities</strong> receives remuneration from the issuers of the following securities(calculated as a % of the amount of the investment):UDC debt securitiesFisher and Paykel Finance debenturesSouth Canterbury Finance debt securitiesMarac Retirement BondsNew Zealand Government Kiwi Bondsup to 0.25% p.aup to 0.5% p.aup to 0.5% p.aup to 0.5% p.aup to 0.25% p.a<strong>ASB</strong> <strong>Securities</strong> also receives one-off remuneration from the issuers of new listed equityand debt securities in respect of “Firm Allocations”. The remuneration varies from issue toissue but does not normally exceed 3% of the amount invested. Specific information willbe provided in respect of specific issues.<strong>ASB</strong> <strong>Securities</strong> may also receive one-off remuneration in relation to other investmentsecurities – such as unlisted managed funds – on which advice is provided at a client’srequest. Specific information will be provided in respect of specific investment securities.<strong>ASB</strong> <strong>Securities</strong> may also receive remuneration from <strong>ASB</strong> Bank of up to 2.5% p.a. of fundsheld on call in the Cash Management Account and Foreign Currency Accounts held with<strong>ASB</strong> Bank.<strong>ASB</strong> <strong>Securities</strong> may also receive margin income on foreign exchange transactions of anamount up to 1% of the amount converted.<strong>ASB</strong> <strong>Securities</strong> may also receive remuneration from <strong>ASB</strong> Bank of up to 4% p.a. of amountsoutstanding under any loan provided under a margin lending arrangementThe remuneration referred to in this <strong>Disclosure</strong> <strong>Statement</strong> is current at the date of this<strong>Disclosure</strong> <strong>Statement</strong>. Fees and remuneration may change from time to time.Other InterestsYour <strong>ASB</strong> <strong>Securities</strong> Adviser (or their Prescribed Persons, as defined in the NZX Rules) may, fromtime to time, hold securities, which are the subject of advice given to you. Other than as describedin this <strong>Disclosure</strong> <strong>Statement</strong>, your <strong>ASB</strong> <strong>Securities</strong> Adviser does not have any interest orrelationship that is reasonably likely to influence your <strong>ASB</strong> <strong>Securities</strong> Adviser in giving investmentadvice.

Professional AffiliationsYour <strong>ASB</strong> <strong>Securities</strong> Adviser is a NZX Associate Adviser with the New Zealand Exchange, and isbound by NZX Participant Rules.Dispute ResolutionIf you have a complaint about your <strong>ASB</strong> <strong>Securities</strong> Adviser you can contact:The Compliance Manager<strong>ASB</strong> <strong>Securities</strong> LimitedP O Box 35Auckland 1015New ZealandEmail: asbsecuritiescompliance@asb.co.nzIndependent dispute resolution procedures may be available through NZX ComplianceDepartment, a copy of the complaints process is available online:http://www.nzx.com/regulation/complaintsProfessional Indemnity Insurance<strong>ASB</strong> <strong>Securities</strong> participates in an insurance programme arranged by Commonwealth Bank ofAustralia Limited. The insurances include professional indemnity insurance covering <strong>ASB</strong> Bankand its employees in respect of the conduct of their professional duties in the provision of productsand services to you. The value of this insurance is not less than $50 million and it is subject toexclusions that may be expected to apply to an insurance policy of this nature.Integrity and ReputationYour <strong>ASB</strong> <strong>Securities</strong> Adviser has not:(a) been convicted of an offence under the <strong>Securities</strong> Markets Act 1988 or the <strong>Securities</strong> Act1978 or of a crime involving dishonesty, as defined in section 2(1) of the Crimes Act 1961;or(b) been a director or principal officer of a body corporate convicted an offence referred toabove, when the body corporate committed the offence; or(c) been adjudged bankrupt; or(d) been prohibited by an Act or by a court from taking part in the management of a companyor a business; or(e) been the subject of an adverse finding by a court in any proceeding taken against theinvestment adviser in the adviser’s professional capacity; or(f) been expelled from, or prohibited from being a member of a professional body.______________________________<strong>ASB</strong> <strong>Securities</strong> Investment Adviser29/2/2008____________________Date