aetna_ifp_brochure_c.. - Health Insurance

aetna_ifp_brochure_c.. - Health Insurance

aetna_ifp_brochure_c.. - Health Insurance

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

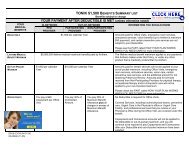

How to select a health insurance planthat fits your needsPerhaps you’ve just left an employer’sgroup plan. Or you’re looking for anoption other than COBRA. Or you’renot currently insured. Or maybe you’vejust received another big rate increasefrom another insurer and you’re lookingfor something more affordable.Whatever your situation, at Aetna, we’rehere to help. Let us offer a few tips tohelp you choose the right plan for yourunique situation and priorities. This chartmay be a good starting point for you…If you…Are looking for an affordable policywith low monthly payments…Use only basic health care servicesand want to keep your monthlypayments low…Don’t want to pay a lot for frequentdoctor visits for you and the kids…Want a balance of low monthly paymentsand quality coverage… Want to cap the amount you’ll spendon total medical expenses each year…Want a plan that works with atax-advantaged <strong>Health</strong> Savings Account(see page 3 for an explanation of HSAs)…Think that robust coverage is moreimportant than the lowest possible cost…Consider…MC* 5000, MC* 2500, MC* Value 5000,MC* High Deductible 5000, Preventativeand Hospital Care 1250 or 3000MC* 5000, MC* Value 5000,Preventative and Hospital Care 1250or 3000MC* 1000, MC* 1500,MC* Value 2500, First Dollar 25MC*1500, MC* Value 2500, MC* 2500MC* 1000, MC* 1500,MC* Value 2500, First Dollar 25MC* High Deductible 3000 or 5000,Preventative and Hospital Care 1250or 3000First Dollar 25*Managed Choice Open AccessIs your doctor in the Aetna network?Which local physicians, hospitals, pharmaciesand eyewear providers participate in theAetna Advantage Plan network?Visit www.<strong>aetna</strong>.com/ docfind/custom/advplans. Or call 1-800-694-3258 and askfor a directory of providers.

Managed Choice Open Accessplan optionsManaged Choice Open Access 1000 Managed Choice Open Access 1500A few thingsto keep in mindn Generally speaking, the lower your“premiums,” or monthly payments,the higher your “deductible,” whichis the amount you pay out of pocketbefore the plan begins paying forexpenses. (Lower premiums alsomean a higher “copay,” which isthe amount you pay out-of-pocketat doctor visits, hospital stays, etc.)n The lower your deductible (some planshave no deductible at all, which meansthey begin paying immediately), thehigher your monthly premiums will be.n You’ll pay less by using “in-network”doctors, hospitals, pharmaciesand other health care providerswho participate in Aetna’s vastnationwide network than by using“out-of-network” doctors.n Visit www.planforyourhealth.comfor an in-depth list of terms in this<strong>brochure</strong> and what they mean.MEMBER BENEFITS In-Network Out-of-Network + In-Network Out-of-Network +DeductibleIndividualFamilyCoinsurance(Member’s responsibility)Coinsurance MaximumIndividualFamilyOut-of-Pocket MaximumIndividualFamilyLifetime Maximum*per insuredNon-Specialist Office VisitUnlimited visitsGeneral Physician, FamilyPractitioner, Pediatrician or InternistSpecialist VisitUnlimited visits$1,000$2,00020%after deductible$2,000$4,00050%after deductible$1,500$3,00020%after deductible$3,000$6,00050%after deductible$0 once out-of-pocket max. is satisfied $0 once out-of-pocket max. is satisfied$1,500$3,000$2,500$5,000$1,500$3,000$3,500$7,000Includes deductible$1,500$3,000$3,000$6,000$1,500$3,000$4,500$9,000Includes deductible$5,000,000 $5,000,000 $5,000,000 $5,000,000$20 copayded. waived$30 copayded. waivedHospital Admission 20%after deductibleOutpatient Surgery 20%after deductibleUrgent Care FacilityEmergency RoomAnnual Routine Gyn ExamNo waiting period,no calendar year max.Annual Pap/MammogramMaternityPreventive <strong>Health</strong> —Routine PhysicalAetna will pay up to $200 per examNo waiting period$50 copayded. waived50%after deductible50%after deductible50%after deductible50%after deductible50%after deductible$100 copay** (waived if admitted)20% coinsurance after deductible$0ded. waived50%after deductibleNot coveredExcept for pregnancy complications$20 copayded. waivedLab/X-Ray 20%after deductibleSkilled Nursing —in lieu of hospital30 days per calendar year*Physical/Occupational Therapyand Chiropractic Care24 visits per calendar year*Home <strong>Health</strong> Care —in lieu of hospital30 visits per calendar year*50%after deductibleIncludes lab work and X-rays20%after deductible20%after deductible50%after deductible50%after deductible50%after deductibleAetna will pay a max. of $25 per visit20%after deductibleDurable Medical Equipment 20%after deductiblePHARMACYPharmacy Deductibleper individualGenericOral Contraceptives IncludedPreferred BrandOral Contraceptives IncludedNon-Preferred BrandOral Contraceptives IncludedCalendar Year Maximumper individual*50%after deductible50%after deductibleAetna will pay up to $2,000per calendar year*$25 copayded. waived$35 copayded. waived20%after deductible20%after deductible$50 copayded. waived50%after deductible50%after deductible50%after deductible50%after deductible50%after deductible$100 copay** (waived if admitted)20% coinsurance after deductible$0ded. waived50%after deductibleNot coveredExcept for pregnancy complications$25 copayded. waived50%after deductibleIncludes lab work and X-rays20%after deductible20%after deductible20%after deductible50%after deductible50%after deductible50%after deductibleAetna will pay a max. of $25 per visit20%after deductible20%after deductible50%after deductible50%after deductibleAetna will pay up to $2,000per calendar year*$250 $250 $250 $250$15 copayded. waived$25 copay afterdeductible$40 copay afterdeductibleDoes not apply to generic$15 copay plus 50%ded. waived$25 copay plus 50%after deductible$40 copay plus 50%after deductible$15 copayded. waived$25 copay afterdeductible$40 copay afterdeductibleDoes not apply to generic$15 copay plus 50%ded. waived$25 copay plus 50%after deductible$40 copay plus 50%after deductibleUnlimited Unlimited Unlimited Unlimited* Maximum applies to combined in and out-of-network benefits.** Copay is billed separately and not due at time of service. Copay does not count towards coinsurance orout-of-pocket maximum.+ Payment for out-of-network facility care is determined based upon Aetna’s Allowable Fee Schedule. Paymentfor other out-of-network facility care is determined based upon the negotiated charge that would apply if suchservices or supplies were received from a Preferred Provider.

Managed Choice Open Accessplan optionsManaged Choice Open Access 2500 Managed Choice Open Access 5000MEMBER BENEFITS In-Network Out-of-Network + In-Network Out-of-Network +DeductibleIndividualFamilyCoinsurance(Member’s responsibility)Coinsurance MaximumIndividualFamilyOut-of-Pocket MaximumIndividualFamily$2,500$5,00020%after deductible$5,000$10,00050%after deductible$5,000$10,00020%after deductible$10,000$20,00050%after deductible$0 once out-of-pocket max. is satisfied $0 once out-of-pocket max. is satisfied$2,500$5,000$5,000$10,000$2,500$5,000$7,500$15,000Includes deductible$2,500$5,000$7,500$15,000$2,500$5,000$12,500$25,000Includes deductibleLifetime Maximum* per insured $5,000,000 $5,000,000 $5,000,000 $5,000,000Non-Specialist Office VisitUnlimited visitsGeneral Physician, Family Practitioner, Pediatrician or InternistSpecialist VisitUnlimited visits$30 copayded. waived$40 copayded. waivedHospital Admission 20%after deductibleOutpatient Surgery 20%after deductibleUrgent Care FacilityEmergency RoomAnnual Routine Gyn ExamNo waiting period, no calendar year max.Annual Pap/MammogramMaternityPreventive <strong>Health</strong> — Routine PhysicalAetna will pay up to $200 per examNo waiting period$50 copayded. waived50%after deductible50%after deductible50%after deductible50%after deductible50%after deductible$100 copay** (waived if admitted)20% coinsurance after deductible$0ded. waived50%after deductibleNot coveredExcept for pregnancy complications$30 copayded. waivedLab/X-Ray 20%after deductibleSkilled Nursing — in lieu of hospital30 days per calendar year*Physical/Occupational Therapy and Chiropractic Care24 visits per calendar year*Home <strong>Health</strong> Care — in lieu of hospital30 visits per calendar year*20%after deductible20%after deductible50%after deductibleIncludes lab work and X-rays50%after deductible50%after deductible50%after deductibleAetna will pay a max. of $25 per visit20%after deductibleDurable Medical Equipment 20%after deductiblePHARMACY50%after deductible50%after deductibleAetna will pay up to $2,000per calendar year*$40 copayded. waived$50 copayded. waived20%after deductible20%after deductible$50 copayded. waived50%after deductible50%after deductible50%after deductible50%after deductible50%after deductible$100 copay** (waived if admitted)20% coinsurance after deductible$0ded. waived50%after deductibleNot coveredExcept for pregnancy complications$40 copayded. waived20%after deductible20%after deductible20%after deductible50%after deductibleIncludes lab work and X-rays50%after deductible50%after deductible50%after deductibleAetna will pay a max. of $25 per visit20%after deductible20%after deductible50%after deductible50%after deductibleAetna will pay up to $2,000per calendar year*Pharmacy Deductible per individual $500 $500 $500 $500Does not apply to genericDoes not apply to genericGenericOral Contraceptives IncludedPreferred BrandOral Contraceptives IncludedNon-Preferred BrandOral Contraceptives Included$15 copayded. waived$25 copay afterdeductible$40 copay afterdeductible$15 copay plus 50%ded. waived$25 copay plus 50%after deductible$40 copay plus 50%after deductible$15 copayded. waived$25 copay afterdeductible$40 copay afterdeductible$15 copay plus 50%ded. waived$25 copay plus 50%after deductible$40 copay plus 50%after deductibleCalendar Year Maximum per individual* Unlimited Unlimited Unlimited Unlimited1-800-MY <strong>Health</strong> | www.<strong>aetna</strong>individual.com

Managed Choice Open AccessVAlue PLAN OPtionSManaged Choice Open AccessValue 2500Managed Choice Open AccessValue 5000In-Network Out-of-Network + In-Network Out-of-Network +$2,500$5,00030%after deductible$3,000$6,00050%after deductible$5,000$10,00030%after deductible$10,000$20,00050%after deductible$0 once out-of-pocket max. is satisfied $0 once out-of-pocket max. is satisfiedIf affordability is your top priority,the Value plans and Preventativeand Hospital Care plans are theplans for you! These plans feature healthcare benefit coverage with lower monthlypremiums and varying deductible levels.$3,000$6,000$7,000$14,000$2,500$2,500$5,000$5,000$5,500$11,000$10,000$20,000Includes deductible$7,500$12,500$15,000$25,000Includes deductible$1,000,000 $1,000,000 $1,000,000 $1,000,000Visit 1-2 $30 copay,deductible waived.Visit 3+ 30% afterdeductible. Specialistand Non Specialistshare visit max.Visit 1-2 $30 copay,deductible waived.Visit 3+ 30% afterdeductible. Specialistand Non Specialistshare visit max.30%after deductible30%after deductible$50 copayded. waived50%after deductible50%after deductible50%after deductible50%after deductible50%after deductible$100 copay** (waived if admitted)30% coinsurance after deductible$0 copayded. waived50%after deductibleVisit 1-2 $30 copay,deductible waived.Visit 3+ 30% afterdeductible. Specialistand Non Specialistshare visit max.Visit 1-2 $30 copay,deductible waived.Visit 3+ 30% afterdeductible. Specialistand Non Specialistshare visit max.30%after deductible30%after deductible$50 copayded. waived50%after deductible50%after deductible50%after deductible50%after deductible50%after deductible$100 copay** (waived if admitted)30% coinsurance after deductible$0 copayded. waived50%after deductibleNot coveredExcept for pregnancy complications$50 copayded. waived30%after deductible30%after deductible50%after deductible50%after deductible50%after deductible30%50%after deductible after deductibleAetna will pay a max. of $25 per visit30%after deductible50%after deductible30%50%after deductible after deductibleAetna will pay up to $2,000per calendar year*Not coveredExcept for pregnancy complications$50 copayded. waived30%after deductible30%after deductible50%after deductible50%after deductible50%after deductible30%50%after deductible after deductibleAetna will pay a max. of $25 per visit30%after deductible50%after deductible30%50%after deductible after deductibleAetna will pay up to $2,000per calendar year*$500 $500 $500 $500Does not apply to genericDoes not apply to generic$20 copayded. waived$40 copayafter deductible$20 copay plus 50%ded. waived$40 copay plus 50%after deductible$20 copayded. waived$40 copayafter deductible$20 copay plus 50%ded. waived$40 copay plus 50%after deductibleNot covered*** Not covered Not covered*** Not covered$5,000 $5,000 $5,000 $5,000* Maximum applies to combined in and out-of-network benefits.** Copay is billed separately and not due at time of service. Copay does not count towards coinsurance or out-of-pocket maximum.*** Aetna discount available.+ Payment for out-of-network facility care is determined based upon Aetna’s Allowable Fee Schedule. Payment for other out-of-network facility care isdetermined based upon the negotiated charge that would apply if such services or supplies were received from a Preferred Provider.

AETNA ADVANTAGE PLAN OPTIONSINDIVIDUAL DENTAL PPO MAX PLANMEMBER BENEFITS PREFERRED NONPREFERREDAnnual Deductible per Member (Does not apply $25; $25;to Diagnostic and Preventive Services) $75 family maximum $75 family maximumAnnual Maximum Benefit Unlimited UnlimitedDIAGNOSTIC SERVICESOral examsPeriodic oral exam 100% deductible waived 50% deductible waivedComprehensive oral exam 100% deductible waived 50% deductible waivedProblem-focused oral exam 100% deductible waived 50% deductible waivedX-raysBitewing — single film 100% deductible waived 50% deductible waivedComplete series 100% deductible waived 50% deductible waivedPREVENTATIVE SERVICESAdult cleaning 100% deductible waived 50% deductible waivedChild cleaning 100% deductible waived 50% deductible waivedSealants — per tooth Discount Not coveredFluoride application — with cleaning 100% deductible waived 50% deductible waivedSpace maintainers Discount Not coveredBASIC SERVICESAmalgam fillings — 2 surfaces 100% after deductible 50% after deductibleResin fillings — 2 surfaces Discount Not coveredOral Surgery Discount Not coveredExtraction — exposed root or erupted tooth Discount Not coveredExtraction of impacted tooth — soft tissue Discount Not coveredMAJOR SERVICESComplete upper denture Discount Not coveredPartial upper denture (resin based) Discount Not coveredCrown — Porcelain with noble metal Discount Not coveredPontic — Porcelain with noble metal Discount Not coveredInlay — Metallic (3 or more surfaces) Discount Not coveredOral SurgeryRemoval of impacted tooth — partially bony Discount Not coveredEndodontic ServicesBicuspid root canal therapy Discount Not coveredMolar root canal therapy Discount Not coveredPeriodontic ServicesScaling & root planing — per quadrant Discount Not coveredOsseous surgery — per quadrant Discount Not coveredORTHODONTIC SERVICES Discount Not covered10Access to negotiated discounts: members are eligible to receive non covered services, including cosmetic services such as tooth whitening, at the PPO negotiated rate whenvisiting a participating PPO dentist at any time.Nonpreferred (Out-of-Network) Coverage is limited to a maximum of the Plan’s payment, which is based on the contracted maximum fee for participating providers in the particular geographic area.Above list of covered services is representative. A summary of exclusions is listed on page 13. For a full list of benefit coverage and exclusions refer to the plan documents.All products not available in all counties. Please refer to the state map located on page 2 of the Aetna Advantage Brochure.

Aetna Advantage plan programsto help you be wellAetna Advantage Plans includespecial programs 1 with a wealthof features to complement ourstandard health insurancecoverage. These programsinclude substantial savingson products and educationalmaterials geared toward yourspecial health needs. Theseprograms are value added andare not insurance. Here are afew of the ways we can helpyou be well.Fitness ProgramWith our Fitness program, eligible Aetnamembers and their families can enjoy preferredrates* on fitness club memberships at over2,000 fitness clubs within the GlobalFit network. In addition, members can accessother programs such as at-home weight lossprograms, home fitness options and evenone-on-one health coaching** services.Aetna Weight Management SM ProgramThe Weight Management Program canhelp you achieve your weight loss goals byproviding you with a sensible weight lossplan and balanced nutrition guide to fityour lifestyle. This program provides Aetnamembers and their eligible family membersaccess to discounts on Jenny Craig ® weightloss programs and products. Start witha FREE 30-day trial membership 2 ; then chooseeither a 6-month 2 or 12-month 2 program 3that’s right for you. You also receive individualweight loss consultations, personalizedmenu planning, tailored activity planning,motivational materials and much more.Eyecare SavingsAetna Vision SM Discounts*** program offersspecial savings on eye exams, contact lenses,frames, lenses, LASIK eye surgery, and eyecare accessories.Hearing Discount ProgramAetna’s Hearing SM Discounts help Aetnamembers and their families save on hearingexams, hearing services and hearing aids.Aetna Natural Productsand Services SM programEligible Aetna members and their familiescan access complementary health careproducts and services at reduced ratesthrough the Aetna Natural Products andServices program. Members can save onacupuncture, chiropractic care, massagetherapy and dietetic counseling as wellas on over-the-counter vitamins, herbaland nutritional supplements and otherhealth-related products.Informed <strong>Health</strong> ® LineGet answers 24/7 to your health questionsvia a toll-free hotline staffed by a teamof registered nurses.Aetna Rx Home Delivery ®With this optional program, order prescriptionmedications through our convenient andeasy-to-use mail order pharmacy. To learnmore or obtain order forms, visit www.AetnaRxHomeDelivery.com.Aetna Resource ConnectionAetna’s Resource Connection provides ourindividual and self-employed clients withaccess to resources and discounts thatcan help them build a healthier business.Whether it’s purchasing office supplies,finding an effective payroll serviceor upgrading your IT systems, AetnaResource Connection can help. Simplyput, we’re placing the power of aFortune 100 company in the handsof each client we serve.Aetna Navigator It’s easy and convenient for Aetnamembers to manage their health benefits.Anytime – day or night – wherever theyhave Internet access, members can login to Aetna Navigator, Aetna’s securemember website. Members who registeron the site can check the status of theirclaims, contact Aetna Member Services,estimate the costs of health care services,and much more!For more information on any of theseprograms, please visit us online atwww.<strong>aetna</strong>.com.Want to saveon dental expenses?Vital Savings by Aetna ® is a discountprogram that provides you with dentalsavings. This is not insurance. Enrollingin the program will give you accessto a network of providers who haveagreed to accept discounted ratesfor services. To sign up today, visitwww.vitalsavings.com or call1-877-698-4825.Aetna Natural Products and Services SM program, Eyecare Savings, Fitness and similar discount programs are rate-access programs and may be in addition to any plan benefits. Discount and othersimilar health programs offered hereunder are not insurance, and program features are not guaranteed under the plan contract and may be discontinued at any time. Program providers are solelyresponsible for the products and services provided hereunder. Aetna does not endorse any vendor, product or service associated with these programs. It is not necessary to be a member of anAetna plan to access the program participating providers.1 Availability varies by plan. Talk with your Aetna representative for details.2 Offers good at participating centers and through Jenny Direct at home only. Additional cost for all food purchases.3 Additional weekly food discounts will grow throughout the year, based on active participation.*At some clubs, participation in this program may be restricted to new club members.11**Provided by WellCall, Inc. through GlobalFit.*** Formerly known as the Vision One ® discount program.

Things you need to know to applyTo qualify for an Aetna Advantage Plan,you must be:n Under age 64 3/4 (If applying as a couple,both you and your spouse must beunder 64 3/4.)n Under age 25 for dependent childrenn Legal residents in a state with productsoffered by the Aetna Advantage Plansn Legal U.S. residents for at least 6continuous months.Your premium paymentsYour premium payments are guaranteed notto increase for 12 months from your effectivedate. After that, your premiums may change.Final rates are subject to underwriting review.Your coverageYour coverage remains in effect as longas you pay the required premium chargeson time, and as long as you maintainmembership eligibility. Coverage will beterminated if you become ineligible dueto any of the following circumstances:n Non-payment of premiumsn Becoming a resident of a state orlocation in which Aetna Advantageplans are not available.n Obtaining duplicate coveragen For other reasons permissible by lawMedical underwriting requirementsThe Aetna Advantage Plans are notguaranteed issue plans and require medical12underwriting. Some individuals may befederally eligible under the <strong>Health</strong> <strong>Insurance</strong>Portability Accountability Act (HIPAA)through CoverColorado for a specialguaranteed issue plan under Coloradolaws and regulations.All applicants, enrolling spouses anddependents are subject to medicalunderwriting to determine eligibilityand appropriate premium rate level.We offer various premium rate levelsbased on the known and predictedmedical risk factors of each applicant.Levels of coverage and enrollmentn You may be enrolled in your selectedplan at the standard premium charge.n You may be enrolled in your selected planat a higher rate, based on medical findings.n You may be declined coverage based onsignificant medical risk factors.Duplicate coverageIf you are currently covered by anothercarrier, you must agree to discontinue theother coverage before or on the effectivedate of the Aetna Advantage Plan. Do notcancel your current insurance until you arenotified that you have been accepted forcoverage.Pre-existing conditionsDuring the first 12 months following youreffective date of coverage, no coveragewill be provided for the treatment of apre-existing condition unless you havecreditable prior coverage.A pre-existing condition is an illness or injuryfor which medical advice or treatment wasrecommended or received within 6 monthspreceding the effective date of coverage.All You Need to KnowAbout Easy-PaySimple Automatic Payments viaElectronic Funds Transfer (EFT)Registration: Complete the paymentsection of the Aetna Advantage Plansapplication. Select the EFT option toapprove the automatic withdrawal ofyour initial premium and all subsequentpremium payments.Invoices: You will not receive a paperinvoice when you are enrolled in EFT.Payments will appear on your bankstatement as “Aetna Autodebit Coverage.”Terminating: To terminate EFT, you willneed to provide Aetna with 10 days writtennotice prior to the date your next EFTpayment will be deducted. Without thiswritten notice, your bank account may bedebited for the next month’s premium. Youwill then need to contact Aetna to havefunds placed back in the checking account.Refunds: To process an EFT refund(placing money back in member’schecking account), Aetna will requireat least 5 days after the withdrawalwas made to ensure valid payment.Rejected transactions: If the EFTpayment rejects for any reason, Aetnawill automatically terminate the EFT andsend you a letter saying you will receivepaper invoices. Processing time to reinstateEFT will be 30–60 days. If an EFT paymentis rejected, you will need to pay thatpayment by paper check or credit card.Timing: Payments for Cycle 1 accounts(1st of the month effective date) will betaken from your bank account betweenthe 3rd and the 10th of the month thepremium is due. Payments for Cycle 2accounts (15th of the month effectivedate) will be taken from your bankaccount between the 18th and 23rdof the month the premium is due.

Colorado limitations and exclusionsMedicalThese medical plans do not cover all healthcare expenses and include exclusions andlimitations. You should refer to your plandocuments to determine which health careservices are covered and to what extent.The following is a partial list of servicesand supplies that are generally not covered.However, your plan documents may containexceptions to this list based on statemandates or the plan design or rider(s).Services and supplies that are generally notcovered include, but are not limited to:n All medical and hospital services notspecifically covered in, or which are limitedor excluded by your plan documents,including costs of services before coveragebegins and after coverage terminatesn Cosmetic surgeryn Custodial caren Donor egg retrievaln Weight control services includingsurgical procedures for the treatmentof obesity, medical treatment, andweight control/loss programsn Experimental and investigationalprocedures, (except for coverage formedically necessary routine patientcare costs for Members participatingin a cancer clinical trial)n Charges in connection with pregnancy careother than for pregnancy complicationsn Immunizations for travel or workn Implantable drugs and certain injectabledrugs including injectable infertility drugs1-800-MY <strong>Health</strong> | www.<strong>aetna</strong>individual.comn Infertility services including artificialinsemination and advanced reproductivetechnologies such as IVF, ZIFT, GIFT,ICSI and other related services unlessspecifically listed as covered in yourplan documentsn Medical expenses for a pre-existingcondition are not covered for the first12 months after the member’s effectivedate. Lookback period for determininga pre-existing condition (conditions forwhich diagnosis, care or treatment wasrecommended or received) is 6 monthsprior to the effective date of coverage.If the applicant had prior creditablecoverage within 90 days immediatelybefore the signature on the application,then the pre-existing conditionsexclusion of the plan will be waived.n Nonmedically necessary services or suppliesn Orthoticsn Over-the-counter medications and suppliesn Radial keratotomy or related proceduresn Reversal of sterilizationn Services for the treatment of sexualdysfunction or inadequacies includingtherapy, supplies or counselingn Special or private duty nursingn Therapy or rehabilitation other than thoselisted as covered in the plan documentsn Mental <strong>Health</strong> in-network services forManaged Choice Open Access plans notcovered, except for severe biologicallybased mental or nervous disorders.DentalListed below are some of the chargesand services for which these dentalplans do not provide coverage. Fora complete list of exclusions andlimitations, refer to plan documents.n Dental Services or supplies that areprimarily used to alter, improve orenhance appearance. Negotiated ratesfor cosmetic procedures available whena participating dentist is accessed.n Experimental services, suppliesor proceduresn Treatment of any jaw joint disorder,such as temporomandibular jointdisordern Replacement of lost or stolenappliances and certain damagedappliancesn Services that Aetna defines as notnecessary for the diagnosis, care ortreatment of a condition involvedn All other limitations and exclusionsin your plan documents10-day right to reviewDo not cancel your current insuranceuntil you are notified that you have beenaccepted for coverage. We’ll review yourapplication to determine if you meetunderwriting requirements. If you’redenied, you’ll be notified by mail. Ifyou’re approved, you’ll be sent an AetnaAdvantage Plan contract and ID card.If, after reviewing the contract, you findthat you’re not satisfied for any reason,simply return the contract to us within10 days. We will refund any premiumyou’ve paid (including any contract feesor other charges) less the cost of anyservices paid on behalf of you or anycovered dependent.13

1-800-MY <strong>Health</strong>www.<strong>aetna</strong>individual.comGlossary of termsTo help you understand yourhealth care options, here area few definitions of termsyou’ll see throughout this<strong>brochure</strong>. For a more in-depthlist of terms, please visitwww.planforyourhealth.com.*Deductible – A fixed yearly dollar amountyou pay before the benefits of the planpolicy start.Coinsurance – The dollar amount that theplan and you pay for covered benefits afterthe deductible is paid.Copayment (Copay) – A fixed dollaramount that you must contribute towardthe cost of covered medical services undera health plan.Lifetime Maximum – The total dollaramount of benefits you may receive, orthe limited number of particular servicesyou may receive, over the term of thepolicy.Premium – The amount charged, oftenin installments, for an insurance policy.Out-of-Pocket Maximum – Theamounts such as coinsurance anddeductibles that an individual is requiredto contribute toward the cost of healthservices covered by the benefits plan.*Plan For Your <strong>Health</strong> is a public education programfrom Aetna and the Financial Planning Association.If you need this material translated into another language, please call Member Servicesat 1-866-565-1236.Si usted necesita este material en otro lenguaje, por favor llame a Servicios al Miembro al1-866-565-1236.This material is for information only and is not an offer or invitation to contract. Plan features andavailability may vary by location. Plans may be subject to medical underwriting or other restrictions.Rates and benefits may vary by location. <strong>Health</strong> insurance plans contain exclusions and limitations.Investment services are independently offered through JPMorgan Institutional Investors, Inc., asubsidiary of JPMorgan Chase Bank. Providers are independent contractors and are not agents ofAetna. Provider participation may change without notice. Aetna does not provide care or guaranteeaccess to health services. Not all health services are covered. See health insurance plan documentsfor a complete description of benefits, exclusions, limitations and conditions of coverage. Planfeatures are subject to change. Aetna receives rebates from drug makers that may be taken intoaccount in determining Aetna’s Preferred Drug List. Rebates do not reduce the amount a memberpays the pharmacy for covered prescriptions. Material subject to change.The Vital Savings by Aetna ® program (the “Program”) is not insurance.The Program provides Members with access to discounted fees pursuantto schedules negotiated by Aetna Life <strong>Insurance</strong> Company for the VitalSavings by Aetna ® discount program. The Program does not makepayments directly to the providers participating in the Program. EachMember is obligated to pay for all services or products but will receivea discount from the providers who have contracted with the DiscountMedical Plan Organization to participate in the Program. Aetna Life<strong>Insurance</strong> Company, 151 Farmington Avenue, Hartford, CT 06156,1-877-698-4825, is the Discount Medical Plan Organization.For more information about Aetna plans, refer to www.<strong>aetna</strong>.com.AA.02.305.1-CO (12/07)©2007 Aetna Inc.