HDFC Fixed Maturity Plans - Series XI - HDFC Mutual Fund

HDFC Fixed Maturity Plans - Series XI - HDFC Mutual Fund

HDFC Fixed Maturity Plans - Series XI - HDFC Mutual Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

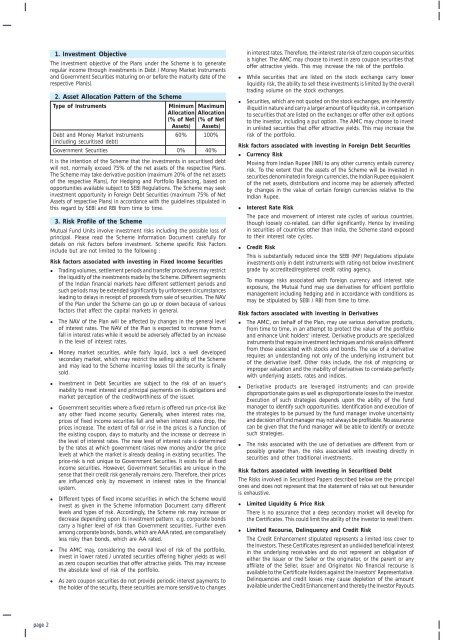

1. Investment ObjectiveThe investment objective of the <strong>Plans</strong> under the Scheme is to generateregular income through investments in Debt / Money Market Instrumentsand Government Securities maturing on or before the maturity date of therespective Plan(s).2. Asset Allocation Pattern of the SchemeType of InstrumentsMinimum MaximumAllocation Allocation(% of Net (% of NetAssets) Assets)Debt and Money Market Instruments 60% 100%(including securitised debt)Government Securities 0% 40%It is the intention of the Scheme that the investments in securitised debtwill not, normally exceed 75% of the net assets of the respective <strong>Plans</strong>.The Scheme may take derivative position (maximum 20% of the net assetsof the respective <strong>Plans</strong>), for Hedging and Portfolio Balancing, based onopportunities available subject to SEBI Regulations. The Scheme may seekinvestment opportunity in Foreign Debt Securities (maximum 75% of NetAssets of respective <strong>Plans</strong>) in accordance with the guidelines stipulated inthis regard by SEBI and RBI from time to time.3. Risk Profile of the Scheme<strong>Mutual</strong> <strong>Fund</strong> Units involve investment risks including the possible loss ofprincipal. Please read the Scheme Information Document carefully fordetails on risk factors before investment. Scheme specific Risk Factorsinclude but are not limited to the following :Risk factors associated with investing in <strong>Fixed</strong> Income Securities Trading volumes, settlement periods and transfer procedures may restrictthe liquidity of the investments made by the Scheme. Different segmentsof the Indian financial markets have different settlement periods andsuch periods may be extended significantly by unforeseen circumstancesleading to delays in receipt of proceeds from sale of securities. The NAVof the Plan under the Scheme can go up or down because of variousfactors that affect the capital markets in general.The NAV of the Plan will be affected by changes in the general levelof interest rates. The NAV of the Plan is expected to increase from afall in interest rates while it would be adversely affected by an increasein the level of interest rates.Money market securities, while fairly liquid, lack a well developedsecondary market, which may restrict the selling ability of the Schemeand may lead to the Scheme incurring losses till the security is finallysold.Investment in Debt Securities are subject to the risk of an issuer'sinability to meet interest and principal payments on its obligations andmarket perception of the creditworthiness of the issuer.Government securities where a fixed return is offered run price-risk likeany other fixed income security. Generally, when interest rates rise,prices of fixed income securities fall and when interest rates drop, theprices increase. The extent of fall or rise in the prices is a function ofthe existing coupon, days to maturity and the increase or decrease inthe level of interest rates. The new level of interest rate is determinedby the rates at which government raises new money and/or the pricelevels at which the market is already dealing in existing securities. Theprice-risk is not unique to Government Securities. It exists for all fixedincome securities. However, Government Securities are unique in thesense that their credit risk generally remains zero. Therefore, their pricesare influenced only by movement in interest rates in the financialsystem.Different types of fixed income securities in which the Scheme wouldinvest as given in the Scheme Information Document carry differentlevels and types of risk. Accordingly, the Scheme risk may increase ordecrease depending upon its investment pattern. e.g. corporate bondscarry a higher level of risk than Government securities. Further evenamong corporate bonds, bonds, which are AAA rated, are comparativelyless risky than bonds, which are AA rated.The AMC may, considering the overall level of risk of the portfolio,invest in lower rated / unrated securities offering higher yields as wellas zero coupon securities that offer attractive yields. This may increasethe absolute level of risk of the portfolio.As zero coupon securities do not provide periodic interest payments tothe holder of the security, these securities are more sensitive to changesin interest rates. Therefore, the interest rate risk of zero coupon securitiesis higher. The AMC may choose to invest in zero coupon securities thatoffer attractive yields. This may increase the risk of the portfolio.While securities that are listed on the stock exchange carry lowerliquidity risk, the ability to sell these investments is limited by the overalltrading volume on the stock exchanges. Securities, which are not quoted on the stock exchanges, are inherentlyilliquid in nature and carry a larger amount of liquidity risk, in comparisonto securities that are listed on the exchanges or offer other exit optionsto the investor, including a put option. The AMC may choose to investin unlisted securities that offer attractive yields. This may increase therisk of the portfolio.Risk factors associated with investing in Foreign Debt Securities Currency RiskMoving from Indian Rupee (INR) to any other currency entails currencyrisk. To the extent that the assets of the Scheme will be invested insecurities denominated in foreign currencies, the Indian Rupee equivalentof the net assets, distributions and income may be adversely affectedby changes in the value of certain foreign currencies relative to theIndian Rupee.Interest Rate RiskThe pace and movement of interest rate cycles of various countries,though loosely co-related, can differ significantly. Hence by investingin securities of countries other than India, the Scheme stand exposedto their interest rate cycles.Credit RiskThis is substantially reduced since the SEBI (MF) Regulations stipulateinvestments only in debt instruments with rating not below investmentgrade by accredited/registered credit rating agency.To manage risks associated with foreign currency and interest rateexposure, the <strong>Mutual</strong> <strong>Fund</strong> may use derivatives for efficient portfoliomanagement including hedging and in accordance with conditions asmay be stipulated by SEBI / RBI from time to time.Risk factors associated with investing in Derivatives The AMC, on behalf of the Plan, may use various derivative products,from time to time, in an attempt to protect the value of the portfolioand enhance Unit holders' interest. Derivative products are specializedinstruments that require investment techniques and risk analysis differentfrom those associated with stocks and bonds. The use of a derivativerequires an understanding not only of the underlying instrument butof the derivative itself. Other risks include, the risk of mispricing orimproper valuation and the inability of derivatives to correlate perfectlywith underlying assets, rates and indices.Derivative products are leveraged instruments and can providedisproportionate gains as well as disproportionate losses to the investor.Execution of such strategies depends upon the ability of the fundmanager to identify such opportunities. Identification and execution ofthe strategies to be pursued by the fund manager involve uncertaintyand decision of fund manager may not always be profitable. No assurancecan be given that the fund manager will be able to identify or executesuch strategies.The risks associated with the use of derivatives are different from orpossibly greater than, the risks associated with investing directly insecurities and other traditional investments.Risk factors associated with investing in Securitised DebtThe Risks involved in Securitised Papers described below are the principalones and does not represent that the statement of risks set out hereunderis exhaustive.Limited Liquidity & Price RiskThere is no assurance that a deep secondary market will develop forthe Certificates. This could limit the ability of the investor to resell them.Limited Recourse, Delinquency and Credit RiskThe Credit Enhancement stipulated represents a limited loss cover tothe Investors. These Certificates represent an undivided beneficial interestin the underlying receivables and do not represent an obligation ofeither the Issuer or the Seller or the originator, or the parent or anyaffiliate of the Seller, Issuer and Originator. No financial recourse isavailable to the Certificate Holders against the Investors' Representative.Delinquencies and credit losses may cause depletion of the amountavailable under the Credit Enhancement and thereby the Investor Payoutspage 2