chana - NCDEX

chana - NCDEX

chana - NCDEX

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHANA

CHANAChana, also called Bengal gram or chick pea, is the premiere pulse crop in theIndian subcontinent. India is the largest consumer and producer of <strong>chana</strong> in theworld. The two popular varieties of <strong>chana</strong> in India are Desi and Kabuli. The desivariety is usually split and relatively small with thick seed coat. Kabuli is cream incolour, relatively large in size with thin seed coat.Bengal gram is widely appreciated as health food. It is a protein rich supplement tocereal based diet in India where large sections of population are either vegetarianor cannot afford animal proteins.USES AND NUTRITIONAL VALUEWhole <strong>chana</strong> is split into <strong>chana</strong> dal and ground to make flour popularly calledbesan apart from being consumed in varied forms with daily Indian meals. Chanais a good source of carbohydrate, and protein.CULTIVATION AND SEASONALITYChana is a Rabi crop sown during the winter months in India. Fertile sandy and loam soil with good drainage is required forcultivation. Cooler climate and low rainfall suits <strong>chana</strong> cultivation. The peak arrival period is March - April at the mandis inIndia.THE CROP CALENDARDOMESTIC SCENARIOChana constitutes 50 per cent of all pulses produced by volume in IndiaSHARE OF CHANA IN TOTAL PULSES PRODUCED BY VOLUME IN 2009-10Source: Ministry of Agriculture, GOINote: Data is fourth Advance Estimate by the Ministry2

Chana production has increased by 36 percent between 2004 and 2010 with 25 percent expansion in acreage and 9percent improvement in yield. The government has set a production target of 7.58 million tonnes for 2010-11.Source: Ministry of Agriculture, Government of India** Area covered as on Jan 28th 2011*** Fourth advanced estimate as released in July 2011STATES' SHARE IN PRODUCTION OF CHANA IN 2008-09Source: CMIEThe export and import of <strong>chana</strong> by India has increased 116 percent and 20 percent respectively between 2005 and 2009YEARLY IMPORT AND EXPORT OF CHANA-INDIA3

INTERNATIONAL SCENARIOOriginally from the Middle East, <strong>chana</strong> is grown throughout the semi arid regions of India and the Mediterranean. Apart fromIndia, the other major producers of desi <strong>chana</strong> are Turkey, Pakistan, and AustraliaTOP CHANA PRODUCING COUNTRIES IN 2008The Indian subcontinent led by India imports maximum volume of <strong>chana</strong> while Australia leads the list of countriesexporting <strong>chana</strong>TOP IMPORTERS OF CHANA IN 2008Source: Food and Agriculture Organization of the United NationsPRICE BEHAVIOURInflation of <strong>chana</strong> prices was least amongst pulses and lower than food articles during 2010 .WHOLESALE PRICE INDEX OF CHANA VERSUS PULSES FAMILY AND FOOD ARTICLESource: Food and Agriculture Organization of the United Nations4Source: Office of the Economic Advisor, GOI

T h e p r i c e bve iho au r d e p oe n di s en rtp l a y be etn w d e m a n d s u p pf l cy hoa nT a h.e m a i n f a c t o r s t i nm g p ad ce ma n ds u p pal y re a s fo l l osw-Fl u ct u a t i oi n asre a p,ro d utci o ann d y i e l dC a ry ro ve r s t o ca k n d i m p ot s ri m p at ci n tgh e s u p p l yFa ct o rosf p ro d utci o i n c l u d ri na ign f a l lT h e Mi n i m uSmu p p t oPr r i c oef fe re d b y t h e g o ve r n m e n tR e t u ron n s c o m p e t ci nro g p sMINIMUM SUPPORT PRICE OF CHANAT h e m i n i m us m u p p t oprr i c ea s re a n n o u n cb eyd t h e c e nt r aglo ve r n m e wn t i t h a v i e w t o e n s ue re m u n e r ae tp irvi c et o s t h ef a r m efor s r t h ep iro r d u c e o n bta hs e i s toh f e C o m m i sos r i oA n r gi cfu l t u r a l C o srt is c ea s n d C( CP A) roe mcm e n d a t. iT oh ne ss ep r i c ea s re a n n o u n ca ettdh e c o m m een mce no t f t h e s e a s ot n o e n a b fl aer m etros p u r s ut e h e ie r f fo rt s w i t h t h e a s s u r ae nt hca tt h e p r i c ef asr m ere r s c e e i vwo u l d n o t b e b e l o w t h e l e ve l f i xe d b y t h e g o ve r n m e nT t h.e N a t i o nAg a l r i c u l t uCo r ao l p e r aet i vM a rk e t i nFe g d e r a t i( oN n A F E iD s t)h e n o d alg e ny cfo r p ro c ue rm e no t f p u l s ef ro s m f a r m e rT s h.e g o ve r n m ern ati s et d h e M S Pfo r c h a nb a y 1 9 p e rc e nt i n 2 0 1 0 - o1 ve 1 r t h e 2 0 0 9 - l1 e0ve lMINIMUM SUPPORT PRICE (RS/QTL) OF CHANASource: Directorate of Economics & Statistics, GOIVALUE CHAIN PARTICIPANTS IN TRADE OF CHANAFarmerDal MillerWholesaler(Dal)Agent/StockistWholesalerRetailerConsumerCHANA @ <strong>NCDEX</strong><strong>NCDEX</strong>, the leading agri futures exchange in the country, offers futures trading in <strong>chana</strong>. Futures contract in Chanacomplements the portfolio of a commodity investor and acts as a hedging tool for the value chain participants in the trade of<strong>chana</strong>25

The <strong>chana</strong> futures contract is an effective tool to manage price riskVOLATILITY IN SPOT PRICE OF CHANA IN 2010The efficient price discovery through the futures contract on <strong>chana</strong> explains the accomplishment of this derivatives product.A close convergence of futures and spot prices of <strong>chana</strong> contract upon expiry illustrates the utility of this futures contract as ahedging instrument.PRICE DISCOVERY THROUGH CHANA FUTURES CONTRACTSource: <strong>NCDEX</strong> (Monthly volatility calculated on the basis of spot prices at basis centre)Source: <strong>NCDEX</strong>TRADED VOLUME OF CHANA FUTURES ON <strong>NCDEX</strong>6Source: <strong>NCDEX</strong>

MONTHLY RETURNS FROM CHANA CONTRACTOver the years, <strong>NCDEX</strong> <strong>chana</strong> contract has been able to build up significant interest among all market participants which isevident from the steady open interest of more than 200,000 MT during the entire financial year 2010-11.AVERAGE MONTHLY OPEN INTEREST IN CHANA CONTRACTSource: <strong>NCDEX</strong>Source: <strong>NCDEX</strong>PHYSICAL DELIVERY OF CHANA ON <strong>NCDEX</strong>Source: <strong>NCDEX</strong>7

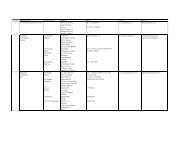

MAJOR MANDIS NEAR THE <strong>NCDEX</strong>'S DELIVERY CENTRES FOR CHANACONTRACT SPECIFICATIONSName of CommodityTicker symbolTrading SystemBasisUnit of tradingDelivery unitAdditional deliverycentresTrading HoursDelivery LogicOpening of contractsCHANACHARJDDELQuantity variation +/-5%<strong>NCDEX</strong> Trading SystemDesi ex-warehouse Delhi inclusive of all taxes and levies10 MT10 MTQuotation/base value Rs per quintalTick size Re 1Delivery center Desi Chana to be delivered at Delhi (up to the radius of 50 kms from the municipal limits )Kantawalla Chana to be delivered only at Indore (up to the radius of 50 km from municipal limits)Desi Chana can also be delivered at Bikaner (up to the radius of 50 km from municipal limits)As per directions of the Forward Markets Commission from time to time, currently -Mondays through Fridays: 10:00 a.m. to 5:00 p.m.Saturdays: 10.00 a.m. to 2.00 p.m.The Exchange may vary the above timing with due notice.Compulsory DeliveryQuality Specification Desi Chana Kantawalla <strong>chana</strong>Foreign Matter (Other than varietal admixture) 1% basis 1% basisGreen (Cotyledon colour), Immature, Shrunken, Shriveled SeedsBrokens, SplitsDamaged and WeeviledMoistureVarietal admixture3% basis 3% basis2% basis 3% basis3% basis(Weeviled 2% max.)10% basis 10% basis3% max 3% maxThe material should be free of Mathara and Khesari and live infestation.3% basis(Weeviled 2% max.)Upon expiry of the contract all outstanding positions will result in delivery. The penalty structure forfailure to meet delivery obligations will be as per circular no. <strong>NCDEX</strong>/TRADING-086/2008/216dated September 16, 2008.Trading in any contract month will open on the 10th day of the month. If 10th day of the month happensto be a non-trading day, contracts would open on the next trading day.Closing of contractDue Date/ ExpiryDateUpon the expiry of a contract all outstanding open positions would result in compulsory delivery20th day of the delivery month. If 20th happens to be a holiday, a Saturday or a Sunday then the due date shallbe the immediately preceding trading day of the Exchange, which is other than a SaturdayNo. of active contracts As per launch calendarMember's PositionLimitClient's PositionLimit100,000 MT for all contracts or 15% of the market-wide open position, whichever is higher.For near month contracts: Maximum of 20,000 MT or 15% of the market-wide near month open position,whichever is higher (The following limits would be applicable from one month prior to expiry date).20,000 MTFor near month contracts: Maximum of 4,000 MTFinal SettlementPrice8The Final Settlement Price (FSP) shall be arrived at by taking the average of the last three days' last polledspot prices.For further details, please refer to the <strong>NCDEX</strong> website http://www.ncdex.comContact our Product Managers for any queries/information:Sachin Purwar : 9999294456, Arun Yadav : 9930006791, Rohit Shukla : 9711371071